Cost accounting: Meaning, process, and techniques

In today’s competitive business landscape, understanding every dollar that flows in and out of your company is crucial. That’s where cost accounting comes into play. Cost accounting is a financial strategy that helps you monitor, analyze, and control your costs, ensuring your operations are as efficient and profitable as possible.

Unlike financial accounting, which focuses on external reporting, cost accounting, which is an integral part of management accounting, offers in-depth internal insights into business expenses and operational efficiency. Mastering the cost accounting process helps businesses make data-driven decisions, increase profitability, and stay competitive in 2025 and beyond.

What is cost accounting?

Cost accounting is a systematic approach to recording, analyzing, and reporting all of the costs associated with the production of goods or services. It enables you to break down your expenses into specific categories, helping you understand where your money is going and how you can optimize your spending.

At its core, cost accounting is about improving cost efficiency and operational decision-making. When you adopt a strong cost accounting management system, you gain the ability to track direct costs like materials and labor, as well as indirect costs like overhead. This deep insight into your business’s financial health empowers you to set better pricing, manage budgets effectively, and drive strategic growth.

What is the importance of cost accounting for businesses?

Implementing a solid cost accounting process is one of the smartest financial moves your business can make. It gives you more than just a breakdown of expenses—it provides a framework for smarter decision-making, improved resource allocation, and sustainable growth.

Whether you're managing a small business or overseeing a large enterprise, cost accounting equips you with the tools to control costs, stay aligned with your goals, and boost profitability.

Analyzes potential investment options

One of the biggest advantages of cost accounting is how it helps you assess potential investments. When you’re considering launching a new product, entering a new market, or upgrading infrastructure, you need to understand the full cost implications.

Cost accounting allows you to perform cost-benefit analysis by comparing expected returns with the true costs involved. This ensures you’re making informed decisions based on actual data, not assumptions.

You can model different scenarios and identify which opportunities are likely to bring the highest return on investment with minimal risk.

Optimizes allocation of financial resources

Resources in any business are limited, whether it’s capital, labor, or time. Cost accounting helps you make the most of what you have.

By understanding the cost structure of every department, process, or product line, you can allocate your budget in a way that maximizes efficiency.

You’ll be able to redirect funds away from underperforming areas and invest more in revenue-generating or strategically important initiatives. This level of visibility is key to optimizing spending and reducing financial waste.

Identifies and evaluates financial risks

Financial decisions always come with a degree of risk. Cost accounting allows you to anticipate and mitigate those risks before they impact your bottom line.

For example, by monitoring cost variances and analyzing historical data, you can identify trends or problem areas that may signal inefficiencies or overspending.

You can also simulate the financial impact of potential changes in supplier costs, labor rates, or demand. This kind of proactive risk assessment helps you avoid surprises and keeps your business financially stable, even in times of uncertainty.

Enhances profitability and overall value

When you understand exactly where your money is going, you can make better decisions to increase your profit margins. Cost accounting breaks down your expenses into categories like direct costs, indirect costs, variable costs, and fixed costs.

With this insight, you can pinpoint where cost reductions are possible without sacrificing quality or performance. Reducing operational waste, negotiating better supplier contracts, and optimizing resource use all contribute to higher profitability.

Over time, this not only boosts your earnings but also enhances your company’s value in the eyes of investors and stakeholders.

Ensures alignment with strategic objectives

To execute your business strategy effectively, your financial planning needs to be aligned with your long-term objectives. Cost accounting supports this by connecting day-to-day financial data with big-picture goals.

Whether you’re targeting market expansion, digital transformation, or product innovation, cost accounting gives you the clarity to determine if your current spending supports those goals.

It also helps you measure whether ongoing initiatives are delivering expected outcomes, allowing you to pivot quickly when needed.

Maintains project spending within budget

Cost overruns can derail even the most promising projects. With cost accounting, you gain the ability to track project costs in real time, compare them against your budget, and adjust course when necessary. This prevents overspending and helps you stick to financial timelines.

For example, if you’re managing a product development project, cost accounting lets you monitor labor costs, material usage, and overhead, ensuring everything stays on track.

It also supports project forecasting and resource planning, so you can spot potential issues before they become costly problems.

Ensures growth and competitiveness

Growth requires control, and that’s exactly what cost accounting gives you. As your business scales, costs can easily spiral out of control if they’re not carefully managed. Cost accounting ensures that growth doesn’t come at the expense of profitability.

By continuously evaluating your cost structure and adjusting your strategy accordingly, you stay lean, efficient, and prepared to handle increased demand. In highly competitive industries, this can be a major advantage, allowing you to offer better pricing, respond quickly to market changes, and maintain strong margins.

Helps prioritize high ROI investments

Not all business investments are equal. Some bring higher returns, while others tie up capital with minimal benefit. Cost accounting helps you separate the two. By providing detailed data on the cost-effectiveness of each initiative it allows you to prioritize projects and expenses that deliver the most value.

For instance, you can evaluate whether investing in new technology, hiring additional staff, or expanding into a new region will yield a strong ROI. This data-driven prioritization ensures your business is consistently moving in the right direction financially.

