Best Excel and spreadsheet alternatives for businesses [February 2026]

Excel and traditional spreadsheets have dominated expense tracking for decades. However, as your business scales and transactions multiply, manual entry becomes error-prone and time-consuming.

Modern alternatives now offer automation, real-time visibility, and seamless integrations that transform how you manage expenses and control spending across your organization.

Why small businesses still rely on Excel for expense tracking

Despite numerous modern solutions, many small businesses continue using Excel or Google Sheets for expense management. Understanding these reasons helps explain the gradual shift toward automated expense tracking platforms and why traditional methods persist in certain business contexts.

1. Familiarity and low initial cost

You already know how to use Excel from school or previous jobs. It comes bundled with Microsoft Office, making it feel free. There's no vendor onboarding, subscription fees, or training required. You simply open a file and start tracking expenses immediately with versatile formulae that you understand.

2. Full control and flexibility of data

Spreadsheets let you structure expense data exactly how you want. You create custom categories, add unique columns, and modify formulas anytime. This flexibility is appealing when your expense tracking needs don't fit standardized software templates or you prefer maintaining complete control over your financial data architecture.

3. Easy sharing and collaboration

Google Sheets enables real-time collaboration without additional software. You share a link with your accountant or business partner, and everyone sees updates instantly. Version history lets you track changes, and commenting features facilitate discussions directly within your expense tracking spreadsheet without switching platforms.

4. Limited awareness of modern tools

Many business owners don't realize spreadsheet alternatives for expense tracking exist or assume they're only for large enterprises. You might not know about specialized platforms that automate receipt matching, enforce spending policies, or integrate with accounting software. This knowledge gap keeps businesses using familiar spreadsheet tools longer.

Why businesses are replacing Excel with modern expense tracking software

Manual spreadsheet-based tracking no longer meets modern business demands. Consider a growing agency owner who spends hours each month consolidating expense reports from five team members across multiple Excel files.

Duplicate entries, missing receipts, and policy violations went undetected until quarterly reviews. When they switched to an automated expense tracking platform, these issues disappeared instantly, saving their finance team several hours monthly and reducing reimbursement errors by as much as 87%.

How spreadsheet alternatives compare for expense tracking

Evaluating different solution categories helps you identify which best Excel alternatives match your specific business requirements, team size, and operational complexity.

What qualifies as a spreadsheet alternative?

A spreadsheet alternative replaces manual expense tracking with specialized software offering automation, policy enforcement, and real-time visibility. These platforms capture receipts automatically, categorize expenses intelligently, sync with accounting systems, and provide approval workflows. Unlike spreadsheets, they reduce manual data entry and minimize human error significantly.

Comparing categories: expense platforms vs. accounting suites vs. custom trackers

Expense platforms specialize in spend management with corporate cards and policy controls. Accounting suites like QuickBooks offer expense tracking alongside invoicing and bookkeeping. Custom trackers like Airtable provide spreadsheet flexibility with database power. Your choice depends on whether you prioritize specialized expense features or broader financial management capabilities.

Matching alternatives to your business type and size

Startups with under ten employees often succeed with accounting suites or enhanced spreadsheets. Mid-sized companies need dedicated expense platforms with approval workflows and policy enforcement. Enterprises require advanced solutions supporting multi-currency operations, complex hierarchies, and ERP integrations. Match your current needs while considering growth trajectory.

Best Excel & spreadsheet alternatives for expense tracking in 2026

In 2026, business expense tracking has moved far beyond traditional Excel spreadsheets. Modern companies now rely on smarter, cloud-based tools designed for automation, accuracy, and collaboration.

Going forward, we are going to explore dedicated expense management platforms that streamline approvals and reimbursements, cloud-based accounting suites that integrate expenses with invoicing and reporting, and customizable spreadsheet-style trackers that balance flexibility with data control.

These solutions help businesses save time, reduce errors, and gain real-time financial visibility, making expense management a strategic advantage rather than just an administrative task.

1. The specialists: Dedicated expense management platforms

Dedicated expense platforms transform how you manage business spending through automation, policy enforcement, and real-time visibility across your organization.

