Cost management in accounting: Definition, process & techniques

Cost management in accounting plays a pivotal role in ensuring that a company operates efficiently and remains financially stable. It involves the planning, monitoring, and controlling of business expenses to achieve strategic goals.

The cost management process in accounting requires accurate tracking of all financial resources to optimize spending and maximize profitability. Effective cost management helps businesses optimize their resources, improve profitability, and make informed financial decisions.

By carefully managing costs, businesses can remain competitive in their industry while ensuring long-term sustainability. Furthermore, it allows organizations to identify areas of improvement and make data-driven adjustments to achieve financial goals.

What is cost management in accounting?

Cost management in accounting refers to the process of planning and controlling the financial resources required to achieve business objectives. It involves tracking, analyzing, and optimizing costs at every stage of business operations.

The cost management process includes various techniques and strategies aimed at minimizing waste, enhancing efficiency, and increasing profitability. By using cost management techniques, accountants ensure that expenses are within budget and aligned with the organization’s financial goals.

In business, effective cost management helps organizations understand their cost structure, leading to better decision-making, resource allocation, and profitability. It also enables companies to identify potential risks and reduce inefficiencies that could harm financial performance.

4 fundamental categories of costs

In accounting, understanding the fundamental categories of costs is essential for effective cost management. These categories include fixed, variable, direct, and indirect costs, which all play a significant role in business financial planning.

1. Fixed costs

Fixed costs are expenses that remain constant regardless of the level of production or sales. Examples include rent, salaries, and insurance premiums. These costs do not fluctuate with business activity, making them predictable.

In cost management in accounting, fixed costs must be carefully monitored to ensure they do not overwhelm a company’s budget. Managing these costs effectively ensures a more stable financial environment for businesses.

2. Variable costs

Variable costs change in direct proportion to the level of production or sales. They include expenses such as raw materials, labor costs tied to production, and utility costs. As production increases, variable costs rise, and when production decreases, so do these costs.

Understanding variable costs is crucial in the cost management process, as it helps businesses align their spending with operational demands. Proper management ensures that these costs are kept in check.

3. Direct costs

Direct costs are expenses that can be directly attributed to the production of goods or services. These include materials, labor, and other costs specifically tied to the manufacturing process. Direct costs are essential for calculating the total cost of goods sold (COGS).

By managing direct costs, companies can gain insight into the profitability of their products or services. Efficient handling of direct costs contributes to more accurate cost management in business.

4. Indirect costs

Indirect costs, or overhead costs, are expenses that cannot be directly attributed to a specific product or service. These costs include utilities, administrative salaries, and depreciation. Indirect costs support the overall business operations but are not directly tied to production.

In cost management accounting, it’s important to allocate indirect costs appropriately to maintain an accurate financial picture. Managing these costs effectively ensures that a company remains financially efficient without sacrificing quality.

Key elements of cost management

Cost management is a critical aspect of business operations, ensuring resources are efficiently allocated and expenses are kept in check. The key elements of cost management include planning, estimation, budgeting, allocation, control, reduction, and variance analysis, all vital to effective financial management.

1. Cost planning

Cost planning is the process of determining and organizing the financial resources needed for a project or business operation. This involves forecasting expenses and establishing guidelines to meet financial goals.

Effective cost planning ensures that the cost management process aligns with business objectives. It allows companies to anticipate future expenses and minimize financial risks. Through proper cost planning, businesses can allocate resources optimally and avoid overspending.

2. Cost estimation

Cost estimation involves predicting the expenses that will be incurred during the execution of a project or operation. Accurate estimations help businesses prepare financially and allocate resources appropriately.

By using historical data, industry benchmarks, and cost management techniques, companies can make more reliable projections. Cost estimation is essential for project success, as it provides a solid foundation for budgeting and planning. Effective cost estimation supports decision-making by providing a clearer financial picture.

3. Budgeting

Budgeting is the process of creating a financial plan to allocate resources and control expenses within a defined period. It involves setting financial goals and outlining how funds will be distributed across various departments or projects.

A well-structured budget allows companies to monitor spending and make adjustments as needed. In cost management in business, budgeting is crucial for ensuring that expenses do not exceed projected revenues. This process helps businesses stay on track with their financial objectives.

4. Cost allocation

Cost allocation refers to the process of assigning indirect costs to specific departments, products, or services. This ensures that overheads are distributed fairly based on usage or benefit received. Proper cost allocation helps businesses understand the true cost of their products or services.

It also provides insights into the profitability of different segments of the business. In the cost management process, accurate cost allocation helps businesses make informed pricing and resource allocation decisions.

5. Cost control

Cost control is the process of monitoring and managing expenses to ensure they stay within budgeted limits. It involves analyzing cost performance and making adjustments to prevent cost overruns.

Effective cost control techniques help businesses maintain financial discipline and optimize resource use. In cost management in accounting, cost control helps improve profitability by reducing unnecessary expenditures. Through constant monitoring, companies can identify cost-saving opportunities and improve operational efficiency.

6. Cost reduction

Cost reduction focuses on lowering expenses without sacrificing product quality or operational efficiency. This process involves evaluating current costs and identifying areas where savings can be achieved.

By implementing cost management techniques like streamlining operations, renegotiating contracts, or reducing waste, businesses can achieve significant savings. Cost reduction is vital for maintaining profitability in competitive markets. It enables companies to reinvest savings into growth and innovation, supporting long-term success.

7. Variance analysis

Variance analysis is the process of comparing actual costs to budgeted or estimated costs to identify discrepancies. This analysis helps businesses understand the reasons behind cost overruns or savings.

By identifying variances, companies can take corrective actions to address any financial issues. Variance analysis provides valuable insights into the effectiveness of the cost management process. It allows businesses to refine their cost management techniques and improve future financial planning and forecasting.

Importance of cost management for a business

Cost management is a critical component of business operations, helping organizations control expenses and improve financial performance. Effective cost management supports financial stability, ensures adherence to budgets, maximizes profits, optimizes resource allocation, and mitigates risks, ultimately driving business success.

Financial stability

Financial stability is achieved by managing costs effectively, allowing businesses to maintain cash flow and meet financial obligations. Through careful cost management in accounting, companies can avoid financial strain, ensuring they have sufficient funds for operations and growth.

By monitoring expenses closely, businesses can avoid unexpected financial challenges, which helps maintain a stable financial position over the long term. This stability builds investor and stakeholder confidence, which is crucial for securing future funding and expansion.

Budget adherence

Budget adherence is crucial for maintaining control over business finances. By establishing clear budgets and following the cost management process, companies can ensure they do not exceed their planned expenses.

Sticking to the budget allows businesses to allocate funds efficiently across various departments and projects, preventing overspending. This process not only aids in managing costs but also ensures that financial resources are available to achieve the company's objectives.

Profit maximization

Maximizing profits is one of the main objectives of cost management. By controlling costs effectively, businesses can improve their bottom line without sacrificing product quality or customer satisfaction.

A well-managed cost structure ensures that revenue generated exceeds expenses, resulting in higher profitability. The cost management process helps identify areas where expenses can be reduced, leading to more efficient operations and increased profit margins for the business.

