How to prevent corporate credit card fraud (2026)

Corporate credit card fraud poses a significant threat to businesses of all sizes, with losses reaching billions annually. As payment technologies evolve and workplace dynamics shift toward hybrid and remote models, fraudsters develop increasingly sophisticated methods to exploit vulnerabilities in corporate payment systems.

Understanding these risks and implementing robust prevention strategies has become essential for protecting your company's financial health. This comprehensive guide walks you through everything you need to know about credit card fraud prevention for businesses.

You'll discover the most common types of fraud, recognize warning signs before they escalate, and learn actionable strategies to safeguard your organization's financial assets and maintain operational integrity in today's complex business environment.

Key takeaways

Corporate credit card fraud can originate internally or externally, including employee misuse, expense manipulation, data theft, and vendor collusion.

Control weaknesses are the primary enablers of fraud, particularly unclear policies, poor oversight, delayed reconciliation, and lack of real-time monitoring.

Early warning signs are often behavioral and transactional, such as unusual spending patterns, missing receipts, round-number charges, and defensive responses to audits.

Prevention requires a multi-layered approach, combining strong internal controls, technology-driven monitoring, employee training, and proactive audits to reduce financial risk.

What is corporate credit card fraud?

Corporate credit card fraud refers to any unauthorized or deceptive use of company-issued payment cards for personal gain or to cause financial harm to the organization. This includes employees making unauthorized purchases, using cards for personal expenses, manipulating expense reports, or external criminals obtaining card information through data breaches, phishing schemes, or physical theft.

Unlike consumer credit card fraud, corporate fraud often involves insiders who have legitimate access to company resources, making detection more challenging and potentially more damaging.

The financial impact of company credit card fraud extends beyond immediate monetary losses. Organizations face increased administrative costs for investigating incidents, potential legal liabilities, damaged vendor relationships, and compromised employee trust.

According to industry research, businesses lose approximately 5% of their annual revenue to occupational fraud, with payment card misuse being one of the most prevalent schemes.

The rise of digital payment platforms and remote work has created new opportunities for fraudsters while simultaneously making traditional oversight mechanisms less effective. Companies must recognize that fraud prevention requires a multi-layered approach combining technology, policy enforcement, and cultural accountability.

Common causes of corporate credit card fraud:

● Weak internal controls and inadequate oversight of card usage

● Lack of clear spending policies or failure to communicate guidelines

● Insufficient employee training on proper card usage and fraud awareness

● Inadequate technology for real-time transaction monitoring and alerts

● Poor expense report review processes and delayed reconciliation

● Financial pressure or perceived job insecurity among employees

● Rationalization that "borrowing" company funds isn't serious theft

What are 5 types of corporate credit card fraud?

Recognizing the various forms of corporate credit card fraud helps you implement targeted prevention measures and detect suspicious activity before it causes substantial damage. Here are the five most common types:

1. Unauthorized personal purchases

Employees knowingly use company cards to buy personal items ranging from everyday expenses like groceries and gas to luxury goods, vacations, or gifts, hoping the charges will go unnoticed among legitimate business expenses.

2. Expense report manipulation

Cardholders submit fraudulent or inflated expense reports by altering receipts, claiming personal expenses as business-related, submitting duplicate reimbursement requests, or fabricating entirely fictitious transactions to receive unauthorized payments.

3. Card information theft

External fraudsters obtain corporate card numbers through data breaches, phishing emails, compromised point-of-sale systems, or physical theft of cards, then use this information to make unauthorized purchases before the breach is discovered.

4. Ghost employee schemes

Dishonest employees or managers create fictitious employees in payroll systems, issue corporate cards in these fake names, and make purchases or cash advances while pocketing the funds or merchandise for personal use.

5. Vendor collusion

Employees collaborate with external vendors to process fake invoices, inflate prices, or bill for services never rendered, then split the fraudulent proceeds while the transactions appear legitimate in company records.

Empower your teams with smarter payments

What are 7 signs of corporate credit card fraud?

Early detection of company credit card fraud significantly reduces financial losses and allows you to address problems before they escalate into major security breaches. Watch for these warning signs:

Unusual spending patterns

Transactions that suddenly deviate from an employee's typical spending habits, including purchases at odd hours, unexpected merchants, or locations inconsistent with business travel or known work activities.

Frequent small purchases

Multiple small transactions that individually fall below approval thresholds but collectively represent significant amounts, a tactic fraudsters use to avoid triggering automatic review systems or manager scrutiny.

