Streamline your business expenses management

The best expense management software in Philippines for automating your complete business spending and transforming your accounting department. Instead of pursuing lump sum payments and paperwork at the end of the month, take command. You can automate, simplify, and streamline your financial processes with a corporate expense management solution tailored to your business needs.

Trusted by finance teams at startups to enterprises.

Corporate cards help you track business expenses

Approving expense claims takes a lot of time for departments and financial teams. Instead of tracking every penny spent from a single account, give your employees smart corporate cards that are integrated with your expense management software. These cards have their own ledger categories, allowing you to quickly categorise them after they've been swiped.

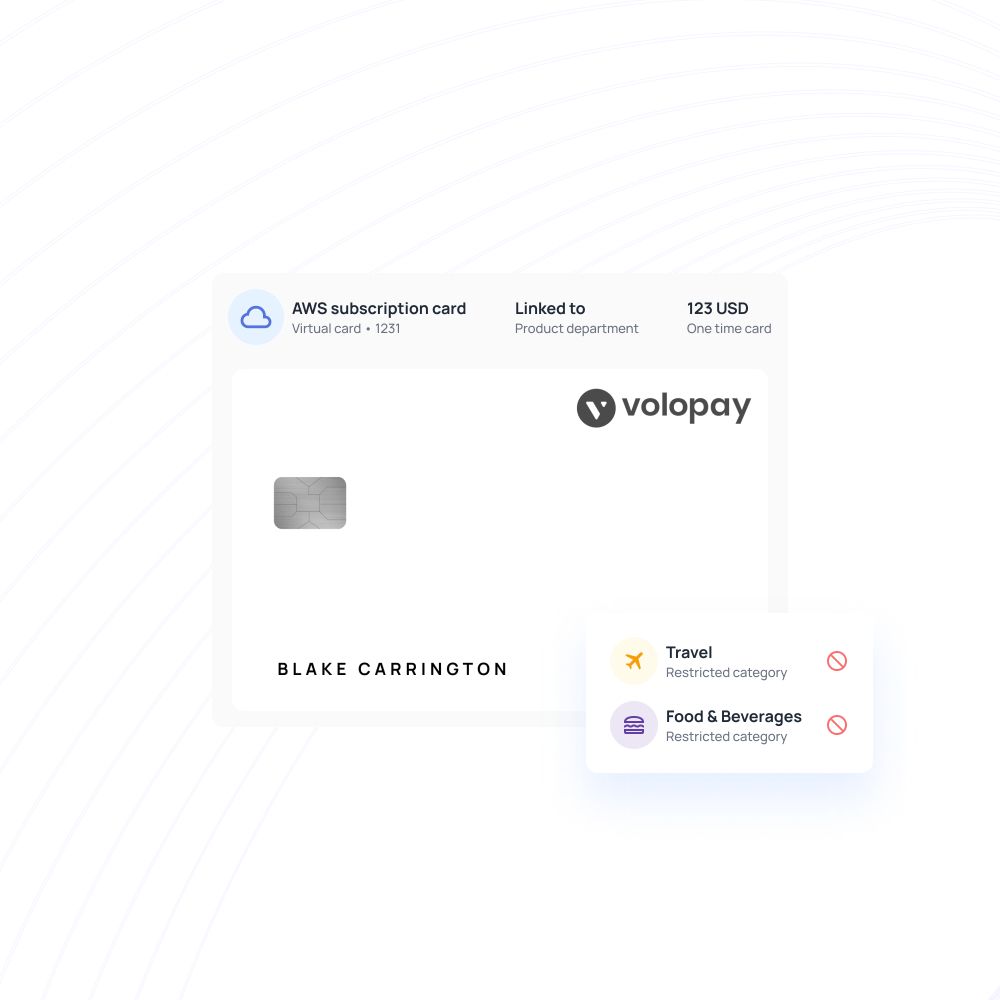

Unlimited virtual cards

Create as many virtual corporate cards as you want to manage online payments. Customize for a certain vendor, employee, or department. You may always set limits to keep your spending in check.

Physical cards

Provide your travelling employees with personalized physical cards. Keep track of every payment and spend and automatically collect unpaid receipts in real time thanks to built-in expense rules.

