Business expense cards: Types, importance, use cases

Handling business expenses used to be a mess earlier, stacks of paper receipts, constantly reminding employees to send in their docs, and only realizing budget problems weeks after the fact. But now, there’s a smarter way to manage spending, and that is through business expense cards.

Think about your current setup. Maybe you’re still stuck with clunky expense reports or trying to keep tabs on spending across a bunch of employee credit cards. Business expense cards make life a lot easier. They combine payment tools with smart spend controls, so you can track where money’s going in real time, no more waiting until month-end to see what happened.

The real game-changer? It’s not just about paying for stuff. These cards actually help you take the headache out of expense management and turn it into something that drives efficiency and growth. Need to set spending limits for your marketing team or keep travel costs in check across departments? These cards are built to flex with your business.

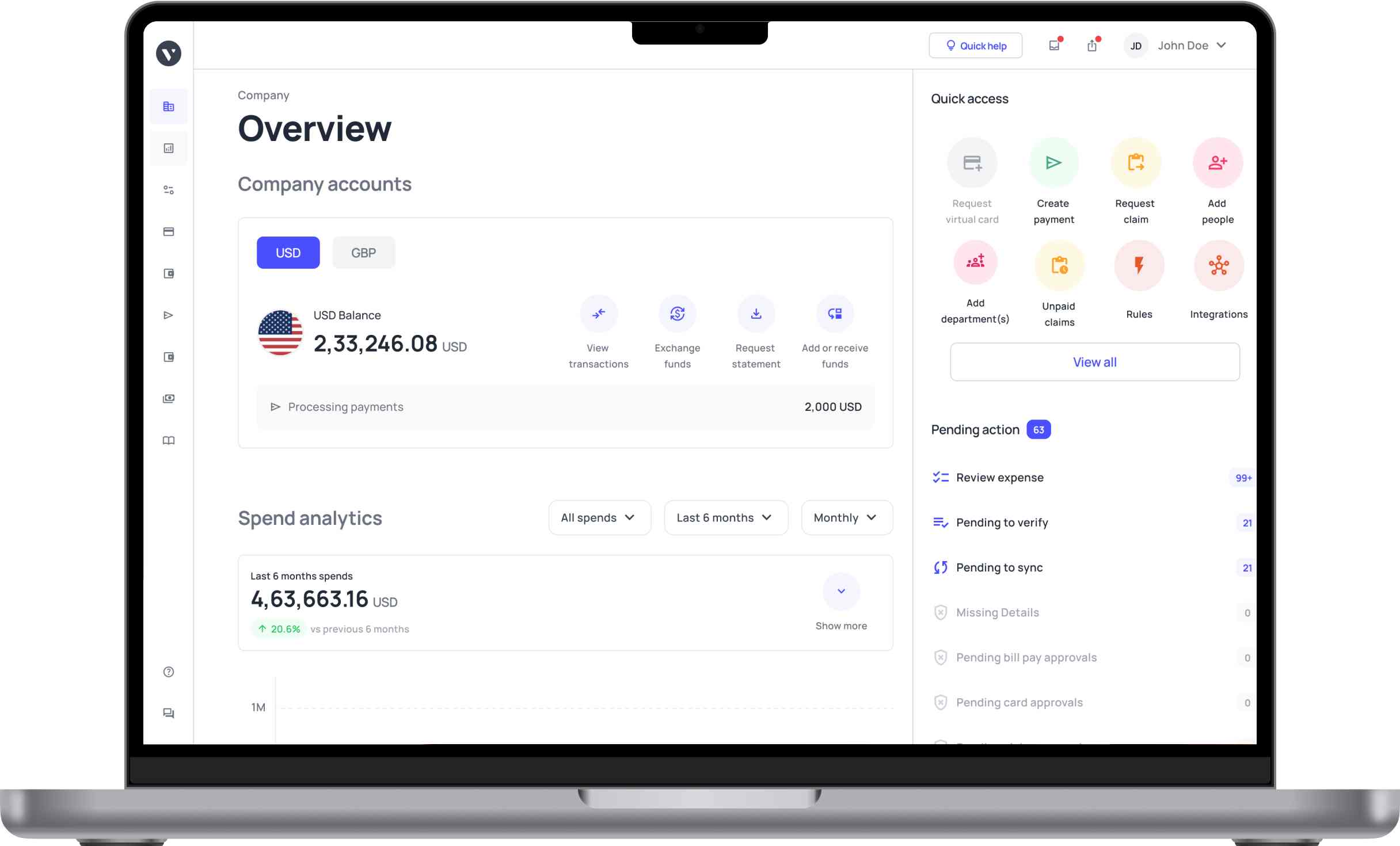

That’s where solutions like Volopay’s corporate cards come in, offering a seamless way to manage expenses and make payments, all while giving you complete visibility and control over company spend. With real-time tracking, customizable limits, and easy integration with accounting systems, Volopay helps you stay on top of spending without the usual hassle.

