What is payment collection? Components, automation & alternatives

Collecting payments is key to keeping a company’s cash flow healthy and its finances on track. It’s all about making sure customers pay for the products or services they’ve received, and that the money comes in quickly and correctly.

When done right, the process of payment collection keeps operations running smoothly by covering essentials like payroll, inventory restocks, and investments. Good processes help avoid delays, cut down on bad debt, and boost financial stability. For today’s businesses, using structured and automated systems makes predicting cash flow easier and supports long-term growth.

What is payment collection?

To fully know what is payment collection one must understand that it is essentially the process through which a business receives payment from its customers for products or services delivered.

It forms a crucial part of the accounts receivable (AR) cycle, beginning once an invoice is issued and ending when the payment is received and recorded. This process ensures that the company converts its sales into actual cash, which is essential for maintaining liquidity.

Effective payment collection involves managing invoices, tracking outstanding amounts, and ensuring timely follow-ups. A structured approach to the payment collection process supports accurate financial reporting and reinforces the company’s cash flow management system.

Why payment collection matters to businesses

Payment collection directly impacts a company’s ability to operate smoothly and grow sustainably. A well-managed payment collection process not only keeps cash flow healthy but also strengthens relationships with customers and enhances financial predictability. Delays or inefficiencies in collecting payments can quickly disrupt business operations and limit future opportunities.

1. Ensures healthy cash flow

Timely payment collection ensures that funds move consistently into the business. Reliable cash inflows allow companies to meet short-term obligations, pay suppliers, and reinvest in growth.

When payments are delayed, liquidity gaps appear, forcing businesses to rely on external financing or credit lines, which can strain profitability over time

2. Strengthens financial stability

Regular and predictable payment inflows contribute to long-term financial stability. By maintaining strong control over receivables, businesses can forecast income accurately, plan expenses confidently, and avoid sudden financial stress.

Effective payment collection reduces the risk of defaults and creates a stable foundation for scaling operations responsibly.

3. Protects customer relationships

A structured and transparent payment collection process builds trust with customers. Clear communication regarding invoices, payment terms, and reminders minimizes misunderstandings and promotes professionalism.

Instead of confrontational collection efforts, well-managed processes foster collaboration, ensuring customers feel respected while still meeting their financial obligations on time.

4. Boosts operational efficiency

Automating and streamlining payment collection reduces manual effort for finance teams. Instead of chasing overdue invoices, employees can focus on strategic work such as forecasting and financial planning.

Efficient payment workflows also reduce human errors, ensuring data accuracy and faster reconciliation of accounts.

5. Enables business growth and scalability

Strong payment collection management supports expansion by ensuring predictable cash inflows. Consistent revenue enables businesses to invest in technology, hire talent, and enter new markets without liquidity concerns.

Scalable payment systems make it easier to manage growing transaction volumes as the company expands its customer base.

6. Provides competitive advantage

Companies that collect payments efficiently operate with greater agility and financial confidence.

By maintaining steady cash flow and reducing collection delays, they can offer better pricing, credit terms, or discounts, making them more competitive and resilient in dynamic markets.

A step-by-step guide to payment collection

An organized payment collection process is essential for maintaining steady cash inflows and avoiding payment delays. Each stage, from invoicing to reconciliation, plays a vital role in ensuring that businesses collect revenue accurately and efficiently. Below is a step-by-step look at how the process of payment collection typically works.

1. Generate accurate and timely invoices

The foundation of effective payment collection begins with issuing precise and timely invoices. Each invoice should clearly detail the products or services provided, total amount due, applicable taxes, and payment terms.

Errors or missing details can delay payments and damage trust, making accuracy critical at this stage.

2. Set clear payment terms

Clearly defined payment terms remove ambiguity and establish expectations upfront. Terms should specify the due date, acceptable payment methods, and penalties or discounts tied to early or late payments.

When customers understand the payment structure from the start, disputes are minimized, and collections become smoother.

3. Deliver invoices to customers

Once invoices are generated, they must be promptly delivered to customers through reliable channels such as email, billing portals, or integrated accounting systems.

Automated systems ensure timely delivery and provide confirmation that the customer has received the invoice, preventing avoidable follow-up delays.

4. Track outstanding payments

Monitoring outstanding invoices helps finance teams maintain visibility into cash inflows. A centralized tracking system enables businesses to see which accounts are overdue and prioritize follow-ups accordingly.

Real-time tracking also helps assess customer payment behavior and identify recurring bottlenecks.

5. Send payment reminders

Even with clear terms, customers may forget or overlook due dates. Regular, polite reminders help maintain awareness without damaging relationships.

