Best Stripe Alternative in 2025

Ready to head on your journey to success? Stripe and Volopay offer a remarkable suite of business finance products to streamline expense management.

However, while Stripe offers tools and features that come at a steep cost, Volopay provides a single end-to-end accounts payable solution that is extremely easy to use and even easier on your pockets.

Trusted by finance teams at startups to enterprises.

Save millions of dollars, and pay zero in fees

Stripe’s limited expense management tools are packaged at extremely high fees. Volopay offers the same for free – and then some more.

With our state-of-the-art software that expertly manages invoices, reimbursements, corporate card payments, corporate travel offers, and world-class accounting integrations, nothing compares to our all-in-one spend management solution.

Financial stack tailored to your needs

Love using corporate cards but need the security of reimbursement feature as well? We got you covered. Unlike Stripe’s incomplete payments platform, we understand the dynamic nature of corporate expenses and are, therefore, perfectly capable of processing any expense that comes our way.

Volopay vs Stripe - A Snapshot

- Global application of the platform and tools

- Free physical & virtual corporate cards

- Corporate card program offered worldwide

- Business credit up to $500K

- Flexible credit repayment cycle

- Automated expense reports for all

- Reimbursement management

- Corporate travel

- Dedicated account managers and 24×7 customer support

Choose Volopay to save 240+ hours and millions of dollars every year

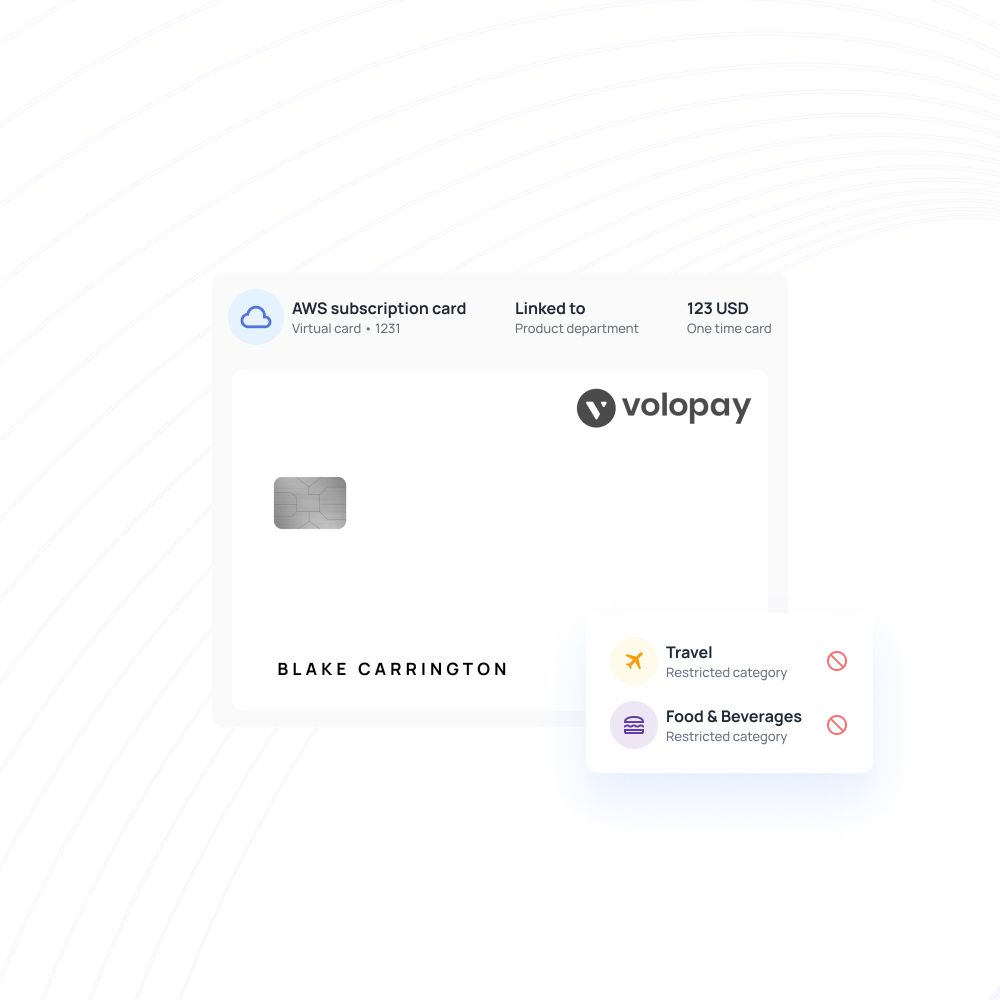

1. Issue physical and unlimited virtual corporate cards – free of charge

What we offer for free, Stripe charges for it - rather expensively, might we add! Instead of paying $3 for every physical card and $0.10 for every virtual card you generate with Stripe, enjoy an effortless payment experience through Volopay’s VISA-powered corporate cards without paying a single penny for card generation.