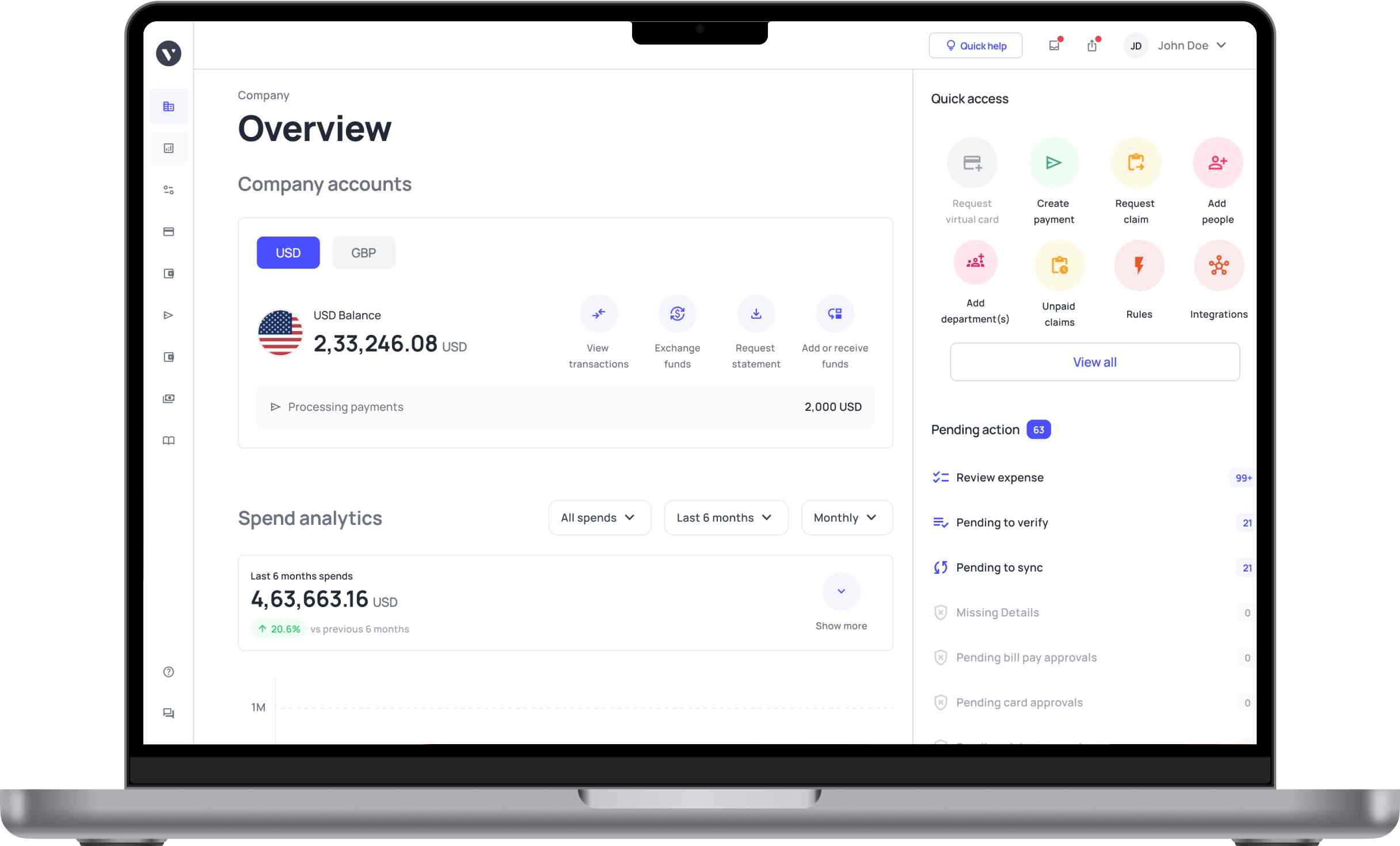

● Volopay

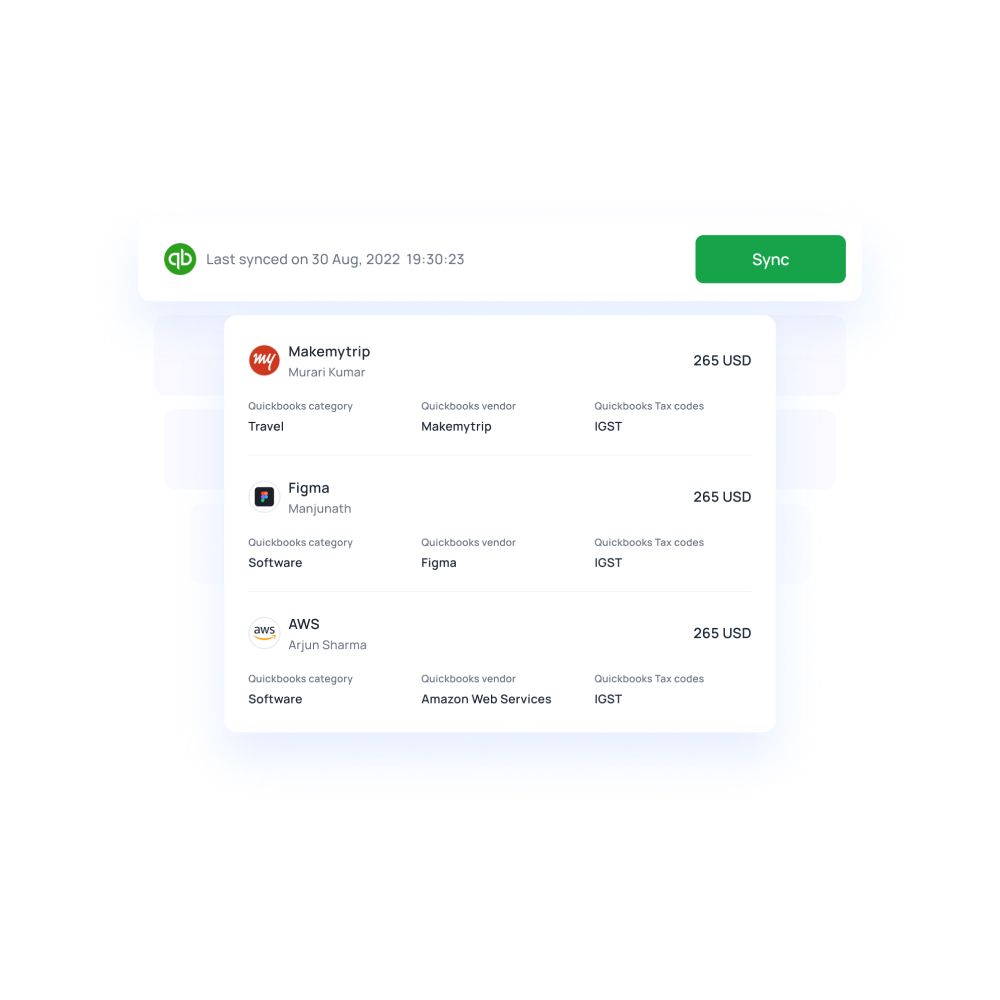

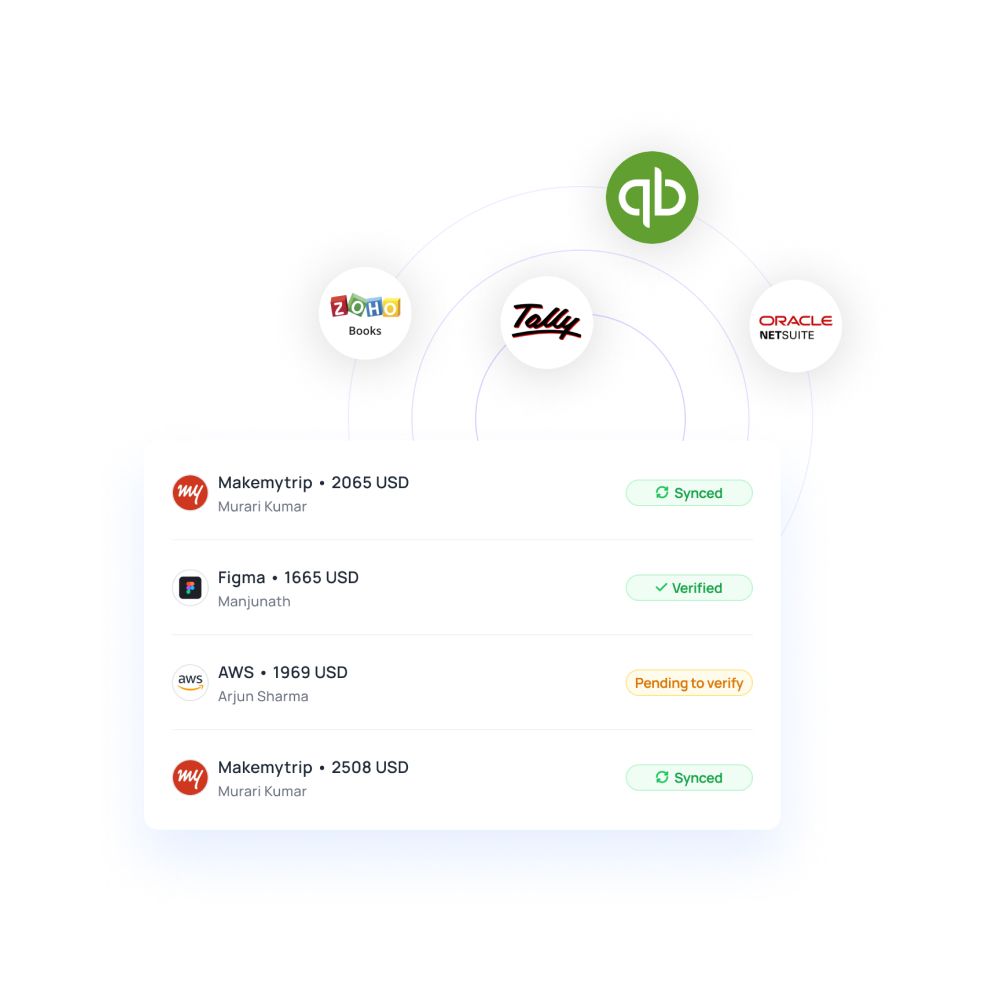

Volopay's comprehensive expense management platform combines corporate cards, expense management, and bill payments into one unified platform. You get real-time visibility into team spending with customizable approval workflows. Our platform automatically matches receipts to transactions, enforces spending policies, and integrates seamlessly with QuickBooks, Xero, and NetSuite for streamlined reconciliation.

● Brex

Brex offers corporate cards specifically designed for startups and technology companies without requiring personal guarantees. You automate expense reporting as transactions happen in real-time. The platform provides spend limits, built-in rewards, and sophisticated analytics that help you understand spending patterns across departments and projects.

● Concur Expense

SAP Concur handles complex enterprise expense management with multi-level approval chains and global compliance features. You manage travel bookings, expense submissions, and policy enforcement through one comprehensive system. The platform supports multiple currencies, tax regulations, and integration with major ERP systems for large multinational organizations.

● Expensify

Expensify excels at mobile-first expense management with industry-leading receipt scanning technology. You photograph receipts, and the platform automatically extracts data, categorizes expenses, and submits reports. SmartScan technology recognizes merchants, amounts, and dates accurately, making it ideal for teams constantly traveling or working remotely.

● Ramp

Ramp provides corporate cards paired with powerful spend management software that helps you save money through price intelligence. You receive alerts about duplicate subscriptions, better vendor pricing, and unusual spending patterns. The platform offers sophisticated budgeting tools, automatic receipt matching, and deep integrations with accounting systems.

2. Cloud-based accounting suites with expense tracking

Cloud accounting platforms provide the best spreadsheet alternatives by combining expense tracking with broader financial management capabilities like invoicing, bookkeeping, and tax preparation.

● QuickBooks

QuickBooks Online dominates small business accounting with integrated expense tracking features. You snap receipt photos through the mobile app, categorize expenses automatically, and reconcile bank transactions effortlessly. The platform connects with your bank accounts, credit cards, and thousands of business applications for comprehensive financial visibility.

● Xero

