What is finance tech stack: Must have integrations and frameworks

In today's digital economy, finance teams need more than spreadsheets and standalone software. A well-integrated finance tech stack connects your accounting, payments, expense management, and reporting tools into one unified system.

This integration eliminates manual data entry, reduces errors, and gives you real-time visibility into your company's financial health. When your finance tech stack integrations work seamlessly together, your team can focus on strategic decision-making instead of reconciling data across disconnected platforms.

What is a finance tech stack?

A finance tech stack is an interconnected suite of software tools and platforms that work together to manage your company's financial operations. This integrated finance systems approach combines accounting software, expense management, payment processing, and analytics tools into one cohesive ecosystem.

Instead of using isolated applications that require manual data transfer, an effective tech stack for finance team automates data flow between systems, ensuring accuracy and real-time financial visibility across your organization.

Why is a finance tech stack important?

1. Centralized financial control

You gain complete oversight of all financial activities from a single dashboard. When your finance tech stack connects various tools, you can monitor expenses, track payments, and review budgets without switching between multiple platforms or requesting reports from different departments.

2. Improves accuracy and reduces errors

Manual data entry creates opportunities for mistakes that can cost your business thousands of dollars. An integrated finance systems approach eliminates duplicate entries and ensures data consistency across platforms, significantly reducing human error and the time spent fixing mistakes.

3. Saves time and operational costs

Your finance team spends less time on repetitive tasks like data reconciliation and report compilation. Automation through finance tech stack integrations frees up valuable hours that your team can redirect toward financial analysis, strategic planning, and process improvement initiatives.

4. Enhances decision-making

Real-time data access empowers you to make informed financial decisions quickly. With an effective tech stack for finance team, you can analyze spending patterns, forecast cash flow, and identify cost-saving opportunities based on current information rather than outdated reports.

5. Improved compliance oversight

Your finance tech stack maintains detailed audit trails and ensures consistent documentation across all financial transactions. This systematic approach simplifies compliance monitoring, making it easier to demonstrate adherence to regulatory requirements during audits.

6. Supports scalability and growth

As your business expands, your integrated finance systems can handle increased transaction volumes without requiring proportional increases in staff. The right technology infrastructure grows with you, accommodating new entities, currencies, and complex financial workflows.

Components of a modern finance tech stack

Core accounting software

Your accounting platform serves as the foundation of your finance tech stack, recording all financial transactions and maintaining your general ledger. This system handles accounts payable, accounts receivable, journal entries, and financial statement generation.

Examples include QuickBooks, Xero, NetSuite, and Sage Intacct, which provide comprehensive accounting functionality while offering API connections to other financial tools in your stack.

Expense management platform

You need specialized software to capture, categorize, and approve employee expenses efficiently. Modern expense management tools allow employees to submit receipts through mobile apps, automatically extract transaction details, and route claims through customized approval workflows.

