How to manage employee expenses with corporate cards?

When you slowly transition from a small business to a medium or slightly large company, it’s quite common to struggle with employee expense management. You might have had different strategies to manage employee expenses and keep that under control, but it will take time to fall in place.

Small companies are generally under the impression that they will have perfect screening methods for employee reimbursements. But CFOs don’t have the time to validate requests one at a time. Before you can breathe and stop this turmoil, your corporate expense management gets messed up, consuming a prominent part of your budget.

Can you solve this problem by distributing corporate cards for employees? We will show you how this can be a valued addition to your accounting process.

How corporate cards work

Corporate cards have a centralized management system where an admin can manage the functionalities and track the expenses of physical and virtual cards present.

Virtual cards can potentially change your corporate expense management altogether due to their versatility. The admin can create a virtual card, assign a budget category to draw funds from, share with a user and delete after usage.

Corporate expense management cards tick two boxes at the same time. One, you get to manage employee expenses just by distributing a card. Two, employees feel at liberty to spend on their own will for making authorized expenses, but the overall control is still with the finance team.

Choosing which employees should receive a corporate card

Top executives and people from departments who travel monthly are in dire need of a regulated corporate expense management solution.

They are tired of the cumbersome reimbursement procedures. Any time-saving alternative like this can benefit them.

They don’t have to make out-of-pocket expenses anymore and collect bills to prove that. Manage employee expenses and track them in real-time with corporate cards.

With corporate cards, employees can make bookings online with the funds assigned to them and request more, if required.

Paying extra attention to vendor invoices due to frequent upswing in their pricing? Wasting human resources and money to cap the vendor payouts within limits? Use corporate cards instead.

If the payment exceeds the approved spending limit, you can easily reload your corporate cards and set up a multi-level approval workflow to ensure proper authorization and compliance before processing the transaction.

By setting limits on corporate cards, you get notified when vendors try to charge more than usual, helping sort pricing discrepancies beforehand. This can save your business a lot of time and money.

If you use SaaS tools and applications with monthly subscription fees, corporate cards are the right choice to pay them at the end of the cycle.

As you can create corporate cards in unlimited numbers, you can have one card for each tool. This way, you can definitely avoid mixing up one with another and bring organization in the corporate expense management.

Corporate cards can put your monthly recurring payments on an autopilot mode and significantly reduce human labor and a lot of time for a business, while also helping you efficiently and effectively manage your employee expenses.

How to manage employee expenses with corporate cards effectively

Employee expense reimbursement and daily allowances exhausting your budget constantly? Here is how Volopay can help you watch your expenses and replace any employee expense management software you already have been using.

Archive or block corporate cards

Corporate cards can be disabled or blocked when and if they are not in use. When you set automated payments through cards, you will never notice when you get charged automatically.

But if you decide to do away with your monthly billing, simply block the corporate card immediately to completely avoid processing your payment from that card anymore.

