Guide to QuickBooks expense management: Categorization, integration & sync fixes

Managing expenses using QuickBooks shouldn't feel like navigating a maze, yet countless businesses struggle with disorganized transactions, manual data entry errors, and reconciliation nightmares that consume valuable time. You're not alone if you've experienced the frustration of mismatched categories, duplicate entries, or spending hours each month trying to make sense of your financial data.

The reality is that without proper systems in place, QuickBooks expense management becomes a bottleneck rather than a solution. Your finance team drowns in administrative tasks while critical insights remain buried under spreadsheets.

But here's the transformative truth: when you leverage strategic categorization, intelligent automation, and seamless integrations, QuickBooks evolves from a basic accounting tool into a powerful financial command center.

This guide reveals how you can eliminate manual inefficiencies, achieve real-time expense visibility, and reclaim countless hours previously lost to tedious reconciliation. You'll discover proven strategies that turn expense management from your biggest operational headache into your competitive advantage.

What is QuickBooks expense management?

QuickBooks Expense Management is a comprehensive financial system that enables you to track, organize, and control your business spending within the QuickBooks platform. It provides you with tools to record transactions, monitor cash flow, and generate expense reports for tax preparation and business analysis.

This integrated approach allows you to maintain accurate financial records while gaining real-time visibility into where your money goes, helping you make informed decisions about budgeting and cost control.

Understanding QuickBooks' expense module

The expense module serves as your central hub for recording and monitoring all business expenditures. Managing expenses using QuickBooks streamlines your workflow by allowing you to enter expenses manually, import bank transactions automatically, or capture receipts through mobile devices.

You can attach supporting documentation directly to transactions, ensuring complete audit trails. The module integrates seamlessly with your chart of accounts, automatically updating your financial statements as you record expenses. This eliminates duplicate data entry and reduces the likelihood of errors in your bookkeeping processes.

Key components: Categorization, receipts, and vendor mapping

Effective expense management relies on three foundational elements.

• Categorization: Enables you to assign each expense to specific accounts, such as office supplies, travel, or utilities, providing clarity in your financial reporting.

• Receipt management: Allows you to digitally capture and store documentation, meeting IRS requirements while eliminating paper clutter.

• Vendor mapping: Connects your expenses to specific suppliers, helping you track spending patterns, manage payment terms, and maintain vendor relationships.

Together, these components create a structured system that transforms raw transaction data into actionable business intelligence you can use for strategic planning.

Why QuickBooks expense management matters for businesses

1. How expense organization drives financial clarity

Organized expenses provide you with an accurate picture of your financial health at any moment. QuickBooks expense management transforms scattered transaction data into structured reports that reveal spending trends, departmental costs, and profit margins.

You gain the ability to compare actual spending against budgets, identifying variances before they become problems. This clarity empowers you to allocate resources effectively and adjust strategies promptly.

2. The risks of inconsistent categorization

Inconsistent categorization creates misleading financial reports that undermine your decision-making. You may misclassify deductible expenses as non-deductible, leaving money on the table during tax season.

Poor categorization also distorts your understanding of where money flows, making it impossible to identify cost overruns or profitable areas. Additionally, you risk audit penalties when examiners find improperly documented or categorized expenses in your records.

3. Benefits of automated data entry and tagging

Automation eliminates manual data entry errors and saves you countless hours on bookkeeping tasks. You benefit from real-time expense tracking as bank feeds automatically import and categorize transactions based on rules you establish.

Automated tagging ensures consistency across all entries, improving report accuracy. This efficiency allows you to focus on analyzing financial data rather than entering it, accelerating your month-end close process.

4. Why expense management forms the backbone of accounting

Expense management anchors your entire accounting system because outflows affect every financial statement and business metric. You cannot accurately calculate profit, assess cash flow, or plan budgets without precise expense data.

Proper expense tracking ensures your balance sheet reflects true liabilities and your income statement shows accurate operational costs. This foundation supports all subsequent financial analysis and strategic planning initiatives.

