How to reduce operating costs? Steps & strategies

If you want to boost your business's profitability, start by learning how to reduce operating costs. These recurring costs, like rent, salaries, and utilities, can quickly eat into your profits if not managed carefully.

By identifying unnecessary spending and making smarter financial choices, you can keep your business lean and agile. Use automation tools, renegotiate vendor contracts, and adopt energy-efficient practices to cut down waste.

You don’t need to compromise quality—just focus on smarter resource allocation. Lower expenses mean better margins, improved cash flow, and greater flexibility. Understanding where your money goes and how to trim excess makes a real difference. Start with small changes and scale your savings strategy as you grow.

What are operating costs?

Operating costs refer to the daily costs required to run your business. These include employee wages, office rent, utilities, maintenance, insurance, and marketing.

You incur these expenses regardless of how much revenue you generate. While essential, they directly affect your net profit, so learning to reduce operating costs can significantly improve your bottom line.

Unlike capital expenses, which are one-time investments in assets, operating costs are ongoing and repeat every month. This makes it vital to control operating costs before they spiral out of control. For example, overspending on software subscriptions or underutilized office space can quietly drain your resources.

By reviewing expenses regularly and making strategic adjustments, you can control operating costs more efficiently. Smart decisions—like outsourcing non-core tasks or adopting cost-saving technologies—allow you to maintain productivity without overspending.

If you aim to grow sustainably, focus on how you manage these recurring costs. The better you monitor and manage them, the more control you’ll have over your financial stability and scalability.

What are the types of operating costs?

Operating costs fall into different categories based on how they support your business. Understanding these types helps you manage costs better and reduce operating costs effectively.

Each category affects your budget differently, so reviewing them regularly helps you identify areas where you can trim unnecessary spending and control operating costs without disrupting your business operations.

1. Selling & marketing expenses

These costs support your efforts to promote and sell your products or services. They include advertising, promotional campaigns, sales team salaries, digital marketing tools, and customer outreach programs.

Since they directly impact your brand visibility and revenue, track these carefully. You can reduce operating costs by automating marketing processes and using targeted strategies that give better returns with lower spending.

2. General & administrative expenses

This category includes office rent, utilities, legal fees, office supplies, and administrative staff salaries. These are essential for day-to-day business operations but can become excessive if left unchecked.

By evaluating your needs and finding cost-effective options, you can control operating costs and maintain functionality without sacrificing quality or disrupting your workflows.

3. Depreciation & amortization

These are non-cash expenses related to the gradual reduction in value of your business assets. Depreciation applies to tangible assets like machinery, while amortization covers intangible assets such as patents.

Although these don’t affect your cash flow directly, tracking them helps you plan future investments wisely and evaluate long-term cost impact to reduce operating costs over time.

4. Research & development expenses

R&D costs include expenses for innovation, product improvement, and testing. These can be significant, especially in tech or manufacturing sectors.

To control operating costs, align R&D efforts with your business goals, monitor performance, and cut spending on experiments with low ROI. Smart allocation of resources can keep your innovation strong without draining your budget.

5. Interest expenses

Interest paid on loans or borrowed funds falls into this category. It’s a financial cost you must account for regularly. To reduce operating costs, consider refinancing existing loans, negotiating better terms, or paying off high-interest debt.

Lower interest payments free up cash for operational needs and give you better control over financial commitments.

6. Insurance premiums

You pay these regularly to protect your business from risks such as property damage, liability, or employee injury. Though necessary, insurance costs can rise quickly. Review your coverage annually and shop for competitive plans.

By comparing policies and eliminating duplicate coverage, you can control operating costs and still keep your business protected from major risks.

7. Maintenance & repairing expenses

These expenses cover the upkeep of equipment, machinery, and property. Regular maintenance prevents costly breakdowns and extends asset life.

If you want to reduce operating costs, adopt a preventive maintenance schedule and invest in quality tools that require fewer repairs. This helps minimize emergency fixes, keeping your business running smoothly and cost-effectively.

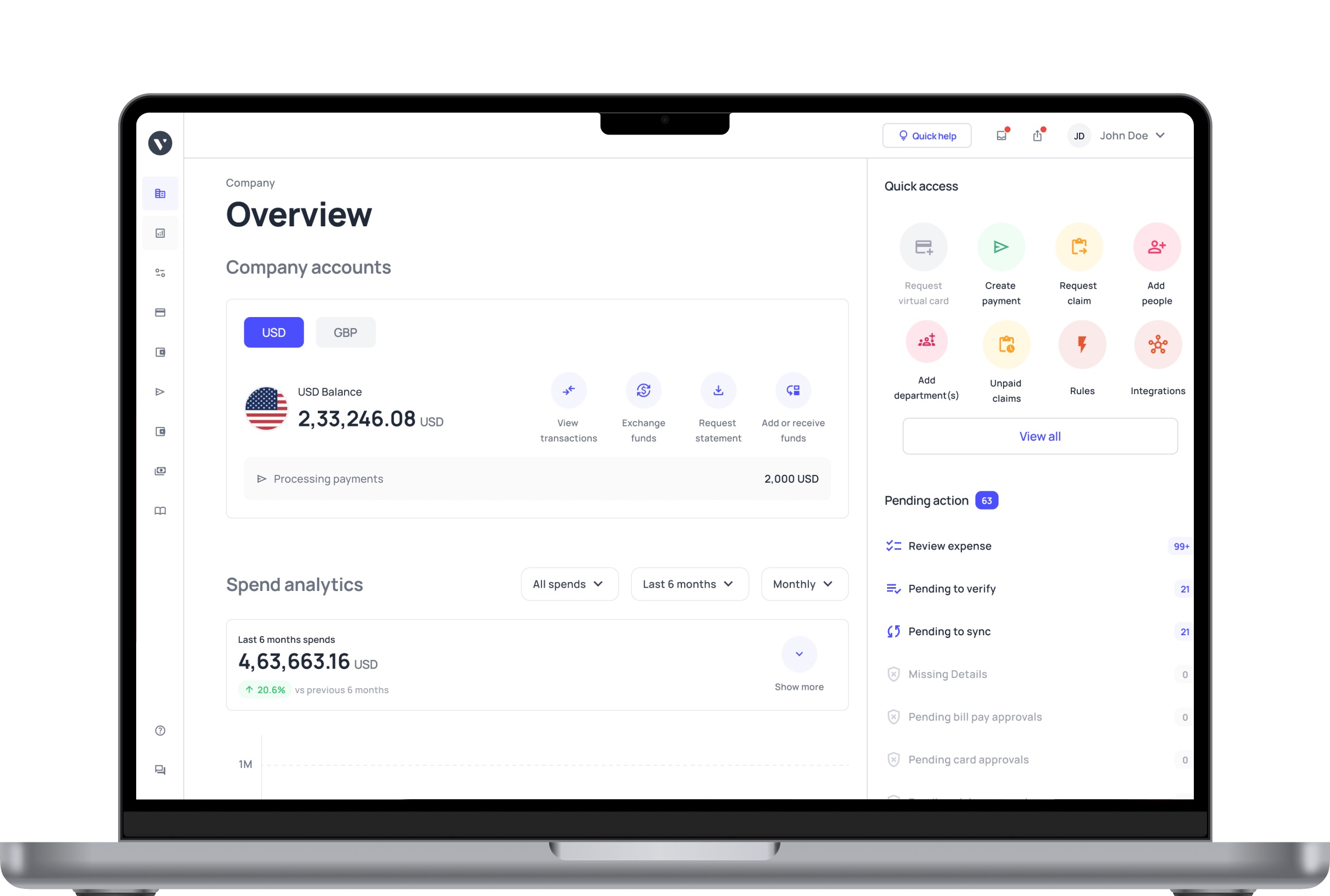

Streamline your business expenses and get real time data on your spending

What is the importance of understanding your operating costs?

