What is a comparative balance sheet? Layout, formula and techniques

A comparative balance sheet is a vital tool for evaluating your business’s financial health over different periods. By placing two or more balance sheets side by side, you can identify trends, spot red flags, and assess growth or decline across assets, liabilities, and equity.

For US-based businesses focused on expansion, strategic planning, or regulatory compliance, this technique offers clear insights into financial progress. This guide walks you through the comparative balance sheet formula and techniques, helping you interpret numbers with confidence.

Whether you're analyzing the comparative balance sheet of any company or preparing your own, mastering the comparative statement of balance sheet is essential.

Understanding the basics of a comparative balance sheet

1. What is a comparative balance sheet?

A comparative balance sheet displays your company’s financial information from two or more periods side by side. This layout allows you to track changes over time, revealing trends in financial health. It compares assets, liabilities, and equity, helping you measure growth, performance, and areas of concern.

Whether used monthly, quarterly, or annually, the comparative balance sheet enables informed decision-making by making fluctuations clearly visible, offering a structured approach to financial review beyond a single snapshot in time.

2. Core elements you need to know

The key components of a comparative balance sheet include assets, liabilities, and shareholders' equity. Assets show what your company owns, such as cash, inventory, and equipment. Liabilities highlight obligations like loans or accounts payable. Equity represents ownership interest, including retained earnings and capital contributions.

These elements are presented across periods to analyze changes and trends. A well-prepared comparative statement of balance sheet helps uncover operational improvements, funding shifts, or risk exposure, giving context to numbers rather than just reporting them.

3. How it provides a dynamic financial overview

Unlike a traditional single-period balance sheet, a comparative version reflects ongoing business activity. It highlights period-over-period movement, showing how values change rather than offering static data. This dynamic view helps assess the effectiveness of business strategies and financial decisions.

Through clear side-by-side comparisons, you can better evaluate liquidity, solvency, and profitability. When paired with the comparative balance sheet formula, it becomes a powerful tool for forecasting and performance measurement, making your financial analysis more forward-thinking and insightful.

4. Historical context in financial reporting

Comparative balance sheets have grown in relevance as accounting standards increasingly favor transparency and detailed reporting. Over time, stakeholders demanded more meaningful data to understand a company’s financial direction. What began as a basic reporting tool evolved into a standard practice among publicly traded and private companies alike.

Today, even small businesses adopt this model for clearer insights. Whether reviewing a startup’s early performance or the comparative balance sheet of any company, this method adds depth to historical financial analysis.

5. How it supports business transparency

Transparency in financial reporting is critical to building trust with investors, lenders, and internal stakeholders. A comparative balance sheet supports this by clearly displaying how financial elements have changed over time. It reveals both progress and setbacks, allowing leadership to explain results with clarity.

It also supports compliance with accounting standards and regulatory expectations. By offering structured comparisons, this report format increases accountability and minimizes ambiguity, helping businesses present themselves credibly and confidently to external audiences.

Why a comparative balance sheet matters to your business

1. Tracking financial health over time

A comparative balance sheet allows you to monitor your company’s financial health by presenting figures from different periods side by side. This approach highlights changes in assets, liabilities, and equity, helping you understand whether your business is gaining or losing stability.

It serves as an early warning system, identifying patterns that may require strategic adjustments for sustained growth. With timely insights, you can take action before issues escalate.

2. Identifying growth opportunities

By examining fluctuations in revenue, expenses, or asset investments, a comparative balance sheet reveals where your business has room to grow. It helps uncover inefficiencies or underperforming areas while pointing to trends that could signal potential for expansion.

This insight allows you to fine-tune operations and allocate resources more effectively for long-term success. Recognizing these patterns early can position your company for a competitive advantage.

3. Supporting strategic planning in the US

Navigating the competitive and regulatory landscape in the US requires precise financial insight. A comparative balance sheet offers that by aligning historical data with current performance. It aids in developing strategies that comply with U.S. financial standards and market expectations.

Applying the comparative balance sheet formula ensures decisions are grounded in factual data. This minimizes risk while supporting sustainable growth.

4. Enhancing accountability with stakeholders

Investors, partners, and lenders need assurance that your business is financially sound. A comparative balance sheet provides that confidence by clearly showing financial trends and performance shifts over time.

This transparency builds trust, supports funding discussions, and reinforces your commitment to financial responsibility and open reporting standards. When stakeholders see consistency and clarity, they are more likely to invest or collaborate.