Key benefits of using QuickBooks for expense management

Improved financial planning and budgeting

QuickBooks enables you to create data-driven budgets based on historical spending patterns, resulting in forecasts with up to 95% accuracy. You gain the ability to set departmental spending limits and receive alerts when expenditures approach thresholds, preventing budget overruns before they occur.

This precision allows you to allocate capital strategically, invest in growth opportunities with confidence, and demonstrate fiscal responsibility to stakeholders and lenders.

Enhanced tax compliance and deduction tracking

The platform ensures you capture every tax-deductible expense, potentially increasing your annual deductions by 15-30% compared to manual tracking methods. You maintain IRS-compliant documentation with digital receipt storage and audit trails that reduce examination risk.

Automated categorization eliminates misclassification errors that trigger penalties, while year-end tax reporting features generate the documentation your accountant needs, reducing preparation fees and filing time by up to 40%.

Real-time cash flow monitoring

When you categorize expenses in QuickBooks, you gain immediate visibility into cash outflows across all business areas, enabling you to identify liquidity issues before they become critical.

Real-time dashboards show your available cash position, upcoming obligations, and burn rate, allowing you to make informed decisions about payments, purchases, and investments. This transparency helps you maintain optimal cash reserves, negotiate better payment terms with vendors, and avoid costly overdraft fees or emergency financing.

Streamlined expense approval and reimbursement

Digital approval workflows reduce reimbursement processing time from weeks to days, improving employee satisfaction and retention. You establish multi-level authorization hierarchies that enforce spending policies automatically, reducing fraudulent claims by up to 60%.

Automated reimbursement calculations eliminate disputes over amounts owed, while direct integration with payroll systems ensures employees receive payments promptly, enhancing morale and demonstrating organizational efficiency to your team.

Setting up QuickBooks for stress-free expense categorization

Auto-importing from connected bank and card accounts

Connecting your business bank accounts and credit cards to QuickBooks eliminates manual transaction entry and ensures no expense goes unrecorded. The system automatically downloads transactions daily, applying intelligent categorization rules based on vendor patterns and historical data.

QuickBooks expense categorization becomes seamless as the software learns your preferences over time, reducing review time by 70% and maintaining up-to-date financial records without constant manual intervention.

Capturing receipts via QuickBooks mobile app

The mobile app transforms your smartphone into a powerful receipt management tool, allowing you to photograph receipts at the point of purchase. Advanced optical character recognition extracts key data vendor name, amount, date, and tax automatically populating transaction fields.

You can attach these digital receipts directly to corresponding expenses, creating complete documentation chains that satisfy audit requirements while eliminating paper storage and the risk of lost receipts.

Enabling multi-user access for expense roles

Configuring role-based user permissions allows you to delegate expense management tasks while maintaining financial controls. You can grant employees access to enter their own expenses, provide managers with approval authority, and restrict sensitive financial data to authorized personnel only.

This distributed approach accelerates data entry, improves accuracy through direct employee input, and creates accountability trails that enhance both efficiency and compliance.

Configuring auto-matching preferences for faster reconciliation

Setting up bank rule preferences enables QuickBooks to automatically match imported transactions with existing bills, purchase orders, or recurring expenses. You establish matching criteria based on amount ranges, vendor names, and date windows that align with your business cycles.

This automation reduces reconciliation time from hours to minutes, minimizes duplicate entries, and ensures your books remain accurate and current with minimal manual intervention required.

How to effectively categorize transactions in QuickBooks

1. Understanding account and category structures

QuickBooks organizes expenses using a hierarchical chart of accounts with parent categories and subcategories that align with standard accounting principles.

You structure your expense accounts to match your business model grouping similar costs under parent categories like "Operating Expenses" or "Cost of Goods Sold" for clear financial reporting.

This framework ensures consistency across all transactions and generates meaningful profit-and-loss statements that reveal true operational costs.

Example: Your monthly office rent of $2,500 flows into the parent category "Occupancy Costs" under the subcategory "Rent Expense," separating it from "Property Insurance" and "Utilities" within the same parent group for detailed facility cost analysis.