Streamline expense reimbursement

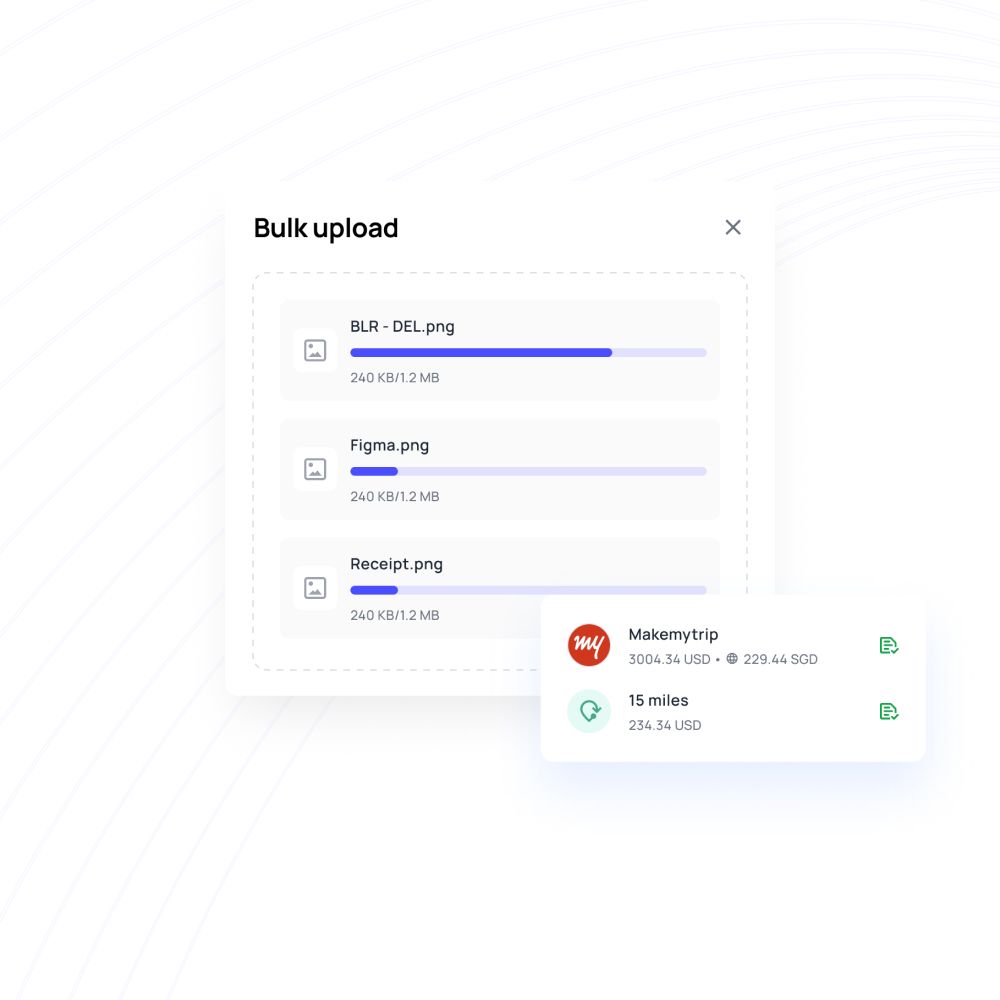

Using corporate expense management software, make the dreaded reimbursement process for employees easier. Employees who make out-of-pocket expenses can use the platform to receive reimbursement right away.

By uploading receipts and details, approvers can quickly approve an expenditure claim. Employees can also earn mileage reimbursement!

Organize your software subscriptions

You can manage global SaaS and software subscriptions using our expense management software Philippines option. Manage SaaS payments easily with both one-time and recurring payments method using cards.

Simply insert the card number into the payment gateway. These cards can be renewed as needed and maintain account of expenditure as it occurs. Accounting gets much faster with distinct cards for each subscription.