Understanding your operating costs gives you full visibility into the financial engine of your business. It helps you allocate funds wisely, improve performance, and prepare for both growth and challenges.

When you monitor these costs consistently, you’re better equipped to reduce operating costs and identify cost-saving opportunities. It also helps you control operating costs before they affect profits or disrupt cash flow.

1. Financial performance evaluation

By monitoring operating costs, you evaluate how efficiently your business runs. High operating costs can shrink profits, even when sales are strong. When you understand your cost structure, you gain clarity on how well your operations convert expenses into revenue.

This allows you to reduce operating costs that are unproductive while maintaining essential functions. It also ensures your financial statements reflect a realistic view of your business's health.

2. Profitability analysis

Profitability isn’t just about revenue—it’s about what remains after covering all your operating costs. If your expenses are too high, they’ll eat into your profits. Analyzing these expenses helps you uncover unprofitable areas and act fast.

When you learn to reduce operating costs that don’t drive growth, you improve your profit margins. A better grasp of profitability also strengthens your pricing strategies and competitive positioning.

3. Budgeting & forecasting

Understanding your operating costs gives you a clear starting point for effective budgeting and forecasting. You can allocate resources based on accurate historical data and future business objectives.

This allows you to forecast expenses under different scenarios, helping you prepare for growth or downturns. As you build your budget, you’ll spot ways to reduce operating costs and use that insight to control operating costs without guesswork.

4. Operating efficiency

Operating efficiency means producing maximum output with minimal waste. By studying your expenses, you identify which operations are cost-heavy and which deliver strong returns. With this insight, you can restructure workflows, cut redundant processes, and adopt new technologies.

These changes help you reduce operating costs while keeping or even improving performance. Efficiency increases profitability and makes your operations more scalable and sustainable.

5. Performance metrics

Metrics like the operating cost ratio, profit margins, and EBITDA reflect how well your business controls costs. These indicators are directly influenced by your operating costs.

When you understand and monitor them regularly, you can set benchmarks and take corrective actions. Tracking performance metrics allows you to control operating costs in real time and measure whether changes you’ve made are improving your financial results.

6. Strategic investment decisions

If you don’t understand where your money goes, you risk making poor investment choices. Knowing your operating costs helps you determine how much capital you can reallocate toward innovation, expansion, or acquisitions.

It ensures your investment plans are financially feasible and well-timed. When you reduce operating costs, you generate surplus funds that support strategic growth without compromising your financial stability or taking on unnecessary debt.

7. Smooth cash flow management

Uncontrolled operating costs can disrupt your cash flow, making it hard to pay vendors, employees, or utility bills on time. When you understand these expenses, you can anticipate cash needs and adjust spending before issues arise.

This allows you to maintain enough liquidity for both daily operations and emergency needs. Managing cash flow effectively depends on your ability to control operating costs and align them with inflows.

8. Long-term sustainability

For your business to survive and thrive over time, you must consistently monitor and manage operating costs. High expenses reduce agility and increase your risk during market fluctuations.

When you understand and regularly evaluate these costs, you create space for reinvestment, innovation, and growth. To reduce operating costs sustainably, make cost control part of your culture and business strategy, not just a short-term fix.

9. Strategic resource allocation

Your ability to allocate resources depends on how well you understand your operating costs. If some areas consume too much without yielding returns, you must redirect funds elsewhere.

Clear cost visibility helps you fund high-impact initiatives like marketing or product development. This makes it easier to control operating costs by prioritizing what matters and eliminating wasteful spending that stalls growth and weakens productivity.

10. Efficient cost control & reduction

Understanding every component of your operating costs is the foundation of cost control. You can’t cut what you don’t see. By analyzing trends, identifying outliers, and setting cost limits, you gain control over unnecessary spending.

Whether it’s reducing utility bills, renegotiating supplier contracts, or automating manual tasks, you use data to reduce operating costs effectively and drive smarter cost-reduction strategies throughout your organization.

11. Regulatory & tax compliance

Maintaining accurate and detailed records of your operating costs ensures your business stays compliant with tax regulations and industry standards. This helps you avoid penalties, audits, or legal issues.

It also helps you take advantage of deductions and credits you may be eligible for. Understanding expenses allows you to control operating costs while maintaining full transparency and integrity in financial reporting and regulatory documentation.

12. Increased stakeholder & investor confidence

Investors and stakeholders want to see that you’re financially responsible. If you demonstrate control over your operating costs, you build trust and credibility. You show that you’re not just chasing revenue but managing costs to build a strong bottom line.

When you consistently reduce operating costs without hurting performance, stakeholders feel more confident supporting your business, knowing you make decisions backed by solid financial discipline.

Risks of not controlling your operating costs

If you don’t monitor your operating expenses carefully, your business faces avoidable risks. Without a clear plan to reduce operating expenses, you invite issues like lower profitability, unstable cash flow, and reduced flexibility. These financial leaks hurt your competitive standing and limit your ability to grow.

Whether you're dealing with fixed or variable costs, failing to control operating expenses directly affects your resilience and sustainability. Long-term success depends on proactive cost management, not reactionary fixes. Let’s explore what can go wrong if you ignore your operating expenses.

1. Reduced profitability

When you ignore your operating costs, profits shrink even if your revenue rises. Every dollar lost to unmanaged overhead lowers your bottom line. High expenses squeeze your margins and reduce the funds available for investment or innovation. Unmonitored spending leads to bloated budgets that don’t deliver real value.

You must reduce operating costs to maintain strong financial health. Letting costs pile up without control drains your earnings, makes financial targets harder to meet, and creates long-term fiscal weakness that slowly erodes your business viability.

2. Deteriorated cash flow process

Cash flow depends on how well you manage income against outflows. When operating costs go unchecked, your outgoing payments outweigh incoming cash, creating liquidity problems. You risk late payments to suppliers, missed payroll, or inability to cover routine bills. Irregular expenses make forecasting difficult.