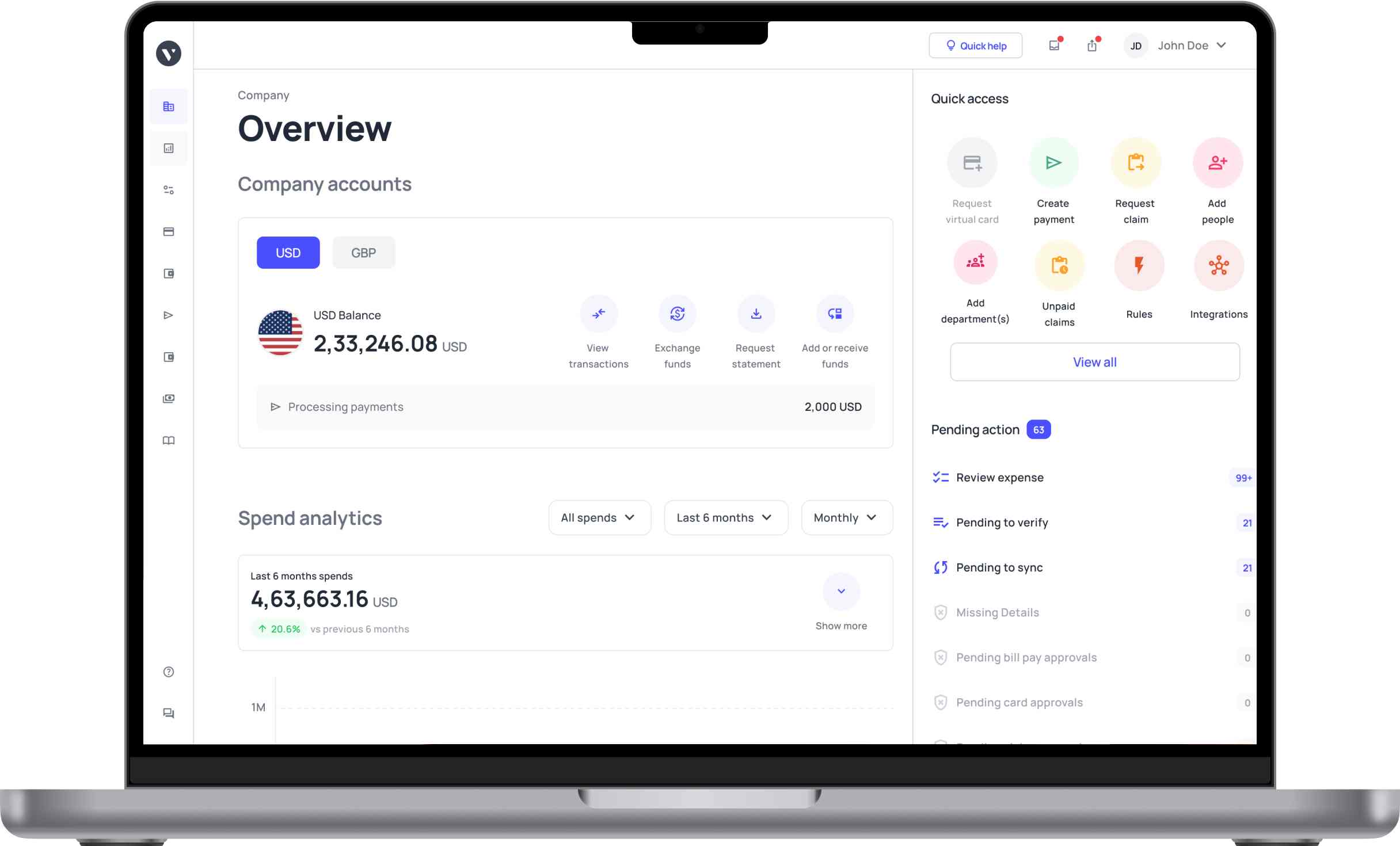

Take control of cost accounting with Volopay

What is the step-by-step process of cost accounting?

If you want to fully unlock the power of cost accounting management, you need to understand its step-by-step execution. Following a structured cost accounting process ensures you capture the right data, analyze it meaningfully, and use it to guide your financial decisions. Here’s a clear breakdown of how you can manage the process of cost accounting in your business.

1. Determine cost objects

The first step is to clearly define your cost objects. A cost object is anything for which you want to separately measure costs, such as a product, a service, a project, or a department.

By identifying your cost objects early, you make sure that every expense you track ties back to something meaningful for your business. This step lays the foundation for effective cost management and strategic financial planning.

2. Categorize different types of costs

Once you know your cost objects, the next move is to classify your costs. You’ll need to break them down into categories like direct costs (e.g., raw materials, labor directly tied to production) and indirect costs (e.g., rent, utilities).

Understanding whether costs are fixed, variable, or semi-variable is also critical. Proper classification ensures that you apply the right costing methods and get a true picture of your financial operations.

3. Document cost-related data

Accurate recording of cost data is at the heart of the cost accounting process. You’ll need to gather data from invoices, timesheets, purchase orders, and production logs, making sure all entries are consistent and up-to-date.

Using automated accounting software can streamline this step and reduce human error. The more accurate your cost data, the better your insights will be when it's time to analyze and make decisions.

4. Distribute indirect costs appropriately

Indirect costs can’t be directly tied to a single cost object, so you need to allocate them systematically. This usually involves applying allocation bases like machine hours, labor hours, or square footage.

Allocating indirect costs fairly is crucial to ensuring that each product or service reflects its true cost. Without careful allocation, you risk underpricing offerings or misjudging their profitability.

5. Evaluate how costs change with activity

Understanding how your costs behave is the next essential step. Cost behavior analysis means studying how costs change in response to variations in production volume, sales activity, or business operations.

You’ll look at which costs are fixed, which are variable, and how mixed costs behave under different conditions. This analysis gives you better forecasting capabilities and prepares you to adapt quickly in dynamic market conditions.

6. Generate detailed cost reports

With your data organized and analyzed, you can now prepare detailed cost reports. These reports summarize the findings of your cost accounting activities and offer actionable insights.

Examples include job cost sheets, production cost reports, and departmental cost summaries. Cost reports are vital for communicating financial realities to stakeholders and driving strategic actions based on real numbers rather than assumptions.

7. Forecast projected costs

Predicting future costs is an important part of proactive cost accounting management. You’ll use historical data and cost behavior analysis to forecast upcoming expenses for projects, product launches, or operational changes.

Estimating future costs helps you build more accurate budgets, set realistic financial goals, and prepare your business for different growth scenarios or economic shifts.