Track every card expense in real-time, review card requests through our multi-level approval workflows, and get customized physical cards to achieve that premium-branded appeal.

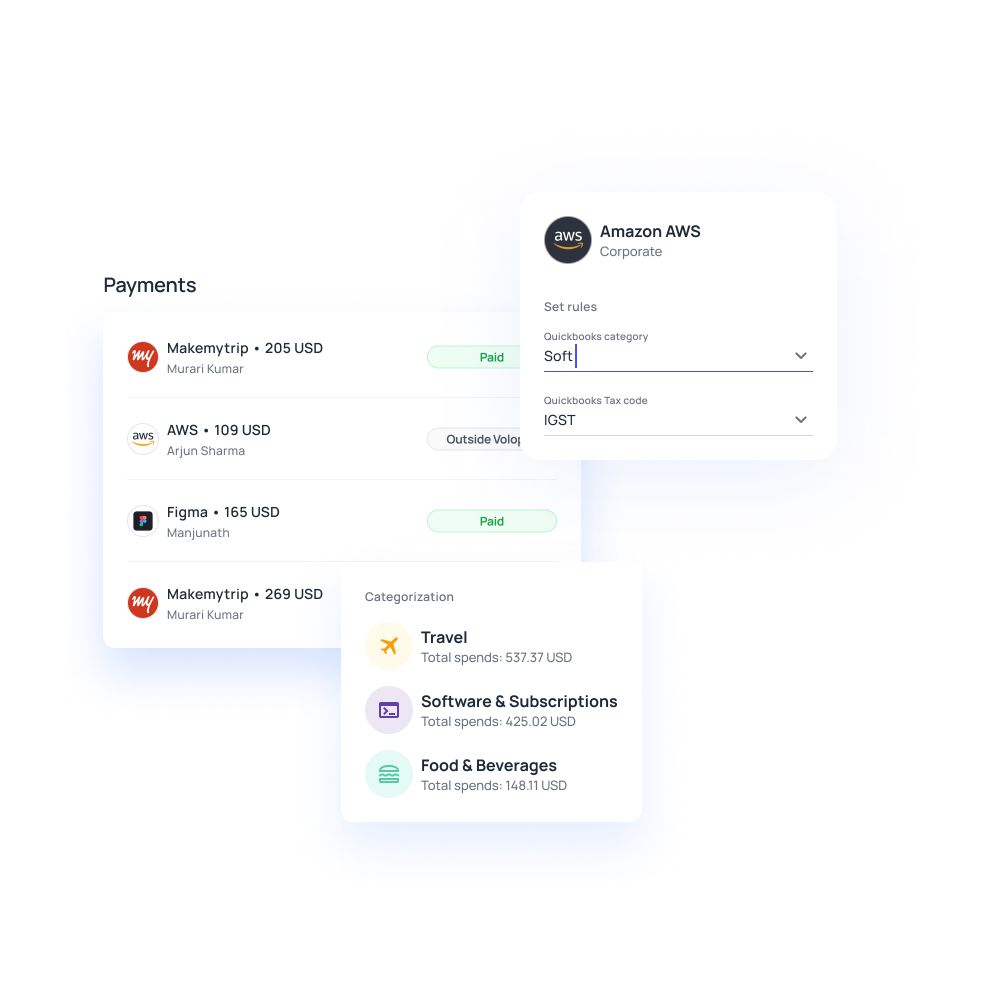

2. Expense report automation for all

Unlike Stripe, Volopay produces automated expense reports for all users, irrespective of your chosen package. Volopay believes in providing useful business finance tools for all, not hiding them behind a paywall.

With Volopay, users receive instantly generated expense reports that can be swiftly updated to the accounting software of your choice through our innovative one-click sync feature. Track, record, and manage all your expenses from a single software with no manual data entry – without paying any extra dime.