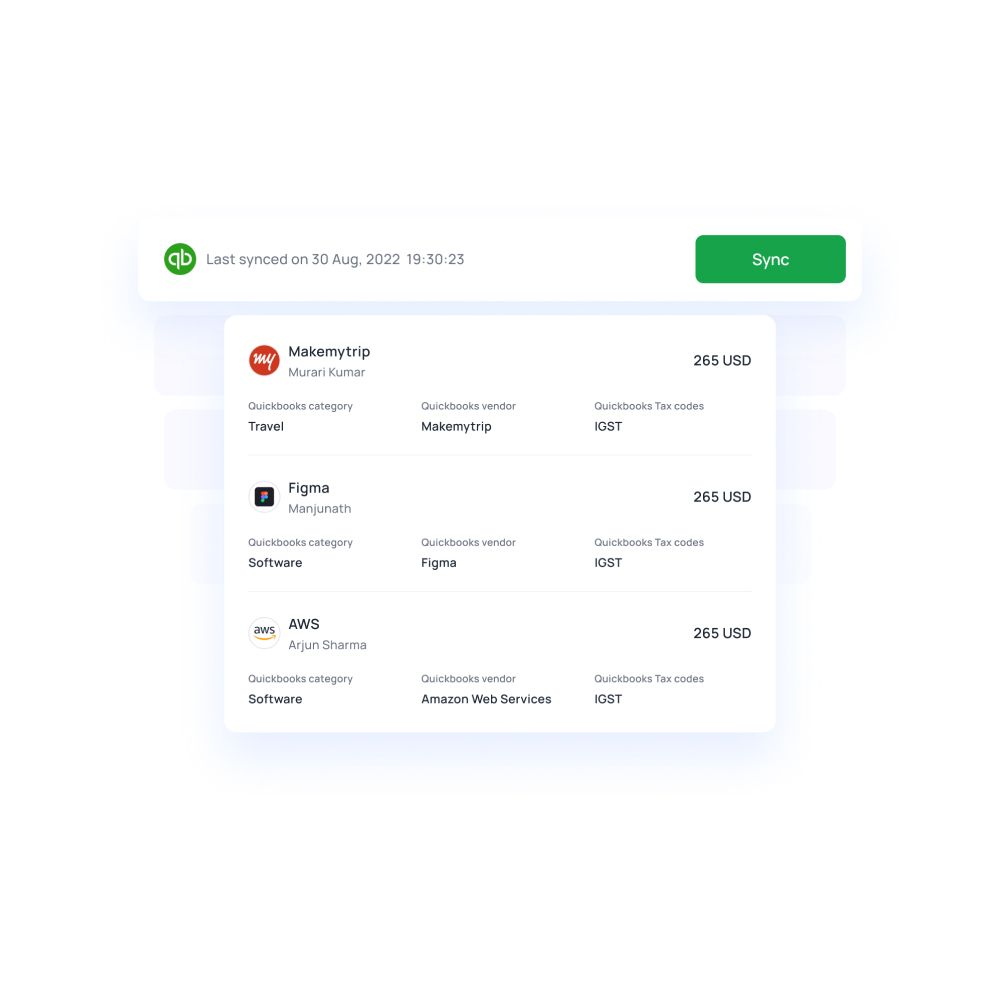

Sync with accounting software

Spend no time on manual work as Volopay syncs seamlessly with your other accounting software automatically and manually in real time.

Businesses use other accounting applications than employee expense management software. If they work together, it spares manual work, and your reports and statements will be accurate.

Create recurring payment

Some business payments can occur monthly or can be one time. In both cases, your accounts team can efficiently and securely put corporate cards to use.

Set the payment frequency based on your needs and discard the card after use. Set expiry dates on cards used for one-time purposes so that they will automatically stop working.

Set limitations on spending

Every company has its T&E policies that state the permissible limits in spending for each category. However, they are hard to insist on and follow over time without any means to manage employee expenses in real-time.

Volopay brings you a nicer alternative for this, which is setting limits. They can only be eligible for employee reimbursement or card usage if the payment is within limits.

Separate cards for every user

One simple trick to manage employee expenses is to separate each employee’s expenses for better tracking and visibility. Distribute one card to each employee as each has a different spending pattern.

Providing corporate cards for employees can reduce the need for employee reimbursements and keeping one card for each employee makes it easier to set budgets.

Building a corporate card control framework for smarter spend

A well-structured corporate card control framework ensures spending is both monitored and efficient. With clear rules, automated workflows, and real-time oversight, businesses can prevent bottlenecks, maintain compliance, and give teams the flexibility to spend responsibly.

The right framework transforms expense management from a reactive process into a strategic advantage for organizational growth.

Set clear spending policies and limits

Establish transparent spending policies that define category-specific limits, merchant restrictions, and approval thresholds. Document acceptable use cases and create tiered spending caps based on employee roles and departments.

Clear guidelines eliminate ambiguity, reduce unauthorized transactions, and empower employees to make confident purchasing decisions while staying within budgetary boundaries that protect company resources.

Design approval workflows to prevent delays

Implement streamlined approval processes that match transaction size and risk level. Configure multi-level authorization for high-value purchases while enabling instant approvals for routine expenses.

Smart routing ensures requests reach the right approvers quickly, reducing bottlenecks that slow operations. Pre-approved vendor lists and recurring expense categories further accelerate workflows without compromising oversight or financial control.

Leverage automation for real-time compliance

Deploy automated systems that enforce spending rules instantly and flag policy violations before transactions complete. Real-time monitoring catches duplicate charges, out-of-policy purchases, and missing documentation immediately.

Automated receipt matching and categorization reduce manual review time significantly. When you manage employee expenses through intelligent automation, compliance becomes seamless, freeing finance teams to focus on strategic analysis rather than administrative tasks.

Balance financial control with employee flexibility

Create a framework that protects company finances while giving employees appropriate spending autonomy. Use dynamic card controls that adjust limits based on project needs, travel schedules, or seasonal demands.

Virtual cards for specific vendors and temporary limit increases provide flexibility without permanent risk exposure. Trust-based policies combined with smart guardrails foster responsibility and improve employee satisfaction.

Track spend and maintain accountability

Implement comprehensive tracking systems that provide complete visibility into all corporate card transactions. Generate detailed reports by department, project, vendor, and expense category to identify spending patterns and optimization opportunities.

Regular audits and automated reconciliation ensure accuracy while deterring misuse. Clear accountability structures, coupled with transparent reporting, create a culture of responsible spending and enable data-driven financial decision-making.

The dual impact of corporate cards on expense tracking

Corporate cards fundamentally transform how organizations monitor and manage spending, offering both significant advantages and notable challenges.

Understanding both the benefits and potential complications helps companies implement controls that maximize efficiency, maintain compliance, and ensure accurate, real-time financial oversight across teams.

Strategic implementation determines whether corporate cards become powerful financial tools or sources of administrative burden.

1. How corporate cards simplify expense tracking

● Instant Insights Across Teams

Corporate cards provide immediate visibility into spending patterns as transactions occur, eliminating the lag time associated with traditional reimbursement processes. Finance teams can monitor expenses across departments in real time, identifying trends and budget concerns instantly.

This immediate access to spending data enables proactive decision-making, prevents budget overruns, and allows managers to address issues before they escalate into significant financial problems.

● Automated reconciliation

Digital transaction feeds eliminate manual data entry and reduce reconciliation time dramatically. When implemented effectively, corporate cards for expense tracking connect directly to accounting systems, automatically matching receipts with transactions and categorizing expenses.

This automation minimizes human error, accelerates month-end closing processes, and frees finance personnel from tedious administrative tasks, allowing them to focus on strategic analysis and value-added activities.

