Food and beverage expense management, simplified by Volopay

Smooth financial tech stacks play a critical role in managing expenses in the food and beverage industry, which demands accuracy across multiple cost centers. From placing high-volume ingredient orders and settling invoices with packaging suppliers to managing daily operational spend, finance teams often struggle with fragmented workflows and limited visibility.

Volopay brings everything together in one unified platform, helping food and beverage businesses control costs, automate accounts payable, and gain real-time insight into spending across the entire supply chain.

Whether you manage a single production unit or multiple outlets across regions, Volopay streamlines the process of approving, paying, tracking, and analyzing expenses without slowing down operations across the US and multi-location setups.

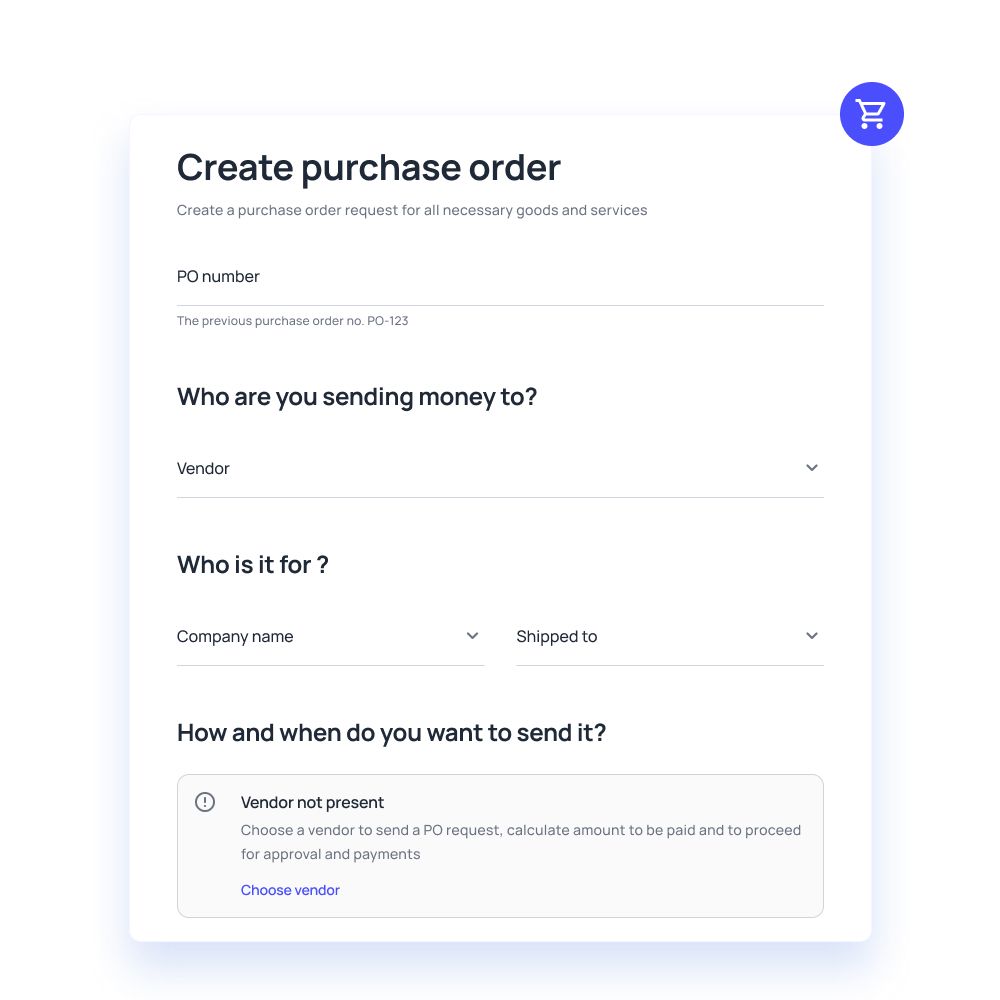

Automate PO workflows and vendor payments

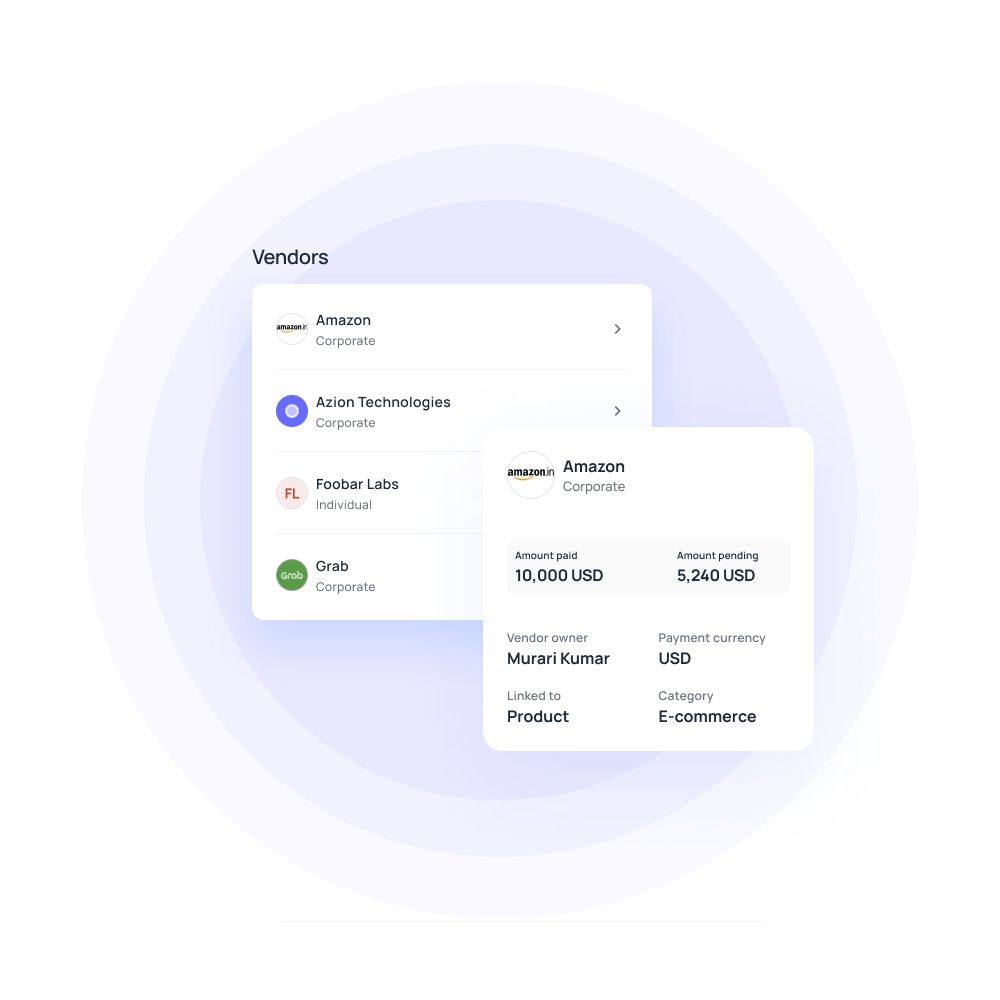

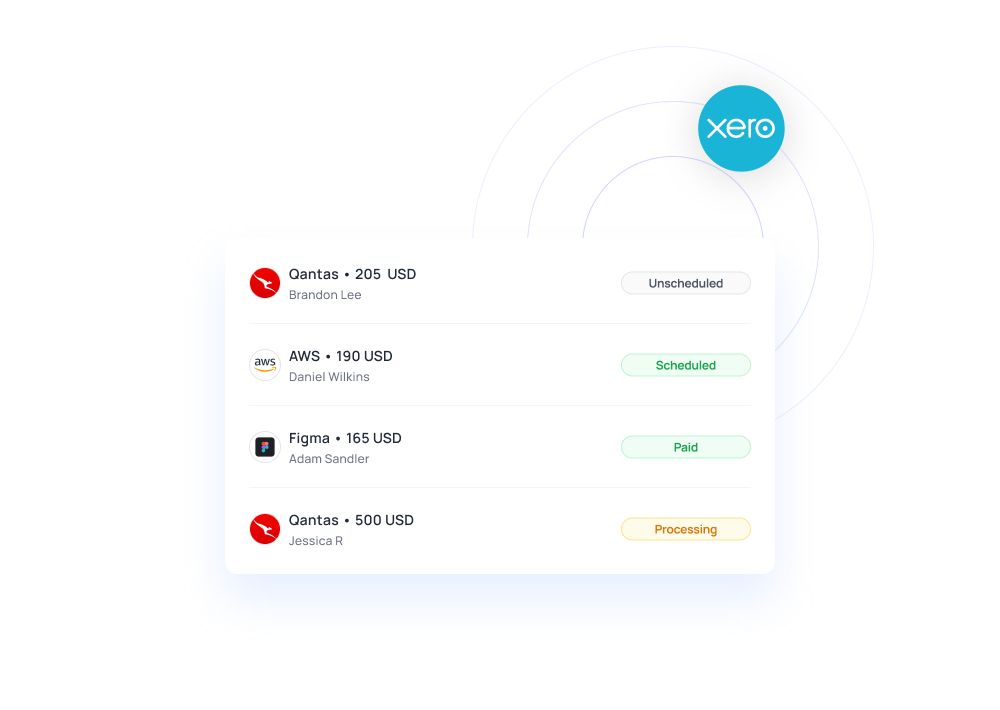

Food and beverage companies deal with frequent, high-value payments to manufacturers, distributors, and wholesalers. Manual invoice handling and disconnected approvals often delay payments and strain supplier relationships.

Volopay automates the full accounts payable workflow, from purchase order creation to invoice matching and payment execution in USD and in line with US vendor billing standards. You can route vendor bills through predefined approval workflows, schedule payments based on agreed terms, and reduce manual errors.

With food and beverage accounts payable automation built into the platform, finance teams gain consistency and control while ensuring vendors are paid accurately and on time, while maintaining clear records for sales tax and audit readiness.

Track raw material and ingredient procurement

Raw material and ingredient purchases make up a significant portion of COGS for food businesses. Without structured tracking, costs can fluctuate without clear explanations.

Volopay's procurement software solution enables you to categorize and monitor ingredient procurement expenses by supplier, product type, or location to support accurate COGS reporting under US GAAP.

By centralizing purchase data, teams can compare planned versus actual spend and identify cost spikes early. This level of food business expense tracking supports better forecasting, improved vendor negotiations, and tighter control over food costs without disrupting procurement workflows.

