How to manage corporate credit cards effectively (2026)

Corporate credit cards have become essential tools for modern businesses, enabling employees to make necessary purchases while providing finance teams with oversight and control.

However, without proper systems in place, these cards can quickly become sources of unauthorized spending, lost receipts, and reconciliation nightmares that drain valuable time and resources.

Effective corporate credit card management transforms these potential headaches into streamlined processes that benefit the entire organization.

With the right policies, controls, and technology in place, businesses can reduce errors, prevent fraud, and gain valuable spending insights that drive smarter financial decisions and improved budget control.

Key takeaways

Managing corporate credit cards requires structured governance and defined accountability, ensuring card issuance, spending authority, and oversight responsibilities are clearly established across the organization.

Modern card management platforms enable scalable visibility and control, replacing fragmented processes with centralized monitoring, automated workflows, and reliable financial reporting.

Ongoing supervision of corporate cards strengthens financial discipline, helping businesses detect irregular activity early, maintain budget alignment, and reduce operational exposure.

A strategically managed corporate card program supports broader finance objectives, improving cash flow forecasting, vendor negotiations, cost efficiency, and data-driven decision-making.

What is corporate credit card management?

Corporate credit card management refers to the systematic process of issuing, monitoring, controlling, and reconciling company-issued credit cards used by employees for business expenses.

It encompasses setting policies, tracking transactions, ensuring compliance, and integrating data into financial reporting to maintain oversight over company spending.

Unlike personal credit cards, corporate cards are tied to a central account, often with customizable limits, categories, and approvals. This structure allows businesses to centralize expense tracking while distributing payment convenience to employees.

In 2026, management increasingly involves digital platforms that automate approvals, categorize spends in real time, and integrate with accounting software for seamless reconciliation.

Effective management goes beyond basic issuance. It includes proactive monitoring to prevent misuse, generate actionable insights, and support strategic budgeting. By treating cards as a controlled tool rather than unrestricted access, companies can turn potential liabilities into assets for better cash flow and visibility.

Why is corporate card management important?

Effective corporate credit card management is crucial for safeguarding finances, boosting operational efficiency, and supporting sustainable growth. Organizations that prioritize robust corporate credit management gain strategic advantages that extend far beyond simple expense tracking.

Enhanced visibility into spending

Real-time insights reveal exactly where and how company money is being spent across all departments, enabling more accurate budgeting, identifying cost-saving opportunities, and eliminating wasteful expenditures before they impact your bottom line.

Improved fraud prevention and security

Advanced monitoring tools detect unauthorized transactions immediately, significantly reducing financial risks and exposure compared to traditional reimbursement models, where personal cards delay visibility into suspicious activity.

Better compliance and policy enforcement

Systematic corporate credit card expense management ensures strict adherence to company guidelines, tax regulations, and industry standards, minimizing costly audit issues, regulatory penalties, and compliance headaches.

Streamlined expense processes

Automation reduces manual paperwork dramatically, speeds up reimbursements or eliminates them entirely, and cuts administrative time for finance teams by up to 70%, allowing them to focus on strategic initiatives.

Optimized cash flow and rewards

Centralizing payments through corporate cards enables better vendor negotiations, captures valuable rebates and rewards programs, and avoids unnecessary interest charges through timely payment scheduling.

Increased employee accountability

Clear spending limits and usage expectations discourage misuse and policy violations while simultaneously empowering staff with convenient, efficient tools for handling legitimate business expenses without friction.

Data-driven decision making

Comprehensive reports and spending analytics inform strategic business choices, from vendor contract renegotiations to travel policy adjustments, turning expense data into actionable intelligence that drives profitability.

How to manage corporate credit cards effectively

Implementing corporate credit card best practices requires a strategic approach that balances employee autonomy with financial oversight while leveraging modern technology to create efficient, compliant processes.

1. Develop a comprehensive policy

Create a clear, written corporate credit card policy outlining eligible uses, spending categories, approval workflows, receipt requirements, and consequences for violations. Include guidelines on prohibited expenses, such as personal purchases, and align with company goals.

Address emerging trends like virtual cards for one-time vendor payments. Distribute the policy during onboarding and require annual acknowledgments to ensure understanding.

2. Implement spending controls

Set customized limits per cardholder, including daily or monthly caps, merchant category restrictions, and geographic limitations. Use features like pre-approvals for high-value purchases or temporary increases for travel.

These controls prevent overspending and enforce budgets in real time. Consider role-based limits where executives have higher thresholds than junior staff, and implement multi-level approval workflows for transactions exceeding certain amounts.