Let’s break down why business expense cards are a must-have, and how to pick the one that fits your company best.

What are business expense cards?

Business expense cards are specialized payment solutions designed to help companies efficiently manage and monitor their spending. They empower employees to make essential purchases while giving businesses greater control and oversight on expenses.

Blending the functionality of traditional business credit cards with modern financial tools, these cards offer features such as real-time expense tracking, automatic categorization, and customizable spending limits.

Whether it's buying everyday office supplies or investing in major software, business expense cards simplify the purchasing process. Teams can make approved transactions without dealing with reimbursement paperwork, and finance departments benefit from instant visibility into all expenses, greatly improving budgeting and accounting processes.

How do business expense cards work?

Business expense cards work by giving companies a smarter way to manage business spending. Unlike traditional credit cards, business expense cards can be preloaded with funds and issued, often instantly, to employees, departments, or vendors.

These expense cards for business come with customizable limits and controls, allowing finance teams to monitor transactions in real time. Corporate expense cards also offer seamless integration with accounting tools, which simplifies tracking, approvals, and reconciliation.

Whether virtual or physical, they help eliminate manual reimbursements and bring transparency to every purchase. This makes business expense cards an essential tool for modern companies looking to streamline expense management efficiently.

Types of business expense cards

When it comes to managing business spending, choosing the right type of business expense card is key. Businesses today have access to both types of expense management cards, physical and virtual, each designed to meet different purchasing needs.

Understanding the strengths of each option helps companies equip their teams with the right tools for secure, efficient, and flexible expense management.

1. Physical cards

Physical cards are ideal for in-person transactions and function similarly to traditional credit cards. However, they come equipped with advanced expense management features, such as real-time tracking and customizable spending controls.

For example, physical cards can be issued to regional operations teams to manage on-ground expenses like travel, lodging, and vendor payments, ensuring swift execution while giving finance teams centralized visibility and control over decentralized spending.

2. Virtual cards

Virtual cards provide businesses with enhanced flexibility and security for online transactions. They can be issued instantly for specific use cases, with options to set spending limits and restrict usage to certain merchants or categories.

For instance, a design team might use a virtual card dedicated to online asset purchases like stock images or fonts, while the HR department could have separate virtual cards for managing recruitment-related subscriptions and tools.

Why expense cards are important for businesses?

Expense cards have become an essential tool for businesses, streamlining financial processes and improving spend management. Below are the key benefits of using expense cards for businesses.

Streamline expense tracking and reduce administrative work

Business expense cards simplify the process of tracking and reporting expenses by automatically categorizing transactions. This reduces the need for manual data entry and allows for quicker, more accurate reporting.

With expense cards for business, finance teams can focus on strategic tasks while maintaining clear oversight, eliminating the burden of administrative work.

Provide real-time visibility into company spending

Business expense cards offer businesses immediate access to transaction data, enabling real-time monitoring of spending. This visibility allows finance teams to track expenses as they happen, helping detect discrepancies early and maintain better control over budgets.

By using corporate expense cards or company expense cards, organizations can make informed decisions and adjust their financial strategies promptly.

Enhance control with customizable spending limits

Business expense cards come with customizable spending limits, giving companies better control over employee expenses.

With expense cards for business, finance teams can set individual card limits or restrict purchases by category, ensuring that employees adhere to budget guidelines. Corporate expense cards offer businesses the ability to enforce stricter spending policies, reducing the risk of overspending.

Improve fraud prevention and transaction security

Business expense cards enhance fraud prevention by offering secure payment methods and real-time transaction monitoring. These cards come with advanced features like card usage restrictions and instant alerts, reducing the risk of unauthorized spending.

With expense cards for business, companies can protect their financial resources, ensuring greater security and reducing the potential for fraudulent transactions.

