Corporate credit card reconciliation: A complete guide (2026)

Managing business expenses requires accuracy, visibility, and control across teams and departments. Corporate credit card reconciliation plays a critical role in aligning transactions with receipts, policies, and accounting records.

In 2026, evolving compliance standards and real-time financial data make reconciliation more strategic than ever. When handled correctly, it minimizes errors, prevents unauthorized spending, accelerates month-end closing, and strengthens reporting accuracy.

This guide explains the core concepts and practical value of reconciliation, helping finance teams build efficient workflows, maintain audit readiness, and support responsible employee spending while preserving strong financial governance across the organization.

Key takeaways

Corporate credit card reconciliation strengthens financial accuracy and internal control, ensuring business spending remains transparent, validated, and aligned with organizational standards.

A structured reconciliation framework improves consistency and scalability, helping finance teams manage growing transaction volumes without compromising oversight or reporting integrity.

Automation enhances speed, visibility, and exception management, allowing discrepancies to be identified early while reducing administrative burden across teams.

Strong reconciliation practices support governance, audit readiness, and strategic planning, providing reliable financial data that informs budgeting, forecasting, and executive decision-making.

What is corporate credit card reconciliation?

Corporate credit card reconciliation is the method of reviewing and validating card transactions against receipts, statements, and internal expense policies. It ensures every charge is accurate, authorized, and properly categorized.

A standardized credit card reconciliation procedure improves transparency, supports compliance, and maintains dependable financial records. Organizations use reconciliation to clearly track how corporate card funds are spent after each transaction occurs.

The credit card reconciliation process links transaction data with receipts, merchant information, and policy rules, enabling continuous review rather than delayed monthly checks. When the corporate credit card reconciliation process is structured and automated, manual effort decreases, and discrepancies surface early.

Finance teams gain stronger oversight, faster close cycles, and audit-ready documentation. With defined ownership, approval workflows, and accounting integrations, reconciliation becomes a scalable financial control that supports growth and accurate forecasting. This structured approach also improves internal accountability and builds trust in financial decision-making across departments.

Why is corporate credit card reconciliation important?

Corporate credit card reconciliation matters because it helps you maintain financial accuracy, control spending, reduce risk, and gain visibility into how business expenses are used.

1. Improves expense accuracy

You ensure every transaction matches receipts and records by following a structured credit card reconciliation procedure, helping you identify errors early, correct discrepancies quickly, and keep your books reliable for reporting and decision making across teams, periods, and growing business operations consistently.

2. Prevents fraud and misuse

When you review transactions regularly, a clear credit card reconciliation example helps you spot duplicate charges, unauthorized spending, or policy violations quickly, allowing you to act faster, protect company funds, and reinforce responsible card usage across your organization at scale.

3. Saves time and effort

By using automation and clear workflows, you reduce manual work and delays, making the best way to reconcile credit card statements faster, more consistent, and less stressful for finance teams handling high transaction volumes while improving productivity and overall process efficiency.

4. Supports compliance and audits

Regular reconciliation helps you enforce spending policies, maintain accurate documentation, and stay audit-ready. This helps in reducing compliance risks and ensuring your organization meets regulatory, internal, and stakeholder expectations without last-minute pressure during reviews and financial evaluations throughout the year cycles.

5. Improves financial visibility

When reconciliation is consistent, you gain real-time insight into spending patterns, budget usage, and card activity, enabling you to make informed decisions and control costs proactively. You are better able to align expenses with business goals while improving forecasting accuracy and strategic planning company-wide.

How to do corporate credit card reconciliation

Corporate credit card reconciliation ensures spending accuracy, accountability, and compliance by helping you systematically review transactions, resolve issues, and maintain reliable financial records as card usage scales.

Gather documents

Begin by collecting all required records, including credit card statements, individual transaction feeds, employee receipts, and expense reports. You also review relevant spending policies and approval guidelines.

Having complete documentation upfront helps you avoid delays, reduces follow-ups with employees, and creates a solid foundation for accurate reconciliation across billing cycles and departments.

Match transactions

Next, compare each card transaction with its corresponding receipt and expense description. Using corporate credit card reconciliation software allows you to automatically align dates, amounts, and merchants.

This step helps you confirm legitimacy, verify business purpose, and ensure expenses are coded correctly before moving further in the reconciliation workflow efficiently.

Identify discrepancies

After matching, you review transactions that do not align with receipts, policy limits, or expected amounts. Discrepancies may include missing receipts, duplicate charges, or incorrect categorizations.

Identifying these exceptions early gives you clarity into potential errors or misuse and prevents inaccurate data from reaching accounting systems.

Investigate & resolve

You then investigate flagged discrepancies by contacting cardholders, reviewing supporting documents, or checking merchant statements. Clear communication helps resolve issues quickly.

