Reliable prepaid travel cards built for U.S. businesses

When you're managing business travel expenses, traditional methods like corporate credit cards or employee reimbursements can create administrative headaches and budget overruns. You're likely familiar with the challenges: delayed expense reports, unauthorized purchases, and complex reconciliation processes that drain your finance team's time.

Prepaid travel cards — a type of prepaid corporate card — offer a smarter solution for your business travel needs. These cards allow you to load specific amounts before trips, giving you complete control over spending while eliminating the paperwork burden.

With real-time tracking and automatic expense categorization, prepaid travel cards streamline your entire business travel expense management process, making them an increasingly popular choice for forward-thinking companies.

What is a prepaid travel card?

A prepaid travel card is a payment solution that allows you to load funds in advance and use them for business expenses while traveling.

Unlike traditional credit cards, these cards operate on a pay-as-you-go basis, giving your company complete control over travel spending.

Prepaid cards for travel eliminate the need for cash advances and provide real-time expense tracking for better financial management.

How prepaid travel cards work for U.S. businesses

You simply load money onto the card before your trip, and employees can use it anywhere the card network is accepted. There's no credit involved—you can only spend what's been preloaded.

This load-and-use model helps you maintain strict budget control while providing employees with convenient access to funds for meals, transportation, and other approved business expenses.

Ideal for global travel

Prepaid travel cards excel in international markets, offering seamless compatibility with global payment systems. You can use them at ATMs, hotels, restaurants, and retailers worldwide without worrying about currency conversion hassles.

Most cards support multiple currencies and provide competitive exchange rates, making them perfect for multinational business operations and frequent international travelers.

Why your US business needs prepaid cards for travel

Managing business travel expenses can be a logistical nightmare without the right financial tools. A prepaid travel card for business offers a streamlined solution that puts you in control while keeping your employees equipped for successful trips.

Budget control

A business prepaid travel card lets you allocate fixed travel funds per trip or team, ensuring you never exceed your travel budget. You can load specific amounts for each journey, preventing overspending and giving you complete visibility into travel costs before trips even begin. This proactive approach eliminates budget surprises and helps maintain financial discipline across your organization.

Eliminate out-of-pocket reimbursements

Stop the cycle of employees using personal cards and waiting for reimbursements. Your team can focus on business objectives instead of tracking receipts and processing expense reports.

This reduces administrative burden on both travelers and your finance team, while improving employee satisfaction by eliminating the need to float company expenses on personal accounts.

Real-time expense tracking

Monitor card usage instantly during trips, giving you immediate insights into spending patterns and budget utilization. You can track transactions as they happen, identify any unusual activity, and ensure compliance with company policies. This real-time visibility helps you make informed decisions about travel budgets and identify opportunities for cost optimization.

Avoid foreign transaction fees

Support global spending without hidden charges that can significantly impact your travel budget. Many prepaid travel cards for business offer competitive exchange rates and eliminate foreign transaction fees, making international travel more cost-effective. Your employees can spend confidently abroad without worrying about surprise charges that can add up quickly on extended trips.

Policy enforcement on the go

Maintain spend rules without needing manual checks, ensuring compliance even when you're not physically present. Set merchant category restrictions, spending limits, and time-based controls that automatically enforce your travel policies. This automated approach reduces the risk of policy violations and helps maintain consistent spending behavior across your entire team.

Real-world scenarios: How businesses use Volopay's prepaid cards for travel

Your growing startup faces unique challenges when expanding internationally. Remote team members need access to funds for overseas travel, client meetings, and business development activities.

With Volopay's prepaid cards, you can instantly issue both physical and virtual cards to remote employees across different countries.

Each card comes with customizable spending limits based on trip duration and purpose, while real-time tracking gives you complete visibility into travel expenses as they happen, eliminating the traditional reimbursement delays that can strain cash flow.

Your field sales representatives are constantly traveling between client meetings, conferences, and territory visits.

Managing their expenses while maintaining budget control can be challenging. Volopay's category-based merchant controls allow you to set specific restrictions on card usage, enabling hotel bookings and meal expenses while blocking non-essential purchases.

Your sales team gets the flexibility they need for client entertainment and travel, while you maintain strict oversight through automated spending alerts and real-time expense monitoring that prevents budget overruns.

Your operations teams work across different regions, each with varying cost structures and travel requirements. With Volopay's departmental budget controls, you can create region-specific spending policies and role-based card limits.