Xero offers intuitive cloud accounting with strong expense management for small to medium businesses. You track bills, reconcile bank feeds, and manage employee reimbursements efficiently. The platform's clean interface and extensive app marketplace make it popular among growing companies needing scalable financial management solutions.

● Wave

Wave provides completely free accounting software perfect for freelancers and very small businesses. You track income and expenses, send invoices, and generate financial reports without subscription fees. While limited compared to paid alternatives, it offers remarkable value for solopreneurs managing straightforward expense tracking needs.

● FreshBooks

FreshBooks focuses on service-based businesses needing time tracking alongside expense management. You log billable expenses, attach receipts, and invoice clients automatically. The platform excels at project-based expense tracking, where you need to allocate costs to specific clients for accurate billing and profitability analysis.

● Zoho

Zoho Books integrates expense tracking within a broader suite of business applications. You manage receipts, automate workflows, and track project expenses while accessing CRM, inventory, and HR tools. This interconnected ecosystem benefits businesses wanting unified data across multiple business functions without switching between disparate platforms.

3. The custom trackers: spreadsheets with database structure

These hybrid solutions offer spreadsheet familiarity combined with database functionality, automation capabilities, and collaboration features that traditional Excel files cannot match.

● Airtable

Airtable transforms spreadsheets into relational databases where you link expenses to projects, vendors, and budgets. You create multiple views showing the same data differently—a calendar view for dates, a kanban for approval workflows, gallery for receipts. Automations trigger actions when expenses meet certain conditions automatically.

● Smartsheet

Smartsheet emphasizes project-based expense tracking with built-in approval workflows and resource management. You track expenses against project budgets, create automated approval chains, and generate reports showing cost allocation. The platform suits project managers needing expense visibility within broader project management processes.

● Google Sheets

Google Sheets remains relevant for basic expense tracking when enhanced with add-ons and scripts. You collaborate in real-time, use formulas for calculations, and integrate with other Google Workspace tools. While lacking native automation, add-ons like Sheetgo and AppSheet extend functionality for more sophisticated tracking.