Resource allocation

Effective resource allocation is essential for optimizing the use of financial and physical assets within a business. By managing costs properly, companies can ensure that resources are allocated where they are most needed, enhancing operational efficiency.

This involves prioritizing critical projects, reducing waste, and avoiding over-allocation of resources. Through careful cost management in business, organizations can better utilize their resources, leading to improved productivity and overall performance.

Risk mitigation

Risk mitigation involves identifying and managing potential financial risks that could negatively impact business operations. By implementing effective cost management techniques, businesses can minimize financial exposure and ensure they are prepared for unforeseen challenges.

Managing costs allows companies to maintain flexibility in their financial planning, ensuring they can absorb unexpected expenses. This reduces the impact of external risks and helps businesses navigate economic fluctuations or market downturns more effectively.

Performance measurement

Performance measurement is essential to evaluate the effectiveness of business operations. Cost management helps track key financial metrics, allowing companies to assess whether they are meeting financial targets.

By analyzing costs, businesses can identify areas for improvement and make necessary adjustments to enhance overall performance. Regular performance measurement, facilitated by cost management in accounting, provides valuable insights into cost efficiency and operational effectiveness, ensuring continuous growth and profitability.

Competitive edge

Effective cost management provides a significant competitive edge in the market. By carefully controlling expenses and optimizing resource allocation, businesses can offer more competitive pricing or invest in areas that differentiate them from competitors.

Streamlined cost structures allow companies to improve profitability while maintaining high product quality. With better cost efficiency, businesses can reinvest savings into innovation, marketing, or customer service, further enhancing their market position.

Informed planning decision-making

Cost management enables informed planning and decision-making, allowing businesses to allocate resources more effectively. With accurate financial data, businesses can evaluate potential investments and assess the financial viability of various strategies.

Understanding cost structures ensures that managers make decisions based on realistic financial projections, minimizing risks. By using detailed cost information, companies can prioritize initiatives with the highest returns, ensuring strategic decisions are grounded in financial insight and long-term sustainability.

Long-term financial planning

Long-term financial planning is essential for achieving sustained business growth and stability. Cost management in business helps companies forecast future expenses, allowing them to anticipate cash flow needs and potential financial risks.

Accurate projections ensure businesses are prepared for market fluctuations and can plan for expansion or new projects. Strategic cost management also allows organizations to allocate funds for long-term investments, ensuring they remain financially sound and able to meet future goals.

Financial transparency

Financial transparency is a crucial aspect of building trust with stakeholders, investors, and employees. By practicing effective cost management, businesses can provide clear and accurate financial reports that reflect their true financial position.

Transparency in financial data helps stakeholders understand how resources are allocated and ensures that funds are being used efficiently. It fosters a culture of accountability and enables better decision-making, which contributes to the company’s overall credibility and reputation.

Compliance & accountability

Effective cost management ensures that businesses comply with financial regulations and maintain accountability. By following established financial processes, businesses can meet tax and reporting requirements while adhering to industry standards.

Accurate cost tracking helps companies avoid fines and penalties associated with non-compliance. Additionally, a strong focus on cost management promotes a culture of accountability, ensuring that managers and teams are responsible for their spending and financial decisions.

Adaptability & flexibility

Adaptability and flexibility are essential for navigating market changes and economic shifts. Cost management in business enables organizations to quickly adjust their financial strategies in response to external factors such as economic downturns or new opportunities.

By managing costs effectively, businesses can absorb shocks and stay flexible, reallocating resources to areas with the most potential for growth. This adaptability ensures that companies remain competitive and resilient, no matter what changes occur in the business environment.

Benefits of effective cost management in a business

Effective cost management in a business not only helps in controlling expenses but also drives long-term success. By strategically managing costs, businesses can improve profitability, streamline operations, and enhance their financial position. This ultimately leads to sustainable growth and increased competitiveness.

Increased profitability

Effective cost management directly contributes to increased profitability by optimizing expenses. By reducing unnecessary costs, businesses can enhance their profit margins while maintaining or improving product quality.

Companies that manage costs efficiently can allocate more resources toward growth initiatives, which further drives profits. Additionally, better cost control enables businesses to stay competitive in pricing, helping them attract more customers and expand their market share. This ultimately supports long-term financial sustainability and growth.

Better cash flow management

Proper cost management ensures better cash flow management by reducing cash outflows and improving liquidity. When expenses are kept under control, businesses can better predict their cash needs and avoid cash shortages.

Efficient management of costs also means that funds can be allocated to the most critical areas of the business, ensuring operations continue smoothly. With improved cash flow, businesses can also take advantage of investment opportunities without risking financial instability. This enables better financial planning and long-term viability.

Enhanced operational efficiency

Cost management improves operational efficiency by identifying and eliminating wasteful practices. By optimizing processes and resource allocation, businesses can achieve more with fewer resources.

Streamlining operations reduces the time and costs associated with production or service delivery, leading to a smoother workflow. This increased efficiency not only reduces costs but also enhances productivity, enabling businesses to scale effectively while maintaining quality. It also helps in maximizing the utilization of existing resources.

Significant cost reduction

A key benefit of effective cost management is significant cost reduction. By analyzing spending patterns and identifying inefficiencies, businesses can cut unnecessary expenses without compromising on quality.

Whether through renegotiating supplier contracts, automating tasks, or reducing overheads, cost management allows companies to lower their operational costs. These savings can be reinvested in growth initiatives, innovation, or employee development, fostering further business success. This also allows businesses to maintain profitability during economic downturns.

Improved financial reporting

Cost management leads to improved financial reporting by ensuring more accurate and timely data. By tracking and controlling expenses, businesses can generate clearer financial statements that reflect their true financial position.

This transparency helps managers, stakeholders, and investors make better-informed decisions. Consistent and accurate financial reporting also helps businesses identify trends and areas of improvement, allowing for more proactive management of financial performance. It also strengthens the overall decision-making process within the organization.

Strengthened supplier relationships

Effective cost management can help strengthen supplier relationships by promoting transparent and mutually beneficial negotiations. When businesses focus on cost control, they may identify opportunities to negotiate better terms with suppliers.

Maintaining a healthy relationship based on fair pricing and timely payments can lead to more favorable deals and long-term partnerships. Strong supplier relationships also ensure reliable supply chains, reducing risks and improving overall business operations. This cooperation fosters mutual growth and stability for both parties.

Improved stakeholder confidence

Cost management enhances stakeholder confidence by demonstrating the company's ability to manage finances effectively. Investors, employees, and customers all benefit from a company that controls its costs, as it ensures stability and profitability.

When stakeholders see that the business is financially disciplined, they are more likely to support long-term growth strategies. This confidence fosters stronger relationships with all key parties involved, promoting a positive business environment. It also helps attract potential investors and partners.

Enhanced market position

Through effective cost management, businesses can enhance their market position by offering competitive pricing and improving profit margins. By reducing operational costs, companies can lower product prices, making them more attractive to consumers without sacrificing profitability.

Additionally, cost efficiency allows businesses to invest in innovation, marketing, and customer service, all of which contribute to strengthening their position in the market. Ultimately, it supports sustainable growth in a competitive landscape. This leads to increased market share and customer loyalty.

