How to identify and fix expense tool sync errors: Everything you need to know

If you've ever watched your expense management system grind to a halt mid-sync, you know the frustration all too well. Expense tool sync errors can disrupt your entire financial workflow, leaving you with incomplete data, frustrated team members, and hours of manual reconciliation work.

Whether you're managing a small business or overseeing enterprise-level operations, sync failures between your expense tools and accounting software can cost you valuable time and money. The good news? Most of these issues are preventable and fixable once you understand what's causing them.

In this comprehensive guide, you'll discover how to identify the root causes of sync errors, implement effective solutions, and establish preventive practices that keep your systems running smoothly. With the right troubleshooting strategies and automation in place, you can eliminate these headaches and streamline your expense management workflow for good.

Understanding the common causes of sync failures in expense tools

Before you can learn how to fix sync errors, you need to understand what's causing them in the first place. Sync failures rarely happen without reason, and identifying the underlying issue is half the battle. Let's explore the most common culprits behind these frustrating disruptions.

1. API errors and authentication failures

One of the most frequent causes of expense tool sync errors involves problems with Application Programming Interfaces (APIs) and authentication protocols.

When your expense tool communicates with your accounting software or banking systems, it relies on API connections that require proper credentials and permissions. If your API key has expired, been revoked, or was entered incorrectly during setup, the sync will fail immediately.

2. Network or connection issues

Sometimes the problem isn't with your software at all—it's with your internet connection. Network instability, firewall restrictions, or server downtime can all interrupt the sync process midway through.

If you're experiencing intermittent sync failures that seem to resolve themselves later, network issues are likely the culprit. Your company's firewall might be blocking specific ports that your expense tool needs to communicate with external servers, or you might be dealing with bandwidth limitations during peak usage hours.

3. Category and account mapping mismatches

When you set up integrations between your expense management system and accounting software, you create mappings that tell each system how to categorize transactions. If these mappings are incomplete, incorrect, or outdated, you'll encounter sync errors.

For example, if an employee submits an expense under a category that doesn't have a corresponding account in your accounting system, the sync will stall. Similarly, if you've recently restructured your chart of accounts or renamed expense categories without updating the mappings, your systems won't know where to route the data.

4. Outdated or unsupported software versions

Running outdated versions of your expense tools or accounting software is a recipe for sync problems. Software developers regularly release updates that include bug fixes, security patches, and compatibility improvements.

When you skip these updates, you risk creating version conflicts between connected systems. Your expense tool might be trying to use newer API endpoints that your outdated accounting software doesn't recognize, or vice versa.

5. Complex transactions or multi-currency challenges

Not all expenses are straightforward, and complex transactions can confuse even well-configured systems. Split expenses shared across multiple projects, reimbursements involving partial approvals, or transactions with attached receipts in unusual file formats can all trigger sync errors.

Multi-currency transactions present their own set of challenges exchange rate discrepancies, timing differences in currency conversion, or missing currency codes can prevent successful syncing. If your business operates internationally or deals with frequent foreign transactions, these issues become even more prevalent and require specialized attention.

Early warning signs that your sync might be failing

How to spot and fix sync failures in expense tools

Knowing how to fix expense tool sync errors starts with early detection and systematic troubleshooting. The faster you identify a problem, the less impact it will have on your financial reporting and team productivity. Let's walk through the practical steps you need to take when sync issues arise.

1. Recognizing sync failure symptoms early

You don't always need an error message to know something's wrong. Watch for these telltale signs: transactions that should have synced hours ago are still missing from your accounting system, expense reports stuck in "pending" status longer than usual, duplicate entries appearing in your records, or discrepancies between your expense tool dashboard and accounting software totals.

Example

You're reviewing your monthly travel expenses and notice that several Uber transactions from last week aren't showing up in your accounting software, even though your team submitted them days ago.

This inconsistency is your first clue that a sync issue exists. Set up regular reconciliation checks weekly or even daily for high-volume businesses—to catch these symptoms before they snowball into bigger problems.