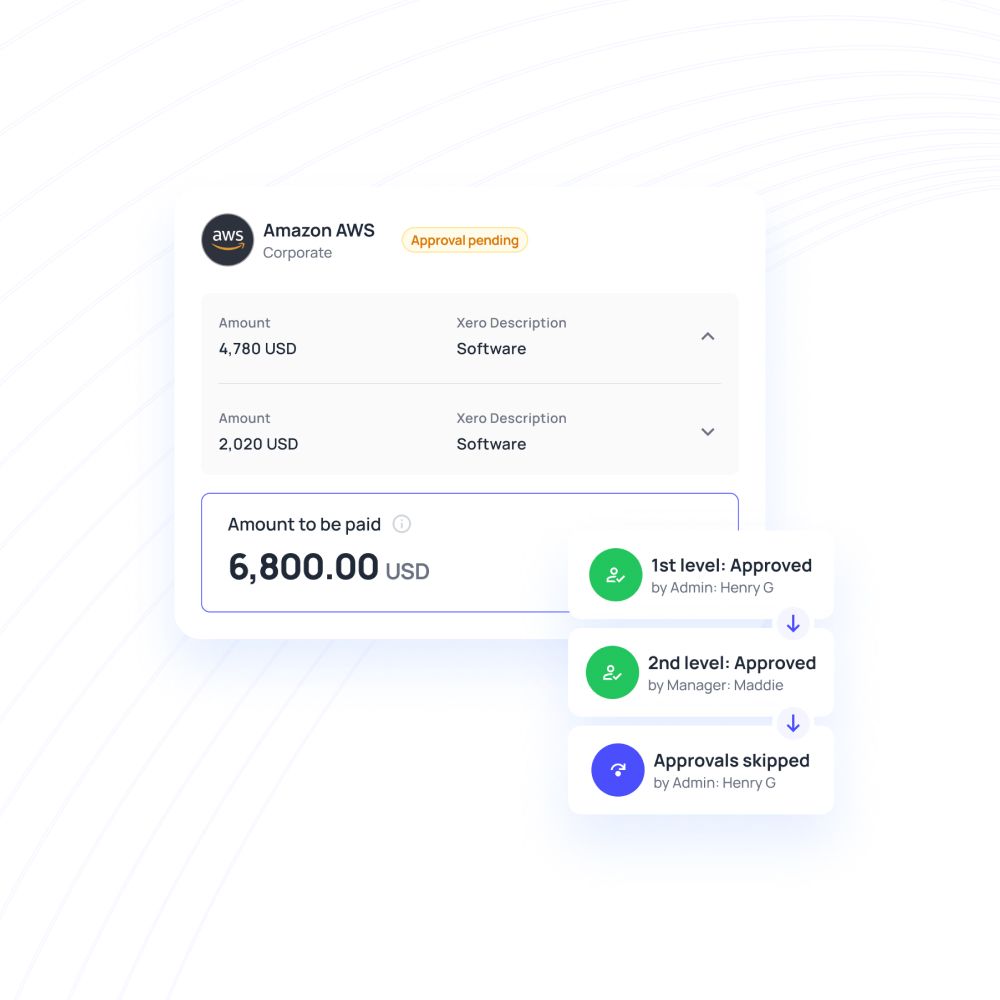

Create your own multi-level approval processes

Set up unique, multi-level approval policies in Volopay’s business expense management software. Multi-tier approvers (up to five tiers) can be set up in maker-checker systems to ensure that spending is tracked.

Auto-decline rules can be set for requests exceeding a certain amount. These approvals can also be done remotely and instantly, decreasing the amount of time spent waiting.

