Corporate credit card policy: Best practices & how to create one (2026)

Managing corporate spending without clear guidelines can quickly spiral into financial chaos. Unauthorized purchases, missing receipts, and inconsistent expense reporting create headaches for finance teams while exposing companies to compliance risks and budget overruns that directly impact profitability.

A comprehensive corporate credit card policy transforms how your organization handles business expenses. It establishes transparent rules for card usage, defines spending boundaries, and creates accountability at every level.

More than just a rulebook, an effective policy protects your company from financial risks while empowering employees to make necessary purchases confidently. The result? Streamlined operations, faster expense reconciliation, and complete visibility into corporate spending patterns that drive smarter financial decisions.

Key takeaways

A well-defined corporate credit card policy establishes financial guardrails, outlining who can access company cards, how they may be used, and the boundaries that protect organizational funds.

Clear documentation and defined workflows reduce ambiguity, ensuring consistent expense reporting, timely reviews, and structured enforcement across departments.

Policy design should align with compliance, risk management, and governance standards, incorporating legal requirements, audit readiness, and data security considerations.

Ongoing communication and periodic policy updates are essential, keeping guidelines relevant as business operations, regulations, and payment technologies evolve.

What is a corporate credit card policy?

A corporate credit card policy is a formal set of guidelines that outlines how company-issued credit cards are issued, used, monitored, and managed. It defines acceptable practices for company credit card use, spending limits, reconciliation requirements, and consequences for non-compliance.

The policy acts as a safeguard against unauthorized spending, ensures accurate expense tracking, and supports tax and audit readiness.

Beyond basic rules, the policy fosters transparency in financial operations. It clarifies responsibilities for cardholders, approvers, and finance teams, reducing administrative burdens associated with manual reimbursements.

In 2026, with digital tools and real-time tracking becoming standard, a strong policy integrates seamlessly with expense management systems to provide visibility and control.

Effective policies also align with broader financial goals, such as cash flow optimization and fraud prevention. They help mitigate risks from personal use or errors, ultimately contributing to healthier financial governance and employee trust in company resources.

What should be included in a corporate credit card policy?

A comprehensive corporate credit card policy should cover all aspects of card issuance and usage to minimize ambiguity and enforce accountability. Essential sections include purpose, eligibility criteria, cardholder responsibilities, permitted and prohibited activities, reconciliation processes, and enforcement measures that protect your organization.

1. Background and purpose

This section of the policy explains why the corporate credit card policy exists, promoting efficient expense management, ensuring compliance with tax laws, preventing fraud, and maintaining financial integrity.

It establishes that cards are strictly for legitimate business expenses, emphasizing benefits like simplified reimbursements and enhanced spend visibility across departments.

2. Eligibility

Outline criteria for who qualifies for corporate cards, typically based on role, department needs, or travel frequency, such as managers, sales teams, or executives.

Include an application process requiring manager approval and a signed acknowledgment of the company credit card use policy. Limiting issuance minimizes organizational risk.

3. Cardholder responsibilities

Cardholders must safeguard their cards, use them exclusively for approved business purposes, retain all receipts, submit timely expense reports, and promptly report any issues or suspicious activity.

They should review monthly statements carefully and never share card details with anyone, maintaining security at all times.

4. Allowable uses

Specify permitted expense categories like business travel (flights, hotels, meals), office supplies, client entertainment within set limits, and professional subscriptions.

Emphasize that all purchases must directly support company operations and require proper documentation. Clear examples help employees make appropriate spending decisions consistently.

5. Inappropriate uses

Prohibit personal expenses, cash advances, gambling, gift cards, or non-business purchases explicitly within your business credit card policy. Clearly state that violations lead to disciplinary action.

Common examples include personal gifts, family travel expenses, entertainment unrelated to business objectives, or unauthorized personal subscriptions.

6. High-risk payment processors

Restrict or require pre-approval for transactions with high-risk processors in industries prone to chargebacks, such as certain online services or volatile business sectors.