2. Troubleshooting authentication and permission issues

When you suspect authentication problems, start by checking your integration settings. Navigate to your expense tool's connected apps or integrations section and look for any warning indicators next to your accounting software connection.

Example

Following up on those missing Uber transactions, you click into your expense tool's integrations dashboard and see a yellow warning icon next to your ride-sharing connection. Upon investigation, you discover the API token expired two weeks ago right around when the sync problems began.

To fix this, you'll need to disconnect and reconnect the integration, which generates a fresh token with proper permissions. Always verify that your connected applications have the necessary access rights: read and write permissions for transaction data, access to the specific accounts or categories you're syncing, and any required approvals from your IT department for security compliance.

3. Fixing data mapping and categorization errors

Data mapping issues require a methodical approach. Start by reviewing your field mappings in both your expense tool and accounting software to ensure every expense category has a corresponding general ledger account.

Example

Your marketing team's Facebook ad expenses are failing to sync. When you check your category mappings, you discover "Social Media Advertising" exists in your expense tool but doesn't map to anything in your accounting system because you recently restructured your marketing expense accounts.

The solution? Either create a corresponding account in your accounting software or remap the expense category to an existing relevant account like "Digital Advertising." Document these mappings in a shared spreadsheet so your team knows which categories to use and how they'll appear in your financial reports.

4. Resolving connectivity and timeout problems

Network-related sync failures often require collaboration with your IT team. If you're experiencing timeout errors or incomplete syncs, first test your internet connection stability and speed. Check if your firewall is blocking the ports your expense tool needs—typically ports 443 for HTTPS connections.

Example

Your overnight batch sync keeps failing at the same point each night. After investigating, you discover your office network performs maintenance between 2-3 AM, causing temporary connectivity drops.

The fix? Reschedule your sync jobs to run at 4 AM instead, or work with your IT team to whitelist your expense tool's IP addresses so they maintain a connection during maintenance windows. For cloud-based tools, verify that your provider's servers are operational by checking their status page.

5. Keeping your tools updated to prevent conflicts

Regular updates are your best defense against fixing expense tool sync errors repeatedly. Enable automatic updates whenever possible, or establish a monthly schedule to manually check for and install updates to both your expense management software and accounting system.

Example

After updating your accounting software to the latest version, you notice new sync errors appearing. This happens because your expense tool is still running an older version that's incompatible with the new API structure.

By updating your expense tool within 48 hours, you restore full compatibility and eliminate the errors. Subscribe to release notes and changelogs from your software providers so you're aware of updates that might affect integrations, and always test updates in a sandbox environment before rolling them out company-wide.

From fixing to preventing; Strengthening your sync foundation

Now that you know how to fix expense tool sync errors when they occur, it's time to shift your focus from reactive troubleshooting to proactive prevention. While fixing sync errors is important, constantly putting out fires drains your resources and leaves your financial data vulnerable to ongoing disruptions.

The most successful businesses build systems that prevent them from happening in the first place. By implementing robust automation workflows, establishing regular audit procedures, and setting up real-time monitoring alerts, you can catch potential issues before they escalate into full-blown sync failures.

This proactive approach not only saves you countless hours of manual troubleshooting but also ensures your financial data remains accurate, complete, and accessible when you need it most. Let's explore the strategies that will transform your expense management system from constantly breaking down to reliably running itself.

