Mastering AR/AP communication: A comprehensive guide for businesses

Every payment delayed, every invoice questioned, and every approval stuck in limbo shares a common root cause: poor communication. In accounts receivable and accounts payable departments, the way you communicate directly impacts your cash flow, operational efficiency, and business relationships.

Strong AR/AP communication reduces payment delays, minimizes disputes, and builds trust with both customers and vendors. When your communication systems work smoothly, payments arrive on time, vendors feel valued, and your finance team spends less time chasing answers.

This guide shows you how to master communication in AR/AP functions, creating processes that support healthy cash flow, reduce operational friction, and foster enduring partnerships with everyone in your payment ecosystem.

Understanding communication in AR and AP

Effective financial operations depend on clear, timely exchanges between your business and the people you pay or who pay you. Accounts receivable communication and accounts payable communication form the backbone of your financial relationships, determining whether payments flow smoothly or get stuck in confusion.

When you understand what each communication stream involves, you can build systems that prevent delays, reduce errors, and strengthen relationships.

These communication channels serve different purposes but share common goals: clarity, consistency, and mutual respect. Your AR team reaches outward to collect what you're owed, while your AP team manages inward obligations, and both require structured approaches that balance automation with human touch.

What is AR communication?

Accounts receivable communication encompasses every interaction between your business and customers regarding the money they owe you. This includes sending invoices with clear payment terms, issuing payment reminders before and after due dates, and responding to questions about charges or billing details.

When customers dispute amounts or request adjustments, your AR communication handles these conversations with professionalism and documentation. You also use AR channels to confirm received payments, provide receipts, and update customers on their account status.

Effective accounts receivable communication maintains a balance between firmness in collection efforts and friendliness that preserves customer relationships. Your goal is to make paying you as easy and frictionless as possible while ensuring your business receives what it's owed promptly.

What is AP communication?

Accounts payable communication covers all exchanges between your business and vendors regarding payments you owe them. This starts with confirming receipt of vendor invoices and providing expected approval timelines, then continues with updates as invoices move through your internal workflow.

You communicate approval status changes, payment scheduling details, and actual payment confirmations once transactions are complete. When issues arise—missing documentation, pricing discrepancies, or budget holds—your accounts payable communication explains delays and outlines resolution steps.

Strong AP communication also includes proactive outreach about upcoming payments, responses to vendor inquiries about payment status, and clear documentation of payment terms and schedules.

This communication stream protects your vendor relationships while ensuring your business pays accurately and maintains good standing with suppliers who keep your operations running.

Key principles for effective AR/AP communication

Set payment terms, approval workflows, and communication expectations in writing before any transaction begins.

Your customers and vendors should never wonder when payments are due, whom to contact with questions, or what happens if issues arise. Clear documentation prevents disputes and creates accountability.

Use technology to handle routine communication tasks like invoice delivery, payment confirmations, and standard reminders.

Automation ensures consistency, reduces delays, and lets your team focus on exceptions and relationship management. Streamlined processes boost efficiency and quality.

Every invoice, statement, and message should contain complete, correct information that's easy to understand.

Ambiguous language, missing details, and errors create costly delays and damage your professional reputation. Accurate documentation builds trust and prevents confusion throughout transactions.

Keep all financial conversations in accessible systems where team members can review history and context.

Scattered emails and lost paper trails lead to repeated questions, confusion, and compliance risks. Centralized and detailed records enable better coordination and provide audit trails.

Approach every communication with respect and courtesy, even when addressing late payments or disputes.

A positive, professional tone preserves relationships while still achieving your financial objectives. Your communication style reflects your company's values and shapes stakeholder perceptions.

Why communication breaks down in accounts receivable and payable

Even with good intentions, communication in AR/AP often falters, creating payment delays and relationship strain. Understanding where breakdowns occur helps you prevent them systematically.

Most communication failures stem from process gaps, not individual mistakes, which means you can solve them with better systems. When you identify common breakdown points in your AR and AP functions, you can implement targeted improvements that address root causes rather than symptoms.

Lack of clear policies and expectations

Without documented standards for payment terms, approval timelines, and communication protocols, each interaction becomes improvised and inconsistent.

Your customer receives their first invoice with 30-day terms, but their second one references "net 45," creating confusion about when payment is actually expected and undermining your collection efforts.

Over-reliance on manual processes

When your team manually sends invoices, writes individual reminder emails, and tracks responses in spreadsheets, human error and delays become inevitable.

Your AP specialist forgets to confirm invoice receipt from an important vendor, who then calls your purchasing department to verify you received their bill, wasting time for both organizations.

Inconsistent communication and follow-up

Different team members use different templates, tones, and schedules for outreach, creating unpredictable experiences for customers and vendors.

One customer receives friendly payment reminders a week before due dates, while another gets no communication until their account is 60 days overdue and receives a harsh collection notice.

Poor data accuracy and accessibility

When payment information, contact details, and transaction history exist in disconnected systems or contain errors, your team can't communicate effectively.

Your AR team sends payment reminders to an outdated email address, while the customer's accounts payable team never receives your invoices and considers your company disorganized.