5. Aligning with long-term business goals

Long-term goals require measurable progress. A comparative balance sheet helps track this progress by mapping changes across fiscal periods. Whether you're pursuing expansion, reducing debt, or improving equity, this tool aligns your current performance with future targets.

Reviewing the comparative balance sheet of any company also offers benchmarks to shape your strategy. It keeps your business focused and financially disciplined.

Building a comparative balance sheet: A step-by-step guide

Collecting data across financial periods

Start by gathering complete balance sheet data for at least two comparable periods—monthly, quarterly, or yearly—depending on your analysis needs. Pull figures for all key categories: assets, liabilities, and equity. Use consistent cutoff dates to maintain accuracy.

Ensure data comes from verified sources such as trial balances or accounting software. Having clean and complete data sets is the foundation for a reliable comparative balance sheet and helps ensure meaningful insights during the review process.

Structuring your comparative balance sheet

Organize the collected data into a clear, column-based format, with each period represented side by side. Begin with listing assets, followed by liabilities, then equity—mirroring the standard layout of a single-period balance sheet. Label columns clearly with the financial period (e.g., FY 2023, FY 2024).

This structured approach enhances readability and comparison. When creating a comparative statement of balance sheet, clarity in format ensures accurate interpretation of financial shifts over time by different users.

Calculating period-over-period changes

To make comparisons meaningful, add two columns after your financial data: one for absolute change and another for percentage change. The absolute change is calculated as (Current Year - Prior Year), while the percentage change is (Change ÷ Prior Year) × 100.

Applying the comparative balance sheet formula this way highlights financial movements and trends. This step is crucial for understanding the direction and pace of change in your company’s performance, allowing for more informed business decisions.

Ensuring accuracy and validating data

Avoid errors by carefully entering figures and ensuring they match original documents such as the general ledger, trial balance, or audited reports. Use formulas in your spreadsheet to reduce manual mistakes and flag any discrepancies. Regular cross-checking is key to maintaining data integrity.

This diligence builds confidence in the comparative balance sheet and ensures that your analysis reflects true financial conditions. Accurate reporting also helps when presenting findings to stakeholders or regulators.

Interpreting trends and identifying anomalies

Once the calculations are complete, review changes in each line item to identify trends like steady increases in inventory or reductions in long-term debt. Pay close attention to unexpected results, such as a sharp rise in liabilities or a sudden drop in cash reserves.

These anomalies may require further investigation. Whether you're analyzing your business or the comparative balance sheet of any company, spotting these patterns early can inform strategic decisions and prevent larger issues down the line.

Saving templates for future use

To simplify the process next time, create and save a reusable spreadsheet template with predefined columns and formulas. Include sections for period-wise data, absolute change, and percentage change. Having this structure in place helps standardize your process and reduce repetitive work.

Templates make updating and reviewing financial data faster and more consistent. With a dependable format ready to go, generating a comparative balance sheet becomes part of your regular financial routine.

The layout and design of a comparative balance sheet

A well-structured comparative balance sheet helps readers quickly understand financial shifts across periods. Its layout should be clean, organized, and easy to navigate for both internal teams and external stakeholders.

Whether for audit, planning, or presentation, a strong design enhances both clarity and decision-making, adding real value to your financial analysis process.

1. Crafting a clear and effective format

Design your comparative balance sheet with consistent fonts, spacing, and column alignment. Each column should clearly label the corresponding financial period to avoid confusion. Use horizontal and vertical lines or shading to separate categories and totals, improving visual flow.

Ensure figures are aligned properly to highlight changes accurately. Consistent formatting supports ease of comparison and helps communicate financial results efficiently. A clean format reduces errors and makes complex data more accessible.

2. Organizing financial categories logically

Group all financial items under standard categories: current assets, non-current assets, current liabilities, long-term liabilities, and equity. Within each category, arrange items in order of liquidity or maturity for clarity. For example, list cash before receivables or long-term debt after accounts payable.

This logical structure makes the comparative balance sheet of any company easier to analyze and compare over time. Clear categorization supports faster decision-making and improves report readability.

3. Visual aids for better interpretation

Enhance the sheet’s usability with subtle visual aids like arrows, conditional formatting, or charts. Use green or red highlights to show increases or decreases across periods. Bar or line graphs can help visualize trends in key metrics like total liabilities or net assets.