Senior managers receive higher spending limits for business development trips, while junior staff get controlled budgets for routine travel.

The platform's multi-level approval workflows ensure that expenses above certain thresholds require managerial approval, maintaining financial discipline across all operational territories.

Your marketing department manages complex travel scenarios, from trade shows and conferences to client presentations and vendor meetings. Volopay's unified platform lets you manage both vendor payments and travel expenses in one comprehensive view.

You can issue separate cards for different marketing campaigns, set event-specific budgets, and track spending against marketing ROI metrics.

Real-time analytics help you understand which events generate the best returns while maintaining complete control over marketing travel budgets.

Your business often works with external consultants who need access to funds for travel and client-related expenses. Traditional corporate cards require extensive background checks and bank account access, creating security risks.

Volopay's prepaid cards solve this by providing controlled access without exposing your main business accounts.

You can issue time-limited cards with specific spending restrictions, automatically expire access when contracts end, and maintain complete audit trails of consultant spending without compromising your financial security.

Upgrade your travel spend with smart prepaid travel cards

Comparing prepaid travel cards vs. traditional payment methods

When it comes to managing business travel expenses, you have several options. However, not all payment methods are created equal.

A prepaid travel card offers distinct advantages over traditional expense management tools, providing better control, transparency, and efficiency for your business operations.

1. Prepaid card vs. credit card

While corporate credit cards create ongoing liability and require credit checks, prepaid cards for travel operate on a pay-as-you-go model with no credit risk. You load only the amount needed for each trip, eliminating the possibility of overspending or accumulating debt.

Credit cards also expose your business to potential fraud with higher limits, whereas prepaid cards contain risk by limiting exposure to the loaded amount, giving you peace of mind during business travel.

2. Prepaid card vs. reimbursements

Traditional reimbursement processes burden employees with out-of-pocket expenses and create administrative nightmares for your finance team. Prepaid travel cards eliminate this friction by providing immediate access to funds without requiring employees to use personal money.

You avoid the cash flow issues that come with reimbursements, reduce processing time from weeks to minutes, and improve employee satisfaction by removing the financial burden of fronting company expenses.

3. Prepaid card vs. bank transfers

Bank transfers for travel expenses are slow, expensive, and lack spending controls, making them unsuitable for dynamic travel situations. Prepaid cards provide instant access to funds with built-in spending restrictions and real-time monitoring capabilities.

Unlike bank transfers that offer no visibility into how money is spent, prepaid cards give you detailed transaction data, merchant information, and the ability to set category-specific limits, ensuring your travel budget is used appropriately.

Volopay's prepaid travel cards for US businesses

Managing global business travel from the US requires a sophisticated financial solution that understands your unique needs.

Volopay's prepaid travel card is specifically designed for US-based companies that need to manage international teams, comply with domestic business standards, and maintain control over travel expenses across multiple currencies and regions.

