Business debit card in the US - Functionality and how to get one

Running a successful business in the US requires careful financial management and strategic planning. A business debit card serves as an essential tool that bridges the gap between your company's daily operational needs and long-term financial goals.

Whether you're launching a startup in Silicon Valley, managing a growing SME in the Midwest, or overseeing enterprise operations across multiple states, understanding how business debit cards function can significantly impact your company's financial health and operational efficiency.

What is a business debit card?

A business debit card is a payment instrument specifically designed for commercial use that draws funds directly from your business bank account. Unlike personal debit cards, these cards are tailored to meet the unique needs of American businesses, offering enhanced features such as expense tracking, employee spending controls, and detailed transaction reporting.

Your business debit card connects seamlessly with your business checking or savings account, enabling immediate access to available funds while maintaining a clear separation between personal and business finances, which is crucial for IRS compliance and tax preparation.

Why consider a business debit card?

Spending control

Managing your business expenses becomes significantly easier when you utilize a company debit card linked directly to your company account. This setup ensures that every transaction reflects your actual available balance, preventing overspending and maintaining debt-free operations.

You gain real-time oversight of all expenditures, allowing you to make informed decisions about cash flow management. American startups and established enterprises benefit from this immediate visibility into spending patterns, helping you identify areas where costs can be optimized and ensuring that your financial resources align with your business objectives.

Tax compliance

Your business debit card automatically generates detailed transaction records that simplify tax preparation and ensure IRS compliance. Every purchase creates a digital paper trail with merchant information, transaction amounts, and timestamps that accountants and tax professionals can easily access during filing season.

This systematic record-keeping reduces the likelihood of audit complications and helps you maximize legitimate business deductions. The clear separation between business and personal expenses that a business debit card provides becomes invaluable when demonstrating the legitimacy of your business expenditures to tax authorities.

Operational ease

Streamlining your payment processes through a business debit card enhances operational efficiency across all aspects of your business. You can quickly pay suppliers, cover travel expenses, purchase office supplies, and handle subscription services without the delays associated with check processing or cash transactions.

This immediate payment capability strengthens vendor relationships and often qualifies you for early payment discounts. Small and medium enterprises particularly benefit from this streamlined approach, as it reduces administrative overhead and allows you to focus on core business activities rather than payment processing logistics.

Growth support

A well-managed business debit card system supports your company's scalability by providing flexible spending solutions that grow with your business. As you expand operations, hire additional employees, or enter new markets, your card system can accommodate increased transaction volumes and more complex spending structures.

Investor-ready financial records generated through consistent business debit card usage demonstrate fiscal responsibility and operational maturity to potential funding sources. This professional financial management approach positions your business favorably for loans, partnerships, and investment opportunities.

FDIC safety

Your funds remain protected through FDIC insurance coverage up to regulatory limits when you use a business debit card linked to qualifying business accounts. This federal protection ensures that your business finances are secure even if your banking institution faces financial difficulties.

The standard FDIC coverage of $250,000 per depositor, per bank, provides peace of mind for businesses maintaining substantial operating capital. This protection extends to all transactions processed through your business debit card, creating a secure financial environment that supports confident business decision-making.

Understanding your business debit card's functionality

Your business debit card operates by establishing a direct link to your business bank account, enabling immediate access to available funds for legitimate business expenses. This connection eliminates the need for credit lines or loan arrangements, ensuring that you maintain complete control over your spending while avoiding interest charges and debt accumulation.

Direct account link

Your business debit card connects seamlessly to your designated business checking or savings account, providing instant access to available funds. This direct connection means that every transaction immediately reflects in your account balance, giving you real-time visibility into your financial position.

The electronic link between your card and account eliminates processing delays common with other payment methods, ensuring that funds are available when you need them most.

This immediate connectivity supports quick decision-making in business situations where timing is crucial for securing deals or taking advantage of limited-time opportunities.

Account flexibility

Your business debit card can link to various account types including checking, savings, and money market accounts, providing versatile fund management options.

This flexibility allows you to optimize interest earnings by maintaining operational funds in higher-yield accounts while still accessing them for daily expenses.

You can switch account connections as your business needs evolve or as banks offer more competitive terms. This adaptability ensures that your business debit card system continues to serve your financial strategy effectively as your business grows and changes.

Debt avoidance

Your business debit card restricts spending to available account balances, effectively preventing debt accumulation and associated interest charges.

This built-in spending control mechanism protects your business from overextending financially and helps maintain healthy cash flow patterns. Unlike credit cards that can lead to mounting debt obligations, your debit card ensures that every purchase is backed by actual funds in your account.

