Streamline your marketing expense management with virtual cards

Managing marketing expenses efficiently requires modern solutions that keep pace with your dynamic campaigns. Traditional expense management methods often create bottlenecks, delay approvals, and provide limited visibility into spending patterns across multiple marketing channels and team members.

Marketing expense management becomes significantly more streamlined when you implement virtual cards designed specifically for marketing operations. These digital payment solutions offer instant issuance, granular spending controls, and real-time tracking capabilities that transform how you handle marketing budgets and vendor payments across your organization.

What is marketing spending?

Marketing spending is the money your team invests in building your brand, raising awareness, and generating leads, including social media, content marketing, paid ads, SEO, PR, and marketing tools.

Factors like industry, business size, growth stage, target audience, and expansion goals should guide your marketing budget, which in turn determines how efficiently you manage marketing expenses.

Using virtual cards can simplify tracking and control of marketing spend, ensuring better budget adherence.

Common marketing expenses for company

Your marketing department generates numerous expenses across various channels and activities throughout the year. Understanding these common expense categories helps you implement better tracking systems and allocate budgets more effectively for maximum return on investment.

Modern marketing operations involve complex spending patterns that require sophisticated management tools. From digital advertising campaigns to creative services, your team needs flexible payment solutions that can adapt to changing priorities while maintaining strict budget controls and comprehensive reporting capabilities.

1. Branding and visual identity development

Your brand identity investments include logo design, brand guidelines, website development, and visual asset creation. These foundational expenses often require payments to multiple designers, agencies, and freelancers working on different aspects of your brand presentation and market positioning strategy.

2. Paid digital advertising campaigns

Your advertising spend covers Google Ads, Facebook campaigns, LinkedIn promotions, and other digital platforms. These expenses fluctuate based on campaign performance and require frequent budget adjustments, making flexible payment solutions essential for maintaining a competitive advertising presence and optimal cost management.

3. SEO and content marketing

Your content marketing investments include keyword research tools, content creation services, and SEO software subscriptions. These ongoing expenses support your organic marketing efforts and require consistent payments to various content creators, tools, and optimization services throughout your marketing calendar.

4. Public relations and outreach

Your PR activities involve media monitoring tools, press release distribution services, and influencer partnerships. These expenses often require quick payments to secure time-sensitive opportunities and maintain relationships with media contacts, journalists, and industry influencers across different markets.

5. Freelancers and creative talent

Your creative projects require payments to graphic designers, copywriters, video producers, and social media specialists. These variable expenses demand flexible payment solutions that can accommodate project-based work, international freelancers, and varying payment schedules based on creative project requirements and deliverables.

Factors to consider while choosing virtual card provider

Selecting the right virtual card provider significantly impacts your marketing spending management efficiency and team productivity. Your choice should align with your specific marketing needs, team structure, and operational requirements to maximize the benefits of digital payment solutions. The right provider will offer scalable solutions that grow with your marketing operations and campaigns.

Instant virtual card issuance

Your marketing campaigns often require immediate payment capabilities for time-sensitive opportunities.

Look for providers that can generate virtual cards instantly, allowing your team to capitalize on urgent advertising placements, last-minute influencer partnerships, and flash promotional opportunities without delays.

Seamless tool integration

Your marketing stack includes various platforms and tools that need payment method integration.

Choose providers that connect easily with your CRM, advertising platforms, expense management software, and accounting systems to streamline workflows and reduce manual data entry across departments.

Multi-currency support

Your global marketing campaigns require payments in different currencies to international vendors and platforms.

Ensure your provider supports multiple currencies with competitive exchange rates, helping you manage international advertising spend and vendor payments more cost-effectively than traditional banking methods.