What is the process of cost management of a project?

Define your cost management plan

Cost management in a project is the process of planning, estimating, budgeting, and controlling costs to ensure that the project is completed within the approved budget. It is crucial for the project's success, allowing effective resource allocation and ensuring financial control throughout the project lifecycle.

The first step in cost management is creating a cost management plan that outlines the approach for managing project costs. This plan includes processes for estimating, budgeting, and controlling costs, and assigns responsibilities for financial oversight.

The plan sets the foundation for tracking expenses and aligning them with project objectives. It ensures that the project is financially managed according to scope and goals, helping to prevent cost overruns and delays.

Identify key stakeholders

Identifying key stakeholders is critical for understanding the expectations regarding the project’s budget and costs. Stakeholders include clients, sponsors, team members, and anyone involved in the financial aspects of the project.

Engaging stakeholders early allows for better communication of cost-related decisions and ensures alignment with business objectives. Regular updates and involvement also help prevent misunderstandings and ensure that costs are tracked according to expectations and approvals.

Set up your cost management tool

Setting up a cost management tool is essential for tracking and managing costs efficiently throughout the project. This tool can include software for project tracking, spreadsheets, or other financial management systems.

It should be tailored to the project’s complexity and size, enabling real-time monitoring of expenses. A reliable tool ensures that all financial data is easily accessible, allowing project managers to spot potential issues early and maintain control over project finances.

Conduct cost estimation

Cost estimation involves predicting the total cost of the resources, materials, and labor needed to complete the project. Accurate estimation is critical to creating a realistic budget and avoiding cost overruns.

This process involves analyzing historical data, consulting experts, and considering the scope and complexity of the project. A clear cost estimate provides a baseline for budget creation and helps set expectations with stakeholders, ensuring that the project remains within financial constraints.

Develop a budget

Developing a budget is a crucial step in cost management, providing a detailed breakdown of estimated costs and allocating funds to each project phase or activity. The budget should align with the project scope and reflect realistic financial expectations.

It is essential to account for all potential expenses, including labor, materials, overhead, and contingencies. Once finalized, the budget serves as a reference point for monitoring actual costs and making adjustments throughout the project lifecycle.

Set up your cost control strategy

Establishing a cost control strategy ensures that the project stays within the allocated budget. This strategy includes setting up monitoring systems, defining cost thresholds, and identifying key performance indicators (KPIs).

By regularly tracking expenses and comparing them with the budget, project managers can identify potential risks early. Effective cost control helps prevent cost overruns and ensures that financial resources are used efficiently throughout the project lifecycle.

Perform variance analysis

Variance analysis involves comparing actual project costs against the estimated costs to identify discrepancies. This analysis helps to pinpoint where costs have exceeded or fallen short of expectations.

By evaluating the causes of variances, project managers can make informed decisions about cost adjustments. Variance analysis provides valuable insights into the project's financial performance, allowing for timely corrective actions to ensure the project stays on track and within budget.

Implement corrective actions

When variances are identified, corrective actions must be implemented to bring the project back in line with the budget. These actions may include adjusting project timelines, renegotiating contracts, or reallocating resources.

The goal is to mitigate any negative financial impacts and ensure that the project remains financially viable. By taking prompt corrective actions, project managers can minimize the risk of further budget overruns and maintain the project’s financial health.

Prepare cost reports

Preparing regular cost reports provides stakeholders with up-to-date information on the project’s financial status. These reports typically include actual costs, variances, forecasts, and potential risks. By consolidating cost data into clear, concise reports, project managers can ensure transparency and keep everyone informed about the project's budget performance.

Cost reports are crucial for decision-making, helping stakeholders understand where adjustments may be needed to stay within budget and meet financial objectives.

Communicate with stakeholders

Effective communication with stakeholders is essential for managing project costs. Project managers should provide regular updates on cost performance, explain any variances, and discuss potential impacts.

Clear communication helps ensure that stakeholders are aware of any financial issues or risks and fosters trust and collaboration. By keeping stakeholders informed, project managers can align expectations and make necessary adjustments to ensure the project remains on budget and meets its financial goals.

Evaluate change requests

Evaluating change requests is a critical step in cost management. When changes are proposed, they can impact the project’s budget, timeline, and scope. It’s essential to assess the financial implications of these changes, including how they will affect costs and whether they align with the project’s objectives.

By carefully evaluating change requests, project managers can make informed decisions about which changes should be approved or rejected to keep the project on budget.

Adjust your budget

Adjusting the budget is necessary when there are significant changes in project scope, unforeseen expenses, or variances in actual costs. This process involves revising cost estimates, reallocating resources, and updating the financial forecast.

By making adjustments to the budget, project managers ensure that the financial plan remains realistic and achievable. Regular budget adjustments help ensure that the project continues to align with financial expectations and does not exceed the allocated resources.

Conduct cost analysis

Conducting cost analysis involves reviewing and interpreting financial data to determine how effectively resources are being utilized. This analysis can identify areas where costs can be reduced or optimized.

By regularly conducting cost analysis, project managers can track financial performance, forecast future expenditures, and identify inefficiencies. Cost analysis supports informed decision-making, helping to ensure that the project remains financially on track and within the allocated budget.

Continuous improvement

Continuous improvement in cost management involves regularly reviewing processes, identifying inefficiencies, and implementing changes to enhance financial performance. By fostering a culture of continuous improvement, project managers can adapt to changing conditions and ensure that cost control measures remain effective.

This approach encourages learning from past projects and making proactive adjustments to future cost management strategies. Ultimately, continuous improvement helps improve financial discipline and supports the long-term success of the project.

Effective cost management techniques

Effective cost management is crucial for business success, as it helps organizations optimize their expenses and improve profitability.

Implementing the right cost management techniques ensures financial stability, boosts efficiency, and allows businesses to make informed decisions that contribute to long-term growth.

1. Activity-based costing

Activity-based costing (ABC) assigns costs to specific activities based on their usage of resources. This technique helps businesses identify the true cost of each product or service by analyzing the activities that generate costs.

ABC provides more accurate cost allocation, allowing managers to make better pricing and resource allocation decisions. It enhances decision-making by offering insights into cost drivers, improving profitability through more efficient cost distribution.

2. Budgeting and forecasting

Budgeting and forecasting involve planning and predicting future expenses and revenues. This technique helps businesses create a financial framework by estimating costs and income over a specific period.

Budgeting ensures that resources are allocated appropriately, while forecasting helps adjust the budget based on changing conditions. It allows businesses to anticipate financial challenges, monitor progress, and adjust operations to meet financial goals, ensuring optimal cost control throughout the year.

3. Variance analysis

Variance analysis compares actual costs with budgeted costs to identify discrepancies. This technique helps businesses detect areas where they are overspending or underperforming. By understanding the causes of variances, such as inefficient resource use or market fluctuations, businesses can implement corrective actions.

Variance analysis provides valuable insights into cost management, enabling decision-makers to adjust strategies to align with financial goals and prevent budget overruns.

4. Target costing

Target costing is a pricing strategy that involves determining the desired cost for a product based on market conditions and competitive pricing. It focuses on reducing costs to meet predefined profit margins, starting with a target cost and working backward.

