Employee spending cards to manage team expenses

Employee spending cards are revolutionizing how businesses manage team expenses by eliminating manual reimbursements, providing real-time spending control, and offering complete visibility into company expenditures. Traditional expense management often leaves you struggling with delayed reimbursements, poor oversight, and administrative headaches.

Volopay's employee spending cards transform this chaos into streamlined, automated expense management that gives you complete control over your team's spending while simplifying the entire process.

What are employee spending cards?

Understanding employee spending cards is crucial for modernizing your expense management approach and solving persistent financial control challenges.

Meaning and purpose of employee spending cards

Employee spending cards are prepaid or credit-based payment solutions that you issue directly to team members for business expenses. A highly effective type among these are reloadable debit cards. These spending cards for employees serve as controlled payment tools that eliminate the need for personal expense advances and provide you with instant oversight over company spending, ensuring every transaction aligns with your budget and policies.

How spending cards for employees work

You issue employee spend cards to team members with predetermined spending limits and category restrictions. Once activated, you can allocate funds, set automatic reloads, and track every transaction in real-time through centralized dashboards.

Your employees use these spend cards for employees like regular payment cards, while you maintain complete visibility and control over all expenditures through automated reporting systems.

Why your business needs employee spending cards

Eliminate out of pocket spending

Employee spending cards eliminate the burden of out-of-pocket expenses and lengthy reimbursement processes.

Your team members no longer need to use personal funds for business expenses, reducing financial stress and improving employee satisfaction while streamlining your accounting processes.

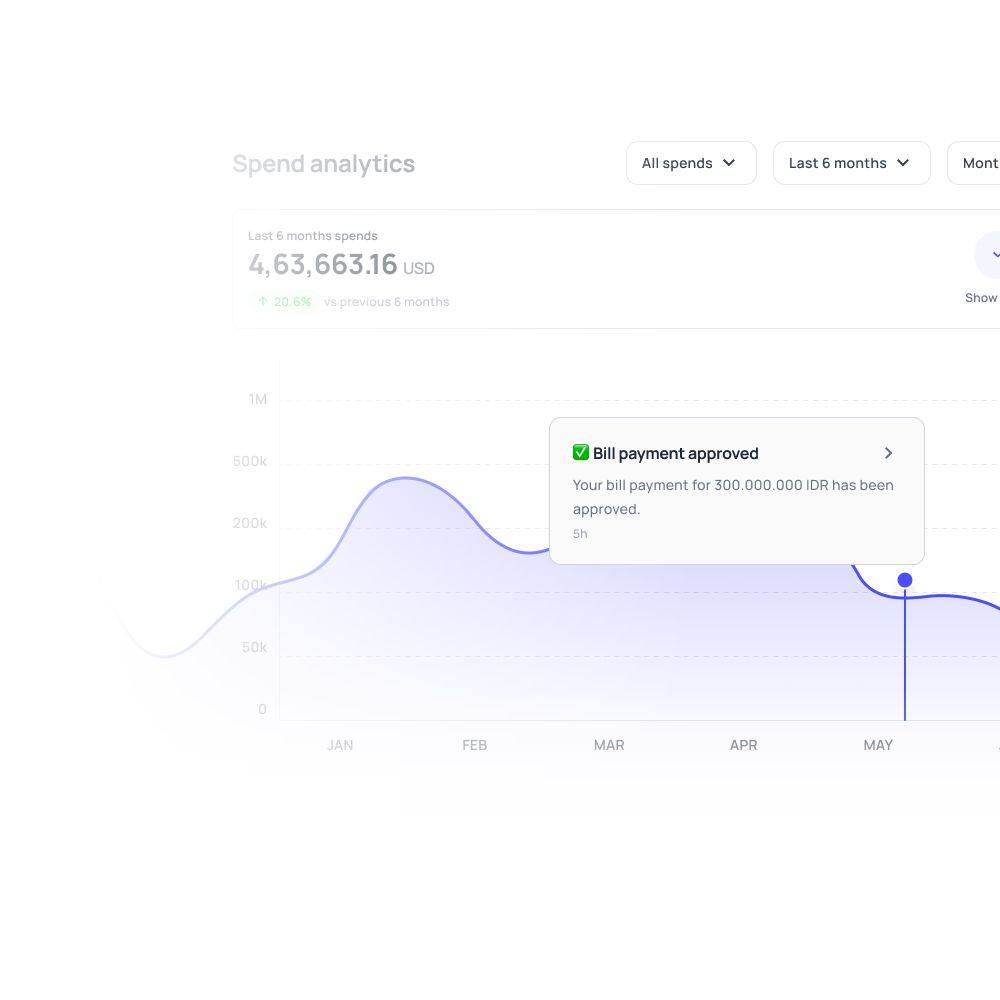

Gain real-time visibility and control

You gain instant visibility into all team spending through real-time transaction monitoring and automated reporting.

