D2C expense management with Volopay: Control every dollar

Managing expenses across your direct-to-consumer brand shouldn't feel like juggling spreadsheets, receipts, and vendor invoices. As your business scales, fragmented spending across marketing channels, fulfillment partners, SaaS tools, and team members creates blind spots that slow you down.

D2C expense management needs to be as agile as your brand, giving you real-time visibility into where every dollar goes without adding administrative overhead.

Volopay centralizes your entire expense ecosystem into one unified platform. From Facebook Ads spend to packaging vendor payments, from Shopify subscriptions to employee travel costs, you get complete control and clarity.

Built specifically for growing ecommerce brands, Volopay helps you track, control, and optimize spending while your team focuses on scaling revenue.

All-in-one D2C expense management

Running a D2C brand means managing multiple expenses: marketing campaigns, vendor operations, and a complex tech stack including analytics, email, and inventory tools.

Traditional expense management for e-commerce brands forces you to cobble together multiple tools, creating data silos that hide your true financial picture. Volopay's comprehensive expense management platform brings everything together: corporate cards, bill payments, invoice approvals, reimbursements, and accounting integrations in a single dashboard.

The platform adapts to your workflows, with custom approvals, team-based spending policies, and automated tasks. As your brand expands into new channels or geographies, Volopay scales with you without requiring system overhauls.

Control marketing spend across multiple channels

Marketing is often your largest expense, across multiple platforms and campaigns, including paid social, search ads, influencer partnerships, and content production. Tracking these costs is essential to understand acquisition and campaign ROI.

Volopay lets you issue dedicated virtual cards for each marketing channel or campaign. Your social media manager gets a card specifically for Meta Ads with preset spending limits. Your performance marketing lead receives separate cards for Google Ads campaigns.

Each transaction auto-categorizes, giving detailed channel-level spending visibility. Card limits can be adjusted instantly, without waiting for finance approvals. Real-time alerts notify stakeholders as budgets approach limits, and month-end reports show exact channel spend and optimization opportunities.

