Corporate credit card: Meaning, eligibility & how it works (2026)

A corporate credit card is a payment instrument issued to businesses, enabling employees to make company-related purchases without using personal funds. These cards streamline expense management, provide detailed spending reports, and help organizations maintain better financial control.

As businesses increasingly embrace digital solutions, many are transitioning to corporate virtual credit cards, which offer enhanced security features and real-time expense tracking capabilities.

Whether you're a growing startup or an established enterprise, these cards can significantly reduce administrative burden while providing valuable insights into your company's spending patterns. This guide will walk you through everything you need to know about corporate credit cards, from eligibility requirements to practical implementation strategies.

Key takeaways

Corporate credit cards enable structured business spending by allowing companies to manage employee expenses without relying on reimbursements.

They improve financial visibility and control through centralized tracking, spending limits, and policy-based oversight.

Approval is based on business credibility, including legal registration, revenue stability, and creditworthiness.

Different card types support different operational needs, from travel-heavy teams to subscription management and controlled project budgets.

What is a corporate credit card?

A corporate credit card is a business payment tool issued directly to a company rather than an individual. Unlike personal credit cards, the liability rests with the organization, and the company is responsible for all charges made on the card. These cards are typically distributed to employees for business-related expenses such as travel, client entertainment, office supplies, and operational costs.

Corporate credit cards offer numerous advantages beyond simple purchasing power. They centralize expense tracking, simplify reconciliation processes, and provide detailed transaction reports that integrate seamlessly with accounting software.

Many providers now offer corporate credit cards with rewards, allowing your organization to earn cashback, travel points, or other incentives on business spending. These rewards can translate into significant savings when leveraged strategically across your company's regular expenditures.

The cards also enhance financial control through customizable spending limits, category restrictions, and real-time monitoring capabilities. You can set individual limits for each employee, restrict purchases to specific merchant categories, and receive instant notifications for transactions. This level of oversight helps prevent unauthorized spending while maintaining the flexibility your team needs to operate efficiently.

Who is eligible for a corporate credit card?

Understanding corporate credit card requirements is crucial before applying, as issuers evaluate multiple factors to determine your business's eligibility for these financial instruments.

1. Business registration and legal status

Your organization must be a legally registered entity with valid documentation such as incorporation certificates, business licenses, and tax identification numbers.

Most issuers require businesses to be operational for at least one to two years, though some providers offer cards to newer companies with strong financial backing or personal guarantees from owners.

2. Financial stability and credit history

Issuers assess your company's financial health through credit reports, revenue statements, and bank account activity. A solid business credit score significantly improves your corporate credit card eligibility.

You'll need to demonstrate consistent cash flow and profitability through financial statements, including balance sheets and profit-and-loss reports from recent fiscal periods.

3. Valid tax identification required

Your business must possess proper tax identification numbers issued by governmental tax authorities. This federal tax identifier distinguishes your company as a separate legal entity from individual owners.

Card issuers use this information for credit reporting purposes and to verify your organization's legitimacy with regulatory agencies.

4. Employee and cardholder criteria

Once your business qualifies, you determine which employees receive cards based on their roles and spending needs.

Organizations typically issue cards to executives, managers, sales teams, and employees who regularly incur business expenses, establishing internal policies that govern cardholder responsibilities and spending authority.

5. Minimum revenue thresholds apply

Most corporate credit card programs establish baseline annual revenue requirements that your business must meet. These thresholds vary by card issuer and card type, typically ranging from moderate to substantial revenue levels.

Higher revenue often qualifies your company for premium cards with enhanced benefits, higher limits, and more favorable terms available.

Is it easy to get a corporate credit card?

Yes, for established businesses with solid financials. Companies demonstrating consistent revenue, strong business credit scores, and clean financial histories typically experience streamlined approval processes.

However, startups and newer enterprises may face additional scrutiny or require alternative providers offering cash flow-based underwriting rather than traditional credit evaluations.

What are the different types of corporate credit cards?

Standard corporate credit cards

Standard corporate credit cards are the traditional model issued to established companies with significant annual revenue, typically in the millions. These cards operate on a revolving credit structure and provide comprehensive expense management capabilities, high credit limits, and detailed reporting features.

Financial institutions evaluate your company's creditworthiness, business structure, and financial statements during the application process.

Corporate virtual cards

Corporate virtual credit card solutions represent digital-first payment innovation for modern businesses. These electronic cards generate unique numbers for individual transactions or specific suppliers, delivering superior security through customizable spending restrictions and expiration controls.

You can instantly create numerous virtual cards with transaction-specific parameters, making them perfect for managing subscriptions, vendor relationships, and preventing fraudulent activity.

Corporate travel cards

Corporate travel cards streamline business travel expenses, including airfare, hotels, car rentals, and meal costs. These specialized cards deliver enhanced earning rates on travel spending, complimentary airport lounge memberships, and seamless integration with travel booking platforms.

Corporate credit cards with rewards prove especially beneficial for organizations whose employees frequently travel for business purposes and conferences.