These aids support faster interpretation and help stakeholders identify critical financial movements with ease. Visual elements also make presentations more engaging and informative.

4. Customizing for stakeholder presentations

Adapt the format to meet the needs of your audience—whether it’s an internal executive team or external investors. Include annotations to explain major changes and highlight sections that align with the stakeholders’ focus, such as profitability or debt levels.

When presenting to banks or partners, customize visuals to support funding discussions or compliance goals. Tailored layouts increase engagement and understanding. Personalizing the presentation demonstrates professionalism and thorough preparation.

Analyzing a comparative balance sheet: Formulas and techniques

1. Calculating year-over-year changes

To analyze financial shifts, calculate both absolute and percentage changes between periods. Absolute change is the difference between current and prior year values, while percentage change divides this difference by the prior year figure.

These calculations highlight how each item evolves, offering a clear picture of growth or decline over time.

2. Identifying trends with ratio analysis

Use key financial ratios, such as debt-to-equity and current ratio, to deepen your analysis. Ratios reveal relationships between balance sheet elements and help detect shifts in financial health.

Consistent monitoring of these ratios uncovers emerging trends that raw numbers alone might miss. Tracking these trends over time assists in making well-informed financial decisions.

3. Spotting red flags in financial data

Look for warning signs like rapidly increasing liabilities or shrinking asset values. Sudden changes can indicate cash flow problems, mismanagement, or hidden risks.

Early detection of these issues allows you to take corrective actions before they escalate. Addressing red flags promptly protects your business from potential financial distress.

4. Using insights to adjust business strategies

Apply your analysis results to refine budgeting, investment, or financing decisions. Understanding financial strengths and weaknesses helps prioritize resources and mitigate risks.

Strategic adjustments based on data ensure your business stays agile and competitive. This proactive approach supports sustainable growth and long-term success.

5. Benchmarking against industry standards

Compare your financial ratios and trends with industry averages to gain perspective. Benchmarking highlights areas where your business excels or lags behind peers.

This context informs goal setting and strategy development to improve overall performance. Staying aligned with industry standards enhances credibility with investors and partners.

6. Documenting findings for future reference

Maintain detailed records of your comparative balance sheet analyses and insights. Documentation enables tracking progress, evaluating past decisions, and supporting audits or investor reviews.

Keeping organized reports strengthens financial transparency and accountability. Well-maintained records also simplify future financial planning and compliance.

Benefits of leveraging a comparative balance sheet

Gaining clarity on financial performance

A comparative balance sheet offers a clear view of how your revenue and expenses fluctuate over different periods. This insight helps you pinpoint which areas are growing or underperforming. Understanding these shifts enables more informed decisions to improve profitability and overall financial health.

Regularly reviewing this data sharpens your awareness of financial trends. It also aids in spotting seasonal or cyclical patterns affecting your business.

Improving resource allocation decisions

By comparing financial data across periods, you can better allocate resources to departments or projects that drive growth. This targeted distribution maximizes efficiency and avoids wasteful spending.

Effective resource management supports your company’s strategic priorities and operational goals. It also provides justification for reallocating funds when necessary to improve overall performance. Making informed allocation decisions prevents financial bottlenecks.

Strengthening financial forecasting accuracy

Using historical balance sheet data improves the reliability of your financial forecasts. Past trends provide a foundation for predicting future cash flows, expenses, and investments. Accurate forecasting helps prepare your business for upcoming challenges and opportunities with confidence.

This reduces guesswork and promotes data-driven planning. It also allows management to set realistic goals based on proven financial patterns.

Building confidence for loan applications

A well-prepared comparative balance sheet demonstrates your company’s financial stability and growth to lenders. Clear evidence of consistent performance reassures banks during loan evaluations.

This transparency can increase your chances of securing favorable financing terms. It also reflects good financial management to potential investors. Presenting solid financials can expedite the approval process for loans.

Supporting cost-cutting initiatives

Reviewing period-over-period changes helps identify areas where expenses have increased without corresponding benefits. This awareness enables you to target unnecessary costs and implement effective reductions.

Cost-cutting based on solid data helps maintain profitability and operational efficiency. It ensures that savings do not compromise critical business functions. This approach also fosters a culture of continuous improvement within the organization.

Challenges you might face with a comparative balance sheet

1. Dealing with inconsistent accounting practices

Changes in accounting methods over different periods can cause inconsistencies in your comparative balance sheet. These discrepancies make it difficult to accurately compare financial data.

