How to reduce T&E expenses for your sales team?

Thanks to globalization and the internet, your company’s client base isn’t just limited to the city it was created in. Businesses have expanded beyond mere brick and mortar establishments, and your ideal client can be halfway across the world.

To drive up revenue, sales teams are encouraged to pursue high-ticket clients, which involves air travel, client dinners, and much more. Corporate travel and expenses are responsible for some of the biggest cash outflows for your business.

What is T&E expenses?

Known as “travel and expense” or “travel and entertainment”, T&E refers to expenses made by employees either through business credit cards, corporate cards, or from their own pockets (which gets reimbursed later). Corporate T&E covers a wide range of business expenses, primarily airfare, accommodation, meals, transportation, etc availed during the time of an employee’s stay.

T&E costs are usually the second-highest expense in a company. Therefore, when the time to trim up business expenses comes around, business owners usually aim to avail travel and expense management services to set strict expense policies, reimbursement conditions and enforce compliance.

What is travel and expense management system?

It refers to the efficient management of corporate T&E by not only associating these expenses with costs but also with growth and revenue. Why revenue? We’ll explain. Sure, globalization and the internet have expanded our reach, but in a lot of ways, they have also limited human interaction.

In this day and age where holding your customer’s attention is the biggest challenge, expecting your sales team to apply the art of selling by using emails and phone calls is putting them at a disadvantage. In-person meetings are important for your team to strike the right deal with your prospects.

When your sales team travels all the way to meet a potential customer, it shows grit and determination, that’s produces better conversion rates than telephonic communication.

Reducing your T&E across the board is a perilous step. Good travel and expense management services identify corporate T&E expenses accounting conducive to your revenue and growth and consistently track them using concrete data analysis.

How to reduce cost of sales team T&E?

While looking to cut T&E expenses, look at avenues that reduce expenses without affecting revenue-generating travel opportunities.

Free up salespeople to sell

Do you know that your sales team spends 65% of their time doing low-priority tasks, instead of selling? Instead of converting high-ticket prospects into clients, your sales team is doing tasks such as filing travel and expense reporting, remembering to store hundreds of little receipts to apply for reimbursement, etc.

When your sales team is more focused on manually doing tasks that can easily be automated, you are essentially paying them for doing chores that drive neither revenue nor any growth.

Let your sales team do what it does best and leave these secondary tasks to be automated by a spend management software like Volopay that provides corporate cards for T&E expenses accounting and automated travel and expense reporting. Remove the added burden of carrying receipts by using digital receipt capturing technology.

Set proactive spend controls, and monitor transactions as they happen

You have set a strict expense policy in place, but to enforce it, you need your managers to be on top of your sales team’s expenses. However, since expenses take up to 6 to 8 weeks to get processed for reimbursement, it is only at least a month after expenses have been made that you realize any expense policy violations.

