Ultimate guide to business credit cards for LLCs (2026)

Operating a Limited Liability Company demands strategic financial management, and selecting the right business credit card for LLC operations represents a critical decision that impacts your company's cash flow.

In 2026, business credit cards have become indispensable tools offering far more than simple payment convenience. Understanding how business credit cards function within your LLC structure enables you to leverage these financial instruments for maximum operational advantage and long-term growth.

This comprehensive guide examines every aspect of business credit cards specifically tailored for LLC owners, from initial eligibility requirements and application strategies to ongoing management best practices and credit building techniques.

You'll discover how to evaluate card features against your actual business needs, understand the implications of personal guarantees, and implement expense controls that scale with your organization.

Key takeaways

A dedicated business credit card strengthens financial separation for LLCs, reinforcing liability protection while supporting organized company spending.

The right card should align with your LLC’s structure, growth stage, and spending patterns, ensuring features, limits, and benefits deliver practical value.

Strategic application preparation improves approval success, particularly by verifying entity status, understanding guarantee requirements, and positioning your credit profile appropriately.

Ongoing management determines long-term advantage, as disciplined usage, controlled employee access, and optimized rewards help build business credibility and scale responsibly.

Why open a business credit card for LLC?

Opening a business credit card for your LLC provides financial separation and builds credit. The strategic advantages it offers can significantly enhance your company's operational efficiency and growth potential.

Protect personal assets

When you use a business credit card for your LLC, you create a critical legal separation between personal and business finances.

This barrier protects your personal assets, including your home, savings, and investments, from business liabilities.

Build business credit

Establishing a business credit card helps your LLC develop its own credit profile independent of your personal credit score.

Meeting business credit card requirements (LLC-specific) and making timely payments builds a strong business credit history.

Improve cash flow

Business credit cards provide flexible payment terms that help you manage cash flow gaps between expenses and revenue.

You can purchase inventory, pay suppliers, or cover operational costs immediately while deferring payment until your billing cycle ends.

Streamline bookkeeping and taxes

Consolidating business expenses onto one card simplifies record-keeping and tax preparation significantly. You'll receive detailed monthly statements categorizing all purchases, making it easier to track deductible expenses.

This organization reduces bookkeeping time, minimizes errors, and ensures you capture every legitimate tax deduction.

Earn rewards and perks

Business credit cards offer valuable rewards programs tailored to company spending patterns.

These rewards effectively reduce your operational costs while providing additional perks like purchase protection, extended warranties, and travel insurance that benefit your business activities.

Employee spending control

Issuing employee cards under your business account allows you to set individual spending limits and category restrictions.

You maintain oversight of all company purchases while empowering employees to handle necessary expenses.

What LLCs should look for in a business credit card

Selecting the right business credit card requires evaluating eligibility criteria, features, and financial terms that align with your LLC's operational needs and long-term growth objectives.

1. LLC eligibility requirements

Before applying, verify that card issuers accept LLCs as eligible business structures. Some cards require a minimum time in business, typically ranging from one to three years, while others welcome newer companies.

Review annual revenue thresholds, as certain premium cards demand higher income levels.

2. EIN vs SSN application

It’s sometimes possible to apply for business credit cards for LLC with EIN (Employer Identification Number) only, which strengthens the separation between personal and business finances.

However, some issuers may still require your Social Security Number for identity verification and personal guarantee purposes.

3. Employee cards & controls

Evaluate cards offering complimentary employee cards with customizable spending controls.