● Notion

Notion lets you link expense entries to related projects, budgets, and documentation within a unified workspace. You create custom databases with formulas, rollups, and relations between different information types. This suits teams wanting expense tracking embedded within their broader knowledge management and project documentation system.

● Coda

Coda combines document flexibility with spreadsheet power and database structure in one platform. You build custom expense tracking workflows with buttons, automations, and conditional formatting. The platform's pack system connects to external services, enabling automated data imports and sophisticated expense management tailored to your workflow.

Common pitfalls in manual expense tracking

Understanding where manual processes fail helps you recognize when you've outgrown spreadsheets and need dedicated automated expense tracking solutions for your growing business.

Manual data entry errors and duplicates

Typing expense amounts, dates, and categories by hand introduces countless mistakes. You transpose numbers, select the wrong categories, or accidentally enter the same expense twice.

For instance, a finance manager consolidating multiple Excel sheets could accidentally duplicate an expense, causing a 5% overstatement in monthly reports that goes undetected until an audit.

Difficulty enforcing policies

Spreadsheets can't automatically prevent policy violations before they occur. You usually discover such out-of-policy expenses only during review, after the money is already spent and recorded.

Imagine if an employee charters a plane instead of booking a business class ticket on a commercial flight, violating travel policy, and you only catch it when reviewing the monthly expense report weeks later.

Limited analytics and forecasting

Excel provides basic calculations but lacks sophisticated analytics showing spending trends, anomalies, or predictive insights. You manually create pivot tables and charts that become outdated immediately.

Picture a CFO suddenly realizing their quarterly financial forecast is wrong because the spreadsheet didn't properly account for complex and unpredictable seasonal spending patterns.

Time-consuming reconciliation

Matching receipts to credit card statements and bank transactions consumes hours each month. You hunt through email attachments, paper receipts, and transaction records manually.

An accounting team can spend nearly three full days each month manually reconciling complex expenses that an automated system would handle instantly.

Security and access control issues

Spreadsheet files get emailed, downloaded, and shared without proper access controls or restrictions in most organizations. You can't accurately track who viewed or edited sensitive financial data.

An employee could accidentally share an expense spreadsheet with salary information externally, creating a serious confidentiality breach that could have been prevented.

The evolution of expense tracking: From Excel to automation

Expense management has transformed dramatically over the decades, moving from paper-based processes to sophisticated automated platforms that provide real-time visibility and control over business spending.

1. From ledgers and receipts to digital spreadsheets

Businesses once tracked every expense in paper ledgers, filing physical receipts in folders for years. VisiCalc and later Excel revolutionized this process in the 1980s and 1990s. You could finally calculate totals automatically, create categories, and generate reports without the manual arithmetic that consumed hours weekly.

2. The cloud era and mobile expense tracking

Cloud computing and smartphones enabled expense tracking from anywhere. You no longer needed to be at your desk to update financial records. Google Sheets allowed real-time collaboration, while mobile apps let employees photograph receipts immediately, reducing lost documentation and improving accuracy significantly.

3. The rise of automation and integrated spend management

Modern platforms eliminate manual data entry entirely through automated receipt capture, bank feeds, and corporate card integration. You get real-time spending visibility, automated policy enforcement, and seamless accounting system synchronization. Artificial intelligence now categorizes expenses, detects anomalies, and even predicts future spending patterns accurately.

The one-sheet system: Simplifying expense tracking before you scale

A one-sheet system consolidates all expense tracking into a single, well-structured spreadsheet. This approach works effectively for small businesses before transaction volume necessitates dedicated software, providing clarity without complexity or overwhelming your financial processes.

Structuring categories for simplicity

Create 8–12 broad expense categories that cover your business needs without unnecessary granularity. You might use categories like ‘Marketing’, ‘Operations’, ‘Travel’, ‘Software’, and ‘Professional Services’.

Avoid creating dozens of subcategories that complicate tracking and make reports harder to analyze effectively.

Using conditional formatting for quick analysis

Apply color-coding rules that automatically highlight expenses exceeding budget thresholds or requiring review. You instantly spot problematic spending without scrutinizing every line item.

Red highlights appear when any category surpasses 85% of its monthly budget allocation, enabling proactive intervention before overspending occurs.

Automating totals and budget alerts

Use formulas that calculate category totals, monthly spending, and remaining budgets automatically. You create a dashboard section at the top showing key metrics updated in real-time for better visibility and decision-making.

SUMIF formulas track spending by category, while simple arithmetic calculations can easily and clearly show variance between budgeted and actual amounts.

When the one-sheet system isn't enough

Your single spreadsheet becomes inadequate when multiple team members need simultaneous access, approval workflows are required, or monthly transaction volume exceeds 100 entries or more.

Version control problems, data entry errors, and reconciliation challenges signal it's time to migrate towards dedicated software, some of the best Excel alternatives for proper expense management.

How to export financial data without drowning in Excel sheets

Many businesses export accounting data to Excel for analysis, creating countless spreadsheet versions that become difficult to manage. Automated data synchronization methods eliminate this chaos while improving accuracy and reducing manual effort significantly.

1. Automated journal entry posting

Configure your expense platform to post journal entries directly into your accounting software automatically. You eliminate manual data transfer entirely while ensuring transactions appear in your general ledger correctly. This method reduces month-end closing time from days to hours while virtually eliminating reconciliation discrepancies.

2. Leveraging API connectors over CSV files

API integrations synchronize data between systems in real-time without any manual downloads or uploads. You connect your expense platform directly to your accounting software through secure APIs. Changes appear instantly across systems, eliminating version control issues and ensuring everyone works with current information.

3. Audit-ready data export

When auditors request documentation, export complete transaction sets with attached receipts, approval chains, and supporting documentation automatically. You provide auditors with structured data packages instead of hunting through scattered spreadsheets and email attachments. This approach reduces audit preparation time by up to 70%, sometimes even more.

4. Direct bank feed synchronization for transaction data

Connect your bank accounts directly to your accounting or expense management platform for automatic transaction imports. You eliminate manual entry of banking transactions while maintaining up-to-date financial records. The system matches transactions to receipts and invoices automatically, streamlining reconciliation dramatically.