2. How AI suggests categories automatically

QuickBooks' artificial intelligence analyzes vendor names, transaction amounts, and historical patterns to recommend appropriate expense categories automatically.

The system learns from your corrections, improving accuracy with each transaction you review for better insights and efficiency every single time.

You simply confirm or adjust the AI's suggestion, dramatically reducing categorization time while maintaining accuracy rates exceeding 90% after the initial learning period.

Example: QuickBooks auto-suggests "Software & Technology" for your monthly $149.99 Zoom invoice, recognizing the vendor name and recurring amount pattern from previous months, requiring only your one-click approval to complete categorization.

3. Creating bank rules to automate recurring expense entries

Bank rules allow you to establish permanent categorization instructions for specific vendors or transaction patterns.

You define conditions such as vendor name contains "Electric Company" or amount equals $500 and QuickBooks automatically applies your designated category to matching transactions.

This automation handles predictable expenses instantly, freeing you to focus on unusual or complex entries requiring judgment.

Example: You create a rule stating "If vendor = State Farm Insurance, then categorize as Insurance Expense," ensuring your quarterly $1,200 business liability premium automatically posts to the correct account without manual review.

4. When and how to use split categories correctly

Split categorization becomes necessary when a single transaction contains multiple expense types that belong in different accounts.

You categorize expenses in QuickBooks by dividing the total amount across relevant categories, maintaining accurate departmental or functional cost tracking.

This precision ensures each category reflects only its true costs, preventing distorted financial analysis and enabling accurate budget comparisons.

Example: Your $800 business trip to a conference splits into three categories: $450 to "Travel Airfare," $250 to "Lodging," and $100 to "Meals & Entertainment," accurately reflecting each cost component separately.

5. Avoiding the most common categorization mistakes

The most frequent errors include mixing personal and business expenses, miscategorizing capital purchases as operating expenses, and using generic "Miscellaneous" categories excessively.

You prevent these mistakes by establishing clear categorization guidelines, regularly reviewing uncategorized transactions, and creating specific accounts for common expense types.

Consistent practices eliminate tax compliance issues and ensure your financial statements accurately represent business performance.

Example: Instead of categorizing your $3,000 laptop purchase as "Office Supplies" (an immediate expense), you correctly record it as "Computer Equipment" under fixed assets, then apply depreciation over its useful life per IRS guidelines.

Why accurate transaction categorization is crucial for easy QuickBooks integration

Ensuring consistent account and vendor mapping across systems

Consistent categorization creates reliable mapping between QuickBooks and connected applications like payment processors, banking platforms, or expense management tools.

When categories align across systems, transactions automatically route to the correct accounts, vendors match accurately, and your financial reports remain synchronized. This consistency eliminates manual data entry and reduces the risk of misclassified transactions disrupting your workflow.

Reducing duplicate and missing transactions

Well-organized categories help integration tools identify and prevent duplicate entries when syncing data between platforms. Managing expenses using QuickBooks becomes effortless when proper categorization enables automatic reconciliation features to detect matching transactions.

Clear categorization also highlights missing entries quickly, ensuring complete financial records. Your integration systems can flag discrepancies immediately rather than letting gaps accumulate over reporting periods.

Preparing your data for multi-currency and complex expense integration

Accurate categorization becomes even more critical when handling multi-currency transactions or complex expense scenarios. Properly tagged transactions allow QuickBooks integrations to apply correct exchange rates, allocate expenses to appropriate cost centers, and maintain audit trails across currencies.

This preparation ensures that advanced features like automated currency conversion and split transactions work correctly when connecting specialized tools for international operations or project-based accounting.

How to integrate your expense management tool with QuickBooks seamlessly

Understanding the role of integrations and APIs

QuickBooks integration relies on Application Programming Interfaces (APIs) that enable secure, automated data exchange between systems. These connections allow expense tools to read your Chart of Accounts, push transaction data, and update records in real-time.