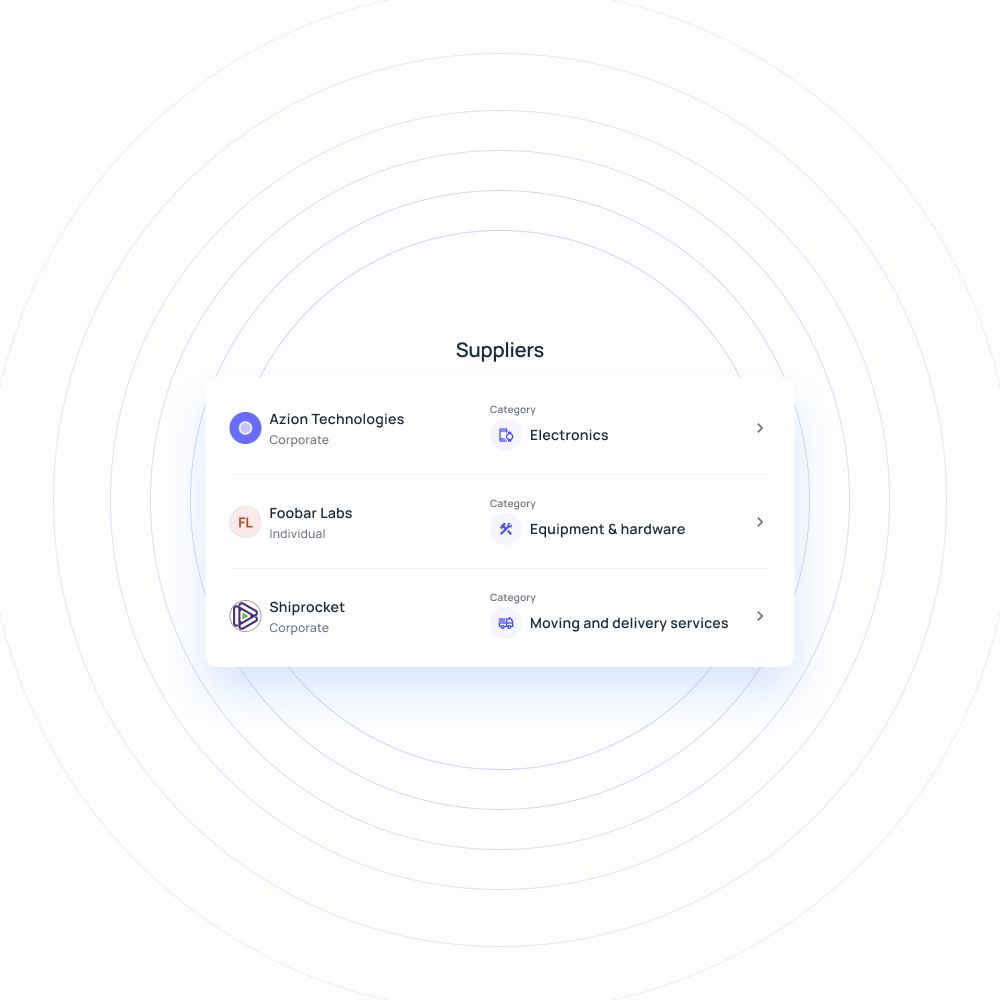

Packaging and material supplier management

Packaging materials, labels, and disposables are essential but often overlooked cost centers. Volopay helps you manage these supplier relationships by consolidating contracts, invoices, and payment schedules in one place, including vendors that charge state-level sales tax or shipping fees.

You can track recurring orders, enforce approval rules for bulk purchases, and maintain a clear record of supplier spend over time. This structured approach makes it easier to analyze packaging costs, avoid duplicate payments, and maintain accountability across procurement and finance teams.