A lack of structure in managing costs disrupts your financial planning. To avoid this, you must control operating costs by tracking each cost category. Solid expense controls help preserve working capital and ensure you can meet obligations without stress or disruption.

3. Increased financial risk

Uncontrolled operating costs expose you to high financial risk, especially during downturns. Fixed costs—like rent, utilities, and salaries—become heavy burdens if revenue drops. Unplanned costs accumulate and can lead to credit reliance, loan defaults, or delayed vendor payments.

Financial stability weakens, and investors may view your business as high-risk. You need to reduce operating costs before they spiral. Smart expense control provides a safety net that helps you manage financial uncertainty and navigate challenges without crippling your business or damaging your financial credibility.

4. Loses competitive edge

A company with excessive costs can’t compete effectively. Competitors who manage expenses will offer better pricing or invest more in innovation. You fall behind when you can’t match their efficiency. High costs reduce your ability to adapt or invest in growth-driving initiatives like marketing or product development.

To avoid becoming irrelevant in your market, you must actively control operating costs. Maintaining cost discipline allows you to stay agile, serve customers better, and outperform rivals who waste resources on unnecessary or redundant expenditures.

5. Increased pricing issues

If your costs rise without oversight, you may need to increase your prices just to maintain margins. This can alienate customers and push them toward more affordable competitors. It limits your ability to offer discounts or promotions that could drive sales. Customers may also perceive your brand as overpriced or unresponsive to market demands.

To avoid pricing problems, reduce operating costs so you maintain your margin without frequent price hikes. Cost efficiency allows you to price competitively and maintain customer trust without compromising profit.

6. Increased compliance & regulatory risks

Improper tracking of expenses may lead to inaccurate records, triggering compliance failures. Regulatory bodies require transparent financial documentation, especially for audits and tax filings. Disorganized expenses create risks of misreporting, penalties, or even legal action. Overlapping or undocumented costs also raise red flags for investors and authorities.

You must control operating costs to ensure accuracy, traceability, and adherence to financial regulations. Robust expense management supports compliance, protects your reputation, and keeps your business on solid ground during any form of external audit.

7. Difficulty in crisis management

In emergencies, you need cost control to respond quickly and preserve liquidity. Without expense visibility, you struggle to identify which areas to cut or prioritize. This weakens your ability to respond during market crashes, supply chain disruptions, or sudden shifts in demand. You lose time and resources making last-minute adjustments.

To remain agile, you must reduce operating costs in advance and build a lean, crisis-ready operation. Good cost discipline gives you the flexibility to act decisively and minimize the damage during tough times.

8. Limited flexibility to change

Adapting to new technologies, customer needs, or business models requires resources. But high overhead ties up your capital and prevents you from seizing opportunities. When your costs are locked into inefficient systems or outdated practices, pivoting becomes expensive and time-consuming.

Flexibility comes from having the space—both financial and operational—to innovate. You gain that space when you control operating costs and keep your operations lean. Without that, every shift becomes a burden, and your business growth slows down dramatically.

9. Inability to invest in growth

You need capital to hire talent, launch new products, and expand into new markets. But bloated operating costs consume the cash you could use for growth. As a result, you delay important initiatives or underfund strategic opportunities. Your growth pipeline dries up because operational waste leaves little room for reinvestment.

When you reduce operating costs, you free up funds to pursue expansion, strengthen your offerings, and gain market share. Efficient spending directly influences your ability to scale and succeed long term.

10. Declined stakeholder confidence

Stakeholders expect you to manage your business with fiscal responsibility. When expenses spiral without control, they question your leadership and judgment. Investors may hesitate to commit funds, lenders might impose stricter terms, and board members could push for operational changes. Poor expense discipline reflects negatively on your financial strategy.

To build trust, you must control operating costs and demonstrate cost awareness. Transparency, accountability, and consistent cost performance improve credibility and reassure stakeholders that their investments are in safe, competent hands.

Steps to calculate operating costs

Understanding how to calculate your operating costs is essential if you want to reduce operating costs effectively. A clear and accurate calculation gives you a full picture of your cost structure, reveals inefficiencies, and helps you plan better.

By taking a systematic approach, you can control operating costs and boost profitability. Let’s walk through a detailed, step-by-step process to calculate your operating costs accurately and ensure your financial decisions rest on solid, real-time data.

1. Identify your expense categories

Start by organizing your costs into relevant categories such as rent, salaries, utilities, marketing, insurance, and repairs. Accurate categorization lays the groundwork for tracking where money goes and spotting opportunities to reduce operating costs. Avoid vague groupings—every cost should fall under a defined category.

This clarity helps you analyze patterns, compare periods, and understand how each segment contributes to total operating costs. Once you know your categories, you can start separating essential from non-essential costs and improve your ability to control operating costs.

2. Gather financial data

Collect detailed financial records for the period you’re analyzing—monthly, quarterly, or annually. Use accounting software, bank statements, invoices, and receipts to ensure every expense is captured. Don’t rely on estimations; accurate data provides the foundation for financial clarity. If you’re missing entries, follow up and fill the gaps.

Historical records also offer trends to monitor. The better the data, the easier it becomes to reduce operating costs and maintain accurate reporting that supports your decision-making and growth strategy.

3. Calculate total cost for each category

Once you have your categories and data, sum the expenses within each category. Make sure recurring costs are included for the full time period. Totaling by category helps you evaluate how much each area consumes and where you might control operating costs without harming output.

Look for unusually high amounts in areas like utilities or marketing that can often be scaled down or renegotiated. Knowing your largest spenders will guide your strategy to cut waste and prioritize resource allocation.

4. Adjust for non-operating costs

Remove costs that don’t fall under operating costs such as loan payments, capital expenditures, and income taxes. These are non-operational and shouldn't be included when calculating operating costs.

Including them would distort the real picture of what it costs to run your core business. Focus only on costs that relate to daily operations. This step is crucial to ensure you don’t overestimate your true expenses and can correctly identify areas where you could reduce operating costs going forward.

5. Calculate total operating costs

Now that you’ve separated and summed each valid category, and excluded non-operating expenses, add the totals to determine your total operating costs. This gives you the baseline figure for managing your operations.

It reflects the actual cost to run your business before taxes and other outside influences. Use this total regularly to compare month-to-month or year-over-year changes. Tracking this consistently helps you control operating costs by showing when spending drifts above expectations and when corrective actions are necessary.

Formula

Operating Costs = Total of All Operational Expense Categories − Non-operating Costs

This formula ensures only business-related costs are included in your calculations.

Example:

Imagine your business has the following monthly expenses: Rent $3,000, Salaries $12,000, Utilities $1,200, Marketing $1,800, Insurance $500, and Repairs $500. Your total operating costs would be $19,000. If you also had $2,000 in loan repayments and $3,000 in tax payments, you wouldn’t include them in your operating cost calculation.

