6 common payroll mistakes to avoid

The payroll department handles the payroll records of current and past employees, wages of the current employees, deduction or bonus for additional hours worked, reimbursements, and so on. Payroll for small businesses is a critical function that requires careful attention to detail. Payroll experts claim that this process can be complex, leaving room for costly errors and mistakes. For small businesses, an integrated HR system can help reduce these payroll errors, which can otherwise impact both finances and reputation.

Common payroll mistakes are missing payroll tax deadlines, sending incorrect payments, not tracking overtime, misclassification of workers, etc. Payroll errors are high key intolerable for they cause financial losses to the company. When your employee is paid higher than the actual salary, the company incurs the loss. And if it’s paid low, the employee might file a lawsuit and sue the company. And employees are also bound to fill income tax returns once or twice a year. Even a minor payroll mistake can cause issues with this process of identifying tax worthy income.

Common payroll mistakes made by startups

Though the Payroll system for small businesses has existed for a long time now, not every startup has rightly used it to manage payroll. Hence startups commit many payroll mistakes as they grow until they run into payroll software for small businesses.

Not paying on time

The beginning of the month is when employees highly anticipate salary to pay their bills and other expenses. If there is a delay in payroll processing, the salary deposit also gets delayed. And if this happens frequently, it only causes disappointment and frustration among employees, which leads to low productivity and employee turnover. The employee can even approach a labor commission or a civil court, which might impose a penalty over the company for payment delay. Starting the payroll process early and making sure there is enough cash flow to process the next month’s wages should be the steps a company should follow.

Not tracking overtime properly

Working overtime is very common these days, especially in small businesses where there is a shortage of employees. From employees' perspective, they mostly do it to meet their financial obligations. There is a standard wage for every hour an employee works post their official work timing. Their managers have to record the extra hours worked and the payroll department to ensure that they are being paid for additional hours. Not holding accountable for this can lead to paying extra interest, fine, or facing employee backlash or lawsuit.

Misclassification of workers

An employee is different from a contingent worker in the same way an exempt employee is different from non-exempt employees. A payroll manager should be aware of this classification and which employee falls under which category. The wages of these employees vary based on the category they fall into. For instance, non-exempt employees are eligible for overtime pay. And contract employees do not qualify for company benefits and work on temporary assignments. In many instances, this misclassification error happens, followed by an employee getting paid incorrectly.

Using a personal account for employee payroll

It’s common to notice small businesses using a personal account for business expenses. You might have concluded getting a business account is an unnecessary expense. But managing payroll through personal accounts is considered unethical and unprofessional. Payroll for small businesses turns complicated without an efficient employee payroll system. But businesses need to have clear records of where cash flow should go from and come into one account. Also, during audit, personal and business expenses will be rummaged.

Using wrong tax rates

Payroll taxes are the tax amount paid by employers and employees to the government. It’s a certain percentage of employees’ salary, spent as local, state, or federal tax. The problem with this is it changes frequently. Not knowing the up-to-date payroll tax rate and miscalculation leads to improper tax payment. This wrong estimation, in turn, makes the company owe more money to the government. Sudden funding needs in a small business are always stressful. Wrong tax payments can also drag your business name and reputation through the mud if you are in the growth phase.