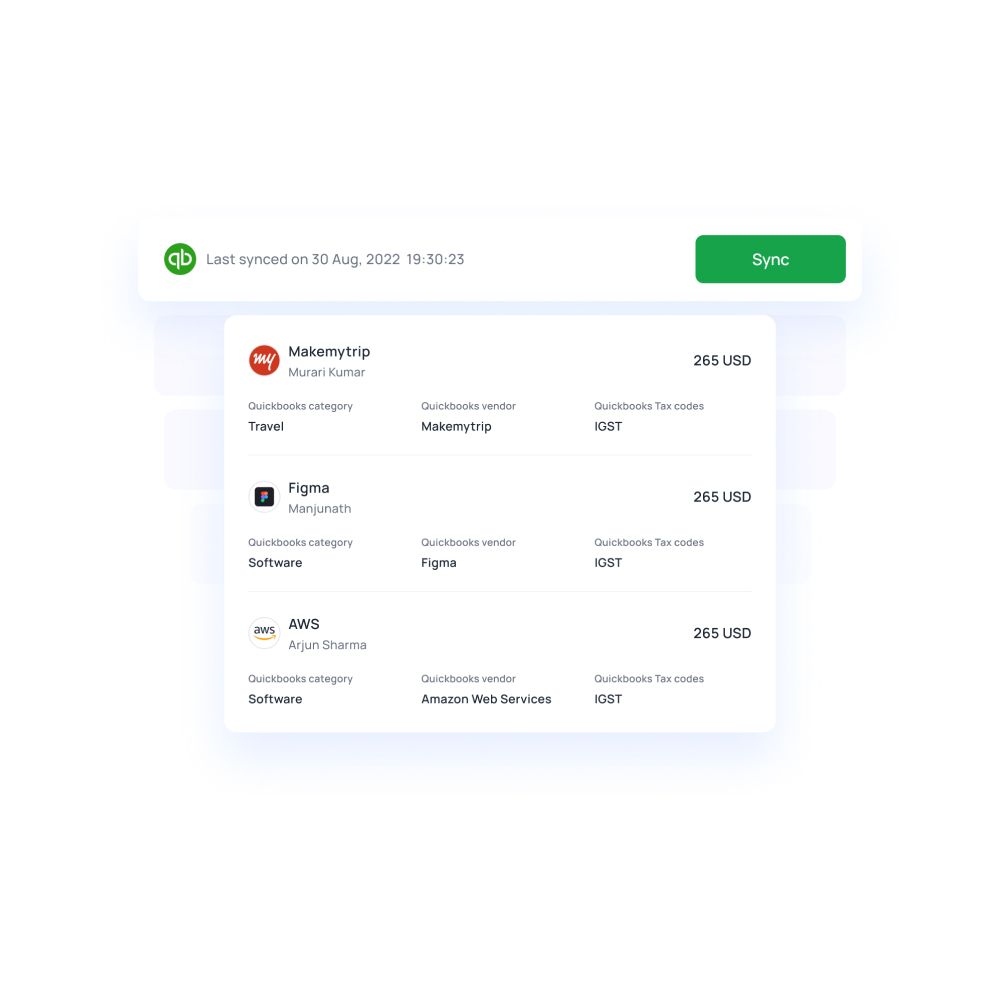

Real-time sync of spend transactions and data

Stop anticipating your month-end statement to catch you off guard. Sync your expenses in real-time to stay on top of your spending as soon as you make a payment. It might be a card or one of the AP accounts.

Expenses are rapidly logged and synched to the ledger for better expense reporting. Payment frequency and amount transparency becomes considerably easy to achieve.