8. Compare projected vs. actual costs

Once operations are underway, you’ll want to compare actual costs against your budgeted or standard costs. This comparison helps you identify variances, understand why they occurred, and take corrective actions if necessary.

Monitoring these differences regularly strengthens your cost control efforts and ensures that your business remains financially disciplined over time.

9. Monitor and improve cost efficiency

The final step in the process of cost accounting is to actively manage and control costs to maintain efficiency. You’ll use the insights gained from previous steps to optimize operations, eliminate waste, and drive continuous improvement.

Setting cost control benchmarks and regularly reviewing performance will keep your business agile, competitive, and financially healthy in the long run.

What is the classification of costs in cost accounting?

Costs can be categorized in multiple ways to support better analysis and informed decision-making. Grasping these classifications is essential for efficient cost control and management.

Fixed costs

Fixed costs remain constant regardless of your production volume. These include rent, salaries, insurance, and other recurring expenses.

Even if your business doesn’t produce anything for a month, these costs still apply. Identifying fixed costs helps you forecast your baseline expenses and assess the profitability of scaling your operations.

Variable costs

Variable costs change based on output levels. The more you produce, the more you’ll spend on raw materials, packaging, or commissions. These costs are directly tied to your business activity.

Tracking variable costs helps you maintain pricing flexibility and ensures you're not overextending your resources when demand spikes.

Direct costs

Direct costs are those you can trace directly to a product, service, or project. This includes materials used in production and wages for labor directly involved in manufacturing.

Accurately allocating direct costs is essential for setting prices, calculating margins, and measuring the true cost of delivering value to your customers.

Indirect costs

Indirect costs—often referred to as overhead—can’t be traced to a specific product or activity. These include utilities, administrative salaries, and office supplies.

While they support your operations, they must be allocated carefully to cost objects to get an accurate view of overall expenses and ensure fair cost distribution.

Sunk costs

Sunk costs are past expenses that can’t be recovered. These might include R&D expenses, failed marketing campaigns, or equipment already purchased.

In cost accounting management, it’s crucial not to let sunk costs influence future decisions. Your focus should always be on marginal gains and future profitability, not unrecoverable losses.

Marginal costs

Marginal cost refers to the additional expense incurred by producing one more unit of a product. This includes extra materials, labor, or energy used.

Understanding marginal costs helps you decide whether scaling production makes financial sense, especially when analyzing break-even points and profit-maximizing output levels.

Opportunity costs

Opportunity cost is the potential benefit you miss out on when choosing one option over another. For example, investing in new machinery might mean foregoing a marketing campaign.

While it doesn't appear on financial statements, considering opportunity costs ensures your resources are always aligned with the most valuable outcomes.

Operating costs

Operating costs are the day-to-day expenses required to run your business. This includes wages, utilities, raw materials, maintenance, and shipping.

Tracking these costs is vital in the process of cost accounting because they directly impact your operating income and determine whether your core activities are profitable.

Non-operating expenses

Non-operating expenses are costs unrelated to your core operations. These include interest payments, foreign exchange losses, or lawsuit settlements.

While they don’t reflect operational efficiency, they still affect your overall financial health. Identifying them separately ensures that your core performance metrics remain accurate and actionable.

Transform your cost accounting with Volopay now!

What are some techniques of cost accounting?

Cost accounting techniques help businesses analyze, allocate, and control costs effectively. These methods support informed decision-making, enhance operational efficiency, and contribute to better financial planning and performance.

1. Job order costing

If your business deals in custom or project-based work, job order costing is an essential technique. It allows you to assign costs to specific jobs or orders rather than applying a blanket average.

You track every cost related to a particular job—materials, labor, and overhead—so you can measure profitability at a granular level. This method works especially well in industries like construction, marketing agencies, law firms, and printing.

By isolating job-specific data, you can evaluate which projects are profitable, spot cost overruns early, and generate more accurate quotes for future work.

2. Process costing

Process costing is used in industries where you produce large volumes of similar or identical items in continuous processes—think oil refining, food production, or textiles. Instead of tracking costs for individual units, you average the total cost across all units produced within a specific process or period.

This approach simplifies the cost accounting process when it’s impractical to assign separate costs to each unit. It helps you understand total production costs, set consistent pricing, and streamline cost tracking across repetitive workflows. It’s ideal if your focus is operational efficiency and production scale.

3. Activity-based costing (ABC)

Activity-Based Costing (ABC) digs deeper into what drives costs by analyzing specific business activities. Rather than allocating overhead using broad averages, you assign indirect costs based on actual resource consumption.

For example, machine setups, inspections, and customer service may all be cost drivers. ABC is useful when overhead costs are significant and traditional allocation methods distort product profitability.

It gives you a more accurate picture of cost behavior, helping you reduce inefficiencies, price products effectively, and allocate resources based on true activity-based needs.

4. Standard costing

Standard costing sets expected costs for materials, labor, and overhead in advance, then compares them to actual results to calculate variances. This method is particularly valuable for budgeting and performance evaluation.

You can track where you're overspending or where you're under budget and adjust operations accordingly. Standard costing is especially useful in manufacturing environments where production processes are stable and predictable.

It supports cost control, helps identify inefficiencies, and improves planning accuracy. Used correctly, it becomes a cornerstone of effective cost accounting management and internal performance monitoring.

5. Marginal costing

Marginal costing focuses on the additional cost incurred by producing one more unit of a product or service. It treats fixed costs as period expenses and includes only variable costs in product costing. This technique is highly beneficial for short-term decision-making, such as pricing, accepting special orders, or entering new markets.

It provides insight into the profitability of scaling production and highlights the break-even point. Marginal costing gives you flexibility and speed in decision-making, especially when analyzing how different levels of output affect profits in the short run.

6. Absorption costing

Absorption costing, also called full costing, includes all manufacturing costs—both fixed and variable—when calculating the cost of goods sold. This technique ensures every unit produced absorbs a portion of both direct and indirect production costs.