Track vendor payments end-to-end

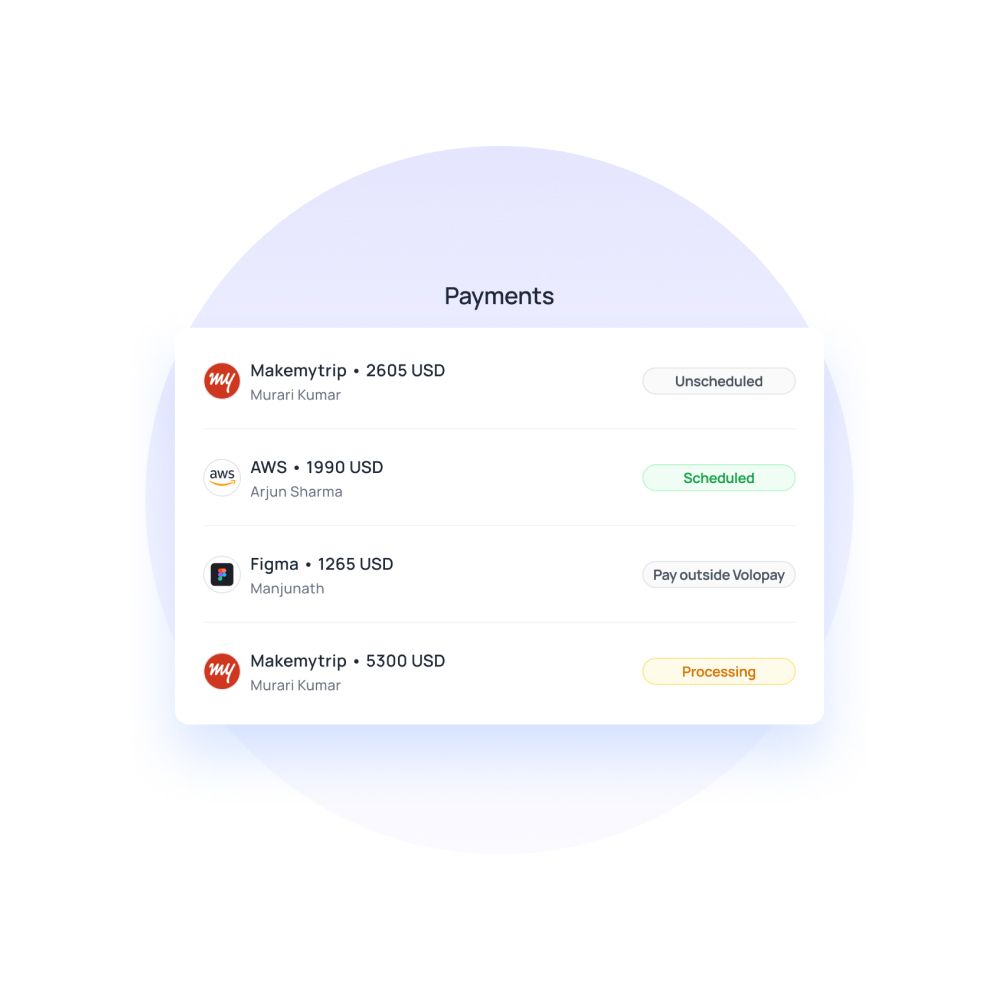

Your vendor network drives product delivery, but managing payments often means scattered invoices, schedules, and reconciliation. Packaging suppliers, co-manufacturers, fulfillment centers, and logistics providers all require timely payments with proper documentation.

D2C business expense software from Volopay digitizes your entire vendor payment workflow. Upload invoices directly into the platform, route them through customized approval chains, and schedule payments according to your cash flow needs. Every vendor relationship gets its own payment history.

The platform supports both one-time and recurring vendor payments. Set up automatic monthly payments for warehouse rent or regular packaging orders. All payment documentation is securely stored for audits or tax filings.

Manage digital expenses & SaaS subscriptions

Your D2C brand relies on software - Shopify, WooCommerce, Klaviyo, Gorgias, and more. These subscriptions renew monthly or annually, often on different cards, making it difficult to track total software spend.

Volopay's D2C spend management platform gives you complete visibility into your SaaS ecosystem. Assign virtual cards to specific software categories, ensuring each subscription has its dedicated payment method.

Renewals automatically appear in your dashboard with proper categorization, helping prevent service disruptions. Set primary and backup payment methods for critical tools and receive alerts before renewals to review, downgrade, or cancel subscriptions.

