Unlock the top virtual card benefits for HR team success

Human Resources departments face mounting pressure to streamline operations while controlling costs. Traditional expense management methods often create bottlenecks, delays, and visibility gaps that hinder HR efficiency. Modern HR teams need solutions that match the pace of today's business environment.

Virtual card benefits for HR team operations have emerged as a game-changing solution for expense management challenges. These digital payment tools offer unprecedented control, visibility, and automation capabilities that transform how HR departments handle financial transactions. From recruitment costs to employee training programs, virtual cards provide the flexibility and security HR teams desperately need.

Your organization's HR department manages countless expenses daily, from subscription renewals to candidate travel reimbursements. Without proper tools, these transactions become administrative nightmares that drain productivity and create compliance risks. Benefits of virtual cards for HR team management extend far beyond simple payment processing, offering strategic advantages that impact your entire organization's operational efficiency.

What are virtual cards?

Virtual cards are online debit or credit cards created by randomly generating a 16-digit number, along with an expiration date and CVV number.

Virtual cards are a booming component of HR employee management software and are issued by the world’s leading card networks such as Mastercard, VISA, etc.

Virtual cards give you the freedom to create customized cards for every HR team member so that there is no need to queue up for a card ever again.

Why the HR team needs virtual cards?

Virtual cards operate independently of traditional bank systems, giving you complete control over how they’re used. You can set spending limits, choose multi-currency payment options, define expiration dates, and even restrict usage to specific expense categories.

This level of flexibility and control makes them an invaluable tool for your HR team, ensuring smarter and more efficient expense management.

What are the most common HR team expenses for businesses?

HR departments handle diverse expense categories that require careful tracking and management. These costs directly impact your organization's bottom line and operational efficiency. Understanding these expense types helps you identify areas where a virtual card for HR team can provide maximum value.

Modern HR operations involve complex financial transactions across multiple vendors and service providers. From recruitment advertising to employee development programs, your team manages expenses that span various categories and payment frequencies. Proper expense categorization and tracking become crucial for budget planning and cost optimization strategies.

1. Recruitment advertising costs

Your recruitment advertising budget covers job board postings, social media promotions, and sponsored content across multiple platforms. These expenses often require immediate payment to secure premium placement and maximum candidate visibility for critical positions.

2. External hiring agency fees

Professional recruitment agencies charge substantial fees for candidate sourcing and placement services. These payments typically involve milestone-based structures requiring secure, trackable transactions to ensure proper vendor relationship management and budget accountability.

3. Recruitment travel and events

Candidate interviews, job fair participation, and campus recruitment events generate significant travel and accommodation expenses. Your team needs flexible payment solutions that accommodate last-minute bookings and varying expense amounts across different geographical locations and vendors.

4. Employee training programs

Professional development initiatives, certification courses, and skills training programs require upfront payments to external providers. These expenses often involve recurring payments, bulk purchases, and vendor relationships that demand consistent payment processing and expense tracking capabilities.

5. Employee referral bonuses

Internal referral programs require prompt bonus payments to employees who successfully refer qualified candidates. These transactions demand secure processing methods that maintain confidentiality while ensuring accurate record-keeping for tax and payroll integration purposes.

6. Applicant tracking system (ATS) tools

HR technology subscriptions, including ATS platforms, background check services, and recruitment analytics tools, require monthly or annual payments. These recurring expenses need automated payment processing to prevent service interruptions and maintain operational continuity.

7. Employee engagement initiatives

Team building events, recognition programs, and workplace wellness initiatives generate various vendor payments and expense categories. Your team requires payment flexibility to handle diverse suppliers while maintaining proper expense categorization and budget tracking.

8. Onboarding tools and materials

New employee welcome packages, equipment purchases, and onboarding software subscriptions create diverse expense streams requiring efficient payment processing. These costs often involve multiple vendors and varying payment terms that challenge traditional expense management approaches.

Control HR expenses effortlessly with Volopay’s virtual cards!

Common challenges HR teams face in managing expenses

Traditional expense management creates significant operational hurdles for HR departments. These challenges impact productivity, budget accuracy, and vendor relationships while increasing the administrative burden on your team members. Understanding these pain points helps identify where virtual payment solutions can provide immediate relief.

Low limited spend visibility

Your current expense tracking system provides delayed, incomplete data that makes real-time budget management nearly impossible.

This visibility gap prevents proactive cost control and creates surprises during monthly financial reviews.

Delayed reimbursements

Manual reimbursement processes create cash flow problems for employees and administrative burdens for your team.

These delays damage employee satisfaction and create unnecessary friction in recruitment and training program execution.

