Benefits of online receipt management over paper receipt

When it comes to business transactions, receipt management is very important. Scaling businesses will have scaling expenses, which means more receipts to handle. Be it reimbursing employees or matching credit statements with the company ledger, receipts in whichever form, paper or online receipts are an indispensable part of the business expenses management process.

But for a long time, the traditional method of receipt management has pulled back finance teams in organizations from performing to their full potential.

What is receipt management?

Receipt management is an activity that involves the collection and sorting of receipts for various purposes. Two of the most common ones are:

Reimbursing your employees when they make an expense on behalf of your business. And matching corporate credit card statements with the expenses recorded in the company books.

Traditional receipt management is done manually by finance teams where they are responsible for collecting all expense receipts from employees, storing them safely, and sorting them when needed. Nowadays the trend, rather a need of the hour, is to adopt digital receipt management.

Why is receipt management important?

Receipt management helps a company be prepared for financial audits. Receipts act as proof of expense for companies. This is why organizations maintain a system to collect and store receipts for future reference and reconciliation.

When finance teams can successfully match company expenses in the ledger with those listed in their expense reports and credit card statements, then they can close the book of accounts on time. This improves the cash flow status and overall financial performance of the organization.

Business receipt management also gives you the visibility to check whether an employee is taking undue advantage of the fact that they can spend on behalf of the company. In cases where it seems like unnecessary expenses were made, they can be identified, clarified with the employee, and ensured that issues like this don’t occur again.

Since this whole business expense management affair is such a big deal, every company strives to make its system as efficient as possible. But the traditional process of receipt management is surely not the way to go about it.

Challenges of traditional receipt management

Delay in approvals and payments

Finance teams usually have a fixed time during a month when they deal with reimbursements. So even if an employee submits their receipts along with their expense receipts early on, they will not be reimbursed before the next month.

Plus, the chances of submitting an expense report early are also quite low as you never know when you might have to carry out another expense. This leads to employees only getting their reimbursements approved and paid in the following month.

Loss of paper receipts

Paper receipts makes the collection and sorting process a tedious task as there is always a chance of losing or misplacing it. Even before the receipt reaches the finance department, there are high chances that an employee might lose the receipt.

In the case that this expense was made by the employee through their personal funds, it becomes tough to get the reimbursement. And if the receipt lost is from an expense made through a corporate card, it turns into a hindrance to carrying out the reconciliation process.

Takes a lot of time

The employee keeps the receipts with themselves until it is time for them to submit it with their expense reports at the end of the month. Once these receipts are collected by your finance team, the receipt management process begins.

The most time-consuming element of this process is probably sorting through the huge pile of paper receipts and trying to find the one that corresponds with those in the company ledger and credit card statements. Depending on the size of your company this can take anywhere from weeks to months.

Fraudulent activity

A major reason why companies have shifted to receipt management software is to minimize and curb the fraudulent activity. Traditional process of managing receipts has too many gaps where fraud can slip through and go unnoticed.

Chances of manipulation are high due to manual data entry. Another way fraud slips through the cracks is when there are duplicate entries or unwarranted expenses on credit statements that go unnoticed or missed by the accountants leading to your organization paying more than you are required to pay. Small frauds that may occur occasionally can add up to huge amounts of money over time.

Data inaccuracy

Part of the traditional receipt management system involves an accountant manually checking and entering the amount from the receipts. Be it for reimbursements or matching expenses, even a small error can lead to many problems.

On one hand, if receipts are being checked for reimbursement, the finance member might accidentally enter a lower amount, or worse a higher amount, and end up sending more money than required. In the case of reconciliation, a small misentry will lead to the entire accounts payable not matching with credit card statements and the accountant will have to recheck all expenses and receipts to see where the error is occurring.