By analyzing customer requirements and market competition, businesses can identify cost-cutting opportunities and streamline production processes. Target costing encourages innovation and efficiency, ensuring that products remain profitable while meeting market expectations.

5. Cost-benefit analysis

Cost-benefit analysis involves comparing the costs of a project or decision with the expected benefits. This technique helps businesses evaluate the financial viability of different projects by quantifying the potential return on investment.

It allows managers to make informed decisions by assessing whether the benefits justify the costs. By conducting a cost-benefit analysis, businesses can prioritize investments that yield the highest value and avoid unnecessary expenditures that do not align with strategic goals.

6. Just-in-time inventory management

Just-in-time (JIT) inventory management minimizes inventory costs by ensuring that materials are delivered only when needed. This technique helps businesses reduce storage costs, eliminate waste, and improve cash flow.

By maintaining low inventory levels, JIT also reduces the risk of obsolescence and overstocking. JIT relies on strong supplier relationships and efficient production scheduling, ensuring that products are available when needed without tying up capital in excess inventory.

7. Kaizen costing

Kaizen costing focuses on continuous improvement by reducing costs incrementally over time. This technique encourages small, gradual changes in processes, materials, and labor to lower production costs. Kaizen costing promotes a culture of ongoing efficiency and innovation.

It emphasizes employee involvement, ensuring that all levels of the organization contribute to cost reduction efforts. This method is effective in maintaining long-term cost control while fostering a proactive approach to operational improvement.

8. Benchmarking

Benchmarking involves comparing a business’s processes, performance, and costs against industry leaders or competitors. This technique helps identify best practices and areas for improvement.

By analyzing the performance of top-performing companies, businesses can set realistic goals and adopt strategies that drive efficiency and cost savings. Benchmarking encourages businesses to continuously refine their operations and adopt proven practices, enhancing overall competitiveness and reducing unnecessary costs in the process.

Strategies for effective cost management

Effective cost management strategies help businesses optimize resources, reduce waste, and enhance profitability. By implementing smart cost management techniques, organizations can improve efficiency, maintain financial stability, and ensure long-term success in a competitive market.

Capitalize on technology

Leveraging technology in cost management allows businesses to automate processes, track expenses, and analyze financial data in real time. Tools like cloud-based accounting software and advanced analytics platforms provide accurate insights into spending patterns.

Technology also enhances collaboration and streamlines workflow, enabling faster decision-making. By adopting these technological advancements, companies can reduce human errors, increase efficiency, and ultimately lower operational costs, leading to better financial control.

Supplier management

Effective supplier management plays a key role in controlling costs. By establishing strong relationships with suppliers, businesses can negotiate better pricing, secure favorable payment terms, and gain access to discounts.

Regular performance evaluations ensure that suppliers meet quality standards and provide timely deliveries. Proactive supplier management also reduces the risk of supply chain disruptions, which can lead to unexpected costs. By optimizing supplier relationships, companies can achieve cost savings and improve overall efficiency.

Cost reduction strategies

Cost reduction strategies focus on identifying areas of waste and inefficiency across the business. This may include renegotiating contracts, reducing overhead costs, or improving resource utilization.

Streamlining operations by eliminating non-value-added activities helps organizations cut unnecessary expenses. Additionally, embracing automation and outsourcing non-core functions can reduce labor costs. Implementing such strategies ensures that businesses remain competitive while maintaining profitability and operational excellence.

Lean management

Lean management focuses on maximizing value by minimizing waste. This methodology involves streamlining processes, reducing unnecessary steps, and improving efficiency across operations. Lean principles emphasize continuous improvement, employee involvement, and customer satisfaction.

By adopting lean management, businesses can reduce costs while maintaining or improving the quality of their products and services. This strategy fosters a culture of cost-consciousness, where every team member contributes to identifying and eliminating inefficiencies.

Financial performance metrics

Utilizing financial performance metrics is essential for tracking and controlling costs. Key metrics such as profit margins, return on investment (ROI), and operating expenses help businesses evaluate their financial health.

These metrics provide insight into areas where cost management can be improved, enabling more strategic decision-making. Regularly monitoring financial performance allows companies to make data-driven adjustments, ensuring that they stay within budget and achieve their financial objectives efficiently.

Cost monitoring systems

Implementing cost monitoring systems enables businesses to track expenses in real time and identify deviations from the budget. These systems help managers monitor financial performance across various departments and projects, ensuring that resources are being utilized effectively.

Cost monitoring systems provide detailed reports on spending patterns, enabling early detection of potential issues. By continuously monitoring costs, businesses can make timely adjustments, reduce waste, and maintain control over their financial performance.

Best practices for effective cost management

Cost management is a vital aspect of running a successful business. By implementing best practices, companies can keep expenses under control, boost profitability, and ensure financial health. A well-structured approach to cost management can help businesses weather economic fluctuations and stay competitive in their industry.

1. Establish clear objectives

Establishing clear objectives in cost management is the first step to guiding financial decisions. Specific goals allow businesses to align their resources and actions with the desired outcomes.

Whether it’s reducing overhead, maximizing profit margins, or improving cost-efficiency, clear objectives provide a roadmap. Setting these goals ensures everyone in the organization understands what needs to be achieved, making the process of managing costs more focused and effective.

2. Monitor costs regularly

Consistent cost monitoring helps businesses stay on top of their finances. By reviewing expenses on a regular basis, companies can quickly identify variances from their budget and address them before they become significant issues.

Regular monitoring also helps in detecting areas of overspending or inefficiency, which can then be targeted for improvement. Staying vigilant with cost tracking enables businesses to make timely adjustments and maintain financial stability.

3. Set up an expense management system

An expense management system is key to controlling business spending. These systems automate the tracking and reporting of expenses, making it easier for managers to monitor costs. With a centralized system, businesses gain real-time insights into financial data, reducing human error and increasing transparency.

This streamlined approach not only improves efficiency but also aids in budget compliance, ensuring that expenses stay within limits.

4. Encourage cross-departmental collaboration

Cost management is not the sole responsibility of the finance team. Encouraging collaboration across departments allows businesses to identify cost-saving opportunities from all angles. When employees from different areas of the organization work together, they can share insights, spot inefficiencies, and suggest improvements.

This approach fosters a sense of collective responsibility and leads to a more holistic approach to reducing expenses and optimizing resources.

5. Continuously optimize budget allocations

Regularly reviewing and adjusting budgets is a crucial part of staying on track financially. Business conditions are constantly changing, and an initial budget may no longer reflect current realities.

By evaluating the budget periodically, businesses can identify discrepancies and reallocate funds to where they are needed most. Adjusting budgets as necessary allows businesses to remain flexible and responsive to market conditions while ensuring that financial targets are met.

6. Implement proper employee training programs

Training employees in cost management is essential for ensuring long-term success. When staff members understand how their decisions impact the company’s bottom line, they can take proactive steps to control costs.

Training programs that emphasize financial literacy and efficient resource usage help create a culture of cost awareness across the organization. With proper training, employees become key players in identifying cost-saving opportunities and driving operational improvements.