This financial discipline contributes to stronger business credit profiles and more favorable lending terms when you do need to access credit facilities for expansion or equipment purchases.

Daily operations

Your business debit card handles a wide range of operational expenses essential to American businesses. You can purchase office supplies from retailers, book business travel, pay for SaaS subscriptions, like QuickBooks or Salesforce, and settle vendor invoices electronically.

The card's versatility extends to both online and in-person transactions, accommodating the diverse payment needs of modern businesses.

This operational flexibility ensures that your team can maintain productivity without payment-related delays or complications.

Right time to get a business debit card

Securing a business debit card should be among your first priorities upon registering your business in the US and obtaining your Employer Identification Number from the IRS.

Even if you're operating as a sole proprietor or launching a startup with minimal initial transactions, establishing this financial foundation early creates the framework for proper business financial management and ensures compliance with federal tax requirements.

When you register your business

Obtaining your business debit card immediately after completing your business registration creates the foundation for proper financial management from day one. This timing allows you to establish business credit history and maintain a clear separation between personal and business finances from the outset.

Early acquisition also ensures that you're prepared for unexpected business opportunities or expenses that may arise during your initial operating period. The documentation required for business registration typically aligns with business debit card application requirements, making this an efficient time to complete both processes simultaneously.

As soon as you start transacting

Once your business begins active buying or selling activities, regardless of transaction size, a business debit card becomes essential for maintaining proper financial records. Even small purchases like business cards, initial inventory, or basic office supplies should be processed through your business account to establish clear expense documentation.

This early transaction history becomes valuable for tax purposes and business analysis, helping you understand your spending patterns and operational costs. Starting with a business debit card from your first transaction eliminates the need to later separate mixed personal and business expenses.

When you need to separate finances

Sole proprietors and business owners transitioning from personal account usage must prioritize obtaining a business debit card to create clear financial boundaries. This separation protects your personal assets from business liabilities and simplifies tax preparation by creating distinct expense categories.

The IRS requires a clear separation of personal and business finances, and a business debit card provides the necessary documentation to support this requirement. This financial separation also strengthens your professional credibility with vendors, clients, and potential business partners who expect to see established business financial systems.

For employee spending control

Planning to have employees make business purchases requires implementing a business debit card system with controlled access and spending limits. You can issue cards to trusted employees while maintaining oversight through customizable spending restrictions and real-time transaction monitoring.

This controlled access eliminates the need for employees to use personal funds for business expenses and subsequent reimbursement processes. Employee cards linked to your business account ensure that all company expenses are properly categorized and documented for tax and accounting purposes.

Unlock smarter expense management with Volopay cards

How to select the best business debit card?

1. Card issuer

Choose a reputable financial institution with a strong track record serving businesses, such as established national banks or trusted fintech companies like Volopay. Research the issuer's financial stability, customer service reputation, and business banking expertise to ensure long-term reliability.

Consider institutions that specialize in business banking and understand the unique needs of companies in your industry or size category. The issuer's technological capabilities and digital banking platform should align with your business's operational requirements and growth plans.

2. Spend limits

Select a business debit card platform that offers customizable daily, weekly, or monthly spending limits that can be adjusted as your business needs change. These limits should accommodate your typical operational expenses while providing safeguards against unauthorized or excessive spending.

Look for systems that allow you to set different limits for different types of expenses or employee access levels. The ability to modify limits quickly through online platforms or mobile apps provides the flexibility needed to respond to changing business conditions or special purchasing requirements.

3. Multi-user support

Ensure your chosen business debit card system can issue multiple cards to employees while providing user-level controls and monitoring capabilities. Each card should offer individual spending limits, transaction categories, and approval requirements based on the employee's role and responsibilities.

The system should provide detailed reporting on each user's spending patterns and allow you to suspend or modify individual cards without affecting others. This multi-user functionality becomes increasingly important as your business grows and more team members need access to company funds.

4. Suitability for business types

Different business structures have varying requirements for their business debit card systems, with startups needing flexible, low-cost solutions, SMEs requiring moderate controls and reporting, and enterprises demanding sophisticated features and integration capabilities.

Consider whether the card system can accommodate your specific industry requirements, such as international transactions for import/export businesses or high-volume processing for retail operations. The system should scale appropriately with your business type and growth projections, avoiding the need for frequent platform changes as you expand.

5. Expense tracking and integration

Your business debit card should integrate seamlessly with popular accounting software used by businesses in the US, such as QuickBooks, Xero, or FreshBooks, to automate expense categorization and reporting. Look for systems that automatically capture transaction details, merchant information, and receipt data to minimize manual data entry.