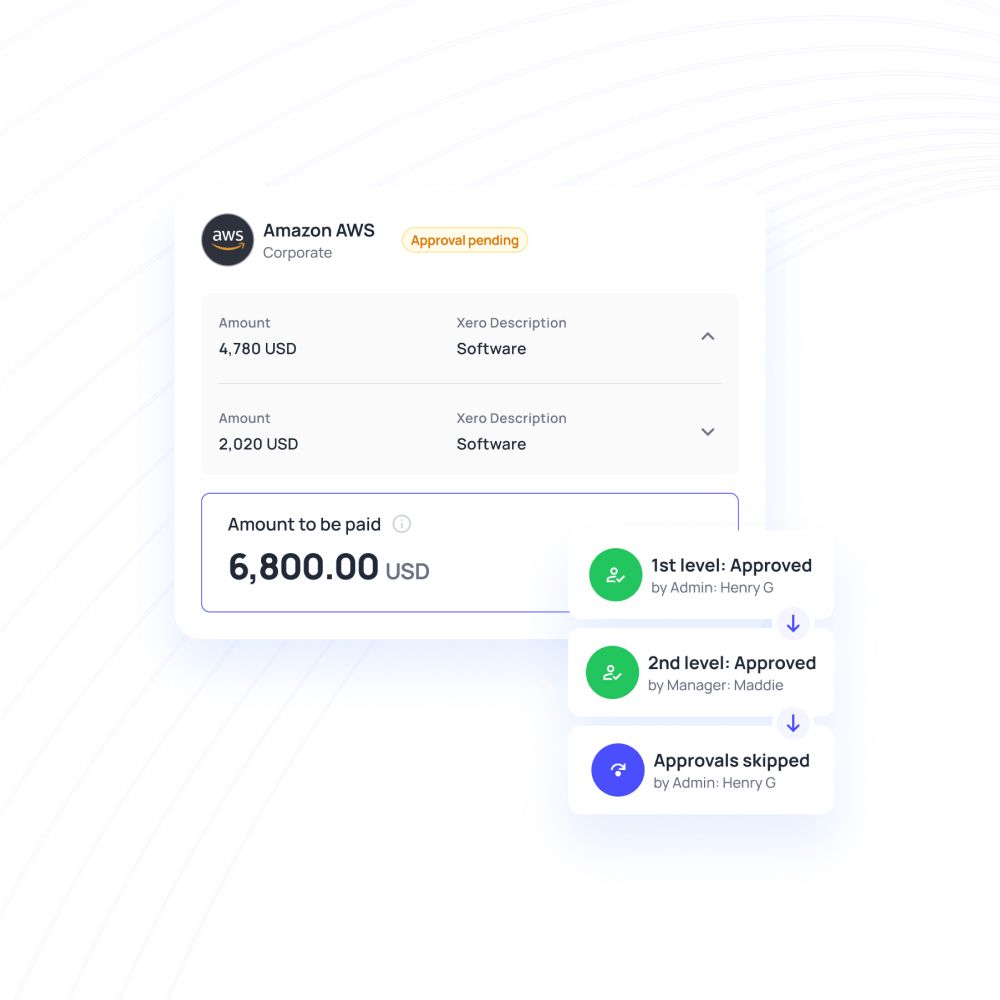

Automate invoice processing and approvals

Manual invoice management consumes finance hours, creating bottlenecks that frustrate vendors and delay payments. Invoices arrive via email, paper, or vendor portals, and teams manually enter data, chase approvals, and reconcile payments across accounts.

With expense management for D2C brands, Volopay automates invoice workflows from receipt to payment. Vendors can submit invoices directly through email or the platform portal. OCR

technology extracts key data automatically, populating payment forms with vendor details, amounts, and due dates.

Approvers receive notifications with full context to decide quickly. Once approved, schedule payments immediately or batch them per your cash strategy. The audit trail stays accessible for month-end close, taxes, and investor reporting.

