Vendor management automation: Process, implementation & standardization

Managing vendors manually can feel like juggling too many moving parts—emails, contracts, payments, and performance reviews—all demanding time and precision. That’s where vendor management automation steps in to change the game. By digitizing your procurement workflows, you simplify complex operations, minimize manual errors, and accelerate decision-making.

You gain complete visibility into supplier performance, financial control, and compliance tracking. This not only improves accuracy but also strengthens vendor relationships. With automation doing the heavy lifting, your team can focus on strategy, innovation, and building partnerships that drive long-term business efficiency and sustainable growth.

What is vendor management automation, and why it matters

Understanding vendor management automation

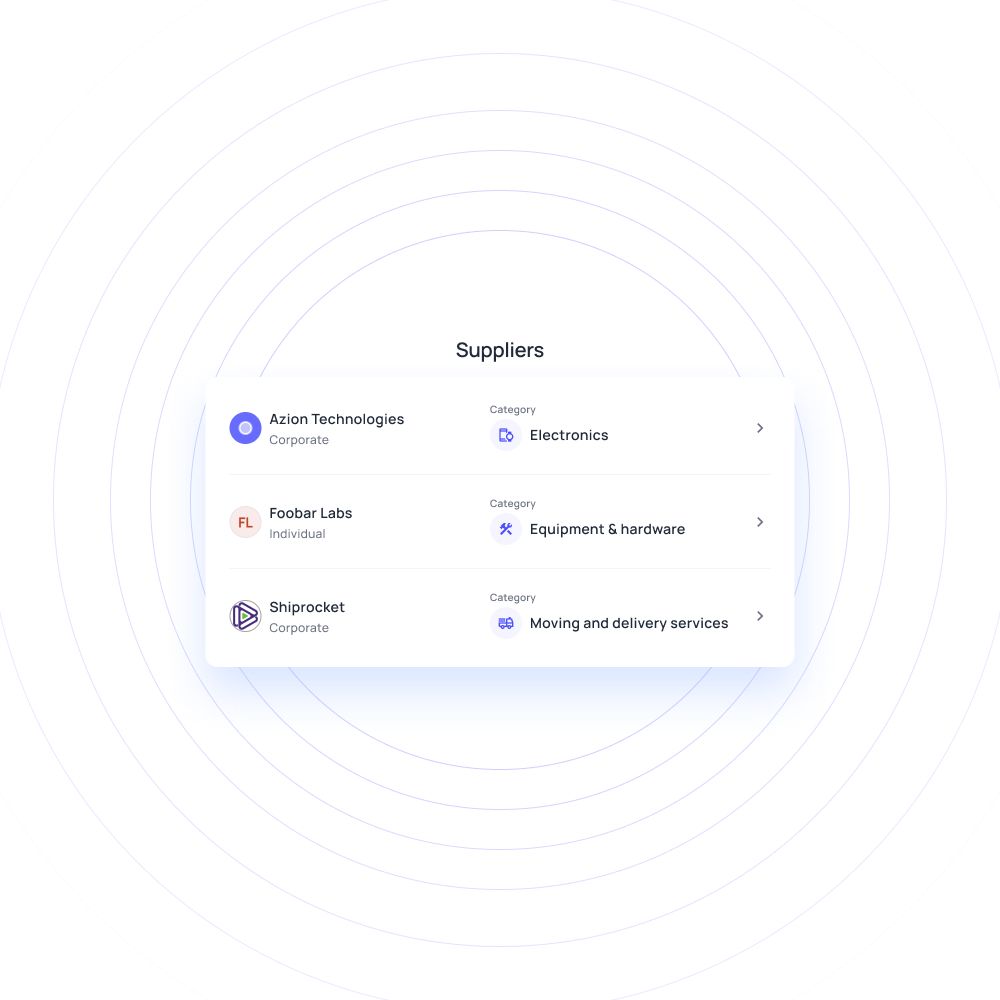

Vendor management automation refers to the use of technology to streamline and manage all processes related to suppliers. You can centralize onboarding, contract management, invoice tracking, and compliance tasks in a single platform.

This approach eliminates manual documentation and communication gaps. It ensures vendors are efficiently monitored and evaluated, allowing consistent performance tracking. With automation of vendor management, your team can operate faster, smarter, and with fewer risks while maintaining transparency throughout the procurement cycle.

Key benefits of automating vendor processes

Automating vendor processes eliminates inefficiencies caused by manual paperwork and fragmented communication. You can process approvals faster, minimize invoice discrepancies, and ensure data accuracy. The system reduces administrative workload while improving compliance and audit readiness. With vendor management automation software, you gain real-time visibility into supplier performance and payment timelines.

This fosters accountability and enhances vendor relationships. Additionally, automation reduces processing costs and strengthens financial control. By integrating procurement, accounting, and vendor management in one system, you improve accuracy and operational scalability across departments, driving measurable long-term value for your organization.

Why automation is critical for modern businesses

Automation has become essential for maintaining operational agility and minimizing risks. Manual vendor management is prone to delays, data errors, and compliance challenges. Automation ensures accuracy and faster decision-making by providing real-time data on supplier reliability, pricing trends, and contractual obligations. You can proactively manage risks, avoid duplicate payments, and enhance vendor accountability.

Furthermore, automated vendor management systems improve collaboration between procurement and finance teams, ensuring not only budget alignment but also cost efficiency. By implementing intelligent workflows, your business gains a strategic advantage, enabling you to scale efficiently, improve supplier trust, and sustain consistent profitability across operations. Ultimately, embracing automation future-proofs your business against market disruptions and evolving regulatory demands.

The strategic value of vendor management automation

When you manage vendors efficiently through automation, you become a reliable partner in their eyes. By ensuring timely payments, clear communication, and accurate compliance, you build mutual trust.

Vendors prioritize businesses that streamline processes and minimize errors. Over time, automation of vendor management helps you negotiate better terms, volume discounts, and priority services.