5. Customizable field mapping for legacy ERPs

Enterprise resource planning systems often require specific data formats and field structures. Customizable mapping lets you transform expense data to match your ERP's requirements exactly. You configure the mapping once, then every export follows the same structure without manual reformatting or data manipulation.

Why it's time to move from spreadsheets to automated expense tracking

Continuing with manual spreadsheets creates mounting problems as your business grows. Modern automated expense tracking platforms deliver measurable benefits that justify migration effort and provide immediate return on investment through time savings and error reduction.

Improved accuracy and audit readiness

Automated systems eliminate transcription errors, duplicate entries, and calculation mistakes inherent in spreadsheets. You maintain audit trails showing who approved expenses, when changes occurred, and supporting documentation for every transaction. This documentation satisfies auditor requirements without scrambling to compile information retroactively.

Significant time savings from automation

Automation reclaims the hours your team currently spends on data entry, reconciliation, and report generation. You redirect this time toward strategic financial analysis and business planning. Studies show companies can save as much as 75% of the time spent on expense management when switching from spreadsheets to dedicated platforms.

Centralized dashboard for spend insights

Modern platforms provide real-time dashboards showing spending trends, budget utilization, and anomalies instantly. You identify problems immediately rather than discovering issues during monthly reviews. Executives can access current spending data anytime without waiting for finance teams to compile reports manually from spreadsheets.

Seamless integration with business tools

Expense platforms integrate with accounting software, ERP systems, HR platforms, and business intelligence tools automatically. You eliminate manual data transfers between systems while ensuring consistent information across your entire technology stack. These integrations create a unified financial ecosystem that improves visibility organization-wide.

How to transition from spreadsheets to automated expense tracking

Review every expense tracking spreadsheet across your organization to understand current categories, workflows, and reporting needs.

Identify data fields requiring migration, custom formulas needing replication, and unique processes requiring accommodation. This comprehensive audit prevents losing important functionality during transition.

Evaluate platforms based on your specific requirements, team size, integration needs, and budget constraints.

Compare features, test user interfaces, and verify accounting system compatibility. Consider requesting demos and running pilot programs with small teams before committing to organization-wide implementation.

Import past expense data carefully using the provided migration tools or CSV import functions.

Verify data accuracy post-migration by reconciling totals and spot-checking transactions. Keep copies of original spreadsheets for a year to resolve future discrepancies.

Configure automated categorization rules, approval workflows, and policy controls precisely matching your business requirements.

Establish spending limits, define approval hierarchies, and set up receipt requirements for different expense types. Proper configuration prevents policy violations while ensuring smooth operations from day one.

Conduct comprehensive training sessions, ensuring everyone understands new processes for submitting expenses, uploading receipts, and following approval procedures.

You can create quick reference guides, offer ongoing support, and designate power users who can assist colleagues. Strong change management ensures high adoption rates and prevents reverting to old spreadsheet habits.

Key features to look for in modern expense tracking tools for businesses

When evaluating the best spreadsheet alternatives, focus on capabilities that address your specific pain points while supporting future growth and evolving business requirements across your organization.

Real-time spend monitoring and alerts

Choose platforms providing instant visibility into spending as transactions occur rather than waiting for end-of-month reports.

You receive automated alerts when departments approach budget limits, unusual spending patterns emerge, or policy violations occur. This real-time awareness enables proactive financial management instead of reactive problem-solving.