It’s required for external reporting under accounting standards like GAAP and IFRS. While it provides a comprehensive view of product costs, it may not reflect short-term profitability as accurately as marginal costing. Still, it’s a crucial method when you want a complete understanding of your product's cost structure and long-term pricing strategy.

7. Direct costing

Direct costing isolates only those expenses that are directly attributable to a product, service, or department, such as raw materials or direct labor. It excludes overhead and fixed costs, which are treated as period expenses.

This technique helps you focus on what’s immediately impacting the cost of goods sold. It's often used to assess the profitability of specific items or projects without the noise of indirect costs.

Direct costing is useful for quick comparisons and simplified reporting, especially in service-based businesses where overhead is hard to allocate precisely.

8. Variable costing

Variable costing considers only variable production costs, like materials and direct labor, when calculating product cost. Fixed manufacturing overhead is excluded from inventory valuation and, instead, is expensed in the period incurred.

This gives you a clearer view of contribution margins and helps with break-even analysis. Variable costing is ideal for internal reporting and decision-making, as it shows how profits are affected by changes in production volume.

It’s especially helpful for performance measurement, forecasting, and strategic planning in fast-paced or seasonal industries.

9. Contract costing

If your business handles long-term, large-scale contracts, such as in construction, shipbuilding, or government procurement, contract costing is essential. This technique tracks costs on a per-contract basis, covering materials, labor, equipment use, and indirect costs over extended timelines.

Payments are usually staged across project milestones, and profits are recognized proportionally. Contract costing helps ensure accurate billing, cost control, and profitability tracking over the life of a project. It also provides transparency and accountability, especially when managing multiple active contracts simultaneously.

Key formulas used in cost accounting

Mastering a few core formulas is essential if you want to make smart, data-backed financial decisions. These calculations simplify the cost accounting process by turning complex data into actionable insights.

Whether you're budgeting, pricing, or forecasting, these formulas help you stay in control of your costs and profitability.

Total Cost (TC)

● Meaning

Total cost is the complete expense incurred to produce a certain quantity of goods or services. It includes both fixed and variable costs. Understanding your total cost helps you price your products correctly and avoid underestimating expenses.

● Formula

Total Cost (TC) = Fixed costs + Variable costs

● Example

Let’s say your business has $20,000 in fixed monthly costs and $10 in variable costs per unit. If you produce 2,000 units, the total cost is:

TC = $20,000 + ($10 × 2,000) = $40,000

Cost of Goods Sold (COGS)

● Meaning

COGS refers to the direct costs involved in producing goods sold by your business. It includes material and labor costs but excludes indirect expenses like distribution or overhead. Calculating COGS is vital for determining gross profit and managing inventory.

● Formula

COGS = Opening inventory + Purchases during the period – Closing inventory

● Example

If your opening inventory is $15,000, you purchased $25,000 worth of materials, and your closing inventory is $10,000, then:

COGS = $15,000 + $25,000 – $10,000 = $30,000

Break-even Point (BEP)

● Meaning

The break-even point is the number of units you must sell to cover all your costs, both fixed and variable. At this point, your profit is zero. It’s a crucial tool for evaluating risk, setting sales targets, and planning for profitability.

● Formula

Break-Even Point (Units) = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

● Example

Assume your fixed costs are $50,000, your selling price per unit is $25, and your variable cost per unit is $10. Then:

BEP = $50,000 ÷ ($25 – $10) = 3,333 units

Contribution Margin Ratio (CMR)

● Meaning

The Contribution Margin Ratio (CMR) shows the percentage of each sales dollar available to cover fixed costs and contribute to profit. It's a key metric for assessing profitability and managing the cost accounting process effectively.

● Formula

Contribution Margin Ratio = (Sales – Variable Costs) ÷ Sales × 100

● Example

If you have sales of $100,000 and variable costs of $60,000:

CMR = ($100,000 – $60,000) ÷ $100,000 × 100 = 40%

Operating Profit (EBIT)

● Meaning

Operating profit, also known as Earnings Before Interest and Taxes (EBIT), measures the profit a company generates from its core operations. It excludes interest and tax expenses, giving you a clear view of operational efficiency.

● Formula

Operating Profit (EBIT) = Revenue – Operating Expenses

● Example

If your revenue is $500,000 and operating expenses (including COGS, salaries, rent, etc.) are $350,000:

EBIT = $500,000 – $350,000 = $150,000

Net Profit (NP)

● Meaning

Net profit is the final amount of income you retain after all expenses, including operating costs, interest, and taxes, are deducted. It's a key indicator of your company’s overall financial health and success.

● Formula

Net Profit = Total Revenue – Total Expenses

● Example

If your total revenue is $600,000 and your total expenses (including taxes and interest) amount to $520,000:

Net Profit = $600,000 – $520,000 = $80,000

Cost-Volume-Profit (CVP) Analysis

● Meaning

Cost-Volume-Profit (CVP) analysis helps you understand how changes in cost and sales volume impact your profit. It's a crucial tool for making pricing decisions, determining the break-even point, and evaluating profitability under different scenarios.

● Formula

CVP Analysis: Profit = (Selling Price per Unit × Quantity) – (Variable Costs per Unit × Quantity) – Fixed Costs

● Example

If you sell a product for $50, your variable cost is $30 per unit, and you have fixed costs of $40,000, the formula would look like:

Profit = ($50 × 1,000) – ($30 × 1,000) – $40,000 = $10,000

Overhead Rate (OR)

● Meaning

The overhead rate is the rate at which you allocate overhead costs to cost objects, such as products or services. It helps you distribute indirect costs (like utilities, salaries, and rent) more accurately across your operations.