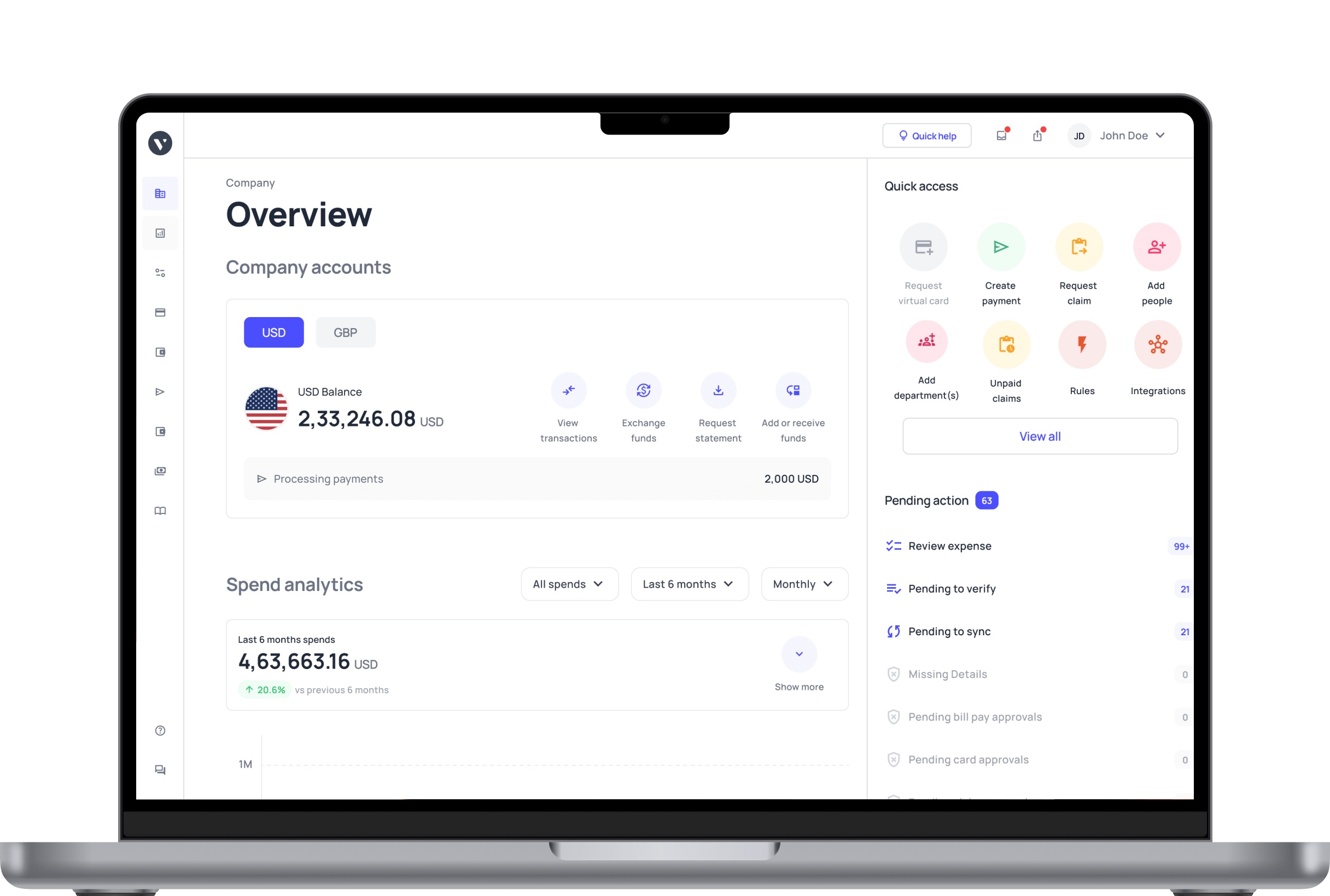

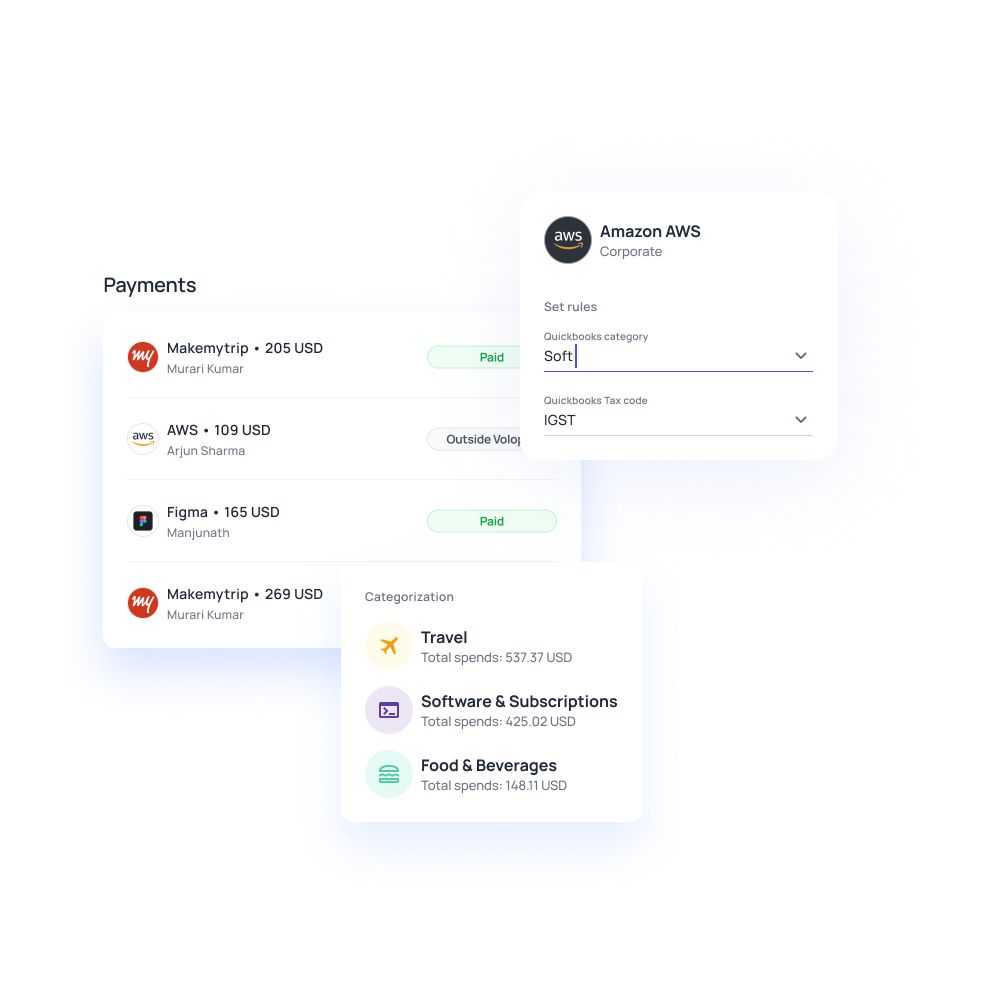

Unified dashboard for all cards

Your entire team's travel spending is visible in one comprehensive dashboard where you can manage team cards, limits, and expenses centrally.

Instead of juggling multiple systems or spreadsheets, you get real-time visibility into every transaction across all your prepaid cards for travel.

This centralized approach eliminates the guesswork in travel budget management and provides instant insights into spending patterns, helping you make data-driven decisions about your travel program.