This way, you focus strictly on what’s required to run your daily business operations and use that figure to set budgets and reduce operating costs.

6. Review & reconcile

After your initial calculation, compare it against your financial statements to confirm accuracy. Look for discrepancies, missing transactions, or misclassified expenses. Cross-check each category and correct errors. Accurate reconciliation ensures financial integrity and sets you up for better planning.

Without reviewing your calculations, you risk making decisions based on incomplete or flawed data. Reconciliation is key to ensuring you control operating costs properly and set realistic expectations across all departments and cost centers.

7. Analyze the results

Break down the data to understand which categories consume the most resources and whether they align with your business priorities. Compare these numbers with industry standards or your past performance. High costs in low-impact areas may signal inefficiencies. You can only improve what you measure.

This step allows you to reduce operating costs intelligently, focusing on real problem areas while protecting what drives your business forward. Use visuals like charts to make trends easier to spot and communicate.

8. Measure key performance indicators

Track performance metrics such as Operating Expense Ratio (OER), Cost per Employee, or Expense-to-Revenue Ratio. These KPIs help you quantify how well your expense structure supports profitability. Set benchmarks and compare them across periods to detect changes.

Monitoring these metrics ensures that you control operating costs consistently over time. They also highlight where you’re succeeding in reducing costs and where attention is needed. Don’t ignore them—they offer insights into both progress and areas needing improvement.

9. Adjust your expenses accordingly

Now use your insights to make cost-saving decisions. Eliminate redundant subscriptions, renegotiate contracts, or cut low-performing campaigns. Automate manual tasks to reduce labor costs. Shift spending toward what drives ROI. This isn’t a one-time task—repeat this review periodically to keep spending efficient.

When you reduce operating costs based on data rather than guesses, you create a leaner operation that supports profitability and growth. Adjustments made today will protect your business’s future and sharpen your competitive edge.

Simplify your expenses effortlessly

What is the operating cost ratio?

The operating expense ratio (OER) helps you evaluate how efficiently your business uses revenue to cover operational costs. It reveals the portion of income spent on daily operations, excluding the cost of goods sold.

A lower OER means you're using revenue effectively and can reduce operating expenses without harming performance. By monitoring this ratio, you can control operating expenses and strengthen financial planning, resource allocation, and long-term profitability.

1. Components

To calculate the operating expense ratio, focus on two main elements: total operating expenses and total revenue. Operating expenses include rent, salaries, utilities, marketing, insurance, and repairs—basically, all costs required for daily operations. Total revenue refers to the income generated from your core business activities before any deductions.

The OER compares these two figures to reflect how much of your revenue goes toward maintaining operations. Knowing these components gives you clarity and helps you make informed decisions to reduce operating expenses and increase profit margins.

2. Formula

Operating Expense Ratio (OER) = (Operating Expenses ÷ Total Revenue) × 100

This formula gives you a percentage that represents the share of revenue used for operating costs. A lower ratio signals better cost management.

3. Cancel unused subscriptions

Sometimes we start using a SaaS tool that later turns out to not be suitable for your business’s requirement.

And then somehow you forget to unsubscribe before the trial period ends or before the renewal cycle begins and get stuck paying for a service you don’t even need. This is not an isolated incident.

SaaS companies make millions of dollars every year, thanks to businesses that forget to cancel their subscriptions or keep paying for duplicate applications for similar tasks.

That’s why it is important to keep track of all the apps being used by departments and teams.

Keep out a special eye for those with an auto-renew cycle and regularly check in with the list to ensure that all the subscriptions you are paying for are being fully utilized by the team.

Related read: How to efficiently track and manage SaaS subscriptions?

4. Outsourcing

As a decision-maker for your business operating costs, it is important to ensure that everyone is working to their strengths. That’s why outsourcing certain skills are important to ensure that you focus on the prioritized tasks.

For example, business owners who take care of production and administrative duties might not have the time or the skills to look after the advertisement and marketing aspects.

Instead of incurring heavy losses by being a jack of all trades, outsource these requirements to someone else who has the necessary skills to conduct the work efficiently. This helps the company reduce operating costs in the long run.

5. Apply strategic inventory management

While attempting to reduce operational costs, one of the most overlooked challenges is the optimization of your company’s inventory.

Keeping inventory on-hand incurs warehouse expenses, maintenance costs, insurance, and labor and staff to operate the warehouse. Inventory expenses alone can form up to 25% of your total operating costs.

To keep inventory costs to a minimum, try to keep a steady flow of low-stocked inventory ready for sales at a given time.

This can ensure that there is no overstocking of any sort and the manufacturing units aren’t backlogged either, thereby saving you a lot in operational expenses.

6. Negotiate

Negotiation is an art that every business owner must know, especially one who is aiming to bring their operational costs down.

Whether it’s with your leased or rented building’s owner, vendors, shipping service providers, negotiate deals and discounts to get the best cost possible.

When the lease or rent renewal date comes around, remember to negotiate with your real estate agent or owner by researching similar properties near them.

This will give you an edge and help you bring your rent or lease amount down. Negotiate with vendors too, ask for discounts on payment plans, such as advance payment discounts, bi-monthly payment discounts.

With your shipping service providers, you can inquire about their offers and conduct thorough research to find out their competitor’s pricing as well.

7. Use online spend management system

If time is money, then using a spend management platform that eliminates paper-based time-consuming filing will save you a fortune!

With the advent of the internet, paying your bills online is a great way to keep track of your expenses more transparently and efficiently.

Spend software also offers an automated payment facility, so you never have to pay late fees ever again. However, not all spend software are built equal.

It is important to choose an application that offers you utmost transparency along with complete control over your operating costs and budgets.

Steps on how to reduce operating costs

If you want to reduce operating expenses effectively, you must take a structured and continuous approach. These steps will help you understand, manage, and bring down unnecessary costs while keeping your operations efficient.

You’ll also build better decision-making habits and support your business’s financial health. Each step plays a key role in helping you control operating expenses and improve your bottom line sustainably.

1. Conduct detailed expense analysis

Start by reviewing all your operational costs in depth. Break down expenses into fixed and variable categories, and classify them by department or function. Examine billing records, vendor contracts, and payment histories. Look for duplicate services, outdated subscriptions, or unnecessary purchases.

By identifying where every dollar goes, you get full visibility, which allows you to reduce operating expenses strategically and eliminate wasteful spending across your organization without compromising efficiency.

2. Identify cost drivers

Once you complete the analysis, identify what’s driving those costs. These drivers can be employee overtime, high energy use, excessive inventory, or inefficient processes. Understanding what factors contribute most to your expenses gives you a clear picture of where to act.

Pinpointing cost drivers helps you control operating expenses by tackling the root cause rather than temporary symptoms, allowing for more sustainable long-term cost reductions.

