End-to-end guide on expense report audit

Be it internal or external financial audits, the importance of this activity cannot be stressed enough. Not only does it determine the financial wellbeing of your organization, but also helps you gain clarity on how money is coming and going out of the business. An expense report audit is one such type of financial audit that enables your business to view, track, and optimize the outflow of cash for future purposes.

Expense report audit checklist

An audit process must check all the following aspects:

Confirm compliance

Check whether expenses follow internal company policies - The type of expense, the amount permitted, nature of the expense, etc.

Match reports

Verify whether expense reports match with the company ledger.

Verify documentation

Check if important documents like receipts are attached along with the expense reports.

Ensure clarity

Identify if the expense policies are clear enough for company-wide implementation

What makes auditing expense reports so unpleasant?

As per the description of an expense report audit that you just read above, you might have noticed that we mentioned that it is a manual process. And whenever there is manual work to be done on something, you can expect to notice inefficiencies in the process. Here is what makes the process of auditing such a tedious task and a challenge:

Managing bulk reports

Since most audits are conducted after all reports have been collected and reconciled with the company ledger, the auditor has no option but to go through each pile of expense reports and manually check everything.

Having an entire bulk batch of expense reports is not an ideal situation for work productivity especially when it has to do with noticing errors or discrepancies.

Complex policies

Identifying if an expense is justified or not becomes tricky when the company expense policy itself is not clear. There might be blurred lines or language used in a way that can easily be misinterpreted.

In such scenarios, it becomes tough for the auditor and responsible authorities to take proper action. The only solution to this is to craft the company expense policy in a crystal clear manner such that there are no doubts regarding what kind of expenses can or cannot be made.

Difficulty in rectification

In a situation where some kind of an error or inconsistency is noticed, then the process of finding out the factual truth and correcting the reports is not straightforward.

The respective employee must be contacted to clarify their stance on the expense, whether it happened, whether it didn’t, if it’s a system error, so on and so forth.

Time-consuming manual process

Probably the biggest drawback of the auditing process is that it has to be done manually. This means that it is a very time-intensive task. Going through each report, one by one, making sure that everything adds up is not easy at all.

The only way to speed things up a bit is to have multiple auditors at one time which is quite rare and not a feasible option.

Constantly increasing expense volume

Auditing is not a one-time process. It is something that should be done regularly. Monthly, quarterly, and at the end of every financial year are great checkpoints to maintain an audit system.

And since this is a constant process, another obstacle in the way of conducting efficient audits is the ever-increasing volumes of expense reports.