Following corporate credit card policy best practices helps your organization avoid elevated processing fees, compliance complications, or fraud exposure.

7. Other policy violations

Additional policy breaches covered in your corporate credit card expense policy include:

● Failing to return cards when reassigned to different roles, upon employment termination, or when specifically requested by management.

● Failing to submit complete expense reports or original receipts within the required timeframes.

● Failing to immediately report lost or stolen cards to prevent unauthorized transactions.

8. Reconciliation process

Detail the step-by-step process for reviewing transactions, attaching receipts, categorizing expenses accurately, and submitting reports. This should be done often, typically weekly or monthly, through your designated expense portal.

Specify submission timelines, approval workflows, manager sign-offs, and documented procedures for resolving discrepancies or investigating questionable charges.

9. Termination

Explain clear procedures for card deactivation upon employee departure, significant role changes, or serious policy breaches.

Requirements include immediate physical return of the card, final reconciliation of all outstanding charges, and documented confirmation that all expenses have been properly categorized and approved.

10. Consequences for policy violations

Outline progressive disciplinary measures in your corporate credit card policy guidelines, from initial written warnings and mandatory policy training to temporary suspension of card privileges, full repayment of unauthorized amounts, or employment termination in severe cases. Consistent enforcement maintains policy credibility.

How to create a corporate credit card policy

Developing an effective corporate credit card policy requires thoughtful planning to address your organization's specific needs while incorporating proven corporate credit card policy best practices.

Start by gathering input from finance, HR, and department leads, and review a corporate credit card policy sample to create a balanced, enforceable document that protects company interests while empowering employees.

Assess business needs and card usage

Evaluate current spending patterns, common expense categories, and reimbursement process pain points across departments.

Identify roles that benefit most from corporate cards, such as frequent travelers or procurement staff, and estimate transaction volumes to establish realistic spending limits, controls, and approval thresholds aligned with your business credit card policy objectives.

Define ownership and stakeholders

Assign clear responsibility for policy oversight, typically to your finance or treasury department, covering card issuance, transaction monitoring, and compliance enforcement.

Involve key stakeholders, including department heads, legal counsel, and executive leadership, early to ensure buy-in, alignment with organizational goals, and smooth implementation of your company's credit card use policy framework.

Align with financial and legal requirements

Incorporate compliance with tax regulations, IRS accountable plan rules, and industry-specific financial standards into your corporate credit card expense policy.

Address data security requirements, including PCI compliance, fraud prevention measures, internal controls, and audit trail documentation to protect your company from financial and legal risks while maintaining regulatory adherence.

Document and standardize the policy

Draft your corporate credit card policy template using clear, accessible language organized into logical sections with practical examples throughout.

Standardize formats for expense reports, receipt submission, approval workflows, and documentation requirements to simplify administrative processes, reduce confusion, ensure consistency, and facilitate comprehensive training for all cardholders across your organization.

Communicate & review the policy

Distribute your corporate credit card policy guidelines widely through multiple channels, require signed acknowledgments from all cardholders, and provide comprehensive training sessions using a corporate credit card policy sample for reference.

Implement corporate credit card policy rules to implement through regular monitoring, schedule annual policy reviews to update for regulatory changes, technological advances, or evolving business needs, ensuring ongoing relevance and effectiveness.