Lack of proper training for staf

Team members who don't understand your communication standards, available tools, or escalation procedures handle situations inconsistently and miss opportunities to resolve issues quickly.

A new AR associate responds to a disputed invoice by simply restating the amount owed instead of investigating the customer's specific concerns and providing documentation to resolve the disagreement.

Common AR/AP communication challenges and their solutions for businesses

How to build a customer-friendly AR communication process

Your accounts receivable function doesn't have to feel adversarial to customers. When you design accounts receivable communication with customer experience in mind, you collect payments faster while strengthening relationships.

Customer-friendly AR processes make paying you easy, pleasant, and predictable, reducing friction at every step. By anticipating customer needs and removing obstacles, you position timely payment as the natural outcome rather than an administrative burden your customers must overcome.

1. Set clear, upfront expectations

Communicate payment terms, due dates, and accepted payment methods before services are delivered or goods are shipped. Include this information in contracts, proposals, and confirmation emails so customers understand their obligations from the start. Clear expectations prevent disputes later.

2. Craft easy-to-understand invoices

Design invoices that clearly show what customers are paying for, how much they owe, when payment is due, and exactly how to pay. Use plain language, organize line items logically, and make your contact information prominent for questions. Simple invoices get paid faster.

3. Use proactive and automated reminders

Send friendly reminders before invoices become due, not just after they're late. Automate this accounts receivable communication to ensure consistency while personalizing messages with customer names, specific amounts, and relevant invoice details. Proactive reminders improve payment timeliness significantly.

4. Offer flexible payment options

Provide multiple payment methods—credit cards, ACH transfers, payment portals, and mobile payments—so customers can pay using their preferred approach. Remove barriers by making the payment process as simple as clicking a link or scanning a code. Flexibility increases payment completion rates.

5. Leverage multi-channel outreach

Use email for routine communications, provide online portals for self-service access to account information, and reserve phone calls for complex situations or high-value accounts. Match your communication channel to the urgency and complexity of each situation for optimal results.

AR/AP communication framework for clearer payments

A structured framework helps you organize your AR/AP communication efforts efficiently, allocating resources appropriately across different interaction types.

This three-level approach ensures routine communications happen automatically while preserving human attention for situations requiring judgment and relationship skills. By layering your communication strategy, you create systems that scale with transaction volume without sacrificing quality.

Common AR/AP communication challenges and their solutions

Leveraging technology to improve AR/AP communication

Technology transforms AR/AP communication from a manual, error-prone burden into a strategic advantage that improves your financial operations. The right tools fundamentally change what's possible, enabling visibility and coordination that manual systems can't achieve.

When you implement technology thoughtfully, you enhance both efficiency and relationship quality, freeing your team to focus on high-value activities while automation handles repetitive tasks flawlessly.