Automation tools can schedule reminders based on due dates, ensuring consistent communication without manual intervention.

6. Escalate when necessary

If payments remain overdue despite reminders, escalation becomes necessary. Finance teams can engage account managers, apply late fees, or initiate formal collection processes depending on internal policy.

Escalation should remain professional, which will focus on resolution rather than confrontation.

7. Reconcile payments

After payments are received, reconciliation ensures that the funds match the respective invoices.

This step confirms that records are accurate across accounts receivable and bank statements, reducing discrepancies and improving financial reporting reliability.

8. Analyze and optimize the process

Continuous analysis of the payment collection process helps identify inefficiencies and patterns causing delays.

Reviewing performance metrics, such as Days Sales Outstanding (DSO), enables businesses to fine-tune their collection strategies and strengthen overall cash flow management.

Why collecting payments is a major pain point for finance teams

Even for well-managed businesses, collecting payments remains one of the toughest responsibilities for finance teams. The challenges often stem from fragmented systems, manual processes, and unpredictable customer behavior. Each of these factors complicates the payment collection process and increases the administrative burden.

1. Fragmented and manual processes

A lot of organizations still use spreadsheets, emails, and disconnected tools to handle collections. This manual process often leads to data silos, duplicate records, and missed follow-ups.

For example, a finance team juggling invoices across several Excel files might miss overdue accounts, causing payment delays and throwing off cash flow forecasts.

2. Lack of real-time visibility

Without real-time visibility into receivables, teams struggle to know which invoices are pending and which customers are consistently late.

This lack of transparency prevents proactive decision-making. For example, when a large client misses multiple due dates, finance teams may only notice the issue after it affects liquidity.

3. Misalignment between finance and sales

Collections often involve both finance and sales departments, but communication gaps between them can create friction.

Sales teams may promise lenient terms to close deals, while finance teams push for timely payments. Without coordinated policies, customers receive mixed messages, undermining the company’s collection efforts.

4. High volume of small and diverse payments

Businesses handling numerous small transactions face a unique challenge. Each payment must be verified, reconciled, and recorded, consuming significant time.

For example, an e-commerce company processing thousands of micro-payments daily can experience reconciliation backlogs that slow reporting and distort revenue insights.

5. Customer behavior and payment delays

Customer payment patterns vary widely. Some delay payments intentionally to manage their own cash flow, while others simply forget the payments.

Late payments disrupt the business’s ability to forecast accurately. For instance, a recurring client paying consistently late by two weeks can skew monthly revenue projections.

6. Psychological and operational strain

Persistent overdue accounts create stress for finance professionals who must balance diplomacy with assertiveness.

The repetitive task of chasing payments can lower morale and productivity. A small finance team managing hundreds of accounts may experience burnout from continuous follow-ups.

7. Compliance and regulatory challenges

Managing collections across regions introduces compliance risks. Regulations around invoicing, taxation, and debt recovery differ by jurisdiction.

Failing to adhere can lead to legal penalties. Finance teams must stay updated and ensure every transaction meets applicable local standards.

From manual to modern: Transitioning your payment collection approach

As businesses expand, manually collecting payments quickly becomes impractical. Using spreadsheets, emails, and manual reminders reduces visibility, increases the chance of errors, and eats up valuable time that finance teams could use for more strategic work.

Switching to automated, data-driven payment systems helps streamline processes, provide real-time insights, and improve control over receivables.

Modern tools bring invoicing, tracking, and communication together in one platform, cutting down friction and boosting efficiency across teams. This move from reactive to proactive management turns payment collection from a chore into a key driver of financial success.

4 smart alternatives to chasing down payments

Key components of an effective payment collection system

An effective payment collection system is built on accuracy, automation, and collaboration. Its purpose is to help finance teams manage receivables efficiently, minimize overdue accounts, and maintain predictable cash flow.

A well-designed framework connects every stage, from invoicing to reconciliation, so that payments are tracked, verified, and reported without disruption.

Invoice management

Accurate invoice management is the foundation of effective collections. It ensures invoices are generated promptly, include all necessary details, and align with agreed terms.

Automated invoicing tools reduce human error, accelerate billing cycles, and keep payment schedules transparent for both the company and its customers.

Customer communication workflows

Consistent and professional communication helps prevent disputes and misunderstandings. Automated workflows send reminders, follow-ups, and acknowledgments at the right time, maintaining courtesy while reinforcing accountability.

A structured communication system builds customer trust and reduces friction in the payment collection process.

Payment tracking and reporting

Real-time tracking of outstanding invoices gives finance teams immediate visibility into pending payments and customer trends.

