Smart corporate credit cards to manage employee expenses

Stop worrying about reimbursements, checks, or petty cash. Shift to smart corporate credit cards with advanced controls. Create unlimited corporate cards and empower your employees.

Keep track of your expenses with proactive built-in spend controls. Set them up, load them with company funds, and spend.

Trusted by finance teams at startups to enterprises.

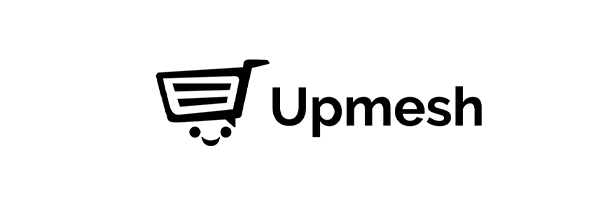

Set multi-level approvals to manage spends

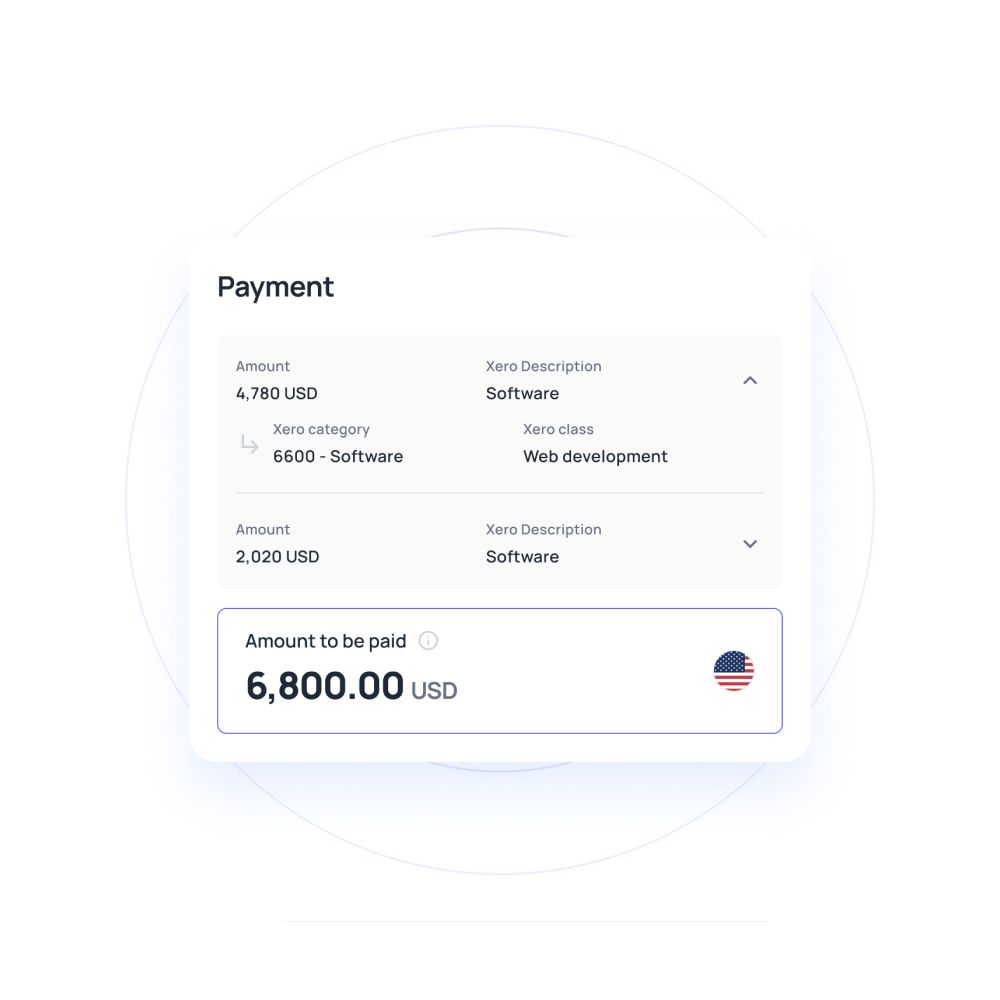

Advanced multi-level approval policies that bring a new degree of transparency and ease of use to corporate card spend management. Our corporate cards allow admins to nominate approvers for fund reloads and spending.

Rather than reconciling charges or exceeding a credit limit, you can safely load funds to employee corporate credit cards and track them in real-time.