Understanding API limitations, sync frequencies, and data field mappings ensures you select integration methods that match your business requirements and technical capabilities for optimal performance.

Choosing the right expense management tool

Select an expense platform that offers native QuickBooks compatibility and supports your specific accounting needs. Evaluate features like receipt capture, approval workflows, mobile accessibility, and reporting capabilities.

Verify that the tool handles your transaction volume, supports required expense categories, and provides reliable customer support. Prioritize solutions with proven track records of maintaining stable QuickBooks connections and regular feature updates.

Mapping chart of accounts, vendors, and classes for integration

Establish precise mappings between your expense tool categories and QuickBooks accounts before initiating data transfer. Align vendor names to prevent duplicate entries, match expense types to corresponding GL accounts, and configure class or department tracking if applicable.

Create a mapping documentation spreadsheet to maintain consistency. This foundational step prevents misclassified transactions and ensures financial reports accurately reflect your organizational structure.

Handling multi-currency and international expenses

Configure currency settings in both systems to maintain exchange rate accuracy for international transactions. Enable multi-currency features in QuickBooks and verify your expense tool supports automatic currency conversion.

Establish protocols for handling foreign transaction fees, set appropriate home currency defaults, and determine whether to use daily rates or fixed conversion values for consistency across reporting periods.

Testing the sync before full deployment and data validation

Conduct thorough testing using a limited dataset before synchronizing your complete transaction history. Create sample expenses across various categories, currencies, and approval states to verify correct data flow.

Review how the integration handles edge cases like split transactions, reimbursements, and credit card payments. Validate that all fields transfer accurately and troubleshoot any discrepancies before processing live data.

Setting up automated data transfer between systems

Configure sync schedules that balance real-time accuracy with system performance requirements. Establish rules for which transaction types sync automatically versus requiring manual approval. Set up notification alerts for sync failures or data conflicts.

Define user permissions to control who can initiate syncs and modify integration settings. Document your automation workflows to ensure team members understand how and when data transfers occur.

Monitoring and maintaining integration health over time

Implement regular audits comparing transaction counts and amounts between systems to identify sync issues early. Monitor API usage limits, review error logs weekly, and stay informed about software updates that might affect connectivity.

Schedule quarterly reviews of your mapping configurations to accommodate business changes. Maintain backup procedures and establish clear protocols for resolving integration disruptions to minimize impact on financial operations.

6 Steps to take when QuickBooks fails to sync your bank account

Step 1 – Verify your bank connection status

Navigate to the Banking section in QuickBooks and examine the connection status indicator for your affected account. Look for error messages, alert icons, or timestamp information showing when the last successful sync occurred.

Check if multiple accounts from the same institution are experiencing issues, which may indicate a broader connectivity problem rather than an account-specific error requiring targeted resolution.

Step 2 – Refresh or reconnect your bank feed

Initiate a manual update by clicking the "Update" button next to your bank account to force a new sync attempt. If this fails, disconnect the bank feed completely through account settings and re-establish the connection by entering your credentials again.

This process often resolves temporary authentication failures or expired security tokens that prevent QuickBooks from accessing your financial institution's data servers.

Step 3 – Clear cached data or old credentials

Remove stored login credentials and cached banking data from QuickBooks to eliminate corrupted information blocking successful connections. Access your browser settings if using QuickBooks Online and clear cookies and cache specifically for the QuickBooks domain.

For QuickBooks Desktop, delete temporary internet files and reset browser components through the application preferences to ensure clean authentication attempts with your bank.

Step 4 – Review bank feed mapping and account links

Verify that your bank account is correctly mapped to the appropriate QuickBooks account in your Chart of Accounts. Examine whether recent changes to account numbers, institution mergers, or internal restructuring affected the connection parameters.

Confirm that the account type designation—checking, savings, or credit card—matches your actual bank account to prevent mismatched data formats from causing sync failures.

Step 5 – Check for updates or QuickBooks maintenance alerts

Review the QuickBooks service status page or your account notifications for scheduled maintenance, known outages, or required software updates. Install any pending QuickBooks updates that may include critical patches for banking connectivity.