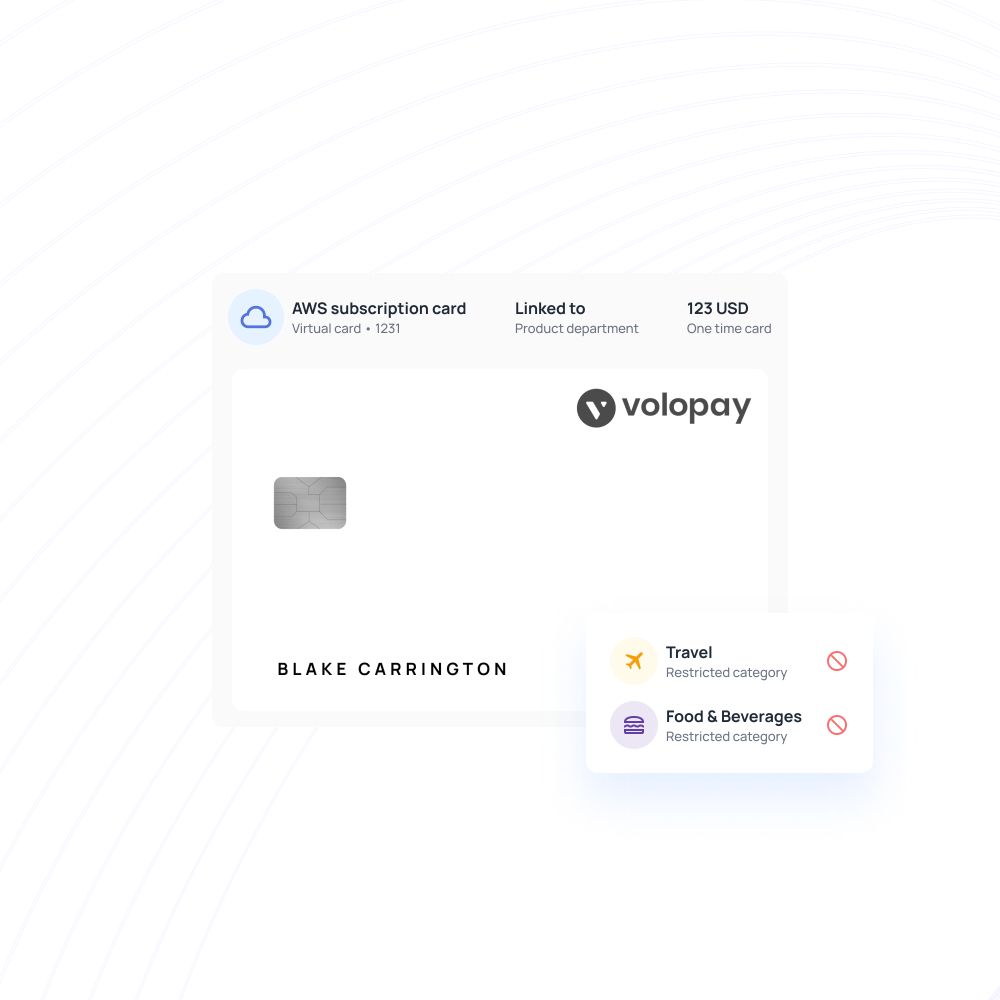

Custom spend controls

Your marketing teams need different spending limits based on their roles and campaign responsibilities.

Select providers that offer granular control settings, allowing you to set channel-specific limits, vendor restrictions, and time-based controls that align with your campaign budgets and approval processes.

Advanced security features

Your marketing expenses involve sensitive vendor relationships and significant budget allocations requiring robust protection.

Prioritize providers offering fraud detection, real-time monitoring, instant card blocking capabilities, and detailed transaction alerts to safeguard your marketing investments from unauthorized use and security breaches.

Real-time expense insights

Your marketing ROI depends on understanding spending patterns and campaign performance quickly.

Choose providers that deliver instant spending notifications, detailed analytics dashboards, and comprehensive reporting features that help you make data-driven decisions about budget allocation.

Benefits of managing marketing spend using corporate virtual card

Real time tracking

With corporate virtual cards, you can now experience marketing expense management with a centralized view of all spending, in real-time. Virtual cards come with expense management software that are extremely customizable and lets you track the updates, changes, and expenses made in real-time.

As a result, based on parameters you set, these platforms help you approve payment requests, reimburse spending and check unauthorized expenses without having to wait an entire month.

Safety

Virtual cards also have the obvious plus point of being impossible to misplace. The fear of theft or accidental loss of cards is completely removed because it literally takes a few clicks and a couple of seconds to block and then reissue the same card to the required individual.

Additionally, the benefits of virtual cards include features such as 3-D security and certification—ensure that even if a card is lost, your data stays protected, letting businesses manage expenses with confidence.

Faster payments

Most company-wide credit cards are not equipped with automated payment facilities. So, these cards usually require manual approvals before each and every payment is made.

Virtual cards, in contrast, come fitted with features that let you set limits, budgets, and pre-approved parameters that can automate this entire process. The need to approve every transaction is made a thing of the past and your payments processes become significantly faster.

Reduces the chances of frauds

Virtual cards are far safer than shared business credit cards, period. Using a corporate virtual card for payments means you can track spending, control budgets, and flag conspicuous behavior the moment it shows up in real-time.

Shared cards also run the risk of being blocked or considered fraudulent by bank software after overuse. This also means they can get blocked if the credit limit runs out, putting your company’s credit line at risk.

Using a virtual card for payment also means your transactions will be secured via far tighter layers of security. Such platforms are usually heavily guarded and equipped against fraudulent activity.

Chances of card getting blocked are very less

If your marketing team uses a single, shared, company credit card for every ad campaign for every client, the probability of it getting blocked is quite high. Repeated use means you are more likely to come up against your credit limit which in turn could cause transactions to get blocked or the card to get declined.

This form of card use can also trigger fraud alerts which can then compel ad programs to block your accounts, derailing campaigns. Keeping things separate by issuing different virtual cards for every account drastically cuts down the probability of these roadblocks. Separate virtual cards issued to different teams not only mean they won’t get blocked but also increases visibility and control to predict and curb blocking before it happens.

Virtual cards are customizable

Virtual cards are also heavily customizable. Some of the commonly customizable features include budget caps, multi-level approvals, currency, and in some cases even the design of the card itself.

Budget caps and approval systems are especially useful for your marketing teams because it sets an automatic limit on how much revenue is to be used for marketing spending without having to manually do the same on the marketing software. Preset caps on spending means there will be less your team will have to do to flag unauthorized behavior.

