How to apply for and get a corporate credit card (2026)

Corporate credit cards have become essential financial tools for modern businesses, streamlining expense management, improving cash flow, and providing valuable spending insights. As companies scale operations and manage distributed teams, these payment solutions offer centralized control over business expenditures while empowering employees to make necessary purchases without cumbersome reimbursement processes.

Understanding the application landscape in 2026 requires familiarity with evolving eligibility criteria, documentation standards, and technological integrations that define today's corporate card ecosystem.

When you apply for corporate credit card products, preparation and strategic planning significantly impact approval outcomes and terms offered. Getting a corporate credit card requires demonstrating financial stability, establishing clear usage policies, and selecting providers whose features align with your operational requirements.

Key takeaways

The application process requires structured preparation, including reviewing business credit, assessing financial health, and organizing required legal and financial documentation.

Eligibility is based on operational history and financial strength, with issuers evaluating revenue stability, tax registration (EIN), and in some cases, owner creditworthiness.

Approval timelines vary by complexity, typically ranging from a few days to several weeks, followed by onboarding steps such as account setup, card configuration, and employee access controls.

Successful implementation depends on governance after approval, including spending policies, monitoring systems, accounting integration, and avoiding common application mistakes.

How to get a corporate credit card

This step-by-step guide walks you through each step, from initial preparation to ongoing card management, ensuring your business maximizes the benefits while maintaining financial control.

Before you apply

Assess your business's financial health and creditworthiness before initiating the process. Review your business credit reports for accuracy, gather recent financial statements, and determine your credit needs based on spending patterns.

When you apply for corporate credit card products, having this groundwork completed strengthens your application and helps you select the most suitable option for your organization's requirements.

Eligibility requirements

Most issuers require businesses to be operational for at least one or two years with verifiable revenue streams. Your company needs a federal tax identification number (EIN), established business credit history, and demonstrated financial stability.

Strong personal credit scores of primary business owners may also factor into approval decisions, particularly for newer companies with limited business credit histories.

Documents required

Prepare comprehensive documentation, including business formation documents, recent tax returns, financial statements, and bank account information. Corporate credit card requirements typically include profit and loss statements, balance sheets, business licenses, and ownership verification documents.

Having your EIN, legal business name, physical address, and industry classification codes readily available expedites the process.

Application process

Complete the online or paper application with accurate business and personal information from authorized signatories. Provide detailed financial data, requested credit limits, and specify intended card usage.

Submit all supporting documentation simultaneously to avoid processing delays. Most applications include personal guarantees from business owners, so review terms carefully before signing.

Approval timeline

Application processing times vary between issuers, typically ranging from a few days to several weeks depending on application complexity. Straightforward applications with strong credit profiles and complete documentation often receive faster decisions, sometimes within 24-48 hours.

More complex situations requiring additional verification or documentation review may extend timelines to 2-4 weeks.

Post-approval setup

Upon approval, activate your cards and establish your online account management portal immediately. Configure user access levels, set spending limits for different cardholders, and integrate the account with your accounting and expense management systems.

Create virtual cards for online transactions and specific vendor payments. Distribute physical cards to authorized employees with clear usage guidelines.

Spend controls

Implement robust spending controls through your card provider's management platform, including transaction limits, merchant category restrictions, and approval workflows. Assign individual spending thresholds based on employee roles and responsibilities.

Configure real-time alerts for unusual activity or threshold breaches. Regular policy reviews ensure controls remain aligned with evolving business needs while preventing unauthorized spending and maintaining accountability.

Monitoring & repayment

Monitor card activity daily through online dashboards, reviewing transactions for accuracy and policy compliance. Reconcile expenses regularly with accounting records and require timely receipt submission from cardholders.

Generate monthly reports analyzing spending patterns, identifying optimization opportunities, and ensuring budget adherence. Conduct periodic audits of card usage and adjust controls as necessary to maintain financial discipline.

What happens after a corporate credit card is approved?

Once your corporate credit card application receives approval, the issuer typically sends physical cards within 7-10 business days, along with detailed terms and conditions documentation. You'll receive information about your credit limit, interest rates, payment due dates, and any applicable fees.

Many issuers also provide immediate access to virtual card numbers through online portals, allowing you to begin making purchases while awaiting physical cards. This initial phase includes setting up your online account, activating cards, and configuring user permissions for authorized employees.

Getting a corporate credit card marks the beginning of implementation rather than the end of the process. Finance teams should immediately establish spending controls, assign cards to designated employees, and integrate the account with existing expense management and accounting systems.

Schedule training sessions to educate cardholders on company policies, expense reporting procedures, and proper usage guidelines. Setting up automated alerts, spending notifications, and regular reconciliation schedules ensures smooth operations and helps maintain financial oversight from day one.

What are some corporate credit card application mistakes to avoid?

1. Failing to review your business credit profile

Many businesses skip checking their credit reports before applying, leading to unexpected rejections. Review your business credit score from major bureaus, identify any errors or discrepancies, and address outstanding issues beforehand.

Understanding your credit standing helps you choose appropriate card products and strengthens your application, increasing approval chances and potentially securing better terms and credit limits.

2. Submitting inaccurate documentation

Rushing through applications with missing financial statements, tax returns, or business licenses creates delays and raises red flags. Ensure all requested documents are current, accurate, and properly formatted.

Double-check that your business information matches across all submitted materials. Incomplete applications signal disorganization to issuers and may result in denial, requiring you to restart the entire process.

3. Choosing cards based solely on rewards

While rewards programs are attractive, selecting cards without evaluating fees, interest rates, and spending requirements can prove costly. Analyze your company's actual spending patterns, assess annual fees against realistic reward potential, and consider foreign transaction costs if applicable.