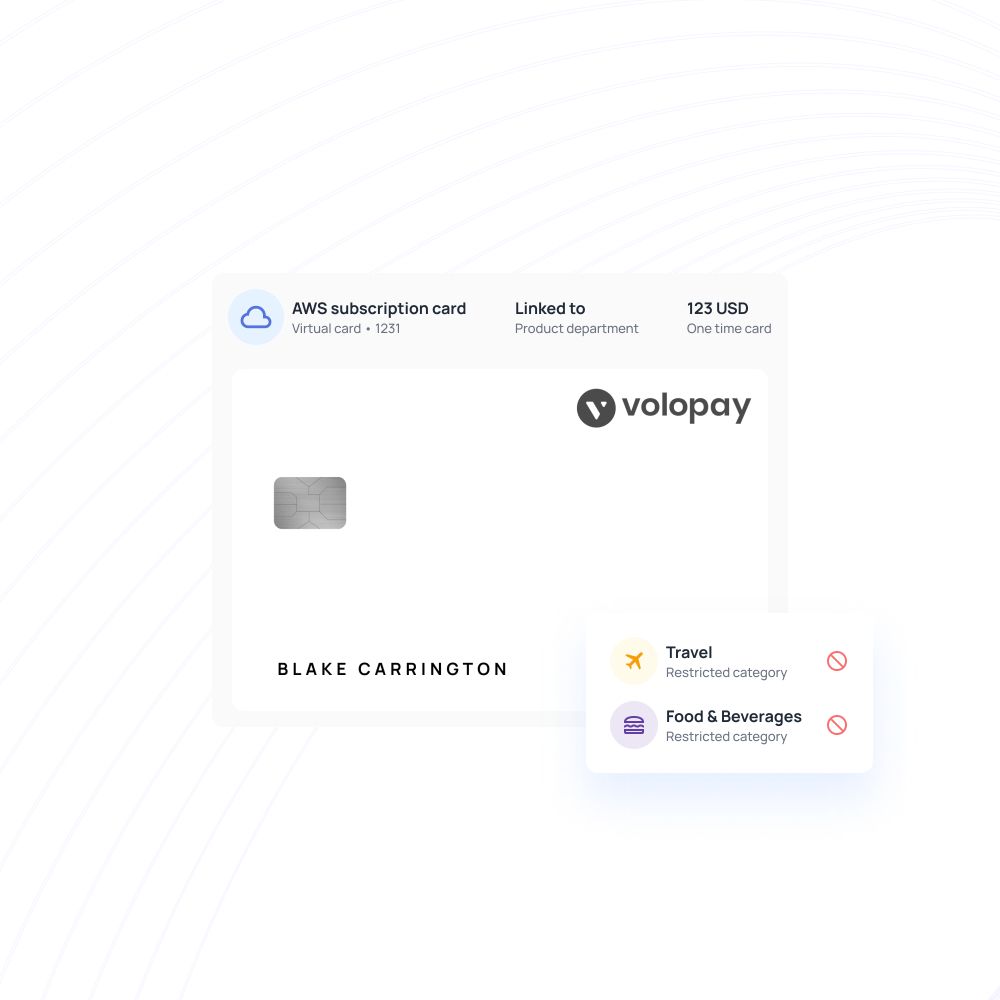

Which begs the question - who is this helping? What you need is a real-time update on your sales team’s expenses so you can curb the unnecessary ones as and when they happen. A corporate T&E credit card provided by Volopay lets you set expense categories so that your employees cannot make any expense that the card isn’t allowed to.

Reward revenue, not spending

When your sales team is used to receiving reimbursement later, they prefer to use their personal credit cards for out-of-pocket expenses. Personal credit cards offer perks to your employees in form of reward points.

Think about it - what are these perks if not a reward for spending as much as you can? They make your employees overspend because they know they’ll get bonus points for it, even if that means extending their food budget as much as they can to the maximum limit in corporate expense policy.

How about you switch the gears on this mindset? Instead of letting personal credit cards dictate your T&E expenses, encourage them to spend within the comfortable limits and award them with bonuses left from your T&E budget when the sales team hits revenue goals! More revenue, more rewards.

Streamline your travel and expense management system

Why your sales team needs travel and expenses management system?

Unprecedented travel costs

It is obvious that while some trips are uneventful in terms of expenses, others might have some very peculiar incidents which might rake up the cost of your employee’s trip. From canceled or missed flights due to weather or illness, to an extremely expensive phone bill because your employee didn’t realize they were on international roaming charges, if problems like that keep happening often, it’s time to consider a T&E management solution.

Unsystematic reimbursements

A company needs to reimburse its employees on time as it builds a relationship of trust and respect between the two. Till the time the company hasn’t paid the employee back what they are owed, it is safe to assume that the employee is expecting to be reimbursed as soon as possible. You need good T&E management in place especially if your employees have expressed a particular disdain regarding the irregular reimbursements they receive.

Unidentified expense

When you have a faulty expense policy and a paper-based reimbursement system, you will come across expenses that simply cannot be identified. Since most expenses are processed a month after the travel, it is quite redundant to complain about it to your employee, who can use the expense policy loophole and lost receipt excuse to get that expense processed. If this happens often, your company will greatly benefit from an efficient T&E management system set in place to eliminate these incidents.

No well-defined travel expense policy

You might have a travel expense policy, but do employees take advantage of any loopholes, grey areas, or blind spots often? If yes, then it’s time to take a long, hard look at your expense policy. Make sure your expense policy serves your goals effectively and clearly.

Collecting and storing paper receipts

Collecting paper receipts is bulky, inconvenient, and prone to being lost when they are supposed to be stored for over a month as proof of purchase. Even for the employer, storing all these receipts requires a physical space to put them and accurate documentation for tax season or audit.