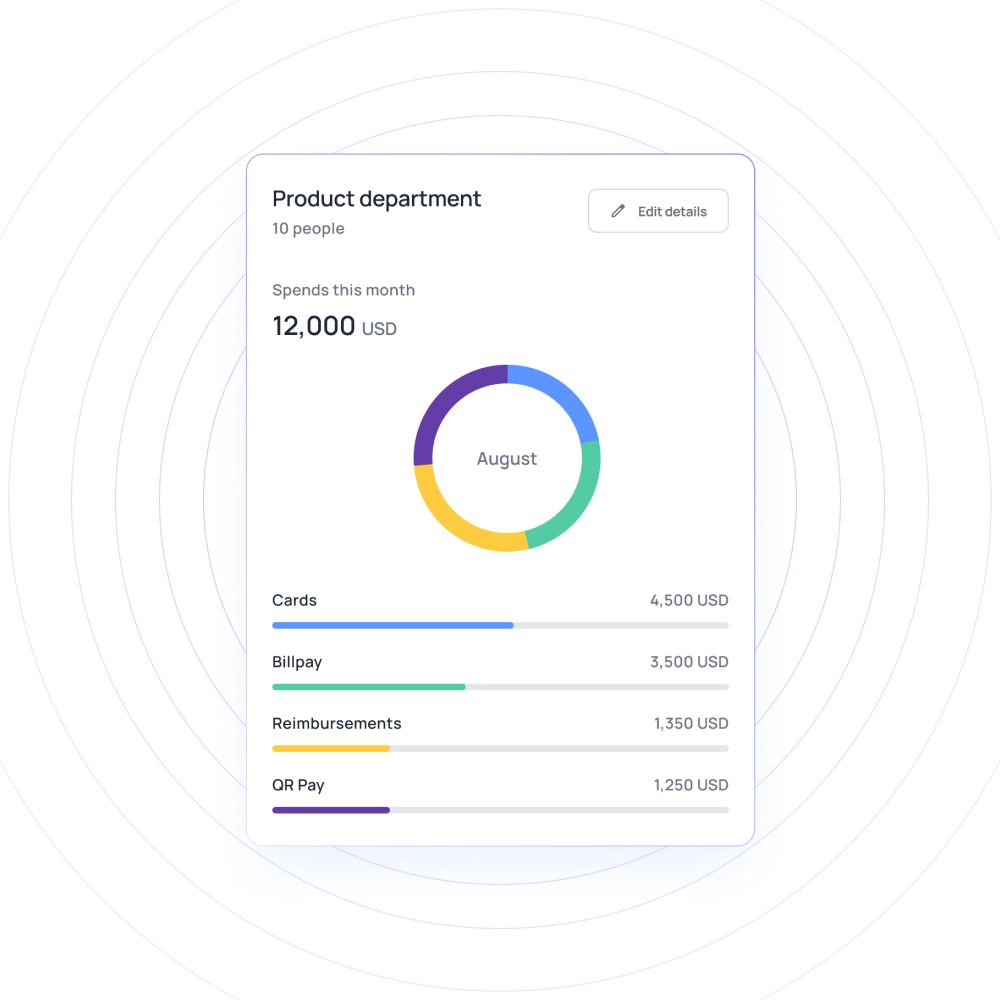

Control operational and facility expenses

Operational costs such as utilities, equipment maintenance, cleaning services, and facility rentals add up quickly across kitchens, warehouses, and outlets. Volopay centralizes these expenses, giving you a clear view of recurring and variable operational spend across multiple US cities or states.

By setting budgets and approval thresholds, finance leaders can prevent overruns while allowing teams to operate efficiently. Centralized visibility also helps identify cost-saving opportunities and ensures operational expenses align with overall financial plans.