3. Involve key stakeholders

Include department heads, finance staff, and operational managers in your expense-reduction process. Their insights can uncover hidden costs and inefficiencies you might miss. Collaboration also fosters accountability and ensures each team takes responsibility for managing its budget.

When everyone is involved, you create a culture focused on financial discipline and transparency—making it easier to reduce operating expenses while aligning cost-saving efforts with organizational goals.

4. Conduct cost estimation

Forecast the potential savings and impacts for each cost-reduction idea. Consider both direct and indirect effects, such as how switching suppliers may affect delivery speed or quality. Evaluate the short-term implementation costs versus long-term savings.

Estimating the real financial impact prepares you to prioritize actions based on value. It also helps you control operating expenses more realistically by setting clear expectations and avoiding unplanned consequences.

5. Develop a budget

Create a detailed and realistic budget based on your refined expense estimates. Include spending limits by department, project, or category. Allocate resources to the most critical operations, and build in a buffer for unexpected costs.

A well-planned budget becomes your financial roadmap and helps reduce operating expenses by setting boundaries and promoting smarter spending decisions across your teams.

6. Track expenses regularly

Monitor every expenditure in real time or at consistent intervals. Use accounting software or dashboards to categorize and report spending patterns. Keeping close tabs on your spending allows you to detect spikes or inconsistencies early.

Regular tracking helps you control operating costs before they get out of hand and ensures that cost-saving strategies are working as intended, reinforcing accountability across departments.

7. Analyze expense trends

Study your spending over weeks, months, or quarters. Look for recurring spikes, seasonal variations, or growing costs in specific areas. Analyzing patterns helps you anticipate future costs and spot emerging inefficiencies.

Understanding these trends lets you take preemptive action to reduce operating expenses and implement timely interventions—keeping your financial performance steady and predictable throughout changing business cycles.

8. Set up a cost control strategy

Design a proactive cost control strategy that outlines rules, tools, and processes for managing expenses. This might include spending limits, approval workflows, vendor negotiations, and policy reviews.

The strategy must align with your business goals while allowing flexibility for changes. A strong control system empowers you to control operating expenses consistently while still meeting operational needs and maintaining employee productivity.

9. Perform variance analysis

Compare your actual spending against the planned budget to identify discrepancies. If certain departments or projects exceed budget, investigate why. Was it due to unforeseen costs, planning errors, or inefficient use of resources?

Variance analysis helps you discover gaps between expectations and reality so you can reduce operating expenses in the future through better forecasting and tighter spending controls.

10. Implement corrective actions

Based on your variance findings, take specific actions to address overages or inefficiencies. This might mean renegotiating contracts, eliminating low-performing assets, or improving workflow systems.

Corrective steps should be practical, measurable, and time-bound. Acting decisively helps you regain control and enables you to control operating expenses while avoiding future budget overruns and operational setbacks.

11. Monitor performance metrics

Track key metrics like expense ratio, cost per unit, or ROI on cost-saving initiatives. Monitoring KPIs allows you to evaluate the impact of your strategies and measure progress toward financial goals.

These metrics give you data-driven insights, helping you make informed decisions that reduce operating expenses effectively and continuously while improving operational performance at all levels.

12. Review and adjust accordingly

Evaluate your cost-reduction strategies periodically to determine what’s working and what isn’t. Involve your teams in feedback sessions to uncover new areas of improvement. Update policies, revise goals, and realign budgets based on your business needs.

This ensures your approach to control operating expenses evolves with market trends and internal growth, creating a dynamic system that adapts and thrives over time.

Strategies for reducing operating costs

If you aim to reduce operating expenses across your business, adopting strategic and targeted approaches is essential. These strategies help you eliminate waste, improve productivity, and boost profitability.

From budgeting and audits to supplier evaluations and employee engagement, each tactic is designed to help you better understand and control operating expenses, ensuring your business remains lean, agile, and financially sustainable over time.

1. Perform detailed budgeting

You should start by building a comprehensive and itemized budget that aligns with your business goals. Break down costs by function, department, and project, ensuring every dollar has a clear purpose. Include both fixed and variable expenses to improve visibility.

A robust budget acts as a spending blueprint, allowing you to control operating expenses better and identify cost-saving opportunities, helping you reduce operating expenses without compromising essential operations or output.

2. Setting industry benchmarks

Compare your expense ratios and operational spending against competitors or industry averages. Benchmarking reveals whether your current spending levels are justified or inflated. Use these insights to identify gaps, eliminate unnecessary costs, and align your practices with the most efficient standards in your sector.

When you benchmark effectively, you’ll be able to reduce operating expenses while staying competitive, productive, and adaptive to changing market dynamics.

3. Conduct regular expense audits

You need to carry out periodic audits to review every aspect of your spending. These audits help identify redundant services, outdated software, duplicated tools, or hidden costs draining your budget.

By questioning recurring charges and analyzing every transaction, you gain a clearer picture of inefficiencies. This allows you to act quickly and decisively to control operating expenses and reduce operating expenses that no longer contribute to your business success.

4. Implement cloud-based solutions

Switching to cloud-based platforms for storage, collaboration, accounting, and software can significantly reduce IT infrastructure and maintenance costs. Cloud services offer flexibility, scalability, and automated updates, allowing you to cut down on hardware, reduce energy use, and minimize staffing needs.

By adopting cloud technology, you can reduce operating expenses long-term and create an agile system that supports remote access and faster workflows without excessive overheads.

5. Employee training & engagement

Investing in employee development helps enhance productivity and reduces costly errors or inefficiencies. Well-trained employees make smarter decisions, avoid wasteful practices, and understand the value of resource management.

Engage your team in cost-saving initiatives and educate them on best practices to control operating expenses. When your workforce is informed and motivated, they become active contributors in your mission to reduce operating expenses consistently and meaningfully.

6. Evaluate supplier performance

Regularly assess the cost, quality, and reliability of your vendors and suppliers. Negotiate better terms, look for bulk discounts, or switch to alternative suppliers offering better value. Don’t hesitate to restructure contracts if they no longer meet your expectations.

This evaluation process allows you to eliminate high-cost vendors and reduce operating expenses while maintaining or improving service levels, helping your procurement processes become more strategic and efficient.

7. Outsource non-core activities

Identify functions that don’t directly impact your core business, such as payroll, IT support, or customer service, and consider outsourcing them. Third-party providers often bring specialized expertise at a lower cost than hiring full-time staff. This helps you focus internal resources on growth and efficiency.

By outsourcing strategically, you control operating expenses without sacrificing performance and reduce operating expenses in areas where scale or specialization matters.

8. Normalize remote work

Support and promote remote work as a cost-saving initiative. By reducing your reliance on physical office space, utilities, and commuting costs, you create room for significant financial savings. Invest in collaboration tools and cybersecurity measures to ensure business continuity.

Remote work also enhances employee flexibility and satisfaction. This hybrid or remote-friendly model helps you reduce operating expenses related to facilities while promoting a lean and modern work environment.