Missing or altered receipts

Employees consistently fail to provide documentation for expenses, submit poor-quality or illegible receipts, or provide receipts that appear modified, photocopied, or suspiciously similar across multiple transactions.

Weekend or holiday transactions

Charges occurring during non-business hours when employees shouldn't be making work-related purchases, particularly at restaurants, entertainment venues, retail stores, or locations unrelated to company operations.

Round-number purchases

Transactions with suspiciously round amounts like $100, $500, or $1,000, which often indicate cash advances, gift card purchases, or fabricated expenses rather than genuine business purchases.

Lifestyle changes

Employees displaying sudden wealth or lifestyle improvements inconsistent with their salary, such as expensive vehicles, luxury items, or increased personal spending, which may sometimes indicate they're funding their lifestyle through fraud.

Defensive behavior

Cardholders who become unusually protective of their expense reports, resist providing additional documentation, avoid taking vacations where someone else would review their transactions, or react defensively to routine questions about spending.

How to prevent corporate credit card fraud

Protecting your organization from corporate credit card fraud requires a comprehensive strategy that combines clear policies, advanced technology, employee accountability, and continuous monitoring to create multiple defensive layers.

1. Policy & internal controls

Establish comprehensive written policies that clearly define acceptable card usage, spending limits, prohibited purchases, and consequences for violations. Implement delegation of duties by ensuring different people handle card issuance, transaction approval, and expense reconciliation to prevent any single individual from controlling the entire process.

Set transaction limits based on employee roles and responsibilities, requiring manager approval for purchases exceeding predetermined thresholds. Mandate detailed documentation for all expenses, including itemized receipts showing what was purchased rather than just credit card slips.

Create a formal card request and approval process that evaluates business necessity before issuing cards, and establish procedures for immediately reporting lost or stolen cards. Conduct regular policy reviews and updates to address emerging fraud tactics and ensure compliance with current regulations.

2. Technology & monitoring

Deploy expense management software that provides real-time visibility into all corporate card transactions and automatically flags suspicious activity based on customizable rules you establish.

Implement virtual card numbers for specific vendors or transactions, which can be assigned spending limits and expiration dates to minimize fraud exposure if compromised.

Use AI-powered analytics tools that identify anomalies by comparing current spending patterns against historical data and industry benchmarks. Enable real-time alerts that notify both cardholders and managers immediately when transactions occur, allowing quick verification of legitimacy.

Integrate your expense system with accounting software to streamline reconciliation and reduce opportunities for manipulation during manual data entry. Employ geofencing technology that restricts card usage to specific geographic locations relevant to employee travel and business operations. Regularly review and analyze spending data to identify trends, patterns, or outliers that warrant further investigation.

3. Employee training & vigilance

Conduct mandatory onboarding training for all new cardholders that covers proper usage, documentation requirements, and the serious consequences of fraud, including termination and potential criminal prosecution.

Provide annual refresher training that updates employees on new fraud schemes, policy changes, and real-world examples of how fraud has impacted other organizations.

Educate staff about social engineering tactics and phishing attempts that criminals use to obtain card information, teaching them to verify requests before sharing sensitive data. Create a confidential reporting mechanism that encourages employees to report suspected fraud without fear of retaliation, making it clear that the company values ethical behavior.

Foster a culture of transparency where employees understand that proper expense practices protect both the company and their own professional reputations. Include fraud awareness in performance reviews and make adherence to spending policies part of employee evaluations.

4. Proactive management

Conduct surprise audits and random expense report reviews rather than only examining transactions when problems are suspected, which deters would-be fraudsters who know oversight could happen anytime.

Reconcile corporate card statements promptly, ideally within days rather than weeks, so you can quickly identify and investigate questionable transactions while details remain fresh. Perform background checks before issuing corporate cards to employees in positions with significant financial access or authority.

Review and adjust spending limits periodically based on actual business needs rather than maintaining unnecessarily high limits that create fraud opportunities. Disable cards immediately when employees leave the company or change roles, and conduct exit audits to ensure all outstanding expenses are properly documented.

Establish relationships with your card issuer's fraud department and leverage their expertise, tools, and resources to strengthen your prevention efforts.