Subscribe to your financial institution's service alerts to identify if banking API issues on their end are preventing third-party applications from accessing transaction data successfully.

Step 6 – Contact support if sync still fails

Reach out to QuickBooks customer support with detailed information, including error codes, screenshots of failure messages, and a timeline of troubleshooting steps already attempted. Request escalation to technical specialists if standard solutions prove ineffective.

Consider contacting your bank's business services department simultaneously to verify that your account has proper permissions enabled for third-party financial software connections and data sharing authorizations.

Common sync challenges and how to troubleshoot them

Leveraging QuickBooks advanced reporting and analytics for expense insights

1. Customizing expense reports to fit your business needs

Tailor standard QuickBooks expense reports by selecting specific accounts, date ranges, vendors, and classes relevant to your operational requirements. Utilize the report customization interface to add or remove columns, apply filters for particular departments or projects, and adjust display formats for clarity.

Incorporate comparative periods to track expense trends and create specialized views that align with your unique reporting hierarchies and management information needs.

2. Using real-time dashboards for monitoring spending trends

Configure QuickBooks dashboards to display key expense metrics through visual charts, graphs, and summary widgets that update automatically as transactions are recorded. Monitor critical indicators such as budget versus actual spending, top vendor expenditures, and category-level trend analysis at a glance.

Real-time visibility enables proactive expense management and immediate identification of anomalies requiring investigation.

3. Scheduling automated reports for timely financial reviews

Establish automated report delivery schedules that distribute expense analyses to appropriate stakeholders without manual intervention. Configure QuickBooks to generate and email reports daily, weekly, or monthly based on organizational review cadences and decision-making timelines.

Set up recipient lists by role to ensure relevant personnel receive pertinent financial information promptly. Scheduled reporting creates accountability, maintains consistent financial oversight, and ensures leadership remains informed of expenditure trends without delays.

Make QuickBooks expense management effortless with Volopay’s smart automation

Ensuring compliance and audit readiness with QuickBooks

Maintaining comprehensive audit trails and documentation

QuickBooks automatically records detailed transaction histories, including user actions, timestamps, modification logs, and approval workflows that create transparent audit trails.

Enable audit log features to track all changes made to financial records, including deletions, adjustments, and reclassifications. Regularly back up your QuickBooks data to secure cloud storage or external systems, ensuring historical records remain accessible.

Implementing role-based access and approval controls

Configure user permissions based on organizational roles to enforce segregation of duties and prevent unauthorized financial activities. Restrict access to sensitive functions such as transaction deletion, vendor management, and bank reconciliation to appropriate personnel only.

Establish multi-level approval workflows for expenses exceeding designated thresholds, ensuring proper authorization before payment processing. Regularly review user access rights to accommodate personnel changes and maintain security integrity.

Ensuring policy alignment for expense classification

Develop standardized expense classification guidelines that align with tax regulations, industry standards, and internal financial policies. Create custom expense categories within QuickBooks that reflect your specific business operations while maintaining compatibility with standard tax forms and regulatory requirements.

Conduct periodic reviews of transaction classifications to identify and correct misallocations that could compromise financial statement accuracy or tax compliance.

Generating audit-ready reports for tax and compliance reviews

Utilize QuickBooks reporting functions to produce comprehensive financial statements, general ledgers, and transaction details formatted for auditor review.

Generate specialized reports, including expense summaries by category, vendor payment histories, and tax-specific documentation such as Form 1099 information. Configure reports to include all required data fields, supporting documentation references, and reconciliation details that auditors typically request.

Centralizing evidence for reimbursements and vendor payments

Implement systematic attachment processes that link receipts, invoices, contracts, and supporting documentation directly to corresponding QuickBooks transactions. QuickBooks expense management capabilities enable digital storage of evidence that provides immediate access during audits without manual file searches.

Centralized evidence management streamlines audit responses, validates business expenses, and demonstrates compliance with corporate expenditure policies and regulatory standards.

