Benefits of bulk payment system for businesses

The accounts payable department takes care of outstanding payments and bills to be cleared. But they cannot work continuously when the company has too many vendors to pay. A bulk payments system is what they prefer in such cases.

The bulk payment system denotes sending out multiple payments to different vendors at once through a unified platform. Uncleared and forgotten bills create a bad impression about you among vendors. Let bulk payment solutions handle that for you.

Why are bulk payments needed?

Bulk payment systems are necessary for businesses of all sizes. In medium and large-scale organizations, it can be hard to keep track of payments if you send them one by one.

Also, if you have multiple payment systems (checks, online wallets, cards, etc.), it will get difficult to track. You have to rely on manual methods for tracking. Businesses clearly understand this and use bulk payment solutions in the accounts payable department.

Other than basic reasons, there are specific purposes for which bulk payment services are sought.

1. Salary dispersal

Even if you have a minimal number of employees, you can only use a bulk payments system to make salary disbursements. Salary must go out on a specific date and time to all employees at once. Hence, bulk payments are a must here.

2. Paying out dividends

Like how employees receive their salary at the same time, shareholders and investors receive their share of dividends every month. Sending them out to each shareholder separately takes time.

Hence, registered organizations always prefer bulk payments method to send out dividends.

3. Refunds

Sending out refunds to customers is common in all sectors. You will have the list of customers who are expecting a refund. Instead of paying them normally, working with a bulk payment service is the best way to go.

Your customer knows the standard time when you release the money and don’t follow up or track repeatedly.

4. Contractors and freelancers

Every small business has freelancers and contractors who work for them. They don’t come under the regular payroll. It’s hard to monitor their payouts because of the nature of their work and payment.

But you can pay them at a defined time using the bulk payments system. Bulk payments establish a routine here. You can easily communicate with your freelancers as they know when they can expect the payment from you.

5. Contests

If you run contests among your employees or customers, you have to pay the winners together. Preparing a bulk list and using bulk payment solutions can help you clear all payments together.

Ways to make bulk payments safely

Bulk payment systems are time savers. You can clear hundreds of pending payments at once. But you must also be safe and careful and look for reliable systems. One small mistake can cause irreversible damage as sensitive information is handled.

Here are the safe and tested methods to make bulk payments:

1. Bank transfers (ACH)

Bank transfers are the most common method used in the bulk payments system. ACH denotes Automated Clearing House, which is a common term for bank transactions. Bank transfers work for bulk payments as they are cheaper, safer, and most reliable.

Many banks offer bulk payment services to corporate accounts.

Making bulk payments through bank transfers

• Almost every business organization or freelancer has a bank account. So it’s workable for all.

• You will collect their banking details and prepare a bulk list.

• Before you initiate this on a specific day, you should let your recipients know when bulk payments will be made. If the accounts are not under your beneficiary lists, you will have to add them first and wait till it’s added.

• Upload them into your online banking portal and initiate the transfer. You will receive a notification when it’s complete.

Limitations

• Support can be an issue as banks' support timings aren’t 24/7. If bulk payments fail or need technical support, you will have to wait.

• They accept files only with specific file formats (CSV, text only, ASIC, etc.). Even if you do it correctly, the bank portal can take time to accept and upload.

2. Paypal

If you have both domestic and international payouts to make as bulk transfers, you can go for Paypal. Paypal has bulk payment systems where multiple payment transfers happen in seconds online.

When the receiver doesn’t have a PayPal account, they should create one to receive the money. You can send in different currencies, too, even if you don’t have a multicurrency account.

Sending bulk transfers through PayPal

You can make bulk payments in three ways through PayPal.

• Go to the PayPal dashboard.

• Go to the tools option. Under the send payment, you will find the mass payment option.

• If it’s not enabled, you will have to enable it by contacting your account manager.

Limitations

• There is a fee associated with using bulk payment systems.

• PayPal is not supported in many countries.

3. Card payments

Bulk payments through cards are the best way to make refunds. Most businesses collect payments from their customers through cards. In such cases, it is easy to send the money back to the same account from which it’s received. You can instantly send it back.

But the major limitation is when the customer expects the refund in a different account. And while sending a bulk payment, it can take a minimum of 4 to 7 business days as the bank has to do its verification.

Your customers will get dissatisfied if they receive late refunds. So, this is not a foolproof solution.

6 Benefits of bulk payment system for businesses

1. Faster speed

Writing checks individually for every vendor can take time. Even if you rely on online banking solutions, one-by-one processing is time-consuming. That’s where the bulk payments systems simplify your job.

Large companies that have an extensive list of vendors can save time by scheduling their payments once and focusing on other tasks. It is also possible to schedule payments ahead of time using bulk payment services.

2. Increased security

Increased security is one of the main benefits of bulk payment systems. As they use encryption technologies, your data will be safe. Any errors or mistakes you can identify early and rectify. It’s a must to consider this as many businesses lose their money and confidential data to fraud.

3. High scalability

When your company grows, you will be handling more vendors and outgoing payments. You need a scalable solution then to streamline these expenditures. Otherwise, it will be chaotic to organize and manage.

When you invest in bulk payment solutions, you invest in something that will reduce your burden in the future. Growing businesses need scalable solutions to automate repetitive tasks.

4. Cost-effective

Corporate payment solutions are expensive. There are banks that charge you a nominal fee for each payment. Banks also place limitations on the number of transactions or amounts being transferred.

To prevent this from happening, you will need a cost-effective solution where you pay less to make more transfers. The bulk payments system is the answer. You just pay once here instead of paying every single time.