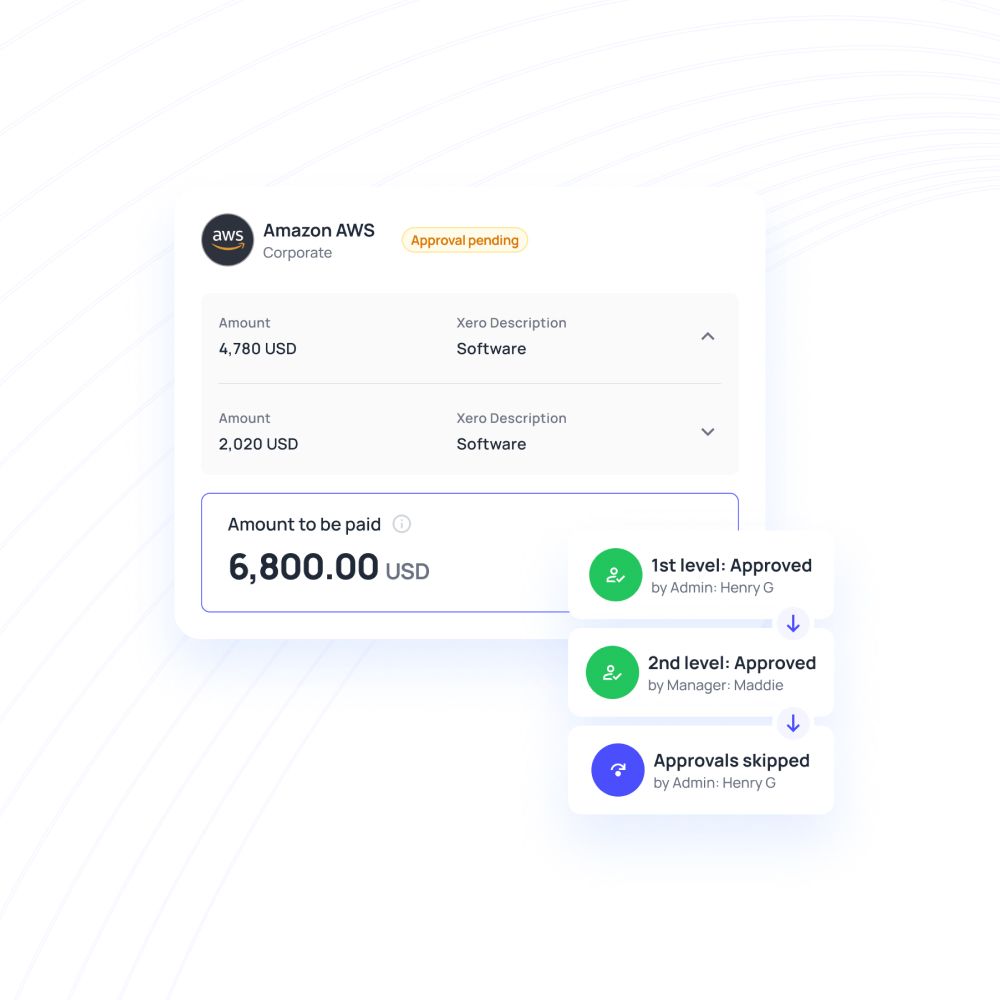

View and track spends in real-time

Unlike a conventional corporate credit card Philippines offers, there is no need to wait for an end-of-month statement. Instead, transactions are recorded in real-time.

The user can add the purchase location, time, and amount, as well as details and receipts, to every line item on the spend-tracker. Manage business finances in a completely transparent manner, with comprehensive visibility across the organization.