Once clarified, corrections are made, or charges are escalated based on policy. This step ensures accountability while maintaining fairness and transparency across teams and spending roles.

Adjust & record

After resolving issues, you update records to reflect corrected amounts, approved exceptions, or reclassified expenses. Using a corporate credit card reconciliation app simplifies adjustments by syncing changes directly with accounting systems.

Accurate recording at this stage ensures financial statements remain reliable and reflect true organizational spending.

Verify balances

You then compare the reconciled transaction totals against the statement balance to confirm everything aligns. This verification step ensures no charges are missing or overstated.

When balances match, you gain confidence that expenses are complete, accurate, and ready for reporting without hidden discrepancies or unresolved gaps remaining.

Document & approve

Finally, you document reconciliation outcomes and route them for managerial or finance approval. Maintaining clear audit trails supports compliance and future reviews.

Once approved, records are finalized, enabling a timely month-end close, smoother audits, and stronger control over corporate card spending across reporting periods.

Empower your teams with smarter payments

What are the best practices for corporate credit card reconciliation?

Following proven best practices helps you maintain accuracy, prevent misuse, and streamline reviews, ensuring corporate card spending remains controlled, transparent, and aligned with financial goals.

1. Reconcile transactions regularly

You reduce errors by reviewing card activity frequently instead of waiting until month end. Regular reconciliation helps you catch mistakes early, address missing receipts, and keep balances accurate.

Consistent reviews also improve visibility into spending trends, allowing better budget control, faster closes, and fewer surprises during audits or leadership reporting cycles across all business units.

2. Use automated reconciliation tools

Automation simplifies complex workflows by syncing transactions, receipts, and approvals in one system. When you rely on corporate credit card reconciliation tools, manual data entry declines, and accuracy improves.

Automated rules flag exceptions instantly, support real-time visibility, and help finance teams scale controls without increasing workload as transaction volumes grow over multiple departments organization-wide.

3. Set clear expense policies

Clear policies define what employees can spend, where they can spend it, and how often. When you communicate limits, categories, and documentation requirements clearly, compliance improves.

You also reduce back and forth during reviews and minimize disputes. Well-defined rules create consistency, protect budgets, and make reconciliation smoother for both employees and finance teams across all departments and regions.

4. Match receipts with transactions promptly

Prompt receipt matching prevents forgotten expenses and incomplete records. When you require employees to submit receipts quickly, transaction context stays fresh, and errors drop.

Timely matching shortens resolution cycles, improves accuracy, and supports real-time spend visibility. This habit reduces month-end pressure and keeps reconciliation continuously up to date for the finance team organization-wide.

5. Review and approve expenses on time

Timely reviews keep reconciliation moving and prevent bottlenecks. When managers approve expenses promptly, issues are resolved faster, and employees stay accountable. On-time approvals also help you close books more quickly and maintain accurate reporting.

Delays, by contrast, increase errors, create confusion, and weaken control over corporate card spending across departments, regions, periods, teams, budgets, and companywide.

What are the challenges in corporate credit card reconciliation?

Corporate credit card reconciliation becomes difficult as transaction volumes increase, systems stay disconnected, and employee behavior differs, making accuracy, visibility, and compliance harder to manage consistently.

Missing or incomplete receipts

Missing or unclear receipts slow down reconciliation and create extra follow-ups. When employees forget to upload receipts or submit poor-quality documents, more time is spent requesting details.

This causes delays, weakens audit records, and increases compliance risk. Without proper receipts, confirming business purpose is harder, leading to disputes, exceptions, and unreliable expense records across reporting periods.

Manual data entry errors

Manual data entry often leads to mistakes during reconciliation. When amounts, dates, or categories are entered by hand, duplicates and errors occur. These mistakes affect expense reports and delay closing activities.

Over time, repeated corrections waste effort, reduce trust in financial data, and create unnecessary back and forth between finance teams and employees during regular reviews.

Delayed expense submissions

Delayed expense submissions interrupt reconciliation and reduce accuracy. When employees wait too long to submit expenses, details are forgotten, and receipts go missing.

This forces extra investigation and rework. Such delays slow month-end close, frustrate approvers, and limit visibility into spending trends, making it harder to manage costs proactively across teams and departments.

Lack of real-time visibility

Lack of real-time visibility makes controlling card spending more difficult. When transaction data is delayed, issues cannot be spotted early. This weakens oversight and limits timely action.

Without up-to-date insights, budgeting becomes less accurate, unexpected costs increase, and finance teams struggle to guide leadership during active reporting and forecasting periods effectively.

Policy violations and unauthorized spending

Policy violations and unauthorized spending add complexity and risk to reconciliation. When rules are unclear or not enforced, employees may overspend or misuse cards. This results in more exceptions, reviews, and disputes.