This immediate oversight allows you to make informed financial decisions, identify spending patterns, and maintain complete control over company expenditures.

Prevent overspending and expense fraud

Employee spending cards include built-in controls like spending limits, merchant restrictions, and transaction approvals that prevent overspending and reduce fraud risk.

These safeguards protect your business from unauthorized expenses while ensuring compliance with company policies.

Issue Volopay prepaid cards with custom limits and real-time tracking

Core features of Volopay’s employee spending cards

Volopay's employee spending cards deliver comprehensive expense management capabilities designed to give you complete control while simplifying your team's spending experience.

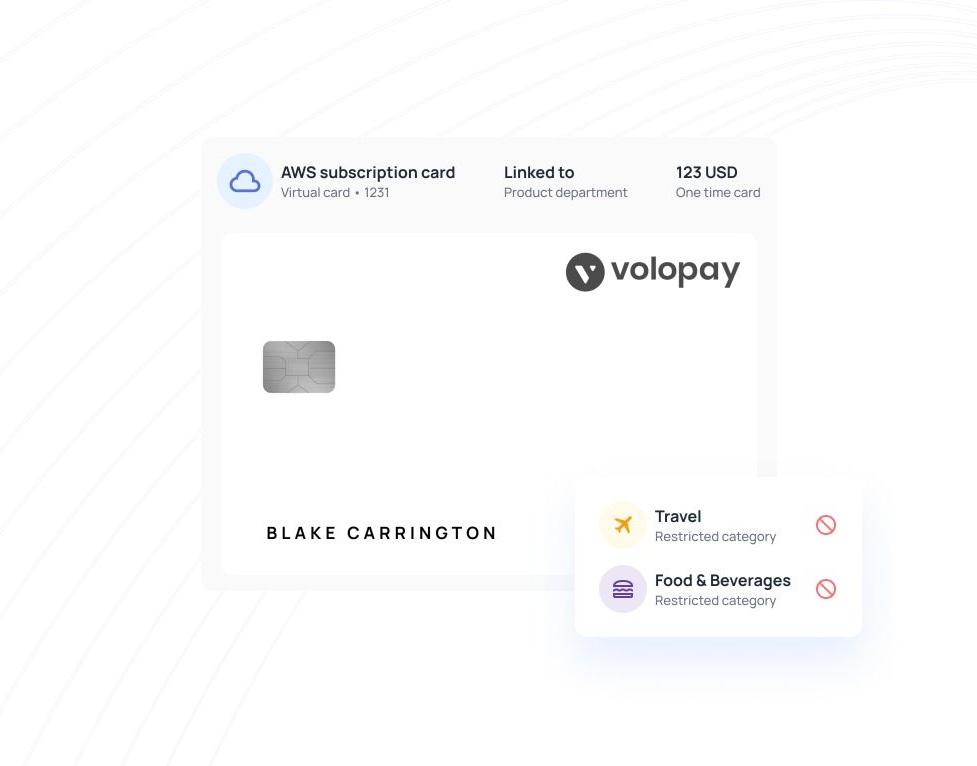

