Does using corporate credit cards affect my credit score?

If you've been issued a corporate credit card by your employer, you might wonder whether your business spending habits will show up on your personal credit report. This is a common concern for professionals who want to protect their personal creditworthiness while managing company expenses efficiently.

The relationship between corporate credit cards and personal credit scores isn't always straightforward. While most traditional corporate cards don't impact your personal credit, certain circumstances can create connections between your business spending and personal credit profile.

Understanding these nuances helps you make informed decisions about corporate card usage and protects your financial future.

Key takeaways

Most traditional corporate credit cards do not affect personal credit scores, because the account is issued in the company’s name and liability rests with the employer.

Personal credit can be impacted in specific situations, such as when a personal guarantee is signed, a hard credit inquiry is performed, or the card is structured like a small business product.

Liability structure determines credit exposure, meaning whether the employer assumes full responsibility or the employee shares legal obligation directly affects reporting to personal credit bureaus.

Corporate cards generally do not help build personal credit, since most programs do not report payment activity to consumer credit agencies.

Does using corporate credit cards affect personal credit score?

The short answer is that most true corporate credit cards do not affect your personal credit score under normal circumstances. Unlike personal credit cards or small business cards, traditional corporate cards are issued in the company's name, not yours.

The company holds primary responsibility for all charges, and the account appears on the business's credit report rather than your personal one.

When you use a standard corporate card issued by a large employer, the credit card issuer typically doesn't report your individual spending activity to consumer credit bureaus.

This means your monthly purchases, payment history, and overall card usage generally remain invisible to anyone checking your personal credit. The liability rests entirely with your employer, who receives the bill and manages payments directly with the card issuer.

However, this doesn't mean corporate cards have zero connection to your personal finances. If you fail to submit proper expense reports or misuse the card for unauthorized personal purchases, your employer might take disciplinary action or require you to reimburse the company directly.

While this wouldn't directly affect your corporate credit card credit score relationship, it could create financial difficulties that indirectly impact your ability to manage personal credit obligations.

The situation changes significantly if you signed a personal guarantee when receiving your corporate card. Some companies, particularly smaller businesses or startups, require employees to accept personal liability for corporate card debt.

In these cases, if the company fails to pay the card balance or goes bankrupt, the card issuer can pursue you personally for outstanding debts. This scenario would definitely impact your personal credit, as the unpaid balance and collection activities would appear on your personal credit report.

Another important consideration involves the initial application process. Some employers conduct soft credit inquiries when issuing corporate cards, which don't affect your credit score, while others might perform hard inquiries that can temporarily lower your score by a few points.

Additionally, certain corporate card programs report positive payment behavior to personal credit bureaus as a benefit to employees, though this is relatively uncommon with traditional corporate cards.

The key distinction lies in understanding who bears ultimate financial responsibility. If your employer assumes all liability and doesn't require a personal guarantee, your personal credit remains protected regardless of how you use the card.

Your spending patterns, payment timeliness, and credit utilization on the corporate card simply don't enter the equation while calculating the corporate credit card credit score.

When can a corporate credit card impact credit score?

While most corporate cards operate independently from personal credit, specific circumstances can create direct connections that affect your credit profile significantly.

1. Personal guarantee

When you sign a personal guarantee agreement, you become legally responsible for corporate card debt if your employer defaults, meaning the card issuer can report delinquencies and unpaid balances to your personal credit bureaus, potentially devastating your credit score.

2. Small business cards

Cards marketed as "small business cards" often differ from true corporate cards and frequently report to personal credit bureaus, treating you as a co-borrower rather than simply an authorized user of company credit.

3. Authorized user status

If your corporate card is structured so you're listed as an authorized user rather than just an employee cardholder, some issuers may report the account activity to your personal credit file, including utilization rates and payment history.

4. Credit utilization (indirectly)

Even when corporate cards don't report directly, maxing out your corporate card might indicate poor financial management to underwriters reviewing your overall credit applications, particularly if you're applying for business credit in your own name.

5. Inquiries

Hard credit inquiries performed during the corporate card application process remain on your personal credit report for two years and can temporarily reduce your credit score by several points, though the impact diminishes over time.

When a corporate credit card doesn't impact credit score

Understanding when corporate cards remain completely separate from personal credit helps employees use these tools confidently without worrying about unintended consequences.

Large employer cards

Corporate cards issued by established companies with strong credit profiles typically don't require personal guarantees and operate entirely on the business's credit, keeping your personal credit completely insulated from activity.

No personal guarantee

When you haven't signed any agreement accepting personal liability for corporate card debt, the issuer has no legal basis to report your account activity or pursue you for unpaid balances.

No personal credit check

Employers who issue corporate cards without running any credit check on employees ensure that both the application and ongoing usage remain invisible to personal credit bureaus from start to finish.

Company liability

Cards where your employer accepts full financial responsibility and appears as the sole account holder prevent any corporate spending from appearing on your personal credit report, regardless of usage patterns.