3. Leverage technology

Adopt expense management software that integrates with corporate cards for automatic transaction feeds, receipt matching via mobile uploads, and AI-powered categorization. This reduces manual entry errors and provides dashboards for instant visibility.

Look for tools with predictive analytics to flag anomalies early. Modern platforms offer mobile apps for immediate receipt capture, with integration to accounting systems eliminating duplicate entry.

4. Train and communicate

Educate employees through regular training sessions, quick-reference guides, and reminders about policy details. Emphasize benefits like faster reimbursements and rewards to encourage compliance.

Ongoing communication through emails, intranet posts, or manager check-ins reinforces expectations and addresses questions promptly. Create scenario-based training covering common situations like splitting bills with colleagues or handling international transactions with proper documentation requirements.

5. Monitor and audit regularly

Conduct periodic reviews of transactions, comparing against policy adherence and budgets. Use automated alerts for unusual activity and perform spot audits on card samples quarterly. Regular monitoring catches issues early and demonstrates due diligence for audits.

Establish metrics for compliance tracking, such as receipt submission rates and policy violation frequencies. Review these metrics monthly with department heads to identify trends and improvement areas.

6. Streamline reporting and reconciliation

Automate data export to accounting systems for monthly closes, with tools that match receipts to charges and flag discrepancies. This minimizes month-end bottlenecks and ensures accurate financial statements.

Set up scheduled exports aligning with your accounting calendar, and create standardized reports for different stakeholders. Automated reconciliation tools can reduce month-end closing time significantly while maintaining accuracy and compliance standards.

Empower your teams with smarter payments

Who should be responsible for managing corporate credit cards?

Responsibility for managing corporate credit cards typically falls to the finance or accounting department, often led by a finance manager, controller, or dedicated spend management team.

These individuals handle critical tasks, including policy enforcement, card issuance, transaction monitoring, spending limit adjustments, and monthly reconciliation processes that ensure financial accuracy and compliance.

In larger organizations, effective management requires cross-functional collaboration. HR departments assist with onboarding new cardholders and providing compliance training, while department managers approve specific expenses and monitor their team's spending patterns.

IT teams ensure system security and integration with accounting platforms. Ultimately, strong leadership from the finance department ensures centralized control, maintaining consistent accountability across the organization.

It creates a framework where all stakeholders understand their roles in protecting company assets while enabling efficient business operations.

What are the common mistakes to avoid in corporate credit card management?

Avoiding common pitfalls in corporate card expense management prevents costly errors, fraud exposure, and operational inefficiencies that drain resources. Here are the key areas every organization should monitor closely to protect finances and maintain control.

1. Policy and oversight mistakes

Failing to establish or update a clear policy leads to confusion and inconsistent usage across the organization. Issuing cards without defined limits or approval processes often results in unchecked spending and budget overruns.

Many companies create overly complex policies that employees struggle to follow, or conversely, policies so vague that they provide no real guidance. Regular policy reviews ensure guidelines stay relevant as your business evolves and adapts to changing needs.

2. Financial and reporting pitfalls

Neglecting timely reconciliation causes discrepancies in financial books, delayed month-end closes, and inaccurate forecasting that impacts decision-making. Ignoring rewards programs or carrying balances incurs unnecessary fees and lost value.

Some organizations fail to capture early payment discounts or cashback opportunities that could significantly offset program costs. Poor categorization of expenses leads to tax reporting errors, compliance issues, and missed deduction opportunities that affect profitability.

3. Security and technology issues

Relying on outdated manual tracking exposes companies to fraud risks without real-time alerts or monitoring capabilities. Poor integration between corporate cards and expense management tools creates data silos and duplicate efforts that waste time.

Failing to implement multi-factor authentication, regular password updates, or immediate card deactivation procedures leaves organizations vulnerable to breaches. Not having clear protocols for handling suspected fraud can result in substantial financial losses and reputational damage.

4. Employee-related errors

Employees treating cards as personal accounts, delaying receipt submissions, or splitting purchases to evade approval limits undermine financial controls and accountability. Inadequate training leads to unintentional policy violations that create reconciliation headaches.

Some employees may not understand reimbursement rules or the tax implications of certain purchases. Creating a supportive culture where employees feel comfortable asking questions before making purchases prevents many compliance issues and fosters responsible spending habits.

Can you automate corporate card management?

Yes, automation has revolutionized corporate card expense management, eliminating most manual tasks that once consumed hours of administrative time.

Modern platforms automatically capture transaction data, match receipts to charges, categorize expenses based on merchant codes, route approvals through proper channels, flag policy violations, and sync everything with your accounting system, all without human intervention.