Automation optimizes payment cycles, allowing better control over outgoing cash. You can automate invoice approvals, detect duplicate entries, and monitor real-time expenses.

With automation of supplier management, payments are processed faster and more accurately, avoiding unnecessary delays. This ensures stronger liquidity, improved working capital, and smarter allocation of financial resources across strategic business functions.

Automation enables data visibility across procurement and supplier operations. You can analyze vendor performance metrics, contract compliance, and spending trends to make informed decisions.

This visibility supports proactive risk management and strategic sourcing. When backed by accurate data, your business gains an edge in negotiation, forecasting, and continuous process improvement.

By automating vendor processes, you eliminate repetitive manual tasks that slow down operations. Your teams can quickly respond to market changes, supplier disruptions, or compliance updates.

Streamlined workflows enhance coordination between departments, ensuring faster approvals and adaptable procurement strategies. This agility allows your business to stay competitive in rapidly evolving markets.

Automation improves collaboration and transparency across departments. Procurement, finance, and compliance teams can access shared data in real time, reducing misunderstandings and bottlenecks.

You experience faster resolution times and fewer escalations. Streamlined reporting and accountability build team confidence, ensuring smoother operations and greater stakeholder satisfaction.

Common challenges in vendor management before automation

Manual vendor data entry and duplication

Manual data entry often leads to duplicate vendor profiles, inconsistent records, and delayed updates. These errors reduce accuracy in payments and compliance tracking.

Without automation, it’s difficult to maintain clean, standardized data across systems. This creates confusion, increases administrative workload, and exposes your organization to costly accounting and audit discrepancies.

Delayed approvals and payment cycles

Manual approval processes slow down invoice verification and payments. Missing documentation or unclear workflows can cause unnecessary delays, affecting vendor trust. Late payments may result in penalties or strained relationships.

Automation eliminates approval bottlenecks, ensuring faster processing, accurate validation, and consistent adherence to payment schedules across all procurement activities.

Limited visibility into vendor performance

Without automation, tracking vendor performance becomes a manual, time-consuming task. You may struggle to monitor metrics like delivery timelines, quality, and compliance.

Inconsistent data makes it hard to evaluate supplier reliability or negotiate effectively. This lack of visibility limits transparency and hinders strategic sourcing and risk mitigation decisions.

High risk of non-compliance

Manually managing compliance requirements increases the risk of missing regulatory updates or contractual obligations. You might overlook document expirations or audit trails.

This not only affects supplier credibility but also exposes your business to legal and financial penalties. Automation ensures consistent tracking, reminders, and documentation for flawless compliance management.

Inefficient communication and document handling

Email-based coordination and physical documentation create delays and confusion. Important records like contracts, invoices, or certificates can easily get lost or misfiled. This inefficiency leads to errors, miscommunication, and missed deadlines.

Automation centralizes communication and document storage, ensuring instant access, better collaboration, and seamless vendor relationship management across teams.

How to structure your vendor management lifecycle for successful automation

A well-defined vendor management lifecycle ensures that automation efforts deliver maximum efficiency. It typically includes vendor selection, onboarding, performance tracking, compliance, and payment management.

Structuring these stages before automation helps you identify inefficiencies, streamline communication, and maintain accountability. With clear workflows, vendor management automation becomes seamless, improving data accuracy and procurement transparency.

Defining the vendor persona and tiers

Start by categorizing vendors based on business impact, spend level, and risk profile. Defining clear tiers—strategic, preferred, or transactional—helps prioritize engagement and resources. This structured classification supports tailored communication and contract terms.

When automation begins, these vendor tiers guide system logic, approval hierarchies, and performance monitoring more effectively across all procurement functions.

Mapping your current manual workflow for bottlenecks

Before automating, analyze your existing processes to pinpoint delays, redundancies, and data silos. Map every vendor-related activity—from onboarding to payment—to visualize inefficiencies.

Identifying bottlenecks ensures smoother automation planning and process redesign. This evaluation not only highlights improvement areas but also helps you anticipate challenges during system implementation and change management efforts.

Setting clear automation goals

Define measurable objectives such as reducing approval time, enhancing compliance, or improving payment accuracy. Clear goals align your automation strategy with organizational priorities.

These benchmarks guide software configuration and help assess performance post-implementation. Setting specific KPIs also ensures cross-departmental accountability, making your automation journey more focused, transparent, and result-oriented.

Establishing data governance rules and ownership

Strong data governance ensures clean, consistent, and secure vendor information across systems. Define ownership roles for maintaining accuracy and updating records regularly. Set rules for access control, approval hierarchy, and data validation.

With supplier management automation, these governance standards safeguard compliance, enhance data integrity, and prevent duplication or unauthorized data manipulation.

Identifying required integrations

List all tools and systems that interact with vendor data—ERP, accounting, procurement, and contract management platforms. Integration ensures seamless data flow and eliminates manual input errors.

Identify APIs, compatibility needs, and reporting requirements early. Proper integration planning ensures your automation framework operates efficiently, delivering unified insights and process synchronization across departments.

Vendor management process automation: Key steps

Before configuring automation tools, establish the foundational steps that ensure process readiness. Begin by organizing data, defining workflow logic, and setting notification structures.

Each step—data centralization, approval setup, and integration—contributes to seamless digital transformation. When done correctly, supplier management automation accelerates efficiency, strengthens compliance, and enhances long-term vendor collaboration.

1. Centralizing your vendor master data

Consolidate all vendor details into a single, reliable source of truth. Centralization eliminates duplicates, outdated records, and inconsistent entries. You gain real-time visibility into supplier performance, contracts, and payments.

With a unified data hub, automation becomes more efficient, improving reporting accuracy and enabling faster, data-driven decision-making across your procurement operations.

