CapEx vs OpEx: What's the difference?

When businesses manage their finances, understanding CapEx vs OpEx is critical for making strategic decisions. Capital expenditures (CapEx) refer to the funds used to purchase, upgrade, or maintain physical assets such as buildings, technology, or equipment.

Operating expenses (OpEx), on the other hand, involve the daily costs needed to run a business, like salaries, rent, and utilities. Knowing the difference between CapEx and OpEx helps companies allocate resources effectively, ensure tax efficiency, and plan long-term growth.

Organizations that clearly distinguish between these two types of expenses can improve budgeting accuracy and drive more sustainable financial strategies.

Understanding capital expenditure

What is capital expenditure (CapEx)?

Capital expenditure refers to the money a company spends to acquire, improve, or maintain long-term assets such as property, buildings, or equipment. These investments are essential for sustaining and growing business operations over time.

Unlike operating expenses, which are recurring, capital expenditures typically provide benefits lasting several years. In the discussion of CapEx vs OpEx, understanding capital expenditure is crucial for financial planning, tax treatment, and long-term budgeting decisions.

Types of CapEx

● Buildings

Investments in buildings are a major type of capital expenditure. Companies may purchase new office spaces, warehouses, or production facilities to expand operations or improve efficiency. Costs involved in constructing or renovating buildings are considered long-term assets.

When exploring the difference between CapEx and OpEx, building investments are classified under CapEx because they offer enduring value and are not part of everyday operational costs.

● Land

Land purchases are another key form of capital expenditure. Unlike buildings or equipment, land typically does not depreciate, making it a unique asset for businesses. Organizations invest in land for future development, expansion, or as a strategic asset for resale.

In the CapEx vs OpEx comparison, acquiring land clearly falls under CapEx since it represents a long-term financial investment and is not linked to routine business operations.

● Machinery & equipment

Spending on machinery and equipment enables businesses to manufacture products, deliver services, and maintain operational efficiency. These are capital expenditures because they are used over many years and directly contribute to revenue generation.

Distinguishing the difference between CapEx and OpEx is important here: machinery and equipment purchases are CapEx, while repairs and maintenance for them could be categorized under OpEx depending on the situation.

● Software

Software purchases intended for long-term use are categorized as capital expenditures. This includes enterprise resource planning (ERP) systems, design tools, or accounting software that support business operations over multiple years.

When considering the difference between OpEx and CapEx, buying new software licenses falls under CapEx, while subscription-based software services are often classified as OpEx, highlighting an important distinction in accounting treatment.

● Server infrastructure

Server infrastructure involves purchasing and installing servers to support IT needs, cloud storage, and network operations. This infrastructure is a significant capital expenditure because it offers value for several years and requires a large upfront investment.

Companies must evaluate the CapEx and OpEx aspects carefully, especially when deciding between owning physical servers (CapEx) or opting for cloud services (OpEx) based on operational and financial goals.

● Transportation

Transportation assets such as vehicles, trucks, or delivery vans are capital expenditures. Businesses invest in these to facilitate logistics, customer service, or operations support. The cost of purchasing vehicles is treated as a long-term investment.

In the CapEx vs OpEx analysis, vehicle purchases are CapEx, whereas ongoing expenses like fuel, insurance, and maintenance are usually classified under OpEx, demonstrating the clear boundary between the two.

● Sustainable energy infrastructure

Investments in sustainable energy infrastructure, such as solar panels, wind turbines, or energy-efficient systems, are classified as capital expenditures. These assets support long-term environmental and cost-saving initiatives.

Businesses adopting green technology often benefit from tax incentives and enhanced public image. When analyzing the difference between CapEx and OpEx, it is important to recognize that initial investments in sustainable energy fall under CapEx, while utility costs remain OpEx.

Importance of managing CapEx

● Ensure strategic investment

Effective management of capital expenditures helps businesses make strategic investments that align with long-term goals. Companies can prioritize projects that offer the highest value and sustainable growth opportunities.

In the context of CapEx vs OpEx, focusing on strategic investment ensures that funds are directed toward assets that strengthen the company’s competitive advantage, ensuring the highest return on investment over time and supporting broader business strategies.

● Ensure financial stability

Managing CapEx carefully contributes significantly to financial stability by controlling large, upfront expenditures. By planning capital investments wisely, businesses can avoid sudden financial strain or cash flow issues.

In balancing CapEx and OpEx, ensuring that CapEx projects are adequately budgeted prevents overspending. Proper planning and monitoring of capital outlays allow organizations to maintain liquidity, meet short-term obligations, and sustain growth without jeopardizing operational health.

● Increase investor confidence

Investors closely monitor how a company manages its capital expenditures to gauge management’s effectiveness and future prospects. Proper CapEx management signals financial discipline, strategic vision, and a commitment to growth.

When businesses clearly differentiate Capex vs Opex and justify their capital investments, it boosts transparency and investor trust. As a result, companies with sound CapEx strategies often enjoy better access to funding and stronger market valuations.

● Ensure maximized ROI

Well-managed CapEx initiatives are key to maximizing return on investment. By selecting projects that promise the highest returns and conducting thorough risk assessments, businesses can achieve stronger profitability.

Understanding the difference between Opex and Capex ensures that resources are appropriately categorized and evaluated for performance. A disciplined approach to CapEx helps organizations optimize asset utilization, reduce wasteful spending, and increase overall value for stakeholders.

● Prevent cash block

Poorly managed CapEx can tie up large amounts of cash, leaving businesses vulnerable to liquidity issues. Careful planning ensures that funds are invested at the right time and in the right amounts, avoiding unnecessary cash blockages.

When comparing CapEx and OpEx strategies, it's crucial to ensure that capital expenditures do not disrupt daily operations. Healthy cash flow enables companies to respond to market changes and new opportunities.

● Ensure proper resource allocation

Managing CapEx effectively promotes proper resource allocation by directing financial, human, and technical resources toward priority projects. It prevents wastage and ensures that investments are made where they will have the greatest impact.

In the broader CapEx vs OpEx discussion, allocating resources appropriately between capital projects and operating needs ensures balanced growth. Companies can then achieve both short-term efficiency and long-term development without compromising either.

● Ensure long-term adaptability

Strategic CapEx management ensures a business can adapt to technological advancements, market shifts, and regulatory changes over time. Investing in flexible, scalable assets prepares companies for future demands.

When examining the difference between Opex and Capex, it becomes clear that thoughtful CapEx planning supports sustainable innovation and operational resilience. Long-term adaptability strengthens a company’s ability to navigate evolving business environments and maintain a competitive edge.

Understanding operating expenditure

What is operating expenditure (OpEx)?

Operating expenditure (OpEx) refers to the ongoing costs required to run daily business operations. These expenses are necessary for maintaining revenue-generating activities but do not result in the acquisition of long-term assets.