7. Plan for contingencies

Contingency planning is an often-overlooked but essential part of cost management. Unexpected expenses, such as equipment breakdowns or sudden market changes, can derail a company’s budget. Having a contingency plan in place ensures that businesses can respond quickly and effectively to unforeseen events.

By setting aside funds and strategies for emergencies, companies can manage risks better and minimize the financial impact of unexpected circumstances.

8. Practice continuous improvement

The business environment is always evolving, so continuous improvement in cost management is necessary for long-term success. By regularly reviewing processes and performance, businesses can identify inefficiencies and make necessary adjustments.

Encouraging a mindset of constant improvement means that cost-saving opportunities are always being sought out. This ongoing effort to optimize operations ensures that businesses remain agile, reduce waste, and improve financial performance over time.

Difference between cost control and cost management

Cost control and cost management are essential financial practices for businesses aiming to achieve sustainable growth and profitability. Understanding the difference between the two helps in aligning the company’s financial goals with day-to-day operations, ensuring long-term success and operational efficiency.

1. Definition

● Cost control

Cost control focuses on monitoring and minimizing expenditures to keep them within set limits. It involves implementing procedures to detect overspending and taking corrective action swiftly.

It’s a key part of maintaining the day-to-day financial health of an organization. Effective cost control ensures that spending is aligned with budget expectations and prevents financial mismanagement.

● Cost management

Cost management is a holistic approach to managing all aspects of a company’s financial performance. It encompasses both cost control and strategic financial planning.

By forecasting, budgeting, and reviewing costs, it aims to align financial resources with broader business objectives. This method helps organizations maximize efficiency and profitability over both the short and long term.

2. Nature

● Cost control

Cost control is a reactive approach that focuses on addressing cost discrepancies and adhering to established budgets. It often requires making adjustments in real-time to prevent financial issues from escalating.

This approach ensures that costs do not exceed their limits, but does not necessarily focus on long-term financial growth. Cost control is essential for maintaining short-term financial stability and preventing waste.

● Cost management

Cost management is proactive, looking at long-term financial strategy to guide decision-making. It involves the development of comprehensive plans and forecasting methods that support business goals.

While cost control is part of cost management, the latter is a broader process that integrates multiple strategies to optimize overall financial health. It ensures resources are used wisely, focusing on both short-term needs and future expansion.

3. Focus

● Cost control

Cost control’s main focus is on preventing overspending by maintaining costs within predetermined limits. It seeks to reduce waste and eliminate unnecessary expenditures as they arise.

This approach is particularly important in businesses where immediate cost savings are critical for profitability. Cost control ensures financial discipline in managing operational expenses day to day.

● Cost management

Cost management’s focus is on the overall allocation and optimization of resources to meet both short- and long-term financial goals. It involves managing direct and indirect costs in a way that supports the overall business strategy.

Rather than simply reacting to cost variances, cost management anticipates future requirements and aligns financial decisions with business priorities. It supports sustainable growth by focusing on profitability, efficiency, and financial resilience.

4. Time frame

● Cost control

Cost control is generally short-term, focusing on immediate financial constraints and preventing overspending. It deals with day-to-day financial management, ensuring that costs do not exceed the established limits.

The goal is to contain expenses within a set timeframe, typically over the course of a fiscal period or specific project duration. It is a reactive approach aimed at correcting deviations before they escalate.

● Cost management

Cost management spans both short-term and long-term periods, as it involves ongoing planning and monitoring of expenses. It integrates strategic financial planning for future needs and goals.

While it deals with current costs, it also aims to align financial resources with future business objectives, making it a continuous process. The strategy is adjusted periodically to respond to evolving market conditions and business needs.

5. Objective

● Cost control

The primary objective of cost control is to keep expenses within the budgeted limits and prevent cost overruns. It focuses on immediate financial health, ensuring that a business does not exceed its budgetary constraints.

Cost control is essential for maintaining day-to-day financial stability without compromising the quality or operations of the business. It also helps in identifying inefficiencies and reducing wastage.

● Cost management

Cost management’s objective is to strategically allocate resources to optimize long-term financial health and business growth. It aims to balance costs effectively across all areas while aligning expenditures with overall business goals.

By proactively managing costs, businesses can ensure sustainable profitability and efficient use of resources over time. The goal is also to improve decision-making, ensuring that investments are aligned with long-term growth.

6. Techniques

● Cost control

Common cost control techniques include variance analysis, budgeting, and real-time cost tracking. These tools help businesses monitor spending and identify discrepancies early, allowing for quick corrective actions.

Regular monitoring of performance against the budget ensures that costs are controlled effectively and any deviations are addressed promptly. These techniques also foster a culture of financial discipline within the organization.

● Cost management

Cost management techniques include activity-based costing, forecasting, and cost-benefit analysis. These methods help businesses plan and allocate resources effectively, ensuring that costs are aligned with strategic goals.

Regular reviews of costs, coupled with performance metrics, allow businesses to optimize their spending over both short and long-term periods. These techniques also provide a clear framework for making data-driven financial decisions.

7. Example

● Cost control

An example of cost control is a manufacturing company implementing strict controls on raw material purchases to prevent overstocking, which could lead to increased costs.

By monitoring inventory levels and spending closely, the company ensures that it stays within budget and reduces waste, maintaining a competitive edge. The company also uses regular audits to ensure compliance with cost-saving measures.

● Cost management

An example of cost management is a business implementing a long-term financial plan that balances current expenses with future investments, such as in technology or infrastructure.

The company uses strategic forecasting and budgeting to ensure that resources are allocated efficiently, supporting both immediate operational needs and long-term growth objectives. This approach also includes risk management strategies to mitigate potential financial uncertainties.

KPIs of effective cost management

Key performance indicators (KPIs) are essential metrics that businesses use to measure the effectiveness of their cost management strategies. They help in tracking financial performance and assessing whether costs are being managed efficiently across various areas of the business.

1. Cost variance ratio

The cost variance ratio measures the difference between the actual and budgeted costs, showing whether a project or business operation is over or under budget. A higher ratio indicates better cost control, while a negative variance highlights inefficiencies.

Tracking this ratio allows businesses to identify areas that need cost adjustments. Consistently monitoring the ratio can prevent budget overruns and help ensure financial stability.

2. Cost performance index

The cost performance index (CPI) is a ratio that compares the earned value to the actual costs incurred. It reflects the efficiency of cost utilization during a project.

A CPI greater than 1 indicates that the project is under budget, while a CPI below 1 signals potential cost overruns. A positive CPI helps ensure resources are used effectively and contributes to project success.

3. Budget utilization rate

The budget utilization rate shows how efficiently a company is using its allocated budget. It is calculated by dividing actual spending by the budgeted amount.

A utilization rate of 100% indicates that the budget has been fully used, while deviations suggest over- or under-spending, highlighting areas of improvement. Monitoring this rate regularly enables businesses to adjust their spending habits and align them with strategic goals.

4. Return on investment

Return on investment (ROI) measures the profitability of investments relative to their costs. It helps businesses evaluate the financial benefits gained from a project or expenditure.

A higher ROI indicates better financial returns, showing the success of cost management strategies in generating profits. Calculating ROI ensures that investments contribute positively to overall business performance and growth.