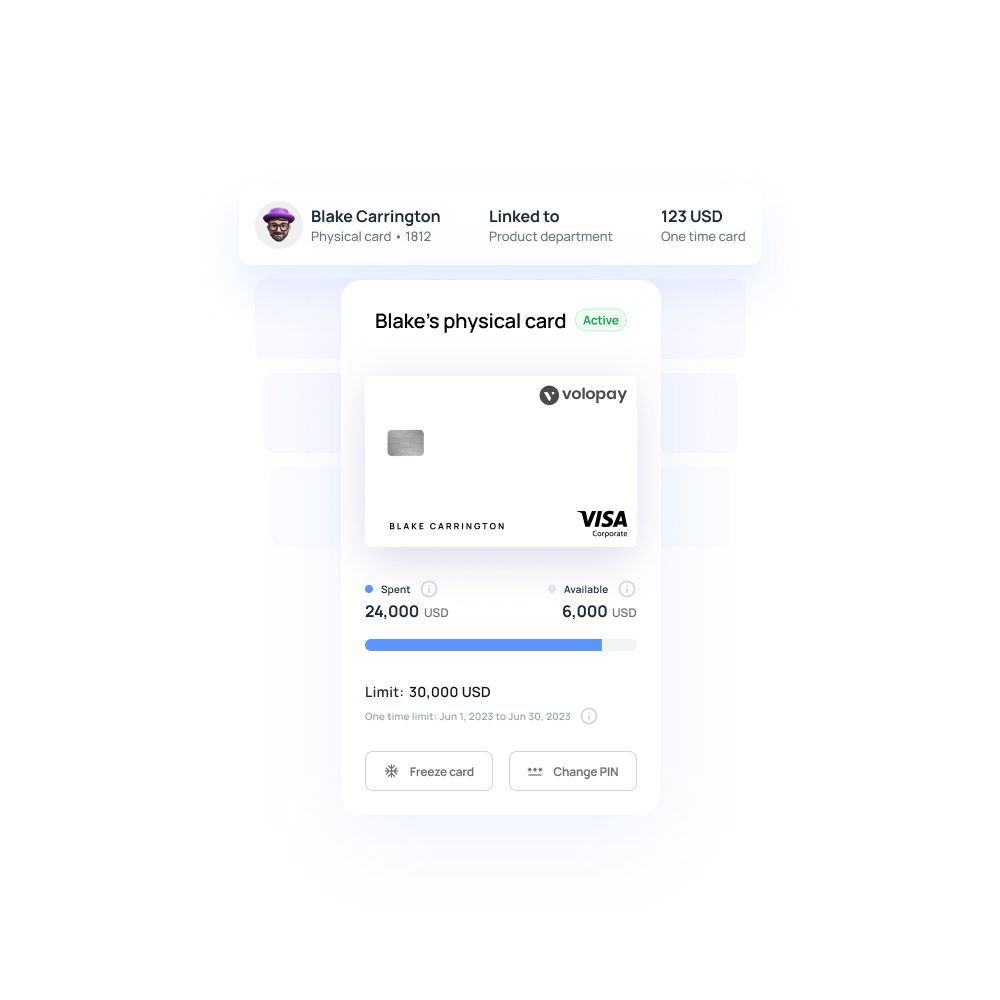

Virtual and physical cards for every employee

Volopay provides both virtual and physical prepaid employee cards to meet your diverse business needs. You can instantly issue virtual cards for online purchases and subscriptions, while physical cards handle in-person transactions and travel expenses.

This dual-card approach ensures your team has appropriate payment methods for every business scenario while maintaining consistent spending controls across all transactions.

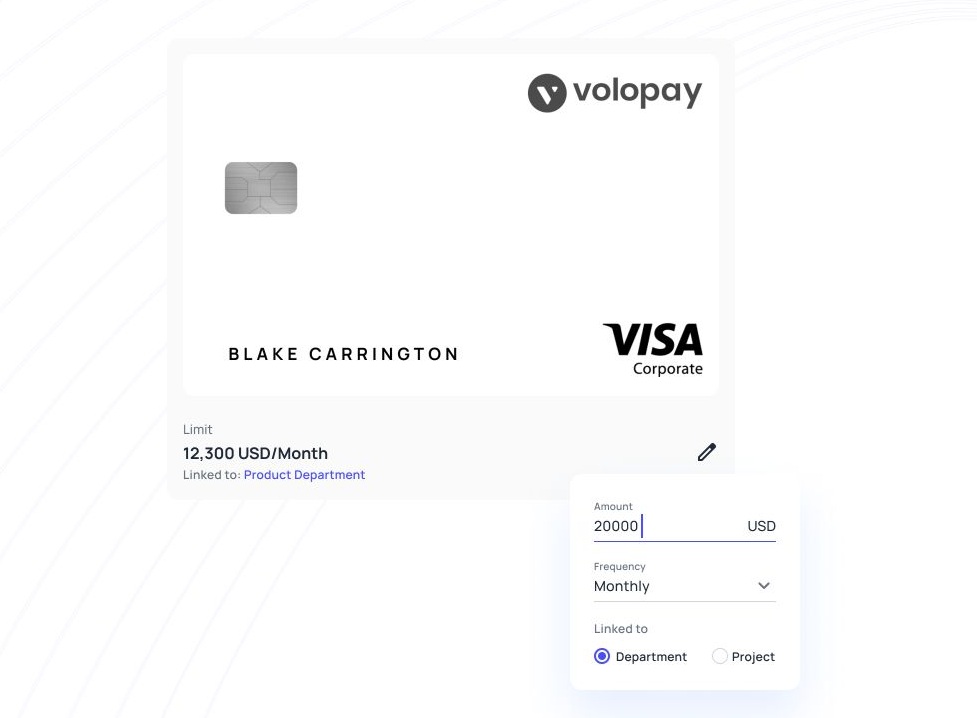

Smart spend limits and merchant restrictions

You control exactly how and where your team spends with Volopay's intelligent spending controls. Set custom spending limits per employee, department, or project, and restrict purchases to specific merchant categories or vendors.