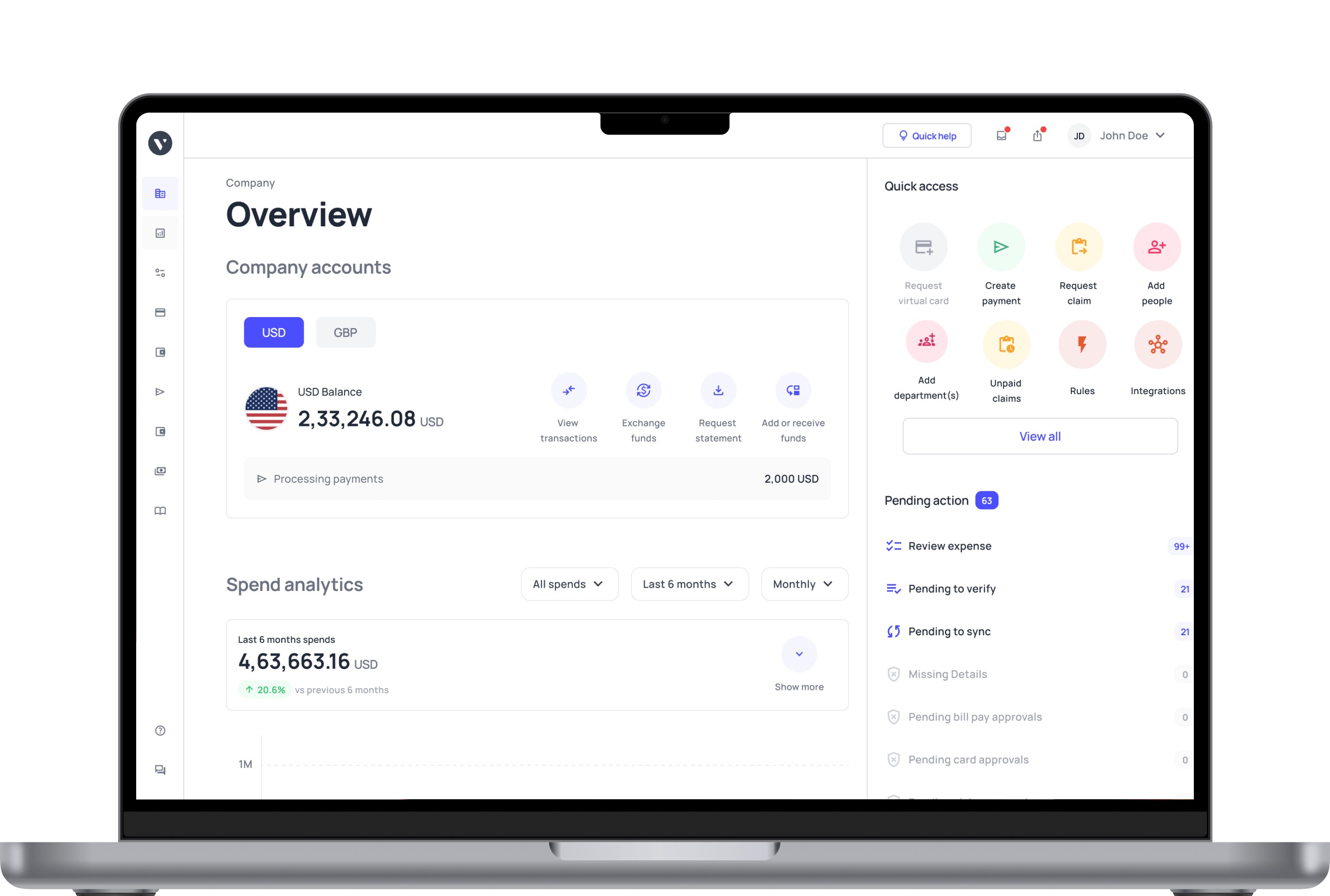

Platforms like Volopay streamline the entire expense lifecycle from submission to reimbursement while maintaining policy compliance.

Accounts payable (AP) automation tools

AP automation eliminates manual invoice processing by capturing bill details, routing approvals, and scheduling payments automatically. These tools reduce processing time from days to minutes while maintaining proper approval controls.

Find solutions that integrate with your accounting system to ensure seamless data synchronization and payment execution.

Accounts receivable (AR) management tools

Your AR tools accelerate cash collection by automating invoice delivery, payment reminders, and payment processing. These platforms provide customers with convenient payment options while giving you visibility into outstanding receivables.

Find a software that can handle everything from recurring billing to managing subscription-based businesses.

Corporate cards and spend management tools

Modern corporate cards come with built-in spending controls, real-time transaction visibility, and automatic expense categorization. These tools give you granular control over employee spending while eliminating expense report submissions.

Volopay offers physical and virtual cards with customizable spending limits and merchant category restrictions integrated directly into your finance tech stack.

Payroll and HR systems

Payroll platforms calculate employee compensation, manage tax withholdings, and ensure compliance with labor regulations. Integration with your accounting software ensures accurate recording of payroll expenses.

This kind of software can provide comprehensive payroll processing while syncing data with your integrated finance systems for seamless financial reporting.

Financial planning & analysis (FP&A) tools

FP&A platforms help you create budgets, build financial models, and generate forecasts based on historical data and business assumptions. These tools transform raw financial data into actionable insights.

Several software programs enable scenario planning and what-if analysis that support strategic decision-making across your organization.

