How to apply and get a business credit card (2026)

Choosing the right financial tools plays a critical role in how effectively you manage and scale your company. In 2026, a business credit card can help you separate expenses, manage cash flow, and build commercial credit with greater confidence. You can streamline purchasing, earn rewards, and gain better visibility into spending patterns across teams.

Understanding eligibility, documentation, and issuer expectations prepares you for getting a business credit card without delays. Applying for business credit card options strategically helps position a company for stronger control and improved reporting. It also supports smarter decisions from day one while navigating approvals, limits, fees, and compliance.

Key takeaways

Preparation significantly improves approval outcomes, as reviewing credit standing, confirming eligibility, and organizing documentation reduces delays and strengthens lender confidence.

Selecting the right card requires strategic evaluation, balancing fees, rewards, repayment flexibility, and spending controls to match operational needs and growth plans.

Accurate applications and proactive follow-up accelerate the process, minimizing verification setbacks and improving the likelihood of favorable limits and terms.

Post-approval setup determines long-term value, as configuring controls, monitoring transactions, and guiding employee usage ensures financial visibility, accountability, and sustainable credit management.

How to get a business credit card

Understanding the process helps you move faster, avoid rejections, and secure the right option by meeting lender expectations before you apply for your growing business.

Before applying

- 1. Assess your business eligibility

Confirm that your company meets issuer criteria, including legal structure, operating history, and revenue stability.

Lenders review industry risk, ownership details, and compliance status to assess eligibility. This helps determine approval, credit limits, pricing, and ongoing account terms.

- 2. Check your credit profile

You should review both personal and business credit reports to understand current scores, utilization, and payment history.

Issuers assess credit behavior to gauge risk, so correcting errors, lowering balances, and improving consistency can meaningfully increase approval odds and access to favorable terms.

- 3. Gather required documents

Organizing essential records such as registration certificates, tax identification numbers, financial statements, and bank details speeds verification and reduces follow-up requests.

Accurate documentation demonstrates reliability and supports efficient reviews. It also helps issuers complete assessments quickly while minimizing delays during submission and approval processes.

- 4. Compare card features and fees

You should evaluate interest rates, annual fees, rewards, controls, and repayment flexibility before selecting a provider.

Comparing terms helps align value and prevent surprises. It also ensures you apply for business credit card options that support spending control and long-term financial efficiency as your business grows.

Application process

- 1. Complete the application form

Accurately entering business details, ownership information, and financial data is critical during submission. Clear, consistent responses help issuers assess risk efficiently.

When you apply for business credit card programs, careful completion minimizes errors, prevents delays, and supports faster reviews without unnecessary clarification requests later internally. Double-checking entries before submission further reduces the risk of avoidable rejections.

- 2. Submit verification documents

Providing requested records promptly allows lenders to confirm legitimacy, financial stability, and compliance status. Documents may include registration certificates, tax identifiers, and bank statements.

Timely submission strengthens credibility, shortens review timelines, and reduces questions that could slow approval decisions. Organized documentation also signals strong internal financial management practices.

- 3. Track application status and approval

Monitoring progress after submission helps you respond quickly to issuer requests and timelines. Status updates reveal whether reviews, checks, or approvals are pending.

Active tracking ensures missed communications are avoided, follow-ups occur promptly, and final decisions are received without unnecessary waiting periods or uncertainty. Proactive engagement can also accelerate the resolution of minor issues during review.

What happens after a business credit card is approved?

1. Card activation and setup

You activate the card, create access, and configure billing preferences. This stage confirms account security, enables statements, and completes getting a business credit card so purchases, alerts, and support features function smoothly from transaction onward.