Ensuring uniform accounting policies or clearly noting adjustments is essential to maintain comparability and reliability. Without this, financial analysis can become misleading or confusing.

2. Adjusting for economic factors in the US

Economic changes like inflation or fluctuating interest rates can distort comparisons in your balance sheet analysis. These factors may exaggerate or understate financial shifts between periods.

Adjusting figures for economic conditions helps present a more accurate financial picture. This approach enables better decision-making in a fluctuating economic environment.

3. Overcoming data quality issues

Missing or inaccurate financial data poses a significant challenge when preparing comparative balance sheets. Such errors can lead to incorrect conclusions or poor decision-making.

Implementing strict data verification processes ensures the reliability of your financial comparisons. Regular audits and reconciliations are key to maintaining data integrity.

4. Balancing complexity with usability

While detailed data improves insights, an overly complex comparative balance sheet can overwhelm users. Striking the right balance between thoroughness and simplicity makes the information accessible.

Clear presentation enhances understanding without sacrificing critical details. Using summaries and visual aids can also improve user engagement.

5. Managing stakeholder expectations

Different stakeholders may interpret the same financial data in varying ways, leading to conflicting expectations. Clear communication and context help align understanding.

Providing explanatory notes and regular updates ensures everyone is on the same page. This transparency builds trust and facilitates smoother decision-making.

Using a comparative balance sheet to optimize financing strategies

1. Assessing your business’s credit profile

A comparative balance sheet helps evaluate your company’s creditworthiness by showing financial trends over time. Lenders use this information to determine eligibility for loans or credit lines.

Regular assessment helps you maintain a strong credit profile and identify areas for improvement.

This proactive approach can increase your chances of securing favorable financing options. Staying on top of your credit profile also builds confidence among investors and partners.

2. Planning for capital investments

Using a comparative balance sheet allows you to allocate funds wisely for large purchases such as equipment or property. It highlights your available resources and potential financing needs. Careful planning reduces the risk of overextending your finances.

This ensures that capital investments align with your overall growth strategy and financial health. It also provides a clearer picture for budgeting and forecasting future expenditures.

3. Managing debt levels effectively

Analyzing debt trends through a comparative balance sheet guides decisions to reduce liabilities or refinance existing debt. You can identify opportunities to negotiate better interest rates or repayment terms.

Effective debt management improves cash flow and lowers financial risk. Staying informed supports sustainable business growth and credit stability. This strategic approach prevents excessive borrowing and enhances your financial flexibility.

4. Supporting vendor payment strategies

A comparative balance sheet helps plan timely payments to suppliers, maintaining strong vendor relationships. Understanding your cash position and liabilities ensures you meet payment deadlines.

This reliability can lead to better credit terms and discounts from vendors. Proper management also avoids disruptions in your supply chain. Consistent payments foster trust and can improve your negotiating power with suppliers.

5. Evaluating lease vs buy decisions

Financial trends revealed in a comparative balance sheet assist in choosing whether to lease or buy assets. You can compare cash flow impacts and long-term financial commitments for each option.

This analysis supports cost-effective decisions that suit your business’s current and future needs. It helps balance flexibility with asset ownership benefits. Careful evaluation ensures that your decision aligns with your company’s operational goals.

6. Preparing for seasonal financing needs

A comparative balance sheet highlights cash flow patterns, helping you anticipate seasonal financing requirements. Planning ahead ensures you have access to funds during peak business cycles or slow periods.

This foresight prevents cash shortages and supports smooth operations year-round. It also aids in negotiating short-term credit when needed. Being prepared minimizes financial stress and keeps your business agile through seasonal fluctuations.

How comparative balance sheets fit into broader financial analysis

Linking with profit and loss statements

A comparative balance sheet complements your profit and loss statement by providing a snapshot of your financial position over time. Together, they offer a fuller view of business performance, revealing how income and expenses affect assets and liabilities.

This combined insight helps identify areas that impact profitability and financial health. Analyzing both statements supports better decision-making for growth and risk management.

Integrating with cash flow analysis

The comparative balance sheet works alongside cash flow statements to monitor liquidity and cash movement. While the balance sheet shows assets and liabilities, the cash flow statement tracks actual inflows and outflows.

