Upgrade your business corporate credit cards for smarter spend

Using outdated credit card systems can slow you down in a rapidly evolving business world. Business corporate credit cards are essential tools for managing company spending, but not all are built for modern demands.

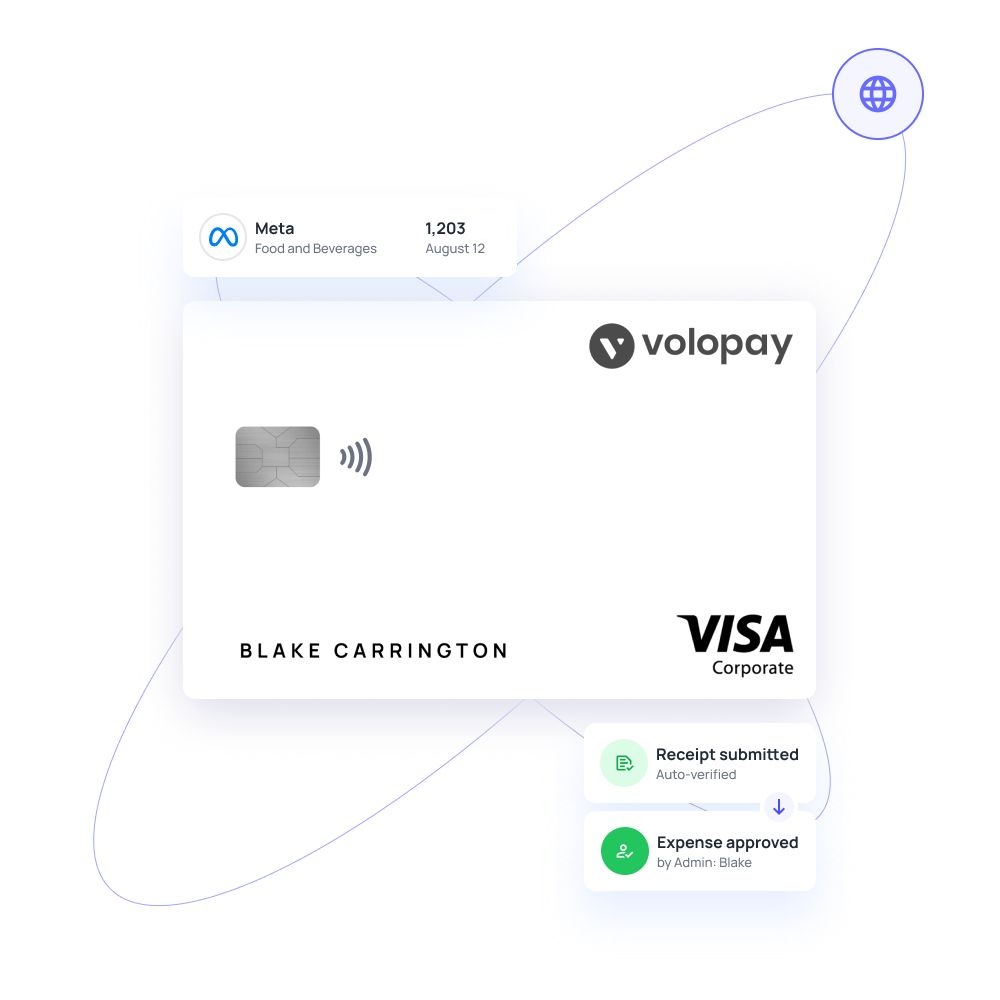

Volopay’s corporate cards offer a digital-first upgrade, giving you smarter control, faster access, and real-time visibility to replace legacy systems with ease.

What are business corporate credit cards?

Business corporate credit cards are financial tools issued to employees for company-related expenses. Unlike personal cards, they’re tied to your business account and let you track team spending with full visibility.

You can assign cards to departments, projects, or individuals, setting rules for where, how much, and when they can spend. These cards help you centralize control, streamline reporting, and eliminate the chaos of manual reimbursements.

Whether you’re managing travel costs, SaaS subscriptions, or vendor payments, business corporate credit cards make corporate spending more efficient, secure, and transparent, giving you a clear view of your finances in real time.

Advantages of business corporate credit cards

With business corporate credit cards, every transaction is recorded instantly.

You get a live view of who’s spending what, where, and why, broken down by team, vendor, or category.

No more end-of-month surprises or scrambling for receipts.

Employees can pay directly using company-issued cards.

This means no out-of-pocket expenses, no waiting for finance to process claims, and no back-and-forth over approvals.