Detailed reports highlight recurring delays, enabling targeted action. This data-driven insight supports better forecasting and cash flow management.

Integration with accounting & ERP tools

Integration connects payment collection with the broader financial ecosystem. When invoicing, reconciliation, and reporting systems work seamlessly together, finance teams gain a unified view of transactions, improving accuracy, compliance, and overall operational efficiency.

How to track and collect outstanding payments faster

Efficient tracking and collection of outstanding payments are key to maintaining liquidity and ensuring business continuity. Finance teams need clear visibility into receivables and a proactive strategy for follow-ups. By combining automation with data-driven insights, businesses can shorten collection cycles and strengthen cash flow predictability.

Build a centralized AR dashboard

A centralized accounts receivable (AR) dashboard provides a single view of all outstanding invoices, customer balances, and payment histories.

This visibility enables finance teams to prioritize collections, track high-value accounts, and take timely action before delays escalate.

Automate follow-ups and escalations

Automating reminders and escalation workflows reduces manual intervention and ensures consistency.

Scheduled follow-ups keep customers informed without straining relationships, while escalation rules help flag persistent delays for managerial attention or external collection measures when required.

Analyze payment patterns with data insights

Using analytics to study payment trends helps identify customers who frequently miss deadlines or require flexible terms.

These insights enable finance teams to design better credit policies and anticipate potential bottlenecks.

Encourage early payments with incentives

Offering small discounts or loyalty-based rewards for early payments motivates customers to pay before the due date. This not only improves cash flow but also promotes goodwill and repeat business.

Use predictive analytics to identify risks early

Predictive analytics tools assess behavioral and transactional data to forecast potential payment delays.

By identifying risk early, businesses can adjust credit limits, strengthen follow-ups, and safeguard revenue.

How automation and technology are transforming payment collection

Automation and digital tech have transformed the way businesses handle payment collection. Gone are the days of juggling spreadsheets, emails, and disconnected accounting tools—now integrated, smart systems make the process smoother and give real-time insights. This shift cuts down on mistakes, speeds up cash flow, and frees finance teams to focus on big-picture strategy instead of repetitive admin tasks.

Streamlining invoicing, reminders, and follow-ups

Automation tools generate and send invoices instantly while scheduling reminders based on due dates. This eliminates human error and ensures customers receive consistent, timely communication.

Real-time tracking and visibility across accounts

Automated systems provide up-to-date insights into every outstanding invoice, helping finance teams prioritize actions, identify delays, and forecast cash flow with greater accuracy.

Predictive analytics for smarter collections

Advanced analytics use historical and behavioral data to anticipate payment trends and risks. This proactive insight enables faster decisions and better allocation of collection resources.

Reducing errors through system integration

Connecting payment collection software with accounting, ERP, and CRM tools ensures all financial data stays synchronized. Automation minimizes manual reconciliation, saving time and improving accuracy.

Enhancing customer experience through digital payments

Offering digital and self-service payment options makes it easier for customers to pay on time. Flexible options like cards, ACH transfers, or wallets improve satisfaction and strengthen relationships.

Ensuring security, compliance, and audit readiness

Automated platforms encrypt sensitive data, maintain transaction logs, and align with regulatory standards, ensuring every payment is traceable, secure, and fully compliant.

Best practices for streamlined payment collection

Efficient payment collection depends on consistency, transparency, and smart process design. Businesses that standardize their approach and leverage automation experience fewer delays, better cash visibility, and stronger customer relationships. The following best practices help finance teams refine their collection strategies for long-term success.

1. Standardize processes across regions

Establish uniform collection workflows across all business units and geographies. A standardized approach ensures consistency in invoicing, communication, and escalation while maintaining compliance with local regulations.

2. Maintain transparent communication

Open and honest communication reduces confusion and builds mutual confidence between businesses and their customers.

Sharing invoices promptly, explaining payment expectations clearly, and keeping clients updated on their account status helps avoid misunderstandings. A transparent process shows professionalism and encourages customers to pay on time.

3. Continuously monitor KPIs

Regular performance tracking keeps the payment collection process efficient and accountable. Monitoring indicators like DSO, average collection period, and overdue invoice ratio helps finance leaders spot issues early.

Using this data to fine-tune reminders, credit limits, and escalation timelines ensures that collection efforts remain proactive instead of reactive.

4. Segment customers by risk and value

Customers don’t all handle their finances the same way. Sorting accounts by payment reliability or transaction value makes it easier to create personalized follow-up plans.

High-risk customers might need closer attention, while dependable clients can be handled with automated reminders.

5. Implement clear payment policies

Written policies establish accountability for both internal teams and customers. Define credit terms, escalation procedures, and penalties for late payments to maintain discipline in the collection process.