2. Designing intuitive approval logic and triggers

Define rules for approval based on vendor category, transaction amount, or department. Automation triggers should match your business hierarchy and risk levels.

Intuitive logic ensures no delays or misrouting during approvals. This clarity helps your team act quickly, reduces manual intervention, and strengthens compliance across your vendor lifecycle.

3. Implementing automated notifications and reminders

Automated alerts keep stakeholders informed of upcoming deadlines, pending approvals, or expiring contracts. These reminders ensure tasks aren’t overlooked, improving accountability and responsiveness.

Notifications also enhance vendor communication by sending real-time updates on invoice or contract status. This continuous transparency supports efficiency and builds stronger trust in vendor relationships.

4. Integrating with existing ERP/financial systems

Connecting your automation platform with ERP and finance systems ensures consistent, accurate data flow. Integration eliminates redundant entries and enables synchronized reporting. It allows teams to track procurement costs, invoices, and payments effortlessly.

This unified environment enhances transparency, improves reconciliation, and ensures your financial records always reflect real-time vendor activity.

5. Configuring workflow escalation protocols

Set clear escalation paths for pending approvals or unresolved issues. Automated escalations prevent bottlenecks by notifying senior stakeholders when timelines are exceeded. This ensures accountability and keeps operations moving.

Well-structured escalation workflows also help maintain compliance, reinforce responsibility, and ensure timely closure of vendor-related tasks across all departments.

Vendor onboarding: A step-by-step approach to supplier approvals

A modern onboarding process involves sequential steps to ensure vendors are qualified, compliant, and integrated into your systems efficiently. By leveraging automation, you streamline documentation, approvals, and compliance checks.

Each stage, from initial vetting to credential provisioning, reduces manual effort and accelerates supplier readiness. Following these steps ensures accuracy, accountability, and faster time-to-value for your procurement operations.

1. Vendor qualification and initial vetting

Begin by evaluating potential vendors based on capabilities, financial stability, and strategic fit. This stage involves automated scoring or checklists to identify risks and alignment with your business needs.

Vendor management automation software can standardize assessments, ensuring consistent evaluations and eliminating subjective bias, helping you focus only on qualified, high-potential suppliers for further onboarding.

2. Automated document collection and validation

Collect essential documents—licenses, certifications, and contracts—through automated portals. Validation tools check for completeness, accuracy, and compliance with regulatory requirements.

This eliminates manual tracking and reduces errors. By centralizing document collection, you speed up approvals while maintaining clear records, making the onboarding process more efficient and reliable for both your team and the vendor.

3. Streamlined internal review and sign-off

Once documents are validated, internal stakeholders review and approve vendors through configured workflows. Automation ensures tasks are routed to the right approvers with predefined deadlines.

You avoid delays caused by manual follow-ups, reduce bottlenecks, and maintain an auditable trail of all decisions, making the approval process faster, more transparent, and accountable across departments.

4. Compliance screening

Automated compliance checks verify adherence to regulatory, legal, and internal standards. This includes anti-corruption, sanctions lists, and industry-specific requirements.

By integrating compliance screening into the onboarding workflow, you reduce risk exposure, prevent onboarding ineligible vendors, and maintain a secure and trustworthy supplier ecosystem that meets both operational and legal obligations.

5. System setup and credential provisioning

After approval, vendors are configured in your systems with the necessary credentials and access rights. Automation ensures accurate data entry into ERP, procurement, or finance platforms. Credential provisioning is secure and role-specific, preventing unauthorized access.

This step completes onboarding efficiently while maintaining control, allowing vendors to transact, collaborate, and communicate seamlessly within your digital environment.

Vendor setup automation: Scaling operations without losing control

Scaling vendor setups requires efficiency, accuracy, and visibility across multiple suppliers. Automation of supplier management allows you to handle large volumes without compromising data integrity or control. By implementing structured workflows, self-service portals, and continuous monitoring, you ensure consistent onboarding, compliance, and reporting. This approach balances speed with risk management, supporting growth while maintaining operational oversight.

Utilizing vendor self-service portals

Allow vendors to input their information directly via secure portals. This reduces manual data entry errors, accelerates processing, and empowers suppliers to manage updates independently.

Self-service portals increase engagement and efficiency while freeing your team to focus on strategic tasks. Automation ensures submitted data is validated in real time for accuracy and compliance.

Establishing role-based permissions

Define permissions based on user roles to control who can view, edit, or approve vendor information. This prevents unauthorized access and protects sensitive data. Automation ensures role assignments are consistently enforced across systems.

By establishing clear access boundaries, you maintain security, reduce errors, and streamline collaborative workflows during vendor setup and ongoing management.

Ongoing onboarding KPI monitoring

Track key metrics such as approval times, document completion rates, and vendor readiness. Automation provides real-time dashboards and alerts for underperforming processes. By continuously monitoring KPIs, you identify bottlenecks, improve efficiency, and make data-driven decisions.

This ensures your vendor setup process remains scalable, controlled, and aligned with strategic business objectives.

Automated W-9/tax form validation

Automatically verify W-9 or other tax documents to ensure compliance with regulatory requirements. Automation flags missing or incorrect information and prevents vendors from proceeding until corrected.

This reduces administrative workload, minimizes errors, and ensures your organization meets reporting obligations while maintaining a clean, accurate vendor database for financial and tax purposes.

Mandatory audit trails for every action

Track and log every onboarding action, approval, and change within the system. Audit trails provide transparency, accountability, and compliance documentation for internal or external audits.

Automation ensures these logs are accurate, tamper-proof, and easily accessible, protecting your business and reinforcing trust among stakeholders while maintaining control over the vendor management lifecycle.

Calculating the hidden costs of vendor inconsistency

Inconsistent vendor processes create significant financial strain that often goes unnoticed. Manual errors, delayed approvals, and unstructured workflows increase operational costs and risk exposure. By quantifying these hidden costs, you can make a stronger case for automation.