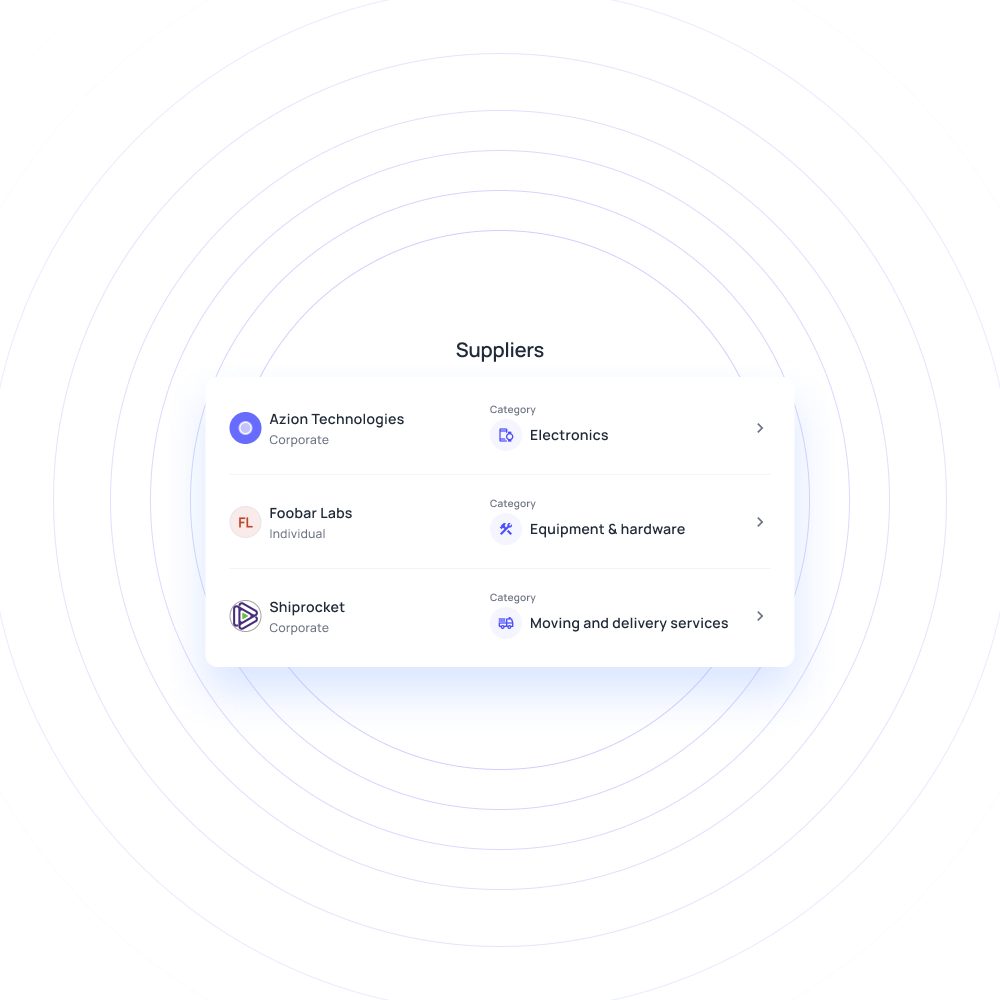

Using AR/AP software for centralized communication

Specialized AR/AP platforms consolidate all communication in AR/AP in one accessible location, creating a single source of data for every interaction.

You eliminate scattered emails, lost messages, and repeated questions because everyone on your team can instantly view the complete conversation history with any customer or vendor.

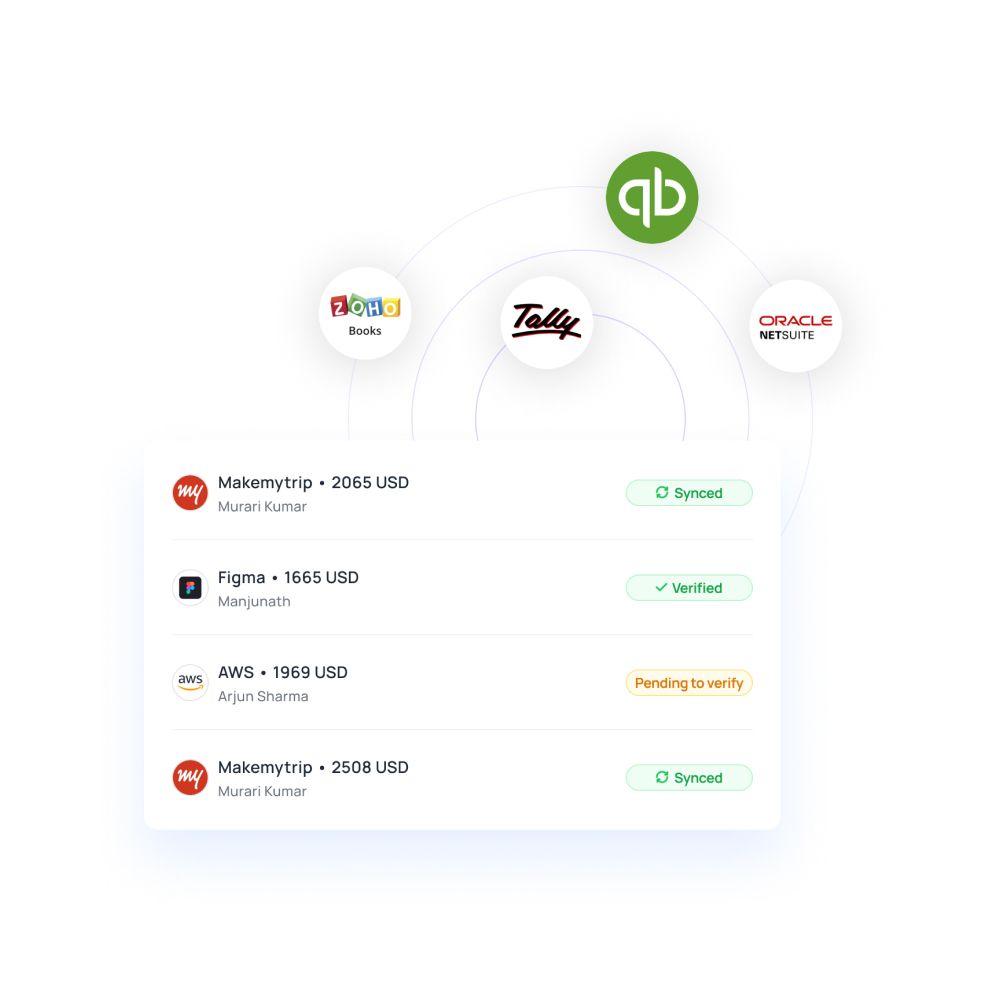

Integrating accounting tools with expense platforms

Connected systems share data between your accounting software, expense management platforms, and payment systems, eliminating manual data entry and reconciliation work.

When your AP team approves an invoice in your expense platform, your accounting system immediately updates, and your vendor receives an automated notification about the approval status.

Automating notifications and reminders

Automated communication tools send timely notifications based on trigger events—invoice generation, approaching due dates, approval completions, or payment processing—without requiring manual intervention.

You ensure consistent, prompt accounts payable communication while reducing the workload on your finance team, who can focus on exceptions rather than routine updates.

Real-time data access and reporting

Modern AR/AP tools provide instant visibility into payment status, aging reports, approval bottlenecks, and communication history, enabling faster decision-making and more informed conversations.