Features to look for in your travel and expense management software

Now that you identified the weak links in T&E management, it is time to look for an ideal T&E software solution that addresses the problems you are facing.

Travel policy competent

Do thorough research and choose a software that is competent with and complements your travel expense policy. Not only this, ensure that the T&E software that you choose can also amend the corporate travel policy as and when the need arises. It should be fully customizable and even personalized per employee if you feel the need for it.

Automatic reports

What good is T&E management software if your employee still has to do all travel and expense reporting by themselves? Your ideal T&E software offers automated expense reporting so your sales team can go out and dedicate its time to converting high-quality prospects, not waste time being bent over their desks scrambling for proofs of purchase.

Reconciliation

Manually reconciling receipts with each expense logged is truly a mind-numbing task. But travel and expense management services can give your finance department a helping hand! Remember to choose travel & expense software that helps you reconcile easily with a transparent view of all your expenses and proofs of purchase in the same place.

Instant reimbursement

An ideal travel and expense software solves the issue of delayed reimbursement by paying your employees instantly after their trips! With quick data capture technology, your T&E software can eliminate the need to carry around hundreds of tiny, fading receipts at the end of the month. Simply upload your expenses, get approved and reimbursed, without waiting at the end of every month.

How Volopay helps automate corporate travel and expense management solution?