How automation and alerts can help you stay ahead of sync failures

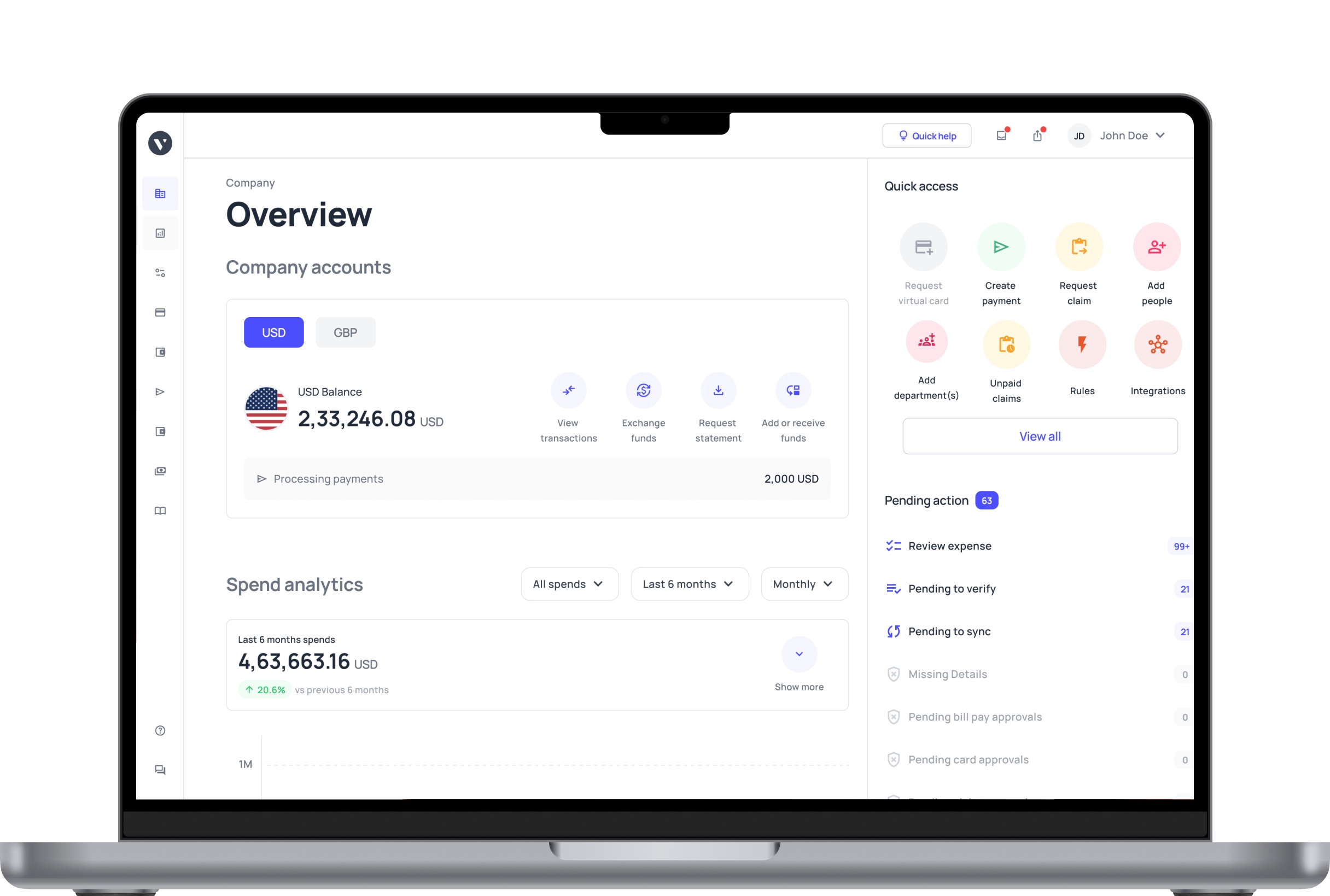

Reduce costly sync failures and improve accuracy with Volopay

Building a proactive sync monitoring and resolution strategy

Implementing real-time sync health monitoring

Real-time monitoring gives you instant visibility into your sync status across all connected platforms. Most modern expense tools offer dashboard widgets or status pages that display sync health metrics, including the timestamp of your last successful sync, the number of pending transactions, and any active errors. Set up a dedicated monitor that your finance team can check at a glance throughout the day.

Example: A mid-sized consulting firm implements a sync health dashboard displayed on a monitor in their accounting department to improve workflow efficiency.

Every morning at 9 AM, a team member checks that all overnight syncs are completed successfully, verifying that employee expense submissions from the previous day appear in their accounting system. This 5-minute daily check catches 90% of sync issues before they impact reporting.

Configuring automated notifications and alerts

Don't rely solely on manual checks. Instead, configure your systems to notify you when problems arise. Set up email or Slack alerts that trigger when syncs fail, when transaction volumes fall outside normal ranges, or when sync duration exceeds typical timeframes. Customize alert thresholds based on your business needs so you're not overwhelmed with false positives.