This integration helps you assess whether the business has enough cash to meet obligations. It also highlights any liquidity gaps that could affect operations, allowing for timely corrective action. Together, they provide a clearer picture of financial stability.

Role in comprehensive financial audits

During financial audits, comparative balance sheets are essential for verifying data accuracy and regulatory compliance. Auditors review these statements to detect discrepancies, inconsistencies, or unusual trends across periods.

They provide evidence of financial stability and proper accounting practices. Including comparative balance sheets strengthens the credibility of your financial reports and builds stakeholder trust. This detailed scrutiny helps prevent financial misstatements and fraud.

Combining with budget variance reports

A comparative balance sheet aids in comparing actual financial performance against budgeted figures through budget variance reports. It helps identify where financial results differ from projections, highlighting areas needing attention.

This analysis supports corrective measures to stay on track with financial goals. Together, they enhance the precision of financial management and resource allocation. This ensures continuous alignment with organizational objectives.

Supporting scenario planning

Using a comparative balance sheet allows you to model various financial scenarios and predict their impact on your business. By adjusting assumptions about assets, liabilities, or equity, you can forecast potential outcomes.

This approach helps prepare for uncertainties and make informed strategic decisions. Scenario planning strengthens your ability to adapt to changing market conditions and financial challenges. It provides a proactive framework to mitigate risks effectively.

Enhancing financial dashboards

Incorporating comparative balance sheet data into financial dashboards provides real-time visibility into your company’s financial status. Dashboards display key metrics and trends, enabling quick assessment and response.

This dynamic presentation improves monitoring efficiency for executives and finance teams. By using dashboards, you can track progress and identify issues promptly, supporting agile business management. This immediate access to data helps maintain operational control and strategic agility.

Industry-specific applications of a comparative balance sheet

1. Financial planning for US retail businesses

Retailers can use a comparative balance sheet to effectively manage inventory levels and plan for seasonal expenses. It helps them adjust stock purchases and cash flow to meet fluctuating customer demand.

This insight reduces the risk of overstocking or stockouts, optimizing overall financial health during peak and off-peak seasons.

2. Insights for tech startups in the US

Tech startups benefit from comparative balance sheets by tracking their burn rates and evaluating funding requirements. It enables them to monitor cash reserves versus expenses over time.

This clarity helps startups plan financing rounds strategically and manage resources to sustain growth and innovation. Additionally, it provides investors with transparent financial data to boost confidence.

3. Strategic uses in manufacturing sectors

Manufacturers rely on comparative balance sheets to keep an eye on production costs, equipment investments, and inventory changes. This helps optimize capital allocation and maintain operational efficiency.

Tracking these elements supports informed decisions about scaling production or investing in new technology. It also assists in forecasting cash flow to meet future production demands.

4. Benefits for service-based businesses

Service firms use comparative balance sheets to monitor and optimize operational expenses such as payroll, rent, and utilities. This ongoing analysis highlights cost-saving opportunities without compromising service quality.

It assists in maintaining profitability while adapting to changing client demands. Furthermore, it helps businesses justify budget adjustments to stakeholders with clear financial evidence.

5. Applications in hospitality industry

Hotels can leverage comparative balance sheets to manage finances influenced by occupancy rates and seasonal trends. This helps balance fixed and variable costs, improving cash flow management.

By analyzing financial shifts, hotels can strategize marketing and staffing more effectively. It also enables better financial reporting for investors and lenders.

6. Supporting e-commerce financial strategies

E-commerce businesses use comparative balance sheets to track sales revenue against logistics and fulfillment expenses. This enables them to evaluate profitability across different periods.

Monitoring these financial elements supports better pricing strategies and inventory management to boost growth. Additionally, it aids in planning for marketing spend and customer acquisition efforts.

Advanced tips for maximizing comparative balance sheet value

Automating data collection with software

Using accounting software and financial management tools can significantly speed up the process of gathering data for your comparative balance sheet. Automation reduces manual errors and saves time by pulling data directly from your accounting system.

Tools like QuickBooks, Xero, or specialized financial reporting software offer features that streamline data compilation. This enables more accurate and efficient preparation of financial comparisons across periods.

Incorporating predictive analytics

Leveraging predictive analytics allows you to analyze historical trends on your comparative balance sheet and forecast future financial outcomes. By applying statistical models, you can anticipate cash flow changes, profit shifts, or risk areas.