Unlike CapEx, which involves large one-time investments, OpEx covers recurring costs such as rent, utilities, wages, and office supplies. Managing these expenses efficiently ensures operational continuity, short-term profitability, and helps in controlling the company’s cost structure.

Types of OpEx

● Selling & marketing expenses

Selling and marketing expenses include costs related to promoting products or services, such as advertising, sales commissions, promotional campaigns, and digital marketing. These expenses are essential for increasing brand visibility and driving customer acquisition.

Since these costs recur regularly and directly impact sales performance, they are treated as operating expenses. Businesses track them closely to ensure marketing efforts generate sufficient returns and align with overall revenue goals.

● General & administrative expenses

General and administrative expenses are costs associated with overall business management and daily administration. Examples include office rent, salaries of HR and finance teams, utilities, supplies, and legal fees.

These are not tied to production or sales but are necessary to keep the business functioning. As ongoing expenditures, they are classified under OpEx. Efficient management of these expenses contributes to operational efficiency and long-term sustainability.

● Depreciation & amortization

Depreciation and amortization refer to the periodic allocation of the cost of tangible and intangible assets over their useful life. While the purchase of an asset is classified as CapEx, the gradual expense recorded each year for wear and tear or usage falls under OpEx.

These non-cash expenses affect the income statement and are vital for understanding the real cost of using assets in day-to-day operations.

● Research & development expenses

Research and development (R&D) expenses cover costs for innovation, product development, and improving existing services. These include salaries of R&D staff, lab equipment usage, materials, and prototype testing.

Although the outcomes may lead to long-term benefits, the recurring nature of these costs classifies them as operating expenses. Managing R&D effectively helps drive innovation while ensuring the spending aligns with business capabilities and goals.

● Interest expenses

Interest expenses are the costs incurred from borrowing funds, such as interest payments on business loans or credit lines. These expenses are reported on the income statement and are considered operating costs if they relate to routine financing activities.

Efficient interest expense management is critical for maintaining strong credit health and managing the cost of capital. It also helps businesses evaluate the affordability of current and future borrowing.

● Insurance premiums

Insurance premiums are recurring payments made to secure business assets, personnel, and operations against risks like fire, theft, liability, or health issues. These premiums are part of OpEx because they are necessary for the business to function safely and compliantly.

Timely payment of insurance ensures risk mitigation, regulatory compliance, and financial protection against unexpected losses, all of which are essential to operational resilience and stability.

● Maintenance & repairing expenses

Maintenance and repair expenses are incurred to keep equipment, buildings, and infrastructure in proper working condition. These include servicing machinery, fixing electrical issues, and maintaining HVAC systems.

Since these activities do not enhance the asset's value but restore its functionality, they are considered operating expenses. Regular maintenance ensures uninterrupted business operations and prolongs asset life, which is crucial for productivity and cost control.

Importance of managing OpEx

● Ensure financial health

Effective OpEx management supports a company’s financial health by controlling recurring costs and improving profit margins. By monitoring expenses like salaries, utilities, and office supplies, businesses can maintain positive cash flow and operational efficiency.

Understanding the difference between CapEx and OpEx ensures that short-term costs are optimized without compromising long-term investments. Strong financial health helps businesses remain agile, competitive, and better prepared for market fluctuations or disruptions.

● Improve risk mitigation

Managing OpEx proactively allows businesses to identify and mitigate financial and operational risks in advance. By monitoring ongoing expenses such as insurance, repairs, and compliance costs, companies can avoid unexpected disruptions.

This preparedness ensures smooth operations even during economic uncertainty. Recognizing the difference between OpEx and CapEx enables organizations to create more resilient budgeting strategies that support both routine operations and emergency responses when needed.

● Ensure proper resource allocation

Strategic control of operating expenses ensures that labor, technology, and budgetary resources are allocated effectively. Businesses can evaluate which functions generate the most value and redirect funds accordingly.

When OpEx is well managed, departments receive adequate support without overspending. Balanced resource distribution also enhances productivity and reduces waste. Differentiating between one-time investments and routine expenditures supports smarter financial planning across both operational and capital budgets.

● Ensure consistent return on investment

Monitoring operating expenses helps sustain a consistent return on investment by reducing unnecessary costs and improving operational efficiency. OpEx decisions impact short-term profitability, and controlling them ensures that revenues grow without a proportional rise in expenses.

Evaluating the ROI of OpEx-related activities, such as marketing or R&D, helps align spending with performance outcomes. This continuous focus on cost-effectiveness builds financial discipline across all departments and business functions.

● Increase stakeholder confidence

Transparent and effective management of OpEx enhances the confidence of stakeholders, including investors, partners, and internal teams. When businesses demonstrate control over recurring costs and maintain operational stability, they present a reliable image.

Understanding how operational expenses contribute to overall strategy, alongside CapEx, reassures stakeholders of the company’s financial competence. Stakeholders value consistency and efficiency, and OpEx transparency plays a crucial role in sustaining that trust.

● Set up performance benchmarking

OpEx management enables performance benchmarking by tracking cost trends across departments and functions. Comparing current spending with industry standards or historical data helps identify areas needing improvement.

This practice supports continuous enhancement and cost optimization. By differentiating fixed versus variable costs and separating OpEx from capital spending, companies can set realistic benchmarks, improve efficiency, and establish accountability at all operational levels, leading to better decision-making.

● Ensure long-term sustainability

Sustainable business growth relies on controlled operating expenses that do not compromise future operations. Managing OpEx carefully ensures the organization stays lean and adaptable while funding innovation and customer service.

Differentiating between operational costs and capital investments allows businesses to plan for changing market demands and allocate budgets wisely. Long-term sustainability is achieved when businesses reduce waste, monitor recurring costs, and align spending with strategic goals.

● Ensure proper debt management

Controlling operating expenses plays a vital role in maintaining healthy debt levels and meeting financial obligations. Lower OpEx leads to higher net income, improving the company’s debt-servicing capacity and credit profile.

By distinguishing between routine operational costs and investment-related spending, businesses can balance their obligations effectively. Proactive debt management through OpEx control also prevents financial strain and supports long-term growth with minimized financial risk.

Why do you need to understand the the difference between CapEx and OpEx?

Understanding the difference between capital expenditure and operating expenditure is essential for financial clarity, effective budgeting, and long-term planning.

It helps businesses manage cash flow, comply with accounting standards, and make informed decisions that drive profitability and operational efficiency.

1. Financial planning

Distinguishing between capital and operating expenses is critical for accurate financial planning. CapEx represents long-term investments, while OpEx includes recurring operational costs.

Proper classification allows businesses to plan budgets, forecast future spending, and maintain healthy cash flow. It ensures that funds are allocated appropriately to support growth without overextending resources.

Effective financial planning also helps attract investors and secure financing by presenting clear and reliable financial statements.

2. Strategic investment decisions

Understanding CapEx and OpEx allows companies to make informed strategic investment decisions.