● Formula

Overhead Rate = Total Overhead Costs ÷ Total Direct Labor Hours (or Machine Hours)

● Example

If your total overhead costs are $60,000 and you have 2,000 direct labor hours, the overhead rate would be:

Overhead Rate = $60,000 ÷ 2,000 = $30 per direct labor hour

Boost efficiency with accounting automation

Key factors influencing the cost accounting process

Multiple factors impact the cost accounting process, often in intricate ways. To remain effective, cost accounting systems must be adaptable and responsive to both internal and external changes.

1. Production volume

Production volume is a critical factor in the cost accounting process, as it influences how costs are distributed across each unit of production.

Higher production volumes typically result in lower per-unit costs due to economies of scale, where fixed costs such as rent and machinery depreciation are spread over a larger number of units.

Conversely, lower production volumes lead to higher per-unit fixed costs. Additionally, as production volume fluctuates, variable costs such as raw materials and labor change accordingly.

Accurate forecasting of production volume helps businesses plan more effectively, manage capacity, and optimize cost allocation to improve profitability.

2. Cost structure

A business’s cost structure—the proportion of fixed and variable costs—determines how costs behave as production levels change.

Fixed costs, such as rent and salaries, remain the same regardless of the amount of output, while variable costs, such as materials and direct labor, vary directly with production volume. This distinction is crucial in cost accounting because it impacts how costs are allocated and controlled.

For instance, businesses with a high proportion of fixed costs may need to focus on increasing sales volume to cover their overhead, while those with more variable costs may have greater flexibility in adjusting production levels without significantly affecting costs.

3. Economic conditions

Economic conditions have a significant impact on the cost accounting process because they affect both the cost of materials and labor. For example, during periods of inflation, the cost of raw materials and wages typically rise, directly influencing your production costs.

Conversely, during recessions or economic slowdowns, demand may decrease, leading to cost-cutting measures or reduced prices to remain competitive. Businesses must adjust their cost accounting systems to reflect these changes, whether it’s by incorporating new cost projections, revising pricing strategies, or adjusting cost controls.

Understanding the economic environment allows for more accurate forecasting and better decision-making in both good and bad economic times.

4. Business strategy

The business strategy a company adopts significantly affects its cost accounting process. For example, a company pursuing a cost leadership strategy will focus on reducing costs across operations, using cost accounting to identify areas where efficiencies can be improved.

In contrast, a differentiation strategy may involve higher production costs but aims to offer unique products with added value. Depending on the strategy, cost allocation methods may be adjusted to ensure that costs are in line with the overall business goals.

If the strategy involves expanding into new markets or launching new products, cost accounting helps manage and forecast additional costs to maintain profitability.

5. Technological advancements

Technological advancements can dramatically change how costs are tracked and managed in the cost accounting process. New technologies, such as automated systems, machine learning, and accounting software, allow businesses to streamline their cost recording, reduce errors, and provide real-time data.

For instance, automation can reduce labor costs and improve efficiency, while advanced software can provide more accurate insights into cost structures and profitability. These improvements make it easier to track overhead costs, allocate indirect expenses, and make data-driven decisions.

Embracing technology helps reduce manual labor and improves the accuracy of financial reporting, which in turn optimizes the overall cost accounting management process.

6. Market competition

Market competition forces businesses to regularly evaluate and adjust their cost accounting management practices. Companies need to ensure that their costs are competitive enough to offer value while maintaining profitability.

For example, in a highly competitive market, businesses might need to reduce their unit costs by optimizing production or cutting unnecessary overheads. Understanding competitors' cost structures through benchmarking can offer valuable insights, enabling businesses to identify areas where they can reduce expenses or improve operational efficiency.

Cost accounting helps businesses assess their cost structure, identify inefficiencies, and adjust prices or strategies to remain competitive in the marketplace.

7. Regulatory requirements

Regulatory requirements can significantly impact the cost accounting process because they influence how costs must be recorded, reported, and disclosed.

For example, changes in tax laws or financial reporting standards (like GAAP or IFRS) may require adjustments to how certain costs are classified or how they must be reported in financial statements.

Regulations can also impact how businesses handle indirect costs such as environmental costs, employee benefits, and pensions. Staying compliant with these regulations is critical to avoid penalties and maintain financial transparency. Therefore, businesses must regularly update their cost accounting systems to align with current legal and regulatory standards.

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute professional legal or financial advice.

8. Labor costs

Labor costs are often one of the largest components in a business's cost structure, especially in service-oriented industries. Fluctuations in wages, benefits, or workforce size can dramatically affect overall production costs.

Accurate tracking of labor costs in the cost accounting process helps ensure that businesses can forecast payroll expenses, evaluate the efficiency of labor usage, and identify areas where labor costs may be reduced or optimized.

For example, businesses might decide to invest in training to increase productivity or introduce flexible work arrangements to control labor expenses. Understanding labor costs helps businesses improve efficiency, manage workforce demand, and keep costs in check.

9. Material costs

Material costs—such as raw materials, components, or inventory—are a major part of production costs in manufacturing businesses. These costs can fluctuate due to market conditions, supply chain issues, or changes in demand.

As material costs rise or fall, they directly impact the cost accounting process. For instance, businesses must constantly monitor material costs to make adjustments to pricing strategies, negotiate with suppliers, or find alternative materials that may be more cost-effective.

Effective tracking and management of material costs are essential for maintaining profitability, especially in industries with high material consumption. Accurate cost forecasting helps prevent stockouts, minimize waste, and optimize inventory.

10. Management decisions

Management decisions have a profound effect on the cost accounting process. Decisions regarding capital investments, production scale, outsourcing, and cost-cutting measures directly influence a company’s cost structure.

For instance, a decision to expand into a new market may lead to higher initial costs, but proper cost accounting management will help track and allocate these expenses for optimal financial planning.

Similarly, the decision to outsource a certain function might result in cost savings by reducing overhead and improving efficiency. With detailed and timely cost accounting, management can ensure that all decisions are backed by data, helping to manage costs and align them with strategic objectives.