Increase employee flexibility for quick purchases

Business expense cards empower employees to make necessary purchases instantly, without waiting for approval or reimbursement. These cards offer flexibility for employees on the go, whether for travel, client meetings, or office supplies.

With expense cards for business, employees can act quickly, boosting productivity and ensuring that operational needs are met without delay.

Simplify expense approvals and streamline workflows

Business expense cards or company expense cards help streamline the approval process by allowing predefined spending limits and automatic transaction tracking. They help reduce the need for manual approvals by automating workflow, ensuring that all purchases are pre-authorized and comply with company policies.

With expense cards for business, businesses can accelerate approvals, reduce delays, and ensure smooth operational efficiency.

Integrate seamlessly with accounting software systems

Business expense cards easily integrate with existing accounting systems, simplifying the reconciliation of transactions. They automatically sync with financial software, ensuring accurate data flow and eliminating manual data entry.

Expense cards for business help finance teams maintain up-to-date financial records, streamline the reconciliation process, and improve overall efficiency in managing company finances.

Manage expenses better with Volopay cards

Practical use cases for business expense cards

Managing business expenses efficiently is crucial for maintaining financial health and operational efficiency. Business expense cards offer a powerful way to control spending, increase transparency, and eliminate reimbursement hassles.

Whether for recurring costs or team-specific budgets, these cards streamline payments and enhance oversight. Below are practical use cases where they add value across the organization.

Everyday employee expenses

Business expense cards simplify how companies manage day-to-day employee purchases. Whether it's office supplies, subscriptions, or a minor equipment purchase, expense cards for business allow real-time tracking and spending limits, eliminating manual reports and reducing the administrative burden of reimbursements.

Business travel costs

Corporate expense cards are ideal for managing travel-related expenses such as airfare, accommodation, meals, and transport. They give employees easy, secure access to funds on the go, while enabling finance teams to monitor transactions in real time and ensure compliance with company policies.

Procurement and vendor payments

Expense cards for business are an efficient alternative to traditional procurement processes, especially for recurring or low-value purchases. They provide clear oversight of spending, simplify vendor payments, and support better reconciliation, making procurement faster and more controlled.

Incentives and employee rewards

Corporate expense cards or company expense cards can be used to offer bonuses, rewards, or holiday incentives to employees or even partners. These cards are preloaded and easy to distribute, offering a flexible way to recognize performance or appreciation without going through payroll.

Emergencies and contingency needs

Business expense cards are excellent tools for contingency planning. Whether it’s a last-minute operational requirement, emergency travel, or unexpected repair, having preloaded corporate cards ensures that businesses are financially prepared without breaking standard approval flows.

Entertainment and client hospitality

Expense cards for business are perfect for managing entertainment expenses, client dinners, team outings, or corporate events. They allow for budget limits and easy expense tracking, helping companies stay accountable and within approved hospitality budgets.

Marketing and advertising spend

Marketing teams can use business expense cards for digital advertising, sponsored content, influencer payments, and campaign tools. Assigning specific cards to campaigns makes it easier to manage budgets, measure ROI, and avoid overspending.

Software and digital subscriptions

Business expense cards are a smart way to manage recurring digital expenses like SaaS tools, cloud storage, or design software. Assigning corporate expense cards to specific tools ensures consistent payments, prevents service interruptions, and simplifies tracking for finance teams managing multiple software subscriptions.

Business expense cards vs business credit cards

Business expense cards and business credit cards both help manage company spending, but they function differently. Understanding these differences highlights why expense cards for businesses are often the better choice for controlling costs and improving financial efficiency.

1. Purpose

● Business expense cards

Business expense cards are designed for managing and tracking operational spending with real-time control. They streamline business purchases while offering visibility, making them ideal for modern expense management.

● Business credit cards

Traditional business credit cards are mainly used for general business spending with access to a revolving credit line. They offer flexibility but limited control over day-to-day team expenses.

2. Spend controls

● Business expense cards

Business expense cards or corporate expense cards offer advanced spend controls like merchant restrictions, category limits, and individual card caps, empowering finance teams to prevent overspending and manage budgets with precision.

● Business credit cards

Standard business credit cards have fixed account-level limits, offering minimal per-user control. This makes it difficult to manage individual spending or enforce team-specific budgets across the organization.

3. Customization

● Business expense cards

Expense cards for businesses can be customized for departments, teams, or even specific vendors, giving companies the flexibility to assign and monitor spending at a granular level.