Your team can answer vendor questions immediately during phone calls instead of promising to "look into it and call back," improving service.

Collaborative dashboards for teams

Shared dashboards give multiple team members simultaneous access to the same information, preventing duplicate work and ensuring coordinated responses.

When a customer contacts your sales team about an invoice question, your sales representative can view the same information your AR team sees, providing immediate answers.

Reducing errors through digital workflows

Digital approval workflows, automated data validation, and system-enforced business rules catch errors before they affect external communications.

Your AP system can flag invoices missing required approval signatures or payment details that don't match purchase orders, preventing incomplete or incorrect communications from reaching vendors.

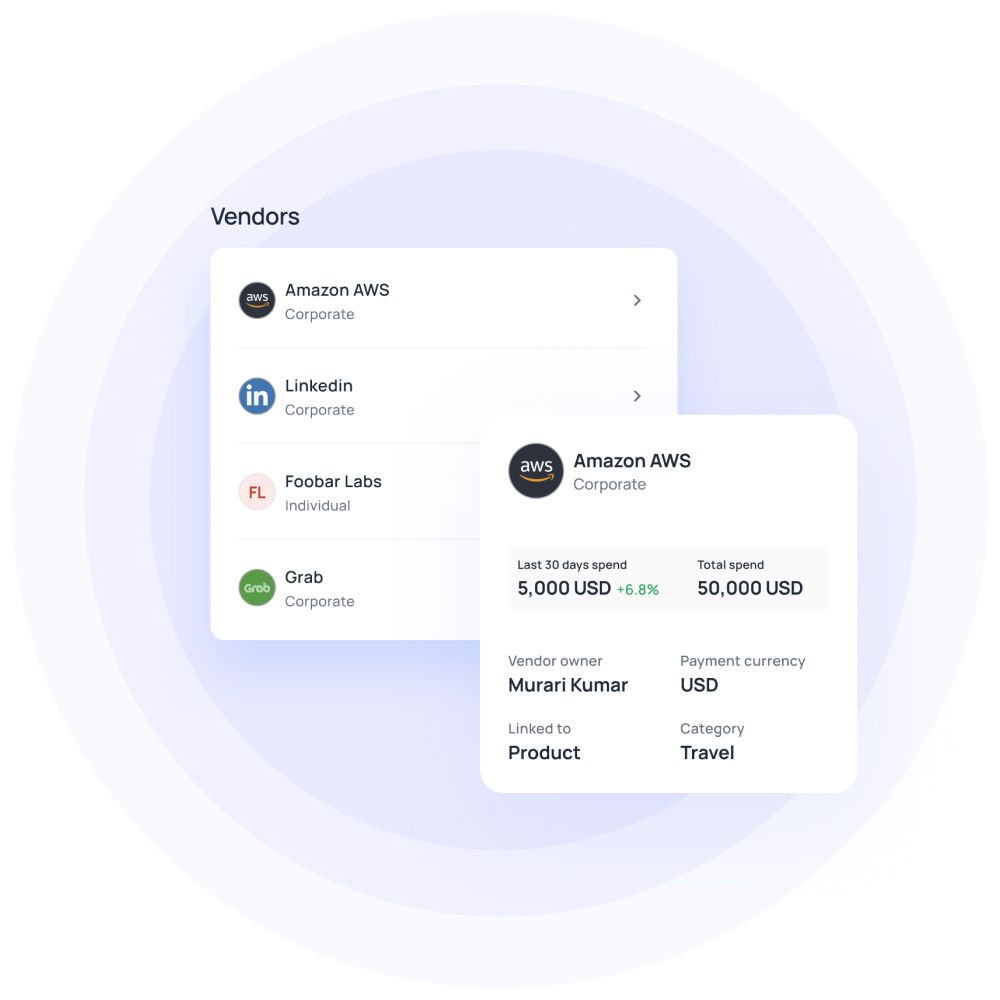

Strengthening vendor relationships through clear AP communication

Your accounts payable communication directly affects whether vendors view you as a valued partner or a problematic customer. Clear, reliable AP communication builds trust that translates into better pricing, favorable terms, and priority service when you need it most.

Strong vendor relationships supported by excellent communication create competitive advantages, while poor communication damages your reputation and can even threaten your supply chain stability.

Clearly share payment timelines

Inform vendors about your standard payment terms during onboarding and confirm expected payment dates when you receive and approve invoices.

Vendors can manage their own cash flow more effectively when they know reliably when to expect payment from you, strengthening partnership quality.

Proactively communicate delays

When payments will be late due to approval delays, budget constraints, or processing issues, contact vendors before the due date rather than waiting for them to inquire.

This proactive accounts payable communication approach shows respect for vendor needs and prevents surprises that damage relationships and your reputation.

Ensure consistent responses

Train your AP team to respond to vendor inquiries using the same information sources and providing the same level of detail, regardless of who handles the interaction.

Vendors should receive accurate, complete answers whether they email, call, or use your vendor portal, building confidence in professionalism.