The platform should provide detailed analytics and spending insights that help you make informed business decisions and identify cost optimization opportunities. Integration capabilities should extend to your existing business management systems and workflows.

6. Security features

Modern business debit card systems must include advanced security features such as EMV chip technology, fraud monitoring, real-time transaction alerts, and the ability to instantly freeze cards if suspicious activity is detected. Look for cards that offer virtual card numbers for online purchases, reducing the risk of compromising your primary card information.

Two-factor authentication for account access and transaction approvals provides additional security layers. The issuer should provide comprehensive fraud protection and quick resolution processes for any security incidents.

7. Online and international use

Your business debit card should function reliably for online purchases from domestic and international vendors, supporting e-commerce transactions essential to modern business operations. For businesses with international suppliers or travel requirements, ensure the card works globally with reasonable foreign transaction fees.

The system should support various online payment platforms and recurring subscription services commonly used by businesses. International compatibility becomes crucial for businesses planning expansion or working with global supply chains.

8. Fees and charges

Carefully evaluate the fee structure associated with your business debit card, including monthly maintenance fees, transaction fees, ATM fees, and charges for additional services like expedited card replacement or wire transfers.

Compare the total cost of ownership across different providers, considering both obvious fees and potential hidden charges. Some cards offer fee waivers based on account balances or transaction volumes, which may benefit your business model. Transparent fee structures help you budget accurately for banking costs and avoid unexpected charges that impact your bottom line.

9. Spend insights and analytics

Advanced business debit card platforms provide detailed spending analytics that help you understand expense patterns, identify cost-saving opportunities, and make data-driven financial decisions. Look for systems that categorize expenses automatically, provide customizable reporting periods, and offer comparative analysis across different time frames.

These insights should be accessible through user-friendly dashboards and mobile applications, allowing you to monitor business spending in real time. Predictive analytics and spending forecasts can help with budgeting and cash flow planning.

Requirements for obtaining a business debit card

Business verification

You must provide your Employer Identification Number and official formation documents such as Articles of Incorporation for corporations or Articles of Organization for LLCs to verify your business's legal existence. Banks require these documents to confirm that your business is properly registered with appropriate state authorities and authorized to conduct commercial activities.

Additional verification may include your business license, operating agreements, or partnership documents depending on your business structure. This documentation establishes the legal foundation necessary for opening business banking relationships and obtaining your business debit card.

Identity confirmation

Personal identification verification requires providing government-issued photo identification such as a driver's license or passport for all business owners, partners, or authorized signers. Banks must comply with federal Know Your Customer regulations, which mandate identity verification for all individuals associated with business accounts.

You may need to provide Social Security information, utility bills, or other documents that confirm your residential address and identity. This verification process protects both your business and the financial institution from fraud and ensures compliance with anti-money laundering regulations.

DBA documentation

If your business operates under a name different from your legal entity name, you must provide "Doing Business As" documentation filed with your local county clerk or state agency. This documentation proves that you have the legal right to conduct business under your chosen trade name and helps banks verify the legitimacy of your business operations.

DBA certificates typically require periodic renewal, so ensure your documentation is current when applying for your business debit card. Some banks may require additional advertising proof or publication records associated with your DBA filing.

Ownership clarity

Banks require clear documentation of business ownership structure, including ownership percentages for partnerships, member agreements for LLCs, or stockholder information for corporations. This information helps financial institutions understand who has the authority to make financial decisions and access business accounts.

You may need to provide operating agreements, bylaws, or partnership agreements that detail ownership rights and responsibilities. For businesses with complex ownership structures, additional documentation such as trust agreements or holding company relationships may be necessary.

License compliance

Submit current state or federal licenses that authorize your business to operate legally in your industry and geographic area. Professional service businesses may need to provide professional licenses, while retail operations might require sales tax permits or reseller licenses.

Some industries require multiple licenses or specialized permits that must be documented during the application process. Ensuring all licenses are current and in good standing demonstrates your business's commitment to legal compliance and operational legitimacy.

Contact details

Provide a verified physical business address and reliable contact information including phone numbers and email addresses to establish your business's legitimacy and accessibility. Post office boxes typically are not acceptable as primary business addresses, as banks prefer physical locations that can be verified.

Your contact information should match what appears on your business registration documents and other official filings. Banks may verify this information through independent sources or require additional documentation such as lease agreements or utility bills in the business name.

Steps to get a business debit card

Provider research

Conduct thorough research on potential business debit card providers by comparing features, fees, integration capabilities, and customer reviews from other American businesses.