Integration and workflow automation layer

Integration platforms connect your various financial tools, ensuring data flows smoothly between systems without manual intervention. These middleware solutions handle data mapping, transformation, and synchronization.

Integration platforms facilitate finance tech stack integrations by providing pre-built connectors and workflow automation capabilities that reduce IT dependency.

Key benefits of a modern finance tech stack

Real-time financial visibility

You access current financial data whenever you need it, without waiting for month-end closes or manual report generation. This immediate visibility allows you to identify issues quickly and respond to changing business conditions with agility and confidence.

Streamlined and automated workflows

Your finance tech stack eliminates bottlenecks by automating routine processes like invoice approvals, expense reimbursements, and payment processing. Automated workflows reduce processing time, minimize delays, and ensure consistent application of policies across your organization.

Improved accuracy and data integrity

When systems communicate directly through finance tech stack integrations, you eliminate transcription errors and ensure consistency across platforms. Single-source data entry propagates information throughout your integrated finance systems, maintaining accuracy from initial transaction capture through financial reporting.

Enhanced compliance and audit readiness

Your tech stack for finance team maintains comprehensive audit trails that document every transaction, approval, and system change. This automated documentation simplifies compliance reporting and reduces the time and stress associated with external audits.

Cost and time efficiency

Automation reduces the manual effort required for routine financial tasks, allowing your team to accomplish more with existing resources. You save money on labor costs while improving processing speed and reducing the opportunity cost of delayed financial information.

Better collaboration across teams

When everyone accesses the same real-time financial data, collaboration improves naturally. Your finance tech stack breaks down information silos, enabling finance teams to work effectively with operations, sales, and other departments using shared data and standardized processes.

How poorly integrated finance tools create hidden technical debt

When your financial tools don't communicate effectively, you accumulate technical debt that compounds over time, creating inefficiencies that slow your operations and increase costs. This hidden burden manifests in multiple ways that drain resources and limit your company's agility.

1. Data silos and inconsistent records

Without proper finance tech stack integrations, each system maintains its own version of financial data. You end up with conflicting information across platforms, making it impossible to trust any single source.

This fragmentation forces your team to reconcile discrepancies manually, wasting hours every week just to determine accurate balances.

2. Manual workarounds increase complexity

Your team develops time-consuming processes to move data between disconnected systems, creating custom spreadsheets and manual data entry procedures.

These workarounds become institutionalized as "the way we do things," making it increasingly difficult to implement improvements or onboard new employees who must learn these idiosyncratic processes.

3. Fragile integrations and breakage risks

Point-to-point custom integrations between tools often break when vendors update their APIs or change data formats.

Each broken connection requires technical resources to diagnose and repair, creating urgent IT tickets that disrupt planned work and introduce periods where financial data becomes incomplete or unreliable.

4. Lack of real-time visibility

Disconnected systems require batch processing and manual data consolidation before you can view current financial positions.

This delay means you make decisions based on outdated information, potentially missing opportunities or failing to address problems until they've grown more serious and costly to resolve.

5. Higher total cost of ownership

Maintaining fragmented systems requires more IT resources, more software licenses, and more staff time for reconciliation and troubleshooting.

The cumulative cost of supporting disconnected tools often exceeds the expense of implementing proper integrated finance systems that reduce ongoing maintenance requirements.

6. Poor employee experience

Your finance team becomes frustrated when they must navigate multiple systems, remember different login credentials, and perform repetitive manual tasks.

This poor experience contributes to burnout, reduces job satisfaction, and increases turnover, creating additional costs for recruiting and training replacements.

7. Security and compliance risks

Each additional system introduces new security vulnerabilities and compliance requirements that your team must monitor and maintain.

Without centralized controls in your tech stack for finance team, you face increased risk of data breaches, unauthorized access, and compliance violations that could result in penalties.

8. Scalability bottlenecks

Manual processes and fragile integrations create capacity constraints that limit growth.

As transaction volumes increase, your existing approach requires proportional increases in staff, making it expensive and slow to scale operations to match business growth and market opportunities.