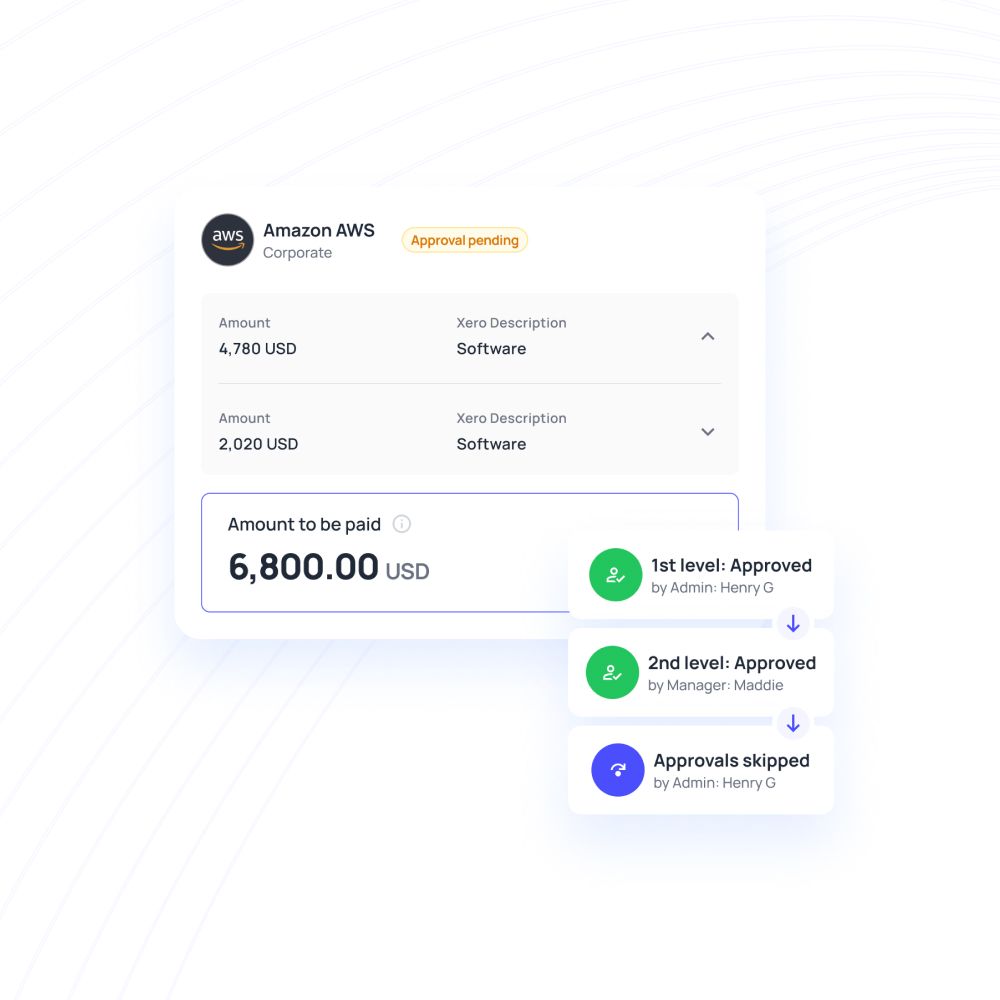

Provide transparent approval status

Give vendors visibility into where their invoices are in your approval workflow—received, under review, approved, or scheduled for payment—so they're not left wondering whether you even have their invoice.

This transparency reduces anxiety and unnecessary follow-up calls that waste time for both parties.

Maintain open vendor feedback channels

Create easy ways for vendors to report problems, ask questions, or provide suggestions about your payment processes, and respond to this feedback constructively.

When vendors can easily communicate issues before they escalate into serious problems, you strengthen relationships while improving your own processes.

How automation transforms AR/AP communication

Automation represents the single most impactful improvement you can make to your communication in AR/AP processes, delivering benefits that compound over time as transaction volumes grow.

Beyond simple efficiency gains, automation fundamentally improves communication quality by ensuring consistency, eliminating human error, and providing immediate responses that manual processes can't match.

When implemented properly, automation doesn't make your AR/AP communication feel robotic; it makes it more reliable and effective, all while preserving human attention for situations where empathy and judgment truly matter.

Reduces manual errors

Automated systems send invoices, confirmations, and reminders at exactly the right time without anyone needing to remember or schedule them manually.

Your team never forgets to send an invoice, misses a payment reminder, or sends duplicate communications because automation handles these routine tasks perfectly.

Improves payment timeliness

Consistent, timely reminders before invoices become overdue significantly increase on-time payment rates by keeping obligations top-of-mind for customers and preventing invoices from getting lost or forgotten.

Your days' sales outstanding improve measurably when you implement automated reminder sequences that gently nudge customers.

Enhances transparency and visibility

Automated status updates keep customers and vendors informed about where things stand—invoices received, approvals pending, payments scheduled—without them needing to contact you for information.

This proactive transparency reduces inbound inquiries while building trust that you're managing their transactions professionally throughout the process.

Strengthens relationships through consistency

When every customer or vendor receives the same high-quality accounts receivable communication regardless of which team member handles their account, you build a reputation for reliability and professionalism.

Automation ensures your newest hire delivers the same communication excellence as your most experienced team member, maintaining quality consistently.