Can corporate credit cards help build credit?

No, traditional corporate credit cards typically cannot help build your personal credit. Since most corporate cards don't report to personal credit bureaus, your responsible usage and timely expense submissions won't appear on your credit report or contribute to improving your credit score.

If building credit is your goal, you'll need to focus on personal credit cards, installment loans, or other financial products that report to consumer credit bureaus.

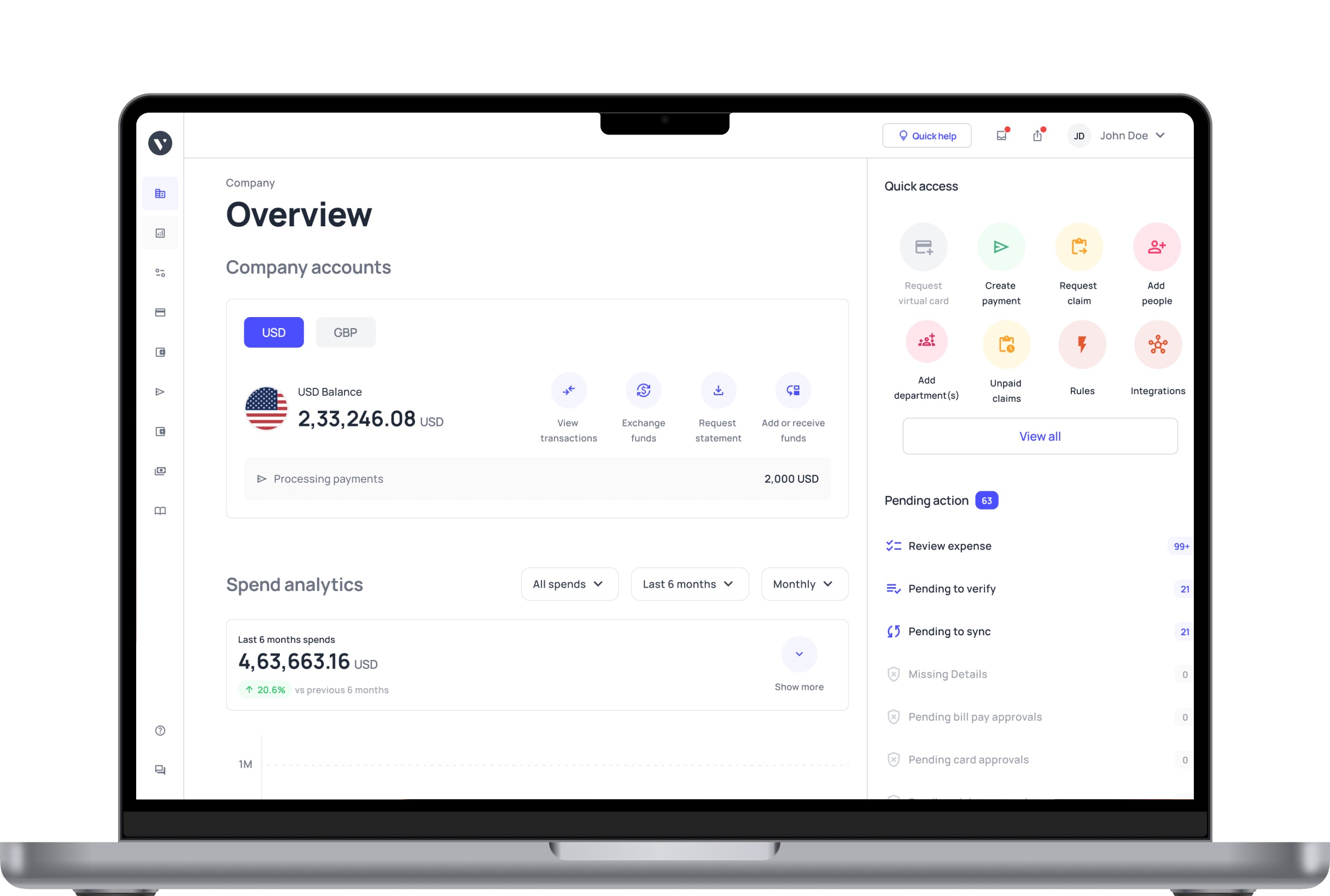

Stay on top of corporate card activity with Volopay

Managing corporate card expenses doesn't have to be stressful or complicated. With Volopay's comprehensive spend management platform, you gain real-time visibility into all corporate card transactions, helping you track spending, submit expense reports promptly, and maintain complete control over your company-issued cards without worrying about personal credit implications.

Our platform streamlines the entire corporate card management process through automated expense tracking, instant spending notifications, and seamless reconciliation tools that ensure you never miss a deadline or lose a receipt — especially when using Volopay's corporate cards for your business spending needs.

By keeping your corporate spending organized and transparent, you protect both your professional reputation and your employer's financial interests while maintaining peace of mind about your personal financial health.