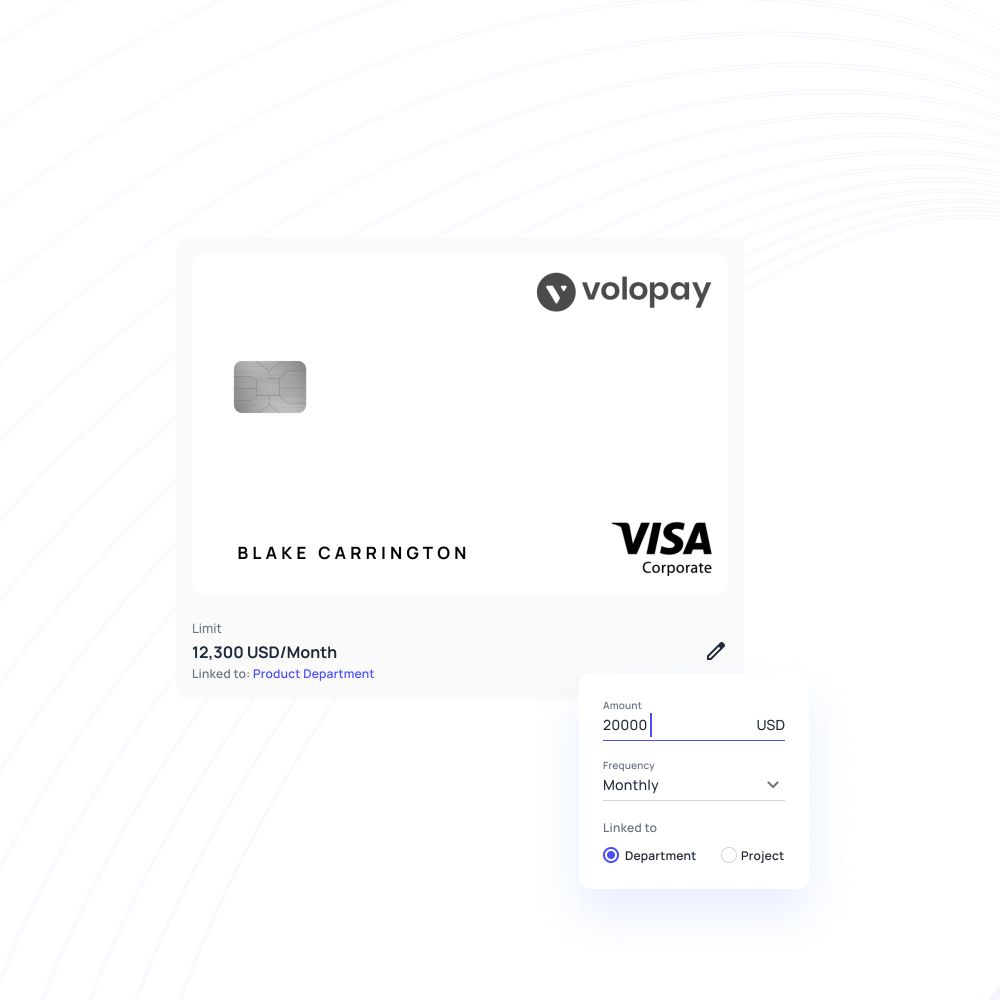

Issue corporate cards with built-in controls

Corporate cards speed up operations but often sacrifice control and visibility. Shared cards cause attribution confusion, individual cards risk overspending, and reimbursements slow legitimate expenses.