These smart controls automatically block unauthorized transactions, ensuring your spending cards for employees operate within your defined parameters while preventing policy violations and unauthorized expenditures.

Real-time dashboards and alerts

Volopay's comprehensive dashboards provide instant visibility into all employees spend card activity across your organization. You receive real-time transaction alerts, spending summaries, and detailed analytics that help you monitor budgets and identify trends.

These automated notifications keep you informed of every transaction, ensuring complete transparency and enabling proactive expense management decisions.

Instant issuance and seamless reloads

You can issue new employee spending cards instantly through Volopay's platform, eliminating waiting periods and administrative delays.

Automatic reload features ensure your team's spend cards for employees maintain adequate balances based on your predetermined rules, while manual reload options give you complete control over fund allocation timing and amounts for specific projects or periods.

Improve compliance and reduce risk with employee spending cards

Employee spending cards transform your compliance framework by automating policy enforcement and creating comprehensive audit trails that reduce financial risk and improve organizational accountability.

1.Built-in spend policy enforcement

Employee spending cards automatically enforce your company policies at the point of transaction, preventing violations before they occur.

You can embed spending rules, approval workflows, and category restrictions directly into each card, ensuring your team's purchases comply with company guidelines without requiring manual oversight or post-transaction corrections.

2.Receipt capture and audit trails

Every transaction made with spending cards for employees automatically generates detailed audit trails with mandatory receipt capture through Volopay's mobile app.

You maintain complete documentation for all expenses, simplifying compliance reporting and tax preparation while ensuring every business expenditure has proper supporting documentation for regulatory requirements.

3.Controlled access by role and location

You can configure employee spend cards with role-based permissions and geographical restrictions that align with your organizational structure and security requirements.

These controls ensure team members can only make purchases appropriate to their position and location, reducing fraud risk while maintaining operational flexibility for legitimate business needs.

Equip employees with Volopay prepaid cards for hassle-free purchases

Multi-currency employee spending cards for global teams

Your international team members can make purchases in local currencies without worrying about exchange rate complications or conversion fees.

Spending cards for employees automatically handle currency conversions at competitive rates, ensuring your global workforce can conduct business efficiently while you maintain transparent cost tracking across all international transactions.

You maintain complete oversight of all global spending through a unified dashboard, regardless of where your team members are located.

Set consistent policies, spending limits, and approval workflows across countries while viewing all employee spend card activity in your preferred base currency for simplified financial management and reporting.

Volopay streamlines global team expansion by enabling instant card issuance for international employees during onboarding.

You can provision spend cards for employees in multiple countries simultaneously, ensuring new team members have immediate access to company funds while maintaining consistent spending controls and compliance standards across your entire global organization.

Use cases for employee spending cards in business

Employee spending cards adapt to various business scenarios, providing targeted solutions for different departments and operational needs while maintaining consistent financial oversight.

Travel and expense management

Employee spending cards eliminate the hassle of travel advances and lengthy reimbursement processes for your traveling team members.

You can preload cards with travel budgets, set location-based spending limits, and track all travel expenses in real-time, ensuring your employees have immediate access to funds while you maintain complete visibility over travel expenditures without manual paperwork.

Vendor, SaaS, and online subscriptions

Spending cards for employees prevent security risks associated with shared login credentials and unauthorized software upgrades.

You can assign dedicated cards for specific subscriptions, set spending limits that prevent costly plan upgrades, and maintain clear ownership of all software expenses while ensuring your team has access to necessary tools without compromising financial control.

Marketing or field team budgets

Employee spend cards empower your marketing and field teams to make quick decisions within predetermined budget constraints.

You can allocate monthly budgets to team leads, set category-specific spending limits for advertising or promotional materials, and enable autonomous spending while maintaining oversight through real-time reporting and automated approval workflows for larger expenditures.

Office management and procurement

Your administrative teams can handle office supplies, equipment purchases, and facility management expenses through dedicated spend cards for employees.

Set merchant restrictions for approved vendors, establish spending thresholds that trigger approval workflows, and streamline procurement processes while maintaining budget control and ensuring all office expenses align with company policies.

