How to get business credit card without personal guarantee (2026)

Accessing funding without risking personal assets is a growing priority for modern founders. Business credit cards with no personal guarantee allow a company to build credit based on its own financial profile rather than the owner’s score.

This option appeals to established entities seeking stronger liability protection, cleaner accounting, and improved risk management. You can separate business and personal finances, improve cash flow planning, and negotiate better vendor terms while maintaining corporate credibility.

Understanding eligibility, documentation, and realistic approval criteria helps you choose the right provider and avoid unexpected obligations later for businesses aiming for sustainable growth over long-term goals.

Key takeaways

No personal guarantee business credit cards protect individual assets, shifting liability to the company and reinforcing true financial separation.

Approval depends on demonstrable business strength, including consistent revenue, healthy cash reserves, structured incorporation, and reliable banking activity.

Issuer selection plays a critical role in success, as fintech and modern underwriting models increasingly evaluate real-time company performance rather than personal credit profiles.

Stronger corporate credit unlocks scalable financing opportunities, enabling higher limits, improved vendor relationships, and long-term growth based on business merit alone.

What is a business credit card with no personal guarantee?

A business credit card (no personal guarantee as a requirement) is a corporate card that evaluates approval using the company’s revenue, cash reserves, and credit history. It does not require the owner to accept personal liability for outstanding balances or default risk. Instead, decisions are made under standard commercial underwriting guidelines applied by issuing institutions.

Such a “no pg” business credit card typically requires strong business financials, such as consistent revenue, sufficient cash flow, and an established entity structure. Lenders may also review tax filings, bank statements, and operating history to assess repayment capacity without owner backing for long-term stability and reduced default exposure overall.

A secured business credit card can be an entry option when financial strength is limited, since deposits reduce issuer risk. You still build company credit, demonstrate payment discipline, and gradually qualify for unsecured limits as performance and revenue improve over time with consistent usage and reporting accuracy.

Who qualifies for a business credit card with no personal guarantee?

Not every company qualifies. But specific financial and structural factors determine whether you can access unsecured corporate credit without assuming personal liability today with confidence.

1. Established LLCs and corporations

If you operate an established LLC or corporation, you can qualify for corporate credit cards without personal guarantee by showing steady revenue and positive cash flow.

Clean financial records and a registered business history also matter. These factors demonstrate consistent operational stability and make lenders more comfortable extending business-only credit.

2. Startups with strong revenue or funding

As a startup, you may access business credit cards for new businesses without personal guarantee if you can prove recurring revenue or strong unit economics.

Verified contracts and sizable cash reserves further reduce lender risk. This helps offset the limited operating history during early growth stages.

3. VC-backed and high-growth businesses

VC-backed companies often qualify because investors validate business viability. You can leverage funding rounds and investor credibility to strengthen your application.

Scalable revenue projections also help you secure higher limits without personal guarantees when financial discipline is clearly demonstrated.

4. Businesses with high monthly spend

If your company processes high monthly expenses, you appear more attractive to issuers. Predictable spending patterns and strong account balances improve approval chances.

Low chargeback risk and efficient payment behavior support access to larger revolving limits over time.

Can you get a business credit card without a personal guarantee?

Yes, but approval depends on how strong your company’s financial profile appears to lenders. You can obtain a card without personal liability when your business demonstrates consistent revenue, healthy cash flow, and reliable banking history.

Issuers focus on corporate risk rather than individual credit, which allows you to separate personal finances from operational obligations and maintain stronger financial boundaries. This also supports better long-term financial planning and clearer accountability within the business.

Small businesses and startups can still qualify, although expectations are higher. You typically need proof of stable income, sufficient reserves, or external funding to offset limited operating history.

Without these factors, most providers require personal backing to reduce default risk. However, some fintech issuers evaluate real-time cash data instead of traditional credit scores. This makes approval more flexible for businesses with strong current performance.

Not all business cards require personal guarantees, but most traditional banks still include them by default. Newer financial platforms now offer easy business credit cards, no personal guarantee, especially for incorporated entities with predictable spending and disciplined payment behavior.