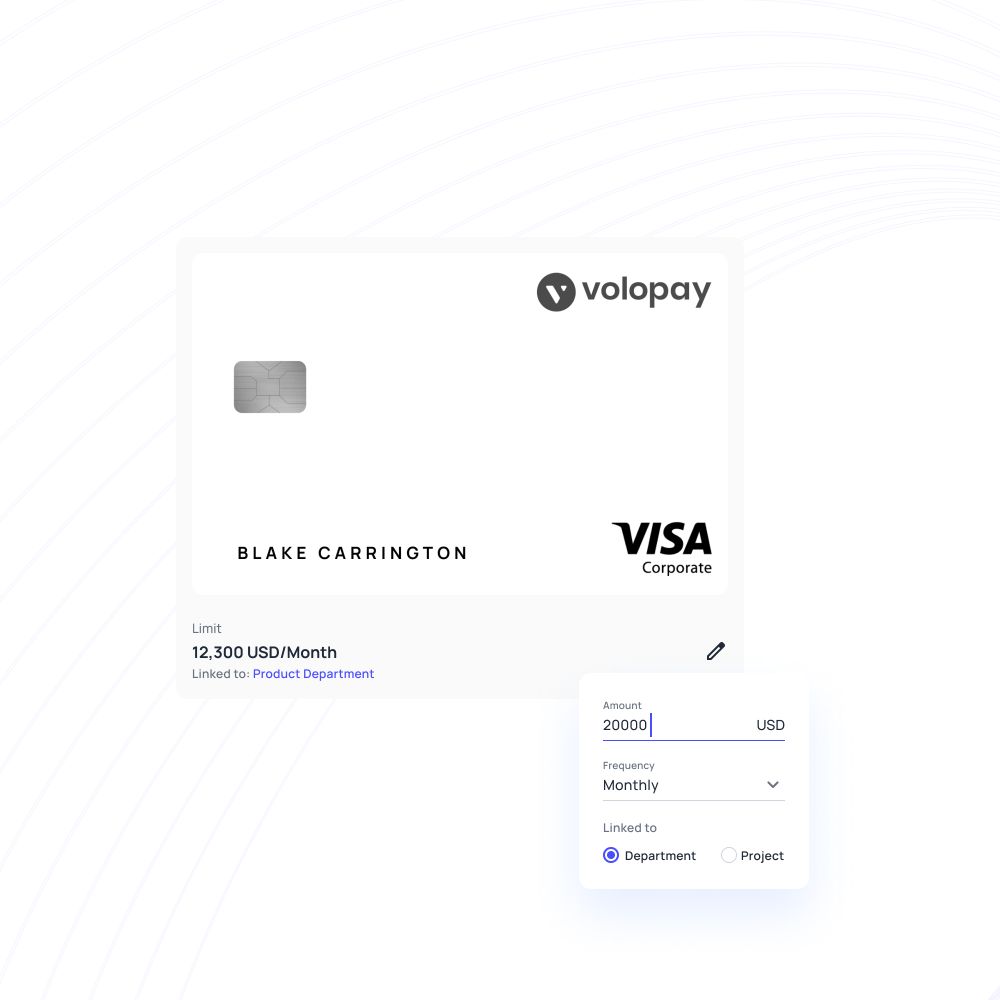

Smart rules and restrictions

Volopay's corporate cards let you control travel spending with smart restrictions that enforce company policies automatically.

Set merchant, category, or geo-based card controls that prevent unauthorized spending without requiring manual oversight.

Whether you need to restrict cards to specific hotel chains, limit spending in certain regions, or block entertainment expenses, these smart rules work 24/7 to ensure compliance with your travel policies while giving travelers the freedom they need to be productive.

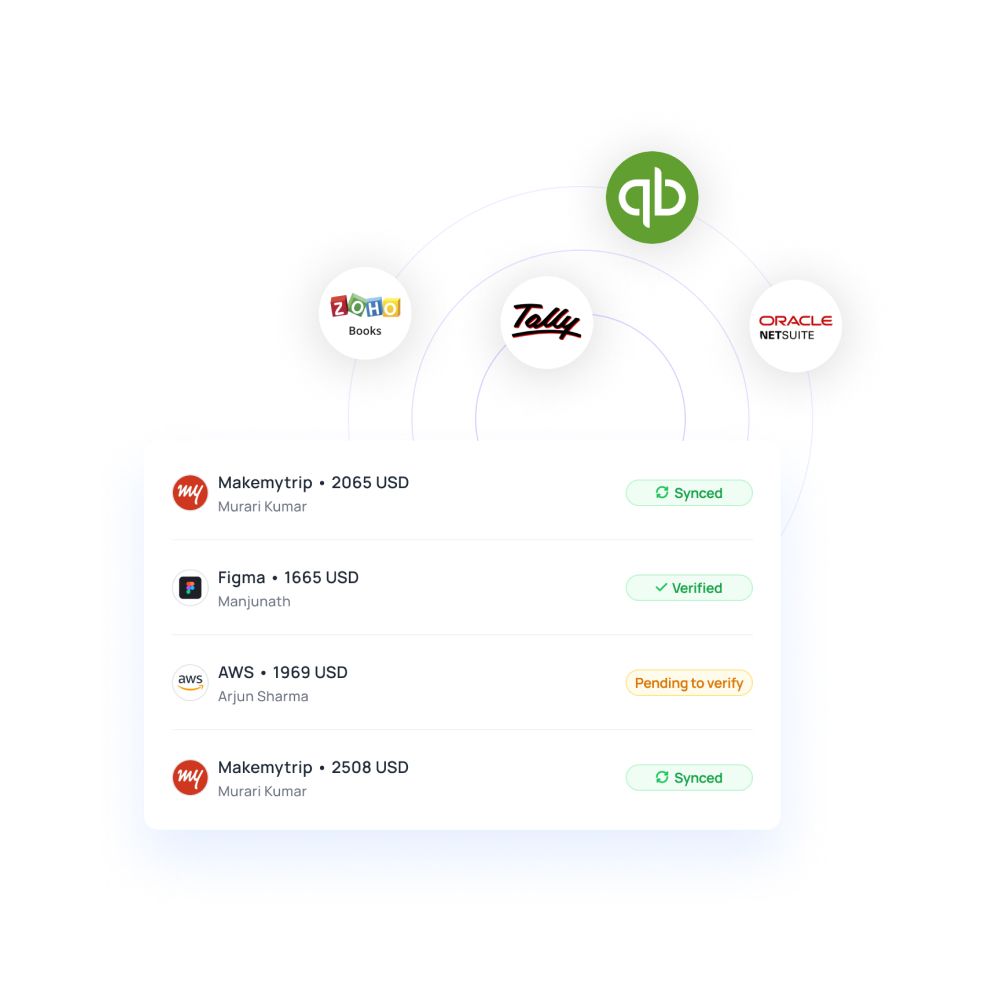

Seamless accounting integrations

Streamline your financial processes with direct integrations to popular US accounting platforms, including QuickBooks, NetSuite, and Xero.