Not maintaining accurate payroll data

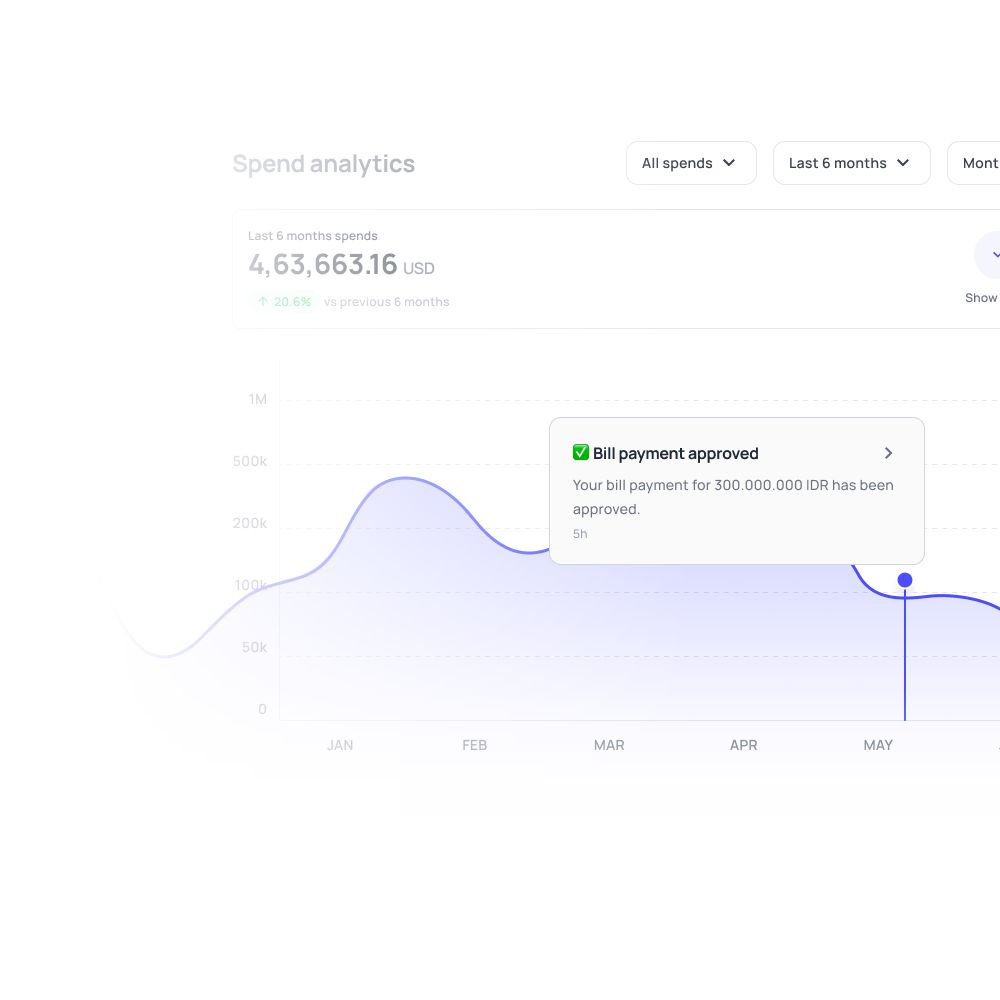

The critical function in payroll for small businesses is to store and keep track of the payroll data. Payroll experts suggest diligent maintenance of payroll records, and it can help businesses in budgeting and expense prediction. This data can also guide you in making hiring decisions and creating an error-free payroll management system. This data should include employees’ information like joining date, basic salary, gross salary credited, net wage, processing date, etc. This payroll data has to be securely protected as it involves the private information of your current and past employees.

How can common payroll mistakes cost your business?

Payroll errors cause significant damages to any business that doesn’t take them seriously. Statistics show that over 40% of small businesses incur severe financial losses up to $840 per year, which shows the existence of payroll for small businesses. These employee payroll mistakes creep into your financial account and bring substantial losses while managing payroll for small businesses.

Penalty charges

Being non-compliant with government and local rules and regulations can cost a lot of money to your business because you are liable to pay penalty charges for every compromise made on compliance. These errors can be anything from sending an incorrect salary or miscalculating the tax amount.

Loss of reputation

Payroll errors don’t just affect your pocket. It involves the hard-earned name as well. If you keep paying employees at wrong timings or mess up with the amount, it leads to multiple follow-ups between them and you to get it fixed. Many employees rely on their paychecks to take care of their mortgage, bills, and home expenses. It can be too distressing for them if their employer doesn't mind their hard work and is ready to pay incorrect amounts.

If the mistake repeats, then it registers in their mind that your company has a lousy history of payroll errors. It hurts the relationship between your employee and you and misplaced trust with fear of getting paid properly.

Time spent on manual corrections

There is also a labor cost involved when there is a payroll error. Your company’s revenue data should always be precise and point out where the money went. For this to happen, you must avoid payroll mistakes, and so as the back and forth corrections. Correction of payroll errors is complex, and it can take more time than the initial payroll processing. This manual work is too much to handle for a small business. And, if the correction is not properly reflected in your overall ledger, it’s another workload.

Affects budget calculations

When the number of hours worked, or overtime is miscalculated and later corrected, it's will affect the budget you have allocated for workers’ compensation. There will be a penalty for even small payroll mistakes like this, so you will be paying in double amounts than what you actually owe. You know how hard it is to assign a budget and stick to it when you grow a small business. But these petty payroll errors will impact them.

Encroaching fair labor act

Some companies intentionally pay their employees less, and legally they are committing a mistake here. So, if you commit a payroll error and pay someone less than their actual wage, it is an unlawful act that can have legal consequences. Your unknown mistake is still is punishable because labor protection laws don’t know to differentiate between the former scenario from the latter.

How to fix payroll errors?

Payroll errors sound daunting only when you manage payroll manually with a small team. There are payroll software for small businesses that you can use. Or you can get help from any third-party payroll management company where there will be dedicated officers to manage payroll.

Keep track of payroll taxes

As a primary step, you should be aware of the payroll tax rates in your location. Do some research and get to know how much other employers pay.

Also, if there is any change in tax rates, be the first person to know and update it in your system. Paying at the wrong tax rates can cause you penalty charges.