● Business credit cards

Business credit cards lack the flexibility of customization. They often serve as shared cards with fewer options to personalize usage based on roles, purposes, or team-specific needs.

4. Risk of misuse

● Business expense cards

With built-in limits and real-time monitoring, business expense cards greatly reduce the risk of fraud or misuse. Each card can be deactivated instantly or limited to approved vendors.

● Business credit cards

Business credit cards are more vulnerable to misuse, especially if shared among employees. Fewer security features and delayed reporting make it harder to catch unauthorized or excessive spending early.

5. Ease of issuance

● Business expense cards

Business expense cards can be issued instantly, especially as virtual cards. Once funds are loaded, companies can distribute cards to teams right away, enabling fast, controlled access to spending.

● Business credit cards

Traditional business credit cards require formal applications and credit checks. The approval process can be slow, delaying card issuance and making it harder to quickly support new hires or urgent needs.

6. Impact on credit

● Business expense cards

Business expense cards are typically prepaid or spend-controlled and not tied directly to a company’s credit line, reducing any impact on credit scores or financial liability.

● Business credit cards

Business credit cards affect the company’s credit and may require a personal guarantee. Mismanagement can harm credit ratings and borrowing capacity, especially for small businesses or startups.

7. Business suitability

● Business expense cards

All types of companies, from startups to large enterprises, can benefit from the modern features of business expense cards. Real-time tracking, customizable controls, and easy issuance make them suitable for any scale.

● Business credit cards

Traditional business credit cards are better suited for established companies needing revolving credit or making large one-time purchases, but they lack modern expense management features.

Smarter expense management starts with Volopay

What makes business expense cards secure against fraud?

Custom spending limits

Business expense cards let you set card-level spending caps, helping prevent budget overruns and ensuring all purchases align with company policies and financial controls.

Category restrictions

Business expense cards can restrict usage to approved merchant categories, blocking unauthorized vendors and keeping business expenses aligned with company guidelines.

Real-time alerts

Receive instant alerts for every purchase made using your expense cards for business, allowing quick detection and response to any suspicious or unauthorized activity.

Role-based access

Only authorized team members can issue or manage business expense cards, reducing internal fraud risks and maintaining control over who accesses company funds.

Single-use virtual cards

Issue one-time-use virtual cards for specific payments, especially online purchases, to reduce the risk of card information theft or repeated unauthorized charges.

Approval workflows

Set up approvals for high-value transactions made with expense cards for business, ensuring oversight and accountability before larger transactions are processed.

Instant card locking/freezing

Freeze or disable business expense cards instantly if misuse is suspected, minimizing financial exposure and protecting company funds from ongoing fraudulent transactions.

Audit trails and transaction logs

Business expense cards provide detailed transaction logs and audit trails, giving finance teams complete visibility and supporting fraud detection through regular reviews.

Factors to consider when choosing business expense cards

Choosing the right business expense cards can significantly improve how your company manages spending, controls budgets, and supports employee purchases. But not all expense cards for business offer the same features, or the same level of control.

To get the most value from your investment, it’s important to evaluate the key capabilities that align with your company’s financial operations.

1. Does it support both virtual and physical cards?

When selecting business expense cards, ensure the provider offers both virtual and physical options. Virtual cards are ideal for online purchases and subscriptions, while physical cards suit in-person transactions. A mix allows for flexibility in managing different types of business spending.

2. Can I customize spending limits per card?

One major advantage of expense cards for business is the ability to assign personalized spending limits to each card. Whether it's for a department or a project, this feature helps prevent overspending and ensures every transaction aligns with your budget policies.

3. Are customizable approval workflows available?

Modern business expense cards or corporate expense cards should enable you to set up custom approval workflows. This ensures that all purchases are reviewed and approved before they happen, helping businesses maintain control and compliance without micromanaging every transaction.

4. Does it integrate with accounting platforms?

To make expense management seamless, look for business expense cards that integrate effortlessly with your existing accounting software. Automated syncing reduces manual errors and allows finance teams to reconcile transactions in real time with ease.

5. Is real-time expense tracking supported?

Transparency is key in business spending. The best business expense cards offer real-time visibility into every transaction, giving finance teams immediate insight into where money is going and enabling faster, more informed financial decisions.