From duplicate payments to stalled procurement, these inefficiencies impact cash flow, compliance, and productivity, directly affecting your bottom line. Understanding the magnitude of these costs illustrates the value of investing in structured, automated vendor management solutions for measurable efficiency and savings.

The cost of invoice exceptions and rework

Invoice errors require time-consuming corrections, approvals, and communication between teams. Each exception may delay payment cycles and disrupt cash flow. Rework increases administrative costs, consuming hours that could be allocated to strategic tasks.

For example, correcting mismatched line items or missing purchase orders repeatedly adds thousands of dollars annually in labor and lost operational efficiency.

Financial impact of duplicate payments

Duplicate payments occur when invoices are processed multiple times due to inconsistent data or approval workflows. This directly drains cash reserves and complicates reconciliation. Resolving these duplicates often involves refunds, accounting adjustments, and vendor negotiations.

Even a single high-value duplicate can cost tens of thousands, illustrating how minor errors escalate into significant financial exposure.

Compliance fines and missed deadlines

Late filings or failure to meet contractual obligations can result in penalties, fines, or legal action. Manual vendor processes increase the risk of missing critical compliance deadlines.

For instance, delayed tax documentation or missing regulatory certifications may trigger costly sanctions, impacting both finances and reputation. Automation helps mitigate these risks through timely tracking and alerts.

Opportunity cost of stalled procurement cycles

Slow procurement due to inefficient vendor processes delays project timelines and strategic initiatives. When approvals or deliveries are stalled, your business may miss market opportunities, lose competitive advantage, or delay client commitments.

The cumulative opportunity cost of these delays can be significant, far exceeding the direct labor expenses tied to manual vendor management tasks.

Increased labor time on dispute resolution

Discrepancies between invoices, purchase orders, and deliveries require extensive back-and-forth communication. Resolving disputes manually consumes valuable employee hours and creates operational bottlenecks.

Repeatedly handling such conflicts reduces productivity and may damage vendor relationships. The cumulative labor cost adds up, representing an often-overlooked financial burden in unstandardized vendor workflows.

How to standardize vendor submissions and automate invoice management

Standardizing vendor data and invoice processes dramatically reduces errors and accelerates accounts payable efficiency. By enforcing structured templates, centralized submission portals, and automated validations, your team spends less time correcting mistakes and more time on strategic tasks.

Automation ensures consistent compliance, faster payments, and clear visibility into financial operations, ultimately strengthening vendor relationships and improving operational cash flow.

1. Mandate a centralized submission portal

Require vendors to submit all invoices and supporting documents through a single portal. This ensures consistency, eliminates scattered emails, and prevents lost or duplicate submissions.

Centralization simplifies tracking, enables real-time validation, and provides a single source of truth for accounts payable teams, improving efficiency and reducing administrative overhead.

2. Enforce standardized document templates

Implement uniform invoice and document templates to guide vendors in providing complete, accurate information. Standardization reduces errors, minimizes missing fields, and ensures critical compliance data is included.

Templates streamline processing, shorten approval cycles, and create a consistent format for easier archiving, reporting, and audit readiness.

3. Utilize automated validation for required fields

Automated checks verify that all mandatory fields are completed before an invoice enters the approval workflow. Missing or incorrect data is flagged instantly, reducing manual follow-up and rework.

This ensures accuracy, accelerates processing, and maintains a high level of compliance across vendor submissions, avoiding delays and errors in accounts payable operations.

4. Implement automated OCR for invoices

Optical character recognition (OCR) technology extracts data from invoices automatically, converting paper or PDF formats into structured, usable data. This reduces manual entry, speeds up processing, and minimizes errors.

OCR integration allows seamless transfer of information into accounting systems, enabling faster approvals and more accurate reporting for all vendor transactions.

5. Set up automated three-way matching

Automate the comparison of purchase orders, invoices, and receipts to confirm consistency before payment. This reduces discrepancies, prevents duplicate payments, and ensures financial accuracy.

Three-way matching strengthens internal controls, enhances compliance, and provides clear audit trails, allowing you to process payments confidently and efficiently without manual verification delays.

6. Configuring payment terms by vendor tier

Set automated payment schedules based on vendor classification or contract terms. Strategic or high-priority vendors may receive faster payments, while transactional suppliers follow standard timelines.

Automation ensures consistent application of these terms, improving cash flow management, maintaining vendor trust, and supporting strategic supplier relationships without manual intervention.

7. Standardizing naming conventions, archiving, and expense categories

Establish consistent naming conventions, categorization, and document storage protocols. Automated systems enforce these standards, making retrieval, reporting, and audits more efficient.

Clear archiving practices reduce confusion, support compliance, and allow accurate expense tracking, enabling your team to focus on high-value financial management rather than administrative tasks.

How to build a dynamic vendor risk scorecard for faster decisions

Designing a vendor management automation system with an effective risk scorecard enables faster, data-driven decisions. By configuring the system to evaluate suppliers across financial, operational, and compliance criteria, you gain a comprehensive view of risk exposure.

Dynamic scoring supports proactive mitigation, prioritizes critical vendors, and improves accountability while reducing manual risk assessments and delays in decision-making.

Defining key risk categories

Identify risk categories relevant to your business, such as financial stability, regulatory compliance, operational reliability, cybersecurity, and supply chain resilience. Each category should reflect potential impact on your operations.

Clearly defining these categories ensures consistent evaluation and allows the risk scorecard to capture meaningful insights for proactive vendor monitoring and mitigation of vulnerabilities.

Weighting scorecard criteria by vendor tier

Assign different weights to risk criteria based on vendor tier—strategic, preferred, or transactional. Higher-value or critical suppliers receive more scrutiny, while lower-tier vendors are evaluated on essential factors.

Weighting ensures the risk score reflects the actual business impact, allowing your team to focus resources on the most significant supplier risks and prioritize mitigation efforts effectively.