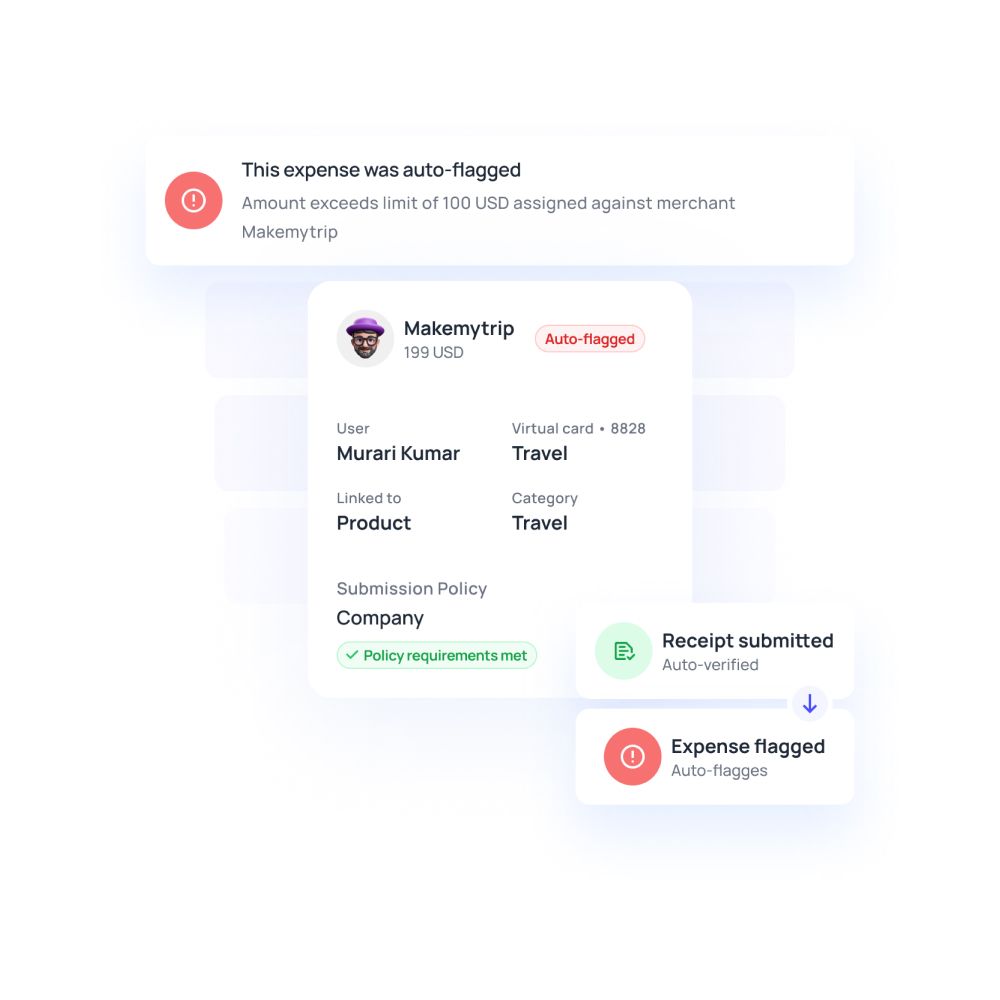

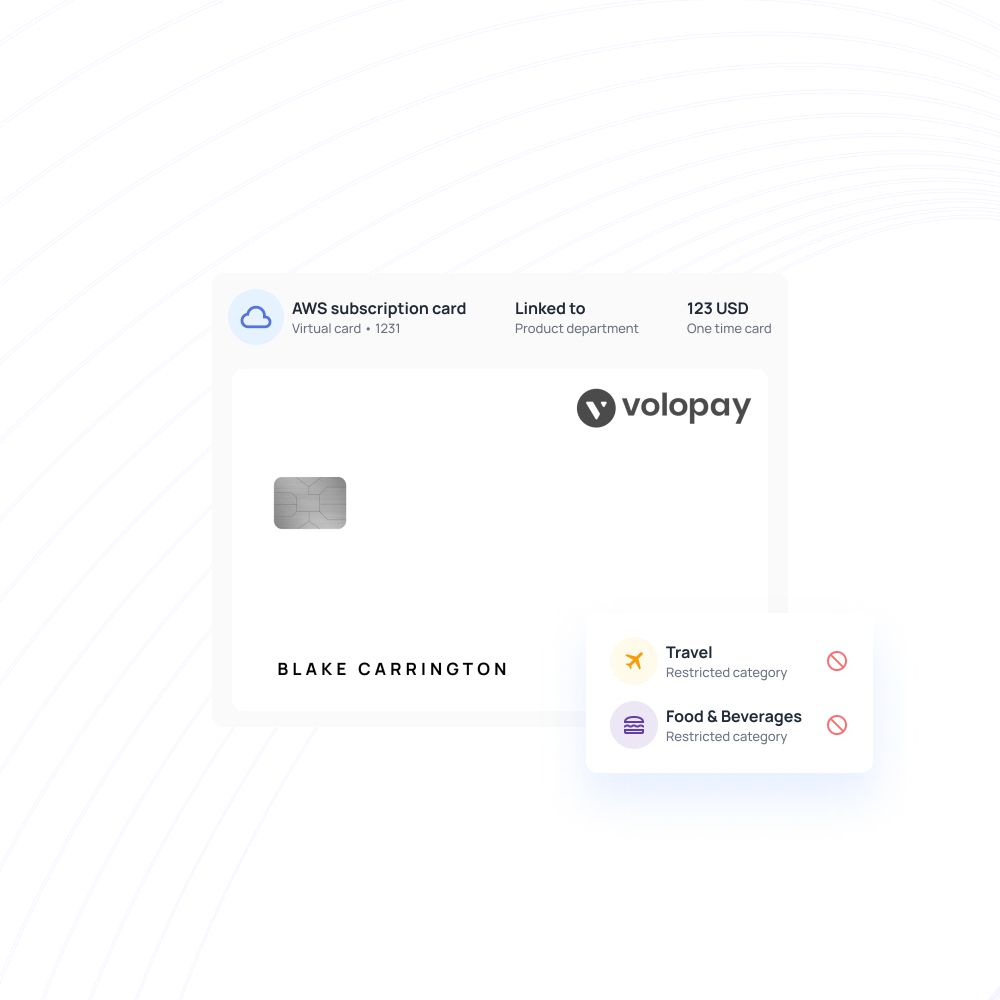

Virtual corporate cards for SaaS management

Your employees and teams can create and assign several virtual corporate cards for burner usage or even recurring cards to make online payments and SaaS subscriptions. You can design vendor-specific cards for better reporting.

Load and spend in USD

The only USD corporate credit cards Philippines had to offer that truly internationalize your company. USD cards allow you to pay merchants in the US without suffering additional costs and high FX rates.

This also makes reconciliation and compliance work easier by allowing you to retain a separate expense record for cash when travelling to the US.

Corporate cards make expense reporting easier

Instead of dealing with awful paperwork, make expense reporting dynamic. By automating spend tracking, Volopay simplifies the process.

When you swipe our corporate credit cards, the expenses are automatically adjusted. The smartphone app reflects this, making reporting more convenient. There hasn't been a single rupee left unaccounted for.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards.

Manage and track every dollar that leaves your company.

Open a global account with multi-currency payments.

Manage vendors, approve invoices and automate payments.

Save hours daily, and close your books faster every month.

Integrate with the all the tools and software that you use daily.

Learn more about our corporate cards

Every facet of expense management is brought together in one place and made visible to everyone - admins, employees, and accountants. From real and virtual corporate cards and business credit to approvals, reimbursements, and accounting, we have a solution for you.

Physical cards

Your employees will no longer be required to use personal credit cards or incur out-of-pocket charges. Employees can spend at a range of merchant portals and on offline transactions with the help of corporate physical cards issued with bank-grade encryption, security, and quality. Spend analytics allows for easier spending tracking.

Virtual cards

You have a limitless number of virtual cards at your disposal. Assign to specific employees, departments, or even particular vendors to keep track of payments. Make contactless and internet payments more efficient than ever before with virtual corporate cards.