Capital expenditures involve significant upfront costs with long-term benefits, such as infrastructure or equipment. Operating expenses are essential for sustaining day-to-day operations.

By evaluating the impact and return of each type of expense, businesses can prioritize investments that align with their goals. Clear insights into both help balance short-term needs with long-term vision and profitability.

3. Key performance metrics

Identifying CapEx and OpEx correctly supports the calculation of key performance metrics such as EBITDA, ROI, and operating margins.

Capital expenditures are recorded as assets, while operating expenses directly impact profit and loss. This distinction allows for accurate financial reporting and performance analysis.

These metrics are crucial for internal evaluations and external stakeholder reporting. Understanding expense classification helps businesses measure efficiency, track growth, and improve financial decision-making.

4. Tax implications

Capital and operating expenses have different tax treatments. Operating expenses are typically fully deductible in the year incurred, reducing taxable income immediately.

In contrast, capital expenditures are depreciated over time, spreading deductions across multiple years. Understanding these differences ensures accurate tax planning and compliance.

Businesses that distinguish correctly between these expenses can optimize their tax liabilities, avoid penalties, and improve their overall financial performance through strategic tax management.

5. Cost management

Effective cost management depends on a clear understanding of CapEx and OpEx. Businesses must evaluate which costs are essential for operations and which are investments for future growth.

Managing OpEx helps control recurring spending, while thoughtful CapEx planning avoids overinvestment. Accurate classification supports better budgeting, cost control, and resource optimization.

By monitoring and adjusting both types of expenses, organizations can maintain profitability and financial discipline in a dynamic market.

6. Risk management

Differentiating between CapEx and OpEx plays a significant role in managing financial risk. Large capital investments carry higher risks due to their long-term commitment and delayed returns.

Operating expenses, though more frequent, must be carefully controlled to avoid margin pressure. Understanding these distinctions enables companies to balance investment risks with operational stability.

It also helps in identifying areas vulnerable to economic downturns and planning accordingly to maintain business continuity.

7. Resource allocation

Properly distinguishing between CapEx and OpEx ensures efficient resource allocation. Capital expenses are allocated to projects that support long-term growth, while operating expenses maintain daily functions.

This separation allows companies to track how funds are used and measure returns effectively. Clear classification helps decision-makers allocate resources in line with business priorities.

By aligning spending with strategic goals, businesses can enhance productivity, avoid waste, and strengthen overall financial health.

Capital expenditure vs operating expenditure: Key differences

Understanding the key differences between capital expenditure and operating expenditure is crucial for financial planning, reporting, and strategic decision-making. Each has a distinct impact on budgeting, taxation, and business growth, requiring careful classification and management to maintain financial health and compliance.

Meaning

● Capital expenditure

Capital expenditure refers to funds used by a company to acquire, upgrade, or extend the life of long-term assets such as buildings, machinery, or infrastructure that provide future economic benefits. These assets contribute to the company’s capacity, productivity, or operational lifespan.

● Operating expenditure

Operating expenditure covers the routine expenses required for a company’s day-to-day operations, including wages, utilities, maintenance, and other short-term costs necessary to keep the business running smoothly. These expenses are vital to sustaining business continuity and functionality

Nature

● Capital expenditure

CapEx is non-recurring in nature and generally involves substantial spending on assets intended to generate benefits over a long period, often beyond a single financial year. It is usually tied to strategic projects or growth initiatives.

● Operating expenditure

OpEx is recurring and short-term in nature, incurred regularly to support continuous business operations, such as rent, administrative expenses, and ongoing services or supplies. These expenses fluctuate with business activity levels and operational needs.

Accounting treatment

● Capital expenditure

Capital expenditure is recorded as an asset on the balance sheet and depreciated or amortized over time, gradually reflecting its cost in the company’s financial statements. This treatment spreads the financial impact across multiple accounting periods.

● Operating expenditure

Operating expenditure is recorded directly as an expense in the income statement of the financial year in which it is incurred, immediately impacting net income. It directly reduces a company’s taxable income in the year of occurrence.

Involvement in procurement

● Capital expenditure

Capital expenditure often involves complex procurement processes including vendor evaluations, long-term contracts, and strategic approval from senior management due to its high value and long-term impact. It may also require capital budgeting and feasibility studies.

● Operating expenditure

Operating expenditure typically follows routine procurement processes, such as recurring orders and departmental approvals, as it involves smaller, predictable, and more frequent purchases. These processes are streamlined to support operational efficiency.

Timing of expense recognition

● Capital expenditure

Capital expenses are recognized gradually over several years through depreciation or amortization, based on the asset’s useful life, rather than all at once. This aligns the expense with the revenue generated by the asset.

● Operating expenditure

Operating expenses are fully recognized in the accounting period in which they occur, as they provide immediate benefits without extending beyond the current financial year. This treatment reflects the short-term utility of such expenses.

Impact on financial ratios

● Capital expenditure

Capital expenditure increases asset values on the balance sheet, thereby improving asset-based ratios like return on assets and fixed asset turnover. However, it may initially reduce liquidity and cash flow-related ratios due to significant upfront spending. Over time, as depreciation occurs, the impact on financial ratios stabilizes.

● Operating expenditure

Operating expenditure reduces net income, directly impacting profitability ratios such as operating margin and net profit margin. It also affects the operating cash flow ratio since these expenses are part of regular outflows. Regular management of OpEx ensures optimal profit margins and operational efficiency.

Direct impact on profit

● Capital expenditure

Capital expenditure does not reduce profit immediately as it is capitalized and depreciated over time. Its impact on profit is gradual through depreciation or amortization across multiple accounting periods. This deferral of expense recognition helps manage cash flow and long-term financial planning.

● Operating expenditure

Operating expenditure is fully deducted in the period incurred, reducing current-year profit. This immediate impact makes OpEx a key consideration in quarterly and annual performance reporting. Frequent monitoring of OpEx helps prevent overspending and supports efficient cost control.

Expense purpose

● Capital expenditure

Capital expenditure is made to acquire or upgrade long-term assets that generate future income. It supports business expansion, infrastructure development, and capacity building. These investments are often tied to strategic growth objectives and long-term sustainability.

● Operating expenditure

Operating expenditure covers the costs required for daily operations such as salaries, utilities, and office supplies. Its purpose is to maintain ongoing business functionality and service delivery. Properly managing OpEx ensures the company’s day-to-day operations are efficient and cost-effective.

Depreciation

● Capital expenditure

Capital expenditure is depreciated over the useful life of the asset, gradually spreading its cost. Depreciation reduces taxable income each year and reflects asset wear and tear. This process helps align the expense with the revenue generated by the asset.

● Operating expenditure

Operating expenditure is not depreciated as it is expensed in full within the current period. These costs are short-term and provide no lasting asset value. They are fully deducted from the company’s profits in the year they occur, providing an immediate financial impact.