Over time, these problems weaken controls, damage trust, and can lead to compliance issues, financial losses, and reputational harm if not addressed promptly.

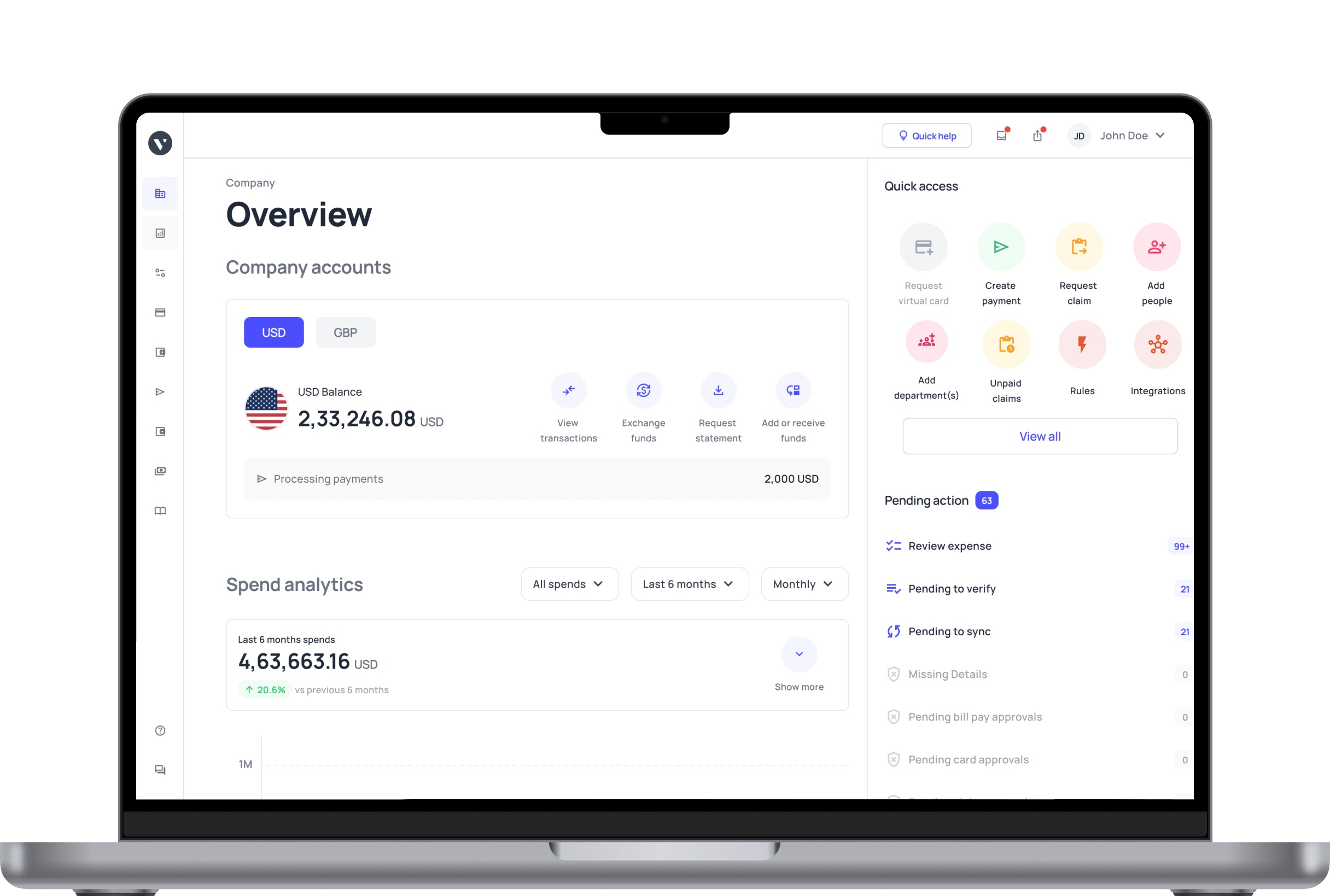

How Volopay automates corporate card reconciliation

Volopay's corporate cards remove manual effort from reconciliation by unifying corporate card transactions, receipts, and approvals within one automated system. Real-time transaction feeds provide immediate visibility, enabling reviews as spending occurs rather than after statements arrive.

Automated receipt capture, policy enforcement, and approval workflows minimize follow-ups and exceptions. Non-compliant expenses are flagged instantly, while budgets and limits remain continuously tracked.

Accounting integrations ensure accurate data flows directly into books. Centralized dashboards offer organization-wide visibility across teams and entities. Audit-ready records are maintained automatically, reducing risk and shortening month end close.

With automation in place, finance teams save time, improve accuracy, and maintain stronger control, while employees spend confidently within defined guidelines as operations scale efficiently. You gain consistent oversight without added complexity.