Business credit

Do you need a credit line to pay for crucial and routine business expenses? A standard business financing does not require months of waiting. We offer a company credit line with flexible billing intervals and lower rates without requiring you to jump through hoops.

Bring Volopay to your business

Get started now

FAQs on corporate cards

The best corporate credit cards Philippines has to offer are powered by VISA, which may be used for both domestic and international transactions. Cross-border payments can be done with both real and virtual corporate cards, and employees can use cards assigned to them via the mobile app to make payments in other countries. An approach to corporate spend management that is truly user-friendly and convenient.

Yes, our corporate credit cards can be used to make international payments. Cards for solely international payments, such as specialized SaaS fees, vendors, and international staff allowances, can also be created. If your company makes regular payments to vendors and retailers in the US, our USD cards are ideal.

Yes, this is a frequent approach for businesses to financially empower their employees. If your team travels frequently both within Philippines and internationally, consider offering them a monthly reloadable corporate card. If an employee has a one-time travel need, you can provide them with a card with a set budget and an expiration date. Additional funds can be requested and granted immediately from the dashboard if they are required at any time..

All of the company's expense and accounting policies are immediately applied to corporate cards. In addition to the basic defaults, department-specific rules can be used. When a card is generated, you can also determine who the approvers are, the reload cycle, and the maximum budget allocation. The only corporate credit card Philiipines has to offer that gives you complete control over every PHP that leaves your firm and who spends it.

Yes. Both expenses and transactions made via our corporate credit cards are automatically synced in real time. This transaction ledger can be accessed from the dashboard, thus making it simple to keep track of and examine card purchases. Admins and approvers can also request additional information for a transaction if necessary.