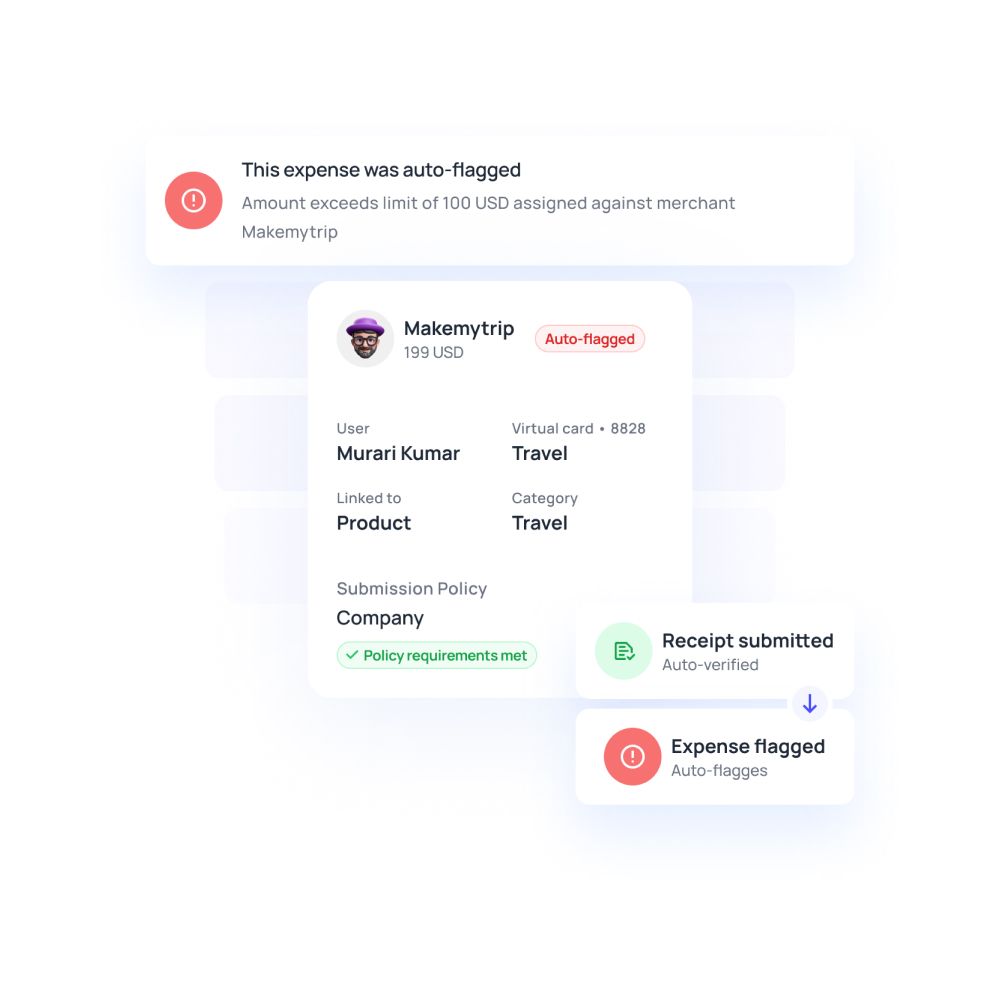

Control spending before it occurs

Don't worry about overpaying. You may keep track of your spending before it happens by using specific controls and expense regulations. The only expense management software in Philippines that allows you to define company-wide spending policies & customise them by department.

Auto-decline limits may apply to payments that exceed certain criteria. You can also use multi-level approvers to delay and double-check payments before they go through.

Enforce smart spending culture

Better corporate expense management software brings control and policy understanding together. It's simple to secure your company's cash by allowing approvers, policies, and live-tracking of all expenses.

Your employees, too, have access to some information. Receipts may be uploaded straight to the website, and reimbursements can be requested. At any time and from any location, employees can request funds for their cards.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards.

Manage and track every dollar that leaves your company.

Open a global account with multi-currency payments.