Cost accounting vs financial accounting: Key differences

Cost accounting and financial accounting are two key disciplines in business finance, each serving different functions. While both track financial data, they differ in their purpose, users, time frame, and decision-making support.

Understanding these distinctions is essential for making informed financial decisions and managing a business effectively.

1. Purpose

● Cost accounting

Cost accounting focuses on tracking and analyzing costs related to production, operations, and overhead. It helps businesses understand where and how they are spending money to improve profitability and efficiency. The goal is to provide detailed cost data for internal management purposes.

● Financial accounting

Financial accounting is designed to track a company’s overall financial performance and create standardized reports for external stakeholders, such as investors, regulators, and creditors. The goal is to present an accurate and transparent picture of a company's financial position over time.

2. Users

● Cost accounting

The primary users of cost accounting are internal managers and decision-makers. It provides data needed for budgeting, cost control, and operational decisions. Managers use cost accounting information to improve operational efficiency and maximize profit margins.

● Financial accounting

Financial accounting is intended for external users, including investors, creditors, regulators, and tax authorities. These users rely on financial statements, such as balance sheets and income statements, to evaluate a company’s financial health and make informed investment or lending decisions.

3. Time frame

● Cost accounting

Cost accounting operates on a more frequent and shorter-term basis. It provides real-time or monthly data on costs, allowing businesses to make adjustments quickly. The time frame can be daily, weekly, or monthly, depending on the company’s needs.

● Financial accounting

Financial accounting works on an annual or quarterly basis, providing reports for a fixed period, typically for the fiscal year. These reports summarize the company’s performance over a longer term, showing trends and outcomes from the previous period.

4. Reporting

● Cost accounting

Cost accounting generates detailed reports on specific aspects of a business, such as cost of production, overhead costs, and operational expenses. These reports are typically internal and used by management to track and control costs effectively.

● Financial accounting

Financial accounting results in formal financial statements, such as the income statement, balance sheet, and cash flow statement. These reports are standardized, summarized, and used to assess the overall financial performance of a company.

5. Decision-making

● Cost accounting

Cost accounting directly aids in short-term decision-making. Managers use the data to make day-to-day operational decisions, such as pricing strategies, production methods, and cost-cutting measures to improve efficiency.

● Financial accounting

Financial accounting supports long-term strategic decision-making. It provides the information needed for investors, stakeholders, and top-level management to evaluate a company’s profitability, financial health, and future growth potential.

6. Inventory valuation

● Cost accounting

In cost accounting, inventory valuation is based on specific costing methods, such as FIFO (First In, First Out), LIFO (Last In, First Out), or weighted average cost. This helps determine the direct costs of inventory and their impact on overall profitability.

● Financial accounting

Financial accounting requires inventory to be valued based on a consistent method that aligns with financial reporting standards. Generally, businesses must choose one method (e.g., FIFO, LIFO) and apply it consistently for reporting on financial statements.

7. Cost classification

● Cost accounting

Cost accounting involves detailed classification of costs, which includes direct costs (like raw materials and labor) and indirect costs (like utilities and rent). This helps businesses analyze specific areas of production and allocate costs effectively.

● Financial accounting

In financial accounting, costs are classified based on financial reporting standards, categorizing them as operating costs, non-operating costs, or extraordinary items. The aim is to present a holistic view of the company’s financial position rather than granular insights into cost structure.

8. Regulations

● Cost accounting

Cost accounting is not bound by external regulations or standardized guidelines, giving companies flexibility in how they classify, track, and report costs. However, internal consistency and transparency are essential for internal decision-making.

● Financial accounting

Financial accounting must comply with regulatory frameworks, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These regulations ensure consistency, transparency, and comparability across financial reports.

9. Scope

● Cost accounting

The scope of cost accounting is narrower and focused on internal management. It provides in-depth information on specific costs like production costs, labor costs, and overheads to help improve operational efficiency and profitability.

● Financial accounting

Financial accounting has a broader scope, summarizing the financial performance of the entire business over a set period. It is used to communicate the company’s overall financial condition to external parties, such as investors and regulators.

10. Examples

● Cost accounting

An example of cost accounting would be calculating the cost per unit of a product, including raw materials, labor, and overhead costs. This data helps managers adjust production schedules and pricing strategies to improve profitability.

● Financial accounting

An example of financial accounting would be the creation of a balance sheet that summarizes a company’s assets, liabilities, and equity at the end of the fiscal year. This report is used by investors and creditors to assess the company's financial stability and risk.

Effortlessly manage costs with Volopay’s solutions

What challenges arise in the cost accounting process?

Inaccurate data collection

Accurate data collection is crucial in the cost accounting process, yet it remains a significant challenge.

Businesses often face issues like incomplete or inconsistent data, human errors in data entry, or delays in collecting necessary information. Without precise data, it's impossible to allocate costs correctly, making cost management less reliable.

Indirect cost allocation

Allocating indirect costs, such as administrative expenses, rent, and utilities, can be complex. These costs don't directly correlate with specific products or services, making it difficult to assign them accurately to cost objects.

Without a proper method for cost allocation, businesses may struggle to understand true production costs and profitability.

Cost structure fluctuations

Cost structures can fluctuate due to various factors like market changes, supplier prices, or production volume. Businesses may face difficulties in adjusting their cost accounting systems to reflect these fluctuations.

Inaccurate cost allocations caused by these changes can lead to misleading financial reports, affecting decision-making and profitability.

Future cost forecasting

Accurately forecasting future costs is challenging due to unpredictable variables such as raw material price hikes, labor wage increases, and changes in demand.

Without reliable forecasting, businesses risk underestimating future expenses, leading to budgetary shortfalls or missed opportunities to adjust strategies before financial pressures arise.