Example: An IT manager configures alerts that notify both the finance director and systems administrator immediately when more than 10 transactions fail to sync within a 2-hour window.

This automated notification system once caught a critical API authentication failure at 6 PM on a Friday, allowing them to resolve it before the weekend instead of discovering hundreds of missing transactions on Monday morning.

Establishing clear roles and responsibilities for sync oversight

Ambiguity about who handles sync issues leads to problems falling through the cracks. Designate specific team members responsible for monitoring, initial troubleshooting, and escalation. Your finance team typically handles data-related issues like mapping errors, while IT addresses technical problems like authentication and connectivity. Document these responsibilities clearly so everyone knows their role when issues arise.

Example: A marketing company assigns their accounting manager as the primary sync oversight contact who monitors daily sync health, their bookkeeper handles category mapping corrections, and their IT specialist manages all authentication and technical issues.

Each person receives relevant alerts based on their domain, streamlining the resolution process and reducing response times from hours to minutes.

Regular audits and data quality checks

Even with automated monitoring, schedule regular manual audits to verify data accuracy and completeness. Weekly spot-checks comparing expense tool totals against accounting software balances can reveal subtle sync issues that don't trigger error messages, such as partial syncs or rounding discrepancies. Monthly comprehensive audits should review all transactions, categories, and vendor assignments.

Example: A healthcare organization’s finance team conducts weekly reconciliation every Friday afternoon, comparing the week's submitted expenses in their expense tool against what appears in their ERP system.

They maintain a simple spreadsheet tracking weekly totals, which once revealed a week where 15% fewer transactions synced than expected—uncovering a silent sync failure that had been skipping transactions with attached PDF receipts over 5MB.

Developing standardized sync protocols and escalation procedures

Create documented procedures that outline exactly how your team should respond when sync errors occur. Your protocols should include step-by-step troubleshooting guides, escalation paths for different error types, and expected resolution timeframes. This standardization ensures consistent, efficient responses regardless of who encounters the issue first.

Example: A manufacturing company developed a one-page flowchart posted in their finance department: authentication errors go immediately to IT with a 4-hour resolution target; mapping errors get assigned to the senior accountant with a same-day fix requirement; and unknown errors trigger an immediate escalation to both department heads.

This clear protocol reduced their average sync error resolution time from 2.3 days to 6 hours, minimizing disruptions to their expense approval workflows.

Key challenges in managing sync issues across multiple tools

As your business grows and your tech stack expands, fixing sync errors becomes increasingly complex. Managing synchronization across multiple expense tools, accounting platforms, banking systems, and ERP software introduces unique challenges that go beyond simple one-to-one integrations. Understanding these multi-tool complications helps you anticipate problems before they disrupt your workflows.

1. Conflicting data between integrated platforms

When you connect three or more systems—say, your expense tool, accounting software, and payroll system—you risk creating data conflicts. Each platform might store the same transaction slightly differently, leading to discrepancies that prevent successful syncing.

For instance, your expense tool might record a meal expense at $47.83, while your credit card feed rounds it to $47.80, causing the systems to treat them as separate transactions rather than matching them automatically.

2. Delays in real-time sync updates

Despite promises of "real-time" syncing, most integrations involve processing delays ranging from minutes to hours. These delays compound when multiple tools are involved in a chain—your expense submission might sync to your approval system immediately, but take 30 minutes to reach your accounting software and another hour to update your financial dashboard.

During high-volume periods like month-end, these delays can extend significantly, creating confusion about which data is current and accurate.

3. Limited API compatibility and permissions

Not all software providers offer the same level of API access. You might discover that while your primary accounting software has robust API capabilities, your legacy expense tool only supports limited data fields or read-only access.

Some platforms restrict API calls per hour, causing sync failures when you exceed these limits during busy periods. Permission structures also vary—one system might grant blanket access while another requires separate permissions for each data type, complicating your integration setup.