Tax saving

● Capital expenditure

Capital expenditure offers tax benefits through annual depreciation deductions. These deductions reduce taxable income over the asset’s life. This allows businesses to lower their overall tax burden in the long term.

● Operating expenditure

Operating expenditure provides immediate tax relief as it is fully deductible in the year incurred. It directly reduces taxable profits for that financial year. This immediate deduction is particularly useful for managing cash flow and minimizing taxes in the short term.

Example

● Capital expenditure

Purchasing a new manufacturing plant is a capital expenditure, as it adds to the company’s asset base. The cost is recorded on the balance sheet and depreciated over time. The plant’s depreciation will spread the expense over its estimated useful life.

● Operating expenditure

Paying monthly electricity bills is an operating expenditure, as it’s a recurring cost for daily business operations. It is fully expensed in the income statement for that period. These types of expenditures must be tracked consistently to ensure optimal budget management.

Capital expenditure and operating expenditure: What are the similarities?

Both capital expenditure (CapEx) and operating expenditure (OpEx) are essential components of a company's financial planning. Though they serve different purposes, they share certain characteristics, such as impacting cash flow, requiring proper management, and contributing to the overall financial health of the organization.

1. Impact on cash flow

● Capital expenditure

Capital expenditure involves large, upfront payments for long-term assets, which can significantly affect a company’s cash flow. While it is a one-time outflow, the cash impact can be spread across multiple periods through depreciation or financing arrangements.

If the purchase is financed, the company must also consider the long-term debt repayments, which can further strain cash flow. A proper cash flow forecast is essential for managing these large outflows and ensuring financial stability.

● Operating expenditure

Operating expenditure involves regular, recurring costs for day-to-day operations. These expenses are deducted from the company’s cash flow immediately, affecting short-term liquidity. Consistent monitoring of OpEx ensures that cash flow remains balanced and operations run smoothly.

Managing OpEx effectively can prevent cash shortages that could impact business operations, especially when unexpected costs arise. Additionally, optimizing OpEx can free up cash flow for reinvestment in growth opportunities.

2. Requirement of planning & management

● Capital expenditure

Capital expenditure requires detailed planning and strategic management due to its large-scale, long-term nature. Proper forecasting, budgeting, and evaluation of returns on investment (ROI) are crucial to ensure CapEx contributes to the company’s sustainable growth.

Businesses must assess the potential benefits over the asset's lifespan, which requires careful market research and financial analysis. Without effective planning, companies may risk over-investing in assets that do not yield the expected returns or fail to meet operational needs.

● Operating expenditure

Operating expenditure also requires careful planning and ongoing management to optimize costs. Businesses must regularly assess and adjust their OpEx to maintain profitability and avoid unnecessary expenses, ensuring that operational costs align with overall business goals.

Effective management of OpEx involves cost reduction initiatives and improved process efficiencies that directly affect profit margins. Additionally, managing OpEx can lead to better operational control, which is critical for long-term sustainability and competitiveness.

3. Impact on overall profitability

● Capital expenditure

Capital expenditure impacts overall profitability indirectly. Although it is not expensed immediately, the depreciation of capital assets reduces taxable income over time, contributing to profitability in the long run. However, large CapEx investments can lower short-term profits due to upfront costs and ongoing maintenance.

Effective planning ensures that the long-term benefits of CapEx, such as increased capacity or efficiency, outweigh the initial financial burden. Proper asset management further maximizes these long-term gains.

● Operating expenditure

Operating expenditure directly impacts overall profitability as it is expensed in full during the accounting period. Since OpEx is deducted from revenue, higher operating costs reduce net income, affecting the bottom line.

Companies must manage OpEx effectively to maintain healthy profit margins. Controlling operating costs can directly improve profitability and enhance financial performance in the short term. Reducing OpEx through efficiency measures can help improve operational profitability consistently.

4. Impact on investment decisions

● Capital expenditure

Capital expenditure plays a critical role in investment decisions, as it involves significant outflows that are expected to generate returns over time. Investors consider CapEx investments in assessing a company’s future growth potential and its ability to generate future income.

However, large CapEx projects can also signal high risk, especially if the investment does not yield the expected returns. Strategic alignment of CapEx with long-term growth prospects is key to attracting investment.

● Operating expenditure

Operating expenditure influences investment decisions by reflecting a company’s ability to manage day-to-day costs efficiently. High OpEx may indicate operational inefficiencies or a lack of control, which can deter potential investors. However, maintaining a steady level of OpEx while optimizing operational costs can improve profitability, making the company more attractive to investors.

Ensuring cost-effectiveness in operations can result in more favorable investment opportunities. Managing OpEx can also demonstrate a company’s ability to adapt to changing market conditions and maintain profitability.

5. Subject to tax implications

● Capital expenditure

Capital expenditure is subject to tax implications, particularly through depreciation. Depreciating capital assets allows companies to reduce their taxable income over time, lowering their tax burden. However, certain capital expenditures may be eligible for tax credits or accelerated depreciation, further reducing taxes in the short term.

Proper tax planning for CapEx ensures that businesses maximize potential savings while staying compliant with tax regulations. Strategic timing of CapEx purchases can also lead to additional tax benefits during specific fiscal years.

● Operating expenditure

Operating expenditure is fully deductible in the year incurred, providing immediate tax relief. This direct deduction from taxable income helps reduce a company’s tax burden for the year. However, excessive OpEx may signal inefficiency, potentially increasing taxable income over time if not managed properly.

Strategic management of OpEx can optimize tax benefits and enhance overall financial performance, ensuring that resources are allocated wisely. Regular review of OpEx categories ensures that only necessary costs are deducted, preventing wasteful spending.

Capital expenditure in a business: Significance & drawbacks

Capital expenditure (CapEx) is essential for a business's long-term strategy, involving investments in assets such as property, machinery, and technology. While requiring significant upfront investment, CapEx drives sustainable growth, productivity, and efficiency. However, it also involves financial risk and maintenance costs, necessitating careful planning for long-term success.

Significance of CapEx

● Asset acquisition

Capital expenditure allows businesses to acquire essential assets such as property, machinery, or equipment, which are necessary for daily operations and long-term growth. These assets often have extended lifespans and contribute to the company's operational capacity.

Investing in quality assets also ensures that the business remains competitive and efficient. Without regular CapEx investments, businesses may face outdated infrastructure, limiting their ability to stay relevant in the market.

● Competitive edge

Investing in capital expenditures provides companies with a competitive edge by enabling them to adopt advanced technologies or upgrade facilities. This can differentiate the business in the market by improving product quality, reducing operational costs, or speeding up production.

CapEx also enhances a company’s ability to innovate, which can strengthen its market position. Staying ahead of competitors often requires significant capital investment in research, development, and infrastructure.