6. Can I restrict vendor categories or specific merchants?

Effective business expense cards allow businesses to block transactions with unauthorized merchants or limit spending to specific vendor categories. This helps enforce company policies and prevents misuse without restricting legitimate purchases.

7. Is card issuance quick and scalable?

A good business expense card or company expense card solution should let you instantly issue cards, especially virtual ones, to team members or departments. This flexibility is critical for growing companies that need to respond quickly to changing operational needs.

Empower teams with Volopay's corporate cards

How to integrate business expense cards with accounting systems?

Once you’ve chosen the right business expense cards, the next step is making sure they work seamlessly with your existing financial tools. Integrating your expense cards for business with accounting systems not only simplifies expense tracking but also improves accuracy and saves time on manual data entry.

A well-integrated setup allows corporate expense cards to automatically sync transactions, categorize expenses, and provide real-time insights, making financial management smarter and more efficient.

Choose compatible accounting software

Link expense cards to accounting system

Enable automatic data syncing

Categorize expenses automatically

Set spending limits and policies

Generate expense reports

Ensure compliance and security

Reconcile transactions

Maintain audit trails

1. Choose compatible accounting software

Select an accounting platform that supports integrations with your expense card provider. Compatibility ensures seamless data flow, reduces manual work, and supports real-time tracking. Popular choices include QuickBooks, Xero, and NetSuite, which offer built-in integration features.

2. Link expense cards to accounting system

Link your business expense cards directly to the accounting system using APIs or built-in integrations. This link allows transactions to flow automatically, reducing the need for manual data entry and minimizing errors in expense tracking and financial reporting.

3. Enable automatic data syncing

Enable real-time data syncing to automatically transfer expense data from the card platform to your accounting software. This ensures up-to-date financial records, improves accuracy, and helps businesses stay on top of their spending without time-consuming manual uploads or corrections.

4. Categorize expenses automatically

Use smart categorization rules within the accounting system to assign expenses to appropriate accounts or departments. Automation reduces administrative workload, speeds up bookkeeping, and improves reporting accuracy by consistently tagging recurring transactions with the correct categories.

5. Set spending limits and policies

Define card-specific spending limits and rules within your system to enforce company policies. This prevents overspending, ensures compliance, and flags out-of-policy purchases automatically, giving finance teams more control over how and where money is being used.

6. Generate expense reports

Use integrated tools to create detailed expense reports that show spending by category, employee, department, or vendor. These insights support budgeting decisions, identify cost-saving opportunities, and help leadership make data-driven financial choices with minimal manual effort.

7. Ensure compliance and security

Set up approval workflows and security protocols to review all expenses before posting. This ensures compliance with financial policies, protects against fraud, and maintains transparency in spending. Proper controls help businesses stay audit-ready and financially responsible.

8. Reconcile transactions

Simplify reconciliation by automatically matching expense card transactions with bank feeds and receipts. Integrated systems flag discrepancies and reduce reconciliation time, ensuring your books stay balanced and financial records are complete, accurate, and ready for reporting or audits.

9. Maintain audit trails

Track every transaction with a timestamped record of actions, including who spent, approved, or edited the entry. A clear audit trail ensures transparency, supports internal reviews, and satisfies external auditors by demonstrating accountability and proper financial controls.

Managing business expense cards: Best practices

Once business expense cards are successfully integrated with your accounting system, the next step is ensuring they're used effectively. Adopting best practices for managing expenses helps maintain control, prevent misuse, and maximize the benefits of your expense card program.

Set clear spending policies

Establish clear guidelines on what employees can and cannot purchase using business expense cards. Well-defined policies prevent misuse, promote accountability, and ensure all spending aligns with company goals. Make policies easily accessible and regularly updated to reflect business changes or evolving financial priorities.

Assign cards based on roles

Distribute cards to employees based on their job function and spending needs. Tailoring card access ensures the right people have the tools they need while minimizing unnecessary risk. For example, managers might need broader access, while junior staff could have limited spending categories or amounts.

Implement spending limits

Set daily, weekly, or monthly spending limits for each card to control costs and reduce financial risk. Limits help prevent overspending, encourage responsible use, and allow finance teams to better forecast and manage cash flow. These controls can be adjusted as business needs change.

Require receipts and notes

Make it mandatory for employees to attach receipts and add brief descriptions for each transaction. This simplifies expense tracking, supports faster reconciliation, and provides context during audits. Digital tools can automate receipt capture and reminders, making compliance easier for both users and admins.