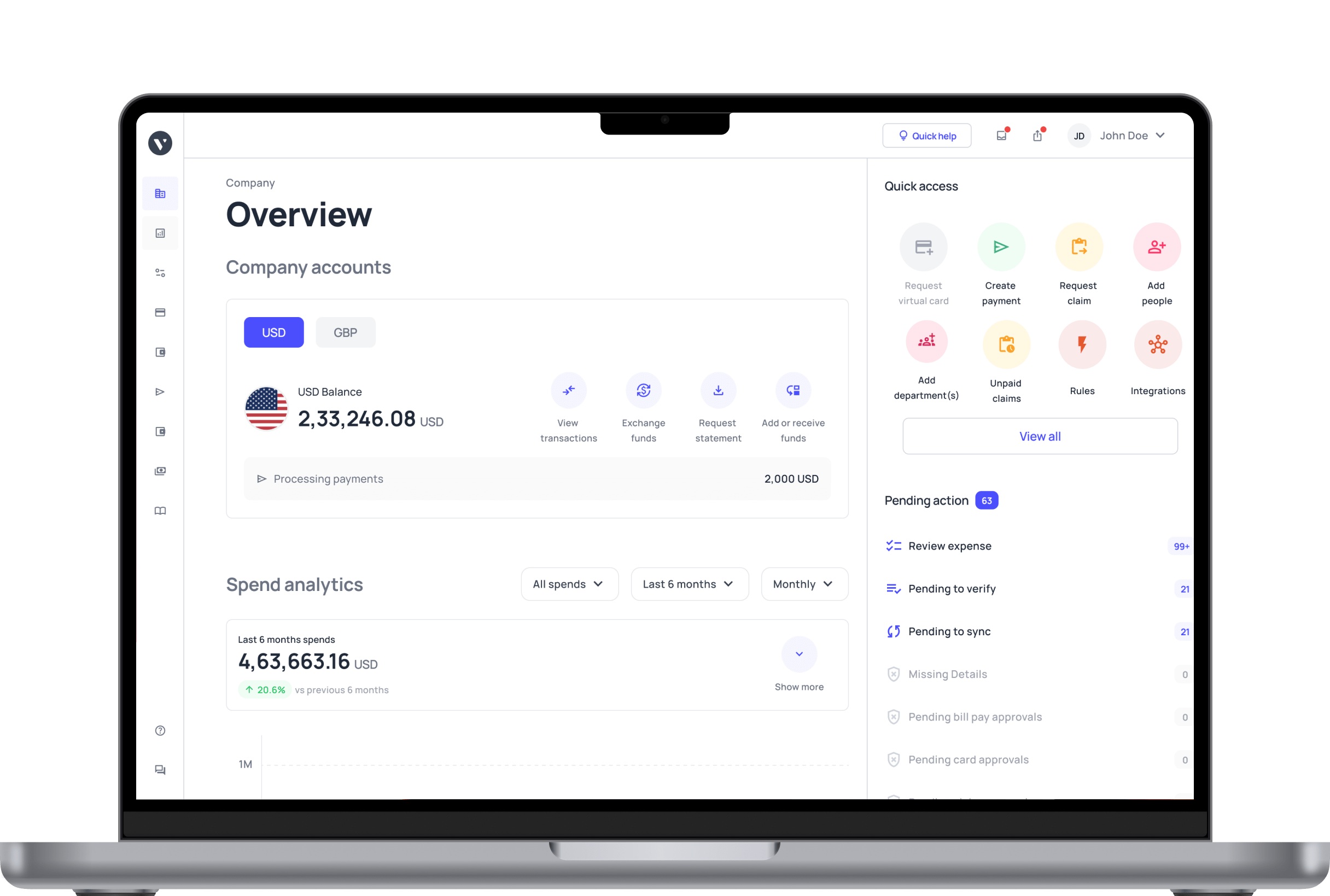

Volopay offers a comprehensive solution that brings all these automation capabilities together in one intuitive platform. Our system issues virtual and physical cards with customizable controls, captures receipt data through mobile apps, and provides real-time spending visibility across your entire organization.

Built-in approval workflows ensure every expense follows your established policies, while seamless integrations with popular accounting software eliminate double entry and accelerate month-end close — making Volopay's corporate cards a seamless extension of your finance operations.

With features like automated reconciliation, spending analytics dashboards, and role-based access controls, Volopay transforms corporate card management from a time-consuming burden into a strategic advantage that gives you complete control over company spending.