You benefit from cleaner accounting, reduced personal exposure, and the ability to scale credit based on company performance rather than individual financial standing alone. This creates a more sustainable foundation for long-term business growth.

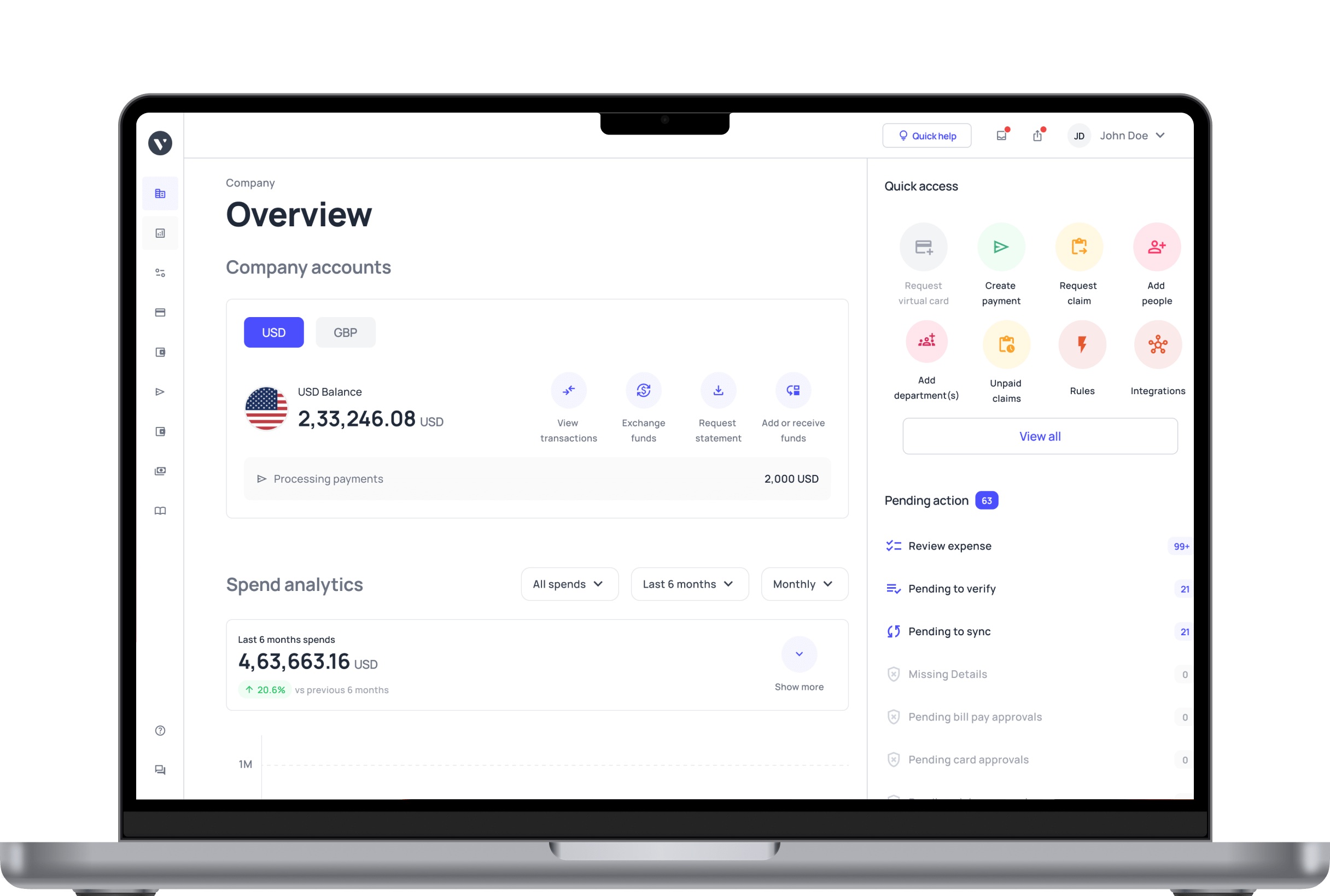

Empower your teams with smarter payments

How to get business credit card with no personal guarantee

You can qualify by aligning legal structure, financial readiness, and issuer selection. This approach helps lenders evaluate company risk directly and reduces reliance on personal responsibility during the approval process.