Major financial budget overruns

Without real-time spending controls, your department frequently exceeds allocated budgets across various expense categories.

These overruns create financial stress and force difficult decisions about essential HR initiatives and programs.

Inefficient approval workflows

Paper-based or email approval processes often unnecessarily slow down urgent purchases and create significant bottlenecks in time-sensitive recruitment activities.

These delays severely hurt candidate experience, efficiency, and add overhead.

Difficulty tracking recurring costs

Subscription services and recurring vendor payments often escape proper tracking, leading to forgotten renewals, duplicate charges, and budget planning errors.

These oversights waste resources and complicate financial forecasting efforts.

Risk of fraud and misuse

Shared corporate cards and manual expense reporting create opportunities for unauthorized spending and fraudulent transactions.

These security gaps expose your organization to financial losses and compliance risks.

Benefits of managing HR spend using virtual cards

Virtual payment solutions revolutionize HR expense management by addressing traditional pain points while introducing powerful new capabilities. These digital tools provide unprecedented control, visibility, and automation, highlighting the key benefits of virtual cards that transform your department's operational efficiency.

Virtual card benefits for HR team operations help your organization gain strategic advantages. From improved budget control to enhanced security features, these tools enable proactive expense management that supports better decision-making and operational planning across all HR functions and initiatives.

Streamline recruitment payments

Virtual cards eliminate payment delays for job postings, agency fees, and candidate expenses, ensuring faster hiring processes. You can issue dedicated cards for specific campaigns while maintaining complete spending visibility and control.

Automate HR subscriptions

Recurring payments for ATS systems, background check services, and training platforms become fully automated, preventing service interruptions. Your team avoids manual payment processing while maintaining complete oversight of subscription costs and renewal dates.

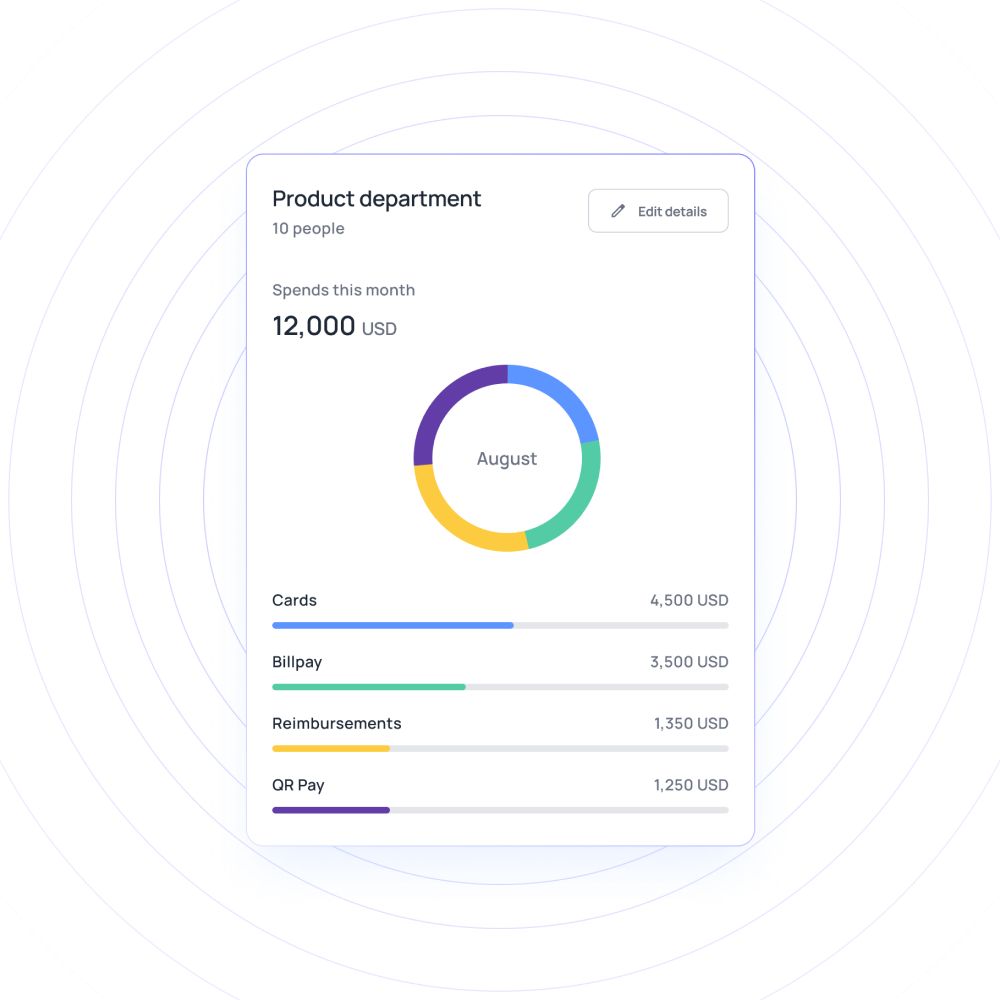

Track spend in real time

Instant transaction notifications and dashboard reporting provide immediate spending visibility across all HR expense categories. You can monitor budget utilization, identify spending patterns, and make informed decisions without waiting for monthly expense reports.