A card with lower earnings but better terms often delivers superior long-term value than one with flashy rewards you'll never maximize.

4. Not establishing clear usage policies first

Applying for corporate credit cards without defined spending policies, approval workflows, or employee guidelines creates operational chaos. Develop comprehensive card usage rules, spending limits, and expense reporting procedures before distribution.

Clear policies protect against misuse, ensure compliance, and demonstrate financial responsibility to card issuers. This preparation also streamlines implementation once your application is approved.

5. Overlooking integration with accounting systems

Many businesses ignore how their chosen card integrates with existing financial infrastructure. Verify compatibility with your accounting software, expense management tools, and reporting requirements before applying.

Poor integration creates manual reconciliation burdens, increases error rates, and diminishes efficiency gains. Seamless connectivity between cards and financial systems maximizes operational benefits and provides accurate real-time spending visibility.

How long does it take to get a corporate credit card?

The complete process typically spans 2-3 weeks from application submission to card activation. Initial approval decisions generally occur within 7–10 business days, depending on application complexity and how thoroughly you've met corporate credit card requirements.

Physical card delivery adds another 5–7 business days, though some issuers provide instant digital credentials for immediate use.

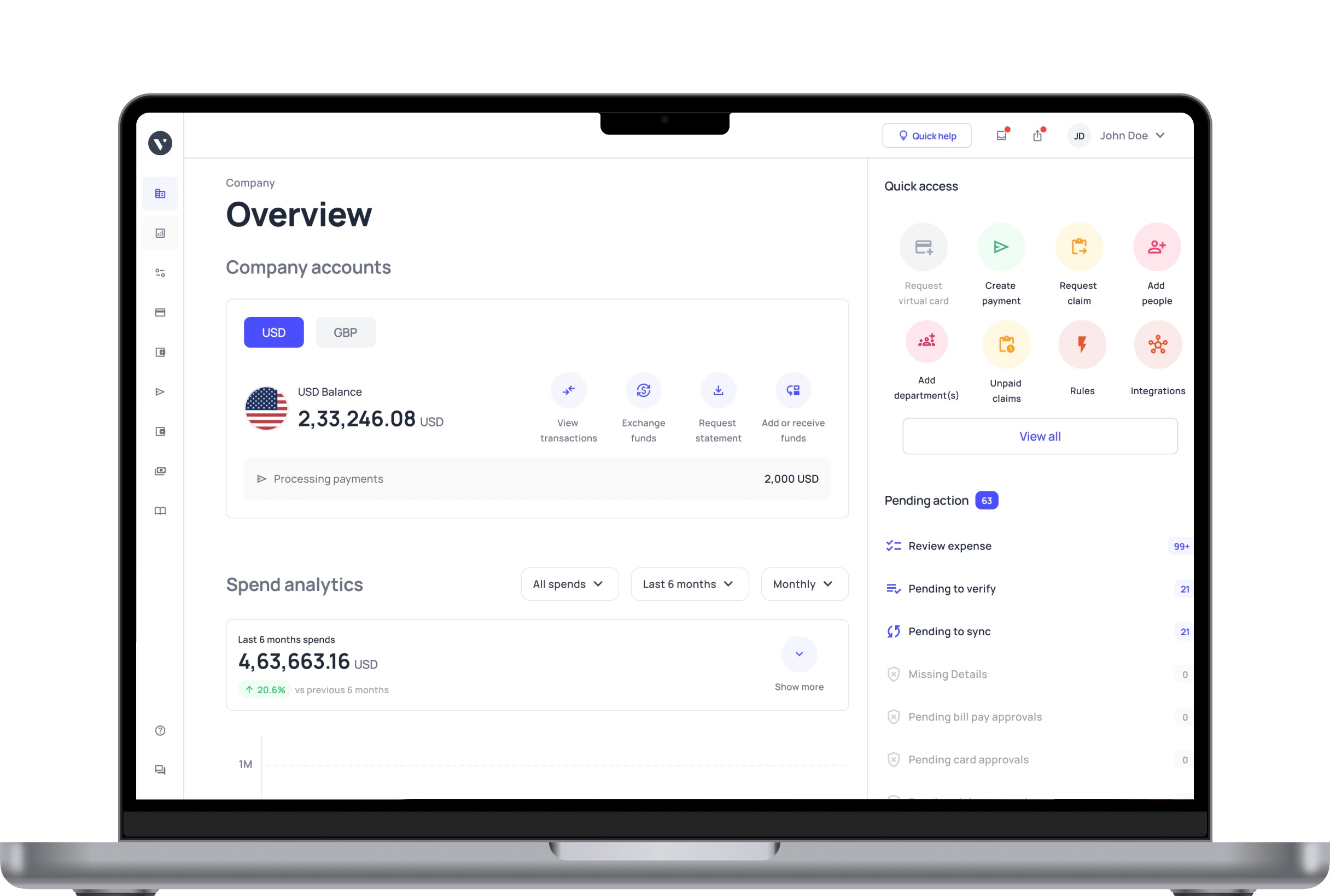

Consider Volopay's smart corporate card

Managing business expenses doesn't have to be complicated. Volopay's smart corporate cards offer businesses a streamlined approach to financial operations, combining physical and virtual cards with automated expense tracking.

The platform integrates seamlessly with accounting software, reducing manual data entry and providing real-time visibility into company spending patterns.

Getting a corporate card solution that adapts to your business needs means having control over employee spending limits, instant card issuance, and detailed reporting capabilities.

Volopay enables finance teams to set custom spending controls, approve transactions in real time, and gain comprehensive insights into expenditure across departments all while maintaining robust security measures and compliance standards.