Common integration challenges in a finance tech stack and how to overcome them

5 must-have integrations for stress-free expense management

1. Accounting software integration

Connect your expense management platform directly to QuickBooks, Xero, or NetSuite to eliminate manual data entry and ensure every expense flows automatically into your general ledger.

For example, when an employee submits a meal receipt through your expense app, the transaction details immediately sync to the correct expense account in your accounting system, complete with proper categorization, cost center allocation, and supporting documentation attached.

2. Corporate cards & payments integration

Link your corporate card program with expense management tools so transactions automatically appear in your system the moment they occur.

Your team at a software company can issue virtual cards for online subscriptions, and each charge instantly creates an expense entry with merchant details, eliminating the need for employees to submit receipts for these recurring costs.

3. HR & payroll integration

Synchronize employee data between your HRIS and expense management platform to ensure accurate employee records, proper approval hierarchies, and seamless reimbursement processing.

When your HR team adds a new employee or updates someone's department, those changes automatically flow through your finance tech stack, maintaining accurate reporting and approval routing.

4. Travel & booking platform integration

Integrate corporate travel tools with your expense management system so flight bookings, hotel reservations, and rental car charges automatically create expense entries.

This integration provides complete trip visibility, ensures policy compliance at booking time, and simplifies expense reconciliation when employees return from business travel.

5. Communication & workflow tools integration

Connect Slack, Microsoft Teams, or email systems to your finance tech stack so approvers receive notifications through their preferred channels and can review expenses without logging into separate systems.

Your CFO can approve a $5,000 software purchase directly from a Slack message, streamlining the approval process and reducing delays caused by context switching.

Integrated vs. fragmented finance tech stacks: A comparison

Challenges in finding the right system to adopt finance automation

Irregular adoption of new technology

Change is difficult but necessary. While adopting new technology can bring about numerous benefits for the company and employees, it is quite normal for businesses to face resistance from their employees as new technology can be daunting and complicated to understand.

This can make finance automation implementation particularly difficult. Therefore it is important to ensure that the chosen system for financial stack automation is aligned with business operations and vetted by key stakeholders.

Using a universal automation solution

The problem with implementing a one-size-fits-all automation solution is the assumption that all automation is homogenous in nature. Automation can differ from department to department, and what may work for the marketing stack will not necessarily work out for the financial stack.

For example, a robust financial automation solution like Volopay uses state-of-the-art automation tools to simplify and streamline your company's expense management processes, from vendor invoice management to subscription management and payment.

Choosing an unscalable solution

While it is important to focus on short-term complications and work on solving them, it is crucial to choose financial stack automation tools that are not only built for long-term use but can also scale along with the company.

As your business grows, so will your workload, and choosing a scalable and flexible solution is what differentiates a good financial stack from a poor one.

How to build an integrated finance tech stack

1. Identify current gaps

You must conduct a comprehensive audit of your existing financial processes and tools to understand where inefficiencies, manual workarounds, and disconnected systems create problems.

Interview your finance team, review process documentation, and map out how data currently flows between systems to identify specific pain points that an integrated finance systems approach can address.

2. Define your objectives

Establish clear, measurable goals for your finance tech stack implementation, such as reducing month-end close time by 50%, eliminating manual data entry, or achieving real-time spend visibility.

These objectives guide your tool selection and help you prioritize which integrations deliver the most value to your specific business needs.

3. Choose a core accounting platform

Select an accounting system that serves as your financial data hub and offers robust integration capabilities through well-documented APIs.

Your choice should accommodate your current transaction volume while providing room for growth, supporting your industry's specific requirements, and offering the finance tech stack integrations you need with other tools.

4. Add key financial tools

Select specialized tools for expense management, accounts payable, corporate cards, and other functions that complement your core accounting platform.

Prioritize solutions that offer native integrations or proven compatibility with your chosen accounting system to ensure seamless data flow throughout your tech stack for finance team.

5. Integrate everything

Connect your selected tools through native integrations, middleware platforms, or API connections to establish automated data flow between systems.

Work with your IT team or integration specialists to configure data mapping, establish synchronization schedules, and ensure proper authentication and security protocols across all connections.

6. Automate workflows

Design and implement automated workflows that move approvals, notifications, and data processing tasks through your finance tech stack without manual intervention.