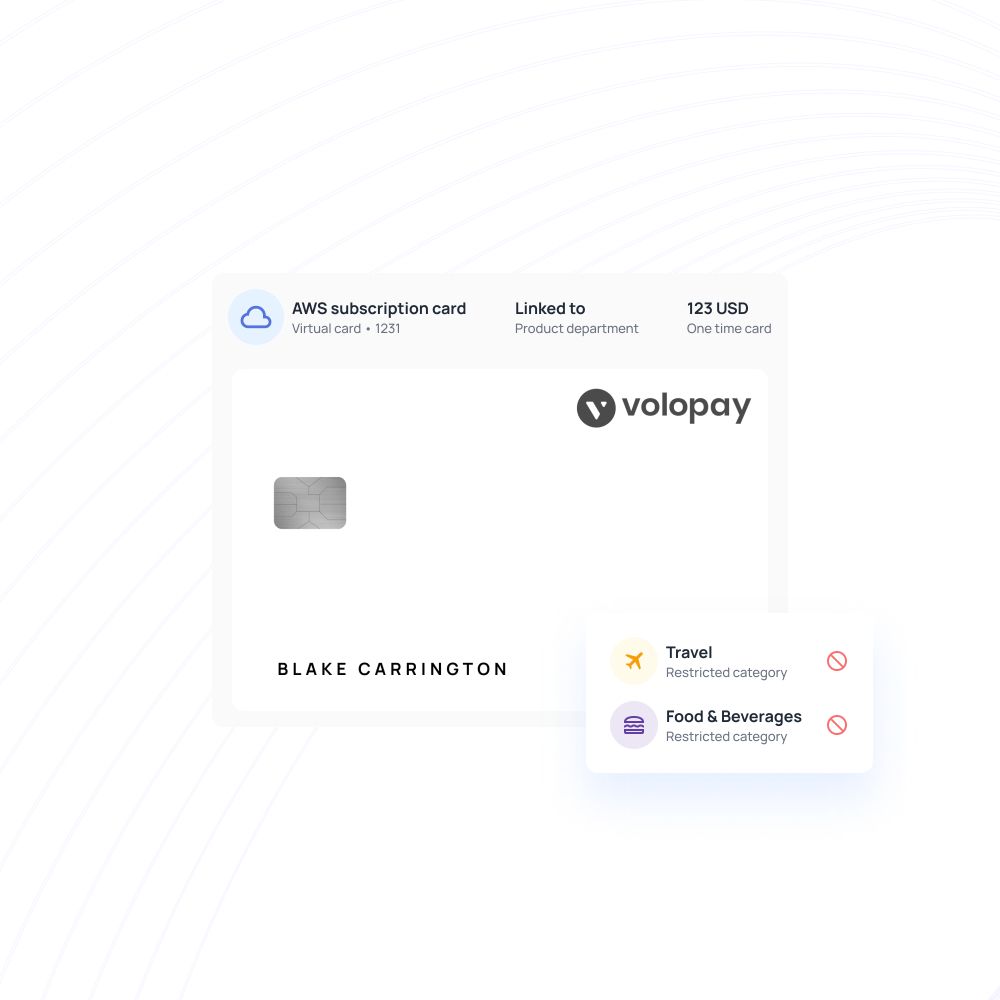

Volopay's corporate card program solves these challenges through programmable spending controls. Issue physical or virtual cards to any team member with custom limits, merchant category restrictions, and validity periods.

Your content creator gets a card for stock photography, and your operations manager for supplier purchases. Each transaction appears in real time with automatic categorization and receipt capture.

Employees snap photos of receipts through the mobile app, attaching them directly to transactions. You gain complete visibility into who spent what, where, and why.