9. Re-evaluate insurance plans

Review your business insurance policies annually to assess if you're over-insured, under-insured, or paying excessive premiums. Compare providers, coverage limits, and deductibles. Look for bundled services or corporate discounts. Involving a broker can also uncover hidden savings.

This process helps you get maximum coverage at minimal cost, letting you control operating expenses tied to risk management and reduce operating expenses without compromising essential business protection.

Better manage your business expenses

What are the key performance indicators to monitor your operating costs?

Monitoring key performance indicators (KPIs) is essential if you want to understand where your money goes and how to reduce operating expenses effectively. These metrics provide insights into your financial health, operational efficiency, and spending habits.

By closely tracking them, you’ll be able to make informed decisions, control operating expenses, and identify opportunities to improve profitability and long-term stability.

1. Operating expense ratio

The operating expense ratio measures the proportion of total operating expenses to your revenue. You calculate this by dividing your operating expenses by total revenue. A lower ratio signals efficiency and stronger profit margins, while a higher one means costs are consuming more of your income.

By regularly evaluating this KPI, you can control operating expenses and make cost-related adjustments that help you reduce operating expenses without disrupting critical business activities or service quality.

2. Expense growth rate

This KPI tracks how your operating expenses change over time. You calculate it by comparing current expenses to those from a previous period and expressing the difference as a percentage. If your expenses are rising faster than revenue, it's a red flag.

Monitoring this indicator helps you react early, assess areas like selling & marketing expenses, and plan interventions to reduce operating expenses before they spiral out of control or jeopardize business performance.

3. Gross profit margin

Gross profit margin shows the percentage of revenue remaining after subtracting the cost of goods sold (COGS). While it doesn't directly include all operating costs, a shrinking margin can indicate cost pressure from other areas.

If your COGS rises without a similar increase in price or revenue, your margin shrinks, hinting at inefficiencies. A healthy margin gives you more room to manage and reduce operating expenses tied to production, logistics, or resource management.

4. Net profit margin

This KPI measures the percentage of profit left after deducting all expenses—including operating, interest, and taxes—from total revenue. A declining net margin often signals poor cost management or overspending.

When you track this closely, you can link it to excessive selling & marketing expenses or back-end costs and use that data to reduce operating expenses, improve your overall cost structure, and ensure you're generating value from every dollar earned.

5. Inventory turnover ratio

This KPI shows how many times you sell and replace your inventory during a specific period. A low turnover means excess stock or weak sales, both of which tie up working capital and increase storage and insurance costs.

Improving inventory turnover boosts cash flow and helps you reduce operating expenses related to holding inventory. You can also spot inefficiencies in your procurement or supply chain strategy and make more agile decisions accordingly.

6. Budget variance ratio

The budget variance ratio compares your actual spending to the budgeted amount, revealing whether you’re over or under budget. A high positive variance signals overspending and poor budget control.

You can use this KPI to evaluate departments, such as high selling & marketing expenses, and quickly take action to control operating expenses. It promotes accountability and helps you maintain financial discipline while working proactively to reduce operating expenses across the board.

7. Return on assets

Return on assets (ROA) evaluates how efficiently your company uses its assets to generate profit. You calculate it by dividing net income by total assets. A declining ROA can mean you’re investing in assets that aren’t producing sufficient returns.

This KPI prompts smarter asset management decisions and helps you cut underperforming investments, streamline your asset base, and reduce operating expenses tied to depreciation, maintenance, and underutilization of valuable business tools.

8. Customer acquisition cost

Customer acquisition cost (CAC) measures how much you spend to gain a new customer. It includes marketing, sales, and promotion-related selling & marketing expenses, High CAC indicates inefficient campaigns or a misaligned sales strategy.

By optimizing CAC, you reduce the cost of growth and marketing. Tracking this KPI helps you reduce operating expenses and focus your marketing spend on the most cost-effective channels that bring in high-value, long-term customers.

9. Energy cost per employee

This KPI measures your total energy spending divided by the number of employees. It helps you understand how efficiently your workspace operates and where utilities are overused. High energy costs per employee signal waste and present opportunities for sustainability improvements.

By adopting energy-efficient practices and tools, you can reduce operating expenses and foster a greener workplace. This also supports long-term savings and aligns with environmental responsibility and operational cost awareness.

Best practices for reducing operating costs

You can adopt specific, well-defined strategies to reduce operating expenses without sacrificing quality or efficiency. These best practices will help you pinpoint unnecessary spending, optimize processes, and strengthen financial performance.

By making informed, consistent decisions, you’ll not only control operating expenses but also promote long-term sustainability, boost productivity, and improve your overall profit margins across every area of your business.

Optimize staffing costs

Begin by evaluating your workforce structure and labor allocations. Look at overtime costs, underutilized roles, and whether you can cross-train employees to cover multiple functions. Hiring part-time staff for cyclical workloads, outsourcing non-core tasks, and adopting automation tools can help you reduce operating expenses without disrupting productivity.

Prioritize output efficiency over headcount, and regularly reassess staffing needs based on real-time demands, skill availability, and organizational growth strategies to ensure cost-effective labor planning and resource utilization.

Ensure an in-depth understanding of your costs

Develop a comprehensive view of where your money goes across the business. Break down each cost center and classify spending by necessity, value, and impact. Understanding both fixed and variable costs helps you make better budgeting decisions.

Track recurring fees like rent, salaries, and selling & marketing expenses, and assess them against results delivered. This level of visibility makes it easier to control operating expenses and reveals clear paths to reduce operating expenses effectively and strategically.

Monitor your costs regularly

Establish a consistent routine for reviewing your expenses weekly, monthly, or quarterly. By keeping a close eye on fluctuations, you can detect unusual patterns and address issues early. Use reporting tools or dashboards to track major spending categories, including selling & marketing expenses, operations, utilities, and supplies.

This proactive monitoring system allows you to react to overspending trends quickly, reassess underperforming areas, and take corrective action to reduce operating expenses with precision and clarity.

Prioritize expenses based on contribution

Rank your expenses by their direct impact on revenue generation or operational value. Essential activities that contribute to business goals should remain funded, while low-yield or non-essential costs should be re-evaluated or phased out. For example, assess whether specific selling & marketing expenses lead to measurable ROI.

This prioritization helps you allocate resources wisely, eliminate waste, and reduce operating expenses without hurting performance. Use clear benchmarks to evaluate and justify every business expense.

Set up an expense management system

Implementing an automated expense management solution helps you streamline cost tracking, approvals, and reporting. These tools ensure all claims and purchases go through a consistent workflow, minimizing the risk of fraud or unnecessary spending.

With real-time expense tracking, you get a better grip on your finances and can quickly flag outliers. Such systems help you stay compliant, support audit readiness, and provide accurate insights to reduce operating expenses across all departments.