Integrating third-party risk data feeds

Enhance your risk scorecard by incorporating third-party data sources such as credit ratings, compliance databases, and market intelligence. These external feeds provide additional verification and early warning signals.

Integration ensures your scorecard remains up-to-date, enabling you to anticipate vendor challenges and make informed decisions with a comprehensive, real-time understanding of supplier risks.

Categorizing expenses for small business risk profiles

Map vendor-related expenses to specific risk categories to identify areas of potential financial or operational exposure. Small business expense tracking helps prioritize high-risk transactions and align mitigation strategies.

Automation enables systematic categorization, providing a clearer picture of cost impact relative to risk, supporting smarter, data-driven procurement and vendor decisions.

Setting up automated alerts for critical score changes

Configure your VMA system to trigger instant alerts when a vendor’s risk score crosses critical thresholds. Notifications can be sent to relevant stakeholders for immediate action.

Automated alerts ensure timely intervention, prevent overlooked risks, and maintain supplier accountability, reducing potential disruptions and protecting your organization’s financial and operational stability.

The psychology behind vendor relationships and renewal anxiety

Renewal anxiety often arises from uncertainty about vendor performance, financial impact, or internal stakeholder expectations. Fear of making the wrong decision or missing an opportunity can influence judgment.

Recognizing these drivers allows you to address concerns proactively, communicate clearly with stakeholders, and reduce stress during contract evaluation and renewal discussions.

Shift from a purely transactional approach to a collaborative one by emphasizing shared goals and mutual benefits. Encourage open communication, transparency, and joint problem-solving.

This mindset strengthens trust, reduces conflict, and aligns incentives, making vendors more invested in your success while reducing anxiety around contract renewals and performance expectations.

Leverage performance metrics, risk scores, and compliance records to guide renewal choices. Data-driven decisions remove subjectivity, provide objective evidence for stakeholders, and justify continuation or termination of vendor relationships.

This approach mitigates bias, builds confidence in decisions, and supports consistent, rational vendor management practices across your organization.

Clearly categorize vendor-related expenses to align contracts with actual financial impact. Simplified expense mapping improves transparency, ensures accurate budgeting, and reduces disputes during renewal evaluations.

By linking costs to contract terms, you can assess value, justify renewals, and maintain clarity for internal teams and vendors, enhancing trust and accountability.

Define shared performance objectives with vendors, such as delivery timelines, quality standards, or compliance targets. Mutual goals foster accountability, incentivize improvement, and strengthen the partnership.

When goals are clear, measurable, and tracked, renewal anxiety decreases, so both parties align on expectations, progress, and improvements before renewal.

How to measure the ROI of vendor management automation

Key metrics to measure ROI

Track metrics such as invoice processing time, cost per transaction, approval cycle duration, and error rates. Monitoring these KPIs shows efficiency improvements, highlights savings from automation, and provides quantifiable benchmarks for assessing the value of vendor management automation across procurement and finance operations.

Calculating cost and efficiency gains

Translate reduced manual labor, faster approvals, and lower error rates into financial terms. Quantify time saved per invoice, administrative hours eliminated, and operational costs avoided.

Combining these figures demonstrates measurable efficiency gains, helping justify investments in automation and showing the direct impact on overall procurement and accounts payable budgets.

Quantifying compliance and risk reduction

Automation minimizes audit risks, regulatory penalties, and human errors by enforcing standardized processes. Assign monetary value to avoided fines, missed deadlines, or compliance breaches.

This calculation illustrates how risk mitigation contributes to ROI, providing a clear understanding of the indirect financial benefits of vendor management automation.

Evaluating vendor performance improvements

Measure improvements in vendor reliability, onboarding speed, and adherence to service-level agreements. Faster approvals, reduced errors, and better communication translate into stronger vendor relationships and higher operational consistency.

These performance gains reflect tangible returns from automation that enhance overall procurement strategy and supply chain stability.

Reporting ROI insights to stakeholders

Present ROI using dashboards, trend reports, and comparative analyses. Highlight key efficiency gains, cost savings, risk mitigation, and performance improvements.

Regular updates through visual reports and performance reviews ensure stakeholders understand the tangible value delivered by vendor management automation and support continuous investment in optimization initiatives.

Proactive vendor renewal management: Strategies and best practices

Automated renewal management ensures contracts are reviewed and renewed systematically, reducing risk and administrative overhead. By combining alerts, timelines, and approval workflows, businesses can maintain control over expirations, align vendor terms with strategy, and improve efficiency.

Structured automation creates transparency, strengthens relationships, and supports informed, timely decision-making throughout the renewal process.

Setting up automated contract expiry alerts

Configure alerts to notify relevant stakeholders ahead of contract expirations. Automation ensures no deadlines are missed, reducing last-minute pressure.

Timely notifications provide ample lead time for reviews, negotiations, or term adjustments, keeping contracts active and aligned with operational requirements without manual monitoring.

Creating a renewal timeline and assigning ownership

Establish a structured timeline for reviews, negotiations, and approvals. Assign specific team members responsibility for each stage to ensure accountability.

Automated workflows track progress, enforce deadlines, and provide clarity, streamlining the renewal process while maintaining operational efficiency and minimizing the risk of missed actions.

Initiating performance reviews and market analysis

Use automated systems to schedule vendor performance evaluations and benchmark against market alternatives. Assess delivery, quality, and cost metrics to inform renewal decisions.

Comparing vendor offerings with market rates ensures competitive pricing, mitigates risk, and strengthens your renewal negotiations.

Renewing contract terms based on future strategy

Align contract renewals with long-term business goals, projected growth, and operational priorities. Automation allows scenario planning and forecasting for cost, volume, and service levels.

By linking renewals to strategy, you ensure agreements support both current needs and future expansion objectives.