Utilize resources like official trend statistics, online banking comparison websites, and industry-specific forums to gather comprehensive information about each provider's reputation and service quality.

Consider scheduling consultations with multiple banks or fintech companies to discuss your specific business needs and understand how their systems would support your operations. This research phase helps you make an informed decision that aligns with your business goals and financial requirements.

Card choice

Select the specific business debit card product that best matches your business needs, considering factors such as spending limits, user controls, reporting capabilities, and integration options with your existing business systems.

Review the terms and conditions carefully, paying attention to fee structures, liability protections, and service level agreements.

Consider whether you need additional features like virtual cards, international transaction capabilities, or specialized industry tools. Your choice should support both your current operations and anticipated future growth, avoiding the need for frequent platform changes.

Document preparation

Organize all required documentation including your EIN letter, business formation documents, personal identification, business licenses, and ownership agreements before beginning the application process.

Ensure all documents are current, properly notarized if required, and clearly legible for submission. Create copies of all original documents and organize them according to the provider's application checklist to streamline the submission process.

Having complete documentation ready reduces application processing time and minimizes the likelihood of delays or additional information requests.

Application submission

Complete the business debit card application accurately and thoroughly, providing all requested information about your business operations, ownership structure, and financial history.

Many providers offer online applications that can be completed efficiently, while others may require in-person meetings or phone consultations. Submit all supporting documentation promptly and respond quickly to any additional information requests from the provider.

Follow up appropriately on application status while respecting the provider's processing timelines and procedures.

Initial funding

Deposit the required minimum balance into your new business account to activate your business debit card and begin using the system for business transactions.

This initial funding should be sufficient to cover your immediate operational needs while meeting any minimum balance requirements to avoid fees. Consider transferring funds from existing business accounts or making deposits that align with your cash flow planning.

Some providers may place temporary holds on initial deposits, so plan your funding timing accordingly to ensure card availability when needed.

Feature setup

Activate online banking portals and mobile applications to enable real-time transaction monitoring, spending controls, and reporting features that maximize your business debit card system's value.

Configure user permissions, spending limits, and notification preferences according to your business management requirements. Set up integrations with your accounting software, expense management systems, and other business tools to automate financial processes.

Take time to explore all available features and customize the system to support your specific operational workflows and reporting needs.

