Corporate credit card agreement: Tips & how to create one (2026)

As organizations scale and spending becomes more decentralized, clarity around card usage is no longer optional. In 2026, evolving compliance standards, distributed workforces, and real-time audits demand clearly documented guidelines.

You depend on well-defined agreements to set spending boundaries, approval responsibilities, and accountability from day one.

This blog outlines how structured policies help you avoid confusion, reduce misuse, and support sustainable growth. You benefit from uniform practices across teams, faster employee onboarding, and cleaner reconciliations.

When expectations are documented upfront, you enable confident spending while ensuring finance teams retain full visibility and control across the organization.

Key takeaways

A corporate credit card agreement establishes structured spending governance, clearly defining access, boundaries, and accountability to protect company funds as operations expand.

Well-designed agreements align employees, managers, and finance teams, creating shared expectations that reduce confusion, disputes, and administrative friction.

Standardized documentation strengthens compliance and risk management, supporting enforceable controls, audit preparedness, and consistent policy enforcement across locations and roles.

A scalable agreement framework supports growth without sacrificing oversight, enabling organizations to adapt limits, roles, and processes as transaction volumes and operational complexity increase.

What is a corporate credit card agreement?

A company credit card agreement, or a corporate credit card agreement, is a written policy that outlines how business-issued cards may be used. It defines who is eligible, spending limits, prohibited purchases, documentation requirements, and consequences for misuse.

It aligns employees and finance on responsibilities, protects company funds, and establishes clear expectations for compliant, auditable card usage across roles, locations, and teams globally.

You use a corporate credit card agreement to formalize card issuance and daily spending behavior. It documents eligibility, controls, approvals, receipts, disputes, and audits, reducing ambiguity as teams scale.

By referencing a company credit card agreement, you clarify ownership, liability, and repayment expectations. For staff clarity, a credit card agreement for employees explains allowed merchants, travel rules, and consequences.

When aligned with your finance systems, policies streamline onboarding, reinforce compliance, and speed reconciliation. Clear language supports accountability, limits risk, and enables confident spending without slowing operations, even across distributed teams and vendors, while maintaining governance standards companywide and audit readiness.

Why do companies have corporate credit card agreements?

Companies establish formal card policies to protect finances, guide employee spending, ensure compliance, and maintain transparency as teams grow, transactions increase, and oversight becomes complex.

1. Clear spending accountability

Defined rules clarify who can spend, where funds may be used, and within what limits. This helps finance teams prevent misuse, reduce ambiguity, and keep transactions traceable, justified, and aligned with approved business purposes across roles and departments.

2. Employee clarity and protection

Clear documentation removes uncertainty around responsibilities, restricted purchases, receipt submission, and consequences, all while providing employees confidence to spend responsibly through a company credit card agreement for employees that standardizes expectations and reduces disputes during audits or reviews.

3. Stronger compliance and risk control

Well-defined agreements support tax, regulatory, and audit requirements by outlining enforceable controls and approvals, reducing fraud exposure, limiting liability, and demonstrating consistent financial governance across teams and spending categories.

4. Operational efficiency at scale

Standardized policies simplify card issuance, limit management, receipt collection, and dispute handling. They enable faster reconciliations, smoother closes, and better coordination between employees, managers, and accounting teams as transaction volumes grow.

5. Policy enforcement and scalability

A structured framework allows updates for new roles, markets, or spend categories without confusion, reinforcing accountability and consistent enforcement as headcount, budgets, and operational complexity increase.

6. Improved budget visibility

Centralized rules improve spend tracking and categorization, helping finance teams monitor budgets in real time, identify trends early, and make informed decisions without waiting for month-end reports.

7. Reduced financial disputes

Clearly documented expectations and consequences minimize disagreements over charges, repayments, or misuse, saving time for managers and finance teams while promoting trust, fairness, and consistent treatment across the organization.

8. Faster onboarding and adoption

A documented policy speeds onboarding by setting clear expectations early, reducing training time, building confidence in card usage, and ensuring consistent understanding across teams and roles.

What does a corporate credit card agreement include?

A well-structured agreement outlines expectations, controls, and processes, helping you manage employee spending consistently while protecting budgets, ensuring compliance, and supporting scalable financial operations.