Expense approval with T&E management

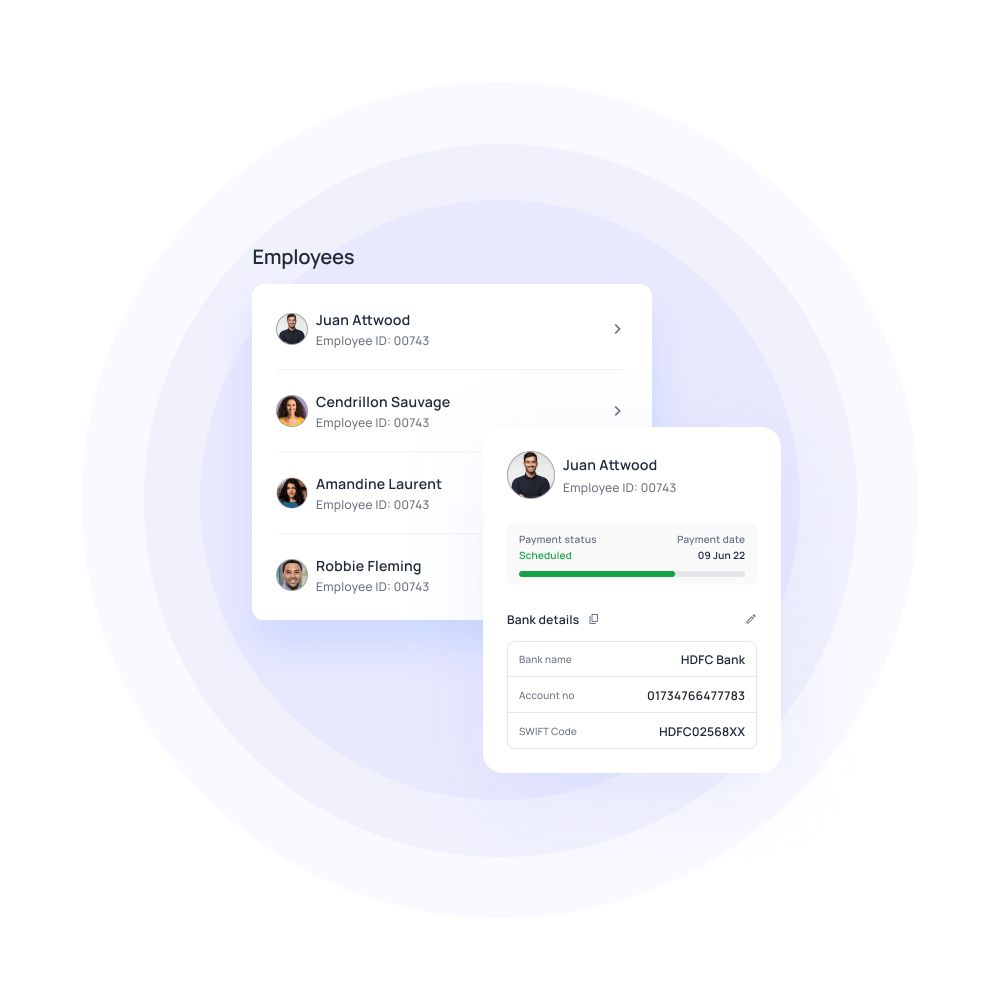

With Volopay, you don’t have to wait till the end of the month to reconcile expenses and realize you’ve gone over budget! Volopay corporate physical and unlimited virtual cards allow you to pre-load cards with set amounts and expense categories, so your employees can only spend on what they need while traveling for business.

Doing this ensures that you always stay within your budget and all trip-related expenses are pre-approved from the get-go. Get corporate travel cards for your employees and fund and control the card easily in one click.

Expense reporting and reconciliation

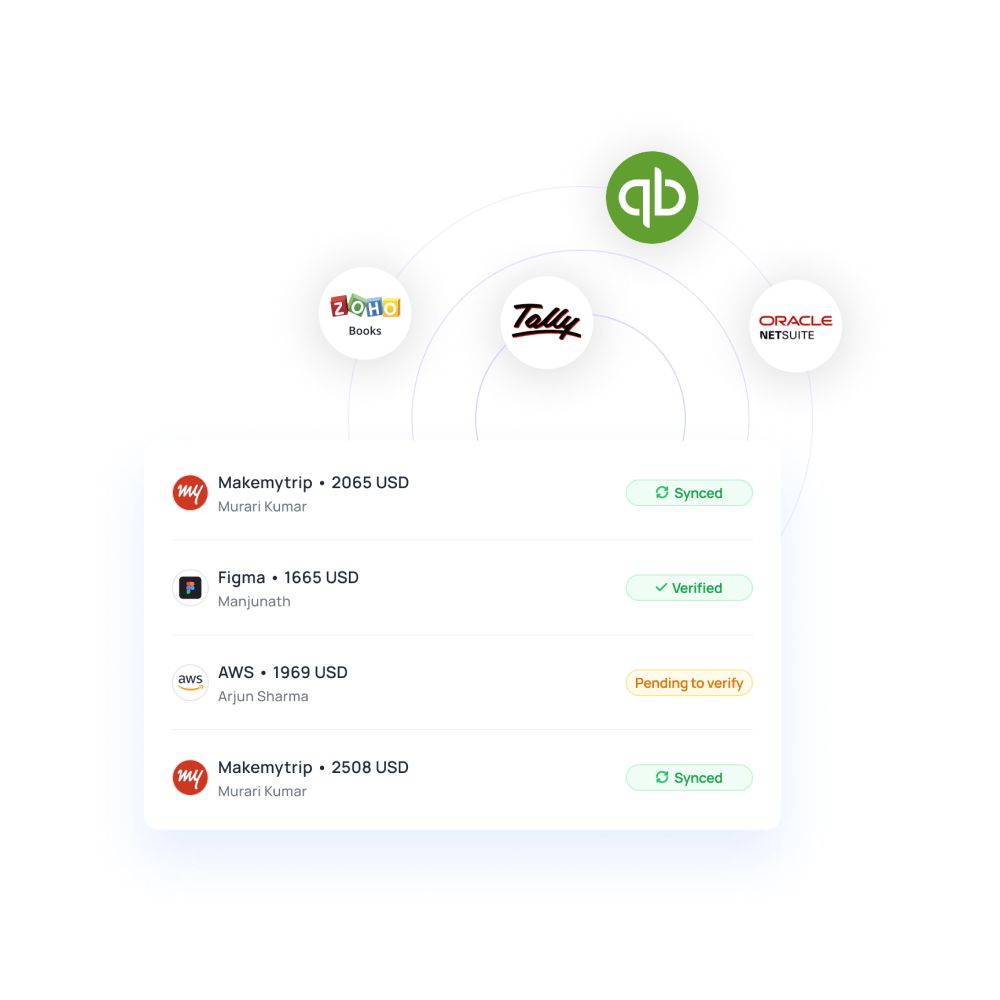

Volopay offers an intuitive end-to-end corporate travel booking platform with payments, expense reporting, and reconciliation solutions seamlessly tied in as well. Save up to 30% on your travel spend by booking cheaper rates at Volopay – no extra charges, book directly and simplify all your business travel in one place.