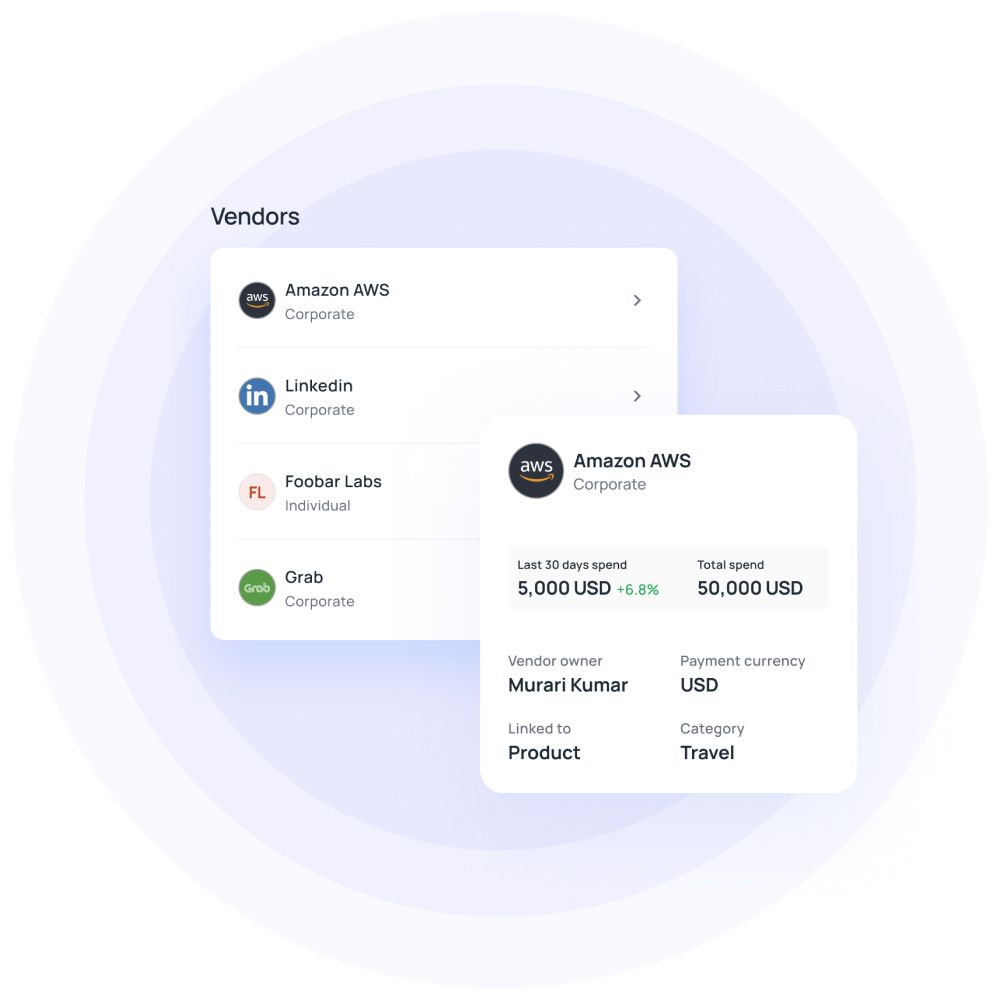

Manage vendors, approve invoices and automate payments.

Save hours daily, and close your books faster every month.

Integrate with the all the tools and software that you use daily.

Learn more about our corporate expense management software

Switch to a single, more contemporary, organized, and integrated expense management software for business instead of several tools and systems. Find approvals, corporate cards, account payments, employee expense reimbursements, accounting automation, and many other features on one single platform.

Multi-level approvals

Multiple approvers ensure that no single person is responsible for an expense and that all payments are thoroughly reviewed and validated. Volopay allows up to five approvers to be assigned to payments, reimbursement punishments, policy enforcement, and card reloading. They can also request details or flag mistakes before approving to verify that no data is missing during the accounting process. The only business expense management software in Philippines that allows businesses to have complete control over every dollar spent.