5. Gross profit margin

The gross profit margin is a profitability ratio that shows the percentage of revenue left after subtracting the cost of goods sold. It helps businesses assess the efficiency of production processes and cost control in generating profit.

A higher margin indicates effective cost management and stronger profitability. This metric is crucial for identifying areas where cost-cutting measures can be implemented without sacrificing product quality.

6. Operating expense ratio

The operating expense ratio compares operating expenses to total revenue, providing insight into the company’s cost structure. A lower ratio indicates more efficient cost control, meaning the company is spending less to generate revenue.

This metric is crucial for assessing overall operational efficiency. Keeping this ratio low enables businesses to improve profitability by optimizing spending on non-revenue-generating activities.

7. Inventory turnover ratio

The inventory turnover ratio measures how frequently a business sells and replaces its inventory within a given period. A high turnover ratio indicates efficient inventory management, reducing storage and handling costs.

It suggests that the business is effectively managing its stock levels, avoiding excess inventory. Maintaining optimal turnover ensures the company doesn’t overstock and ties up unnecessary capital in unsold goods.

8. Days payable outstanding

Days payable outstanding (DPO) is a metric that indicates how long a company takes to pay its suppliers. A higher DPO can signal effective cost management, as it allows the business to retain cash longer.

However, excessively high DPO might strain supplier relationships and affect future negotiations. Monitoring this metric ensures the business maintains favorable terms with suppliers without jeopardizing long-term partnerships.

9. Overhead costs percentage

The overhead costs percentage measures the proportion of total costs that are fixed, such as rent, utilities, and administrative expenses. A lower percentage indicates that a company has better control over its fixed costs, allowing more of its revenue to contribute to profit.

Effective cost management aims to reduce this percentage over time. Reducing overheads boosts profitability by enabling more funds to be directed toward business growth and development.

Challenges faced while implementing cost management

Implementing effective cost management often encounters several challenges, including data accuracy, employee resistance, complex cost structures, inadequate training, frequent budget revisions, lack of visibility, changing market conditions, insufficient stakeholder engagement, and integration issues with existing systems.

Accuracy & availability of data

Accurate and timely data is crucial for cost management. Inaccurate or incomplete data can lead to flawed financial analysis and decisions. Businesses often struggle to collect and maintain reliable data, which can hinder cost optimization efforts.

Without proper systems, ensuring data integrity is challenging, impacting decision-making and cost control measures. Ensuring data accuracy and availability often requires investing in advanced technologies and robust data governance practices.

Employees’ resistance to change

Employees may resist new cost management practices due to fear of job cuts or changes in their responsibilities. This resistance can slow down the implementation process and reduce the effectiveness of cost management initiatives.

Overcoming this challenge requires clear communication, employee involvement, and ensuring that cost management goals align with employee interests. Additionally, providing incentives for employees to adopt cost-saving behaviors can help foster a culture of cooperation and improvement.

Complexity of cost structure

A complex cost structure with multiple layers of expenses can make it difficult to implement cost management. Identifying which areas to focus on and how to allocate costs effectively becomes challenging when the structure is unclear or overly complicated.

Simplifying cost allocation and enhancing transparency can help in addressing this issue. Businesses should regularly audit their cost structures to ensure they are aligned with strategic goals and easily manageable for decision-makers.

Inadequate employee training

Proper training is essential for cost management success. Without sufficient training, employees may not fully understand the importance of cost management or how to implement effective strategies.

Inadequate training can lead to errors, inefficiencies, and resistance to new methods, making it difficult to achieve desired financial outcomes. Offering ongoing training and development opportunities ensures that employees stay updated on best practices and are equipped to contribute to cost-saving efforts.

Regular budget readjustments

In dynamic business environments, frequent budget adjustments are often necessary. However, regular changes to the budget can cause confusion and disrupt cost management efforts. Repeatedly shifting budgets may lead to inconsistent financial planning, making it challenging to achieve long-term financial stability and effectively manage expenses.

Establishing a clear budget review process can help mitigate disruptions and ensure that any adjustments align with the company's financial objectives.

Lack of complete visibility

Cost management can be hindered by a lack of visibility into all areas of a business. If managers are unable to access comprehensive financial data, they may struggle to identify cost-saving opportunities.

Full visibility into all operational areas ensures that businesses can monitor spending, improve forecasting, and make informed decisions. Implementing integrated financial systems can help provide real-time insights and enhance visibility across departments.

Changing market conditions

Cost management strategies can be affected by changing market conditions, such as fluctuating raw material prices, new regulations, or competitive pressures. These changes may necessitate adjustments to cost structures, creating challenges in maintaining financial control.

Businesses must remain adaptable and continuously reassess their cost management strategies to keep pace with market shifts. Being proactive and agile in adjusting cost management plans can help businesses stay competitive and mitigate risks associated with market volatility.

Insufficient stakeholder engagement

Cost management requires the support of key stakeholders, including executives, managers, and employees. If stakeholders are not sufficiently engaged, the initiative may lack direction and fail to achieve its goals.

Regular communication and alignment with stakeholders are vital to ensuring that cost management efforts are supported and effectively implemented across the organization. Stakeholder engagement also helps ensure that the cost management strategies are aligned with broader business objectives.

Integration with existing systems

Integrating cost management processes with existing systems, such as financial software or ERP systems, can be a challenge. Compatibility issues, technical constraints, or lack of system flexibility may hinder the smooth implementation of cost management strategies.

Overcoming these obstacles often requires investing in technology upgrades or system customization to enable seamless integration. Successful integration can lead to more efficient data flows and a more cohesive approach to financial management across the business.

Software solutions and tools for effective cost management

In today’s fast-paced business world, leveraging software solutions for cost management can significantly improve efficiency and profitability. These tools help businesses track, control, and optimize expenses, streamline processes, and enhance financial decision-making to ensure long-term success and sustainability.

1. Cost management softwares

Cost management software enables businesses to monitor and control expenses effectively by providing real-time insights into spending patterns. These tools often include features such as budgeting, expense tracking, and reporting to help organizations identify areas for cost reduction.

With detailed analytics and reporting capabilities, companies can make informed decisions that align with their financial goals. Additionally, these tools improve transparency and accountability in managing financial resources.

2. ERP systems

Enterprise Resource Planning (ERP) systems integrate various business functions, including finance, procurement, and inventory management, into a single platform. These systems streamline cost management by providing a comprehensive view of all financial data.

By automating processes like order management and expense tracking, ERP systems improve operational efficiency, reduce manual errors, and enhance data accuracy, helping organizations control costs and optimize resource allocation. They also enable real-time reporting and better decision-making across departments.

3. Budgeting and forecasting software

Budgeting and forecasting software helps businesses plan and predict future expenses based on historical data and market trends. These tools allow companies to create realistic budgets, adjust them as needed, and forecast potential financial outcomes.

With features such as scenario analysis and trend tracking, this software enables businesses to proactively manage their finances, avoid overspending, and ensure that funds are allocated effectively to achieve organizational objectives. It also enhances financial planning and forecasting accuracy.

4. Expense management software

Expense management software allows businesses to streamline the process of tracking and controlling employee spending. This software provides features such as automated approval workflows, receipt scanning, and real-time expense reporting.