Cardholder responsibilities

Cardholder responsibilities define how you safeguard cards, follow approved purchase rules, submit receipts, and report issues promptly, ensuring accountability, accurate records, and responsible use aligned with internal policies, manager approvals, and audit expectations without exposing the business to avoidable risk during daily transactions, travel spending, vendor payments, and recurring expenses.

Spending limits and controls

Spending limits and controls specify transaction caps, monthly budgets, merchant restrictions, and approval workflows. This allows finance teams and you to balance flexibility with oversight, prevent overspending, reduce fraud exposure, and maintain real-time visibility into expenses across departments, roles, and locations.

All of this becomes crucial as spending scales, policies evolve, and reporting requirements increase across the organization.

Approved and restricted expenses

Approved and restricted expenses clearly distinguish allowable business purchases from prohibited personal or high-risk transactions. The separation avoids confusion, enforces consistency, simplifies audits, and ensures card usage supports legitimate operational needs.

These could include travel policies, vendor relationships, and cost control objectives without exceptions that undermine policy enforcement or financial discipline in the long term.

Billing, payment, and reimbursement terms

Billing, payment, and reimbursement terms explain minutiae such as statement cycles, due dates, dispute handling, and employee repayment obligations.

They help you understand cash flow timing, while a corporate credit card usage agreement clarifies liability, reduces late fees, supports accurate accounting, and aligns payments with internal finance processes across teams, vendors, and reporting periods.

Reporting and reconciliation requirements

Reporting and reconciliation requirements outline receipt submission timelines, coding standards, and review processes, helping finance teams match transactions accurately.

Meanwhile, a company credit card agreement for employees ensures consistency, faster month-end closes, fewer discrepancies, and reliable financial data, which come in handy when it’s time for audits, forecasting, and decision-making across departments and reporting cycles.

Compliance, misuse, and penalties

The compliance, misuse, and penalties sections define investigation procedures, corrective actions, and disciplinary measures.

It aids in reinforcing accountability while signaling that improper spending carries consequences, protects company assets, deters fraud, and supports ethical behavior aligned with governance standards and leadership expectations across all roles, regions, spending scenarios, audits, and evolving regulatory requirements.

How to create a corporate credit card agreement

Creating a clear agreement requires planning, collaboration, and accuracy, ensuring you set practical rules that scale with growth, protect finances, and guide consistent employee spending.

1. Involve key stakeholders

Involving finance, HR, legal, and department leaders helps you capture real spending needs, compliance requirements, and operational realities.

You want to ensure that the policy reflects daily workflows, approval structures, risk tolerance, and accountability expectations across teams while gaining early alignment, reducing resistance, and supporting smoother adoption as card usage expands companywide.

2. Use clear language

Using simple, direct language ensures you avoid ambiguity and reduce misinterpretation, making the agreement easier to follow, enforce, and audit while supporting consistent decisions, faster onboarding, and better compliance for employees who rely on a company credit card agreement template as their daily reference document.

3. Match workflow

Aligning rules with existing approval flows, expense tools, and reporting systems ensures you minimize friction, maintain visibility, and encourage adherence.

An employee credit card agreement template mirrors how teams actually spend, submit receipts, and reconcile transactions across departments without forcing inefficient steps that slow operations unnecessarily at scale, companywide.

4. Get legal review

Legal review validates enforceability, liability terms, data protection, and regulatory alignment. It reduces risk, addresses jurisdictional requirements, and ensures consequences are consistent and fair.

It also protects the organization during disputes, audits, employee exits, and policy enforcement scenarios across regions, regulatory changes, evolving business models, and global market operations.

5. Train employees

Training employees ensures you communicate expectations, demonstrate real scenarios, and reinforce accountability. The goal is to help teams adopt policies confidently while reducing errors, misuse, and disputes.

This is done through ongoing education, refreshers, and accessible documentation that supports responsible spending behavior as roles, tools, and limits change over time.