Incorporate real-time monitoring tools

Using real-time monitoring systems, you can track expenses as they happen rather than after they occur. Whether it’s utility consumption, travel expenses, or project-related costs, these tools provide up-to-date visibility and alert you to any anomalies.

When combined with spend policies, alerts, and dynamic dashboards, real-time data empowers you to make immediate decisions that control operating expenses. This approach fosters accountability and helps you consistently identify opportunities to reduce operating expenses efficiently.

Incentivize employee engagement

Your employees play a vital role in cost management. Educate your team about the importance of responsible spending and involve them in the process. Offer incentives for departments that find ways to save or meet expense reduction targets.

Encourage employees to suggest process improvements or highlight areas where waste can be eliminated. Engaged and informed teams are more likely to contribute actively and consistently help you reduce operating expenses while boosting morale and collaboration.

Review & adjust budgets periodically

Don’t treat your budgets as static. Regularly review actual expenses versus forecasted ones and adjust budgets accordingly. Look at which departments are overspending and determine whether the excess is justifiable or needs control.

Refine budget allocations based on seasonality, performance, and market conditions. Making timely adjustments helps you respond to external changes more effectively and gives you room to reduce operating expenses by eliminating unproductive spending or reallocating funds more strategically.

Conduct periodic benchmarking

Benchmark your business expenses against industry standards and competitor performance. Identify where your spending exceeds the average and explore why. Are you overpaying vendors? Are your energy or IT costs higher than peers? Benchmarking offers context and helps you identify gaps in operational efficiency.

It serves as a foundation for improvement plans and cost reductions. Regular benchmarking allows you to control operating expenses while pushing your company to reduce operating expenses through data-backed comparisons.

Make early payments when possible

Suppliers often offer discounts or favorable terms for early payments. If your cash flow allows it, negotiate early settlement terms to reduce your payable amounts. Doing this across multiple vendors may result in significant savings over time.

Prioritize reliable partners and review contracts to identify early payment opportunities. These discounts directly help you reduce operating expenses, strengthen supplier relationships, and can even improve your reputation as a preferred and financially responsible client.

Monitor essential KPIs

Track essential KPIs related to cost management such as the operating expense ratio, net profit margin, and budget variance. These indicators reveal inefficiencies, spending patterns, and areas where corrective action is needed. By using real-time data, you can quickly control operating expenses and develop practical cost-saving measures.

KPI tracking allows you to set measurable goals, benchmark performance, and create accountability—all of which help you reduce operating expenses without harming operational quality or outcomes.

Encourage cross-departmental collaboration

Promote collaboration between finance, operations, HR, and other departments when developing cost-saving strategies. Shared visibility into budgets and spending can foster smarter decision-making and help eliminate duplicate efforts. For example, marketing and procurement teams can align on campaign budgets and vendor negotiations.

Cross-functional collaboration leads to a better understanding of business needs, improves transparency, and enables collective actions to reduce operating expenses effectively while maintaining synergy and consistency across the organization.

Review contracts & subscriptions periodically

Contracts and subscriptions often become recurring costs that go unnoticed. Regularly audit them to identify underused or outdated services. Cancel unnecessary subscriptions, renegotiate terms, or switch providers for better deals.

Look at licenses, SaaS tools, and service agreements to ensure you're only paying for what you truly need. Periodic reviews help you stay lean, avoid hidden charges, and reduce operating expenses without compromising the essential services your business depends on.

Technological advancements in managing your operating costs

You now have access to smarter tools that help you reduce operating expenses without compromising output. Technology empowers you to spot inefficiencies, track costs in real time, and automate financial workflows.

From cloud-based platforms to data-driven insights, each solution helps you control operating expenses better. Embracing these innovations makes your cost management more dynamic, accurate, and aligned with long-term business goals.

Data analytics

You can use data analytics to uncover hidden trends and spending behaviors across departments, giving you detailed insight into how funds flow through your operations. With accurate analytics, you can control operating expenses by identifying outliers, optimizing purchasing patterns, and reducing waste.

Predictive models help you plan better by showing future cost implications. Real-time dashboards provide continuous updates, enabling smarter and faster decisions. Data analytics gives you the power to correct inefficiencies before they escalate.

Cloud computing

Cloud computing reduces your dependency on costly physical infrastructure and gives you flexible, scalable access to digital tools. You eliminate the need for in-house servers, reduce IT maintenance costs, and only pay for what you use.

By switching to the cloud, you can reduce operating expenses related to software upgrades, energy consumption, and hardware support. Plus, it promotes remote work, collaboration, and real-time access to financial data from anywhere at any time.

Corporate cards

Corporate cards help you track spending efficiently while managing to control operating expenses. They allow real-time monitoring of transactions and simplify expense reporting by categorizing purchases automatically.

With spending limits and approval workflows in place, you reduce the risk of unauthorized or excessive expenses. Integrated dashboards show you spending across departments and individual employees, giving you instant clarity. Corporate cards offer accountability, transparency, and better alignment between spending behavior and your business goals.

Expense management software

Expense management software digitizes your entire expense workflow—from submission and approval to reimbursement and analysis. You no longer have to deal with paper receipts or manual data entry. Instead, everything syncs with your accounting software for seamless reconciliation.

This lets you reduce operating expenses by saving administrative time, eliminating duplicate payments, and catching policy violations early. Most platforms also generate expense insights, making it easier to set realistic budgets and adjust them in real time.

Artificial intelligence & machine learning

AI and ML bring automation and predictive accuracy to expense tracking, helping you control operating expenses with precision. These technologies can detect unusual spending patterns, suggest savings opportunities, and even automate recurring cost approvals.

They adapt to your business rules, learning from historical data to suggest cost-saving strategies. You spend less time on manual reviews and more time on strategic planning. AI and ML tools optimize workflows, reduce errors, and support fast, data-informed decision-making.

Business intelligence (BI) tools

BI tools consolidate financial data from multiple sources into a single, visual interface. You can evaluate your operating expenses by department, vendor, or category, and compare them to your budget in real time.

BI tools highlight where you're overspending and suggest corrective steps to reduce operating expenses. You’ll gain actionable insights through dynamic dashboards, automated alerts, and trend visualizations. This empowers you to take proactive steps before small inefficiencies become costly problems.

Experience easy business expense management

How does expense management software help in managing your operating costs?

Expense management software gives you tighter control over your finances and lets you reduce operating expenses with ease. You no longer rely on scattered receipts or delayed reports. Instead, everything from submission to analysis is automated.

This real-time visibility helps you identify unnecessary spending and improve budgeting accuracy to better control operating expenses and maintain financial health.

1. Employee spending reports in real time

You gain immediate access to how your employees are spending across departments, projects, or trips. With real-time tracking, you can spot spending anomalies instantly and take corrective action. This transparency allows you to control operating expenses before they snowball into major issues.