How an expense report software makes auditing easier

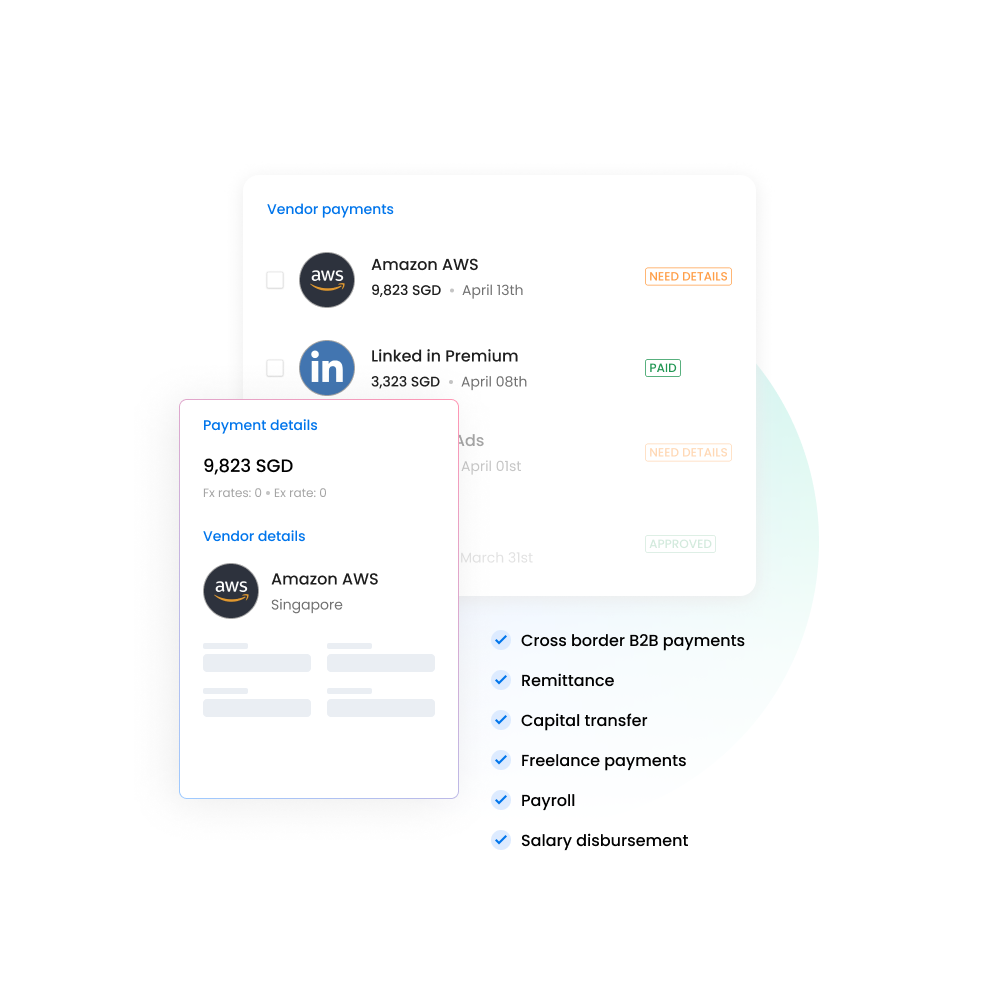

Everyone knows that an audit takes place after expenses have been made; this is so because traditionally, it takes a lot of time for an expense request to be approved. By the time the funds reach the employee, they’ve already lost a few days or a week of potential work. So conducting audits before assigning funds would only end up slowing down business operations. This is where an expense management software like Volopay comes into play.

For example, you set a rule on our platform that if a card transaction is above $100, then it will send a notification to the approvers to allow the employee to execute the expense. This is a great way to avoid unnecessary expenses and carry out small pre-expense audits which make the actual end-of-the-month audit process much faster.

With the help of fixed spend limits and approval systems in place, the chance of an expense being fraudulent or finding an error is quite low. This makes generating an expense management report for the audit process much more efficient.

Using the platform, you can easily set spending limits on each corporate card that you provide to your employees. This solves the problem of employees spending more than what is required.

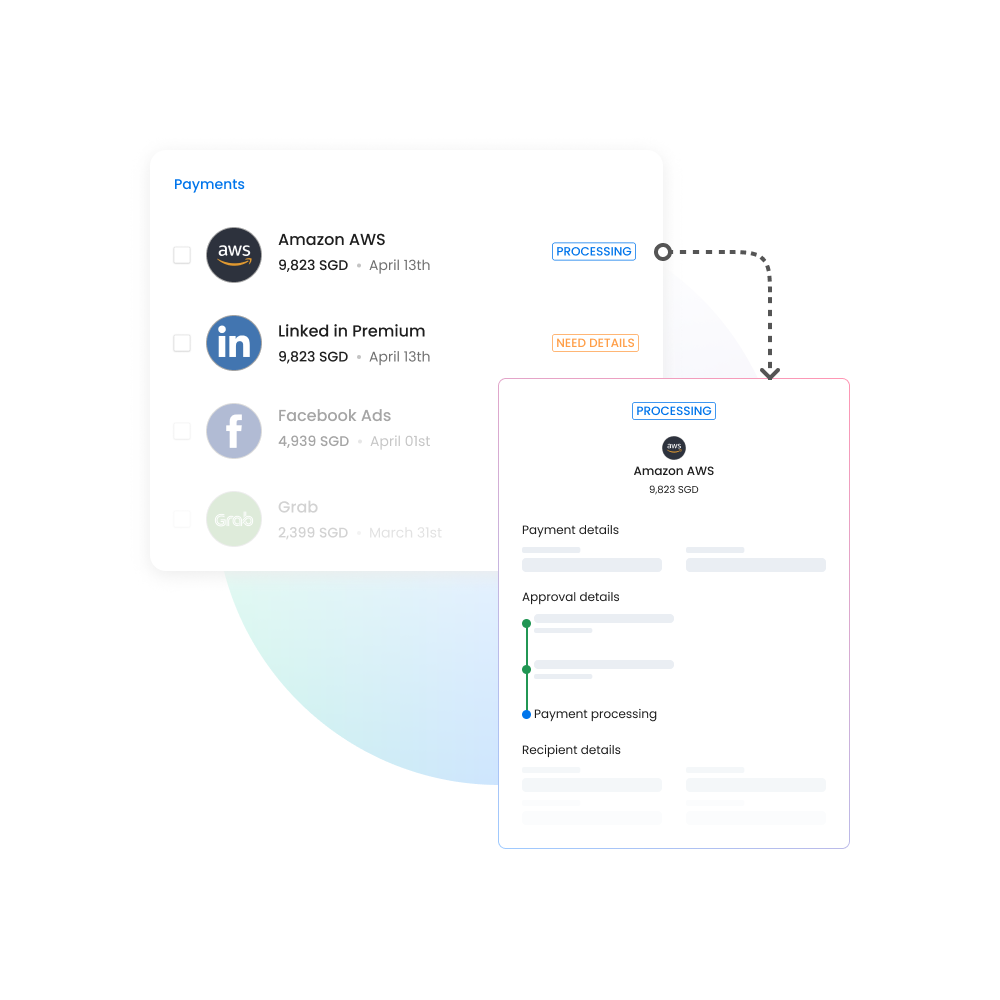

Secondly, you can also set up and enforce expense policies, within which you can create multiple approval workflows for transactions above a certain amount. What this means is that if an employee wants to spend above a particular amount that your admin sets, then the transaction will first have to be approved by the individuals who have been authorized and set as the approvers for a particular department.