Best practices for maintaining data accuracy after integration

Regularly reviewing synced transactions for discrepancies

Schedule weekly reviews comparing transaction counts, amounts, and dates between QuickBooks and source systems to identify synchronization gaps or mismatched entries. Examine recently imported transactions for incorrect categorizations, duplicates, or missing vendor information that could compromise financial reporting accuracy.

Establish standardized checklists for reviewers to ensure consistent validation processes across accounting team members and maintain documentation of identified issues and resolutions.

Example

A finance manager discovers that 15 expense transactions from the previous week show different amounts in QuickBooks versus the expense management platform. Investigation reveals a currency conversion setting discrepancy.

By catching this during the weekly review, the team corrects the mapping before month-end closing, preventing financial statement inaccuracies that would require time-consuming adjustments.

Setting up automated alerts for data conflicts

Configure notification systems that immediately flag synchronization failures, duplicate transaction attempts, or unrecognized accounts requiring manual intervention. Establish alert thresholds for unusual transaction volumes, amounts exceeding expected ranges, or QuickBooks expense categorization mismatches that indicate potential errors.

Route notifications to appropriate personnel based on transaction type and severity to ensure prompt resolution and minimize disruption to financial workflows and reporting timelines.

Example

An automated alert notifies the accounting supervisor when the integration system attempts to create a vendor payment without matching it to an existing QuickBooks vendor record.

The supervisor immediately updates the vendor mapping table, allowing the transaction to process correctly rather than creating a duplicate vendor entry that would complicate future reporting and payment tracking.

Refreshing API tokens and integration credentials

Proactively update authentication credentials, API tokens, and security certificates before expiration dates to prevent unexpected connection failures. Monitor integration platform notifications regarding upcoming credential renewals and schedule maintenance windows for updates.

Document credential refresh procedures, storage locations for authentication information, and emergency contact protocols for access issues that require immediate resolution to maintain continuous data synchronization between systems.

Example

The IT team receives a 30-day expiration warning for the API token connecting QuickBooks to the payment processing platform. They schedule credential renewal during a low-transaction period and test the connection thoroughly.

This proactive approach prevents the integration from breaking during month-end processing, which would have delayed critical vendor payments and financial reconciliation activities.

Updating Chart of Accounts and vendor mappings

Review and update account mappings quarterly to reflect organizational changes, new expense categories, restructured departments, or modified vendor relationships. Communicate Chart of Accounts modifications to all stakeholders managing integrated systems to ensure consistent updates across platforms.

Create version-controlled mapping documentation that tracks changes over time and provides historical context for transaction classification decisions during audits or troubleshooting efforts.

Example

After a departmental reorganization, the company adds three new cost centers to its Chart of Accounts. The accounting team updates integration mappings within 24 hours, ensuring new project expenses automatically route to the correct accounts.

Without this prompt update, transactions would have defaulted to generic accounts, requiring manual reclassification of hundreds of expenses and delaying accurate project cost reporting.

Running monthly validation and backup procedures

Execute comprehensive reconciliation procedures comparing total transaction values, account balances, and vendor payment summaries across all integrated systems at month-end. Perform complete QuickBooks data backups before and after major synchronization operations to enable recovery from corruption or errors.

Test backup restoration processes quarterly to verify data integrity and confirm recovery procedures function properly when needed for business continuity or disaster recovery scenarios.

Example

During monthly validation, an accountant discovers a $12,000 discrepancy between the bank feed total and recorded deposits in QuickBooks. The investigation reveals that a batch of 20 transactions failed to import due to a temporary API disruption.

Because the team maintains comprehensive backup procedures, they restore the missing transactions from the pre-sync backup and reprocess them, ensuring complete financial records without permanent data loss.