Create rules for expense approvals based on amount thresholds, automate invoice processing and payment scheduling, and establish automatic reconciliation processes that flag exceptions for human review.

7. Test and optimize

Conduct thorough testing of all integrations and workflows using relevant real-world scenarios before rolling out to your entire organization.

Process sample transactions, test error handling, verify data accuracy across systems, and refine your configurations based on test results to ensure reliable performance under production conditions.

8. Train teams and go live

Provide comprehensive training to all users, covering both new tools and updated processes that result from the implementation of your integrated finance systems.

Develop documentation, conduct hands-on training sessions, and establish support resources to help team members adapt to new workflows and maximize the value of your technology investment.

9. Monitor and improve

Continuously track system performance, user adoption, and achievement of your initial objectives to identify opportunities for further optimization.

Gather feedback from users, monitor integration health, and stay informed about new features and capabilities that vendors add to keep your finance tech stack aligned with evolving business needs.

Best practices for building a finance tech stack

1. Start with a strong core system

You should choose an accounting platform that provides a solid foundation for your finance tech stack with comprehensive functionality, reliable performance, and extensive integration options.

This core system becomes your financial data hub, so selecting one with proven scalability and vendor stability protects your technology investment as your business grows.

2. Prioritize seamless integrations

Focus on selecting tools that communicate effectively with each other through native integrations or well-documented APIs rather than choosing best-of-breed solutions that require extensive custom development.

Seamless finance tech stack integrations reduce implementation time, minimize ongoing maintenance requirements, and ensure reliable data flow between systems.

3. Automate repetitive processes

You gain the most value from your tech stack for finance team by automating routine tasks like data entry, reconciliation, invoice processing, and approval routing.

Identify processes that consume significant staff time and implement automation rules that handle these tasks without manual intervention, freeing your team for higher-value activities.

4. Ensure data consistency and accuracy

Establish data governance practices that maintain a standardized chart of accounts, vendor records, employee information, and other master data across all records in your integrated finance systems.

Consistent data structures prevent reconciliation issues and ensure accurate reporting regardless of which system generates the information.

5. Keep scalability in mind

Choose tools and integration approaches that accommodate business growth without requiring complete system replacements or major reconfigurations.

Your finance tech stack should handle increased transaction volumes, additional entities or subsidiaries, and expanded user counts without proportional increases in cost or complexity.

6. Strengthen security and compliance

Implement robust security measures, including role-based access controls, encryption for data in transit and at rest, regular security audits, and comprehensive audit trails.

Your finance tech stack handles sensitive financial data, so security cannot be an afterthought but must be built into your tool selection and integration design.

7. Centralize analytics and reporting

Consolidate financial data from all systems into centralized dashboards and reporting tools that provide unified visibility across your entire organization.

This approach eliminates the need to log into multiple systems or manually compile data from various sources to understand your financial position.

8. Continuously review and optimize

Schedule regular assessments of your finance tech stack performance, user satisfaction, and alignment with business objectives to identify optimization opportunities.

Technology evolves rapidly, and periodic reviews ensure you leverage new capabilities, retire underutilized tools, and adapt your stack to changing business requirements.

Use cases of an integrated finance tech stack

SaaS company

Your subscription business efficiently manages recurring billing for thousands of customers across different pricing tiers and payment schedules.

An integrated finance systems approach connects your subscription management platform, payment processor, and accounting software so revenue recognition happens automatically based on subscription terms, failed payments trigger dunning workflows, and customer lifetime value calculations stay current with real-time data.

E-commerce business

You process hundreds of daily orders through multiple sales channels while also efficiently managing inventory costs and vendor payments.

Your finance tech stack links your e-commerce platform, inventory management system, and accounting software so product sales automatically update inventory values, trigger reorder points, and record cost of goods sold with accurate margin calculations for each product line.

Professional services firm

Your consulting firm bills clients based on time and expenses while accurately managing project profitability across multiple engagements.

Integration between your time tracking system, expense management platform, and accounting software ensures accurate client invoicing, automated expense reimbursement for consultants, and real-time project profitability reporting that helps you identify your most profitable engagements.