This forward-looking insight helps in making proactive business decisions and refining budgets. Predictive analytics transforms raw data into strategic guidance, enhancing the value of your financial reporting. It also helps identify potential risks before they impact your business significantly.

Customizing formats for your business needs

Tailoring the comparative balance sheet format ensures that the most relevant financial metrics for your business are front and center. You can rearrange sections, highlight key ratios, or add notes to emphasize critical data points.

Customization improves clarity and focuses attention on areas that drive decision-making. This approach helps stakeholders quickly grasp essential insights without sifting through unnecessary details. Moreover, it allows you to align financial reporting with your company’s unique goals and industry standards.

Regularly updating for real-time insights

Frequent updates to your comparative balance sheet ensure you’re working with the latest financial information, enabling timely decisions. Real-time or near-real-time data reflects current business conditions more accurately than static, outdated reports.

This ongoing process helps detect trends or issues early, so you can respond swiftly. Consistent updating keeps financial analysis relevant and actionable. It also facilitates better communication across departments by providing everyone with current data.

Training your team on interpretation

Educating your finance team and key stakeholders on how to read and interpret comparative balance sheets improves data-driven decision-making. Training sessions can cover understanding changes, ratios, and red flags within the reports.

When everyone shares a common financial language, collaboration and strategic planning become more effective. Empowered teams can spot opportunities or risks sooner. This also reduces the chance of misinterpretation that could lead to costly errors.

Using cloud-based solutions for collaboration

Cloud-based financial platforms enable multiple team members to access and update comparative balance sheets simultaneously from anywhere. This supports real-time collaboration and reduces version control issues.

Cloud tools often include secure sharing, audit trails, and integration with other financial software. By centralizing data, businesses can streamline workflows and ensure everyone stays aligned on financial status. It also enhances data security by providing controlled access and regular backups.

Regulatory considerations for US businesses

1. Ensuring compliance with US GAAP standards

Aligning your comparative balance sheet with US GAAP ensures financial statements are consistent, transparent, and comparable. This adherence helps maintain credibility with investors and regulatory bodies.

It requires following strict guidelines on asset valuation, liabilities, and equity presentation. Proper compliance also reduces the risk of financial misstatements. Staying updated on GAAP changes is essential to remain compliant.

2. Meeting IRS reporting requirements

A comparative balance sheet helps track tax-related assets and liabilities accurately, simplifying IRS reporting. It ensures all taxable items, such as deferred taxes or liabilities, are properly recorded.

This transparency supports timely and accurate tax filings. Accurate tracking reduces the risk of penalties or audits. It also aids in identifying tax planning opportunities.

3. Preparing for audits and inspections

Using a comparative balance sheet makes audits more straightforward by presenting clear, period-over-period financial data. This organized information allows auditors to verify accuracy efficiently.

It helps identify discrepancies before inspections occur. Clear records foster trust with regulators and reduce audit durations. Preparation also minimizes disruptions to daily operations.

4. Addressing multi-state financial reporting

Managing financial reporting across multiple US states requires understanding diverse tax laws and regulations. A comparative balance sheet can be adapted to reflect these differences clearly.

This ensures accurate reporting of assets, liabilities, and taxes in each jurisdiction. Proper handling avoids costly compliance issues. It supports strategic decision-making by highlighting state-specific financial impacts.

5. Navigating SEC regulations for public companies

Publicly traded companies must use comparative balance sheets to comply with SEC reporting standards. This involves disclosing accurate financial positions over time to investors and regulators.

The document helps meet transparency and disclosure requirements under SEC rules. Proper reporting builds investor confidence and supports market integrity. Regular updates ensure ongoing compliance with evolving SEC regulations.

6. Handling tax authority requirements

A comparative balance sheet supports precise sales tax filings by documenting liabilities related to collected and owed taxes. It assists businesses in tracking tax obligations across periods to avoid underpayment.

Accurate records help ensure compliance with federal and state tax authorities. This reduces audit risks and penalties. Maintaining detailed tax-related data streamlines the filing process.