Get the perfect card for your business

Volopay prepaid cards: An alternative to traditional business debit cards

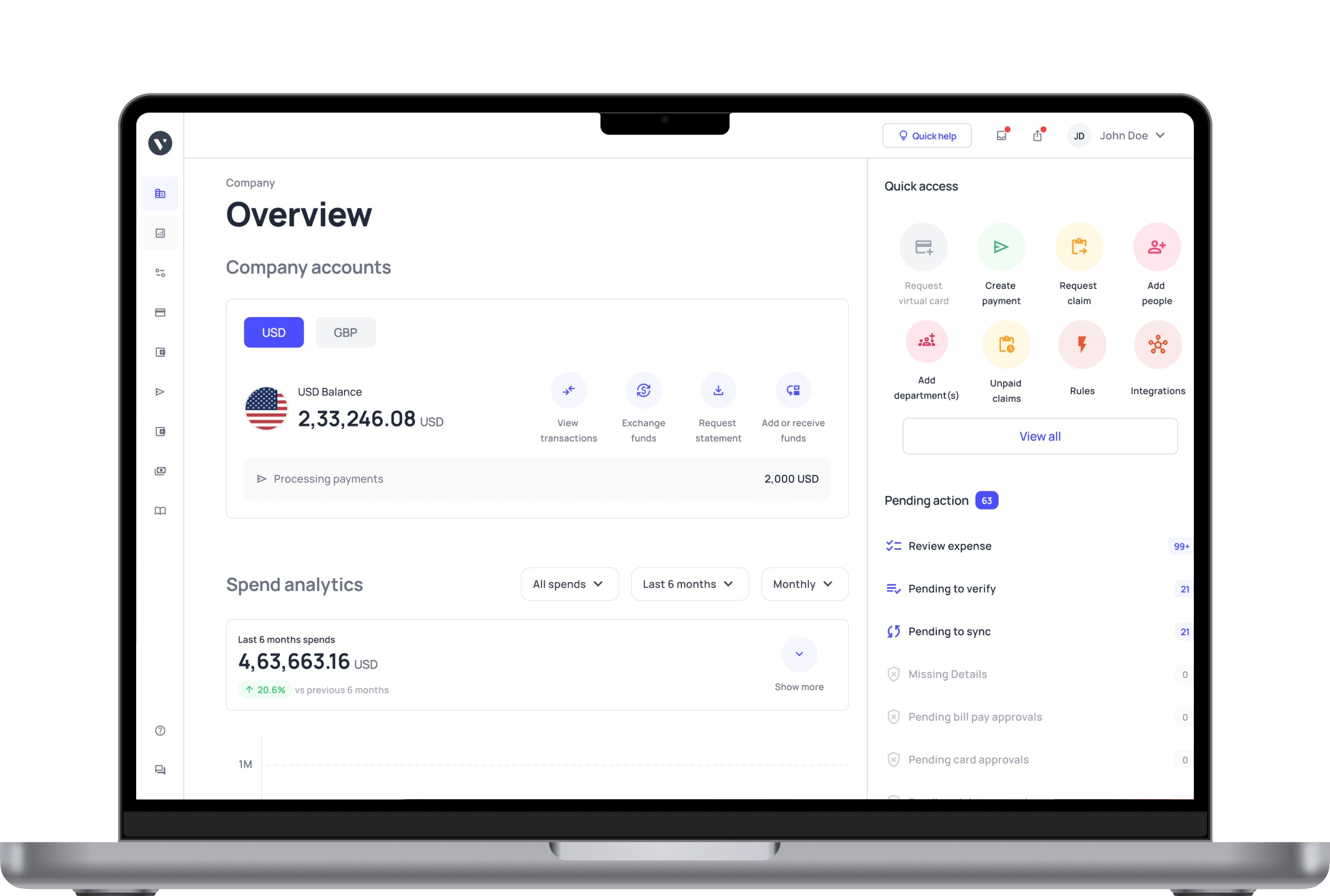

Volopay offers an innovative prepaid card solution that addresses many limitations of traditional business debit cards while providing enhanced control and visibility for US businesses. Their platform combines the convenience of card-based spending with advanced expense management features, real-time controls, and seamless accounting integration.

This modern approach to business spending management particularly benefits companies seeking more sophisticated financial controls and detailed spending analytics than conventional business debit cards typically provide.

Instant card top-ups

Volopay's prepaid card system allows you to instantly add funds to individual cards or card categories, providing immediate access to necessary business funds without traditional banking delays.

This instant funding capability ensures that your team can respond quickly to urgent business needs or unexpected opportunities without waiting for bank transfers or approval processes. The real-time funding feature particularly benefits businesses with fluctuating cash flow requirements or those operating in fast-paced industries where timing is crucial for success.

Real-time transaction monitoring

Volopay provides comprehensive real-time visibility into all card transactions, allowing you to monitor business spending as it occurs and respond immediately to any unusual or unauthorized activity.

This immediate oversight capability helps prevent overspending, identifies potential fraud quickly, and ensures that all business expenses align with approved budgets and policies. Real-time monitoring also supports better cash flow management by providing instant updates on available balances and spending patterns across all business cards and users.

Simplified accounting integration

Volopay seamlessly integrates with popular accounting software, including QuickBooks, Xero, and NetSuite, automatically categorizing expenses and eliminating manual data entry requirements that consume valuable administrative time.

This integration ensures that all card transactions are properly recorded in your accounting system with appropriate expense categories, tax classifications, and project codes. The automated integration reduces accounting errors, speeds up monthly closing processes, and provides accurate financial reporting that supports better business decision-making.

Unlimited virtual cards for online expenses

The platform provides unlimited virtual card generation for online purchases, subscriptions, and vendor payments, enhancing security while maintaining detailed spending controls and transaction tracking.

Each virtual card can have specific spending limits, expiration dates, and merchant restrictions, providing granular control over online business expenses. This virtual card capability particularly benefits businesses with significant online spending, subscription services, or concerns about card information security in digital transactions.

Industry-leading security protections

Volopay implements advanced security measures including multi-factor authentication, real-time fraud detection, instant card freezing capabilities, and encrypted transaction processing to protect your business financial information.

The platform's security infrastructure meets enterprise-grade standards while remaining user-friendly for businesses of all sizes. These comprehensive security features provide peace of mind for business owners concerned about financial fraud or unauthorized access to company funds.

Multi-tier approval workflows

The system supports customizable approval workflows that require management authorization for expenses above specified thresholds, ensuring that larger business expenditures receive appropriate oversight before processing.

These workflows can be configured based on expense amounts, categories, or individual user permissions, providing flexible control that adapts to your business's organizational structure. Multi-tier approvals help maintain budget discipline while ensuring that legitimate business expenses are processed efficiently without unnecessary delays.

Bring Volopay to your business

Get started now