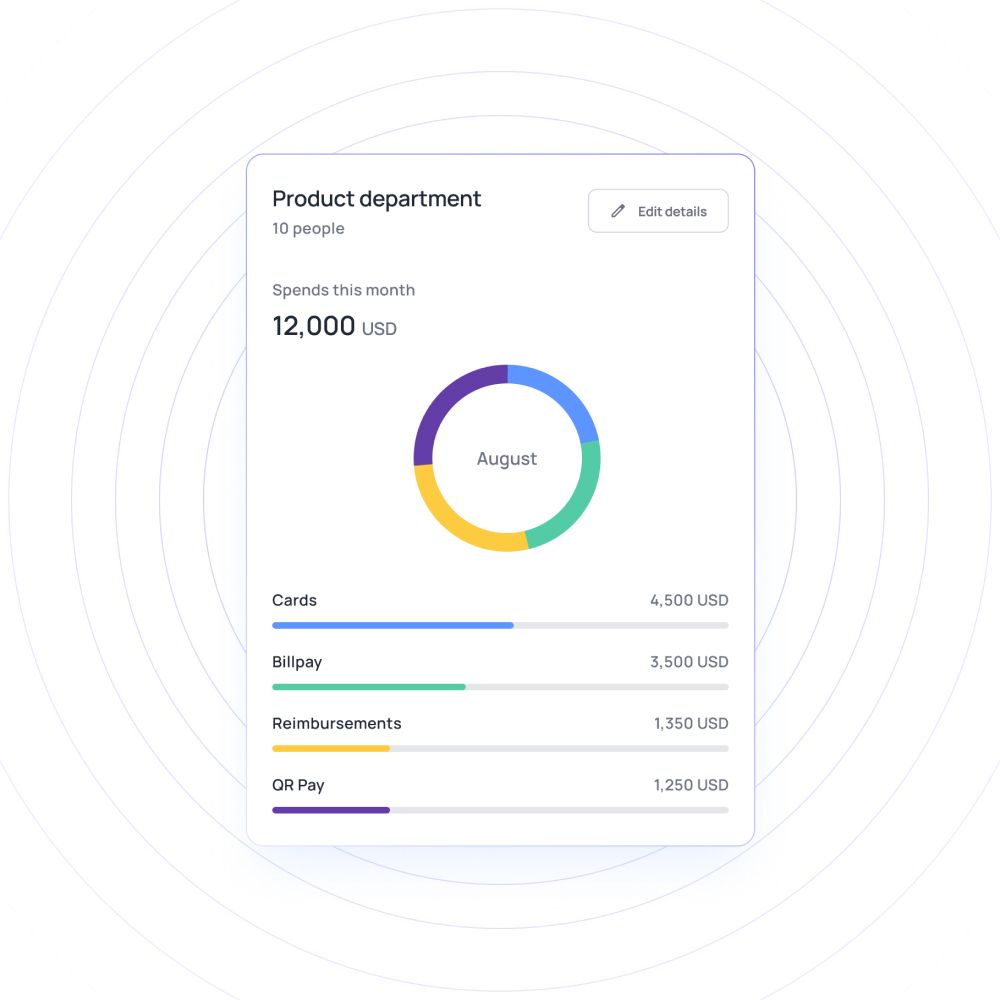

● Unified financial overview

Corporate cards consolidate all business spending into a single platform, creating comprehensive financial visibility across the organization. Centralized dashboards display spending by department, project, vendor, and employee, providing finance leaders with a complete picture of resource allocation.

This unified view simplifies budgeting, forecasting, and strategic planning while identifying cost-saving opportunities that would remain hidden in fragmented expense data.

● Frictionless approval workflows

Pre-approved spending limits and automated authorization processes eliminate bottlenecks that delay critical purchases. Employees can acquire necessary resources immediately without submitting manual requests or waiting for reimbursement cycles.

Conditional approvals based on transaction type, amount, or merchant ensure oversight without sacrificing speed. This streamlined approach improves operational efficiency while maintaining appropriate financial controls throughout the organization.

● Actionable reporting analytics

Advanced reporting capabilities transform raw transaction data into strategic business intelligence. Customizable dashboards highlight spending trends, policy compliance rates, vendor performance, and cost optimization opportunities.

Predictive analytics identify future budget needs and potential overspending risks. These insights enable finance teams to make data-driven recommendations that improve profitability, negotiate better vendor terms, and align spending with organizational priorities.

2. How corporate cards can challenge expense tracking

● Policy violations risk

Without robust controls, corporate cards can facilitate unauthorized purchases, personal expenses, or transactions that violate company spending policies. Employees may inadvertently or intentionally exceed limits, purchase from restricted vendors, or make inappropriate expenditures.

Insufficient monitoring creates opportunities for fraud and abuse, potentially exposing organizations to financial losses, compliance violations, and reputational damage that undermines stakeholder trust.

● Managing multiple cards

Organizations with numerous cardholders face complexity in tracking individual card activity, managing credit limits, and ensuring consistent policy enforcement. Different card types, varying spending authorities, and multiple billing cycles complicate oversight efforts.

Coordinating cancellations, replacements, and limit adjustments across large teams demands significant administrative resources, and fragmented card management systems can create blind spots in financial visibility.

● Delayed reporting

Employees who fail to submit receipts promptly or provide incomplete expense documentation create reconciliation challenges that compromise financial accuracy. Missing merchant details, vague transaction descriptions, and delayed expense reports obstruct proper categorization and audit trails.

These gaps become particularly problematic when implementing corporate cards for employee expense management, as incomplete data undermines compliance efforts, complicates tax reporting, and extends month-end closing processes significantly.