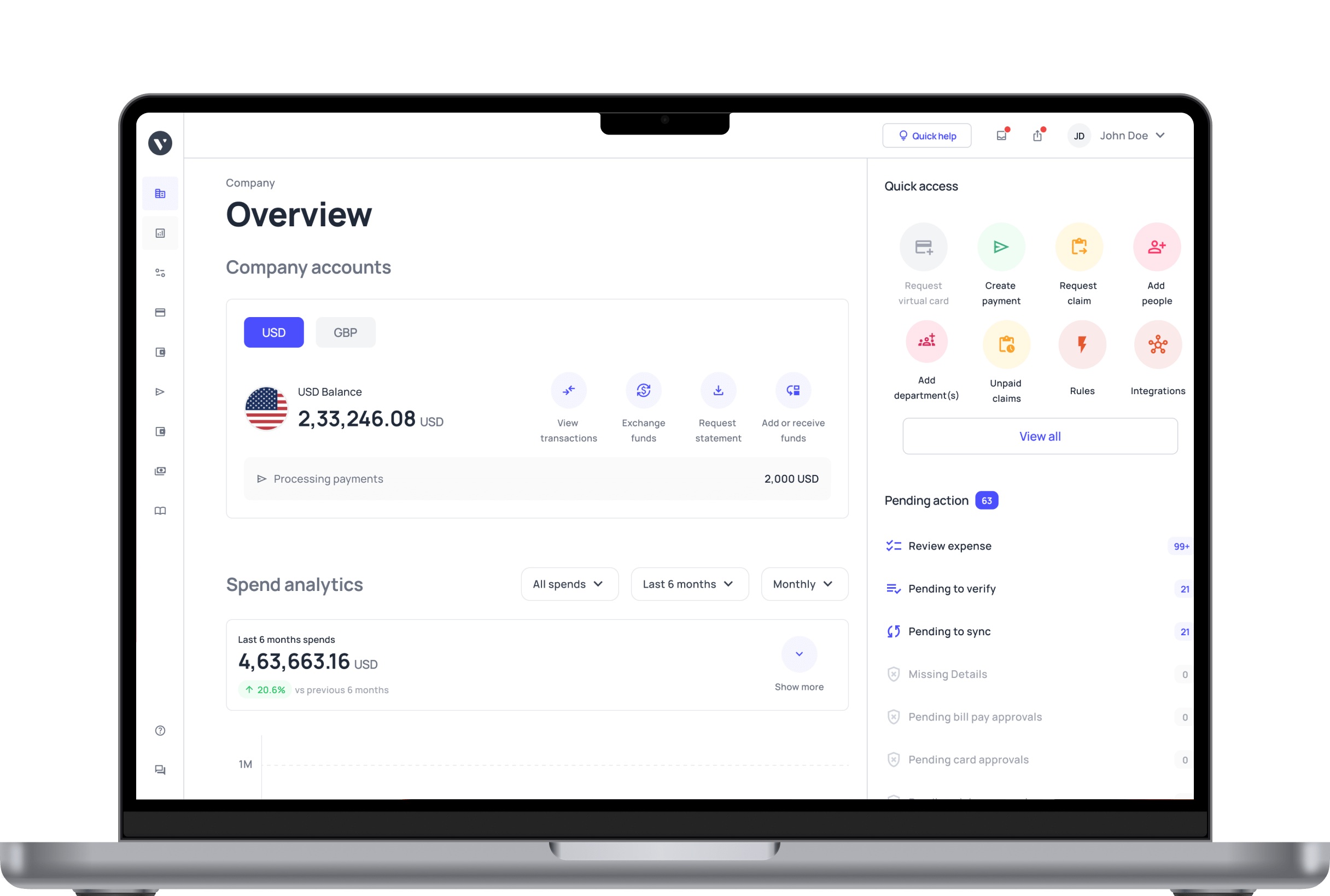

Enhance your financial control with Volopay

1. Why Volopay aligns with your financial goals

A comparative balance sheet offers clear insights into your company’s financial status, helping you make informed decisions. Volopay corporate cards complement this by simplifying expense management, improving transparency, and controlling spending in real time.

Together, they enhance your financial oversight and support your business objectives efficiently. Using Volopay also helps reduce the risk of overspending by setting spending limits and real-time monitoring.

2. Simplify expense tracking with Volopay

Volopay’s unified expense management platform automates expense tracking and approval workflows, reducing manual errors and saving valuable time. With seamless integration into your accounting software, every transaction is accurately recorded—giving finance teams real-time visibility and better control over budgets.

Signing up for Volopay empowers your team to manage expenses effortlessly while maintaining financial discipline. Plus, with Volopay’s intuitive mobile app, employees can easily track and submit expenses on the go—enhancing convenience, compliance, and company-wide efficiency.