By centralizing and automating the expense management process, businesses can reduce administrative overhead, ensure compliance with company policies, and gain insights into spending patterns, making it easier to implement cost-saving measures. It also reduces the risk of fraudulent claims and errors.

5. Accounting softwares

Accounting software helps businesses manage their financial records, track transactions, and generate reports. By automating routine accounting tasks, such as invoicing, bookkeeping, and reconciliation, this software minimizes errors and reduces manual labor.

It also helps businesses maintain accurate financial statements, which are essential for cost management, tax filing, and financial decision-making. Many accounting software solutions also integrate with other financial tools for seamless cost tracking, further improving operational efficiency.

6. Procurement management software

Procurement management software enables businesses to control spending by optimizing the purchasing process. These tools help track supplier performance, negotiate better deals, and automate purchasing workflows.

By centralizing procurement data, companies can gain visibility into their spending, reduce unnecessary purchases, and ensure that they are getting the best value for their investments. This leads to cost savings, improved supplier relationships, and better alignment with business goals. The software also improves the efficiency of the entire procurement cycle.

7. Invoice automation software

Invoice automation software streamlines the process of generating, approving, and paying invoices. By automating invoicing tasks, businesses can reduce the risk of errors, improve payment accuracy, and ensure timely payments to suppliers.

This software often integrates with other financial tools, such as ERP systems, to provide a comprehensive solution for managing costs. By eliminating manual invoice processing, companies can reduce administrative workload and accelerate cash flow. It also enhances visibility into outstanding payments and cash flow forecasting.

8. Accounts payable software

Accounts payable software automates the process of managing incoming payments and liabilities. It helps businesses track outstanding invoices, schedule payments, and ensure compliance with payment terms. By automating these tasks, the software improves accuracy, reduces manual errors, and enhances cash flow management.

Accounts payable software also provides visibility into cash outflows, enabling businesses to make informed decisions about their financial commitments and avoid late fees or penalties. Additionally, it helps ensure timely vendor payments and maintains good relationships.

9. Corporate cards

Corporate cards offer businesses a convenient way to manage and control employee spending. These cards provide real-time expense tracking and reporting features, making it easier to manage costs across departments. By allocating cards to employees for specific purposes, businesses can ensure that spending remains within budget and aligns with company policies.

Corporate cards also offer the added benefit of simplifying administrative tasks, such as expense reimbursement and approval workflows. They also provide enhanced control over employee expenses.

10. Vendor management systems

Vendor management systems (VMS) help businesses manage their relationships with suppliers and service providers. These systems enable organizations to monitor supplier performance, track contract compliance, and streamline procurement processes.

By centralizing vendor data, VMS tools provide insights into costs, delivery schedules, and performance metrics, which help businesses negotiate better terms and reduce overall procurement costs. Effective use of VMS also strengthens supplier relationships and enhances operational efficiency, leading to smoother and more cost-effective operations.

Future trends in cost management

As businesses navigate an increasingly competitive landscape, adopting advanced technologies for cost management is crucial for maintaining efficiency and profitability. Emerging trends in cost management leverage cutting-edge innovations such as AI, cloud-based solutions, data analytics, and predictive modeling to drive smarter decision-making and optimize resources.

1. Integration of artificial intelligence

AI integration in cost management enables businesses to automate routine tasks, analyze financial data more effectively, and optimize spending patterns. Machine learning algorithms can identify cost-saving opportunities by processing large amounts of data and offering real-time insights.

AI tools can also predict cost trends, making it easier to plan and allocate resources efficiently. With its ability to enhance decision-making, AI is transforming traditional cost management approaches into smarter, data-driven solutions.

2. Cloud-based solutions

Cloud-based solutions are revolutionizing cost management by providing businesses with access to scalable and flexible tools that can be accessed remotely. These solutions allow for seamless collaboration, real-time tracking, and enhanced data security.

Businesses can manage costs across departments, monitor budgets, and generate reports without the need for on-premise infrastructure. The cloud also enables companies to integrate various cost management tools and platforms, ensuring a unified, efficient approach to financial management.

3. Data analytics & business intelligence

Data analytics and business intelligence tools are becoming vital in cost management by offering businesses insights into their financial performance. Through advanced data analysis, companies can uncover spending patterns, forecast expenses, and identify areas for cost optimization.

These tools allow for real-time monitoring, providing accurate financial reports and performance metrics that help businesses make more informed decisions. Data-driven cost management enables proactive approaches to cost control, enhancing long-term profitability.

4. Blockchain technology

Blockchain technology is gaining traction in cost management due to its ability to improve transparency and security in financial transactions. By creating immutable, decentralized ledgers, blockchain ensures that cost-related data is accurate and tamper-proof.

It also enhances traceability, allowing businesses to track every step of their spending and procurement processes. This technology can reduce fraud, improve supplier relationships, and streamline payment processes, ultimately driving cost efficiency and providing greater visibility into financial data.

5. Predictive cost modeling

Predictive cost modeling uses historical data and advanced algorithms to forecast future costs with greater accuracy. By analyzing patterns in spending, companies can predict potential expenses and allocate resources more effectively.

This approach helps businesses identify upcoming cost trends, allowing for better budget planning and financial strategy. Predictive modeling enables proactive cost management, reducing the risk of unexpected financial burdens and enhancing the overall financial health of the business.

