A complete guide to secured business credit card (2026)

Starting a business comes with numerous financial challenges, especially when you lack an established credit history. You need funding, you need purchasing power, and you need to build credibility with vendors and suppliers.

A secured business credit card offers a practical solution for entrepreneurs and small business owners who want to access credit while simultaneously building their business credit profile.

Understanding how secured business credit options work can help you make informed financial decisions, regardless of whether you're launching a startup or managing an established LLC.

This guide walks you through everything you need to know about secured credit card for business options, from how they operate to how you can leverage them for long-term growth.

Key takeaways

A secured business credit card provides accessible credit for newer or credit-challenged businesses, using a refundable deposit to unlock purchasing power and reduce issuer risk.

Responsible usage helps establish a credible business credit profile, especially when issuers report activity to major commercial credit bureaus.

Secured cards create a structured pathway toward unsecured financing, enabling businesses to graduate to higher limits and better terms as credit strength improves.

Choosing the right secured option requires evaluating fees, reporting practices, upgrade eligibility, and cash flow impact, ensuring the card supports both short-term operations and long-term growth.

What is a secured business credit card?

A secured business credit card is a type of business credit card that requires you to make a cash deposit as collateral before you can use the card. The deposit you provide typically determines your credit limit, which means if you deposit $1,000, you'll generally receive a $1,000 credit limit.

This type of card serves as a stepping stone for businesses that don't qualify for traditional unsecured credit cards due to limited credit history or poor credit scores.

The security deposit reduces the risk for card issuers, making them more willing to approve applications from newer businesses or those with credit challenges.

Unlike personal secured cards, these cards are specifically designed for business expenses and help you separate your personal and business finances while building your company's creditworthiness.

How does a secured business credit card work?

When you apply for a secured business credit card to build credit, you submit a refundable security deposit to the card issuer. This deposit acts as insurance for the lender; if you fail to make payments, they can use your deposit to cover the outstanding balance.

Your deposit remains with the card issuer as long as your account stays open and in good standing. You use the card just like any other business credit card, making purchases for business expenses, paying suppliers, or covering operational costs.

Each month, you receive a statement showing your charges, and you're required to make at least the minimum payment by the due date (though it is highly recommended you clear the entire bill).

Making on-time payments demonstrates responsible credit behavior, which gets reported to business credit bureaus.

Over time, if you maintain good payment habits and demonstrate creditworthiness, many issuers allow you to transition to an unsecured card. When this happens, or when you close your account in good standing, you receive your security deposit back.

The key difference from unsecured cards is that your own money secures the credit line, reducing risk for the issuer and opening doors for businesses that might otherwise struggle to access credit.

How to get a secured business credit card

Obtaining a secured credit card for business involves several straightforward steps that prepare you for approval and successful card usage.

Determine the security deposit needed

Review your business cash flow to decide how much you can afford to set aside as a deposit. Most issuers require deposits ranging from $200 to $10,000, with your deposit amount directly correlating to your credit limit. Choose an amount that provides sufficient purchasing power without straining your working capital.

Gather required documents

Collect necessary documentation, including your Employer Identification Number (EIN) or Social Security Number, business registration documents, and financial statements. You'll also need personal identification and may need to provide information about your business revenue, industry, and time in operation.

Compare secured business credit card options

Research different secured business credit card offers from various issuers. Look beyond just the deposit requirement. You should compare annual fees, interest rates, the reporting methods (and frequency) to business credit bureaus. Also, look into additional benefits like rewards programs and the potential for upgrading to an unsecured card.

Complete the application process

Fill out the application with accurate information about your business and personal financial details. Many issuers require personal guarantees, meaning you're personally responsible if the business defaults. Be thorough and honest in your responses to avoid delays or denials.

Submit your security deposit

Once approved, you'll submit your security deposit through the method specified by the issuer, typically via bank transfer or check. This deposit must clear before your account activates, so plan accordingly if you need the card by a specific date.

Wait for approval

Application processing times vary by issuer, ranging from instant decisions to several business days. Some issuers may request additional documentation or verification before finalizing approval. Monitor your email and phone for any communication from the card issuer.

Activate and start using the card

After receiving your card in the mail, activate it according to the issuer's instructions. Set up online account access, review your terms and conditions, and begin using the card responsibly for business purchases while tracking your spending carefully.