● Increased production capacity

Capital expenditure often leads to an increase in production capacity, allowing businesses to meet higher demand. By purchasing new machinery or expanding facilities, companies can scale operations without compromising product quality.

This expansion can lead to greater economies of scale, reducing per-unit costs. With a larger capacity, companies can explore new markets or respond more effectively to fluctuations in demand, driving higher profitability.

● Long-term value creation

CapEx plays a vital role in creating long-term value for businesses by fostering sustainable growth. Investments in assets like real estate or technology can generate returns over many years.

Unlike operating expenses, which are deducted from profits immediately, CapEx typically leads to increased revenues over time. Well-planned CapEx investments contribute to the long-term stability of the business, ensuring it remains profitable and competitive in a dynamic market.

● Tax benefits

Capital expenditure can offer valuable tax benefits, primarily through depreciation. Depreciation allows businesses to spread the cost of an asset over its useful life, reducing taxable income in future years. Certain types of CapEx may qualify for accelerated depreciation, providing immediate tax savings.

These tax incentives can ease the financial burden of large capital investments, allowing businesses to reinvest the savings into additional projects or growth initiatives.

● Business growth

Through strategic capital expenditure, businesses can foster growth by expanding their infrastructure, entering new markets, or enhancing their product offerings. CapEx enables companies to enhance their competitive position and innovate in ways that drive customer satisfaction and revenue growth.

It also supports long-term sustainability by ensuring the business can scale to meet increasing demand. As businesses grow, CapEx investments play a crucial role in maintaining operations and seizing new opportunities.

● Improved financial planning & strategy

Capital expenditure forces businesses to engage in thorough financial planning, requiring them to forecast cash flows, analyze returns on investment, and assess risks. It encourages strategic decision-making that aligns with long-term business objectives, such as expansion, innovation, or operational efficiency.

A well-structured CapEx strategy can help companies achieve greater financial stability and better manage resources. By planning for future capital needs, businesses can avoid unnecessary financial strain and focus on sustainable growth.

● Attracts potential investments

Investors view capital expenditure as an indication of a business's commitment to growth and sustainability. Regular CapEx investment can attract potential investors by demonstrating a focus on improving operational efficiency, expanding market presence, or increasing capacity.

Companies that invest in strategic CapEx tend to have higher growth potential, which makes them appealing to investors seeking long-term returns. Furthermore, a strong track record of CapEx can signal that the company is well-managed and prepared for future challenges.

Drawbacks of CapEx

● High initial cost

Capital expenditure requires a substantial upfront investment, which can strain a company's financial resources. The high cost of acquiring assets like property, machinery, or technology often demands financing, impacting cash flow.

Companies may need to take on debt or divert funds from other projects, affecting their financial flexibility. This significant expenditure can limit funds available for other operational needs or growth initiatives.

● Long-term commitment

CapEx investments typically involve long-term commitments, making businesses responsible for the assets for many years. The return on investment may take time, and any changes in market conditions could affect the profitability of these assets.

If the business faces financial difficulties, the long-term nature of CapEx commitments can be challenging to manage. These extended commitments may also limit the ability to adapt quickly to new opportunities.

● Required ongoing maintenance

Assets acquired through CapEx often require continuous maintenance, which adds to the overall cost. Regular upkeep, repairs, and replacements can consume valuable resources, especially for complex machinery or aging infrastructure.

While the initial investment may seem beneficial, ongoing maintenance expenses can reduce profitability and prevent the company from achieving the desired return. Failure to maintain these assets properly may also lead to inefficiencies and unanticipated costs.

● Risk of becoming obsolete

Capital expenditures, particularly in technology, carry the risk of becoming obsolete due to rapid advancements or changes in market demands. Assets like machinery or software may become outdated before they’ve fully paid off, rendering them less useful or even irrelevant.

This obsolescence risk forces businesses to stay on top of trends, continually reinvesting in new technologies or systems. It creates the challenge of balancing current needs with future-proofing investments.

● Impact on liquidity

Large capital expenditures can significantly impact a company’s liquidity, reducing the cash available for day-to-day operations. The upfront investment required for CapEx may limit a company's ability to meet short-term financial obligations, such as paying bills or covering payroll.

Companies with strained liquidity may face challenges in managing working capital effectively, which can lead to financial instability. Effective planning is essential to maintain liquidity while making necessary investments.

● Challenges in financing

Securing financing for capital expenditures can be difficult, especially for smaller businesses with limited access to capital. Lenders often require collateral, and the terms of loans may not be favorable, putting additional financial strain on the company.

Furthermore, interest payments on loans or debt can increase overall costs. Businesses may face challenges in raising funds for CapEx without diluting ownership or risking financial instability, complicating their ability to grow effectively.

Operating expenditure in a business: Significance & drawbacks

Operating expenditure (OpEx) refers to the ongoing costs necessary for the day-to-day functioning of a business. Unlike CapEx, OpEx does not require large upfront investments, providing flexibility to manage finances more easily while supporting continuous operations. However, it comes with both advantages and drawbacks that influence business strategy.

Significance of OpEx

● Flexibility

Operating expenditure offers businesses the flexibility to adapt to changing conditions. Unlike capital investments, which are long-term commitments, OpEx allows companies to adjust their spending as needed. This enables businesses to respond quickly to market shifts, economic fluctuations, or unexpected events.

With OpEx, organizations can maintain a more fluid approach to their finances, ensuring they remain agile in competitive markets. It also facilitates quicker decision-making without being restricted by long-term investments.

● No huge upfront costs

One of the key advantages of OpEx is that it does not require significant upfront investment. This allows businesses to allocate funds towards other priorities, such as expansion or innovation, without the burden of large capital expenditures.

Companies can avoid taking on substantial debt or depleting their cash reserves to make these investments. This cost structure makes OpEx more accessible for businesses of all sizes. It also provides smaller companies with the financial flexibility they need to compete.

● Easier control over expenses

With operating expenditure, businesses have greater control over their costs, as these are typically recurring and easier to predict. By closely monitoring OpEx, businesses can identify areas of inefficiency and take corrective actions to reduce waste.

Tight control over expenses ensures that resources are allocated effectively, contributing to better overall financial management and preventing unexpected cost overruns. This allows for more predictable budgeting and a more stable financial outlook.

● Easier cash flow forecasting

Operating expenses are generally predictable and consistent, making it easier for businesses to forecast cash flow. Since these costs are recurring and necessary for ongoing operations, companies can plan more accurately for upcoming expenses.

This predictability aids in budgeting and ensures businesses can allocate enough resources for daily functions. Reliable cash flow forecasting also reduces the likelihood of financial strain. It further enables better short-term and long-term financial planning.

● Tax benefits

Operating expenditure is typically deductible for tax purposes, providing businesses with valuable tax savings. These deductions reduce taxable income, resulting in lower tax liabilities. As OpEx is incurred regularly and is essential for business operations, the ability to deduct these costs helps companies maintain a healthier cash flow and improve profitability.