4. Overlapping expense categories and chart of accounts

Managing consistent categorization across multiple platforms becomes exponentially harder as you add more tools. Your expense management system might use "Travel - Airfare," your corporate card program labels it "Transportation," and your accounting software expects "Business Travel: Air."

Without careful mapping, transactions bounce between systems, unable to find their proper home, resulting in sync failures or miscategorized expenses that distort your financial reporting.

5. Manual interventions and human errors

The more complex your multi-tool ecosystem becomes, the more manual interventions you'll need, and each human touchpoint introduces error opportunities. Someone might update category mappings in one system but forget to mirror those changes elsewhere.

Employees might submit expenses in the wrong format, IT might misconfigure integration settings, or accountants might manually override synced data without documenting their changes, creating discrepancies that cause future sync failures and hours of detective work.

How to solve multi-tool sync failures and reporting errors

Understanding multi-tool sync complexity

Start by mapping your complete integration landscape. Document every system that touches your expense data, the direction of data flow between them, and the timing of each sync.

Create a visual diagram showing how information moves from expense submission through approval, accounting, and reporting. This clarity helps you pinpoint exactly where sync breakdowns occur and understand cascading effects when one connection fails.

Synchronizing data across multiple expense and accounting systems

Establish a single source of truth for your expense data—typically your primary accounting system. Configure all other tools to sync to this central platform rather than creating complex peer-to-peer connections between every system.

Use scheduled sync windows instead of continuous syncing to reduce conflicts, running syncs during off-peak hours when transaction volumes are low. Implement sync sequencing so your expense tool syncs first, then your card feeds, followed by your reporting tools, ensuring each system receives complete data before the next sync begins.

Aligning the chart of accounts and vendor codes between tools

Create a master reference document that maps how each expense category and vendor appears across all your systems. Standardize naming conventions wherever possible—if one system won't accept spaces in vendor names, remove them from all systems.

When you can't achieve perfect alignment, build translation tables within your integrations that automatically convert category names and vendor codes from one system's format to another's, ensuring seamless data flow regardless of platform-specific requirements.

Using middleware to manage sync across systems

Consider implementing middleware platforms like Zapier, Workato, or dedicated iPaaS solutions that act as traffic controllers for your data. These tools sit between your various systems, translating data formats, managing sync timing, and providing error handling that your native integrations lack.

Middleware solutions offer visual workflow builders that make it easier to implement complex sync logic without coding, plus centralized logging that helps you troubleshoot issues faster by showing exactly what data moved where and when.

Preventing reporting discrepancies from sync failures

Build validation checkpoints into your reporting process. Before generating financial reports, run automated reconciliation scripts that compare total transaction counts and amounts across all connected systems.

Set up exception reports that flag any discrepancies exceeding your tolerance thresholds—perhaps transactions differing by more than $5 or daily totals varying by more than 2%. When you catch these discrepancies early, you can identify and resolve the underlying sync issues before they contaminate your financial statements or management reports.

How to test and validate your expense syncs effectively

1. Running manual spot checks on transactions

Perform random sampling of synced transactions weekly. Select 10-15 expenses from your expense tool and verify they appear correctly in your accounting system with matching amounts, dates, categories, and vendor information.

Focus your spot checks on transaction types that have caused problems before—multi-currency expenses, split transactions, or those with attachments. Manual reviews catch subtle issues that automated checks might miss, like correct amounts syncing to wrong accounts.

2. Using automated tools for sync validation

Leverage built-in validation features within your expense and accounting software. Many platforms offer reconciliation reports that automatically compare transaction counts and totals between systems. Set these to run daily and email results to your finance team.

Third-party validation tools can also monitor sync health continuously, flagging anomalies like unusual transaction volumes, missing data fields, or timing gaps between submission and sync completion that exceed normal parameters.

3. Comparing source and destination reports

Generate identical reports from both your expense tool and accounting system, then compare them side-by-side. Pull monthly expense summaries by category, department, or employee from each platform and verify the totals match exactly.

Export both datasets to spreadsheets and use VLOOKUP or comparison formulas to identify discrepancies. This systematic comparison reveals whether data is transforming incorrectly during sync or if certain transaction types are failing to transfer completely.