Verify business structure

You should operate as an incorporated entity, since LLCs and corporations provide clearer legal separation and documented ownership.

This structure signals stability and compliance, which lowers lender concerns about liability, governance, and long-term operational continuity for business-only credit approval.

Check revenue & cash flow requirements

You must show predictable revenue and strong average balances, as issuers review regular inflows and spending patterns over time.

This data helps assess repayment ability without relying on personal income or consumer credit, supporting fair business-based underwriting decisions.

Prepare EIN and business documents

You need an EIN and official formation records, along with recent bank statements and tax filings.

These documents verify legitimacy and allow lenders to evaluate business performance without referencing personal financial history, while also speeding up approval timelines and reducing follow-up requests.

Identify no-pg card issuers

You should research fintech providers offering easy business credit cards with no personal guarantee, since these platforms focus on real-time cash data and business performance.

They rely less on traditional credit checks and more on actual activity, which makes them more accessible for modern, digitally operated companies.

Submit an EIN-based application

You apply using company information only, including legal name, EIN, revenue, and banking details.

Issuers review this data to assess operational strength and financial stability without pulling personal credit reports, which keeps the evaluation strictly business-focused and reduces unnecessary processing delays.

Undergo business-only underwriting

You are evaluated through revenue trends, account balances, and overall spending behavior.

Payment consistency also matters, since these indicators show whether your business can manage revolving credit responsibly and support higher limits over time.

Review terms and limits carefully

You should examine fees, repayment cycles, interest structures, and reporting policies in detail.

This ensures the card aligns with cash flow and long-term operational needs, while preventing unexpected costs or financial strain later.

Activate card and set spending controls

You can issue cards and assign budgets across teams while setting approval rules and real-time tracking.

This helps prevent overspending, improve accountability, and maintain strong financial governance throughout daily operations.

What are the pros and cons of no personal guarantee business credit cards?

These cards offer strong liability protection and financial independence, but they also involve stricter approval standards, increased financial scrutiny, and higher expectations around long-term business performance.

- Higher qualification requirements apply, since lenders expect strong revenue, clean financial records, and proven operational stability before extending business-only credit.Personal assets remain protected because liability stays with the business entity, which reduces financial exposure during defaults, disputes, or unexpected cash flow disruptions.Cons

- Lower starting credit limits are common, as issuers manage risk more cautiously without personal repayment guarantees.Clear separation between personal and business finances improves accounting accuracy, simplifies audits, and supports structured financial reporting for long-term planning.Cons

- Higher interest rates or fees may apply due to increased lender risk and limited repayment security.Independent business credit is built, strengthening future access to loans, trade credit, and enterprise-level financial products.Cons

- Consistent cash flow becomes essential, since missed payments can quickly trigger account restrictions or reviews.Personal credit scores remain unaffected, ensuring business issues do not impact individual borrowing capacity or financial reputation.Cons

- Limited access exists for early-stage companies, especially those without sufficient operating history or financial documentation.Corporate credibility improves when working with vendors, partners, and financial institutions through professional credit usage.Cons

- More detailed financial disclosures may be required, reducing privacy compared to traditional small business cards.Structured spending controls support compliance, internal governance, and expense discipline across departments.Cons

- Fewer issuer options are available, which limits flexibility in choosing providers and card features.Scalability improves as credit limits grow based on business performance rather than individual financial standing.Cons

Are there high-limit business credit cards available with no personal guarantee?

Yes, high-limit options do exist if your business shows strong financial performance and stability. You can qualify for business credit cards for LLC, no personal credit check required, when your revenue and cash flow demonstrate a reliable repayment capacity.

Lenders are more willing to extend larger limits, but typically require solid metrics and an established track record before approving unsecured limits tied solely to company strength.

You should prepare detailed financial documentation and maintain consistent profitability to improve chances. Smaller or newer entities may start with moderate limits and build toward higher thresholds as performance and credit history strengthen over time.