3. Reimburse employees and make payments – all from one app

A big part of running a business is reimbursing employees for company expenses made through their personal funds. Stripe’s incomplete payments platform lacks Volopay’s robust reimbursement management that allows you to reimburse employee expenses directly into their bank accounts through the software.

Enforce expense policy by configuring it into Voopay’s customizable submission policy, track receipts, and set multi-level approval workflows to validate expense claims.

4. Save big on corporate travel

One of the substantial expenses incurred by companies is corporate travel. Volopay takes care of travel, accommodation, and other travel-related expenses with our salient TruTrip integration.

Unlike Stripe, Volopay offers a laser focus on managing all kinds of expenses, including an intuitive end-to-end corporate travel booking. Save up to 30% on all travel bookings made through the Volopay platform at no extra cost to you.

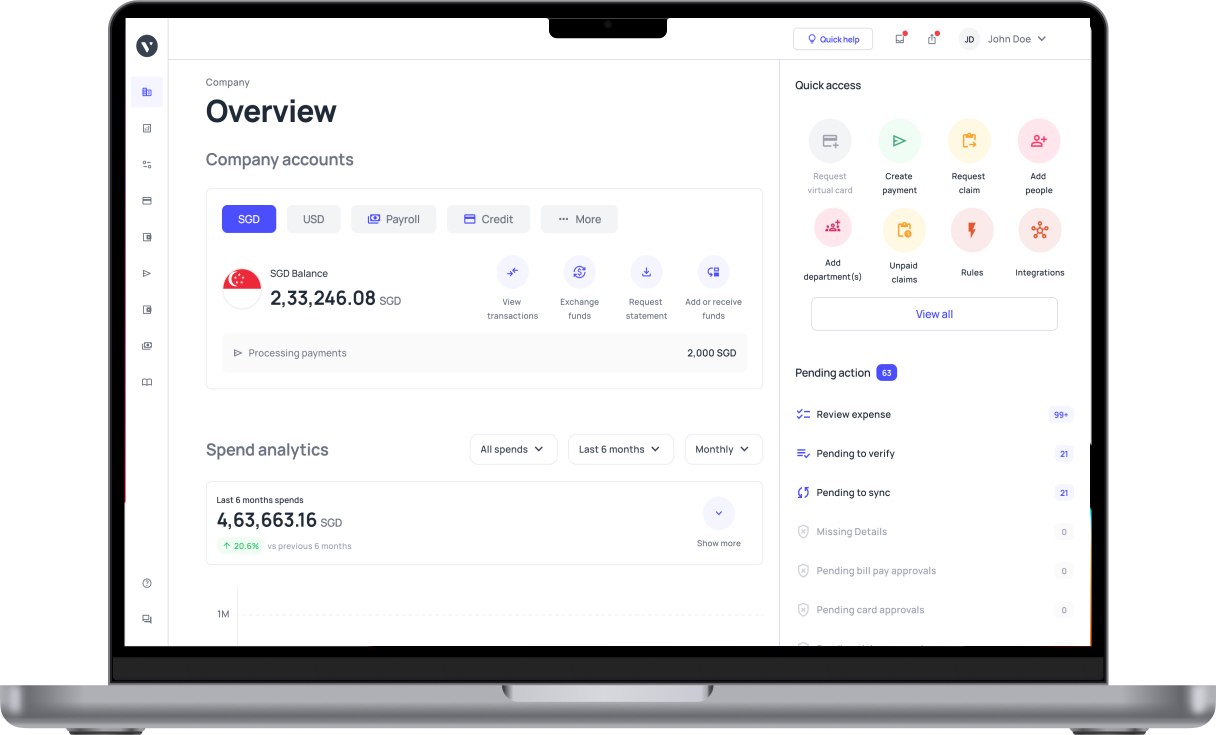

5. Complete transparency with real-time visibility

With Volopay, you can get complete transparency of all your business expenses. Any information in relation to your spending can be easily viewed from one dashboard.

Your expenses will also be updated in real-time. Having this level of transparency and visibility helps you identify any leaks in your cash flow, meaning that you can take action to put a stop to it before it becomes a big issue.

Gather insights based on the information that you have to improve your decision-making. Back up your choices with data and facts and make well-informed decisions.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Unlock the many benefits of Volopay

Business finance management is an indispensable part of company operations, and no other expense management platform is as ready as Volopay to manage your payments from the get-go.

With a powerful mobile application, efficient vendor management features, and the lowest FX rates ever — we’ve got so much more to offer!