4. Documenting testing results for audit purposes

Maintain a testing log that records what you checked, when you checked it, what you found, and how you resolved any issues. This documentation proves to auditors that you have controls in place for data accuracy.

Create a simple spreadsheet tracking test dates, transaction samples reviewed, discrepancies discovered, and remediation actions taken. This audit trail also helps you identify patterns in sync failures over time, informing your prevention strategies.

Preventive and best practices to avoid sync failures

Regularly update connected tools, APIs, and integrations

Schedule quarterly reviews of all software versions across your expense management ecosystem. Enable automatic updates for security patches while testing major version upgrades in a sandbox environment first.

Subscribe to your software vendors' developer newsletters to stay informed about API changes, deprecated endpoints, or new authentication requirements. When providers announce upcoming changes, update your integrations proactively rather than waiting for them to break.

Maintain a software inventory spreadsheet tracking current versions, last update dates, and planned upgrade schedules to ensure nothing falls through the cracks.

Maintain a clean chart of accounts and vendor list

Regularly audit and clean your master data to prevent mapping confusion. Archive obsolete expense categories rather than deleting them to preserve historical data integrity.

Merge duplicate vendor entries that might appear under slightly different names—"Amazon.com," "Amazon," and "AMZN" should all map to one canonical vendor. Establish naming conventions and enforce them consistently across all platforms.

Quarterly reviews of your chart of accounts help identify unused categories, consolidate redundant ones, and ensure alignment between your expense tool and accounting system before mismatches cause sync problems.

Conduct routine data audits and automated backups

Beyond sync validation, perform comprehensive monthly audits examining data completeness, accuracy, and consistency. Check that all expense categories have appropriate tax codes, that employee records sync correctly between HR and expense systems, and that approval workflows function as intended.

Implement automated daily backups of your expense data from all connected systems. These backups serve as safety nets if sync errors corrupt data, allowing you to restore clean records and identify when problems first appeared by comparing backup versions over time.

Standardize permissions and user roles across platforms

Create permission templates that define exactly what access each role needs across all your expense tools. Your expense approvers, for instance, should have consistent capabilities whether they're working in the expense tool, accounting system, or reporting dashboard.

Document these permission standards and review user access quarterly, removing permissions for departed employees and adjusting access for role changes.

Inconsistent permissions often cause partial sync failures where some data transfers successfully while other fields fail due to insufficient access rights in the destination system.

Monitor sync health through scheduled reports and alerts

Establish a comprehensive monitoring routine that combines automated alerts with scheduled human review. Configure immediate notifications for critical failures while setting up daily digest reports summarizing sync activity, transaction volumes, and any minor issues that don't require urgent attention.

Create a weekly sync health scorecard that your finance team reviews every Monday, tracking metrics like sync success rate, average sync duration, and number of manual interventions required. This consistent monitoring helps you spot degrading performance before complete failures occur.

Train your team on data entry and integration workflows

Many sync errors originate from incorrect data entry rather than technical failures. Conduct biannual training sessions teaching employees how to submit expenses correctly, which fields are mandatory for successful syncing, and what file formats work best for receipt attachments.

Create quick-reference guides showing approved expense categories, proper vendor name formats, and common mistakes to avoid. When you implement new integrations or change workflows, communicate these updates clearly and provide hands-on training rather than assuming everyone will figure it out independently.

Choosing the right expense tools to ensure reliable syncing

Evaluating integration capability and API support

Before committing to any expense tool, thoroughly investigate its integration ecosystem. Does it offer native integrations with your existing accounting software, or will you need third-party middleware? Review the API documentation to ensure it supports all the data fields you need to sync some platforms only sync basic transaction details while omitting custom fields or metadata.

Check API rate limits to confirm they accommodate your transaction volumes without throttling. Request a technical demo where the vendor demonstrates actual data flowing between systems, not just marketing claims about integration capabilities.