Supports scalable processes

Your communication quality doesn't degrade as transaction volumes increase when automation handles the routine work, allowing you to grow revenue without proportionally growing your finance team headcount.

The same automated workflows that handle hundreds of monthly transactions work equally well for thousands.

Provides actionable insights

Automated systems track communication metrics—delivery rates, open rates, response times, and payment behaviors—that help you optimize your processes based on data rather than assumptions.

You can identify which reminder templates generate best results, which communication channels your customers prefer, and where bottlenecks occur.

Common mistakes to avoid in automation

While automation offers tremendous benefits, poorly implemented automation can damage relationships and create new problems. Understanding common pitfalls helps you deploy automation thoughtfully, maximizing benefits while avoiding the mistakes that give automated communication in AR/AP a bad reputation.

Your goal is automation that feels helpful and professional, not robotic or impersonal, requiring careful attention to implementation details.

1. Over-automating without human review

When you automate everything without building in checkpoints for human judgment, you lose the ability to recognize when situations require personal attention and relationship management.

Your automated system continues sending increasingly aggressive collection messages to a long-time customer experiencing temporary hardship, damaging a valuable relationship unnecessarily.

2. Not aligning tone across teams

If your automated AR communications sound formal and stern while your AP communications are casual and friendly, you create inconsistent brand experiences that confuse your stakeholders and weaken your professional image. Establish tone guidelines that work across all automated communications for consistency.

3. Sending reminders from generic or confusing email IDs

Messages from "noreply@yourcompany.com" or cryptic system addresses get ignored, filtered to spam, or create confusion about whether they're legitimate communications.

Use recognizable, professional email addresses like "payments@yourcompany.com" that clearly identify who's communicating and allow recipients to easily respond with questions.

4. Failing to communicate internal status updates

When your automated systems only communicate externally without keeping your team informed about what communications were sent and when, team members can't provide consistent information when customers or vendors contact them. Ensure your automation logs create accessible records that any team member can review.

5. Ignoring analytics on communication performance

Installing automation and then never reviewing performance metrics means you miss opportunities to optimize message timing, improve template effectiveness, and identify process bottlenecks.

Schedule regular reviews of your automation analytics to identify which accounts receivable communication performs well and which need refinement, continuously improving effectiveness.

How to automate payment reminders

Payment reminders represent the most common and valuable automation opportunity in accounts receivable, dramatically improving collection rates without increasing workload. However, poorly executed reminder automation annoys customers and damages relationships, so implementation details matter greatly.

Your reminder strategy should make paying easy while respecting customer relationships, balancing persistence with professionalism throughout the collection cycle.

1. Establish a clear communication cadence

Schedule reminders at logical intervals—perhaps 7 days before due date, on the due date, and 7, 14, and 30 days after—creating predictable touchpoints that keep payments top-of-mind without overwhelming recipients. Communicate this schedule to customers during onboarding so they know expectations.

2. Personalize your messages

Include customer names, specific invoice numbers, exact amounts due, and relevant due dates in every reminder, making accounts receivable communication feel tailored rather than mass-produced. Personalization also helps customers immediately identify which invoice you're referencing, reducing confusion and making payment more likely.

3. Keep reminders concise and direct

State clearly what action you need (payment), how much is owed, when it was due, and exactly how to pay, without unnecessary explanation or apology. Busy customers appreciate brevity that lets them quickly understand what's needed and take action immediately.

4. Use the right communication channel

Start with email for early reminders since it's non-intrusive, then escalate to phone calls for significantly overdue accounts where personal conversation becomes necessary. Match communication intensity to situation urgency, reserving more assertive channels for situations that warrant them appropriately.

5. Make it easy to pay

Every reminder should include a direct payment link, clear instructions for all accepted payment methods, and your contact information for questions. Reducing friction at the moment customers decide to pay dramatically increases completion rates and improves your cash flow.

Optimized workflows to streamline AR/AP operations

Sustainable AR/AP communication requires thoughtful workflow design that coordinates people, processes, and technology into cohesive systems. Well-designed workflows ensure the right actions happen at the right time without requiring constant management attention, creating efficiency that scales with your business. Your workflows should be documented, measurable, and regularly refined based on performance data, evolving as your business needs change.

Map out your AR and AP processes clearly

Document every step in your current accounts receivable (AR) and accounts payable (AP) workflows, identifying who's responsible for each action, what triggers each step, and where handoffs occur between team members or systems.

This mapping reveals inefficiencies, redundancies, and gaps that you can't address until you understand processes.

Standardize internal communication protocols

Establish how team members will communicate about exceptions, escalations, and complex situations: which tools they'll use, what information they'll document, and how they'll ensure continuity when cases transfer between team members.

Standardized protocols prevent information loss and ensure smooth handoffs throughout lifecycles.

Automate repetitive tasks where possible

Identify routine activities that happen the same way every time—invoice delivery, receipt confirmations, approval routing, payment reminders—and implement automation for these tasks.

Freeing your team from repetitive work allows them to focus on judgment-intensive activities like dispute resolution.

Track and monitor workflow performance

Establish metrics for workflow efficiency—processing time, approval delays, communication response rates, error frequencies—and review these regularly to identify bottlenecks and improvement opportunities.