Expense report audit best practices

Checking expenses before approvals

If you can stop a problem from occurring in the first place, then the audit process becomes much easier. As mentioned earlier, the only way you can do this without affecting work productivity and transparency is by using expense report software that can easily be accessed by all employees remotely.

Cover all expenses for compliance

The expense policy that your company drafts should cover as many types of expenses as possible. It should mention what type of expenses you can make for business purposes and what type of expenses are not allowed to be made by employees.

Timely submission of expense reports

It is crucial to convey the importance of timely expense report submissions. If employees don’t submit their reports on a timely basis then it becomes difficult to track and verify expenses.

Regular audits

Audits should be conducted at regular intervals. It completely depends on the organization how often they want to conduct audits, but usually, it is done at least once every quarter and at the end of every fiscal period.

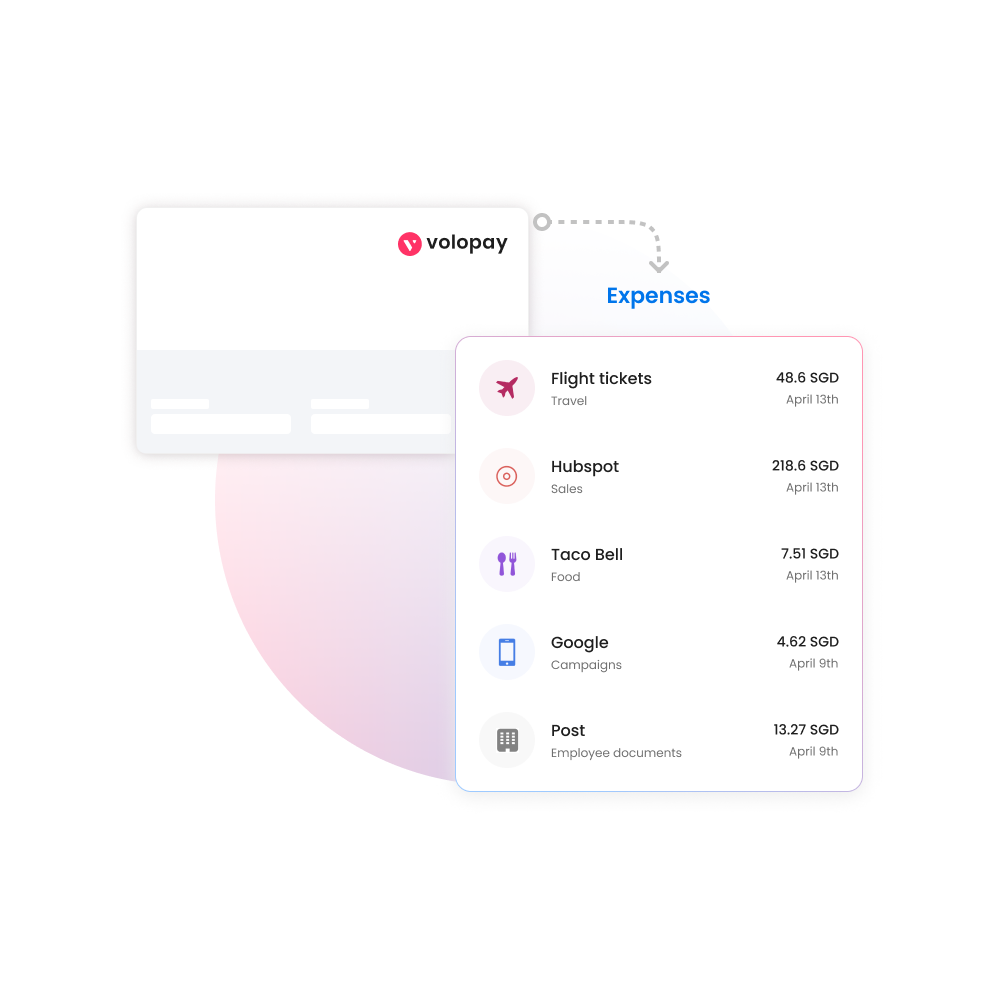

Use corporate credit cards

Now while this isn’t really a part of the auditing process, it makes the activity much easier. When you issue corporate credit cards from a provider like Volopay, the expense report policy is such that each transaction gets automatically recorded in an expense ledger within the platform in real-time. So instead of going through all expenses at the end of the month, finance members and admins get complete visibility immediately.

Implement an expense management software

An expense management software automates and makes a huge portion of auditing completely redundant as controls are set before expenses can even be made. This ensures that all guidelines are followed making the audit just a quick double-check for small human or system errors.

Audit expense reports efficiently

Using an expense management system like Volopay gives you complete visibility and control over how your budget is being spent across your organization. The auditor can see every data point to verify an expense right in front of them making the expense report audit process much simpler.