Corporate charge cards

Corporate charge cards mandate complete balance payment by each statement deadline, preventing revolving debt accumulation. Despite this payment requirement, they typically offer substantially higher spending thresholds and sophisticated expenditure controls.

Your organization benefits from maintaining disciplined cash flow management while accessing superior credit capacity for large business expenditures.

Corporate prepaid cards

Corporate prepaid cards function through preloaded funding without requiring credit lines or traditional bank account connections. You deposit specific amounts onto these cards, ensuring absolute expenditure control for designated projects, business units, or contract workers.

This structure eliminates credit exposure while preserving convenient payment functionality for controlled spending scenarios.

Empower your teams with smarter payments

How does a corporate credit card work?

Corporate credit cards function through a structured system that connects your organization's financial infrastructure with employee spending capabilities. The process begins when your company applies for a corporate card program through a financial institution or fintech provider. Unlike personal credit cards, issuers evaluate your business financials, revenue, business credit score, and organizational structure rather than individual credit histories.

Once approved, your finance team establishes spending policies, credit limits, and approval workflows within the card management platform. You can configure parameters such as merchant category restrictions, transaction amount thresholds, and department-specific budgets.

The system then issues physical or virtual cards to designated employees based on their roles and spending requirements. Each card connects to the master account while maintaining individual tracking capabilities for accountability and reporting.

When employees make purchases, transaction data flows automatically into your expense management system and integrates with your accounting software or ERP platform. This real-time visibility allows finance teams to monitor spending patterns, identify policy violations, and maintain budget compliance without manual intervention.

The automated categorization eliminates hours of reconciliation work while providing accurate financial reporting. Understanding how to use corporate credit card systems effectively requires proper employee training on spending policies, receipt submission procedures, and approval protocols.

At the end of each billing cycle, your company receives a consolidated statement covering all cardholder activity. Depending on your liability structure, the organization makes a single payment for all charges, or in some configurations, individual cardholders may be responsible for their balances.

Corporate credit card validity typically ranges from three to five years, after which cards are renewed automatically if the account remains in good standing, ensuring uninterrupted access to your business credit facilities.

What are the pros and cons of corporate credit cards?

- Fraud risk: Corporate cards are vulnerable to both external theft and internal misuse without proper monitoring systems in place.Centralized expense tracking: All transactions consolidate into a single system, simplifying reconciliation and financial reporting for your accounting team.Disadvantages

- Limited oversight: Real-time spending control can be challenging with traditional cards, often requiring monthly statement reviews.Improved cash flow: Payment grace periods provide 30-45 days between purchases and due dates, enhancing working capital management.Disadvantages

- High interest costs: APRs typically exceed other financing options, making carried balances expensive if not paid monthly.Rewards programs: Earn cashback, points, or travel benefits on business purchases, generating cost savings across company-wide spending.Disadvantages

- Strict eligibility: Requires established credit history and substantial revenue, often limiting access for newer businesses.Eliminates reimbursements: Employees make direct purchases without using personal funds, reducing administrative processing time.Disadvantages

- Misuse potential: Without strong policies, employees may make unauthorized purchases, creating compliance and financial issues.Financial separation: A clear distinction between business and personal expenses simplifies tax preparation and protects individual credit.Disadvantages

- Fewer protections: Corporate cards typically offer reduced purchase protection and more complex dispute resolution compared to consumer cards.Builds business credit: Responsible usage strengthens your company's credit profile, improving future financing terms and opportunities.Disadvantages

How to implement a corporate credit card program

Understanding how to set up and manage corporate credit card systems requires a structured approach that balances operational efficiency with financial control. Successful implementation involves strategic planning, clear policy development, and robust monitoring mechanisms to maximize benefits while minimizing risks.

1. Preparation & planning

Begin by assessing your organization's spending patterns, identifying which departments and employees require card access. Analyze current expense volumes, payment methods, and reconciliation challenges.

Establish clear objectives for your program, whether focused on streamlining processes, earning rewards, or improving cash flow visibility.

2. Application process

Research providers by comparing fee structures, credit limits, rewards programs, and integration capabilities. Gather required documentation, including financial statements, tax returns, business licenses, and organizational details.

Submit applications to your chosen issuer, ensuring all information accurately reflects your company's financial position.

3. Policy & implementation

Develop comprehensive usage policies defining eligible expenses, spending limits, approval workflows, and violation consequences. Establish clear guidelines for receipt submission, expense categorization, and reporting timelines.

Implement approval hierarchies that reflect your organizational structure while maintaining appropriate oversight and accountability throughout the system.

4. Card issuance & configuration

Once your corporate credit card program is approved, configure individual cardholder profiles with role-appropriate spending limits and merchant category restrictions.

Issue physical or virtual cards to designated employees based on their responsibilities and travel requirements. Set up automated controls, including transaction alerts, velocity limits, and real-time spending notifications.

5. Expense tracking & accounting integration

Connect your card program to existing accounting software, ERP systems, or dedicated expense management platforms for automated data synchronization.