Train employees on proper use

Educate employees on how to use their expense cards, submit receipts, and follow policies. Training reduces errors, increases compliance, and builds a culture of financial responsibility.

Consider including short onboarding sessions, written guides, or quick-reference videos as part of your expense program rollout.

Leverage analytics and reporting tools

Use the analytics features in your expense platform to identify spending trends, spot inefficiencies, and make data-driven decisions. Reporting tools can highlight departments or vendors with high spending, helping finance teams adjust budgets, renegotiate contracts, or enforce tighter controls where needed.

Schedule regular reviews and reconciliation

Perform routine checks to review transactions and reconcile accounts. Regular reviews ensure data accuracy, help catch duplicate charges or errors, and verify policy compliance.

This practice supports cleaner books, smoother audits, and more informed decision-making across departments and leadership teams.

Upgrade your expense management with Volopay

Volopay corporate cards: Built to do more than business expense cards

After implementing best practices for managing expenses, selecting the right expense card is crucial. Volopay’s corporate expense management cards offer a smarter, more efficient alternative to traditional business expense cards.

With advanced controls, real-time tracking, and seamless integrations, they simplify expense management, reduce manual work, and provide businesses with full visibility over spending in one unified platform.

Access to both virtual and physical cards

Volopay enables businesses to instantly issue unlimited virtual cards for employees, vendors, or specific expense categories. These cards can be used immediately and customized for one-time or recurring use.

Volopay's physical business prepaid cards offer flexible issuance and management, ideal for employees who need to make in-person purchases regularly, streamlining expense management without delays or cumbersome processes.

Customizable spending controls

Volopay allows businesses to set specific spending limits for individual employees, departments, or projects. These customizable controls ensure that spending remains within company-approved budgets and policies.

By restricting purchases to necessary categories, businesses can prevent wasteful spending while still giving employees the flexibility to make required purchases.

Multi-level approval workflows

Volopay’s customizable approval workflows ensure that all transactions are reviewed and authorized before being processed. Companies can set rules for approvals based on criteria such as spending limits or specific categories.

This process ensures full compliance with company policies and helps prevent unauthorized or unnecessary expenses, improving oversight.

Centralized control and visibility

Manage all corporate card activities from a single, unified platform with Volopay’s centralized dashboard.

This provides complete visibility over all transactions, allowing managers to oversee spending across departments, track expenses in real-time, and easily spot discrepancies. Centralized control ensures better financial management and reduces administrative complexity.

Multi-currency support

Volopay’s multi-currency support allows businesses to handle international expenses seamlessly. Transactions in different currencies are automatically converted, eliminating the need for manual calculations or dealing with hidden fees.

This feature is especially useful for businesses with global operations, as it simplifies expense management across different regions and currencies.

Enhanced security and fraud prevention

Volopay incorporates advanced security features, such as real-time alerts and instant card-blocking options, to prevent fraudulent activity. The platform’s monitoring system flags suspicious transactions, allowing businesses to react quickly.

These security measures ensure that company funds remain protected, giving business owners and finance teams peace of mind.

Complete audit trail and compliance

Volopay’s corporate cards ensure full transparency with a complete audit trail of every transaction. This feature tracks who made the purchase, the approval status, and any changes made to the transaction.

A clear audit trail simplifies internal and external audits, helps ensure compliance, and keeps financial records organized.

One platform, total control with Volopay

FAQs on business expense cards

Yes, assigning individual business expense cards improves accountability, simplifies tracking, and reduces fraud. Shared cards often lead to confusion and make expense reconciliation difficult.

Yes, virtual business expense cards are highly secure. They’re generated instantly, can be restricted by vendor or use case, and deactivated anytime, reducing the risk of fraud or misuse.

Yes, you can issue business expense cards to freelancers or contractors, enabling them to make approved purchases while keeping all expenses under control and within specific limits set by your company.

Yes, Volopay allows you to manage multiple departments, set different budgets, and assign separate spending limits, all from one centralized dashboard, streamlining company-wide expense management.

No, Volopay provides transparent pricing with no hidden fees. All fees related to card issuance, usage, and transactions are clearly outlined, ensuring no surprises for businesses.

If a corporate card is lost or stolen, you can instantly block the card through Volopay’s platform and request a replacement with just a few clicks.