Stay compliant with corporate card policies through Volopay

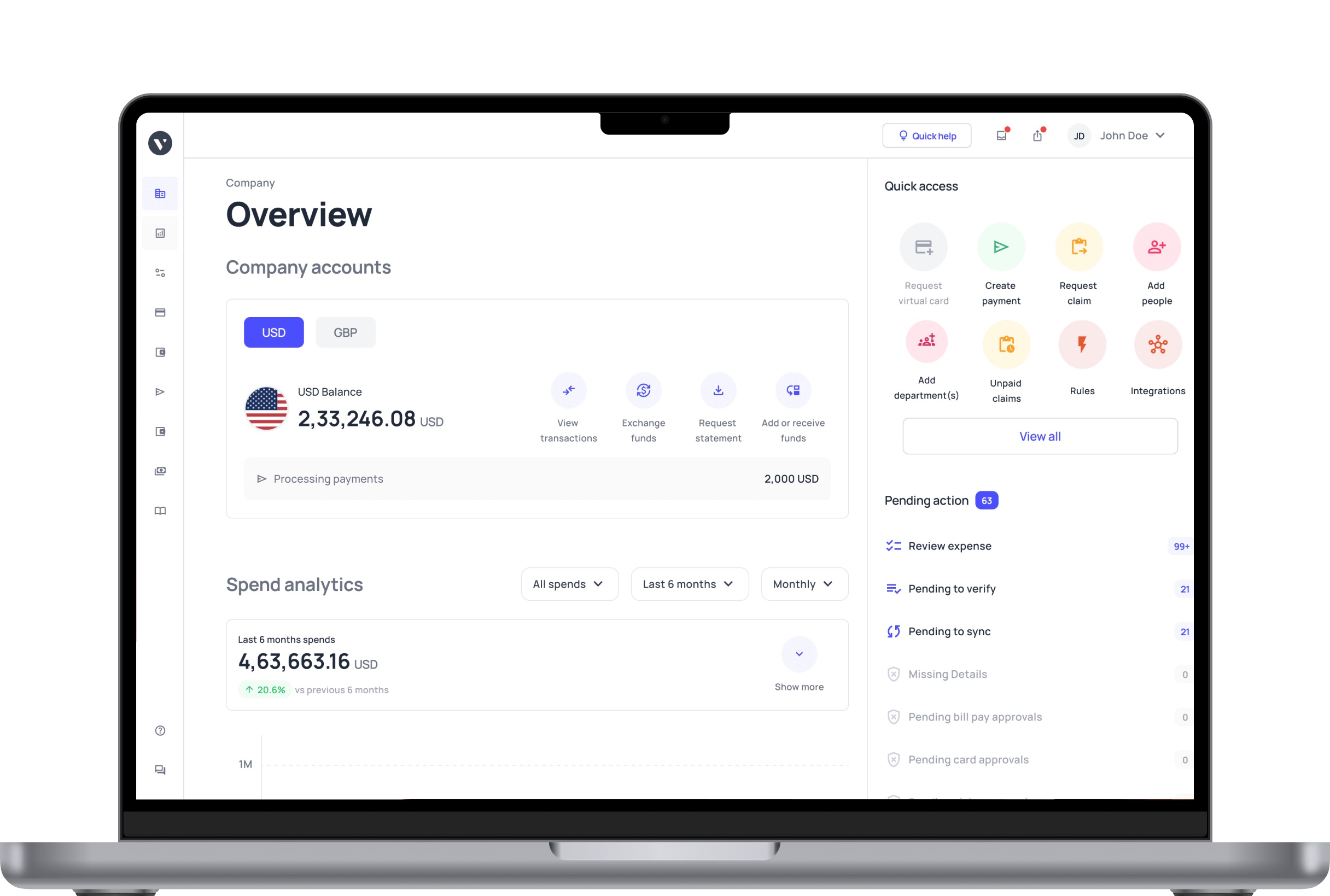

Maintaining compliance with your corporate card policy becomes significantly simpler when you leverage modern spend management systems like Volopay that automate tracking, enforce spending limits in real-time, and provide comprehensive insights into organizational expenses.

Volopay's corporate cards integrate seamlessly with your existing business card policy framework, offering powerful features such as automated expense reconciliation, intelligent receipt matching, customizable spending controls, and instant policy violation alerts to keep your finance team informed.

This streamlined approach dramatically reduces manual errors, accelerates approval workflows, and enhances spending visibility across departments and management levels.

By leveraging Volopay's platform, companies can confidently manage corporate expenses in strict alignment with established company card use policy guidelines while freeing up valuable finance team resources to focus on strategic growth initiatives, financial planning, and value-added activities that drive business success.