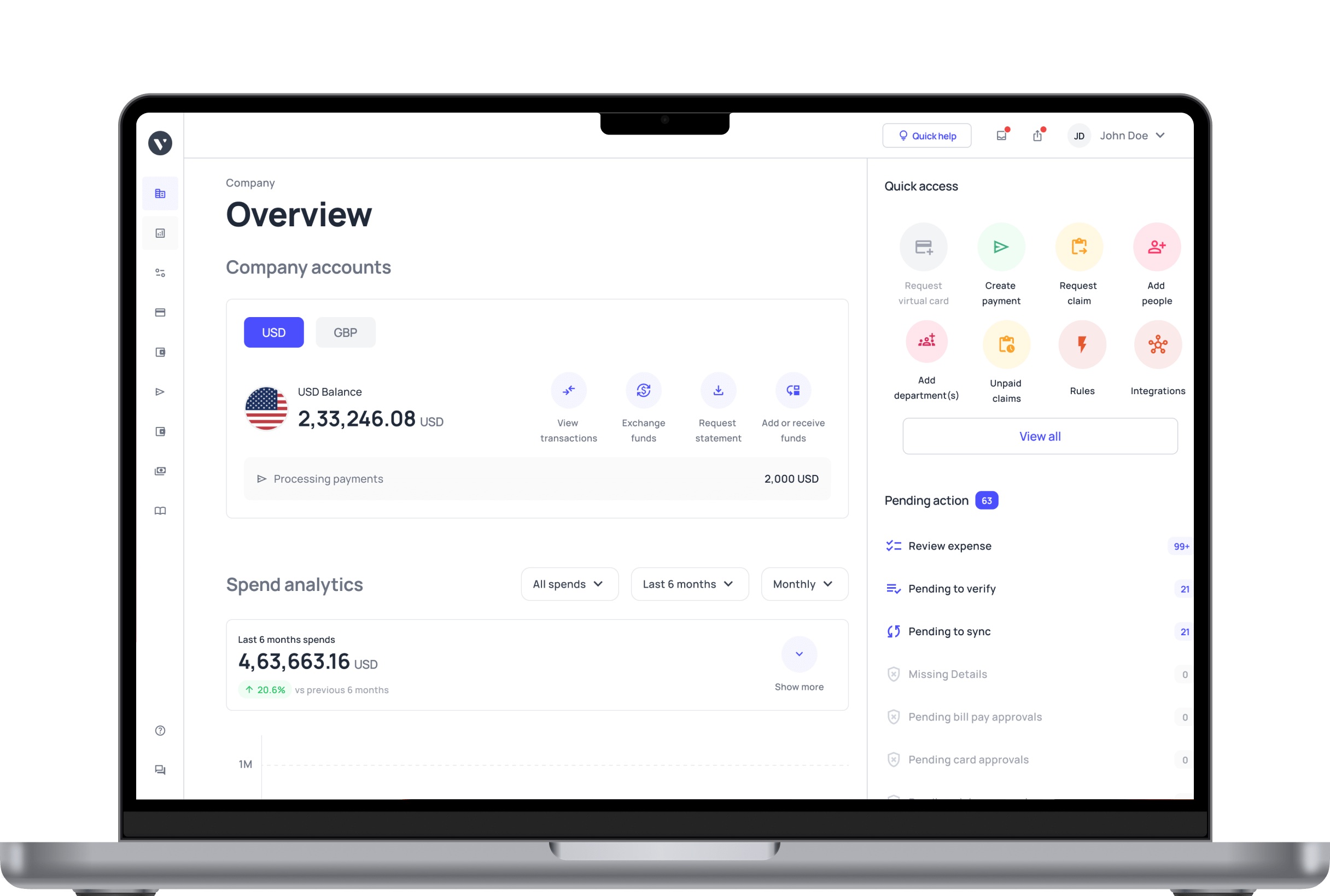

Easily monitor and secure corporate cards using Volopay

Volopay transforms how you manage and protect your company's payment cards by providing an all-in-one platform that eliminates common vulnerabilities associated with traditional corporate cards. With Volopay's corporate cards, you gain enhanced security, flexibility, and control tailored to modern business needs.

You gain complete real-time visibility into every transaction, with instant notifications and automated approval workflows that catch unauthorized spending before it becomes a problem.

The platform allows you to issue virtual cards and physical cards with preset spending limits and merchant restrictions, ensuring employees can only make purchases that align with your policies.

You'll streamline fraud prevention through intelligent automation that flags suspicious activity, requires receipt uploads before reimbursement, and automatically matches expenses to accounting categories.

The intuitive dashboard gives you powerful analytics to identify spending patterns and anomalies across your organization, while role-based access controls ensure only authorized personnel can view sensitive financial information.

With Volopay, you protect your business from corporate card fraud while empowering employees with the financial tools they need to work efficiently, creating a secure payment ecosystem that scales with your company's growth.