Your travel expenses automatically sync with your existing accounting workflows, eliminating manual data entry and reducing the risk of errors.

This seamless integration means your finance team can focus on strategic initiatives rather than reconciling travel expenses, while maintaining the accuracy and compliance standards your business requires.

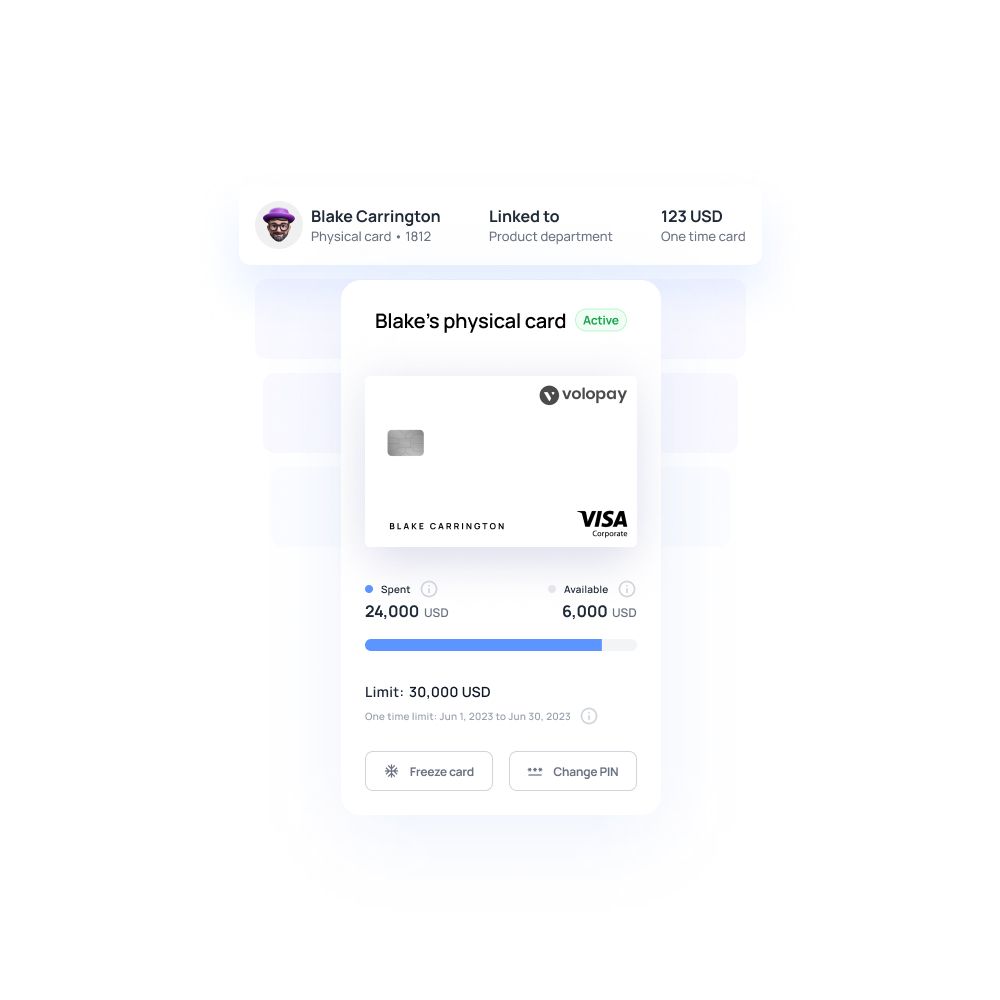

Issue cards instantly to travelers

Create new cards from your Volopay dashboard in seconds, perfect for last-minute business trips or new team members.

When urgent travel opportunities arise, you don't have to wait for physical cards to be mailed or processed through lengthy approval chains.

Digital cards can be issued instantly and used immediately, ensuring your team never misses important business opportunities due to payment delays or administrative bottlenecks.

US-based support

Get expert assistance during your local business hours with dedicated US-based customer support that understands business practices and regulations.

When you need help with card issues, policy questions, or account management, you can speak with knowledgeable support representatives who are available when you're working.

This local support ensures quick resolution of any issues that might arise during critical business travel, giving you confidence in your payment solution.

Start streamlining your business travel costs

How Volopay empowers smarter travel spend management for U.S. businesses

Volopay transforms how US businesses handle travel expenses by offering more than just a prepaid travel card for business. Our comprehensive platform delivers a complete travel spend control system that eliminates the hassles of traditional expense management while providing unprecedented visibility and control over your company's travel budget.