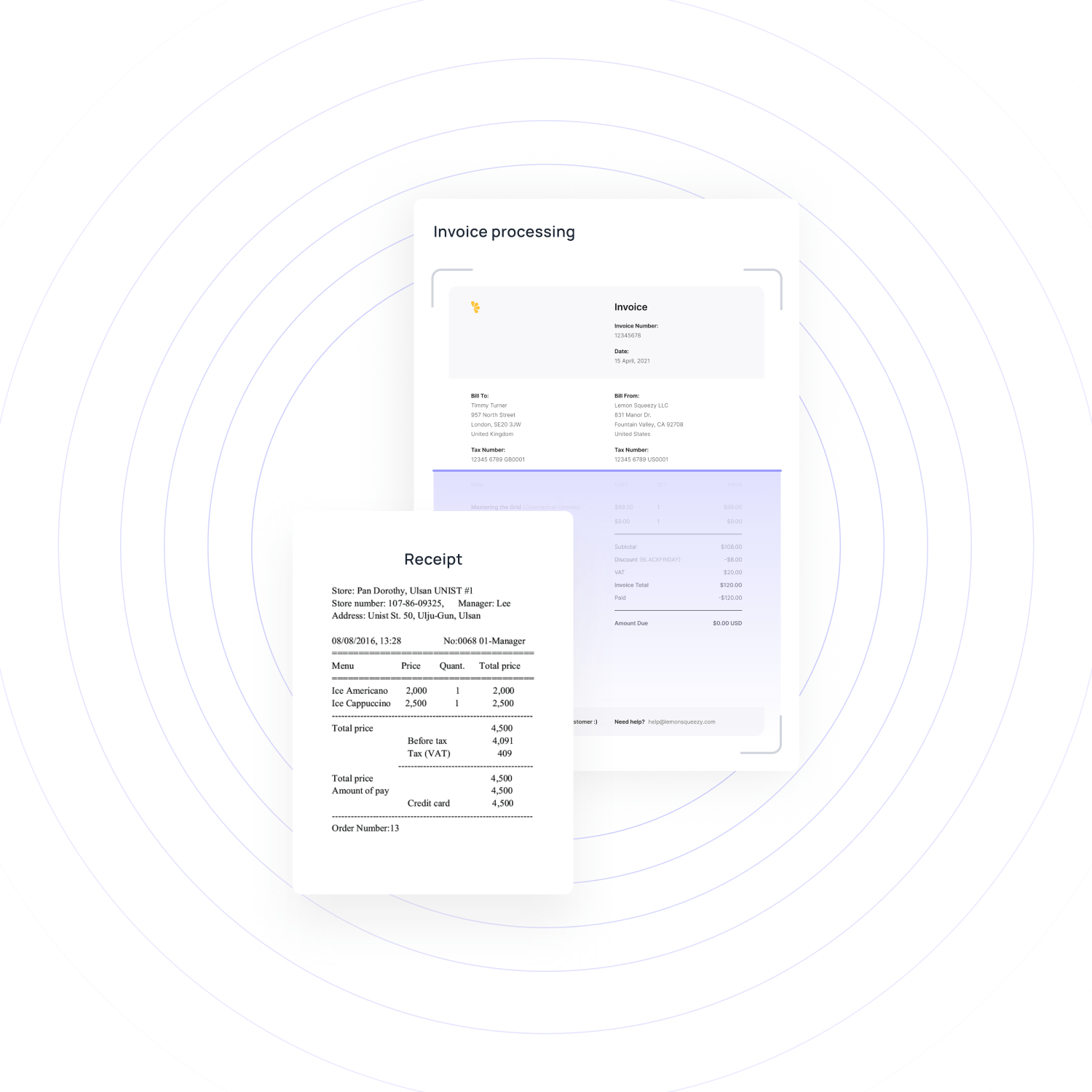

Automated receipt capture and OCR scanning

Modern platforms use optical character recognition to extract data from receipt photos automatically. You eliminate manual data entry while ensuring every expense has supporting documentation.

Advanced systems match receipts to credit card transactions automatically, streamlining reconciliation and reducing the administrative burden significantly.

Role-based access and approvals

Implement granular permission controls determining who can submit expenses, approve transactions, access reports, and modify settings.

You create multi-level approval workflows routing expenses to appropriate managers based on amount, category, or department. This control structure enforces spending governance while maintaining operational efficiency.

Integrations with accounting and ERP tools

Select platforms offering native integrations with your existing accounting software, ERP systems, and payroll platforms. You eliminate manual data transfers and ensure consistent information across systems.

Strong integration ecosystems enable end-to-end automation from expense submission through accounting reconciliation and financial reporting.

Policy enforcement and expense rules

Configure automated policy rules preventing out-of-policy expenses before submission rather than catching violations during review.

You set maximum amounts for meal reimbursements, require receipts above thresholds, and restrict certain expense categories entirely. Proactive enforcement reduces violations and eliminates uncomfortable conversations about breaches.

Global usability and multi-currency support

For international operations, choose platforms handling multiple currencies, tax regulations, and compliance requirements across different jurisdictions.

You should be able to track expenses in local currencies while reporting in your base currency automatically. The system should handle currency conversions, VAT recovery, and country-specific receipt requirements seamlessly.

Regulatory compliance and audit readiness requirements in expense tracking

Maintaining compliance with tax regulations, accounting standards, and industry requirements becomes significantly easier when using specialized expense management platforms designed with regulatory requirements integrated throughout their functionality.

Expense reporting regulations

Different jurisdictions impose specific requirements for expense documentation, receipt retention, and reimbursement processes. You must maintain records showing business purpose, date, amount, and attendees for meals.

Modern platforms prompt employees for required information during submission, ensuring compliance from the start rather than fixing deficiencies later.

Enhanced audit trail capabilities

Comprehensive audit trails document every action taken on expense reports, including submissions, modifications, approvals, and payments. The platform should demonstrate complete transparency, showing who did what and when for every transaction.

This documentation satisfies auditor requirements and internal controls while identifying potential fraud or policy violations quickly.

Data security & privacy compliance

Expense platforms must protect sensitive financial information through encryption, secure access controls, and regular security audits. You need compliance with standards like SOC 2, GDPR for European operations, and industry-specific requirements.

Verify that platforms store data securely, maintain reliable backup systems, and have clearly well-documented incident response procedures.

Multi-currency compliance

International businesses face complex tax and compliance requirements varying by country. You must handle VAT recovery in Europe, GST in Australia, and various withholding tax requirements globally.

Choose expense tracking platforms with built-in compliance features for your operating regions, thereby significantly reducing the overall risk of costly business regulatory violations.

Automated policy enforcement

Beyond regulatory compliance, internal policy enforcement prevents expense fraud and ensures consistent spending practices. You should be able to configure rules matching your travel policies, entertainment limits, and approval requirements.

The system enforces these policies automatically before expenses are approved, creating a culture of compliance throughout your organization.

How to choose the best expense tracking solution for your business

Define your volume, complexity, and industry needs

Analyze your monthly transaction volume, number of employees submitting expenses, and specific unique industry requirements in detail.

You might need specialized features for construction project tracking, healthcare compliance, or non-profit grant management. Understanding these specifics helps narrow options to platforms designed for businesses like yours.

Prioritize end-user experience and adoption rate

The best-featured platform fails if employees won't use it consistently. You should prioritize intuitive mobile apps, simple submission processes, and minimal training requirements.

Test platforms with actual employees before deciding, as high adoption rates directly correlate with successful implementations and realized return on investment.

Evaluate integration and automation capabilities

Assess how well platforms integrate with your existing accounting software, payroll systems, and business tools. You want seamless data flow, eliminating manual transfers.

Strong automation capabilities for receipt matching, categorization, and reconciliation deliver the time savings justifying platform investment and ongoing subscription costs.

Assess proactive policy enforcement and control

Look for platforms that proactively prevent policy violations before they occur rather than catching problems later during detailed expense review.

You need configurable spending limits, receipt requirements, and approval workflows matching your governance structure. Proactive controls reduce the finance team's burden while ensuring spending compliance organization-wide.

Consider scalability and total cost of ownership (TCO)

Choose platforms that grow with your business without requiring complete replacement. You should evaluate not just subscription costs but implementation effort, training time, and ongoing administration.

Sometimes platforms with higher subscription fees deliver lower total cost through superior automation, better integrations, and reduced administrative overhead.

Common challenges when switching from Excel

Anticipating migration obstacles helps you prepare solutions proactively, ensuring smoother transitions and higher adoption rates when implementing new automated expense tracking systems across your organization.

Data migration and formatting issues

Historical expense data often requires cleaning and reformatting before importing into new systems. You encounter inconsistent date formats, merged cells, and non-standard categories requiring standardization.