● Compliance challenges

Navigating diverse regulatory requirements, tax obligations, and industry-specific spending restrictions becomes more complex with widespread corporate card usage. Different jurisdictions impose varying documentation standards, receipt requirements, and expense categories.

Ensuring all transactions meet legal and regulatory standards across multiple locations demands sophisticated tracking systems. Non-compliance risks include penalties, failed audits, and complications during financial examinations by external authorities.

● Complex reconciliation

Despite automation potential, corporate cards can create reconciliation difficulties when systems lack integration, data feeds contain errors, or transaction categorization requires manual intervention. Disputed charges, merchant name variations, foreign currency conversions, and split transactions complicate matching processes.

Multiple approval levels, shared expenses, and project-specific allocations add layers of complexity that demand significant finance team attention and expertise to resolve accurately.

Centralizing corporate card expenses across teams

When you centralize expense management, you gain complete visibility into your organization's spending patterns and eliminate blind spots that drain resources.

A unified system prevents duplicate purchases, identifies cost-saving opportunities, and ensures consistent policy enforcement across all departments.

You'll streamline reporting processes, accelerate financial closing, and equip leadership with real-time data needed for strategic planning, ultimately strengthening your competitive position through superior financial control.

Decentralized expense systems create fragmented data that obscures your true financial picture and complicates budget management.

You'll struggle with inconsistent policy interpretation, duplicated vendor relationships, and inefficient spending across teams operating independently.

Manual consolidation consumes valuable time, increases errors, and delays critical financial insights. Without centralization, you risk budget overruns, compliance failures, and missed opportunities to leverage your organization's collective purchasing power.

Modern expense management platforms integrate with your corporate card programs, consolidating all transactions into a single dashboard regardless of team or location.

You should implement cloud-based solutions that automatically categorize your expenses, sync with accounting software, and provide customizable reporting across different departments.

Look for tools offering mobile receipt capture, automated policy enforcement, and API connectivity with existing financial systems to create a truly unified, efficient, and scalable expense tracking ecosystem.

Establish role-based access controls that give managers appropriate visibility into their team's spending while providing finance leadership with comprehensive organizational oversight.

Real-time dashboards should display departmental budgets, spending trends, and policy compliance metrics at a glance. Implement standardized workflows for corporate card expense approvals that ensure consistent review processes across all teams.

Regular transparency reports and automated alerts keep stakeholders informed, enabling you to address issues proactively before they impact financial performance.

Your centralized system should enforce necessary controls without stifling operational efficiency or team autonomy, ensuring balance and sustainable business growth.

Configure flexible spending limits that adapt to project needs, seasonal demands, and departmental requirements while maintaining oversight. Empower employees with purchasing authority, using automation to flag exceptions, not routine transactions.

This balanced approach lets you maintain financial discipline while giving teams the agility they need to operate effectively and drive sustained growth forward.

How to automate corporate card expense approvals for employees efficiently

Implementing pre-approved spending tiers

Establish tiered spending limits based on employee roles, seniority levels, and departmental responsibilities to enable instant approvals for routine purchases. Configure your system so transactions below the specified thresholds bypass manual review, while higher-value expenses trigger appropriate authorization chains.

Create category-specific tiers that reflect business needs; for instance, travel expenses may warrant different limits than office supplies. This structure accelerates everyday spending while ensuring significant expenditures receive proper scrutiny and financial oversight.

Set real-time notifications and alerts

Deploy instant notification systems that alert relevant stakeholders when transactions require approval, approach spending limits, or violate policy parameters. Configure alerts that notify employees immediately when their purchases are approved or flagged for review, eliminating uncertainty and communication gaps.

Real-time monitoring through corporate cards for expense tracking enables finance teams to catch anomalies instantly, respond to urgent approval requests promptly, and maintain continuous oversight without constant manual surveillance of transaction activity.

Balance speed and compliance

Design approval workflows that prioritize both operational efficiency and regulatory adherence by automating compliant transactions while flagging potential violations. Build intelligence into your system that recognizes patterns.

For example, recurring vendor payments, pre-approved expense categories, and standard business purchases flow through instantly, while unusual transactions trigger compliance checks. This balanced approach ensures employees aren't delayed by unnecessary bureaucracy while protecting your organization from policy breaches, fraud risks, and regulatory non-compliance issues.

Use rule-based expense routing

Create sophisticated routing logic that directs expense approvals to appropriate managers based on amount, department, project code, merchant type, or expense category. Configure your corporate cards for employee expenses with conditional rules that escalate high-value purchases to senior leadership while keeping routine approvals within immediate management chains.

Smart routing eliminates confusion about approval authority, reduces processing time dramatically, and ensures the right decision-makers review transactions based on expertise and budgetary responsibility.

Maintain audit-ready tracking

Implement comprehensive documentation systems that automatically capture approval timestamps, decision-maker identities, policy compliance confirmations, and supporting documentation for every transaction. Your automated workflows should create immutable audit trails showing who approved what expenses, when decisions occurred, and which policies were applied.

Centralized record-keeping with searchable archives ensures you can respond instantly to audit requests, demonstrate compliance during reviews, and maintain complete transparency throughout your expense approval process.

Simplifying employee expenses with corporate cards

Businesses can simplify employee expenses with corporate cards as they help save time, reduce manual work, and gain real-time control over company spending. When you manage employee expenses with corporate cards, every transaction becomes easier to track, approve, and reconcile.