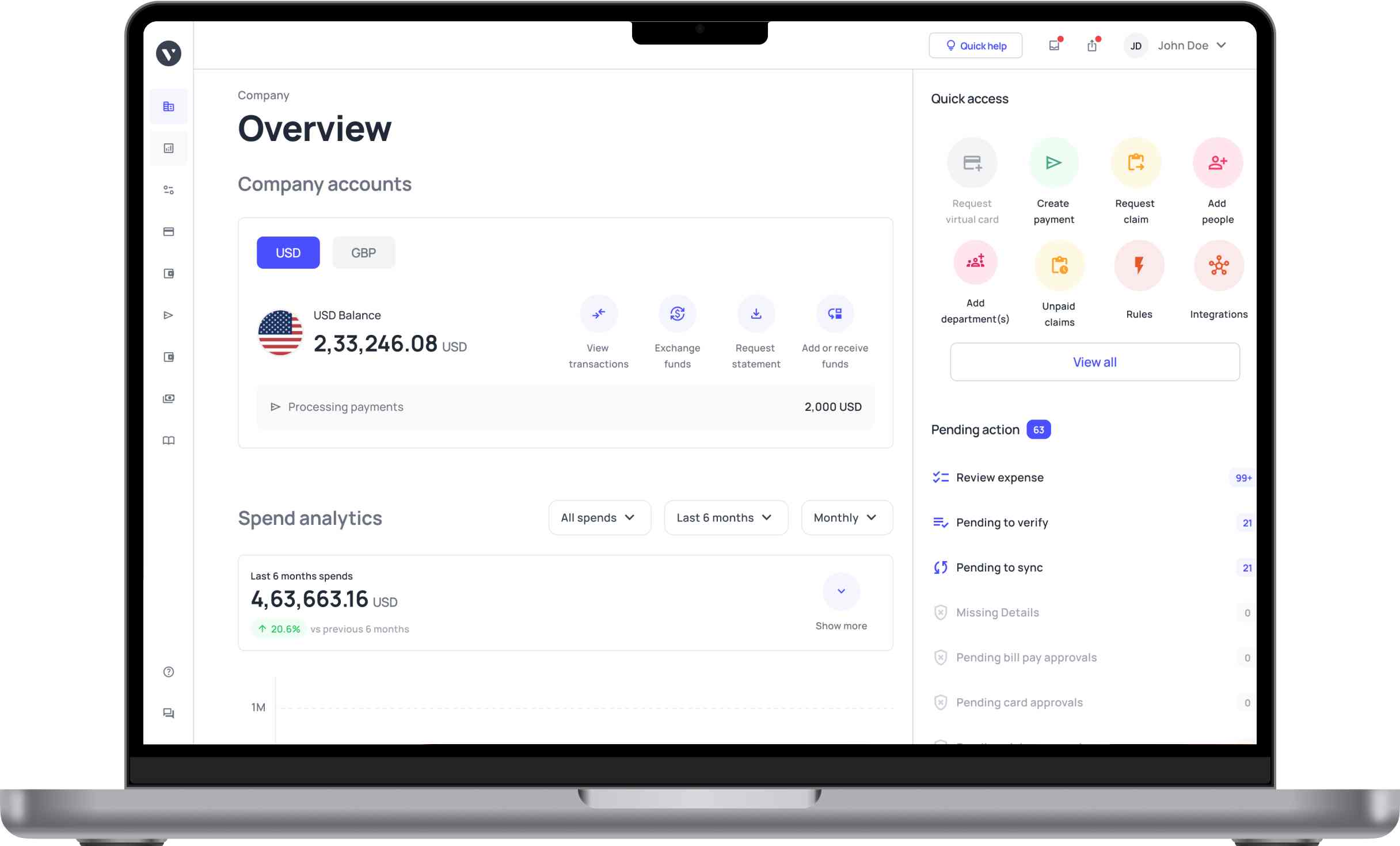

How does Volopay assist in efficient cost management for your business?

Volopay's unified accounting automation platform offers businesses a comprehensive solution to streamline, simplify and automate financial processes and reduce costs.

With features that automate expense tracking, reporting, and reconciliation, Volopay enhances visibility and control over company spending, ensuring optimal financial management and efficiency.

Real-time expense tracking

Volopay enables real-time expense tracking by providing businesses with instant updates on every transaction. This feature allows managers to monitor spending as it happens, providing greater visibility into cash flow.

With real-time data, businesses can make timely adjustments to stay within budget and prevent overspending. This ensures financial transparency and helps keep everyone on the same page when it comes to tracking company expenses. Moreover, it allows businesses to identify any discrepancies quickly, preventing costly mistakes.

Automated expense reporting

Volopay simplifies the reporting process by automatically generating detailed expense reports. This eliminates manual data entry and ensures accuracy in reporting, saving time for finance teams. Businesses can quickly access comprehensive reports, improving efficiency and enabling more informed decision-making.

The automated system also reduces human error, ensuring that reports are accurate and reliable. Additionally, Volopay's reporting software capabilities allow businesses to customize reports based on specific metrics, enhancing the ability to analyze spending patterns effectively.

Automated expense reconciliation

Volopay automates the reconciliation of expenses, reducing the workload for accounting teams. By matching expenses with company policies and transaction records, this feature ensures that all financial data is accurate and consistent.

Automation streamlines the process, reducing errors and saving valuable time. This also helps identify discrepancies between expected and actual expenses, enabling faster resolution. The reconciliation process is more efficient, freeing up time for accounting teams to focus on strategic tasks, thus improving overall financial management.

Customizable spend controls

Volopay provides customizable spend controls to ensure that businesses maintain strict oversight over company expenditures. Administrators can set limits, multi-level approval workflows, and usage policies for different departments and individuals.

This level of control helps prevent overspending and ensures that all expenses are within budgetary constraints. Customizable controls can be tailored to align with a company’s unique spending rules, making the system adaptable to a wide range of business models.

Vendor management system

Volopay’s vendor management system allows businesses to efficiently track and manage vendor relationships. By centralizing vendor data, companies can easily monitor payments, review terms, and ensure timely deliveries. This helps streamline procurement processes and maintain cost-effective supplier relationships.

Through this system, businesses can also gain better insights into vendor performance, identifying areas for improvement and fostering stronger collaborations. Furthermore, it provides the transparency needed to negotiate better terms and secure discounts, thus enhancing cost management.

Integration capabilities

Volopay integrates seamlessly with accounting softwares , ERP, and payment systems, ensuring smooth data flow across platforms. This integration reduces the need for manual data entry and minimizes the risk of errors.

It enables businesses to consolidate financial data and make informed decisions based on up-to-date information. These integrations allow teams to work with a unified data set, improving cross-departmental collaboration and financial analysis.

Automated cost allocation

Volopay automates cost allocation across departments, projects, or teams. This ensures that expenses are accurately categorized and distributed according to predefined rules.

Automating this process improves financial accuracy, enhances reporting efficiency, and allows businesses to allocate costs effectively for better budget management. The automation removes the guesswork and manual labor involved in cost distribution, reducing the chance of misallocated funds.

Detailed spend analytics

Volopay provides detailed spend analytics to help businesses analyze and optimize their financial performance. With insights into spending patterns, businesses can identify cost-saving opportunities, track budgets more accurately, and forecast future expenses.

This data-driven approach allows for more strategic decision-making and improved financial planning. The detailed reports also help businesses measure performance against set targets, making it easier to identify inefficiencies. By analyzing trends over time, businesses can take proactive measures to reduce costs and improve profitability.

FAQs

Employee engagement is crucial in cost management, as motivated employees are more likely to identify inefficiencies and contribute to cost-saving ideas. Engaged employees can also improve productivity, reducing unnecessary expenses.

Scenario analysis helps anticipate potential financial outcomes by evaluating different economic conditions. This enables businesses to adjust their cost management strategy accordingly, mitigating risks and optimizing financial decisions under various scenarios.

To integrate sustainability, businesses should consider long-term environmental and social costs alongside financial ones. This includes assessing energy consumption, waste management, and sustainable sourcing to ensure financial and environmental benefits align.

Cultural factors can impact decision-making processes, spending habits, and organizational priorities. Understanding these differences helps tailor cost management strategies to align with diverse cultural norms and improve operational efficiency in global teams.

In a remote work environment, cost management focuses more on digital tools, reducing physical office expenses. Additionally, remote work can lead to changes in resource allocation and communication processes to maintain cost control.

Encourage employees to regularly identify inefficiencies and suggest improvements. Offering rewards or recognition for innovative cost-saving ideas fosters a culture where continuous improvement is valued and integrated into everyday practices.

Track key performance indicators (KPIs) such as profit margins, cost savings, and return on investment. Monitoring these metrics over time helps assess the effectiveness of cost management strategies and informs future decisions.

Ethical cost management involves ensuring fairness in budgeting, avoiding cost-cutting that harms employees, and maintaining transparency in financial decisions. Ethical practices prioritize long-term sustainability over short-term savings and uphold corporate integrity.