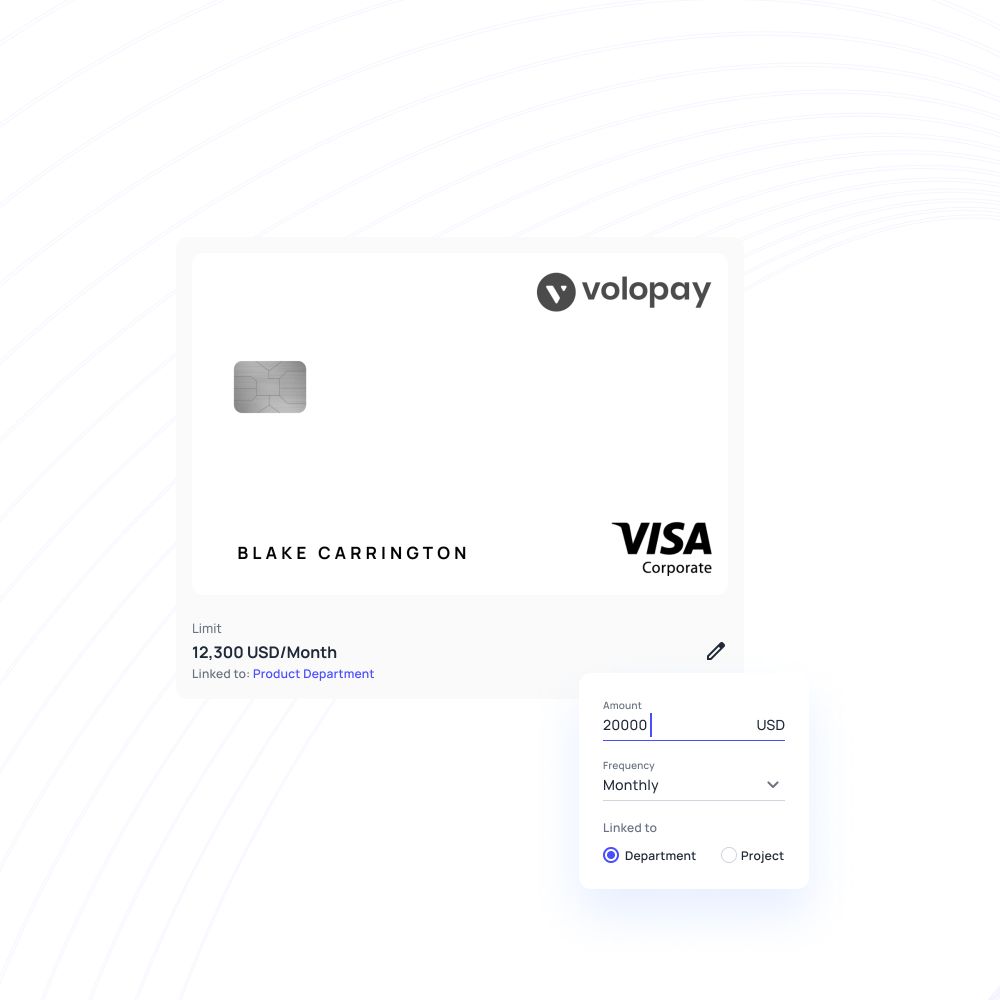

Issue corporate cards for employee & business use

Employee spending for travel, client meetings, urgent purchases, or local sourcing is common in the food and beverage industry. Volopay's corporate card program allows you to issue physical and virtual corporate cards with predefined spending limits and category controls for USD-based transactions at US merchants.

Employees can pay directly using their assigned cards, upload receipts instantly, and eliminate manual reimbursement claims. This simplifies expense management for food and beverage companies while reducing policy violations and improving transparency.

Track SaaS subscriptions & technology expenses

Modern food businesses rely on multiple software tools for POS, inventory, delivery, analytics, and workforce management. Volopay helps track SaaS subscriptions and technology expenses in a single dashboard, including tools commonly used by US-based F&B businesses.

Finance teams can monitor renewals, prevent unused subscriptions, manage current subscriptions and allocate software costs accurately across departments or locations. This ensures technology spend remains aligned with business growth and operational needs.