Allow extra time for thorough data preparation and validation, running parallel systems temporarily to verify accuracy before fully committing to new platforms.

User resistance and change fatigue

Employees comfortable with existing spreadsheet processes may resist learning new systems, especially if your organization frequently changes tools or introduces unfamiliar digital workflows.

You combat resistance through clear communication about benefits, comprehensive training, and leadership support. Highlight how new systems reduce their administrative burden rather than creating additional work.

Integrating with legacy systems

Older accounting software or custom ERP systems may lack modern API integrations, requiring manual workarounds. You might need middleware solutions or custom development connecting your expense platform to legacy systems.

Budget time and resources for integration projects, potentially phasing implementation to address technical challenges methodically.

Over-customization leading to complexity

Modern platforms offer extensive customization, tempting you to replicate every spreadsheet formula and unique process. You risk creating overly complex configurations that confuse users and complicate maintenance.

Start with standard configurations, adding customization only for truly essential requirements that standard features cannot accommodate.

Benefits of automating expense tracking beyond Excel

Imagine having a dashboard that updates expense reports in real time instead of waiting for end-of-month Excel uploads. Modern platforms deliver transformative benefits extending far beyond simple automation of manual processes.

Real-time reporting and forecasting

Access current spending data instantly rather than waiting for the month-end consolidation of multiple spreadsheets. You should monitor budget utilization continuously, identify trends immediately, and adjust spending proactively.

Finance teams generate accurate, board-ready reports in minutes instead of spending days compiling information from disparate sources.

Reduced fraud and policy violations

Automated policy enforcement and audit trails significantly reduce fraudulent expense claims and policy violations. You can detect duplicate submissions, unusual spending patterns, and out-of-policy expenses before approval.

Studies show companies can significantly reduce expense fraud by up to 60% when implementing automated systems with strong internal controls.

Streamlined reimbursements and approvals

Automated workflows route expenses to appropriate approvers automatically based on amount, category, or organizational hierarchy. Eliminate email chains and manual routing while ensuring proper authorization.

Employees receive reimbursements faster, improving satisfaction and reducing the finance team's workload handling reimbursement inquiries.

Enhanced financial decision-making

Rich analytics reveal spending patterns, vendor concentrations, and optimization opportunities invisible in spreadsheets. You can identify duplicate subscriptions, negotiate better rates with frequently used vendors, and reallocate budgets based on actual utilization.

Data-driven insights enable smarter strategic decisions, significantly improving overall financial performance measurably over time across all business functions

Best practices for ongoing expense tracking efficiency

Success requires ongoing processes even after implementing software, ensuring accurate, compliant, and efficient expense management that delivers lasting value to your organization.

Regular expense audits and data hygiene

Conduct monthly spot-checks of expense reports, ensuring proper categorization, adequate documentation, and policy compliance. Identify training gaps, process improvements, and potential policy violations early.

Regular audits maintain data quality and demonstrate organizational commitment to expense management best practices.

Continuous policy review and enforcement

Review expense policies annually, adjusting limits and rules to match current business conditions and inflation. Gather feedback from employees and managers about policy pain points or unclear guidelines.

Keep policies current and clearly communicated, ensuring everyone understands expectations and consequences for violations.

Leveraging analytics for budget forecasting

Use historical spending data and trend analysis to create more accurate departmental budgets and financial forecasts. Identify seasonal patterns, growth trajectories, and cost-saving opportunities through sophisticated analytics.

Data-driven budgeting reduces variance between projected and actual spending, improving overall financial planning accuracy.

Encouraging team-wide adoption and feedback loops

Create channels for employees to share feedback about expense processes, suggest improvements, and ask questions. You must foa ster continuous improvement culture while ensuring systems evolve, meeting user needs.

High engagement leads to better compliance, more accurate data, and greater return on your expense management investment.

Key metrics to track for smarter expense management

Monitoring specific metrics helps you measure expense management effectiveness, identify improvement opportunities, and demonstrate value from your investment in modern spreadsheet alternatives for expense tracking platforms.

1. Expense-to-revenue ratio and budget utilization

Track total expenses as a percentage of revenue, monitoring trends over time, and comparing against industry benchmarks. Measure budget utilization rates across departments, identifying those consistently over or under budget. These metrics reveal whether your business maintains healthy spending relative to income.

2. Spend by department and category trends

Analyze spending patterns by department, category, and time period to identify anomalies, growth areas, and cost reduction opportunities. Spot unusual increases in specific categories requiring investigation or departments consistently exceeding budgets. Trend analysis enables proactive management rather than reactive problem-solving.

3. Policy violation rates and approval delays

Monitor the percentage of expense reports containing policy violations and average approval times across your organization. Identify departments needing additional training, policies requiring clarification, or approval bottlenecks slowing reimbursements. Lower violation rates indicate effective policy communication and enforcement.

4. Reimbursement time and employee satisfaction

Track average time from expense submission to reimbursement payment, as delays negatively impact employee satisfaction and morale. Measure processing efficiency and identify bottlenecks in approval or payment workflows. Faster reimbursements improve employee experience while indicating efficient finance operations overall.

The future of expense tracking: AI and predictive spend automation

Artificial intelligence and machine learning are transforming expense management from reactive reporting to proactive spend control, enabling unprecedented visibility and optimization across organizational spending.

AI-powered categorization and smart expense detection

Machine learning algorithms automatically categorize expenses with increasing accuracy as they learn your business patterns. You can benefit from intelligent duplicate detection, anomaly identification, and even fraud prediction before losses occur. AI eliminates manual categorization work while improving accuracy beyond what humans achieve consistently.

Predictive budgeting and intelligent spend forecasting

Advanced analytics predict future spending based on historical patterns, seasonal trends, and business growth trajectories. Receive early warnings when departments will likely exceed budgets, enabling proactive intervention. Predictive models help finance teams create more accurate budgets and forecasts, improving strategic planning capabilities.

From reactive reporting to proactive spend control

The future shifts from reviewing past expenses to preventing problematic spending before it occurs. Implement intelligent systems suggesting budget reallocation, identifying cost-saving opportunities, and automatically negotiating vendor pricing. This transformation makes finance teams strategic partners rather than just scorekeepers of historical transactions.