Manufacturing company

You coordinate procurement of raw materials, track production costs, and manage supplier payments while maintaining accurate inventory valuations.

Your tech stack for finance team connects procurement, production, and accounting systems so material costs flow automatically from purchase orders through work-in-progress to finished goods, providing accurate product costing and inventory valuation.

Startups and SMEs

Your growing company needs strong enterprise-grade financial controls without the added complexity and cost of traditional ERP systems.

An integrated finance systems approach using cloud-based tools provides the automation and visibility you need while maintaining the agility to adapt quickly as your business model evolves and your team expands.

Remote-first companies

You manage many employees across multiple countries, each with different currencies, tax regulations, and unique payment requirements.

Your finance tech stack includes multi-currency support, automated foreign exchange management, and country-specific compliance tools that simplify global payroll, expense reimbursement, and financial reporting across your distributed workforce.

The plug-and-play integration framework for finance teams

Modern finance teams need integration approaches that deliver results quickly without extensive technical resources or custom development. A plug-and-play framework leverages pre-built connectors, standardized data formats, and visual workflow builders that enable finance professionals to implement and maintain finance tech stack integrations without depending on IT teams.

Step 1 – Define business process and data flows

You begin by mapping your current financial processes and identifying exactly what data needs to flow between systems.

Document approval hierarchies, transaction types, reporting requirements, and timing considerations so you understand which integrations deliver the most value and what data transformations your integrated finance systems require.

Step 2 – Select core platforms and integrations

Choose your primary accounting system and complementary tools based on their integration ecosystems and availability of pre-built connectors.

Prioritize platforms that offer native integrations with each other or robust marketplace offerings that provide tested, maintained connections requiring minimal configuration.

Step 3 – Choose integration architecture

Decide between native point-to-point integrations, middleware platforms like Zapier or Workato, or enterprise integration platforms based on your complexity requirements and technical capabilities.

Native integrations work well for simple scenarios, while middleware provides flexibility for multi-system workflows in your tech stack, for finance team efficiency.

Step 4 – Data governance & standardisation

Establish consistent data formats, naming conventions, and validation rules across all systems to prevent integration issues and ensure data quality.

Create standardized vendor lists, employee records, chart of accounts structures, and approval hierarchies that all systems reference to maintain consistency throughout your finance tech stack.

Step 5 – Build feedback loops & monitor performance

Implement monitoring dashboards that track integration health, data sync status, and error rates so you can identify and resolve issues before they impact operations.

Set up alerts for failed synchronizations, unusual transaction patterns, or performance degradation that require attention from your team.

Step 6 – Scale & evolve

As your business grows and requirements change, add new tools and integrations to your framework while maintaining the principles of standardization and automation.

Regular reviews ensure your finance tech stack integrations continue meeting business needs and take advantage of new capabilities vendors introduce.

How automation enhances integration performance

Enables real-time data sync across systems

Automation eliminates batch processing delays by synchronizing data between systems immediately when transactions occur. Your finance tech stack updates all connected platforms simultaneously, ensuring everyone works with current information and preventing the confusion that results from different systems showing different balances or transaction histories.

Reduces manual intervention and errors

Automated data transfer removes the human element from routine data movement, preventing transcription mistakes and ensuring consistent application of business rules. Your team no longer manually re-enters invoice details, employee information, or transaction data, eliminating the single largest source of errors in financial processes.

Improves workflow efficiency

You can configure automated workflows that route approvals, trigger notifications, and execute subsequent actions based on predefined rules without requiring staff intervention. When an expense exceeds policy limits, your integrated finance systems automatically escalates to appropriate managers, sends notifications, and creates audit flags without anyone manually monitoring transactions.

Strengthens data accuracy and consistency

Automation ensures that information entered once propagates correctly throughout your tech stack for finance team, maintaining referential integrity across all platforms. When you update a vendor's payment terms in your accounts payable system, that change automatically flows to your accounting software, maintaining consistency without manual updates.

Enhances scalability of integrations

Automated integrations handle increasing transaction volumes without requiring proportional increases in processing resources or staff time. Your finance tech stack processes ten thousand transactions as easily as one hundred, allowing your business to grow without integration performance becoming a bottleneck.