Assessing sync frequency and data latency

Different tools offer vastly different sync frequencies. Some provide true real-time syncing where transactions appear in your accounting system within minutes, while others batch sync hourly or only once daily. Consider your business needs—if you require up-to-the-minute expense visibility for cash flow management, daily batches won't suffice.

Ask vendors about their sync architecture: are updates pushed immediately or pulled on schedules? What happens during high-volume periods? Does sync frequency slow down? Understanding these technical details helps you set realistic expectations and choose tools that match your operational tempo.

Importance of vendor support and documentation

When sync issues inevitably arise, responsive vendor support becomes critical. Evaluate the support tiers available: does basic support include integration troubleshooting, or must you purchase premium support for technical assistance? Review the quality of their integration documentation: are setup guides clear and comprehensive?

Do they provide troubleshooting flowcharts for common sync errors? Check user forums and review sites to gauge how quickly the vendor typically resolves integration problems. Companies with dedicated integration support teams and extensive knowledge bases will save you countless hours compared to vendors offering only generic customer service.

Evaluating data security and compliance features

Sync reliability means nothing if your data isn't secure during transmission. Verify that expense tools encrypt data both at rest and in transit using industry-standard protocols. Confirm they comply with relevant regulations for your industry GDPR for European data, SOC 2 for financial controls, or HIPAA for healthcare organizations.

Ask about authentication options: do they support single sign-on, multi-factor authentication, and granular permission controls? Understanding how tools handle API keys and access tokens helps you maintain security while ensuring smooth syncing. Request their security audit reports and certifications to validate their claims.

Assessing user experience and ease of integration

Even powerful integration capabilities fall flat if they're too complex for your team to manage. Evaluate the initial setup process. Can your finance team configure integrations independently, or do you need dedicated IT resources or expensive consultants? Look for tools with intuitive mapping interfaces that visually show how data flows between systems.

Test the error messaging: when syncs fail, do you receive clear, actionable error descriptions, or cryptic technical codes? Tools with user-friendly integration management reduce your dependency on specialized knowledge and empower your team to resolve minor issues quickly without constant vendor support escalation.

How Volopay enhances expense syncing and error prevention

While understanding how to fix expense tool sync errors is essential, choosing a platform built to minimize these issues from the start makes all the difference.

Volopay's comprehensive expense management platform addresses the core challenges of expense synchronization through intelligent automation, robust integrations, and proactive error prevention, helping you spend less time troubleshooting and more time focusing on strategic financial management.

Seamless two-way sync across expense and accounting tools

Volopay offers native integrations with major accounting platforms, including QuickBooks, Xero, NetSuite, and more, enabling bidirectional data flow that keeps your systems perpetually aligned.

Unlike one-way syncs that only push data from expenses to accounting, Volopay's two-way synchronization automatically pulls your chart of accounts, vendor lists, and tax codes from your accounting system, ensuring perfect mapping from day one.

When you update categories or create new accounts in your accounting software, Volopay reflects these changes automatically, eliminating the mapping mismatches that plague most expense tools and significantly reducing manual configuration work.

Automated expense categorization and reconciliation

Volopay's intelligent categorization engine learns from your historical spending patterns to automatically assign expenses to the correct GL codes, departments, and projects. Machine learning algorithms analyze merchant names, transaction amounts, and user behavior to predict categories with increasing accuracy over time.

Our platform's automated reconciliation matches corporate card transactions with submitted receipts and expense reports, flagging discrepancies immediately rather than letting them accumulate. This automation dramatically reduces the manual interventions that often introduce errors into your sync workflows, while accelerating your month-end close process.

Real-time sync of receipts, payments, and approvals

Rather than batch processing that creates data latency, Volopay syncs transaction data, receipt images, and approval status in real-time as events occur. When an employee makes a purchase, submits a receipt, or receives approval, that information flows instantly to your accounting system, giving you up-to-the-minute visibility into your expense data.

Real-time visibility and syncing eliminates the confusion caused by timing delays and ensures your financial dashboards always reflect the current reality. The platform also syncs payment status bidirectionally, so you can track which expenses have been reimbursed without manual cross-referencing between systems.