Method change resistance

Introducing new cost accounting methods or software can meet resistance from employees or management, especially if they are accustomed to traditional processes.

Overcoming this resistance requires training, support, and clear communication about the benefits of adopting more accurate, efficient, or comprehensive accounting methods to improve cost tracking and reporting.

Inconsistent department reporting

In large organizations, different departments may use different methods for recording costs, leading to inconsistencies.

Disparate data collection systems or a lack of standardized procedures make it difficult to get a unified, accurate picture of the overall costs. This inconsistency can result in inaccurate financial reports and hinder effective decision-making.

Outdated costing systems

Many businesses still rely on outdated or inefficient cost accounting systems, which are unable to handle complex data or scale with the company’s growth.

These legacy systems may require manual intervention or lack integration with other business functions, leading to increased costs, inefficiency, and potential for errors in cost allocation.

How to tackle these challenges in the cost accounting process?

Automate data collection

Automating the data collection process can greatly reduce errors and inefficiencies in cost accounting.

By using software or integrated tools that automatically gather and record data, businesses can ensure accuracy, consistency, and timeliness. Automation reduces manual intervention, streamlines processes, and frees up resources for more strategic tasks.

Implement activity-based costing (ABC)

Activity-Based Costing (ABC) helps in overcoming the complexity of allocating indirect costs. By linking costs to specific activities or processes, ABC provides a more accurate view of resource consumption.

This method helps businesses allocate overhead costs based on actual activity rather than arbitrary allocations, improving cost control and decision-making.

Adapt to cost changes

Frequent fluctuations in cost structures require constant monitoring of market conditions, such as changes in raw material prices, labor costs, and competition.

By staying updated on market trends and adapting cost structures accordingly, businesses can adjust their cost accounting processes to reflect changes, ensuring more accurate financial reporting.

Leverage predictive analytics

Leveraging predictive analytics can significantly improve the ability to forecast future costs. By analyzing historical data and identifying patterns, predictive models can provide more reliable projections for costs like raw materials, labor, and overhead.

This foresight allows businesses to plan better and mitigate the risk of unforeseen expenses.

Strengthen training programs

Resistance to new cost accounting methods can be minimized through effective training and change management initiatives. Providing employees with the necessary skills and knowledge ensures a smooth transition when adopting new systems or methodologies.

Communicating the benefits of new tools and involving key stakeholders in the change process fosters acceptance and reduces friction.

Unify reporting standards

Inconsistent reporting across departments can be addressed by standardizing cost accounting procedures and templates. Establishing uniform guidelines for recording and reporting costs helps ensure accuracy and comparability across all departments.

This consistency allows for better consolidation of data, leading to more reliable financial insights and smoother internal decision-making.

Modernize accounting systems

Upgrading to modern, automated accounting systems can significantly enhance the accuracy and efficiency of cost tracking. New software solutions can integrate various business functions, streamline data entry, and reduce human error.

These systems allow for real-time reporting, improved cost allocation, and better scalability as the business grows.

Make cost accounting seamless with Volopay today

Why choose automated accounting software to simplify cost accounting?

Automated accounting software provides businesses with the tools they need to streamline cost accounting processes.

By automating key tasks, companies can improve accuracy, save time, and gain better insights into their financials, all of which contribute to more efficient and effective decision-making.

Enhances accuracy and minimizes errors

Automated accounting software minimizes human error by automatically recording and categorizing data, ensuring accuracy in cost tracking. With fewer manual inputs, there’s less chance for misclassification or mistakes in cost allocation, leading to more reliable financial reporting.

Reduces time spent on manual tasks

Manual cost accounting processes, such as data entry and reconciliations, can be time-consuming and prone to error.

Automated software streamlines these tasks, allowing your team to focus on more strategic activities. This reduces the time spent on routine tasks and enhances productivity across the finance department.

Delivers real-time financial insights

Automated accounting systems offer real-time tracking of costs and financial metrics, allowing you to make informed decisions instantly.

With up-to-date data, you can monitor expenses, revenue, and profit margins on the fly, giving you a clearer understanding of your business's financial health at any given moment.

Scales easily with business growth

As your business expands, so do your accounting needs. Automated software scales with your business, handling increased transaction volumes, cost centers, and complexity without the need for manual adjustments. This ensures that your accounting processes remain efficient and accurate as your business grows.

Supports better decisions with detailed reports

Automated software generates detailed reports that provide deeper insights into cost structures, margins, and performance.

These reports allow you to analyze data from different angles and make more informed, data-driven decisions to improve operational efficiency and profitability.

Maintains compliance with accounting standards

Staying compliant with accounting standards and regulations is crucial. Automated accounting software is designed to adhere to the latest industry regulations and ensure your cost accounting processes are aligned with legal requirements, reducing the risk of penalties or compliance issues.

Seamlessly integrates with other systems

Automated accounting software often integrates seamlessly with other business systems, such as ERP, CRM, and inventory management tools.

This integration ensures that cost accounting data flows seamlessly across departments, eliminating silos and ensuring consistency across your business operations.

Simplifies audits and record keeping

Audits can be time-consuming and complex, but automated accounting software simplifies this process.

With all cost accounting data stored digitally and organized in one place, retrieving records for audits becomes quick and easy, making the audit process smoother and less disruptive.

Automates operational cost tracking

Automated software can track operational costs in real time, ensuring that all expenses are captured accurately and promptly. This automation helps prevent missed costs, improves budgeting accuracy, and gives you a clearer picture of where money is being spent across different areas of your business.

Factors to consider before choosing an automated accounting solution

Carefully consider these factors to choose an automated accounting solution that best meets the unique needs of your business and helps you achieve your financial goals.

1. User access and permission controls

It’s essential to choose an accounting solution with robust user access controls. This ensures that sensitive financial data is only accessible to authorized individuals.

Role-based permissions allow you to assign different access levels to various users, improving data security and preventing unauthorized changes to financial records.