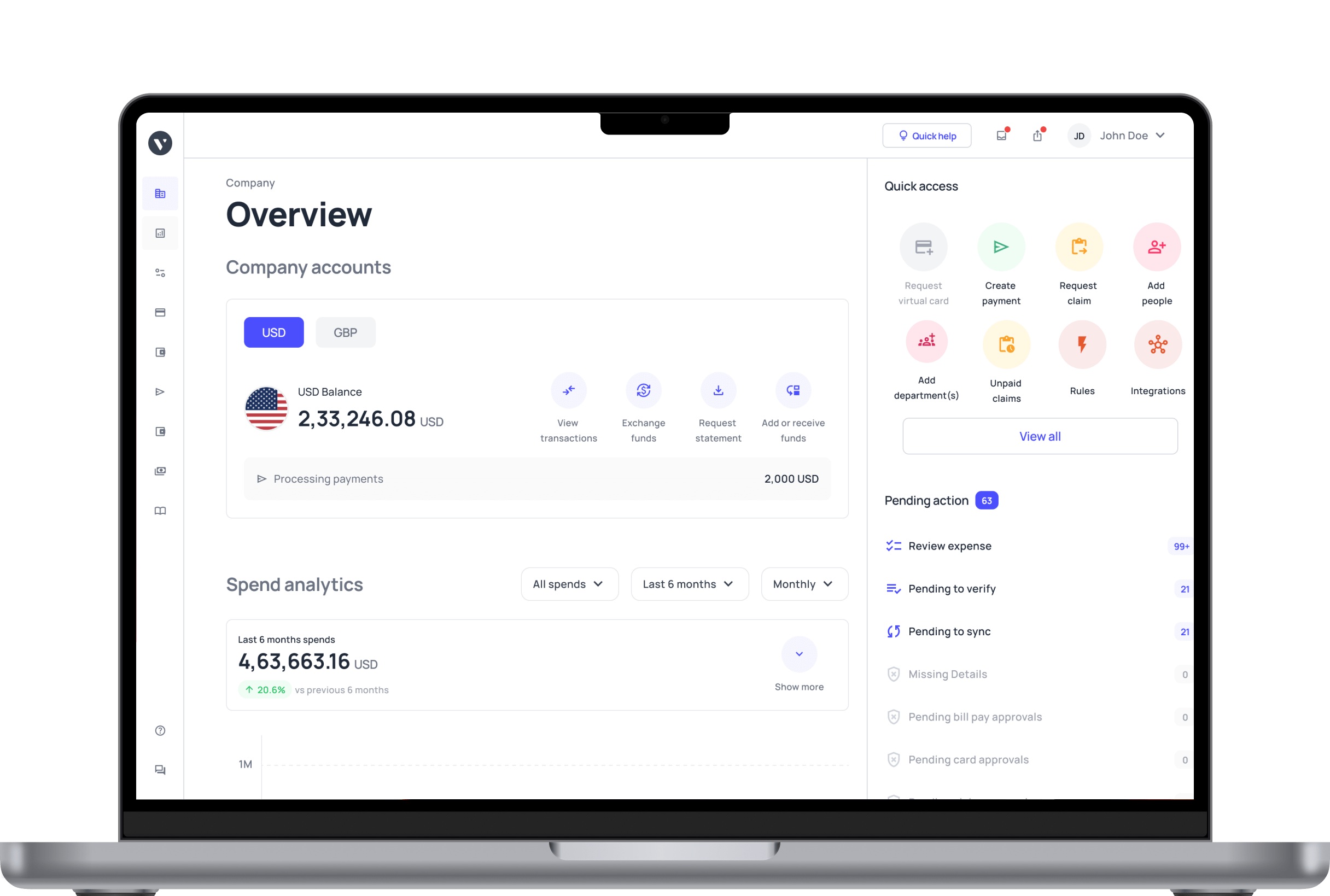

Simplify QuickBooks expense management with Volopay's seamless integration

Transform your financial operations with Volopay's powerful QuickBooks integration. Eliminate manual data entry, reduce reconciliation errors, and gain real-time visibility into your company's spending.

Volopay's all-in-one expense management system streamlines expense tracking, accelerates month-end closures, and empowers your finance team to focus on strategic growth rather than tedious administrative tasks.