Data-driven workflow management helps you make targeted improvements rather than relying on anecdotal observations.

Integrate your workflows with AR/AP tools

Connect your workflow management systems with your AR/AP software so approvals, communications, and status updates flow automatically between systems without manual data entry.

Integration ensures consistency between your workflow tracking and your financial systems, preventing discrepancies.

Review and optimize workflows regularly

Schedule periodic workflow reviews where you assess whether processes still serve your current business needs and identify opportunities for simplification or enhancement.

Your workflows should evolve as your business grows, technology capabilities improve, and you learn from experience.

Key metrics to measure AR/AP communication success

DSO measures how quickly customers pay you, while DPO tracks how long you take to pay vendors, both directly reflecting accounts receivable communication and accounts payable communication effectiveness.

Improving communication typically reduces DSO by accelerating collections and may strategically extend DPO.

Track how quickly customers and vendors respond to your communications and how long it takes to resolve questions, disputes, or issues from first contact to final resolution.

Faster responses and resolutions indicate your AR/AP communication is clear, accessible, and effective at moving situations toward completion.

Monitor what percentage of payments arrive by the due date and what percentage of transactions completed without errors or disputes requiring correction.

High accuracy and timeliness suggest your communication sets clear expectations and provides information that enables correct, prompt payments.

Gather direct feedback through surveys, reviews, or informal check-ins about how customers and vendors experience your payment processes and communications.

Satisfaction scores reveal relationship health that financial metrics alone don't capture, highlighting areas where process efficiency might be undermining quality.

Count how often transactions result in disputes, how many require escalation beyond standard processes, and whether these frequencies trend up or down over time.

Decreasing dispute and escalation rates indicate your communication in AR/AP is becoming more effective at preventing problems.

Choosing the right AR/AP communication tool for your business

The technology platform you choose fundamentally shapes your communication capabilities, making tool selection one of your most important decisions. Different tools offer varying feature sets, integration capabilities, and user experiences that will affect both internal efficiency and external relationship quality for years.

Rather than selecting based solely on features, consider how each option aligns with your specific business needs, existing technology stack, and team capabilities.

Real-time visibility features

Choose platforms that provide instant status updates on invoices, approvals, and payments accessible to everyone who needs this information.

Real-time visibility eliminates the delays inherent in batch processing or manual status checks, enabling faster responses and better customer service.

Integration capabilities

Prioritize tools that connect seamlessly with your existing accounting software, ERP systems, payment processors, and communication platforms, avoiding data silos that require manual reconciliation.

Smooth integration reduces implementation effort, ongoing maintenance burden, and error rates while enabling more automated workflows.

Automation and customization options

Evaluate how much automation each platform supports and whether you can customize workflows, templates, and rules to match your specific business processes and communication style. The best tools offer powerful automation capabilities while allowing you to tailor implementation to unique needs.

User experience and accessibility

Consider how intuitive the interface is for your team members, how easily customers and vendors can access their information, and whether the platform works well across devices. Poor user experience creates adoption resistance internally and friction externally, undermining the value.

Security and compliance

Verify that platforms protect sensitive financial data with appropriate encryption, access controls, and audit trails while supporting compliance with relevant regulations affecting your industry. Security breaches or compliance failures create catastrophic risks that far outweigh any efficiency benefits.