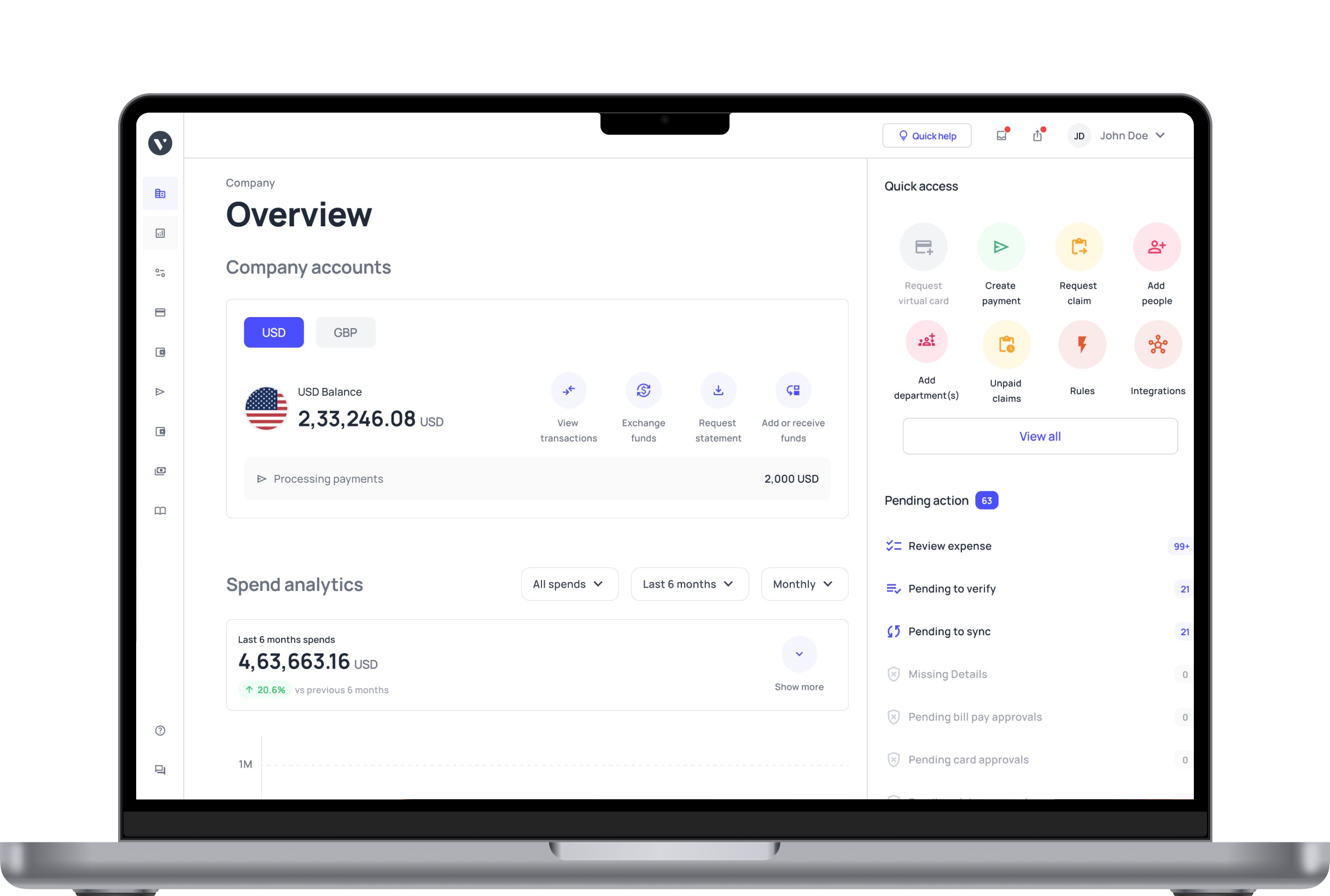

Look for features that let you set individual spending limits, restrict purchases by merchant category, and require transaction approvals above certain thresholds. Real-time alerts and detailed reporting help you monitor employee spending patterns.

4. Rewards for business spend

Choose cards with reward structures matching your LLC's primary expense categories. If you travel frequently, prioritize cards offering bonus points on airfare and hotels. For office-based operations, seek cash back on office supplies, telecommunications, and advertising.

Calculate the earning rate against your typical monthly spending to determine the actual value.

5. Fees, APR, and terms

Analyze the complete fee structure, including annual fees, foreign transaction charges, and balance transfer costs. Compare annual percentage rates if you anticipate carrying balances occasionally, though paying in full monthly is ideal.

Review introductory APR periods for purchases or balance transfers that can provide temporary financing flexibility.

6. Expense tracking tools

Select cards with robust digital platforms that categorize transactions automatically and generate customizable expense reports. Mobile apps with receipt capture, expense tagging, and real-time notifications streamline financial management.

These tools simplify tax preparation by organizing deductible expenses throughout the year rather than scrambling during filing season.

7. Scalability for growing LLCs

Choose cards that accommodate your LLC's expansion plans with increasing credit limits based on payment history and business growth.

Consider cards providing volume discounts, tiered rewards that improve with higher spending, or access to additional financial products like business loans or lines of credit. This scalability ensures your credit card evolves alongside your business needs.

Do I need a business credit card for an LLC?

Yes, obtaining a business credit card for LLC operations is highly recommended, though not legally required. A dedicated business credit card strengthens the corporate veil by maintaining clear financial separation between your personal and business finances.

This distinction protects your personal assets from business liabilities and demonstrates your LLC's legitimacy to vendors, clients, and financial institutions.

Beyond asset protection, a business credit card provides essential operational advantages that position your LLC for sustainable growth. You'll build an independent business credit profile that enables access to larger financing opportunities with favorable terms as your company expands.

Empower your teams with smarter payments

How to get a business credit card for LLC

Securing a business credit card for your LLC involves strategic preparation, proper documentation, and selecting the right issuer that accommodates your company's specific structure and needs.

1. Verify LLC is active and in good standing

Before applying, confirm your LLC maintains an active status with your state's Secretary of State office. Obtain a certificate of good standing demonstrating compliance with all filing requirements and tax obligations.

Even a business credit card for a new LLC requires proof of legal existence and proper registration.

2. Use the LLC's legal name exactly

Submit applications using your LLC's exact legal name as registered with your state, including designations like "LLC" or "Limited Liability Company." Any discrepancies between your application and official records can trigger delays or rejections.

Verify the precise spelling and formatting of your formation documents before completing the application process to establish your business entity.