Simplify employee card management with Volopay

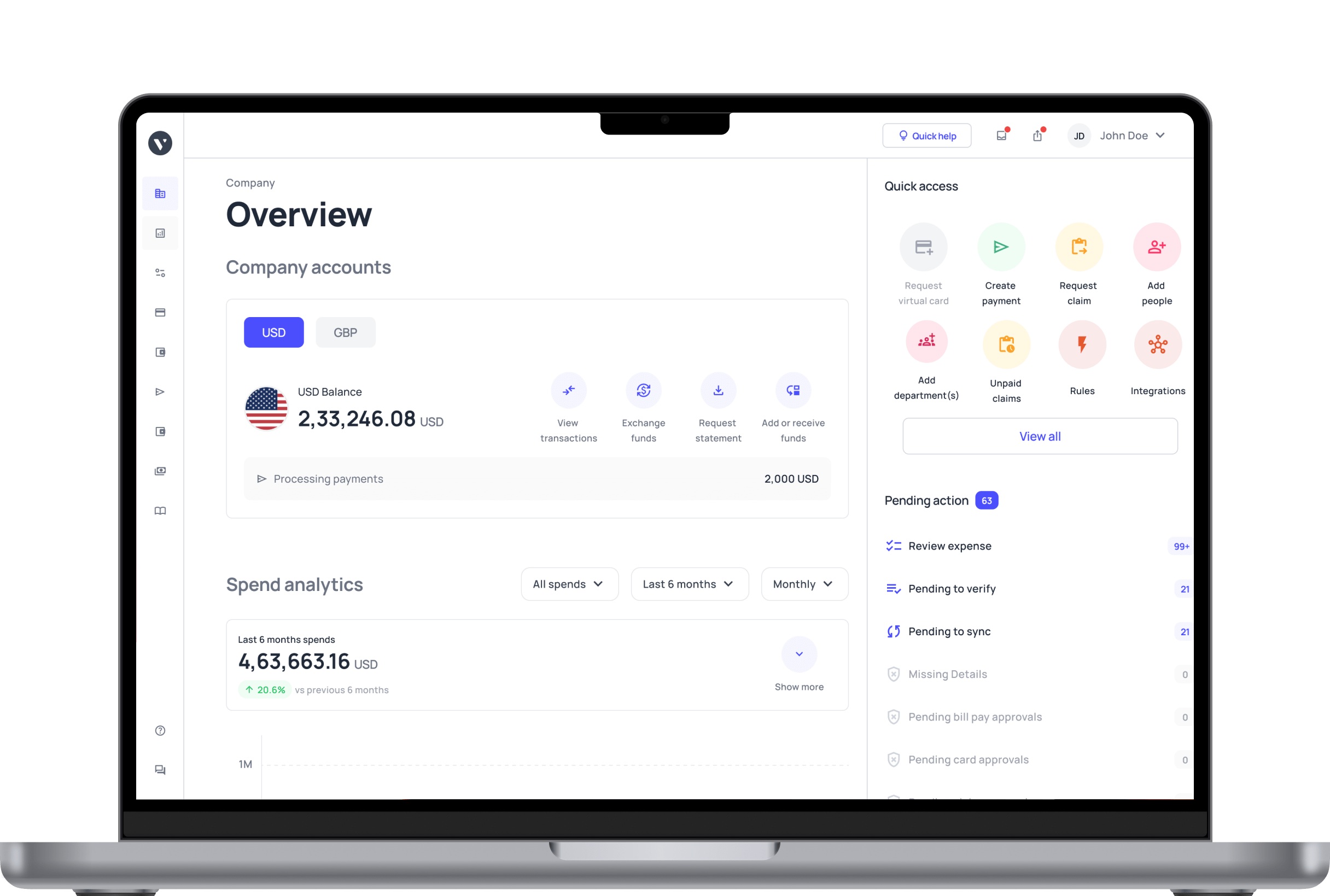

Modern finance teams need card management that balances speed, control, and visibility without adding operational complexity. Volopay enables instant corporate card issuance, granular spending limits, and real-time tracking across teams and departments.

Manual receipt chasing and reconciliations are replaced with automated capture, approvals, and coding, reducing errors and closing timelines. Controls remain consistent as organizations scale, since rules and limits apply automatically.

When workflows align with corporate card usage agreements, compliant spending happens naturally without slowing teams down. Centralized dashboards provide complete oversight for finance, while employees benefit from clarity and flexibility.

You gain faster onboarding, stronger governance, and reliable reporting that supports audits, forecasting, and daily operations across locations, roles, and evolving business requirements worldwide.