Corporate cards for employee expense management allow finance teams to automate policy enforcement and set predefined corporate card controls for safer spending. These corporate cards for expense tracking also streamline reimbursements and provide full visibility into where company money goes.

By using corporate cards for employee expenses, businesses can simplify corporate card expense approvals and build a seamless, transparent expense workflow. With Volopay’s smart corporate cards, this process becomes fully automated, efficient, and error-free.

Effortless employee expense management with Volopay corporate cards

Managing employee expenses doesn't have to be complicated. Volopay's corporate cards streamline the entire process, from issuance to reconciliation.

Eliminate manual reimbursements, reduce administrative burden, and gain complete visibility over company spending. Transform expense management into a seamless, automated workflow that saves time and enhances financial control across your organization.

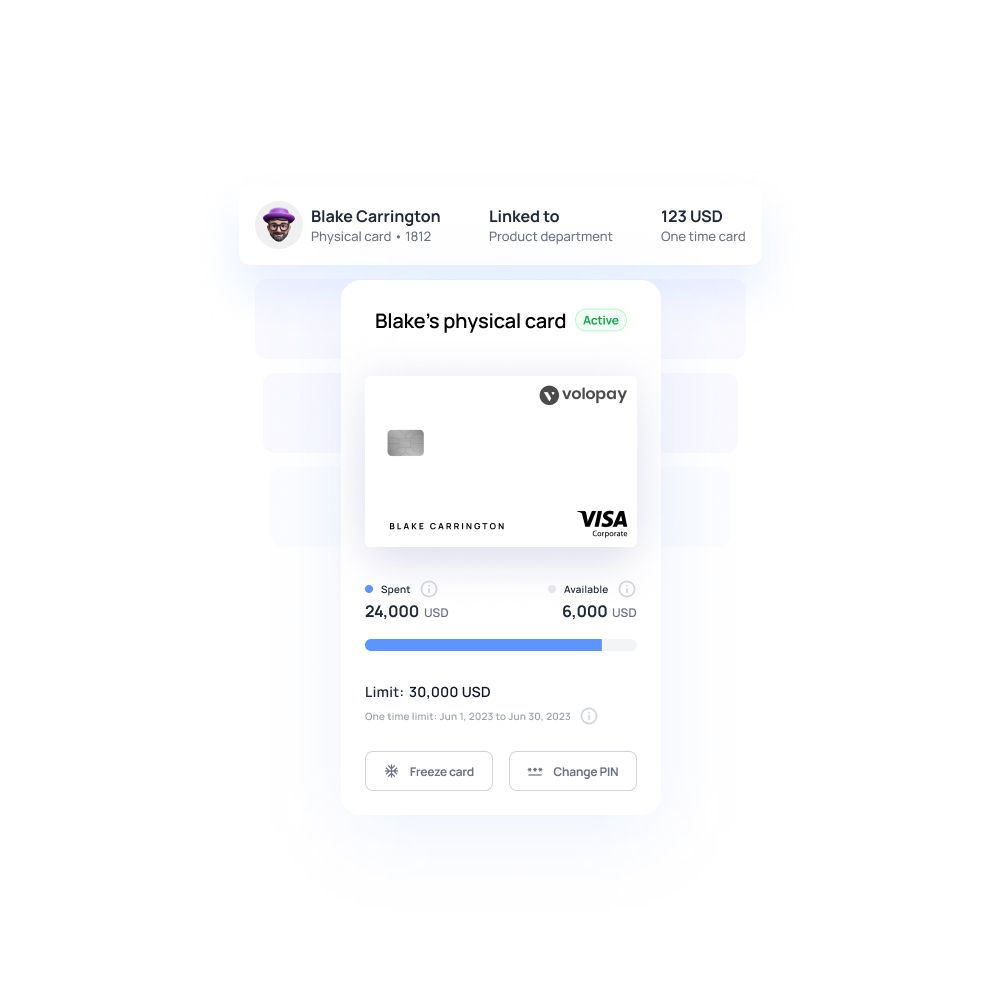

Issue corporate cards for employees

Deploy physical or virtual corporate cards to your team within minutes. Volopay's flexible card issuance system allows you to create employee-specific cards instantly, whether for recurring expenses or one-time purchases.

Each card integrates directly with your accounting system, eliminating the need for manual expense reports. Empower your employees with spending power while maintaining full organizational control over every transaction.