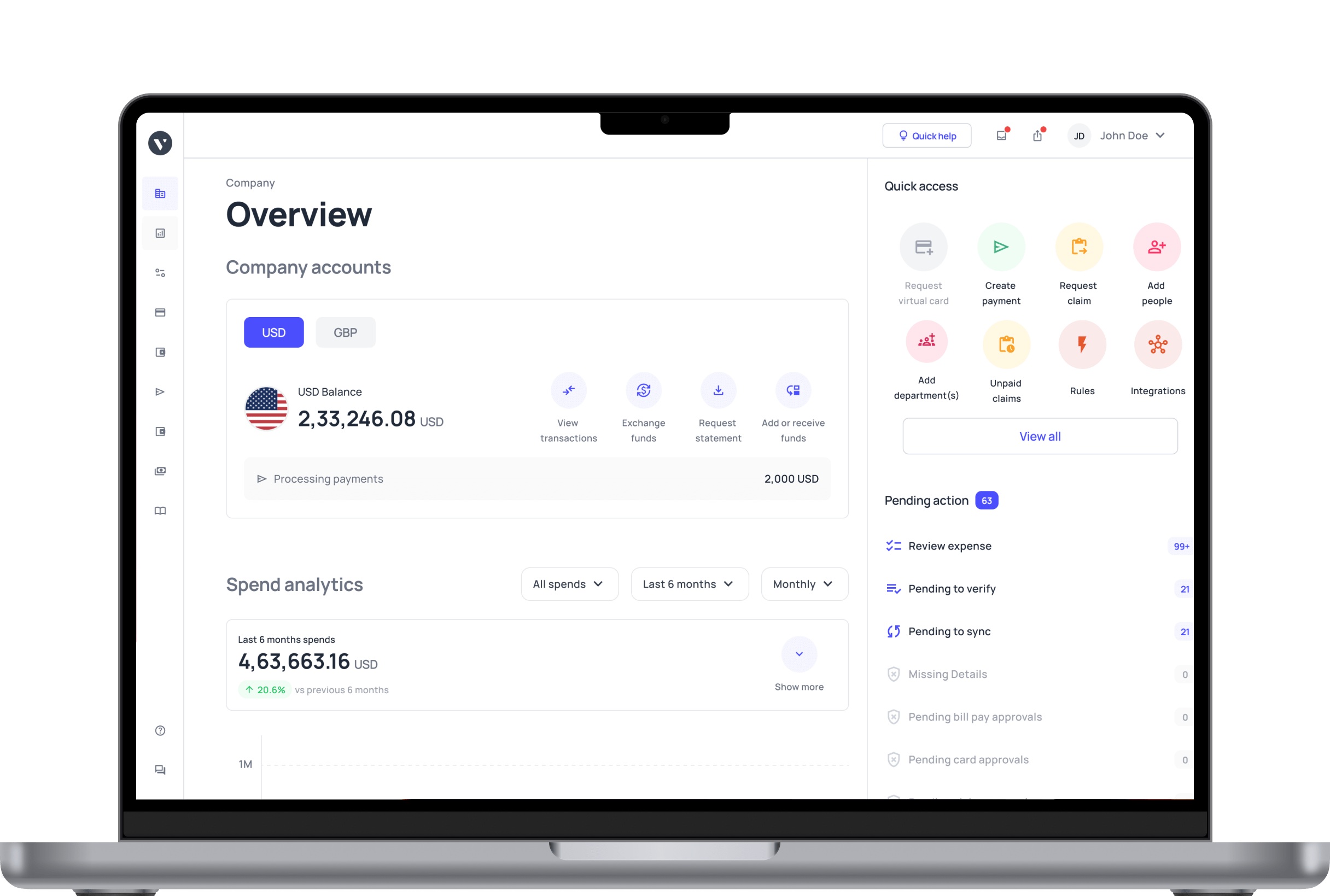

2. Setting spending limits and controls

Spending limits and controls are configured to align budgets, roles, and risk tolerance. You define caps, merchant rules, and approvals, ensuring expenses stay compliant while teams spend independently within approved thresholds and policies.

3. Distributing cards to employees

Cards are issued to employees based on responsibilities and spending needs. Clear usage guidelines, acknowledgments, and training help you ensure accountability, reduce misuse, and support smooth adoption across departments without disrupting daily operations routines.

4. Tracking expenses and transactions

Expense tracking tools record transactions in real time, categorizing spend automatically. You review activity and reconcile statements to improve visibility, accuracy, and control. Teams generate reports that simplify audits, budgeting, and financial decision-making across teams.

What are some business credit card application mistakes to avoid?

Knowing common application errors helps you avoid delays, protect your credit standing, and improve approval chances when selecting a business credit card aligned with your financial goals.

Poor personal credit

You may overlook how personal credit affects approval, but low scores, high utilization, or late payments signal risk to issuers. This can reduce limits or cause rejection, even when business finances and growth prospects remain stable.

Incorrect business information

Submitting inaccurate or inconsistent business details creates red flags and slows verification. Issuers rely on precise ownership, revenue, and registration data to validate legitimacy during compliance reviews and risk assessments.

Applying without eligibility

Applying without meeting issuer eligibility criteria wastes time and impacts credit. Requirements around revenue, operating history, and structure determine whether applications reach full review or face automatic declines from underwriting systems.

Choosing the wrong card

Selecting a card without comparing fees, rewards, controls, and interest terms can limit value. Over time, this increases costs and restricts flexibility as spending patterns and business needs evolve across teams and growth stages.

Multiple applications at once

Submitting several applications simultaneously may appear risky to lenders and trigger multiple credit inquiries. This reduces approval odds by signaling financial stress or uncertainty around funding needs and cash management.

Ignoring fees and APR

Focusing only on approval while ignoring annual fees, penalty charges, and APR can lead to higher long-term costs. These expenses often outweigh rewards and convenience when balances carry month to month across billing cycles.

How long does it take to get a business credit card?

Approval timelines for a business credit card vary based on issuer processes and application completeness. Some providers deliver instant decisions while others require manual review. Verification checks, document submission, and credit evaluation can extend timelines.

Once approved, card delivery may take several days. Planning ahead and submitting accurate information helps reduce delays. This ensures faster access to credit for growing businesses that are managing cash flow during expansion phases.