Using past performance data for stronger negotiations

Leverage historical performance data on reliability, compliance, and cost adherence to guide contract discussions. Data-driven insights support favorable terms, reinforce accountability, and justify renegotiation requests.

This ensures negotiations are driven by data, not bias. Additionally, analyzing trends over multiple periods highlights areas for improvement and identifies opportunities to strengthen the overall vendor relationship.

Automating budget forecasts and renewal approvals

Integrate renewal planning with budget projections and automated approval workflows. Automation ensures financial alignment, timely approvals, and efficient allocation of resources.

This reduces administrative bottlenecks, maintains compliance, and supports strategic decision-making for upcoming contracts. Furthermore, real-time visibility into projected costs and approvals allows you to anticipate cash flow needs and adjust budgets proactively.

Formalizing renewal documentation and archiving

Capture signed contracts, amendments, and supporting documentation digitally with audit-ready storage.

Automated archiving ensures easy retrieval, compliance tracking, and historical reference for future negotiations or audits.

This approach reduces manual filing errors and enhances transparency across vendor contracts.

Applying break clauses and evergreen contract policies

Incorporate flexible termination clauses and automatic renewal options where appropriate.

Automation tracks key dates and conditions, ensuring you can exercise break clauses or maintain evergreen terms without oversight errors.

This provides operational flexibility while protecting your organization from unintentional contract risks.

How to identify the ideal vendor automation software for your business

Selecting the right vendor automation software requires a clear checklist of essential features, seamless integrations, scalability, and support quality. Evaluate tools based on usability, compliance, reporting capabilities, and how well they align with your current workflows.

Considering these factors ensures you choose a solution that automates vendor management, enhances efficiency, mitigates risk, and supports long-term goals.

1. Must-have integration capabilities

Ensure the software integrates smoothly with ERP, accounting, procurement, and communication systems. Strong integration eliminates manual data transfer, reduces errors, and provides a unified view of vendor performance.

Compatibility with existing workflows allows your team to adopt automation quickly while maintaining accurate, real-time financial and operational data across platforms.

2. Assessing scalability and future-proofing

Select a solution that can grow with your business, handling increasing vendor volumes and expanding processes. Evaluate whether the software supports multiple locations, currencies, or regulatory environments.

Scalability ensures long-term usability, reduces future migration costs, and guarantees that your investment remains relevant as organizational needs evolve.

3. Evaluating user interface and ease of use

A user-friendly interface accelerates adoption and reduces training time for your team. Intuitive dashboards, customizable workflows, and clear navigation improve efficiency.

Software that prioritizes ease of use ensures employees can quickly access vendor data, approve workflows, and generate reports without errors or delays, maximizing the benefits of automation.

4. Checking compliance and security certifications

Verify that the software complies with industry standards and holds relevant security certifications. Features like data encryption, access controls, and audit trails protect sensitive vendor and financial information.

Ensuring regulatory and security compliance minimizes risk exposure, strengthens stakeholder trust, and safeguards your business from potential legal or operational issues.

5. Evaluating implementation and vendor support quality

Assess the vendor’s onboarding, training, and customer support services. Efficient implementation reduces downtime, ensures smooth configuration, and addresses challenges promptly.

Reliable ongoing support guarantees quick resolution of issues, continuous system updates, and optimal utilization of the software’s features, enhancing the return on your automation investment.