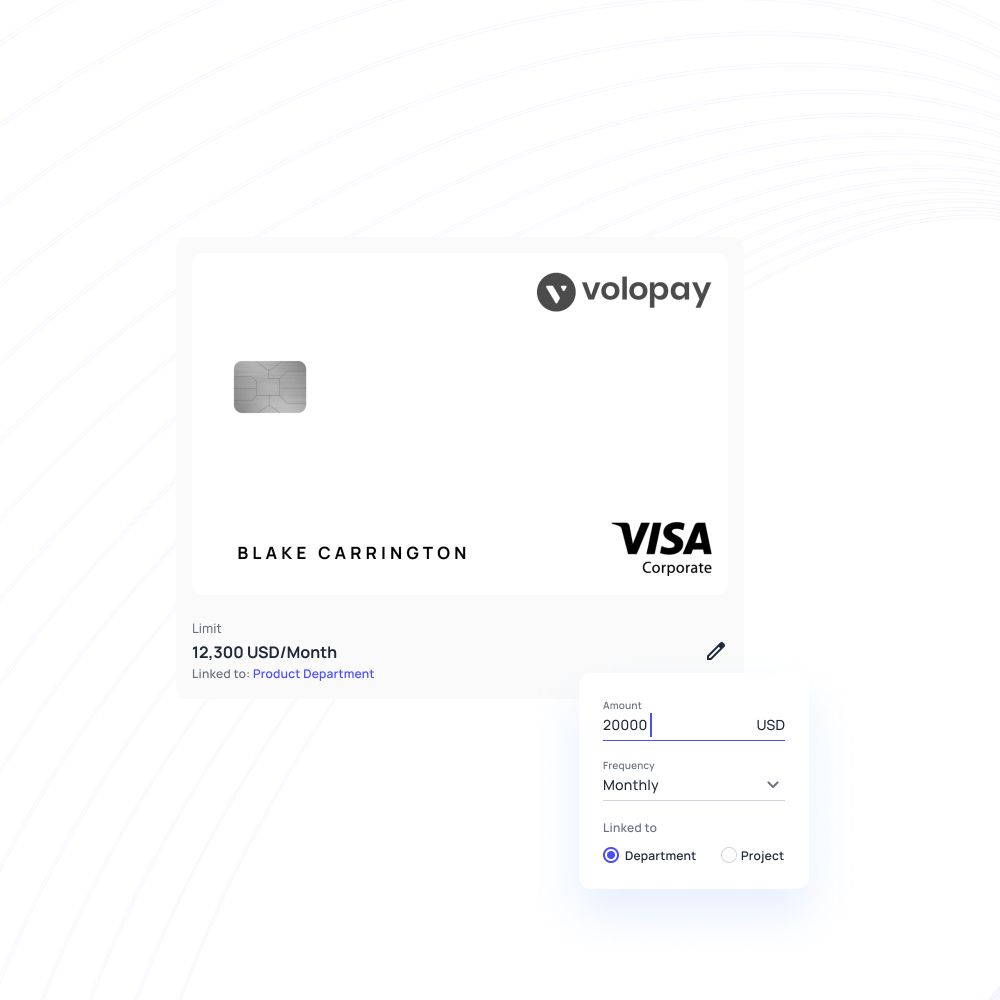

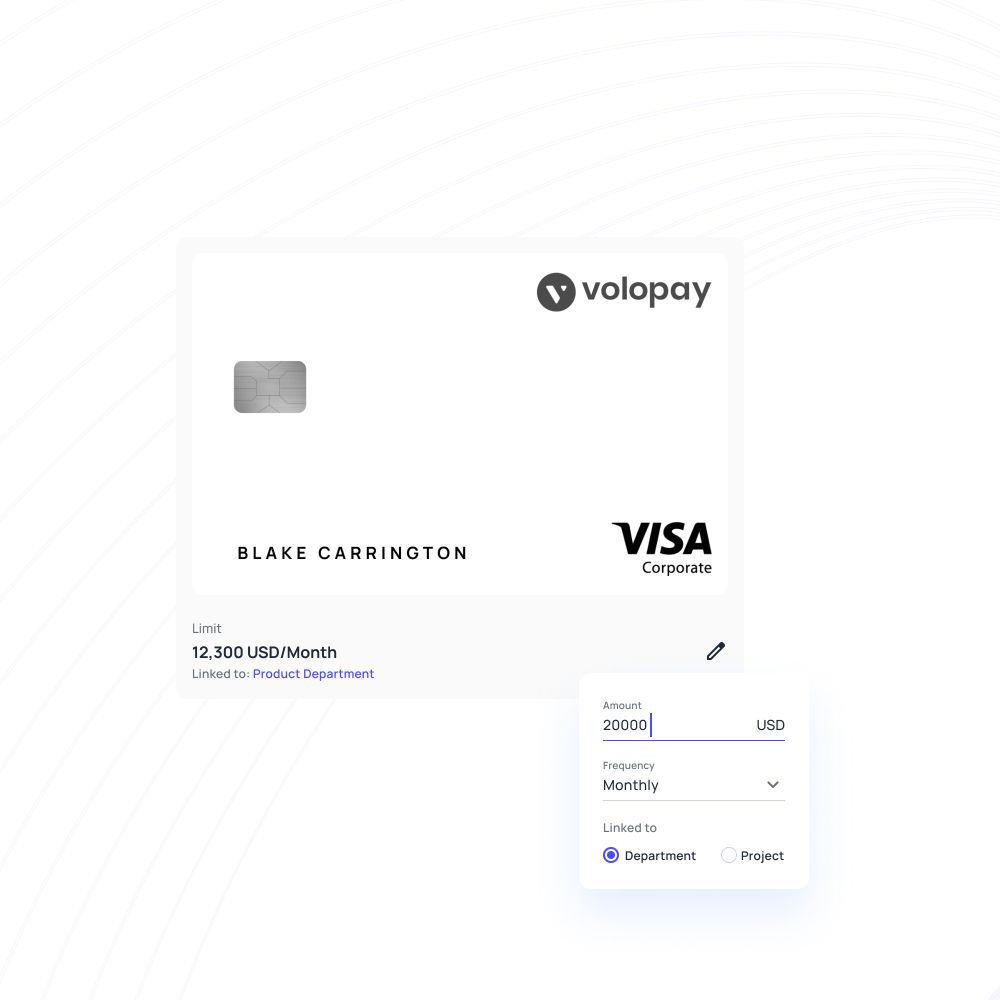

Set individual budgets

Establish customized spending limits for each employee or department based on their role and requirements. Volopay enables you to define daily, weekly, or monthly budgets that automatically reset, preventing overspending before it happens.