Go paperless with digitization and automation

Benefits online receipt management for your business

Easy to audit

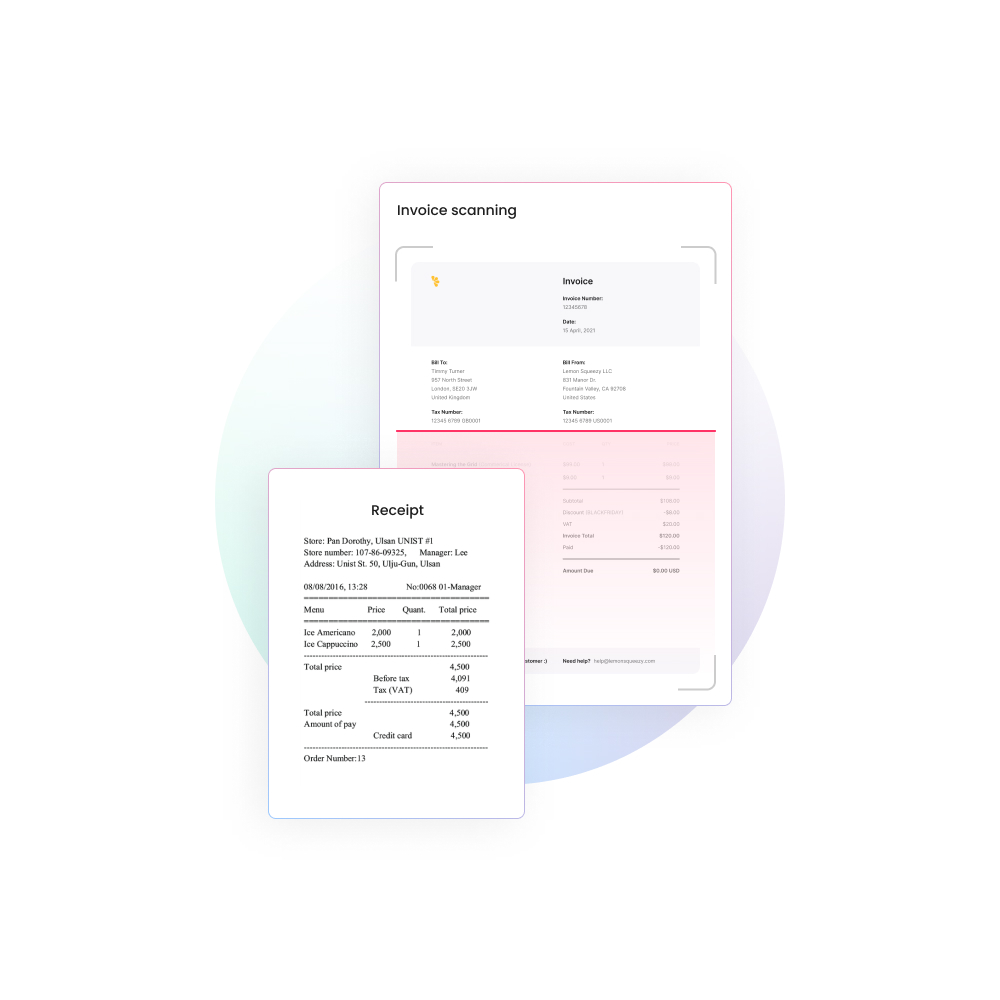

When receipts are submitted by employees using an receipt scanning app, there is much more transparency and visibility across all stakeholders. Employees can easily attach receipts to their corresponding transactions on the credit provider’s platform making the need for manually sorting receipts redundant.

The financial controller can immediately check the receipt and the transaction statement as they’re already matched together. This approach makes the reconciliation and auditing process for accountants extremely straightforward. No more spending hours sorting through piles of paper receipts trying to find the correct expense report.

Advanced expense reporting

Now instead of an employee submitting their expense report at the end of each month, they get the option to report their expense and digitally attach a picture of the receipt instantaneously.

When using Volopay, it works through our mobile app where every time an employee makes a purchase using our corporate credit card, it is reflected in their expense ledger, and the financial controller can see it as well. The employee can attach the receipt immediately making the whole process transparent. Plus, they don’t need to worry about losing the receipt anymore.

Easy to use and open access

A business receipt management system that makes things easy should innately be easy to use as well. For the employee, the financial controller, and any other member who is part of the process.

Volopay is a business expense management software that has a desktop web dashboard and a mobile application to report expenses remotely. Any employee can easily be added to the business account as a member and given access to company funds.

Reduce manual efforts

When you decide to utilize a digital receipt management software like Volopay, the happiest among your employees will most definitely be your finance team. The traditional receipt management approach involved your accountants spending a lot of time doing manual work. Collecting, sorting, and then matching expenses was all done manually.

With receipt management software, the collection process gets eliminated. There is no more need to sort receipts as they are uploaded by employees directly to the expense that was made, and all the accountants need to do now is verify whether the receipt matches the expense. Some systems take this even further with automated reconciliation of receipts using AI and ML technology.

Faster reimbursements

Since employees don’t need to submit expense reports with all their receipts only at the end of the month, they can now receive faster reimbursements. Since the receipts are directly uploaded on the platform where the expenses are recorded, the financial controller or admin can check and process the reimbursement immediately. Employees receiving their reimbursements within a day or two keeps them happy and morale high.

Easier for finance team

Saying that an online receipt management system makes your finance team’s job easier would be an understatement. It literally makes their life easier. From carrying out reimbursements to the reconciliation of credit statements, everything a business needs to do with expense receipts becomes a streamlined process with little to no friction at all.

Saves money and time

Submitting receipts online saves an employees time from sitting and creating expense reports at the end of each month. Automated collection and sorting of receipts save a finance team member’s time.

Since most of the manual work of an accountant gets automated, they get more time to check and verify the legitimacy of all expenses. In the case that there are errors, they are spotted quickly and action can be taken to rectify them and ultimately save the business from losing money.

Automate your workflow

Using the tech ecosystem for receipt management makes the entire process more efficient. Each step that your accountant had to complete previously is now automated. This makes controlling and maintaining your budget even easier.

Integrate with accounting software

A big part of online receipt management is that it gives you the ability to integrate expenses with your accounting software. This helps you sync expenses directly to your company ledger and close the books of accounts more efficiently.

How can Volopay help you manage business expense receipts better?

Volopay along with being an online receipt management software is a complete expense management ecosystem. Collecting, tracking, sorting, storing, viewing, and managing receipts becomes as efficient as the click of a button through an OCR expense management system.

Digital receipt management is the step companies take to make managing expenses a hassle-free process and keep your financial statements audit-ready at any time. Many organizations around the world still use the traditional approach to receipt management. But, it’s never too late to change for the better.

Trusted by finance teams at startups to enterprises.