It’s simpler for your team and easier for finance to manage.

Modern business corporate credit cards come with built-in safeguards.

EMV chip security protects against fraud, and virtual cards can be issued for one-time or online-only use.

This capability makes it nearly impossible for unauthorized charges to slip through.

What makes Volopay corporate cards the better choice for modern businesses

Volopay corporate cards aren’t just an upgrade; they’re a total rethink of how business spending should work. Traditional business corporate credit cards are slow to issue, hard to control, and lack real-time insights.

Volopay fixes all that with instant issuance, smart automation, and digital-native features built for today’s teams.

Issue physical & virtual cards instantly

Skip the bank delays. You can generate new cards directly from your Volopay dashboard in seconds, ready to use immediately for online or in-person transactions.

Generate unlimited corporate cards

Create cards for vendors, contractors, software tools, or individual employees. Set custom rules for each one to maintain tight control without slowing down operations.

Per-card spend controls & expiry options

Set spending caps, merchant category restrictions, and expiration dates on a per-card basis. You’re always in control of how, when, and where company funds are used.

Multi-currency business card support

Hold and spend balances in USD, EUR, GBP, and more. Volopay automatically converts currencies at real-time market rates, cutting down on hidden fees and foreign transaction charges.

Built-in approval flows & real-time alerts

Tie each spend action to customizable approval workflows. Get instant alerts for transactions and reloads so you’re never in the dark about where your money is going.

Volopay gives you the speed and flexibility legacy cards can’t match, letting you scale your financial operations without scaling up the chaos.

Supercharge expense management with corporate cards

Managing company spend shouldn’t mean drowning in spreadsheets or chasing receipts. Volopay corporate cards give you advanced tools to automate and streamline expense management, turning a manual mess into a smart, scalable process.

With Volopay, your business corporate cards don’t just handle payments; they become a powerful expense management system. You get speed, accuracy, and accountability without the administrative drag.

Department & project budget allocation

Assign budgets directly to specific teams, departments, or projects.

Every card issued under that budget follows preset spend limits, preventing overspending before it happens and helping you stay aligned with your financial goals.

Custom approval policies by amount or category

Not all expenses are created equal. Set up multi-level approval workflows based on transaction size, department, or expense type.

Whether it's a high-value purchase or a recurring software fee, Volopay lets you customize who approves what automatically.

Automated policy enforcement

Say goodbye to policy breaches. If a transaction goes beyond an approved threshold or violates spending rules, it’s instantly flagged or blocked.

You stay in control without needing to micromanage every purchase.

Drill-down expense oversight

Volopay’s dashboard gives you real-time visibility into spend performance.

Filter by team, project, category, or cardholder to spot trends, fix inefficiencies, and optimize budgets with confidence.

How Volopay delivers a smarter corporate card experience

Volopay doesn’t just digitize your corporate cards; it transforms them into intelligent tools for smarter financial operations. From automation to global readiness, every feature is built to give you more control with less effort.

Volopay’s corporate cards go beyond what standard business corporate credit cards offer. They help you enforce financial discipline, boost operational speed, and collaborate in real time, all from a single platform.

Department & project budget controls

Allocate specific budgets at the card level for any department or project. Volopay enforces these limits automatically, so spend stays aligned without manual oversight or approvals getting delayed.

OCR-technology powered receipt capture

Receipts are no longer a headache. Snap a photo or upload a file—Volopay’s OCR technology captures and extracts the details with high accuracy, instantly matching it to the correct transaction.

Automated multi-level approval workflows

Complex purchases often need more than one sign-off. Volopay supports up to five levels of approval per transaction, ensuring every dollar is reviewed appropriately without slowing down your team.

Inline expense commenting & collaboration

Got questions about a charge? Team members can comment directly on any transaction. This keeps all discussions, clarifications, and decisions in one place. No more digging through emails or Slack threads.

Bring Volopay to your business

Get started now

FAQs about business corporate credit cards

Your business must be a registered legal entity with a verifiable operational history. Additional criteria may include a minimum monthly revenue or credit evaluation, depending on the provider.

Yes. Modern cards come with EMV chip technology, fraud detection systems, and the option to use virtual cards for secure, one-time online payments.

Absolutely. Most business corporate credit cards support global usage. Volopay corporate cards also support multi-currency balances to simplify international spending.

Volopay provides both physical and virtual corporate cards that can be issued instantly. These cards can be allocated to employees, departments, projects, or vendors with ease.

Yes. Volopay lets you assign cards to departments or projects and set individual budgets, giving you complete visibility and control over spending.