Advanced trip funding

Streamline your travel budgeting with intelligent pre-trip fund allocation that puts you in control before employees even leave the office.

Easily assign specific travel budgets to teams or individual travelers directly through the Volopay platform, completely eliminating the need for reimbursements or last-minute fund transfers.

This proactive approach ensures every trip stays within budget while giving your team the financial flexibility they need.

Dynamic card controls

Take command of your business prepaid travel card spending with sophisticated, real-time controls that adapt to your company's unique needs.

Set intelligent rules based on geography, merchant categories, or transaction limits directly from your Volopay dashboard.

Whether you need to restrict spending in certain locations, limit transactions to specific vendor types, or enforce daily spending caps, our dynamic controls give you granular oversight without micromanaging your team.

Real-time visibility

Stay informed about every travel expense as it happens with comprehensive real-time tracking that keeps you connected to your spending.

Monitor every card swipe, online transaction, and purchase instantly through live notifications and in-app complete visibility features.

This immediate insight allows you to spot potential issues early, make informed decisions on the go, and maintain complete awareness of your travel spending patterns.

Built-in compliance features

Ensure your travel expenses meet regulatory standards with automated compliance tools that simplify audit preparation and policy enforcement.

Our platform automatically enforces company travel policies while capturing and organizing receipts for complete audit trails.

Every transaction is documented and categorized for IRS-ready documentation, making tax season and compliance reviews seamless and stress-free.

Centralized platform experience

Manage your entire travel expense ecosystem from one powerful, unified interface that brings everything together in one place.

Control all travel cards, approval workflows, and spending data through a single dashboard that's accessible anytime, anywhere.

This centralized approach eliminates the need to juggle multiple systems, reduces administrative overhead, and provides a complete view of your organization's travel spending landscape.

How to get started with Volopay prepaid cards for corporate travel expenses

Getting your business set up with Volopay's prepaid travel card for business is straightforward and completely digital. Our streamlined onboarding process gets you from signup to spending control in minutes, not days. Here's your step-by-step guide to transforming how your company manages travel expenses.

Sign up for an account

Begin your Volopay journey by creating your business account with just a few essential details.

You'll need basic information about your company, including business registration details and authorized contact information.

The signup process is designed to be quick, requiring only the necessary documentation to verify your business identity and get you started with your business prepaid travel card solution.

Load funds securely

Once your account is verified, you can securely add funds directly from your business bank account. Volopay uses bank-grade security protocols to ensure your transfers are safe and processed quickly.

You can load funds via ACH transfer, wire transfer, or other secure payment methods, giving you flexibility in how you capitalize your travel spending account. All transactions are encrypted and monitored for your peace of mind.

Issue cards to employees

Create virtual or physical prepaid travel cards for your team members instantly through the Volopay platform.

Virtual cards can be generated immediately for online bookings and digital payments, while physical cards are shipped directly to your employees within a few business days.

You can issue cards on demand for specific trips or maintain standing cards for frequent travelers, giving you complete flexibility in how you distribute spending power.

Set controls and track spend

Customize spending controls and monitoring parameters for each employee, trip, or department according to your business needs.

Set transaction limits, geographic restrictions, merchant category controls, and approval workflows that align with your company's travel policies.

Real-time spending tracking gives you instant visibility into how funds are being used, while automated reporting keeps you informed of all travel-related expenses as they occur.

Bring Volopay to your business

Get started now

FAQs about prepaid cards for travel

Yes, prepaid cards are funded with a pre-loaded amount and aren't linked to your bank account, offering better spending control and security. Debit cards draw directly from your bank account, which can lead to overdraft fees and expose your primary banking information during travel.

Absolutely. Volopay prepaid travel cards can be reloaded instantly through your dashboard, allowing you to add funds from your business bank account as needed during trips.

Volopay cards can be instantly frozen through your mobile app or dashboard. We'll issue a replacement card immediately, and virtual cards can be created instantly for continued spending while you wait for a physical replacement.

Virtual cards are issued instantly for immediate online use. Physical cards are shipped within a few business days, ensuring your team has payment solutions ready when they need them.

Yes, Volopay prepaid travel cards work worldwide and support multi-currency transactions, automatically converting payments at competitive exchange rates for smooth international business trips.