Configure expense categories, cost centers, and GL coding to match your chart of accounts. Enable receipt capture through mobile applications and automated matching algorithms.

6. Monitoring, controls & optimization

Regularly review spending patterns, identifying trends, anomalies, and policy violations requiring attention. For corporate credit card example scenarios, analyze department-specific usage to optimize limit allocations and reward category selections.

Conduct periodic policy reviews, adjusting controls based on evolving business needs and emerging risks.

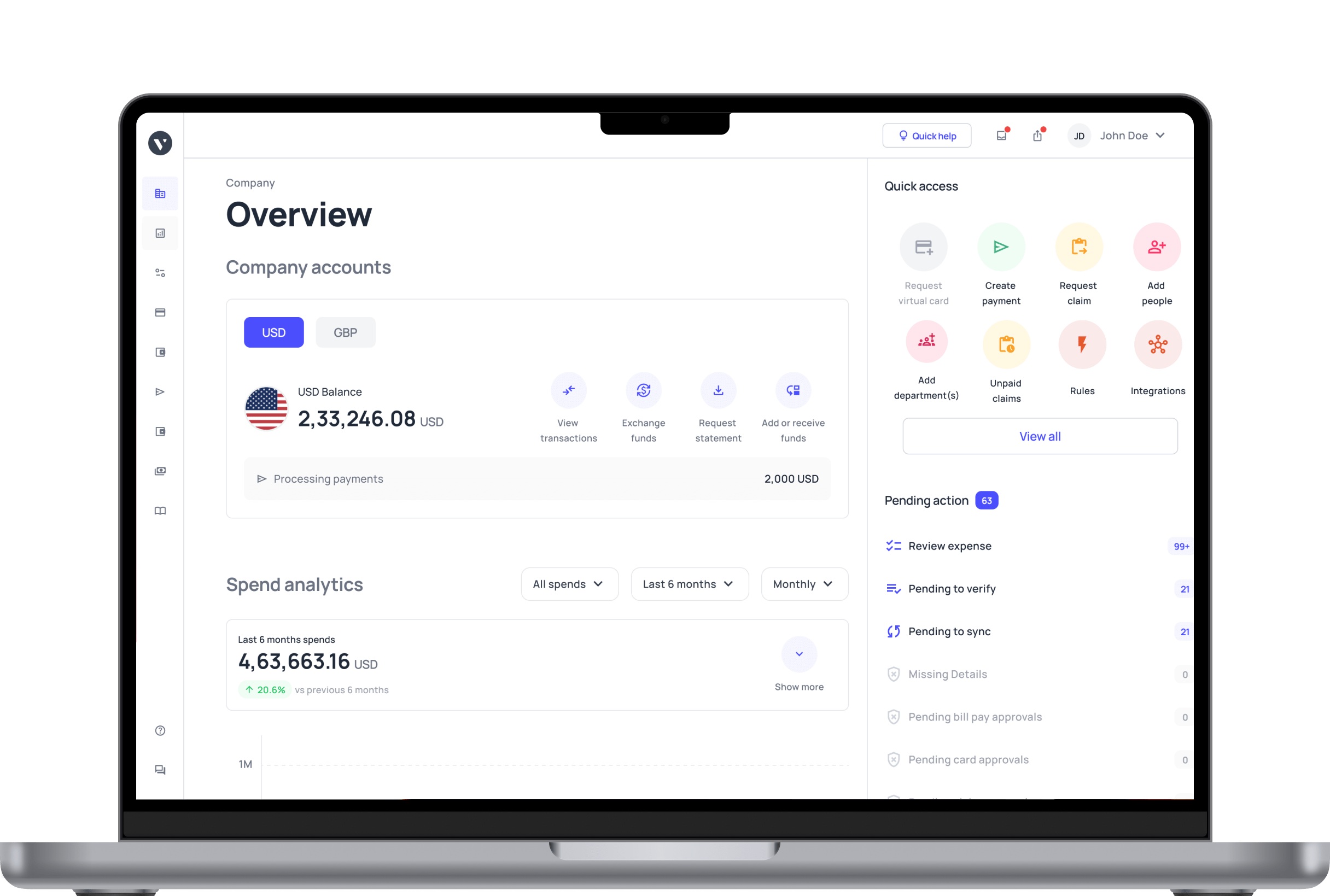

Keep your corporate cards organized with Volopay

Managing multiple corporate payment solutions across departments can quickly become overwhelming without proper systems in place. Volopay offers businesses a centralized platform that brings order to card management, enabling finance teams to issue, track, and control both physical and virtual cards from a single dashboard.

The platform provides real-time visibility into all transactions, eliminating the confusion of scattered statements and manual reconciliation processes. Using company card infrastructure effectively requires robust organizational tools and automated workflows.

Volopay allows businesses to automatically categorize expenses, set department-specific budgets, and generate detailed reports with minimal effort. Whether you’re managing subscriptions, vendor payments, or day-to-day team spending, Volopay’s corporate cards simplify financial oversight and empower smarter decision-making across your organization.