Using payroll system for small businesses

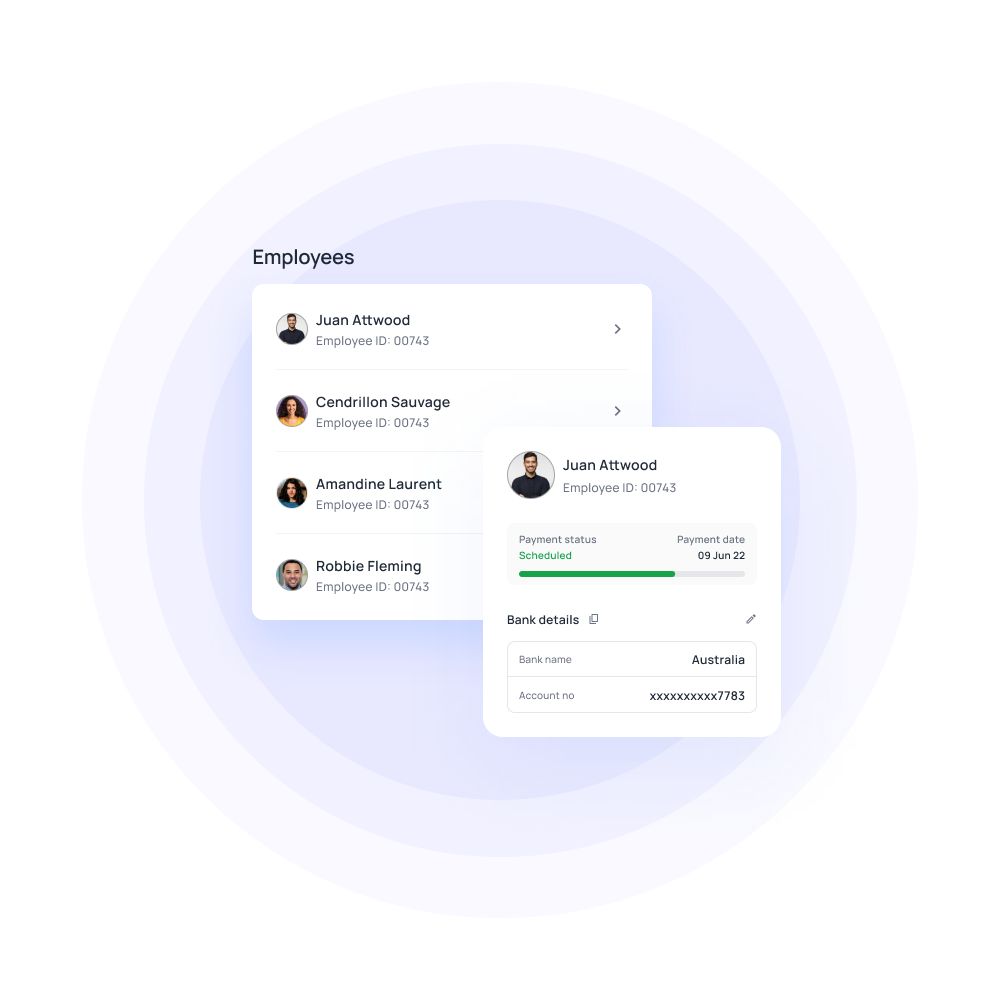

Payroll software for small businesses processes the employee payroll much more efficiently than a third-party payroll team. A payroll system is the best solution if you are concerned about your private data being handled by someone else. Payroll software is an automated program where you can load the necessary data, and it will process the payment to employees at a predetermined time.

Thus, managing payroll for small businesses becomes more painless. Not just does it process the salary, it also stores the payroll data and makes sure that your employee payroll sticks to the local compliances and tax regulations. These are generally cloud-based solutions that guarantee the total safety of your data.

Time consumption must be your primary concern when you upgrade to payroll software for small businesses. As a small business owner, the number of employees you handle might be less now. But it’s going to increase in future years exponentially. And to drive the humongous data effortlessly and in a short time, you need payroll software. As it will be an error-free automated process, you don’t have to worry about paying penalty charges.

Expense management software lets you manage, track and pay from one place. You can also handle reimbursements through this with an easy-to-handle approval process. You can schedule payments ahead of time, track the status and receive notifications once it is sent. With Volopay manage entire business financial needs, including sending out salary. Any transactions done instantly get reconciled with other accounts systems and the general ledger.

Continuous use of old and outdated methodologies is prone to creating more errors and exhaust you as you spend fixing them. Professionals don’t make mistakes here; they choose intelligent solutions that tend to their requirements. So, to handle it professionally, review your current payroll process and update to smart, automated payroll systems. Advanced payment solutions help develop good payment practices.

FAQs

Depending on the issue's complexity, it can take 2 to 10 days to resolve a payroll error upon discovery.

Tax documents, payroll documents, the employer identification number, personal identification documents like driver’s license, passport, etc.

If there is an overpay that you can identify, your employer can claim it back. They will either ask you to return the money or deduct it from your next paycheck.

In general, payroll is an expense as it means providing wages to your employees. It is taxable because the employee salary is eligible for the business tax write-off. It includes the salary and monetary benefits you offer to your employees along with employee payroll tax. Also, Payroll is either managed by a group of laborers or software for which the company has to spend. To sum up, it is an expense.

Bring Volopay to your business

Get started now