Volopay has a live dashboard that lets you access spend analytics for all your trips with real-time updates. Get the information on who is spending what and where instantly. With automated accounting, you don’t have to worry about manually entering trips expenses into your books of accounts, Volopay does that for you with our seamless sync feature.

Efficient reimbursement process

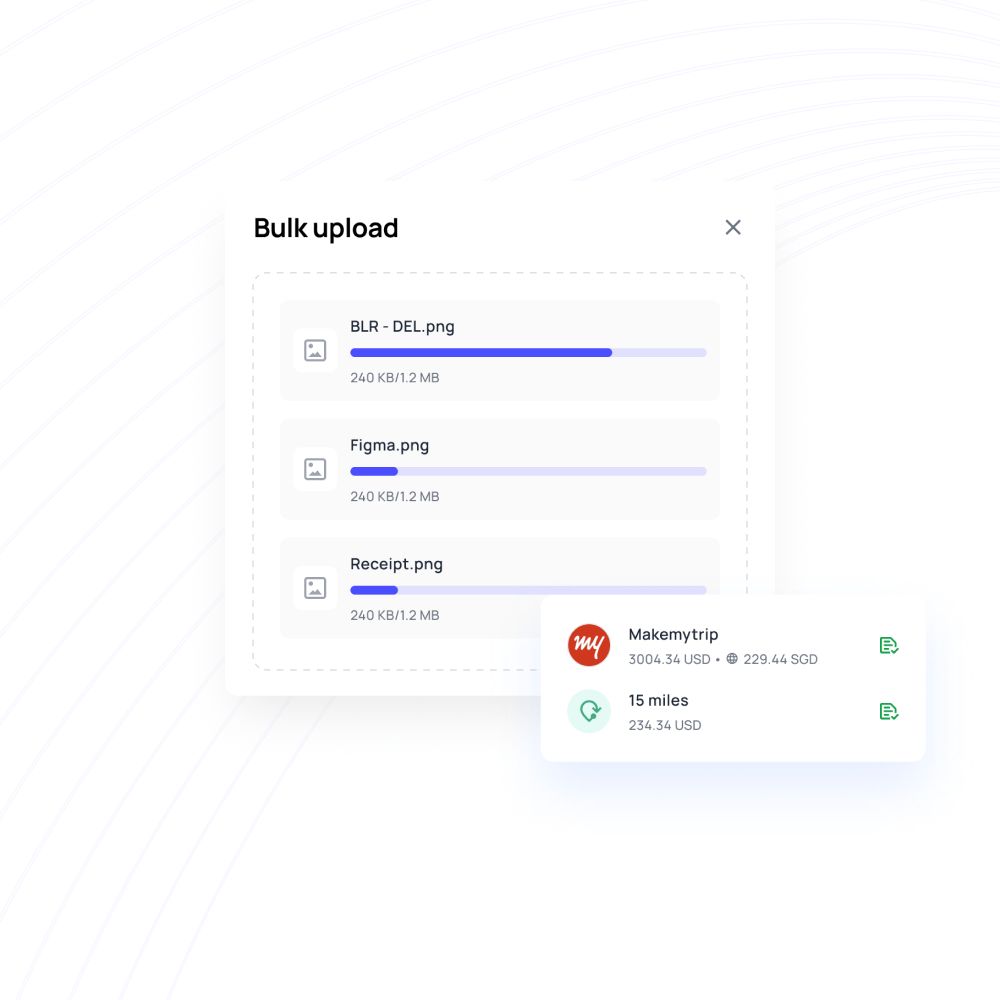

No paper, no problem! Volopay’s expense reimbursement eliminates the need to have any paper-based information sharing. Using the innovative OCR technology, Volopay lets your sales team capture receipt image and automatically scans and sorts them into an expense category.

Accept or refuse the expense in real-time and schedule reimbursements whenever you wish. Not only that you can export your T&E spend analytics data to cinch and finesse your T&E expense management even further!

FAQs

Common T&E expenses include the travel itself (through different modes of transportation), accommodation, food, and tertiary work-related expenses.

With Volopay, you can set up to 5 levels workflow approval system to ensure maximum vigilance over your travel and expense management.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free