Reduces burden on the finance team

It goes without saying that the automated payments systems, pre-approval parameters, reimbursement facilities, fraud prevention, and integration capabilities are all factors that can significantly lighten the load on your finance teams.

By delegating the mundane, automatable, tasks to expense management software your finance team can spend more time on more specialized tasks that need human intervention.

Effortless marketing expense management using Volopay virtual cards

Volopay transforms your marketing expense management approach through innovative virtual card solutions designed specifically for modern marketing operations. These digital payment tools eliminate traditional expense management friction while providing unprecedented visibility and control over your marketing budgets and spending patterns.

Your marketing teams gain immediate access to flexible payment solutions that adapt to campaign requirements and vendor needs. Volopay's comprehensive platform integrates seamlessly with your software tools while providing the security and oversight necessary for effective budget management across all channels.

Instant card issuance

Your urgent marketing opportunities no longer wait for slow payment approvals or lengthy card delivery delays.

Generate virtual cards instantly through Volopay, enabling immediate payments for time-sensitive advertising opportunities and vendor requirements that drive your marketing success forward.

Channel-wise spend limits

Your different marketing channels require tailored spending controls that reflect their unique budget allocations and risk profiles.

Set specific limits for social media advertising, content creation, PR activities, and other marketing categories to ensure responsible spending while empowering teams with appropriate autonomy.

Real-time spend tracking

Your marketing budget visibility improves dramatically with instant transaction notifications and detailed spending analytics.

Monitor every purchase as it happens, track campaign expenses in real-time, and receive immediate alerts when spending approaches predetermined limits emerge across channels.

Fraud prevention tools

Your marketing investments stay protected through advanced security, including instant card blocking and suspicious activity detection.

These automated safeguards protect your budgets from unauthorized use while maintaining the flexibility your marketing teams need for legitimate business expenses.

Simplified reconciliation

Your accounting processes become more efficient with automatic transaction categorization and detailed spending reports.

Eliminate manual expense report creation and reduce reconciliation time through automated data capture that integrates directly with your accounting systems.

Empower external teams

Your freelancers and contractors gain secure access to designated budgets without compromising your financial systems.

Provide temporary cards with specific spending limits and expiration dates, ensuring external team members can make necessary purchases while maintaining complete oversight and control.

Why Volopay is the ideal partner for scalable marketing operations

Your growing marketing operations require payment solutions that scale efficiently with your expanding teams and increasing campaign complexity. Volopay’s corporate cards provide enterprise-grade capabilities that adapt to your evolving needs while maintaining the simplicity and user experience that keep teams productive and focused.

Modern marketing demands agility, transparency, and control that traditional payment methods cannot deliver effectively. Volopay address these requirements through intelligent automation, detailed analytics, and flexible configuration options that support your unique marketing objectives and operational requirements.

Centralized control across campaigns

Your marketing oversight improves through unified dashboard management that provides complete visibility into all campaign spending and team activities.

Monitor multiple campaigns simultaneously, track cross-channel budget allocation, and maintain strategic control while empowering teams with operational freedom to execute effectively.

Empower teams with budget ownership

Your marketing teams operate more efficiently when they have direct access to their allocated budgets with appropriate controls and oversight.

Delegate spending authority while maintaining visibility and approval processes that ensure responsible budget utilization and alignment with strategic marketing objectives.

Streamline vendor and SaaS payments

Your marketing tool subscriptions and vendor relationships require consistent, reliable payment processing that reduces administrative overhead.

Automate recurring payments for marketing software, services, and partnerships while maintaining detailed records that simplify vendor management and contract oversight processes.

Minimize admin work with smart automation

Your team productivity increases through automated expense categorization, approval workflows, and reporting generation that eliminates manual administrative tasks.

Focus your valuable time on strategic marketing activities rather than expense management paperwork and reconciliation processes that add little strategic value.

Adapt quickly to dynamic marketing needs

Your virtual card for marketing spends is flexible, allowing rapid response to changing market conditions and emerging opportunities.

Scale spending limits up or down based on campaign performance, seasonal demands, and strategic pivots without lengthy approval processes or administrative delays.

Gain insights to optimize ROI

Your marketing ROI improves through detailed analytics that reveal spending patterns, vendor performance, and budget efficiency across all channels.

Use these insights to optimize future budget allocation, identify cost-saving opportunities, and demonstrate marketing impact to leadership stakeholders and decision-makers.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQs

Yes, you can instantly pause or revoke virtual cards through Volopay, providing immediate protection against unauthorized use or budget changes.

A virtual card for marketing expense management supports multiple currencies, enabling seamless international payments with competitive exchange rates and transparent fee structures.

Virtual cards generate instantly upon request, allowing immediate payments for time-sensitive marketing opportunities without waiting for physical card delivery or approval delays.

Yes, you can create temporary virtual cards with specific limits and expiration dates for contractors, freelancers, and interns working on marketing projects.

Volopay provides a mobile application that enables real-time spending monitoring, transaction alerts, and budget tracking from anywhere for complete marketing expense visibility.