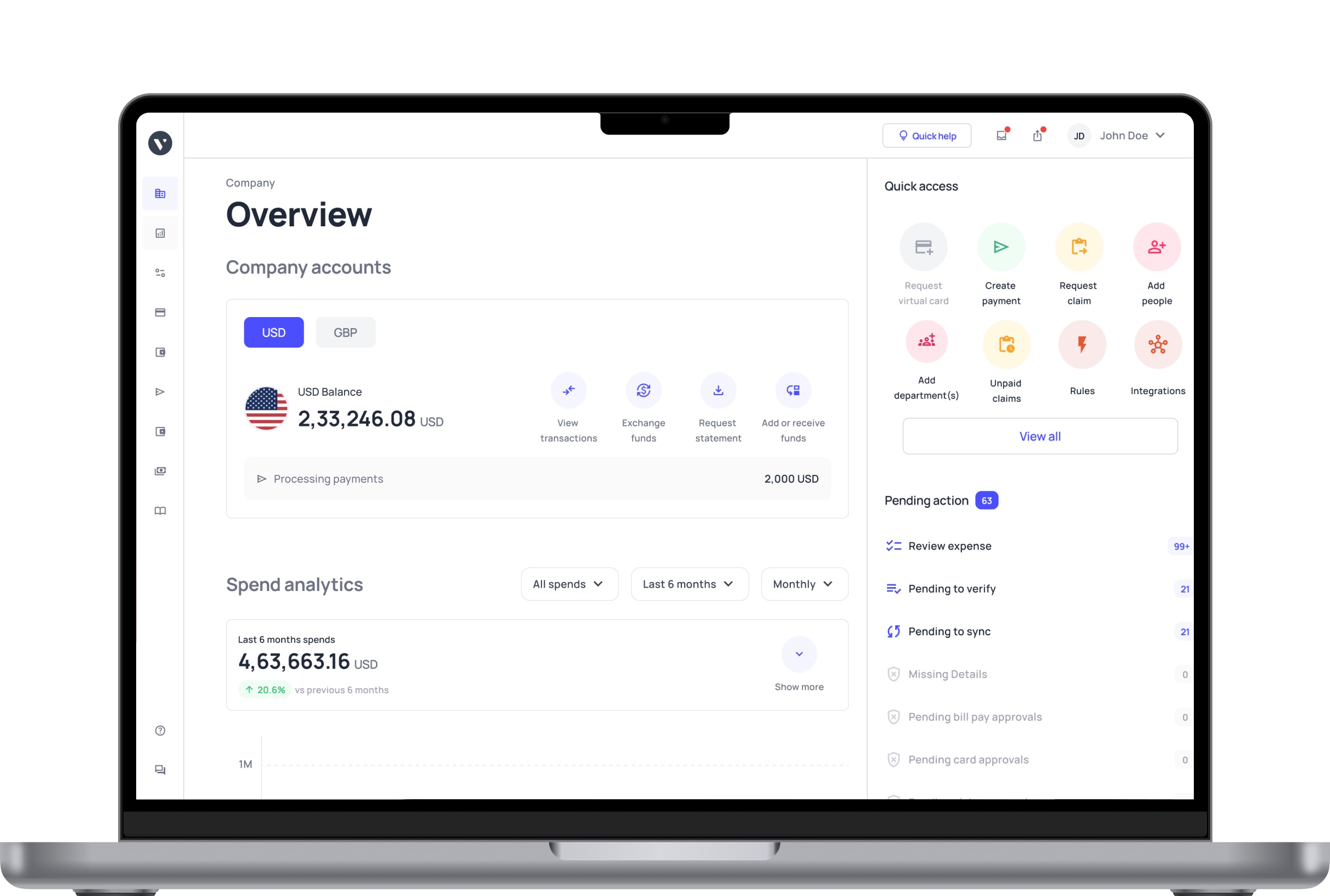

Empower your teams with smarter payments

Is it hard for a new LLC to get a credit card?

Yes and no. New LLCs often face challenges when applying for traditional business credit cards because they lack an established business credit history and financial track record. However, secured business credit cards for new business entities provide an accessible alternative.

Since you're providing collateral through your security deposit, issuers are more willing to approve newer businesses that don't have years of revenue history or established credit profiles to evaluate.

Does a secured business credit card help build business credit?

Yes, a secured business credit card to build credit can effectively establish and strengthen your business credit profile when used responsibly. The key factor is ensuring your card issuer reports your payment activity to major business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business.

By making consistent on-time payments and maintaining low credit utilization ratios, you demonstrate creditworthiness that gets recorded on your business credit reports.

This positive payment history helps you qualify for better financing terms, higher credit limits, and eventually unsecured credit products as your business grows and your credit profile strengthens.

Can you get a secured credit card for a small business?

Yes, secured small business credit cards are available specifically for small business owners and entrepreneurs. These cards cater to businesses of all sizes, from sole proprietorships to growing companies with multiple employees.

The secured format makes them particularly accessible for small businesses that might not meet the revenue requirements or credit standards needed for unsecured business cards.

What's the difference between a secured and unsecured business credit card?

Understanding the distinction between these two card types helps you choose the right option for your business needs and financial situation.

Secured business credit card

A secured corporate credit card requires you to provide a cash deposit that serves as collateral and typically determines your credit limit. This deposit protects the issuer from loss if you default on payments.

These cards are easier to obtain for businesses with limited or damaged credit histories because the deposit minimizes the issuer's risk. You can recover your deposit when you close the account in good standing or upgrade to an unsecured card.

Unsecured business credit card

An unsecured business credit card doesn't require any security deposit or collateral. Your credit limit is based on your business credit history, revenue, time in business, and personal creditworthiness.

These cards typically offer higher credit limits, better rewards programs, and more premium benefits than secured cards. However, they require stronger credit profiles for approval, making them less accessible to newer businesses or those rebuilding credit. Secured business credit cards for startups often serve as a pathway to eventually qualify for these unsecured options.