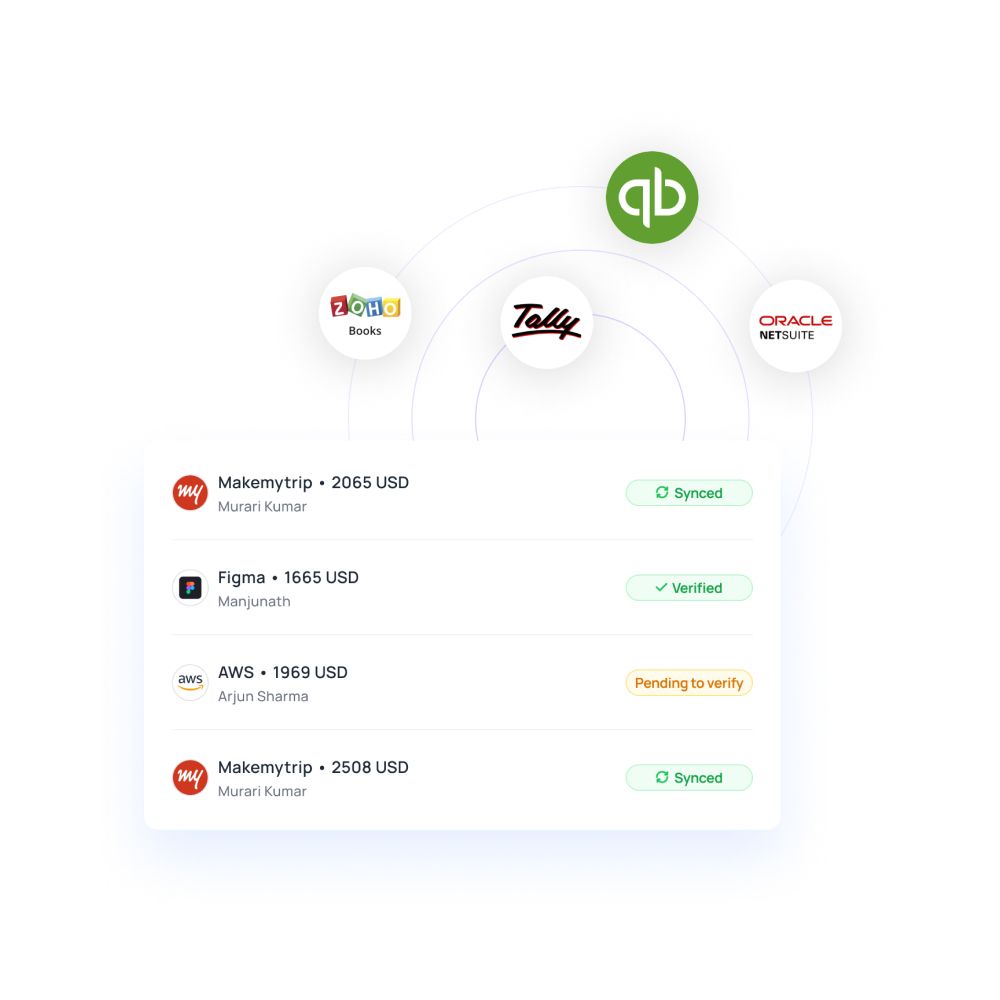

Integrate with food and beverage ERP systems

Volopay integrates with leading accounting and ERP systems used by food and beverage companies, reducing manual data entry and reconciliation efforts. Transactions, bills, and expense data sync automatically with your accounting software in line with US accounting and reporting practices.

This seamless integration improves accuracy, speeds up month-end close, and gives finance teams confidence in their numbers. With F&B spend management software working alongside your accounting stack, reporting becomes faster and more reliable.

