How Volopay helped BukuWarung

Volopay helped BukuWarung in managing their expenses across different countries efficiently

BukuWarung, an Indonesian fintech company offering a bookkeeping app, caters to over 60 million MSMEs in Indonesia by building digital infrastructure.

Starting with bookkeeping, the company aspires to deliver the right financial guidance to MSMEs and help them manage and grow their businesses using the platform.

Some of the company's clients include big players like AC Ventures, Golden Gate Ventures, Y-Combinator, Quona Capital, and many more.

The company, being well established in Indonesia and having its main office in Singapore, also deals with lots of cross-border payments to a number of its vendors worldwide.

Transferring payments to these vendors proved to be a challenge during the global pandemic as fintech infrastructure and banking operations differ per country depending on the gravity of the Covid situation in the area.

Moreover, working with multiple vendors in different countries meant working with different currencies, and this brought unexpected problems to BukuWarung's operations.

BukuWarung's vendor payout challenges before trying out Volopay

BukuWarung's finance team said that with the current challenges, they would need to have a payment platform that could cover all payment functions the same as a bank does but with a better user experience.

With their then-payment platform, they could not upload the invoice directly and needed to email these as attachments. They also decided to look for a platform with payment method selection - Swift or Non-Swift - so they would have an option of lesser charges.

The Finance manager also stated that to pay for their vendors, they had to record the vendors and the corresponding amounts needed to transfer, then deposit the amount into their respective bank accounts, and then transfer the amount. Yes, that's tedious. Since the currencies were different, Rio said, he had to deal with high fees from the banks.

BukuWarung also only had one corporate card for all expenses and transactions, and this corporate card is named after its founder who is based in Singapore. They had limited access to the use of the said corporate card, and reconciling their expenses and keeping their bookkeeping was challenging.

The challenge

1. Getting more efficient and competitive cost for a remittance payment

2. Easy payment process

3. Integration with the bookkeeping process

4. Subscription management for each department

5. Reporting expenses

6. Multiple line approval

The solution

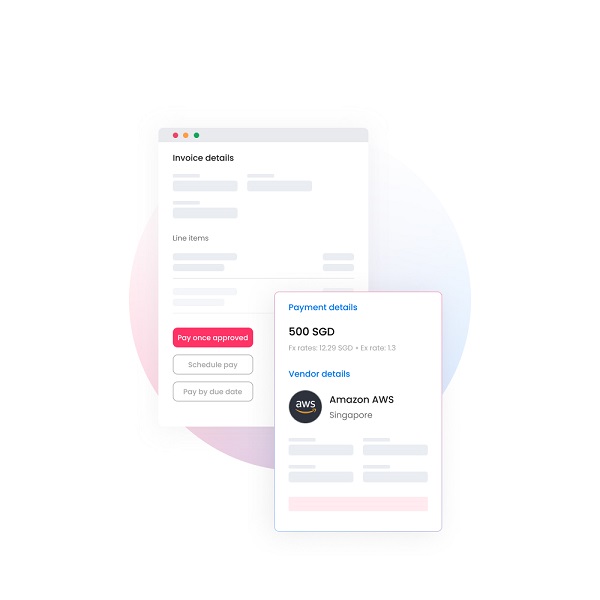

1. Bill Pay for vendor management

2. Virtual Cards for online subscriptions

3. Real-time visibility for expense tracking

The result

1. Efficient and cost-effective remittance payments

2. Streamlined process in paying vendors

3. Savings on transfer fees

4. Subscription payment per department

5. Empowered users to choose the payment method

How BukuWarung uses Volopay for payments

With Volopay, BukuWarung found paying their vendors a non-tedious, easy task.

Replacing the need for their multiple bank accounts, Volopay equipped them with a business account where they could seamlessly transfer money without the need to switch across different platforms.

With this, Rio said, they could pay using multiple platforms including Facebook, Twilio, and Volopay's Bill Pay which has the lowest international transfer fees in the market.

The finance team also stated how Volopay made tracking payments and expenses easy with just a few clicks on the app. Quick instant notifications contained all the details including the amount, invoice, and additional details under notes.

Instead of using just one corporate card for all expenses, BukuWarung also then used Volopay's virtual card for paying online subscriptions.

Why BukuWarung recommends Volopay?

Volopay's solutions helped BukuWarung in managing all expenses across different countries.

Volopay eliminated the need forBukuWarung to process their vendor payments in multiple steps using different platforms. The finance team can now also focus on other tasks instead of spending time reconciling the transactions and tracking the expenses and payments made, creating a streamlined process.

Volopay also helped BukuWarung save big, as Volopay's bill pay had relatively lower charges than banks.

Users in BukuWarung are empowered to make choices when it comes to payments because they can now choose the payment method that is suitable for the transaction.

With Volopay, we can use local or swift. We can attach the invoice and get the invoice number. This is very helpful especially when the beneficiary bank is asking for supporting documents. It's just one whole process.

Finance Team, , Bukuwarang

Trusted by finance teams at startups to enterprises.