6. Train and empower finance staff

Empowered finance teams drive better results. Regular training on negotiation skills, collection tools, and compliance requirements prepares staff to manage payment delays professionally and efficiently.

Legal considerations in payment collection

Legal awareness is essential for managing payment collection responsibly and protecting business interests. Each transaction must comply with the relevant contractual, financial, and regulatory requirements to avoid disputes and legal exposure.

Contract terms and enforcement

Every payment collection effort begins with a solid contract. Clear clauses defining payment timelines, penalties for late payments, and dispute procedures provide a legal foundation for enforcement. A well-drafted agreement minimizes ambiguity and protects both parties in case of default.

Debt recovery laws

When voluntary collection efforts fail, businesses may need to pursue legal recovery. Understanding applicable debt recovery laws, such as notice requirements or collection limits, ensures compliance and prevents reputational harm. Working with legal counsel helps navigate jurisdiction-specific rules effectively.

Dispute resolution & mediation

Even with clear contracts, disagreements can arise. Using mediation or arbitration instead of litigation allows for faster, less costly resolution. These alternative methods preserve customer relationships while ensuring fair outcomes.

The future of payment collection

The future of payment collection is moving toward faster, smarter, and more integrated systems. As digital infrastructure evolves, businesses will rely heavily on automation, embedded finance, and real-time data to manage receivables with greater precision.

Manual follow-ups and fragmented workflows will be replaced by intelligent tools that predict risks, guide decision-making, and remove friction from the payment experience. Finance teams will operate with heightened visibility and better control over cash flow as technology becomes more proactive and interconnected.

Embedded finance and instant payments

Instant payment rails and embedded finance tools will make transactions seamless, enabling businesses to receive funds within seconds and reduce dependence on traditional banking timelines.

Predictive cash flow forecasting

AI-driven models are rapidly developing that can be implemented by organizations. These models will forecast payment behavior, helping companies prevent delays and improve planning accuracy.

Convergence of AP and AR automation

Platforms like Volopay will unify accounts payable and receivable processes, giving businesses a single system to manage cash flows, approvals, and transactions end-to-end.