3. Apply with EIN instead of SSN

Whenever possible, use your LLC's Employer Identification Number rather than your Social Security Number on credit card applications.

While some issuers still request your SSN for verification purposes, leading with your EIN demonstrates your LLC operates as a distinct legal entity with a separate financial identity.

4. Understand personal guarantee rules

Most business credit card issuers require LLC owners to sign personal guarantees, making you individually liable for debts incurred. Review guarantee terms carefully before accepting responsibility.

This requirement remains standard even for established LLCs, though building strong business credit for LLC needs may eventually qualify you for non-guaranteed options.

5. Link an LLC business bank account

Connect a business bank account registered under your LLC's name to facilitate payments and establish financial credibility.

This linkage also simplifies payment processing, enables automatic bill pay, and maintains the critical financial separation between personal and business finances throughout your credit card usage.

6. Choose cards that support multi-member LLCs

If your LLC has multiple owners, select card issuers accommodating multi-member structures with flexible ownership documentation. Clarify these requirements upfront, especially regarding who can authorize purchases, access account management features, and bear liability.

Ensure the card's terms align with your operating agreement regarding financial authority and member responsibilities.

7. Set authorized users for LLC members

After approval, designate LLC members or employees as authorized users with appropriate access levels.

Configure spending limits, transaction categories, and approval thresholds matching each user's role and responsibilities. Maintain detailed records of who receives card access and their authorized spending parameters.

Can a new or single-member LLC get a business credit card?

Yes, both new and single-member LLCs can absolutely obtain business credit cards, though approval depends on demonstrating financial credibility. Many issuers offer business credit cards for LLC startups specifically designed for emerging companies with limited operating history.

As a single-member LLC owner, you'll typically rely on your personal credit score during the initial application process, as your business hasn't yet established its own credit profile.

Start by applying for cards with lower credit requirements or those marketed toward startups and small businesses. Maintain excellent payment habits, keep utilization low, and your LLC will gradually build independent business credit.

Do business credit cards for LLC require a personal guarantee?

Yes, most business credit cards require LLC owners to sign personal guarantees, making you personally liable for all account obligations. When you apply for a new LLC credit card, issuers typically evaluate both your business entity and your personal creditworthiness before approval.

However, personal guarantees serve as standard industry practice rather than punitive measures, and some exceptions exist for well-established businesses. As your LLC builds substantial business credit history, demonstrates consistent revenue, and maintains strong financial performance, you may eventually qualify for corporate credit cards without personal guarantees.

How to choose the best business credit card for LLC

Selecting the optimal business credit card requires analyzing your LLC's current operations, financial patterns, and growth trajectory to match features with your specific business requirements.

LLC stage and size

Assess your LLC's maturity level and operational scale when evaluating card options. Startup LLCs with limited credit history should target entry-level cards with accessible approval criteria, while established companies can pursue premium offerings.

Larger LLCs benefit from cards offering higher credit limits, bulk employee cards, and enterprise-level reporting capabilities tailored to complex organizational structures.

Primary use case

Identify your LLC's dominant spending categories to maximize card value. If travel constitutes your primary expense, prioritize cards offering airline miles, hotel points, and trip protections.

Office-based operations benefit from cash back on telecommunications, software subscriptions, and office supplies. Align card benefits with your actual spending patterns rather than aspirational categories to ensure tangible returns.

Approval probability

Evaluate your likelihood of approval based on personal credit score, business revenue, and time in operation before applying. Multiple rejections damage your credit profile and waste valuable time.

Match your financial profile to cards where you meet or exceed typical approval standards, increasing success rates while protecting your creditworthiness.

Spend-based rewards

Calculate potential rewards earnings against your documented monthly spending across various categories. Compare percentage-based cash back versus points systems, factoring in redemption values and restrictions.

Evaluate welcome bonuses requiring minimum spending thresholds that you can naturally achieve without artificial purchases. Ensure the rewards structure delivers measurable value exceeding any associated fees.

Cost vs value

Conduct a comprehensive cost-benefit analysis weighing annual fees against total rewards potential, perks, and operational benefits. Premium cards with substantial fees may deliver superior value through travel credits, insurance coverage, and elevated earning rates if properly utilized.

Conversely, no-annual-fee cards suit LLCs with moderate spending or those prioritizing simplicity over maximized returns.

Tool usability

Test digital platforms and mobile applications for intuitive expense management, reporting capabilities, and integration functionality. Evaluate how seamlessly the card connects with your existing accounting software, payment systems, and financial workflows.

User-friendly tools reduce administrative burden, improve financial visibility, and enhance your team's ability to manage expenses efficiently without extensive training requirements.

Upgrade flexibility

Select issuers offering clear pathways to premium products as your LLC expands and spending increases. Research whether the credit card you're considering allows seamless upgrades without closing accounts and losing payment history.

Evaluate the issuer's complete portfolio to ensure future card options align with your growth projections. Consider relationship benefits like improved terms, limit increases, or access to business loans for loyal customers.