2. System integration capabilities

The accounting software should integrate seamlessly with other business systems, such as CRM, ERP, payroll, and inventory management tools.

Integration eliminates the need for duplicate data entry and ensures that financial data is consistent across all platforms, improving efficiency and reducing the risk of errors.

3. Scalability and adaptability

As your business grows, your accounting needs will evolve. Choose a solution that can scale with your business, accommodating increased transaction volumes, users, and complexity.

The software should be flexible enough to adapt to changing business requirements, such as new accounting standards or business processes.

4. Support for multiple currencies

If your business operates internationally, multi-currency support is a critical feature. This allows you to handle transactions in different currencies, automate conversions, and generate financial reports that reflect currency fluctuations.

Multi-currency support ensures accurate accounting and reporting across different regions.

5. Mobile and cloud accessibility

Cloud-based accounting software allows for real-time access from anywhere, providing flexibility and convenience.

Mobile access is particularly valuable for business owners or managers who need to monitor financial data on the go. This feature ensures that you can stay connected to your business’s financial status at all times.

6. Customization options

Customization capabilities enable you to tailor the accounting software to your specific business needs.

Whether it’s customizing financial reports, workflows, or user interfaces, having this flexibility allows the system to align with your business processes, improving both efficiency and user experience.

7. Automated tax compliance and calculation

Tax calculation is a crucial feature, especially for businesses in regions with complex tax laws. An automated accounting solution should have built-in tools for tax calculation, reporting, and compliance, ensuring that your business meets all local, state, or international tax regulations, reducing the risk of penalties or errors.

8. Advanced reporting and analytics

The ability to generate detailed reports and perform financial analysis is essential for effective decision-making.

Look for software that provides comprehensive reporting and advanced analytics tools, allowing you to track key performance indicators (KPIs), manage costs, and gain insights into profitability, cash flow, and other financial metrics.

9. Customer feedback and ratings

Customer reviews and testimonials can provide valuable insights into the reliability and user experience of the software.

Researching user feedback helps you understand the software’s strengths, weaknesses, and customer support quality. Look for reviews from businesses similar to yours to ensure the software meets your needs.

10. Comprehensive audit trail and record management

An audit trail feature tracks every change made within the system, including data edits, user actions, and report generations. This is vital for ensuring transparency, improving accountability, and simplifying audits.

A comprehensive record-keeping system guarantees that you maintain a clear, organized history of all financial transactions.

Automate your accounting and reduce errors

Revolutionize cost accounting with Volopay’s automated accounting software

Volopay’s automated accounting platform helps businesses streamline their cost accounting processes, providing time-saving features, enhanced accuracy, and seamless integration with other systems.

With Volopay, you can manage your expenses and financial workflows effortlessly, allowing you to focus on growth and strategic decision-making.

Save time with automation

Volopay automates transactions, reducing the need for manual entries and improving efficiency. This means less time spent on repetitive tasks like recording payments, processing invoices, and managing transactions, allowing your team to focus on higher-value activities that drive business growth.

Improve accuracy using triggers

Smart triggers in Volopay ensure that all transactions are automatically captured and categorized correctly based on predefined rules.

This reduces the risk of human error, improves accuracy in cost allocation, and guarantees that your financial data is consistently reliable, saving time on corrections.

Enable fast accounting integration

Volopay integrates easily with your existing accounting tools, ERP systems, and other business platforms.

Volopay's seamless integrations ensure that your cost accounting processes remain uninterrupted, enabling smooth data flows between systems and eliminating manual data entry, reducing the chances of inconsistencies and errors.

Auto-sync receipts and transactions

With Volopay, all transactions and receipts are automatically synced with your accounting system in real time. This eliminates the need for manual entry of receipts, ensuring that all expenses are accurately tracked and updated without delay, leading to more efficient expense management.

Automatic expense categorization system

Volopay automatically categorizes and classifies expenses based on your preset rules, reducing the effort required to sort out transactions manually. This feature ensures that your cost accounting system remains organized and accurate, improving financial reporting and making it easier to track and analyze expenses.

Easily export prepared expenses

Volopay makes it easy to prepare and export expenses with just a few clicks. Whether you need to generate detailed reports for internal analysis or export data for compliance purposes, Volopay simplifies the process, ensuring that all expenses are organized and readily accessible when you need them.

Optimize financial workflows across platforms

Volopay connects with multiple business platforms, enabling you to streamline your financial workflows across various tools.

This integration eliminates the need for manual updates and ensures that all financial data is consistent and synchronized, improving efficiency and ensuring a seamless accounting process.

Unlock smarter cost accounting with Volopay

FAQs

Cost drivers are factors that influence costs, such as production volume or labor. Identifying them helps allocate costs more accurately and manage expenses more effectively.

Variances show the difference between expected and actual costs. Large variances can signal inefficiencies or unexpected issues, impacting profitability and highlighting areas that need improvement or attention.

Cost accounting helps track variable and fixed costs, enabling businesses to identify areas where cost-cutting measures can be implemented without affecting product quality during slowdowns.

Cost accounting adjusts for seasonality by analyzing historical data, allocating variable costs, and forecasting demand to ensure that cost structures reflect seasonal variations in production or sales cycles.

Sunk costs are past expenses that cannot be recovered. In decision-making, cost accounting disregards sunk costs to focus on future costs and benefits that impact current decisions.

Volopay’s automatic categorization streamlines the allocation of overhead costs, ensuring accurate expense tracking and improved cost visibility. This reduces manual errors and helps businesses manage their overhead effectively.

Volopay provides detailed expense tracking for each project, helping businesses allocate costs accurately. Its integration with financial systems ensures that project budgets and expenses are aligned for better cost management.

Volopay’s multi-user access allows different departments to manage and track their specific costs while ensuring overall transparency. This promotes accurate cost allocation and easier coordination across the business.