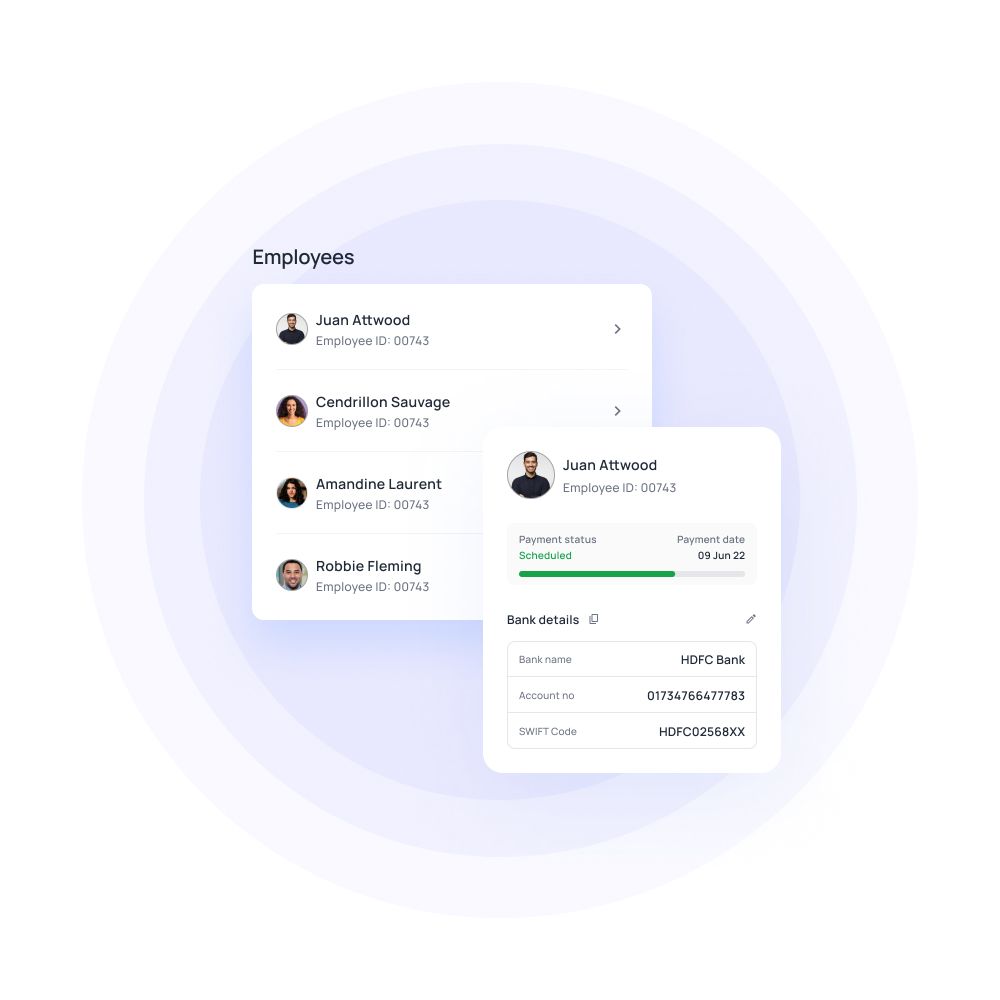

Employee reimbursement

Rather than being intimidated by week-long procedures, allowing employees to request reimbursement for out-of-pocket expenses through employee expense management software makes the process much easier to manage. They need merely submit a receipt with payment details; approvers must then review and approve the refund. Money is transferred to their bank account instantly, making the transaction simple and speedy.

Subscription management

With only one glance at an expense report, you can accurately assign funds and identify who was paid how much money using virtual corporate cards for each vendor. This also allows you to deal with cross-border suppliers and prevent payments for forgotten subscriptions. All SaaS subscription management issues that businesses have can be solved with a single click.

Real-time visibility

Admins, accountants, and managers can obtain real-time information about the movement of your company's funds. You always have complete control over how your company's funds are spent, so you don't have to be concerned about unexpected spending reports or big debt. Know every detail of every rupee spent before it's too late, approve it quickly, or freeze it.

Bring Volopay to your business

Get started free

FAQs on expense management

Employee expense reimbursement using Volopay is faster than the old, time-consuming approach. Employees submit mileage or out-of-pocket compensation claims directly through the app. The name of the merchant, the purpose for payment, and a receipt are all options. As soon as an approver looks at the expense, it can be accepted. The employee is notified right away, and the transaction is completed. Approvers can request further information, which the employee can provide when they receive the notification, rather than dealing with weeks of back-and-forth discussion.

Create distinct cards based on different spend categories and types to use Volopay's corporate cards for subscription and online payments. In the case of recurring payments, the allocated cardholder's card information can be saved on the vendor's site. The payment will be processed as long as the card is funded and valid, either as needed or by reloading money on a regular basis. Virtual cards allow you to build vendor-specific cards for one-time payments for better reconciliation and verification. This also allows you to keep track of missed payments and terminate subscriptions by freezing a vendor card.

Enforce expense policies automatically through our automated expense reporting, making compliance and spend analysis easier. Vendor management can be enhanced by scanning receipts and invoices. To avoid late fines, payments can be scheduled ahead of time, and early payments may result in discounts. With the help of one-click report generation, forecasting and analysis require less data collection and data entry. Expense reporting streamlines your company's overall financial operations and management process, eliminating extra mundane labor and human intervention.

The data you've filtered is reflected in expense reports. The ledgers show who made payments, from which account (wallet or credit card), and to which department. Vendor information, invoices, and receipts are all linked to this payment. You can filter the information based on the sort of expense report you want to make, but it's all there by default.