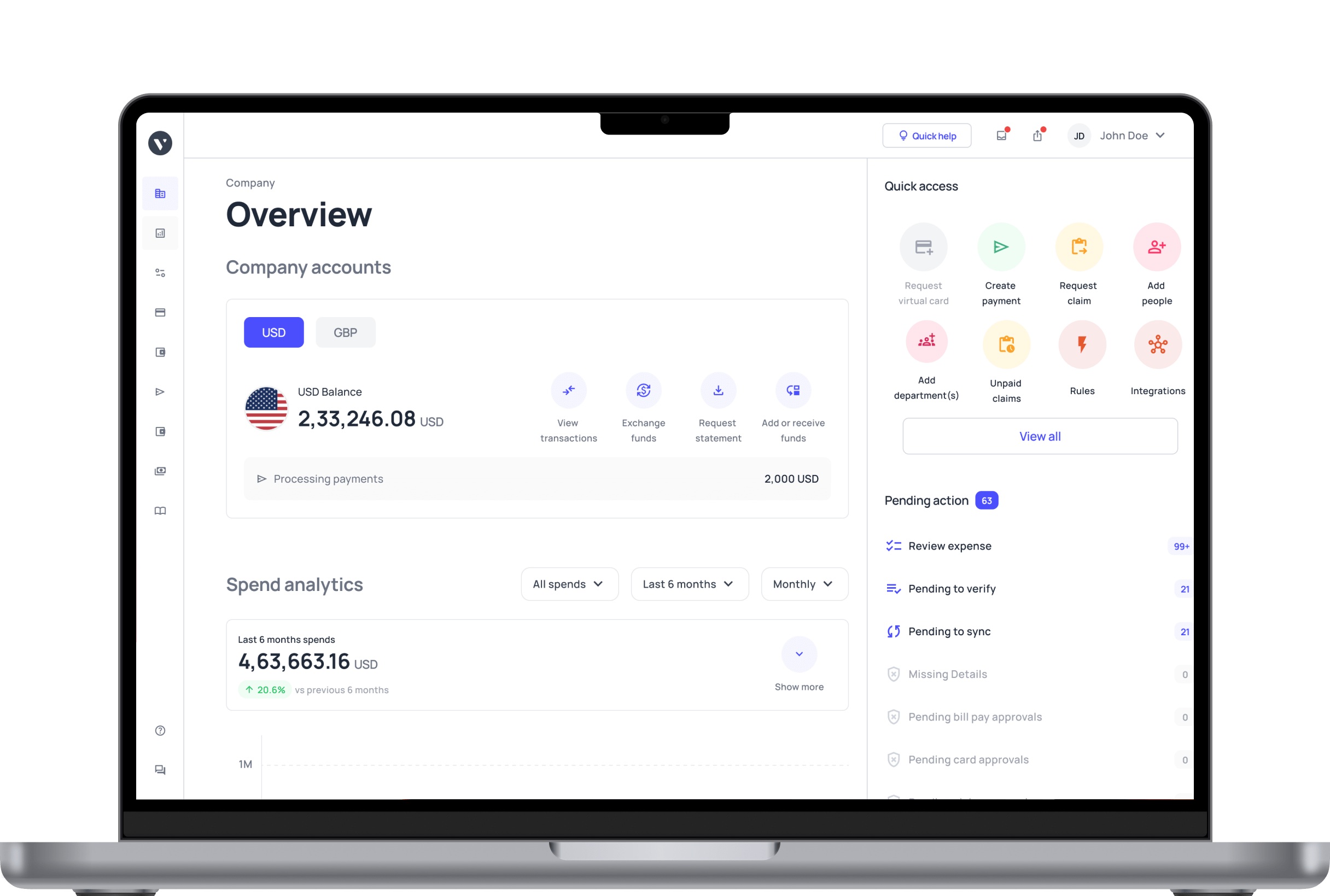

Streamline vendor management with Volopay

Volopay's vendor management system simplifies vendor payments through centralized data, automation, and real-time insights. By combining onboarding, performance tracking, and compliance monitoring, it reduces manual work while improving visibility and control.

The platform fosters collaboration and strategic decision-making, enabling you to manage vendors efficiently, mitigate risk, and strengthen supplier relationships across all operations.