Adjust limits on the fly as business needs evolve. This granular budget control ensures employees have the resources they need while keeping company spending aligned with financial goals and policies.

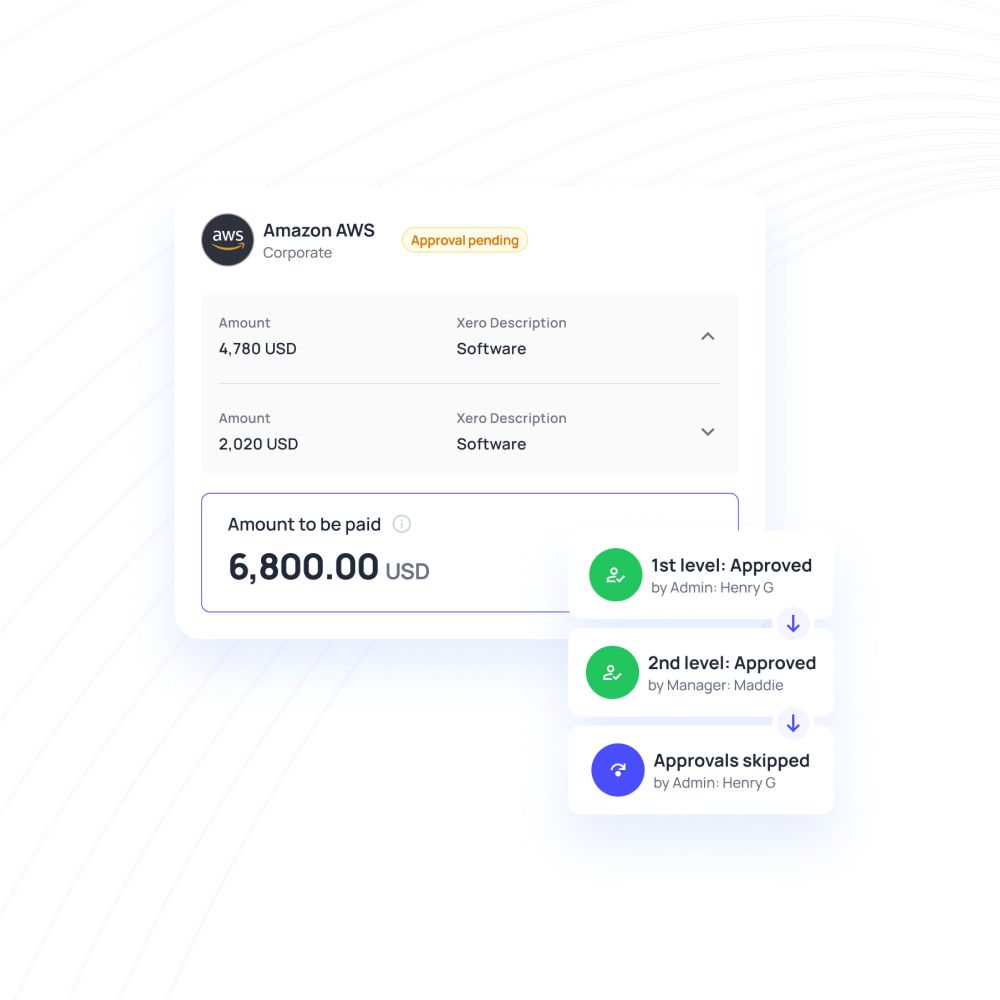

Implement multi-level approvals

Create sophisticated approval workflows that match your organizational hierarchy. Manage employee expenses through customizable multi-tiered authorization processes, ensuring appropriate oversight for every transaction.

Route high-value purchases through senior management while allowing routine expenses to flow through automatically. Configure approval chains based on amount thresholds, departments, or expense categories, maintaining accountability without slowing down legitimate business spending.

Track and categorize expenses

Automatically capture and categorize every transaction in real-time as expenses occur. Volopay's intelligent system organizes spending into predefined categories, simplifying reconciliation and financial reporting.

Employees can add receipts and notes directly through the mobile app, ensuring complete documentation. Say goodbye to lost receipts and month-end scrambles. Every expense is recorded, categorized, and ready for accounting review immediately.