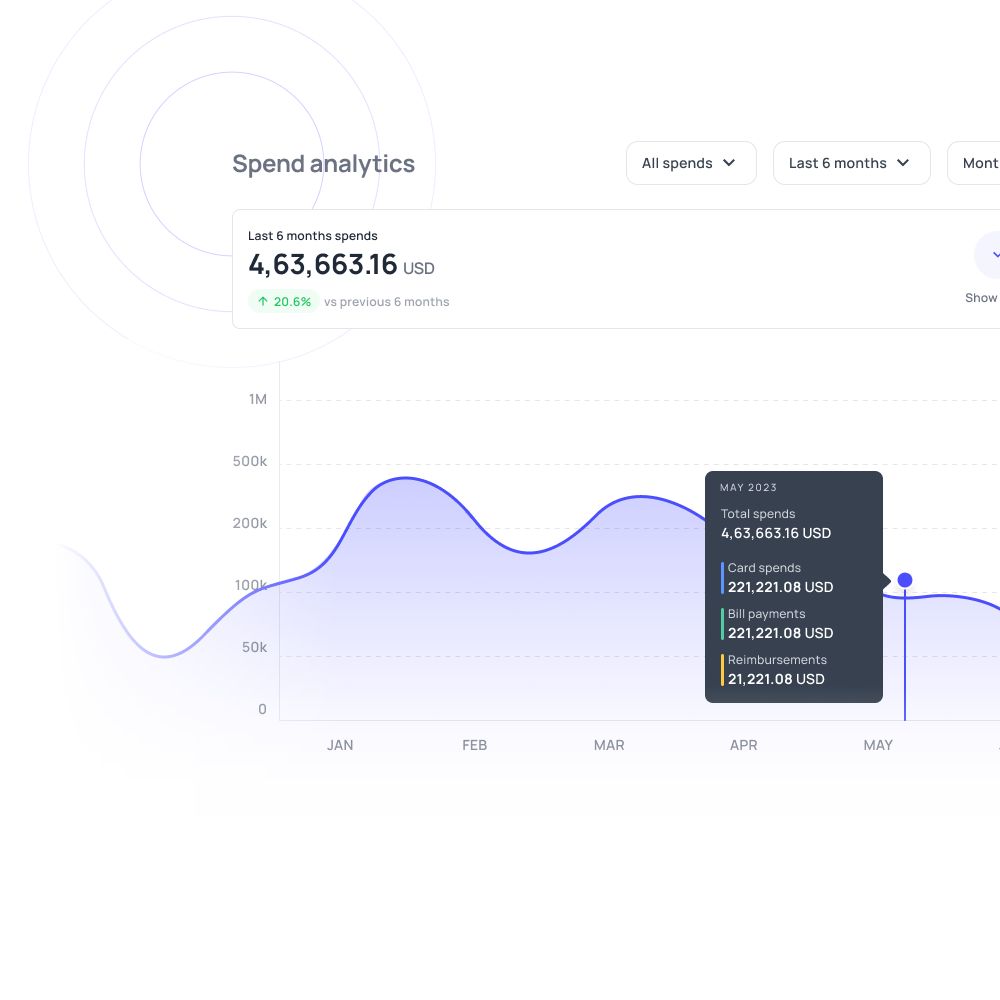

Gain cash flow and payment visibility

Cash flow management is especially important when dealing with bulk purchases and extended payment terms. Volopay provides real-time visibility into approved expenses, upcoming vendor payments, and committed spend, supporting common US payment cycles such as Net 30, Net 60, and Net 90.

Finance leaders can forecast cash requirements more accurately, avoid last-minute funding gaps, and make informed decisions. A centralized view of liabilities and expenses strengthens financial planning across the organization.

Bring Volopay to your business

Get started now

FAQs

Volopay automates invoice approvals, schedules payments based on agreed terms, and consolidates vendor data. This helps manage high-value bulk payments efficiently while maintaining strong supplier relationships and clear audit trails for US compliance needs.

Yes. Volopay allows you to categorize and track ingredient procurement, packaging costs, utilities, maintenance, and other operational expenses in one unified system.

You can schedule payments in advance, track outstanding liabilities, and align cash flow planning with longer payment cycles, all without manual follow-ups.

Volopay lets you define budgets, approval workflows, and spending limits based on category, department, or role, ensuring policy compliance across the business.

Yes. Volopay integrates with popular accounting and ERP platforms used in the US, enabling automatic data sync and faster reconciliation.

All supplier invoices and payments are centralized, making it easy to analyze spend trends, manage contracts, and avoid duplicate or unapproved purchases.

Volopay supports corporate card spending as well as employee reimbursements, giving you flexibility while maintaining full visibility and control.

Real-time dashboards show approved spend, pending payments, and upcoming commitments, helping finance teams plan cash flow with confidence.

You can generate detailed reports by category, vendor, location, or time period to support COGS analysis and cost optimization efforts aligned with US financial reporting requirements.

Most food and beverage businesses can get started within a few days, with guided onboarding and integrations to existing systems.