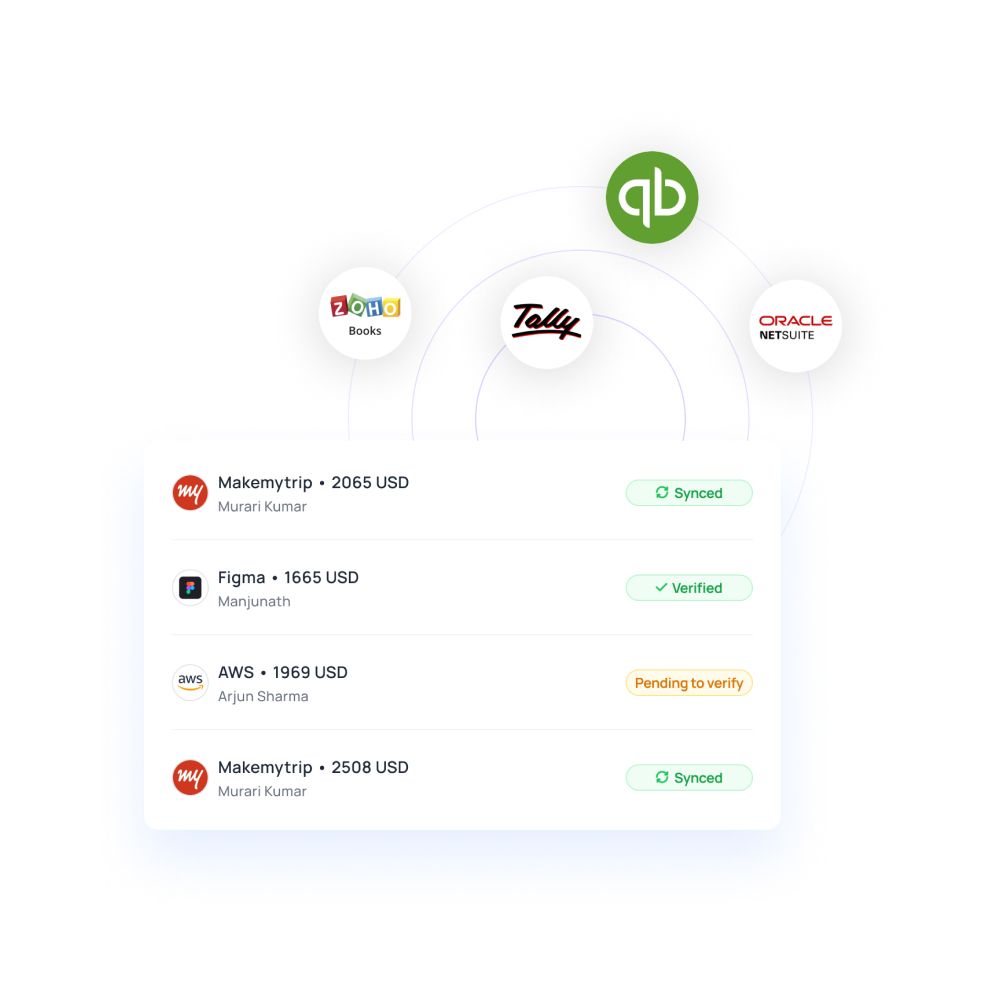

E-commerce accounting system integration

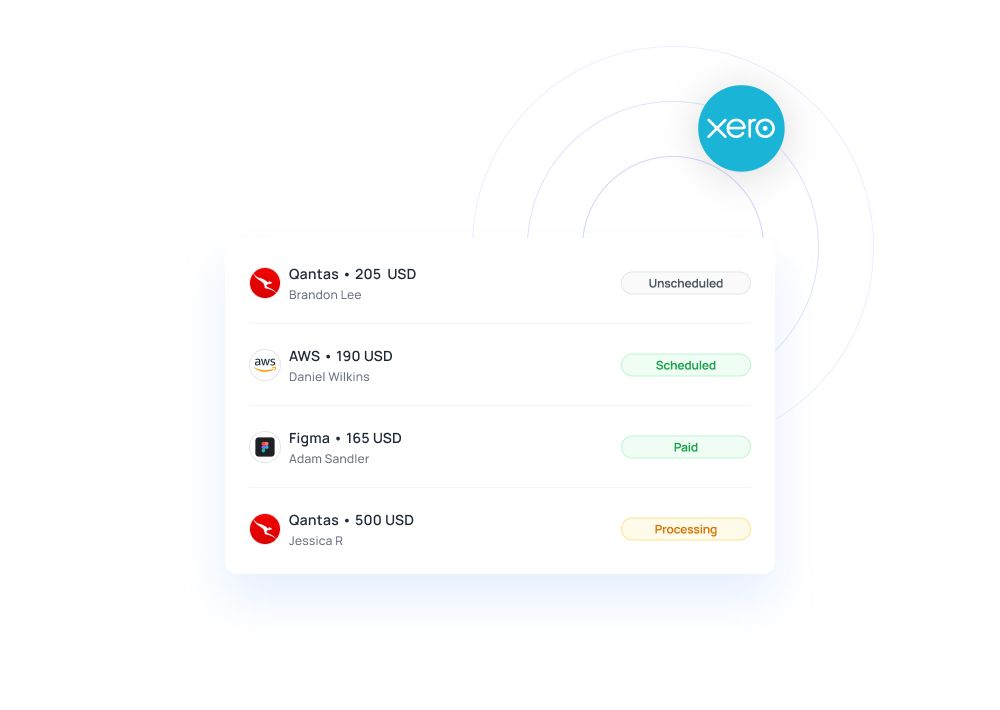

Isolated financial systems create reconciliation headaches and reporting delays. Your direct-to-consumer expense tracking platform must connect with accounting, ecommerce, and other systems to create a single source of truth.

Volopay integrates directly with popular accounting platforms like QuickBooks, Xero, NetSuite, and more. Transactions sync automatically with proper categorization, eliminating duplicate data entry and reducing month-end close time by days. Custom fields map to your chart of accounts.

Beyond accounting, the platform connects with your e-commerce and operational tools. Pull revenue data from Shopify to track spending versus sales. Integrations create a connected financial ecosystem with automatic data flow.