Centralized expense management and team collaboration

Volopay consolidates corporate cards, reimbursements, invoice payments, and travel expenses in one unified platform, reducing the complexity of managing multiple sync connections.

This centralization means fewer integration points where sync errors can occur and provides a single source of truth for all spending data. Team collaboration features allow finance teams, approvers, and employees to communicate directly within the platform about expense issues, reducing the back-and-forth that often delays resolution.

When sync questions arise, everyone accesses the same data rather than working from potentially outdated copies across different systems.

Customizable integration settings and smart error handling

Volopay gives you granular control over integration behavior through customizable sync settings. You can define which data fields sync, set sync frequency based on your needs, establish validation rules that prevent problematic transactions from syncing, and create custom field mappings for unique accounting requirements.

The platform's intelligent error handling provides specific, actionable guidance about what went wrong and how to fix it.

Volopay's error logs capture detailed information about failed transactions, making troubleshooting straightforward, while automatic retry logic resolves transient failures like temporary network issues without manual intervention.

Bring Volopay to your business

Get started now

FAQs

The most frequent causes include expired API tokens and authentication failures, network connectivity issues or firewall restrictions, category mapping mismatches between your expense tool and accounting software, outdated software versions creating compatibility conflicts, and complex transactions like multi-currency expenses or split bills that systems struggle to process correctly.

Watch for missing transactions that should have synced, expense reports stuck in pending status for an unusually long time, duplicate entries appearing in your accounting system, or discrepancies between totals in different platforms. Check your integration dashboard regularly for warning indicators, and run daily reconciliation comparing transaction counts between systems to catch issues early.

Automation reduces human error by eliminating manual data entry and categorization mistakes. Automated alerts notify you immediately when sync failures occur, while scheduled validation scripts catch discrepancies before they impact reporting. Automated retry logic resolves temporary issues without intervention, and machine learning improves category mapping accuracy over time, creating increasingly reliable sync workflows.

Regularly clean your chart of accounts and vendor lists to eliminate duplicates and outdated entries. Standardize naming conventions across all platforms, conduct monthly data audits to verify completeness and accuracy, train employees on proper expense submission procedures, and establish validation rules that prevent incorrect data from entering your system in the first place.

Designate one system as your single source of truth and sync all others to it. Use middleware platforms to centralize sync management rather than creating complex peer-to-peer connections. Establish sync sequencing so systems update in order, create master mapping documents showing how categories translate between platforms, and schedule syncs during off-peak hours to reduce conflicts.

Volopay offers native integrations with major accounting platforms, providing two-way sync that automatically aligns charts of accounts and eliminates mapping errors. The platform uses intelligent categorization to reduce manual entry mistakes, syncs data in real-time to prevent latency issues, and provides smart error handling with actionable troubleshooting guidance when problems occur, significantly reducing sync failure frequency.

Yes, Volopay automatically converts multi-currency transactions using current exchange rates and syncs both original and converted amounts to your accounting system. The platform handles currency codes correctly, manages exchange rate differences transparently, and ensures foreign transactions map properly to your multi-currency accounts, eliminating the common sync failures that plague international expense management.

Volopay provides real-time sync status dashboards showing successful and failed transactions, automated email and in-app notifications when sync errors occur, detailed error logs explaining what went wrong and how to fix it, customizable alert thresholds based on your tolerance levels, and scheduled sync health reports that summarize activity and flag anomalies for proactive issue resolution.

Volopay offers pre-built native integrations with QuickBooks, Xero, and NetSuite, and requires minimal technical setup. The platform automatically pulls your chart of accounts and vendor lists, eliminating manual mapping work. User-friendly configuration interfaces allow finance teams to manage integrations without IT support, while comprehensive documentation and responsive support ensure smooth implementation and ongoing operation.

Yes, Volopay's automated reconciliation matches corporate card transactions with receipts and expense submissions in real-time. The platform flags discrepancies immediately, verifies that all synced transactions appear correctly in your accounting system, and provides reconciliation reports comparing totals across platforms. This continuous reconciliation catches sync issues instantly rather than discovering them weeks later during the manual month-end close.