Seamless two-way data sync between Volopay and QuickBooks

Experience effortless synchronization as transactions flow automatically between platforms. Volopay's bidirectional integration capabilities ensure that your QuickBooks ledger reflects real-time expense data with complete accuracy.

No more duplicate entries or data discrepancies. Every corporate card purchase, reimbursement, and bill payment updates instantly across both systems for perfect financial harmony.

Automatic expense categorization and reconciliation

Say goodbye to manual categorization headaches. Volopay intelligently maps expenses to the correct QuickBooks accounts, tax codes, and departments automatically.

With real-time visibility into every transaction as it happens, our smart engine learns your spending patterns, ensures consistent categorization, and flags anomalies for review. Reconciliation becomes effortless as matching transactions are identified instantly, reducing month-end processing time by up to 80%.

Custom rules to map your transactions

Tailor the integration to your unique business needs with flexible mapping rules. Define custom criteria based on merchant names, amounts, employees, or departments to route transactions precisely where they belong.

Create unlimited rules that automatically assign GL codes, classes, and locations, ensuring every expense aligns perfectly with your chart of accounts structure.

Prepare, reconcile, export with ease

Managing expenses using QuickBooks reaches new efficiency levels with Volopay's streamlined workflow. Review and approve expenses within Volopay's intuitive dashboard, then export clean, categorized data directly to QuickBooks with a single click.

Attach receipts automatically, add notes for auditors, and maintain a complete audit trail, all while slashing reconciliation time from days to minutes.

Advanced rule-based integration for accuracy

Leverage sophisticated automation that eliminates human error from your expense management process. Set up conditional rules for complex scenarios, establish approval hierarchies, and enforce policy compliance automatically.

Volopay's intelligent system validates data before syncing, preventing errors from reaching QuickBooks and ensuring your financial records maintain impeccable accuracy and regulatory compliance.

Bring Volopay to your business

Get started now

FAQs

Enable bank feeds to automatically import transactions, then create rules that assign categories based on vendors or amounts. QuickBooks learns patterns and suggests categorizations, while third-party integrations like Volopay provide advanced automation for corporate expenses.

Suggested categories are QuickBooks' default classifications based on transaction patterns and merchant data. Custom categories are user-defined expense accounts tailored to your specific business structure, offering greater control and alignment with your unique chart of accounts requirements.

Recurring transactions are automated entries for regular income or expenses without vendor management. Recurring bills track scheduled payments to specific suppliers, include due dates, and integrate with accounts payable workflows, providing comprehensive vendor payment tracking and management capabilities.

Duplicate syncs occur from overlapping bank feeds, multiple integration connections, or manual entries alongside automated imports. Timing mismatches during synchronization, incorrect mapping rules, or repeated sync attempts after errors also create duplicate transactions requiring manual reconciliation and cleanup.

Volopay connects via secure API integration, enabling automatic bidirectional data sync. Transactions from corporate cards, reimbursements, and bill payments flow directly into QuickBooks with pre-mapped categories, eliminating manual entry while maintaining real-time financial visibility across platforms.

Yes, Volopay automatically converts foreign currency transactions using real-time exchange rates and syncs them to QuickBooks. The system records both original and converted amounts, ensuring accurate financial reporting while maintaining complete multi-currency transaction visibility for global operations.

Volopay employs validation checks before syncing, verifying account mappings, tax codes, and transaction details. The system flags discrepancies for review, maintains audit trails, prevents duplicate entries, and allows pre-sync approval workflows to guarantee error-free financial data transfer.

Absolutely. Once expenses are approved in Volopay's workflow, they sync instantly to QuickBooks. Real-time updates ensure your financial records reflect current spending immediately, enabling accurate cash flow monitoring, timely reporting, and up-to-date financial decision-making without delays.

Yes, Volopay offers robust rule-based mapping allowing you to define custom criteria by merchant, employee, department, or amount. Create unlimited conditional rules that automatically assign specific GL accounts, classes, locations, and tax codes for precise QuickBooks categorization.