Boosts analytical and reporting capabilities

Automation ensures that analytical tools always have access to complete, current data from all source systems, enabling accurate real-time reporting and analysis. Your dashboards reflect actual business performance without waiting for manual data consolidation, supporting faster, better-informed decision-making.

Helps with continuous audit preparedness

Your automated finance tech stack maintains comprehensive audit trails documenting every transaction, approval, and system action without manual record-keeping. This continuous documentation means you're always audit-ready rather than scrambling to compile evidence when audits occur.

Finance tech stack automation: Myths vs. facts

Measuring the cost and ROI of a finance tech stack

1. Identify the total cost of ownership

You must calculate all expenses associated with your finance tech stack, including software subscriptions, implementation costs, integration development, training, and ongoing maintenance.

Don't forget to include the opportunity cost of staff time spent managing systems and performing manual processes that technology should handle.

2. Define ROI metrics

Establish specific, measurable metrics that demonstrate value from your technology investment, such as hours saved on manual processes, reduction in processing errors, days reduced from month-end close, or percentage decrease in late payments. These quantifiable metrics provide objective evidence of your integrated finance systems delivering business value.

3. Quantify efficiency improvements

Calculate the time your team previously spent on manual tasks like data entry, reconciliation, and report generation, then measure the reduction after implementing your tech stack for finance team. Multiply time savings by average hourly costs to determine the dollar value of efficiency gains your automation delivers.

4. Track financial impact over time

Monitor changes in key financial metrics like days sales outstanding, payment processing costs, late payment penalties, and audit fees to understand how your finance tech stack affects bottom-line results. Track these metrics quarterly to demonstrate consistent value delivery and identify additional optimization opportunities.

5. Measure the strategic ROI

Beyond operational efficiency, assess how your finance tech stack integrations enable strategic initiatives like faster expansion into new markets, improved cash management, or more accurate forecasting.

These strategic benefits often exceed operational savings but require different measurement approaches focused on business outcomes rather than process efficiency.

6. Regularly reassess and optimize

Conduct annual reviews of your technology investments to ensure you're maximizing value from your finance tech stack and identify underutilized capabilities or redundant tools.

Technology evolves rapidly, and regular assessments ensure you adapt your stack to changing business needs while eliminating tools that no longer deliver sufficient value.

Security and compliance considerations for integrated finance systems

Maintaining data integrity across tools

Your integrated finance systems must ensure that data remains accurate and consistent as it moves between platforms, with validation rules preventing corrupt or incomplete information from propagating throughout your stack. Implement checksums, transaction matching, and reconciliation processes that verify data integrity at each integration point.

Compliance risks in multi-tool environments

Each additional system in your finance tech stack introduces new compliance requirements for data retention, access controls, and audit documentation. You must understand the regulatory obligations specific to each tool and ensure your integration approach maintains compliance across the entire ecosystem.

Role-based access controls and permissions

Implement granular permission structures that ensure employees access only the financial data and functionality appropriate to their roles across all systems in your tech stack for finance team. Consistent access controls prevent unauthorized transactions while maintaining proper segregation of duties.

Secure API integrations and encryption standards

All connections between systems in your finance tech stack must use encrypted channels, secure authentication methods, and regularly rotated credentials to prevent unauthorized access or data interception. Implement API security best practices, including token-based authentication, rate limiting, and logging of all integration activity.

Ensuring audit readiness and transparency

Your integrated finance systems should maintain comprehensive, immutable audit logs documenting every transaction, approval, system change, and data modification with timestamps and user attribution. This complete audit trail demonstrates compliance with financial regulations and supports efficient external audits.

Future trends in finance stack technology

AI-driven financial decision-making

Artificial intelligence increasingly analyzes financial patterns, predicts cash flow needs, and recommends optimal payment timing without human intervention.

Your finance tech stack will leverage machine learning models that learn from historical data to identify anomalies, prevent fraud, and suggest strategic decisions based on comprehensive financial analysis.

Real-time and predictive cash flow management

Advanced analytics tools provide instant visibility into current cash positions while forecasting future scenarios based on pending transactions, payment patterns, and business trends.