Proper management of OpEx can lead to significant tax advantages. Additionally, it helps businesses optimize their tax strategy by reducing overall tax exposure.

● Essential for daily operations

OpEx covers essential costs like salaries, utilities, and maintenance, which are necessary for the smooth functioning of a business. Without these ongoing expenditures, a company would not be able to maintain its regular activities.

These expenses ensure that employees are paid, operations are running, and the infrastructure is functioning properly. Essentially, OpEx sustains the operational continuity of the business on a daily basis. Without it, businesses would be unable to meet customer expectations and maintain service levels.

Drawbacks of OpEx

● Long-term expenses

While operating expenditures are necessary for day-to-day operations, they can accumulate over time, leading to substantial long-term costs. These ongoing expenses might limit the ability to allocate funds for other business needs, such as innovation or expansion.

Over time, high OpEx can weigh down the company’s profitability and hinder overall financial health. It’s important to balance these expenses with the ability to reinvest in the business. Prolonged high OpEx can hinder future cost reductions, limiting profitability growth.

● Recurring expenses

Operating expenditure involves consistent costs that recur on a regular basis, such as salaries, utilities, and maintenance. This predictability can become a burden for businesses, especially during periods of low revenue. While predictable costs can aid in budgeting, they also limit flexibility by tying up funds.

Businesses must manage these recurring expenses carefully to avoid them becoming a financial constraint over time. Failure to control these expenses may lead to budget overruns and reduce financial flexibility.

● Low returns on investment

Operating expenditure generally does not generate a direct return on investment (ROI). Unlike capital expenditures that often result in long-term asset growth, OpEx primarily covers the costs of operations without increasing company value.

While necessary for daily functions, OpEx doesn’t contribute to future growth or profit. Over-reliance on OpEx can prevent a business from generating the returns it needs to thrive long-term. This lack of ROI can affect a company's ability to attract investors seeking high returns.

● Regulatory compliance expenses

Businesses must often spend significant amounts on compliance with regulatory requirements, which are part of OpEx. These expenses can include legal fees, audits, and other costs associated with maintaining regulatory standards.

Such compliance costs can be burdensome, especially for smaller businesses. These expenditures, while essential, add pressure to the operating budget and may reduce available funds for more strategic investments. Over time, non-compliance could lead to legal penalties, further straining financial resources.

● Puts pressure on cash flow

Operating expenses can put significant pressure on a business's cash flow, especially if they are high or unpredictable. If not carefully managed, recurring costs may leave the business with limited cash reserves.

Negative cash flow due to high OpEx can restrict a company’s ability to cover other essential expenses or invest in growth opportunities. Effective cash flow management is crucial to prevent operational disruptions. Additionally, poor cash flow can lead to delayed payments and damage supplier relationships.

● Short-term focus

Focusing heavily on operating expenses can lead businesses to prioritize short-term survival over long-term growth. While OpEx is necessary for daily operations, excessive focus on it may cause neglect of strategic investments that drive future profitability.

Over time, this short-term focus can hinder a business’s ability to innovate or adapt to changing market conditions, which may ultimately harm its competitive position in the market. A lack of long-term focus can result in missed opportunities for expansion and improvement.

CapEx vs OpEx: How to decide between both

When deciding between capital expenditure (CapEx) and operating expenditure (OpEx), businesses must evaluate their needs and long-term goals. CapEx typically involves large, one-time investments in assets like property, machinery, or technology that are expected to generate long-term benefits.

For instance, purchasing new manufacturing equipment or building a new office would fall under CapEx. These investments are essential for business growth but require significant upfront costs. As CapEx results in asset creation, it requires financing and longer-term planning.

On the other hand, OpEx refers to the day-to-day expenses required to run a business. This includes costs like salaries, utilities, and maintenance. For example, paying for software subscriptions or employee wages would be considered OpEx. While these expenses are recurring, they are necessary to maintain operations without a long-term commitment.

OpEx offers businesses more flexibility, as costs can be adjusted or reduced more easily compared to CapEx. To decide between CapEx and OpEx, businesses should consider their financial situation and goals.

If they need to acquire or upgrade assets for long-term use, CapEx is the right choice. However, if flexibility and easier management of recurring costs are needed, OpEx may be better. Balancing both expenditures is key to aligning financial strategies, ensuring growth, and managing their impact on cash flow, profitability, and taxes.

Financial reporting of capital expenditure and operating expenditure

Proper financial reporting of capital expenditure (CapEx) and operating expenditure (OpEx) is essential for accurately reflecting a business’s financial position. These expenditures impact key financial statements, including the income statement, balance sheet, and cash flow statement, which help stakeholders assess the company’s financial health.

Capital expenditure

● Income statement

CapEx does not immediately affect the income statement, as it is capitalized. However, depreciation or amortization is recorded as an expense over the asset’s useful life, reducing net income gradually.

These non-cash expenses help spread the cost of an asset over time, reflecting its consumption in the business. As a result, the company’s operating profit is impacted each period, but the full expense is not recognized upfront.

● Balance sheet

On the balance sheet, CapEx is recorded as an asset, such as property, plant, or equipment. Over time, the asset’s value decreases through depreciation, impacting the asset’s net book value. This process ensures the balance sheet reflects the declining value of long-term assets.

The recorded value helps investors assess the company’s asset base and overall financial stability. Additionally, CapEx is shown as part of the company’s long-term investments, impacting both total assets and equity.

● Cash flow statement

CapEx appears under investing activities in the cash flow statement. It reflects the cash outflow for purchasing, upgrading, or maintaining long-term assets, affecting the company’s investing cash flow. A high CapEx outflow can signal significant investment in growth or infrastructure.

These investments might also impact the company’s available cash for day-to-day operations. The investing section highlights how the business allocates resources to improve or expand its asset base.

Operating expenditure

● Income statement

Operating expenditure (OpEx) is fully recorded on the income statement in the period it occurs, impacting the company’s net income immediately. This includes expenses such as wages, rent, utilities, and marketing costs.

Since these costs are incurred in the normal course of business, they directly reduce operating profit and are crucial for calculating the company’s profitability during each reporting period. The immediate recognition of OpEx helps provide a clearer picture of short-term financial performance.

● Balance sheet

OpEx does not appear directly on the balance sheet as it is not capitalized. However, its impact is seen through the reduction in assets like cash or accounts payable.

For instance, when a company incurs expenses such as rent or utilities, it may reduce cash or increase liabilities, reflecting the use of resources in ongoing operations. Over time, these operational expenses affect the business's financial health by reducing its liquid assets or increasing outstanding liabilities.

● Cash flow statement

In the cash flow statement, OpEx is reflected under operating activities as an outflow of cash. These regular expenditures are essential for maintaining the business’s day-to-day operations and affect the company’s operating cash flow.