Enable faster expense approvals

Digital approval workflows eliminate paperwork delays and provide instant spending authorization for urgent HR needs. Your team can respond quickly to recruitment opportunities while maintaining proper spending controls and audit trails.

Improve budget control

Preset spending limits and category restrictions prevent budget overruns while enabling necessary flexibility for HR operations. You can allocate specific amounts for different expense types while monitoring usage in real-time across all team members.

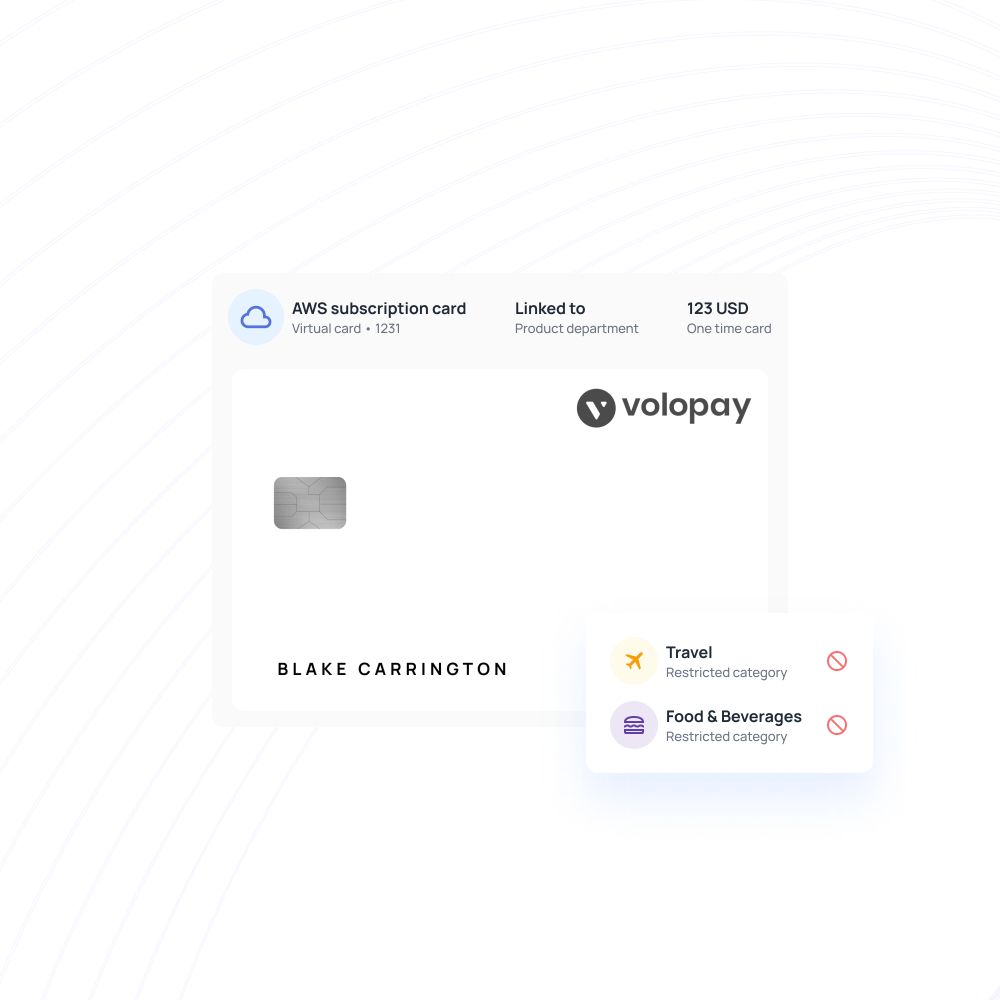

Prevent fraud with role-based cards

Individual virtual cards with specific spending parameters eliminate shared card risks and provide clear transaction accountability. Your organization gains enhanced security while maintaining operational flexibility for diverse HR expense requirements.