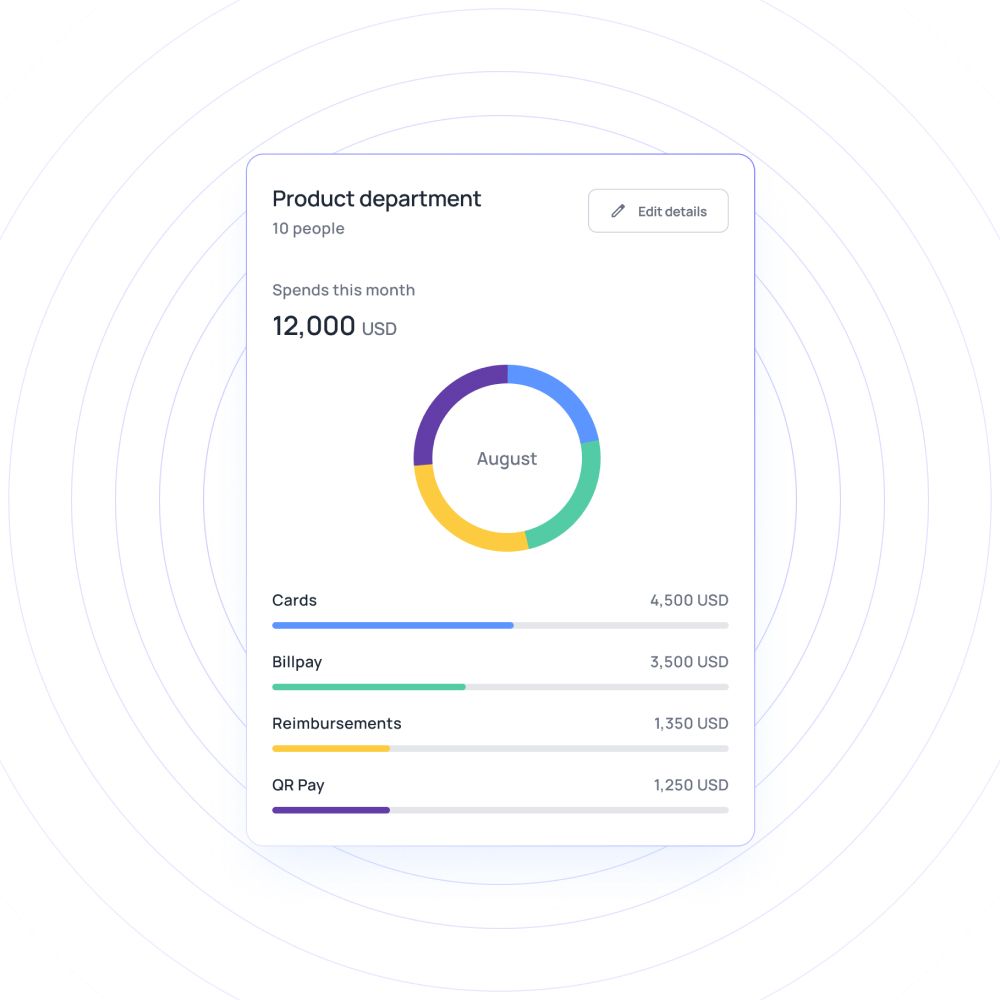

Gain visibility into cash flow and burn rate

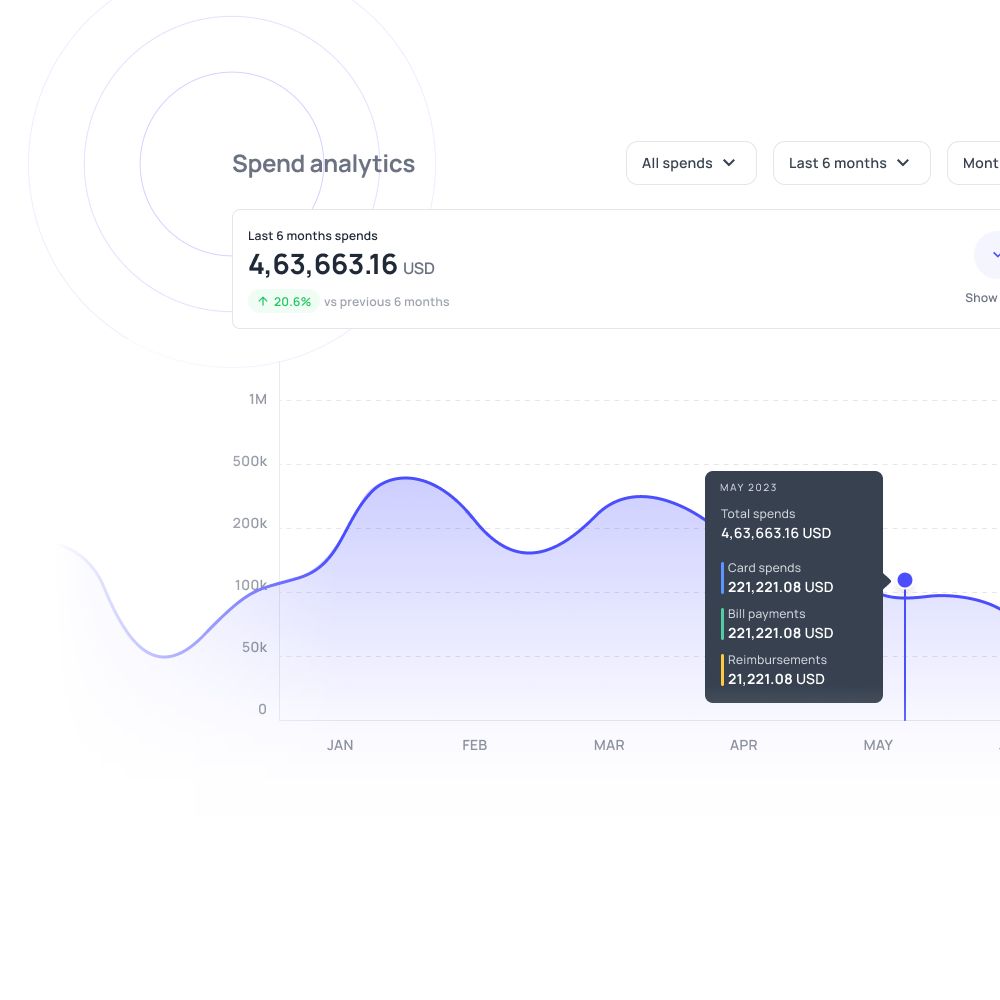

Understanding your financial runway is critical for D2C brands, whether bootstrapped with tight margins or venture-backed monitoring burn for investors. Traditional accounting provides backward-looking reports weeks after month-end.

Volopay's real-time dashboards show exactly where your money flows as it happens. See daily spending across all categories, compare actual expenses against budgets, and project your runway based on current burn rate.

Filter views by department, vendor, or expense type. These insights enable proactive cash management. If marketing spend exceeds plan, adjust budgets before using critical runway. During fundraising or investor updates, pull accurate financial reports instantly.

Bring Volopay to your business

Get started now

FAQs

Volopay assigns unique virtual cards to each SaaS subscription, automatically categorizing renewals and providing visibility into your entire software stack to identify unused subscriptions.

Yes, Volopay handles vendor bill payments, invoice approvals, corporate card expenses, and employee reimbursements in one platform.

You can set up virtual cards for recurring digital expenses with automatic renewals. The platform tracks subscription costs and alerts you before renewals.

Absolutely. Volopay allows custom spending policies, budgets, and card limits for each department, project, or individual team member.

Real-time dashboards show daily spending patterns, budget utilization, and runway projections, enabling proactive adjustments before cash burns beyond planned thresholds.

Yes, you can create unlimited virtual cards with custom limits, merchant restrictions, and validity periods tailored to specific use cases.

The platform digitizes vendor invoice submission, approval workflows, and payment scheduling while maintaining complete payment history and documentation.

Volopay connects with QuickBooks, Xero, NetSuite, and other major accounting platforms. Transactions sync automatically with proper categorization.

Most D2C brands complete implementation within a few days, including setting up your chart of accounts, configuring approval workflows, and integrating with existing systems.