These predictive capabilities transform cash management from reactive to proactive, helping you optimize working capital and avoid liquidity issues.

Embedded finance and API-first architecture

Financial services become embedded directly into operational workflows rather than requiring separate systems, with API-first design enabling seamless connections between platforms.

Your tech stack for finance team will include banking, payment, and lending capabilities integrated natively into business applications.

No-code and low-code integrations

Visual integration builders enable finance professionals to create and modify finance tech stack integrations without writing code or depending on technical resources.

These democratized tools accelerate implementation while giving finance teams direct control over their technology workflows.

Unified data and advanced analytics

Consolidation platforms aggregate financial data from all sources into data warehouses that power sophisticated analytics, forecasting, and scenario modeling.

This unified approach eliminates data silos and enables comprehensive financial intelligence that drives strategic business decisions.

Blockchain for transparent transactions

Distributed ledger technology provides immutable transaction records and enables smart contracts that execute automatically when predefined conditions occur.

Your integrated finance systems may leverage blockchain for vendor payments, multi-party transactions, and transparent audit trails that prevent disputes and simplify reconciliation.

Volopay: The all-in-one solution for an integrated finance tech stack

Managing multiple disconnected financial tools creates unnecessary complexity and hidden costs for your organization. Volopay provides a unified expense management platform that combines corporate cards, accounts payable automation, accounting automation and accounting integrations into one seamless solution, eliminating the integration challenges that plague traditional finance tech stack implementations.

Seamless integration with accounting and ERP systems

Volopay connects directly with major accounting platforms through native integrations that require minimal configuration.

Your financial data flows automatically between systems, ensuring your general ledger stays current without manual reconciliation or data export procedures.

Automated reconciliation and real-time syncing

Every transaction processed through Volopay synchronizes instantly with your accounting system, complete with proper categorization, supporting documentation, and cost center allocation.

This real-time sync eliminates the days-long reconciliation processes that traditionally follow month-end close.

Advanced spend controls and approval workflows

You design customized approval hierarchies based on transaction amount, category, department, or any other criteria relevant to your business policies.

These intelligent workflows route requests automatically while maintaining proper controls and creating comprehensive audit trails for compliance purposes.

Multi-currency management

Volopay handles transactions in several currencies with competitive exchange rates and transparent fee structures, simplifying international payments and expense management.

Your team can make payments or incur expenses in local currencies while your accounting system receives amounts in your base currency.

Real-time reporting and analytics dashboards

Access comprehensive spending insights through customizable dashboards that provide visibility into expenses by department, category, vendor, employee, or any dimension relevant to your business.

These analytics help you identify spending patterns, enforce budgets, and make data-driven decisions about resource allocation.

Streamlined invoice payment workflows

Upload vendor invoices directly to Volopay, where OCR technology extracts relevant details, routes approvals according to your policies, and schedules payments automatically.

This end-to-end invoice management automation reduces processing time from days to minutes while maintaining proper controls and documentation.

Bring Volopay to your business

Get started now

FAQs

You experience frequent data inconsistencies, spend excessive time on manual reconciliation, or lack real-time visibility into spending and cash positions.

Automation eliminates manual data entry mistakes while automated controls flag unusual transactions and maintain comprehensive audit trails for oversight.

Track time savings, error reduction, faster close cycles, and strategic value from improved visibility and decision-making capabilities.

Volopay serves startups through mid-market companies across industries needing modern expense management and accounts payable automation solutions.

Volopay offers native integrations with major accounting platforms and connects with other tools through APIs and integration platforms.

Volopay implements bank-level encryption, role-based access controls, secure API connections, and comprehensive audit logging across all operations.

Most integrations complete within one to two weeks, depending on complexity, data migration requirements, and customization needs.

Volopay provides dedicated implementation specialists, comprehensive training sessions, documentation resources, and ongoing customer success support.

Volopay offers customizable dashboards with real-time visibility into spending patterns, budget tracking, and comprehensive financial analytics.

Volopay improves collaboration through shared visibility, automated workflows, and transparent approval processes, enabling seamless collaboration without email chains or spreadsheet sharing.