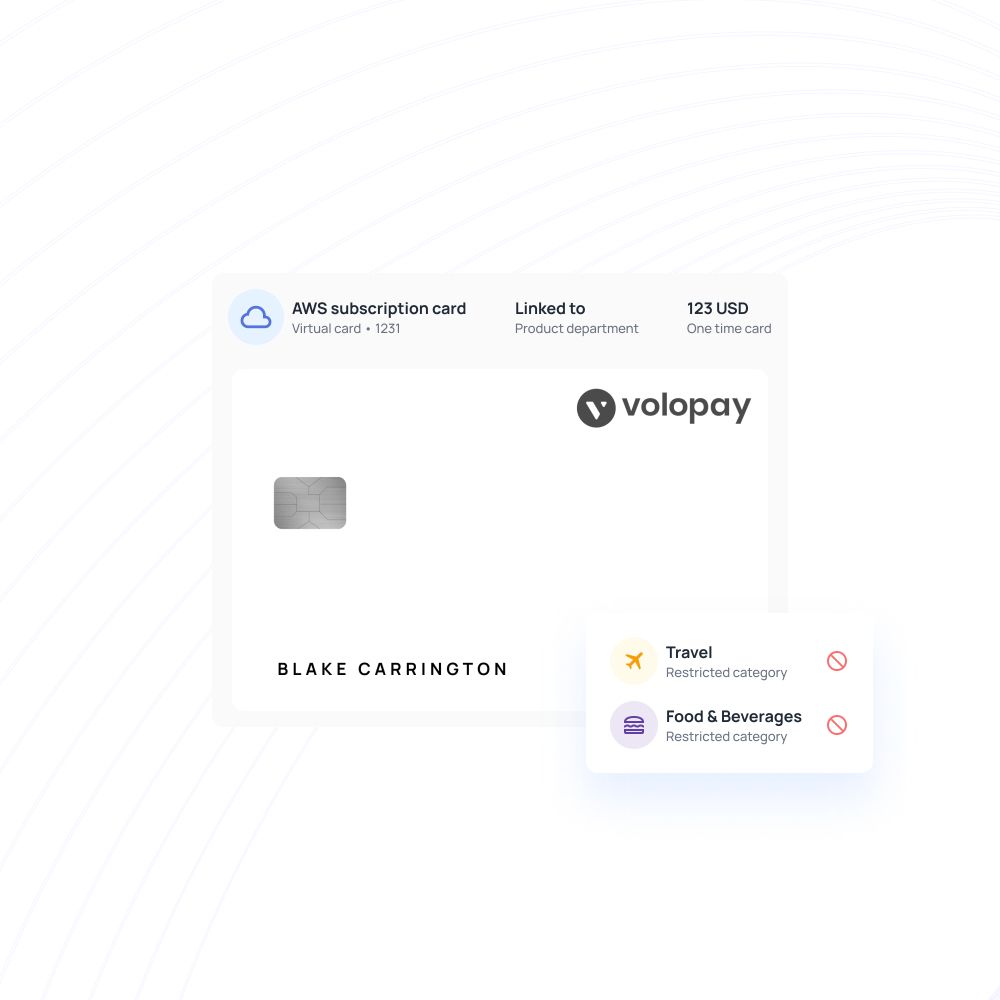

Monitor for compliance and fraud

Protect your organization with built-in compliance monitoring and fraud detection capabilities. Corporate cards for employee expense management provide instant alerts for unusual spending patterns, policy violations, or suspicious transactions.

Set merchant restrictions, spending categories, and geographic limitations to enforce company policies automatically. Volopay's real-time monitoring system flags potential issues immediately, allowing swift action to prevent unauthorized expenses or fraudulent activity.

Gain real-time insights across teams

Access comprehensive dashboards that deliver instant visibility into organizational spending patterns and trends. Monitor departmental budgets, analyze expense categories, and identify cost-saving opportunities through detailed analytics.

Generate custom reports for stakeholders with just a few clicks. Real-time data synchronization ensures your financial information is always current, enabling informed decision-making and strategic resource allocation across your entire organization.

Related pages to corporate cards

Explore the differences between corporate cards and employee reimbursements to discover which method offers more efficiency and cost-effectiveness.

Choosing the right corporate card provider is crucial. Learn what features, controls, and support your business should prioritize before making a decision.

Understand the risks of employee corporate card misuse and learn how to prevent it with smart controls, clear policies, and real-time tracking.

Get Volopay for your business

Get started free

FAQs

Corporate cards automatically capture transaction details in real time, eliminating manual expense report creation and data entry. Employees simply upload receipts through mobile apps, which automatically match to transactions. This automation reduces administrative time, minimizes errors, and accelerates reimbursement cycles significantly.

Yes, spending limits are fully customizable based on employee roles, departments, and specific needs. You can set daily, weekly, or monthly limits, restrict merchant categories, and adjust budgets dynamically. Individual configurations ensure appropriate spending authority while maintaining organizational financial control.

Corporate cards effectively eliminate most reimbursement needs by providing employees with direct purchasing power for business expenses. This approach removes out-of-pocket spending, accelerates procurement processes, and reduces administrative burden. However, some organizations maintain reimbursements for exceptional circumstances or specific expense types.

Yes, Volopay offers sophisticated multi-level approval workflows that route expenses based on amount, category, department, or custom rules. You can configure conditional approval chains requiring multiple stakeholders for high-value transactions while enabling instant approvals for routine purchases, ensuring appropriate oversight.

Volopay automates reconciliation by syncing transactions directly with accounting systems, matching receipts automatically, and categorizing expenses intelligently. The platform eliminates manual data entry, reduces closing time dramatically, and creates audit-ready records. Integration with existing financial software ensures seamless, accurate reconciliation processes.

Volopay uses real-time monitoring, automated policy enforcement, and AI-powered fraud detection to identify suspicious transactions instantly. You receive immediate alerts for policy violations, unusual spending patterns, or restricted merchant purchases. Granular controls, spending limits, and comprehensive audit trails further prevent misuse.

Yes, Volopay provides a unified platform that consolidates all employee expenses across departments, locations, and teams. Centralized dashboards offer complete visibility into organizational spending, standardize policy enforcement, and enable consistent tracking. This consolidation simplifies reporting, budgeting, and strategic financial decision-making organization-wide.