How Volopay simplifies expense tracking for modern businesses

Volopay addresses common expense management challenges through a unified platform combining corporate cards, automated expense tracking, bill payments, and accounting integrations designed specifically for growing businesses.

Unified platform for spend and expense management

Volopay consolidates corporate cards, expense reimbursements, bill payments, and accounting into one comprehensive platform. You eliminate juggling multiple tools while gaining complete visibility across all business spending.

This unified approach simplifies operations while providing finance teams with centralized control over organizational expenditures.

Real-time expense visibility across teams

Monitor spending as transactions occur rather than waiting for monthly reports compiled from spreadsheets. You can track budget utilization continuously, receive alerts when limits approach, and identify spending trends immediately.

Real-time visibility enables proactive financial management, preventing overspending and improving budget accuracy significantly.

Automated receipt matching and reconciliation

Volopay automatically matches submitted receipts to card transactions, eliminating time-consuming manual reconciliation processes. You reduce month-end closing time from days to hours while virtually eliminating matching errors.

Our platform reminds employees to submit missing receipts, ensuring complete documentation for every transaction.

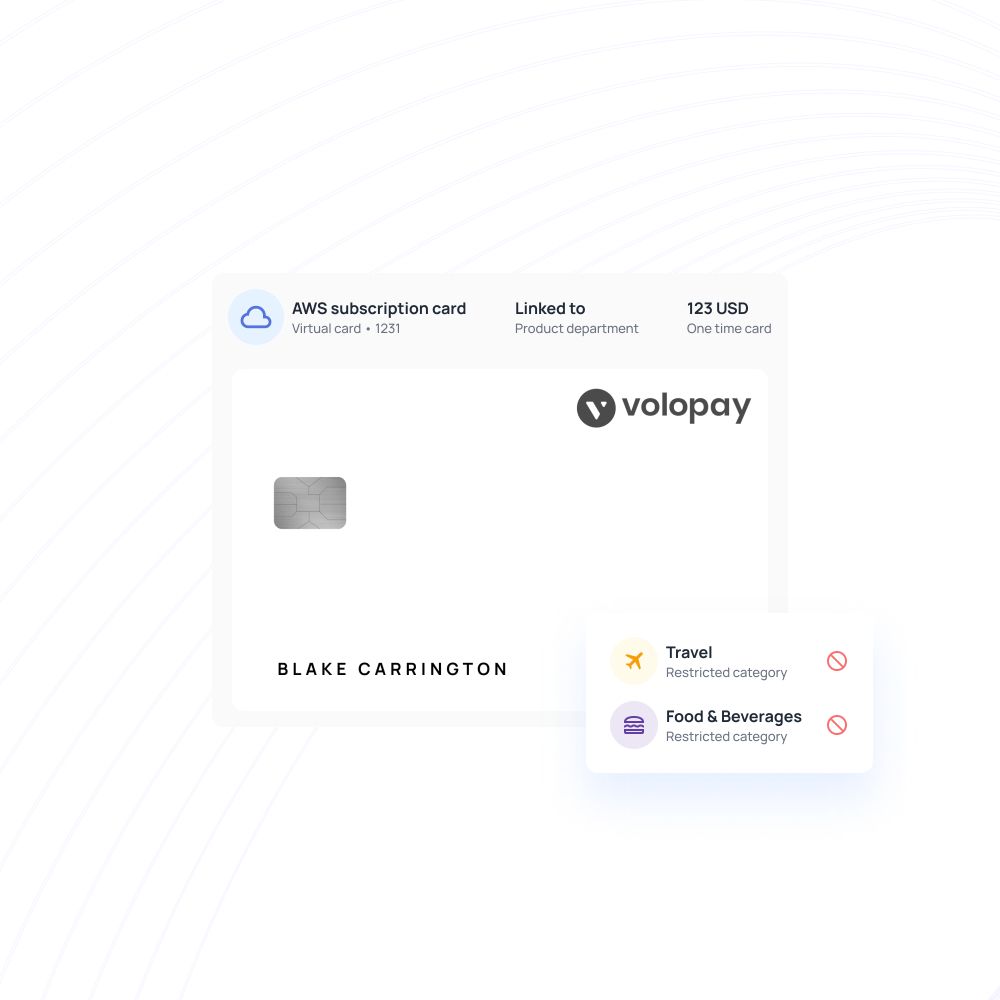

Smart corporate cards for instant control

Issue virtual and physical prepaid cards with customizable spending limits, merchant restrictions, and validity periods for complete spending control.

Your team can create single-use cards for specific purchases, department cards with monthly budgets, or employee cards with category restrictions. This granular control prevents unauthorized spending while maintaining operational flexibility.

Integration with leading accounting platforms

Volopay integrates seamlessly with accounting platforms like QuickBooks, Xero, NetSuite, and more through native connections. You eliminate manual data entry and CSV imports while ensuring consistent financial data across systems.

Automated synchronization posts transactions directly to your general ledger, streamlining accounting processes dramatically.

Bring Volopay to your business

Get started now

Frequently asked questions

Yes, modern platforms offer extensive customization, including custom expense categories, approval workflows, policy rules, and reporting formats. You configure systems matching your specific business processes without requiring technical expertise or coding knowledge.

These platforms automate receipt capture, expense categorization, policy enforcement, approval routing, and accounting system synchronization. You eliminate repetitive manual tasks, reduce errors, and accelerate reimbursement processing while ensuring complete compliance with organizational policies.

Yes, Volopay offers comprehensive mobile apps for iOS and Android, enabling employees to submit expenses, photograph receipts, and track approvals from anywhere. Managers approve expenses on the go, ensuring fast reimbursement processing without desktop access requirements.

Volopay eliminates most manual data entry through automated receipt capture, transaction matching, and bank feed synchronization. The platform validates submissions against policies automatically, flags duplicates, and requires proper documentation before approval, virtually eliminating common expense reporting errors.

Volopay provides real-time spending visibility, automated approval workflows, and seamless accounting integrations, eliminating manual processes. You gain complete control through corporate cards with built-in limits while reducing administrative burden through automation, making expense management effortless for growing teams.