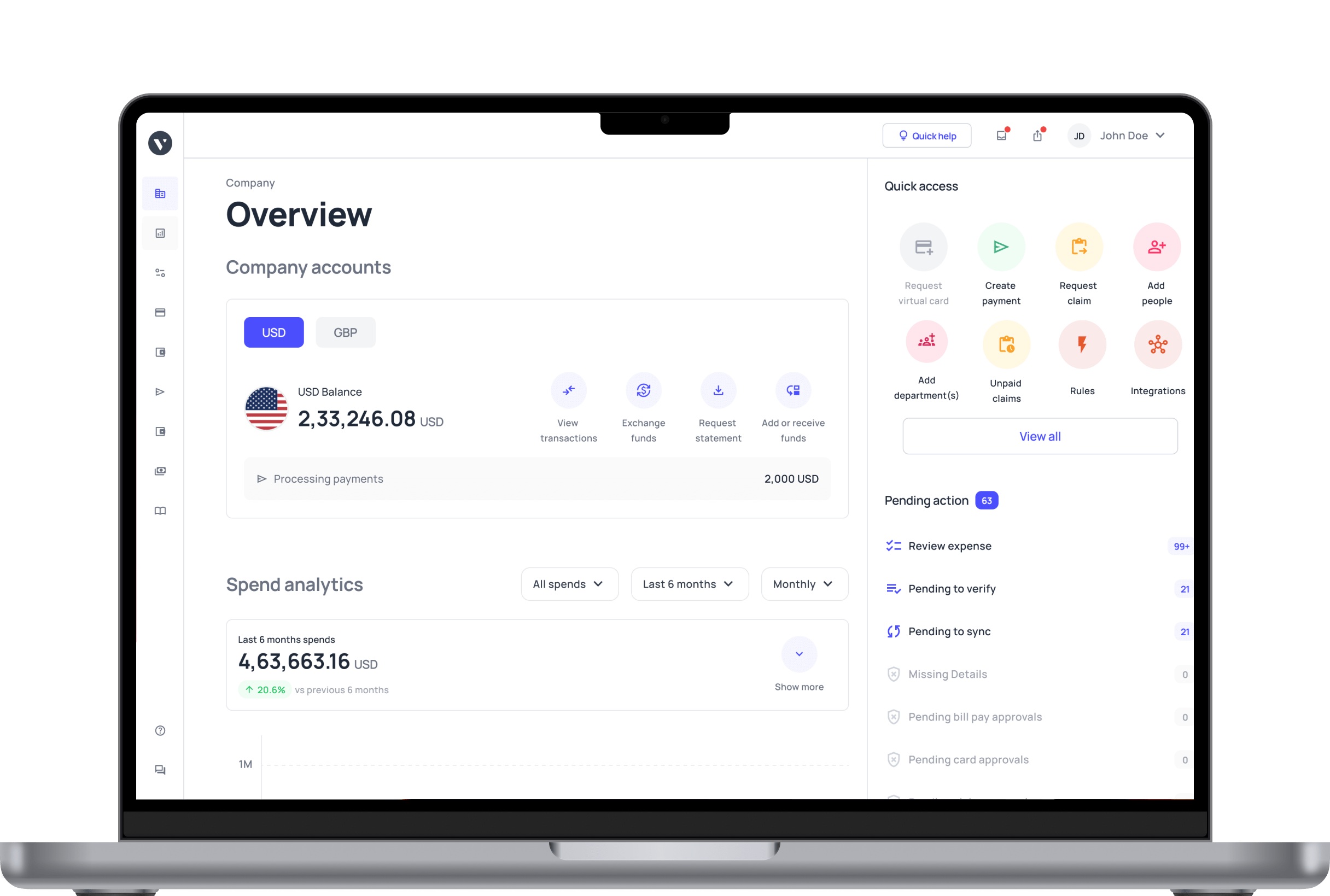

How Volopay simplifies AR/AP communication

Volopay's smart accounts payable automation software provides a comprehensive financial operations platform that transforms AR/AP communication from a manual burden into a strategic advantage. By centralizing visibility, automating routine tasks, and providing self-service access for stakeholders, Volopay helps you achieve the communication excellence we’ve described in this guide.

Our platform's integrated approach means you implement one tool that addresses multiple communication challenges rather than cobbling together point solutions that don't work together smoothly.

Centralize management of all business spend

Volopay consolidates accounts receivable, accounts payable, expense management, and corporate card administration in one platform, giving you complete visibility across all financial operations.

This centralization means your team works from a single source of truth, eliminating discrepancies between systems.

Real-time invoice and payment tracking

The platform provides instant real-time visibility into where every invoice sits in your approval workflow, when payments are scheduled, and when transactions are complete.

Your team can answer customer and vendor questions immediately without researching across multiple systems, dramatically improving response speed and quality.

End-to-end workflow automation

Volopay automates invoice processing, approval routing, payment execution, and stakeholder notifications throughout the entire transaction lifecycle, reducing manual work while ensuring consistent accounts receivable communication and accounts payable communication.

You configure workflows once, then rely on automation to execute them perfectly.

Integration with accounting and ERP tools

Volopay integrates with major accounting systems and ERP platforms, automatically synchronizing data and eliminating duplicate entry or reconciliation work.

Integration ensures your communications reflect the same information your other systems contain, maintaining consistency across all stakeholder touchpoints.

Vendor portals

Volopay provides secure portals to check payment status, to view invoice details, and to make payments, reducing inbound inquiries while improving stakeholder experience.

Self-service access empowers your customers and vendors to get information when needed.

Bring Volopay to your business

Get started now

FAQs

Automation handles invoice delivery, reminders, and confirmations automatically, reducing manual workload by as much as 60–80%. Your AR/AP communication becomes consistent while teams focus on complex disputes and relationship management.

Send 3–5 reminders: one before the due date, one on the due date, then at 7, 14, and 30 days past due with escalating urgency for effective accounts receivable communication. Also, ensure that you have a workflow set up to pause reminders once the payment is complete to avoid creating unnecessary spam and friction in the business relationship.

Document disputes immediately, investigate promptly, and communicate resolution timelines clearly. For partial payments, acknowledge receipt and state the remaining balance with updated due dates for transparent AR/AP communication.

Start automating high-volume routine tasks like invoice delivery and reminders while maintaining manual processes for complex situations. Gradually expand automation as you refine your communication in AR/AP workflows.

Prioritize automation for routine accounts receivable communication and accounts payable communication, implement self-service portals, and use integrated platforms that consolidate multiple functions to reduce switching between tools.

Yes, Volopay customizes reminder templates with customer names, invoice details, and amounts, making automated accounts receivable communication feel personal while maintaining efficiency through automation and customer segmentation options.

Volopay works well for all business sizes with scalable pricing. Small teams benefit from automation and consolidation that help limited staff manage AR/AP communication efficiently without enterprise complexity.