Whether it’s travel costs or operational purchases, live data helps you maintain oversight without micromanaging. Quicker access to reports also improves decision-making and speeds up reimbursement processes.

2. Compliance with spend policies

The software enforces your internal spending policies without requiring manual checks. It automatically flags non-compliant entries, sends alerts, and even blocks unauthorized expenses. This allows you to maintain control operating expenses and reduce errors or policy violations.

With pre-set rules and approval workflows, your team learns to spend responsibly. Over time, you build a culture of accountability and reduce unnecessary costs without needing constant supervision or intervention.

3. Dashboard for a broad view of expenses

A centralized dashboard consolidates all your spending data in one place, giving you a complete snapshot of your company’s financial activity. You can segment data by team, category, or time period, helping you reduce operating expenses through improved visibility.

With everything accessible from a single interface, you make faster, more informed decisions. This macro-level view uncovers trends, budget leaks, or seasonal fluctuations that might otherwise go unnoticed.

4. Analytics and insights into spending

Expense management software transforms raw data into actionable insights. You get analytics that break down your costs by vendor, team, or purpose. These insights highlight overspending, recurring charges, and inefficiencies, helping you control operating expenses strategically.

Predictive trends and visual charts help you understand where to cut back or reallocate resources. With this kind of clarity, you can fine-tune your budgets and prevent wasteful spending before it affects profitability.

5. Automated expense reporting

Manual expense reporting takes time and often introduces errors. With automation, reports are generated as expenses are submitted, categorized, and approved. This eliminates paperwork, reduces administrative workload, and ensures timely reimbursements.

You reduce operating expenses by eliminating redundancies, flagging duplicate entries, and preventing human error. Automation streamlines approvals and integrates with your accounting tools, giving you a seamless end-to-end system that boosts compliance and transparency.

Choose Volopay's all-in-one expense management platform for your business

If you’re looking to reduce operating expenses and gain full control over your company’s spending, Volopay offers the ideal solution. Its all-in-one platform equips you with automation, visibility, and precision to control operating expenses effectively while supporting smarter financial decisions.

Automated expense reporting

Volopay automates the entire expense reporting process from submission to approval, saving hours of manual work. You don’t have to chase receipts or manually enter data. The system captures every transaction, assigns it to the right category, and generates reports in real time.

This helps you reduce operating expenses by avoiding redundant tasks, minimizing errors, and streamlining reimbursements. Employees stay compliant, and finance teams stay focused on strategy instead of paperwork.

Customizable spend controls

With Volopay, you can define specific spending rules for teams, projects, or individual employees. You get to set spending limits, merchant restrictions, and approval workflows that adapt to your company’s policies.

This ensures tighter control over operating expenses and curbs unnecessary purchases before they happen. You empower employees to spend responsibly while staying aligned with your budget goals. These tailored controls offer flexibility without compromising oversight or compliance.

Detailed spend analytics

Volopay offers deep insights into how and where your business is spending. Its powerful analytics dashboard highlights trends, cost centers, and areas of potential savings. You can filter data by department, vendor, or time frame to detect inefficiencies or unusual patterns.

This visibility helps you reduce operating expenses strategically by making data-driven adjustments. Real-time analytics also support accurate forecasting and smarter allocation of your financial resources.

Automated expense reconciliation

Reconciliation becomes effortless with Volopay. The platform automatically matches receipts with transactions and syncs them to your accounting software. It flags duplicates, policy violations, or missing documentation, reducing manual reviews and errors.

You save hours of reconciliation time and avoid discrepancies that can hurt your financial reporting. This automation enhances accuracy, speeds up month-end closings, and ensures reliable financial records while keeping your control operating expenses workflow intact.

Schedule payments and smart triggers

You can schedule recurring payments and set up smart triggers for vendor invoices or internal transactions. Volopay ensures you never miss due dates, helping you avoid late fees and take advantage of early payment discounts.

Smart triggers automate approvals and prevent bottlenecks in your payment cycle. This level of automation helps you reduce operating expenses by improving cash flow management and maintaining strong vendor relationships through timely settlements.

Real-time expense tracking

Volopay provides real-time tracking of every business expense as it happens. You see where money is going instantly, whether it's employee travel, office supplies, or SaaS subscriptions. This allows you to control operating expenses by addressing issues as they arise instead of waiting for monthly reports.

The instant visibility also reduces fraud, encourages accountability, and improves compliance. Real-time insights give you more power to act, adjust, and manage costs proactively.

Integration capabilities

Volopay integrates seamlessly with popular accounting, HR, and ERP platforms, making your workflows more cohesive and less time-consuming. You no longer have to manually transfer data between systems or worry about entry errors.

These integrations ensure consistent, accurate financial information across departments. With a connected ecosystem, you reduce operating expenses caused by redundancies and inefficiencies. Everything works in harmony, creating a streamlined, productive, and scalable finance environment for your business.

Bring Volopay to your business

Get started now

FAQs

Volopay prioritizes data security by implementing multi-factor authentication, end-to-end encryption, and role-based access controls to protect sensitive financial information. Regular security audits and compliance with industry standards ensure that your financial data remains secure.

Additionally, spending controls and real-time monitoring reduce the risk of fraud while keeping all transactions transparent.

Volopay helps businesses manage recurring expenses by allowing them to automate payments for subscriptions, vendor invoices, and other fixed costs.

You can set schedules, assign budgets, and receive alerts for upcoming payments to prevent missed deadlines or overspending. This automation helps you reduce operating expenses while maintaining full control over recurring outflows.

Volopay offers multiple customer support channels, including 24/7 live chat, email assistance, and dedicated account managers for personalized support. An extensive knowledge base with helpful guides and FAQs is also available.

This ensures businesses can resolve issues quickly and efficiently while maintaining seamless expense management and strong control over operating expenses.

Fluctuating interest rates directly impact your borrowing costs, which can increase or decrease operating expenses depending on rate changes. Higher rates raise loan repayments and financing costs, reducing cash flow, while lower rates ease debt burdens.

Monitoring interest rate trends helps you manage liabilities effectively and reduce operating expenses where possible.

Import duty is generally treated as a capital expenditure when it’s directly related to acquiring long-term assets, such as equipment or machinery. In such cases, the duty cost is added to the asset’s value and depreciated over time.

However, import duties for inventory purchases are considered operating expenses and affect short-term costs.

Operating expenses can be both fixed and variable, depending on the type of cost. Fixed operating expenses include rent, salaries, and insurance, which remain constant regardless of business activity.

Variable operating expenses fluctuate based on output or sales, such as utilities, raw materials, and shipping costs. Managing both effectively helps you control operating expenses.

Volopay’s platform allows you to manage various expenses, including employee reimbursements, vendor payments, travel costs, subscriptions, and recurring bills. It also supports corporate card spending, expense reporting, and invoice management.

By consolidating these expenses into one platform, you gain full visibility, improve cost control, and reduce operating expenses across your organization.