Why Volopay is the smartest choice for employee spending cards

Volopay stands out as the premier platform for employee spending cards by combining comprehensive functionality with enterprise-grade security and exceptional support infrastructure.

Unified solution for card issuance, control, and tracking

Volopay provides everything you need for employee spending cards management through a single, integrated platform. From instant card issuance and fund allocation to real-time expense tracking and compliance reporting, you control every aspect of your spending cards for employees through one comprehensive dashboard.

This unified approach eliminates the complexity of managing multiple vendors while ensuring seamless integration across all expense management functions.

Advanced controls built for finance teams

You gain sophisticated financial controls designed specifically for modern finance operations without sacrificing team autonomy.

Volopay's employee spend cards include multi-level approval workflows, automated policy enforcement, custom spending categories, and granular reporting capabilities that meet enterprise compliance requirements while empowering your teams to make necessary purchases efficiently and independently within established parameters.

Transparent pricing with no minimums

Volopay offers clear, predictable pricing for spending cards for employees without hidden fees, minimum commitments, or surprise charges. You pay only for what you use, making it cost-effective for businesses of any size to implement comprehensive expense management.

This transparent approach allows you to scale your employee spending card program based on actual needs without worrying about escalating costs.

Dedicated onboarding and success team

You receive personalized support from Volopay's dedicated customer success team throughout your entire journey, from initial setup to ongoing optimization.

This human-centered approach ensures smooth implementation of your employee spend cards program, provides training for your finance teams, and offers ongoing strategic guidance to maximize the value of your expense management investment.

Scalable infrastructure for businesses of all sizes

Volopay's robust platform grows with your business, supporting everything from small team implementations to complex global operations.

Whether you need spend cards for employees across multiple countries or sophisticated reporting for enterprise compliance, Volopay's infrastructure adapts to your evolving requirements while maintaining consistent performance and security standards throughout your growth journey.

Get started with Volopay’s employee spending cards today

Transform your expense management process with Volopay's reloadable prepaid card solution designed to eliminate administrative burdens while providing complete financial control.

Issue cards instantly for your team

You can begin issuing employee spending cards to your team members within minutes of setting up your Volopay account. The platform's instant provisioning capabilities mean no waiting periods or complex approval processes.

Simply onboard your employees, and they receive immediate access to controlled company funds. This rapid deployment ensures your team can start benefiting from streamlined expense management without operational disruptions or delays.

Customize roles, budgets, and spending limits

Volopay's flexible platform allows you to tailor spending cards for employees according to your specific organizational needs and hierarchy. Configure individual spending limits, department budgets, merchant restrictions, and approval workflows that align with your company policies.

These customizable controls ensure each team member has appropriate spending authority while maintaining your desired level of oversight and compliance across all transactions.

Book a demo and experience smarter spending

Discover how Volopay's employee spend cards can revolutionize your expense management by scheduling a personalized demonstration with our team. During your demo, you'll see firsthand how the platform simplifies card issuance, automates expense tracking, and provides real-time financial visibility.

Experience the difference that intelligent spend cards for employees can make in your organization's financial operations and operational efficiency.

FAQs about employee spending cards

Employee spending cards automatically categorize transactions, capture receipts, and generate detailed expense reports that integrate directly with your accounting workflows. This automation eliminates manual data entry, reduces reconciliation time, and ensures accurate financial records for seamless month-end closing processes.

Yes, Volopay's spending cards for employees work globally with multi-currency support and competitive exchange rates. Your team can make international purchases while you maintain centralized control and visibility across all countries through unified reporting dashboards.

You can instantly deactivate employee spend cards when team members leave, preventing unauthorized usage. Any remaining balances automatically return to your company account, and all transaction history remains accessible for audit purposes and final expense reconciliation.

Volopay's employee spending cards integrate seamlessly with popular accounting platforms like QuickBooks, Xero, and NetSuite. Transaction data, expense categories, and receipt information automatically sync to your existing financial systems, eliminating duplicate data entry and ensuring consistency.

No, Volopay allows unlimited employee spending cards’ issuance based on your business needs. Whether you have ten employees or thousands, you can provision spend cards for employees without restrictions, scaling your expense management program as your organization grows.

Remote teams, growing startups, consulting firms, and companies with frequent travel or procurement needs benefit significantly from spending cards for employees. Any business seeking better expense control, reduced administrative burden, and improved financial visibility gains substantial value.

You can start issuing employee spending cards within hours of onboarding with Volopay. The onboarding process includes account setup, policy configuration, and immediate card provisioning, allowing your team to begin using controlled company funds almost instantly.

Bring Volopay to your business

Get started now