The statement helps stakeholders assess the company’s ability to generate cash from its core activities and manage its operating costs effectively. Additionally, consistent management of OpEx is critical to maintaining positive cash flow and ensuring the sustainability of business operations.

Capital expenditure & operating expenditure: Best practices to manage these expenses

Effective management of capital and operating expenditures ensures financial stability, optimized resources, and long-term growth. Following best practices helps businesses allocate resources wisely and make informed decisions, balancing immediate operational needs with future strategic investments.

Capital expenditure

● Prioritize your projects

When managing CapEx, prioritize projects that align with business objectives and generate long-term value. Consider factors such as return on investment (ROI), strategic importance, and overall impact on business operations.

By prioritizing wisely, you ensure that capital is allocated to high-value projects that enhance growth and operational efficiency. This helps avoid unnecessary spending on less critical projects, keeping your focus on strategic goals.

● Conduct a feasibility analysis

Before committing to significant capital projects, conduct a thorough feasibility analysis. This involves evaluating the financial, operational, and strategic implications of the investment. By analyzing risks, expected returns, and potential roadblocks, you can make informed decisions that maximize the value of CapEx expenditures.

This ensures that only viable projects move forward, reducing the likelihood of costly failures or inefficiencies. Additionally, it helps identify areas where resources may be overestimated or underestimated, ensuring a more accurate financial projection.

● Implement a structured approval process

Establish a clear approval process for all capital expenditure projects. This should include a step-by-step evaluation of the project's alignment with company goals, cost-benefit analysis, and risk assessment. A structured process ensures accountability and transparency, helping mitigate unnecessary or poorly-planned investments.

It also enables better tracking and oversight, ensuring that the CapEx budget is used responsibly and strategically. Having clear guidelines in place helps prevent delays and ensures that the decision-making process is consistent and well-documented across all projects.

● Ensure stakeholder involvement

Engage relevant stakeholders in the decision-making process for capital expenditures. This includes executives, department heads, and financial experts who provide diverse perspectives on the feasibility and impact of potential projects.

Involving stakeholders ensures that all aspects of CapEx projects are thoroughly reviewed and that decisions are well-supported. Collaboration among stakeholders leads to more informed and balanced decisions, aligning the investment with the broader company strategy.

● Develop a comprehensive budget

Create a detailed budget that outlines all anticipated capital expenditures. This should include costs for equipment, technology, construction, and other significant investments. A comprehensive budget allows businesses to forecast expenses, track spending, and avoid overspending on capital-intensive projects.

Regularly reviewing and updating this budget ensures that spending stays within set parameters and any unanticipated costs are addressed promptly.

● Separate CapEx budget from annual budget

Separate the capital expenditure budget from the regular operational (OpEx) budget. This distinction allows for clearer tracking and management of long-term investments, preventing misallocation of resources.

By keeping CapEx distinct, businesses can better manage cash flow and ensure they meet both immediate operational needs and strategic growth goals. This separation also helps to maintain a clear financial picture of both ongoing operations and major investments for the future.

Operating expenditure

● Implement benchmarking standards

Establishing benchmarking standards helps compare the company's operating expenditures with industry norms. By assessing performance against peers, companies can identify areas of inefficiency and focus on cost-saving opportunities.

This process also facilitates the identification of best practices that can be implemented to streamline operations and reduce unnecessary expenses. Benchmarking encourages continual improvement and aligns financial strategies with industry standards, contributing to better decision-making and overall performance.

● Conduct regular expense audits

Regular expense audits help ensure that all operating expenditures are accurate, justified, and aligned with the company’s financial goals. These audits identify discrepancies, potential fraud, or over-expenditure areas, providing an opportunity to correct issues before they escalate.

Additionally, conducting these audits on a routine basis can uncover hidden costs that can be minimized or eliminated. This proactive approach also enhances accountability and transparency, helping maintain a healthy financial environment.

● Implement cloud-based solutions

Cloud-based solutions offer businesses the opportunity to reduce costs associated with traditional IT infrastructure and services. By migrating to the cloud, companies can lower expenses related to hardware, software, and maintenance, while also benefiting from enhanced scalability and flexibility.

Cloud solutions also support collaboration and improve data security, offering operational efficiencies that can streamline processes and reduce overhead costs. This transition allows organizations to focus more resources on core business functions.

● Ensure proper employee training & engagement

Providing ongoing employee training and engagement programs can significantly reduce operating costs by improving productivity and reducing errors. Well-trained employees are more efficient and capable of managing tasks with less supervision, reducing the need for additional labor or costly corrections.

Engaged employees are also more likely to contribute innovative solutions to reduce costs, which can lead to more effective business practices and enhanced profitability in the long run.

● Evaluate supplier performance

Regularly evaluating supplier performance is crucial to ensure that the company is getting the best value for its operating expenditures. By assessing suppliers on criteria such as quality, delivery timelines, and cost efficiency, businesses can identify areas for improvement or potential changes in suppliers.

This evaluation helps in building stronger relationships with reliable suppliers and potentially renegotiating contracts for better terms. It also reduces the risk of operational disruptions due to poor supplier performance.

● Implement energy efficiency initiatives

Energy efficiency initiatives can significantly lower operational costs and reduce the company's environmental impact. By adopting energy-efficient technologies and practices, businesses can lower utility expenses while also contributing to sustainability goals.

These initiatives may include upgrading lighting systems, improving HVAC efficiency, and optimizing production processes. Over time, these changes result in cost savings that improve profitability, while also enhancing the company’s reputation as an environmentally conscious organization.

● Ensure regular reviews and audits

Routine reviews and audits of operating expenditures ensure that companies stay on track with their financial goals. These reviews help detect inefficiencies, identify areas for cost reduction, and confirm that expenses are being used effectively.

Regular audits offer transparency and reinforce financial discipline within the organization, encouraging responsible spending. They also provide insights into trends and areas that may require strategic adjustments to maintain optimal financial health.