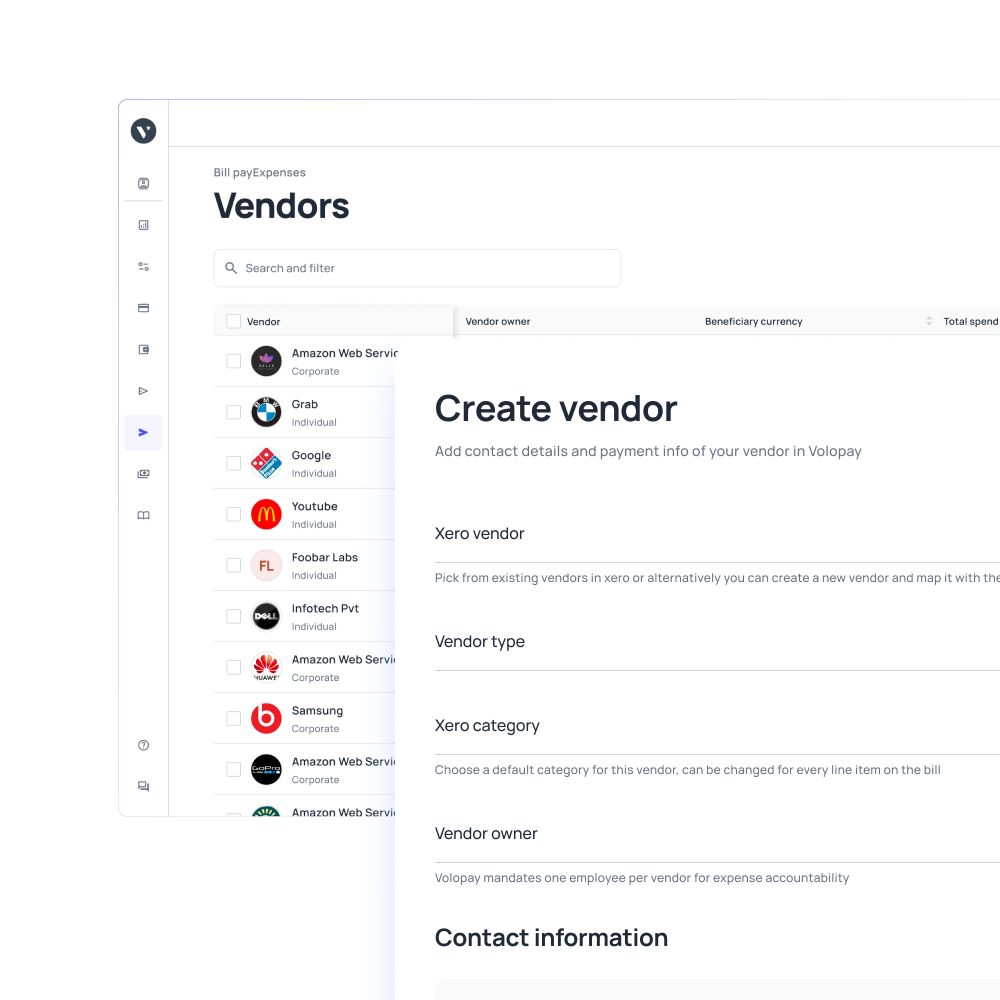

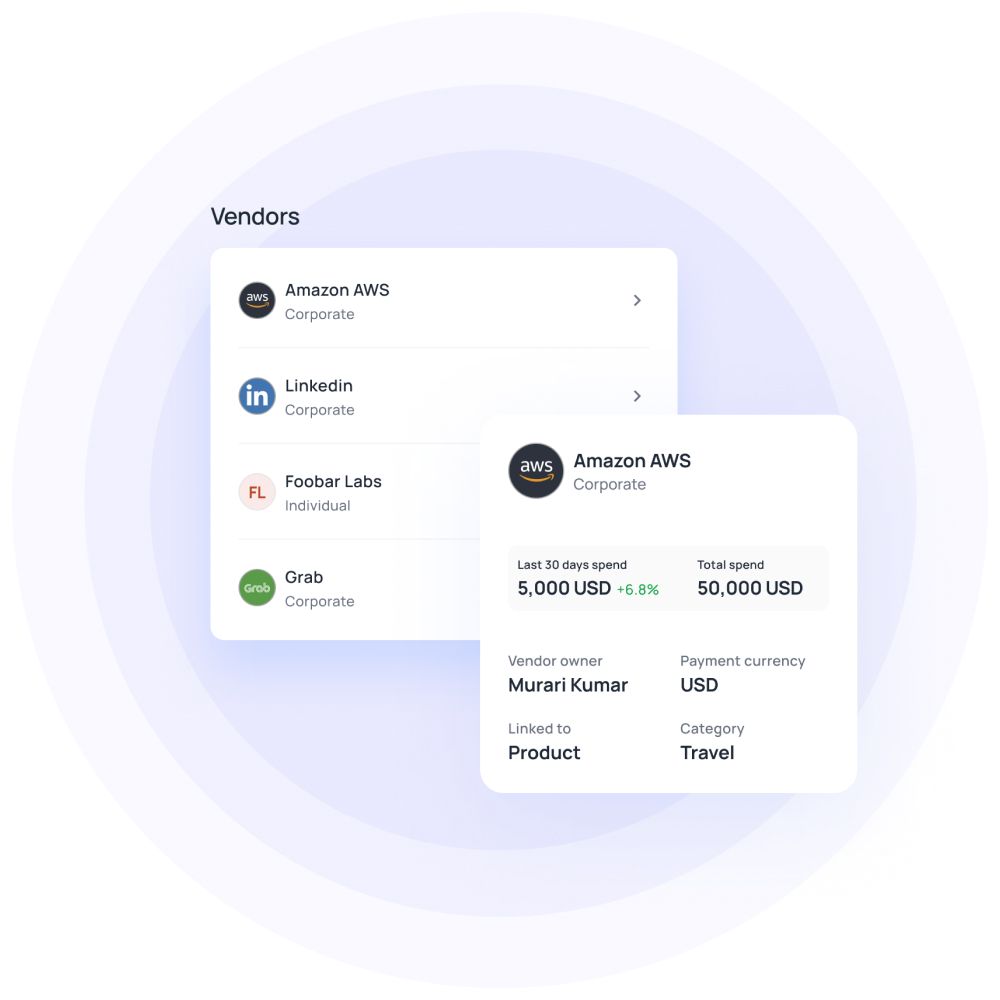

Centralized vendor database

Maintain all vendor information in one secure, accessible location. Centralization eliminates duplicate records, streamlines searches, and provides accurate, real-time data.

Your team can track contracts, financials, and performance metrics efficiently, improving decision-making and reducing administrative workload across procurement and finance functions.

Automated vendor onboarding

Automate the collection, validation, and approval of vendor documents. This ensures faster, error-free onboarding, consistent compliance, and clear audit trails.

By removing manual steps, your team can focus on strategic procurement activities while vendors are integrated efficiently and accurately into your systems.

Real-time performance tracking

Monitor vendor KPIs, delivery timelines, and compliance metrics continuously. Real-time tracking enables proactive risk management, identifies underperformance, and supports data-driven decisions.

Visibility into vendor performance fosters accountability and strengthens relationships while improving operational efficiency across procurement and finance workflows. It also allows you to spot trends early and implement corrective actions promptly.

Compliance & risk management

Volopay’s accounts payable automation software helps enforce regulatory standards, internal policies, and audit readiness. Automated alerts, documentation tracking, and risk assessments reduce non-compliance, financial penalties, and operational disruptions.

This proactive approach ensures your vendor ecosystem remains secure, reliable, and fully aligned with organizational requirements.

Supplier collaboration portal

Facilitate seamless communication and document sharing with vendors through a dedicated portal. Suppliers can submit invoices, update information, and track approvals in real time.

This centralized collaboration enhances transparency, reduces delays, and fosters stronger, more productive vendor relationships while keeping your team informed and in control.

Bring Volopay to your business

Get started now

FAQs

You can automate vendor onboarding, document collection, approval workflows, compliance checks, performance tracking, invoice processing, and payment scheduling. Automation reduces manual errors, accelerates processes, and improves transparency across all procurement and supplier management activities for more efficient operations.

Automation ensures timely payments, consistent communication, and clear compliance tracking. By reducing delays and errors, vendors experience smoother interactions, fostering trust, accountability, and stronger long-term partnerships that benefit both parties strategically.

Absolutely. Small businesses gain efficiency, reduce administrative workload, and improve cash flow visibility. Automation allows them to manage multiple vendors, maintain compliance, and scale operations without adding manual processes or additional staff.

Automation streamlines invoice submission, validation, approvals, and payments. It reduces errors, prevents duplicate payments, and accelerates processing cycles. This improves financial control, strengthens vendor trust, and ensures accurate reporting for accounts payable teams.

Automated tools monitor KPIs, contract compliance, and delivery timelines continuously. Alerts and dashboards provide real-time insights, helping you identify underperformance early, enforce accountability, and make informed data-driven decisions for vendor optimization.

Yes. Volopay tracks supplier KPIs, payment histories, and compliance metrics in real time. The platform offers actionable insights, dashboards, and reports that support performance evaluations, risk management, and strategic decision-making.

Volopay ensures data security through encryption, role-based access, audit trails, and compliance with industry standards. Your vendor information is protected from unauthorized access, breaches, and misuse at all times.

You can manage all types of vendors, including service providers, suppliers, contractors, and consultants. Volopay accommodates different tiers, contract types, and compliance requirements, providing flexibility for diverse business needs.

Yes. Volopay allows you to create customized approval hierarchies, conditional rules, and multi-level workflows. This ensures transactions and vendor activities are reviewed efficiently while maintaining accountability and compliance.

Volopay automates three-way matching between purchase orders, invoices, and receipts. This reduces errors, prevents duplicate payments, and ensures accuracy, streamlining accounts payable while maintaining compliance and audit-ready records.