Streamline your payment collection with Volopay

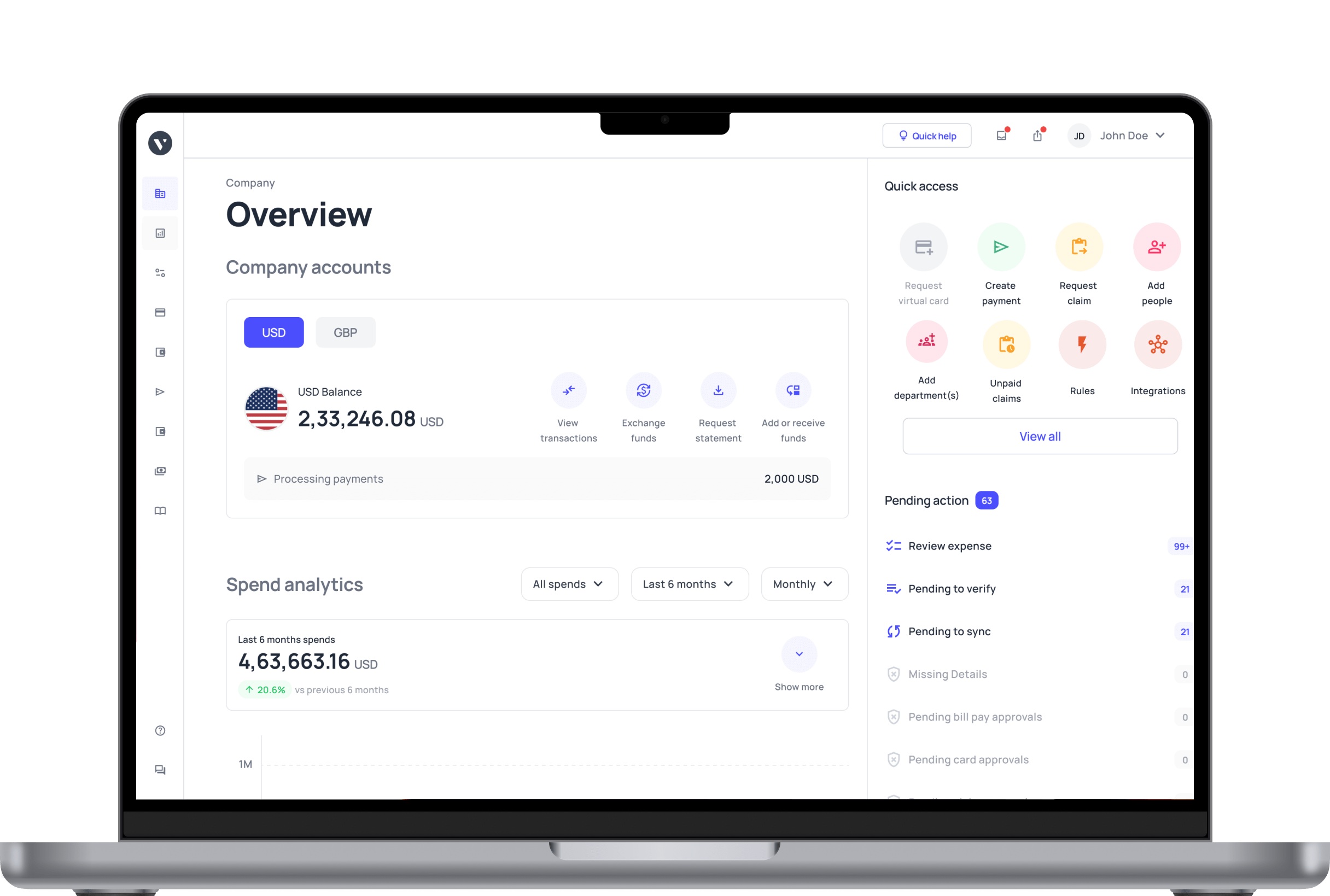

Managing payment collection becomes significantly easier when businesses use a unified platform designed to automate routine tasks, track receivables, and improve visibility.

Volopay provides finance teams with an end-to-end accounting automation system that consolidates invoicing, reminders, reconciliation, and reporting, helping organizations strengthen cash flow, reduce delays, and scale their operations with confidence.

Centralize invoice and payment tracking

Volopay puts all your invoices, outstanding payments, and customer records in one easy-to-use dashboard.

By centralizing everything, it cuts out manual tracking, minimizes errors, and gives finance teams instant visibility into overdue accounts and top-priority follow-ups.

Real-time insights

With real-time visibility and updates on payment statuses, expected inflows, and overdue accounts, businesses can make faster decisions and plan more accurately.

Volopay’s dynamic reporting tools allow teams to identify bottlenecks and adjust strategies before delays impact cash flow.

Seamless integrations with accounting tools

Volopay connects seamlessly with major accounting and ERP systems, automatically syncing every transaction into the company’s financial records.

This streamlines reconciliation, eliminates duplicate entries, and keeps the books consistent and ready for audits.

Compliance & risk management

Our platform supports secure data handling, automated documentation, and audit trails that help businesses meet regulatory requirements with ease.

Built-in controls reduce compliance risks and ensure that every payment action is traceable and compliant with internal policies.

Implement policy-driven automation

Volopay lets companies create rules for reminders, escalations, multi-level approval workflows, and payment terms.

These automated policies streamline the payment collection process, removing the need for constant manual work and helping maintain a disciplined, on-time receivables cycle.

Bring Volopay to your business

Get started now

FAQs

It’s best to review your collections strategy quarterly. Regular reviews help identify process gaps, improve communication workflows, and ensure your approach aligns with changing customer behavior and business needs.

Automation reduces DSO by speeding up invoicing, standardizing reminders, and improving tracking. Faster follow-ups and real-time visibility help finance teams address delays sooner and keep cash inflows predictable.

Yes. Small businesses gain efficiency, reduced manual work, and better visibility into receivables. Automation ensures timely reminders, accurate records, and smoother customer communication, helping them collect payments faster.

Key KPIs include DSO, aging buckets, collection effectiveness index, average collection period, and promise-to-pay rates. These metrics highlight performance trends and help identify areas requiring corrective action.

Reminder frequency depends on payment terms, but most businesses send reminders a few days before the due date, on the due date, and periodically after if the invoice becomes overdue.

Yes. Modern payment collection systems support partial payments, installment schedules, and recurring billing. Automation ensures each transaction is accurately tracked and reconciled without manual intervention.

Volopay automates invoicing, reminders, tracking, and reconciliation. Our centralized platform helps finance teams monitor outstanding payments, streamline communication, and enforce policies efficiently.

Volopay provides real-time dashboards showing overdue invoices, expected inflows, and customer payment trends. This visibility helps businesses plan better and address issues quickly.

Implementation generally takes a short onboarding period, depending on system complexity. Most businesses can start using key features quickly once integrations and configurations are complete.

Volopay uses secure infrastructure, encrypted data handling, and detailed audit trails. These features protect sensitive financial information and ensure compliance with regulatory and internal standards.