Choose Volopay's all-in-one expense management platform for your business

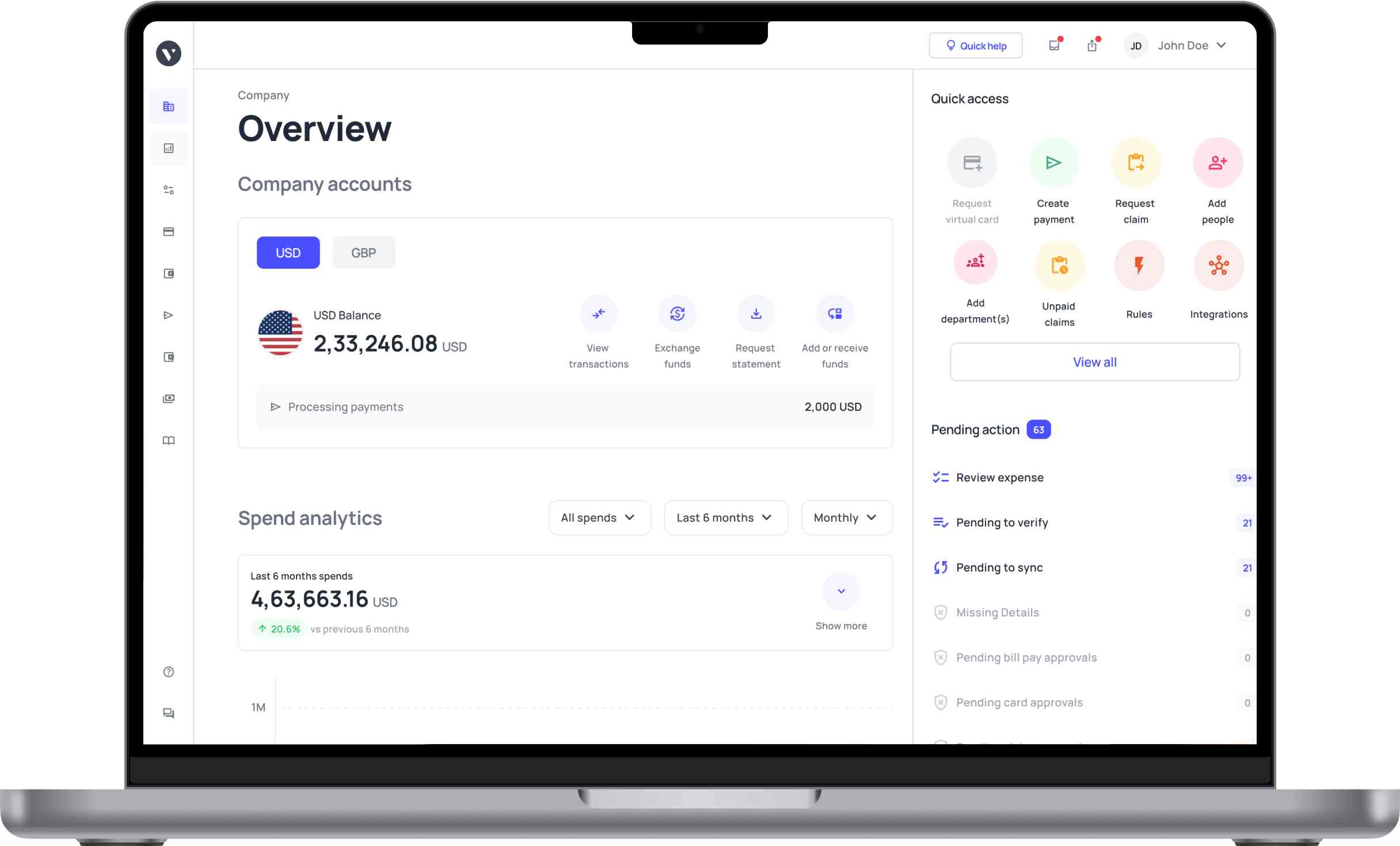

Volopay's all-in-one expense management platform streamlines financial operations for businesses, offering a comprehensive suite of features designed to simplify expense reporting, tracking, and control. Here's how it benefits your organization:

Automated expense reporting

Volopay automates expense reporting, saving time and minimizing human error. Employees can easily capture receipts through mobile apps, and the system automatically generates reports based on predefined rules.

This reduces administrative overhead, ensuring accuracy and efficiency while maintaining compliance with company policies. The seamless integration of automation also improves transparency and speeds up the approval process for faster financial decision-making.

Customizable spend controls

With Volopay, businesses can set flexible spending limits for individual employees, departments, or teams. This feature helps to monitor and control expenses while staying within budgetary limits.

Customizable approval workflows ensure that only authorized personnel can approve significant expenditures, reducing the risk of unauthorized purchases. These controls offer granular visibility and help prevent overspending, improving cost management and financial discipline across the organization.

Detailed spend analytics

Volopay provides in-depth analytics, helping businesses track and assess spending patterns. This data can be used to identify areas where costs can be reduced or optimized. With actionable insights, financial teams can make informed decisions and adjust budgets based on real-time data.

By having a clearer understanding of spending behavior, businesses can improve profitability and align their spending strategies with overall financial objectives.

Automated expense reconciliation

Volopay automates the process of reconciling credit card statements with expense reports. This reduces the need for manual data entry and ensures that all financial records are accurate and up-to-date.

The system automatically matches transactions to reports, making it easier to identify discrepancies or errors. With faster reconciliation, businesses can close their financial books quickly and with fewer mistakes, improving the overall accuracy of financial reporting.

Schedule payments and smart triggers

Volopay allows businesses to schedule payments in advance and set smart triggers to automate recurring payments. This feature ensures that invoices are paid on time, reducing late fees and improving vendor relationships.

Additionally, the system can automatically notify managers when payments are due, allowing for timely approvals. By automating these tasks, businesses free up time for strategic financial planning and reduce administrative burdens.

Real-time expense tracking

Volopay's platform provides real-time visibility into all business expenses. Finance teams can monitor employee spending across departments and track where funds are being allocated in real-time.

This transparency helps identify areas of overspending early and enables quicker intervention to maintain budget control. With real-time tracking, businesses can manage cash flow more efficiently, ensuring that funds are being used effectively to drive company goals.

Integration capabilities

Volopay integrates seamlessly with various accounting software, ensuring smooth data transfer and synchronization across systems. This integration helps businesses maintain accurate financial records without the need for duplicate data entry.

By connecting with existing financial tools, Volopay simplifies the expense management process and enhances operational efficiency. The integration allows for automatic updates to accounting systems, reducing the risk of errors and streamlining the overall financial workflow.

Bring Volopay to your business

Get started now

FAQs

Volopay utilizes advanced encryption protocols, multi-factor authentication, and secure cloud storage to protect sensitive financial data. These measures ensure that transactions and personal information remain safe from unauthorized access.

Volopay automates recurring payments by scheduling them in advance and providing reminders. It ensures that businesses stay on top of subscription renewals and recurring invoices without the risk of missing payments.

Volopay offers 24/7 customer support via live chat, email, and phone, ensuring that users can resolve issues promptly. Dedicated account managers are also available to assist with complex inquiries.

Changes in interest rates can increase or decrease borrowing costs, directly impacting operating expenses. Higher rates can lead to increased interest payments on loans, raising overall operating costs.

Import duty is typically considered part of the cost of goods purchased and should be classified as part of operating expenses, not capital expenditure. However, it may be capitalized for imported assets.

Operating expenses can be both fixed and variable. Fixed expenses remain constant regardless of business activity, while variable expenses fluctuate with production or sales volume.

Volopay’s platform allows businesses to manage a wide range of expenses, including employee reimbursements, vendor payments, subscriptions, travel expenses, and recurring bills, all in one place.