Reduce global transaction costs

Multi-currency support and competitive exchange rates minimize international recruitment and training expenses. Your team can manage global hiring initiatives without excessive currency conversion fees or international transaction charges.

Strengthen payment security

Advanced encryption, tokenization, and fraud detection provide superior security compared to traditional corporate cards. Your sensitive HR transactions receive enterprise-grade protection while maintaining ease of use for daily operations.

Volopay virtual cards: The smarter way for HR to manage expenses

Volopay transforms HR expense management through comprehensive virtual card solutions designed specifically for modern business needs. Your team gains access to powerful features that eliminate traditional expense management pain points while introducing advanced capabilities that enhance operational efficiency and financial control.

Your organization benefits from integrated expense management that connects payments, approvals, and reporting in one seamless platform. Volopay's benefits of virtual cards for HR team management include automated workflows, real-time visibility, and advanced security features that transform how your department handles financial transactions and budget management.

Issue unlimited cards instantly

Generate unlimited virtual cards for any HR expense category or team member instantly through the intuitive dashboard.

Your organization eliminates payment delays while maintaining granular control over spending permissions and usage parameters across all transactions.

Set limits for every expense

Configure specific spending limits, merchant categories, and time restrictions for each virtual card to prevent overruns.

Your team consistently maintains budget discipline while enabling greater operational flexibility for diverse HR expense requirements and complex vendor relationships.

Track every expense in real time

Monitor all HR transactions instantly through comprehensive dashboard reporting and automated expense categorization.

Your department gains complete live spend visibility without manual data entry or delayed reporting that hampers decision-making and budget planning.

Automate payroll and SaaS subscriptions

Schedule recurring payments for HR software, benefits administration, and vendor services to eliminate manual processing.

Your team avoids service interruptions while maintaining complete oversight of subscription costs, renewal dates, and vendor relationship management.

Prevent fraud with advanced security

Multi-layered security features, including card freezing, transaction alerts, and spending control,s protect against unauthorized usage.

Your organization maintains enterprise-grade protection while enabling legitimate HR expenses and maintaining operational efficiency across all departments.

Eliminate reimbursements for HR spend

Direct virtual card payments eliminate employee out-of-pocket expenses and subsequent reimbursement processing.

Your team reduces administrative burden while improving employee satisfaction and maintaining accurate, real-time expense tracking and budget management.

Empower strategic HR spend management with Volopay

Volopay's comprehensive expense management system enables HR departments to focus on core business objectives rather than administrative overhead. Volopay's intuitive platform provides the tools and insights needed to transform your expense management approach from reactive to proactive, enabling better resource allocation and operational planning.

Your organization gains competitive advantages through improved expense efficiency, enhanced vendor relationships, and better budget predictability. These improvements, powered by corporate cards, translate directly into enhanced HR service delivery, faster recruitment processes, and more effective employee development programs that support overall business objectives and growth initiatives.

Automate recurring HR payments

Eliminate manual processing for subscription services, vendor contracts, and regular expense categories through intelligent automation. Your team focuses on strategic initiatives while maintaining complete oversight of recurring costs and vendor relationship management across all departments.

Enable role-based spend access

Configure spending permissions based on team member roles, responsibilities, and budget allocations for optimal control. Your organization maintains security while enabling operational flexibility that supports diverse HR functions and departmental requirements.

Centralize spend data across departments

Integrate HR expense data with broader organizational spend management for comprehensive financial visibility and reporting. Your team contributes to enterprise-wide cost optimization while maintaining departmental autonomy and operational efficiency.

Reduce manual reporting workload

Automated expense categorization, receipt capture, and reporting generation eliminate time-consuming administrative tasks. Your team redirects effort toward strategic HR initiatives while maintaining compliance and audit readiness across all financial transactions.

Control global HR spend across currencies

Manage international recruitment, training, and vendor payments with multi-currency support and competitive exchange rates. Your organization expands global operations without excessive transaction costs or currency conversion complications that impact budget predictability.

Streamline approvals and policy controls

Multi-level approval workflows with customizable rules ensure spending compliance while eliminating paperwork delays. Your team maintains proper oversight while enabling rapid response to urgent HR needs and time-sensitive recruitment opportunities.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs

Yes, you can create unlimited virtual cards for specific expense categories, ensuring better tracking and budget control.

Absolutely, each virtual card can have customized spending limits based on role and responsibility requirements.

Yes, virtual cards handle recurring payments automatically while providing complete oversight of subscription costs and renewals.

Volopay offers integration capabilities with popular HR platforms to streamline expense data synchronization and reporting.

Virtual cards work perfectly for distributed teams, providing secure payment access regardless of geographic location.