5. International transfers

There are many bulk transfer applications that have international transfer facilities. You can transfer at lower fx transfer rates. You can make international transfers even without having accounts in that currency.

6. Less prone to errors

Manually payment systems are prone to human errors. Making a transaction with incorrect details will make you lose money. But when you automate them using the bulk payments systems, you can put an end to erratic details and mistaken transactions.

These systems can also help you find out if the inputted details are correct. They allow you to verify the bank account details of each beneficiary added. This prevents money from going to the incorrect accounts.

Streamline bulk payments for your business with Volopay

Businesses that manually manage their payments or use inefficient banking applications for money transactions go for bulk payment services. Bulk payments alone cannot streamline your entire payment process.

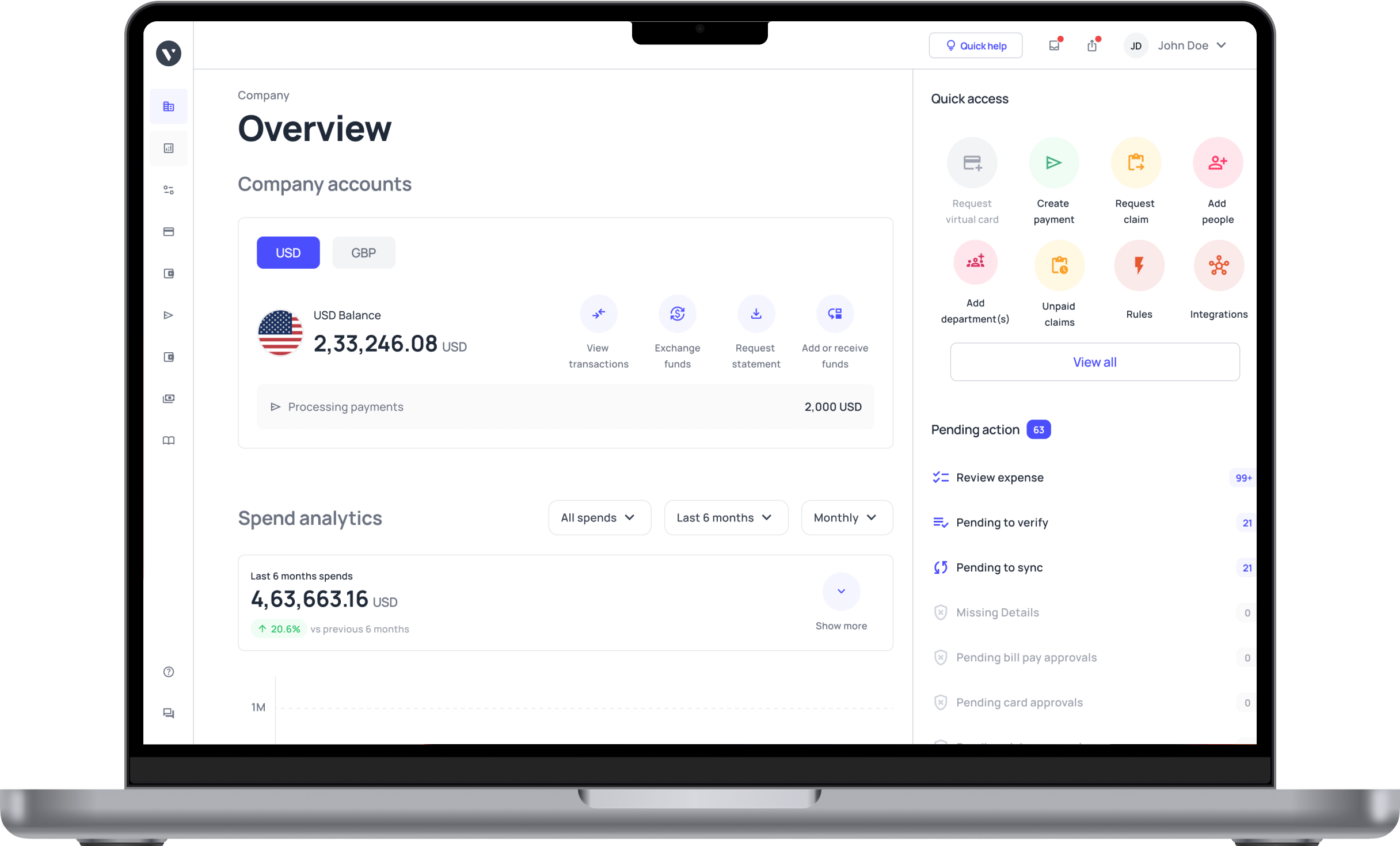

You need a fully automated payment system where you make all business payments from one place. What if the above-mentioned solution can support bulk payments, too? Introducing Volopay!

Volopay is an expense management suite with capabilities to make and schedule domestic and international payouts. It also has a reimbursement platform, card management system, credit line facility, budgets, and every other solution you need to methodize outgoing payments.

Want to make bulk payments? Make a bulk payment file and send it to our team. We will schedule and send it on your behalf. Make the smartest move by switching to Volopay at your convenient budget.

Bulk remittance is the process of sending payments from a single account to multiple recipients.

A bulk payment file is a document that carries the list of beneficiaries and their account details to send as a batch altogether.

You can use ACH account transfer, applications like PayPal, or credit card payouts. But if you are looking for pain-free ways to make bulk payments without taking any effort from your own, consider Volopay.

Most bulk payment services offer instant payment delivery. In some instances, it can take up to 3 to 5 business days or reach the recipient’s account the next day. It’s possible to schedule the bulk payments too to go out anywhere in the near future.