Virtual prepaid cards to simplify business transactions

Volopay’s prepaid virtual cards make managing online payments and subscriptions simple for Canadian businesses. Create unlimited virtual cards to streamline expenses and track every transaction with ease.

Empower your Canadian team with as many virtual cards as needed, boosting responsibility and visibility while keeping payments straightforward.

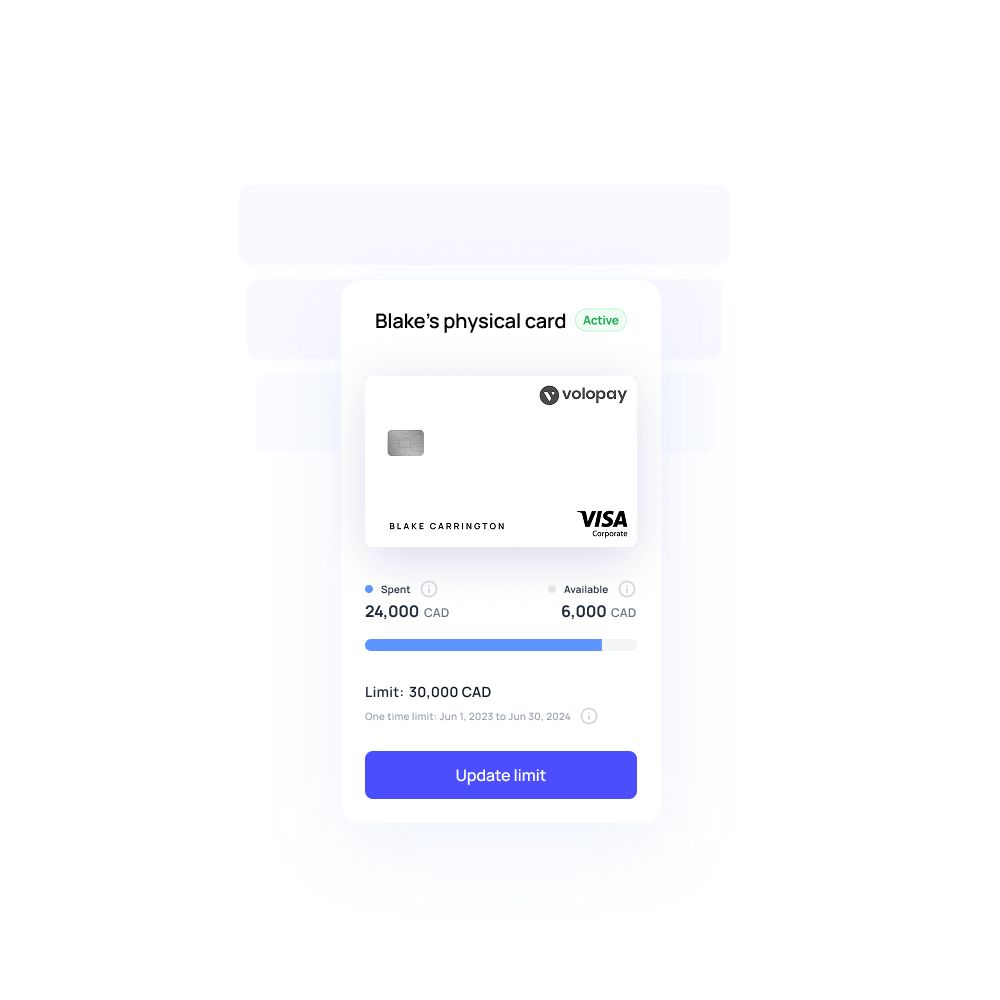

Adjust spending limits to your needs

Eliminate overspending with Volopay’s customizable spend limits for each virtual prepaid card. Set approval workflows, block or allow specific merchants, and use flexible reload options to control spending for Canadian businesses.

Instant access to funds

Manage cash flow better with business virtual cards, eliminating employee reimbursements. With a simple application process, Canadian businesses can start using Volopay’s virtual prepaid cards quickly.

Quick and seamless payment processing

Volopay’s virtual prepaid cards enable fast online payments.

Once activated, employees can make secure, restricted payments, balancing convenience and security for Canadian businesses.

Perfect virtual card solution for your business!

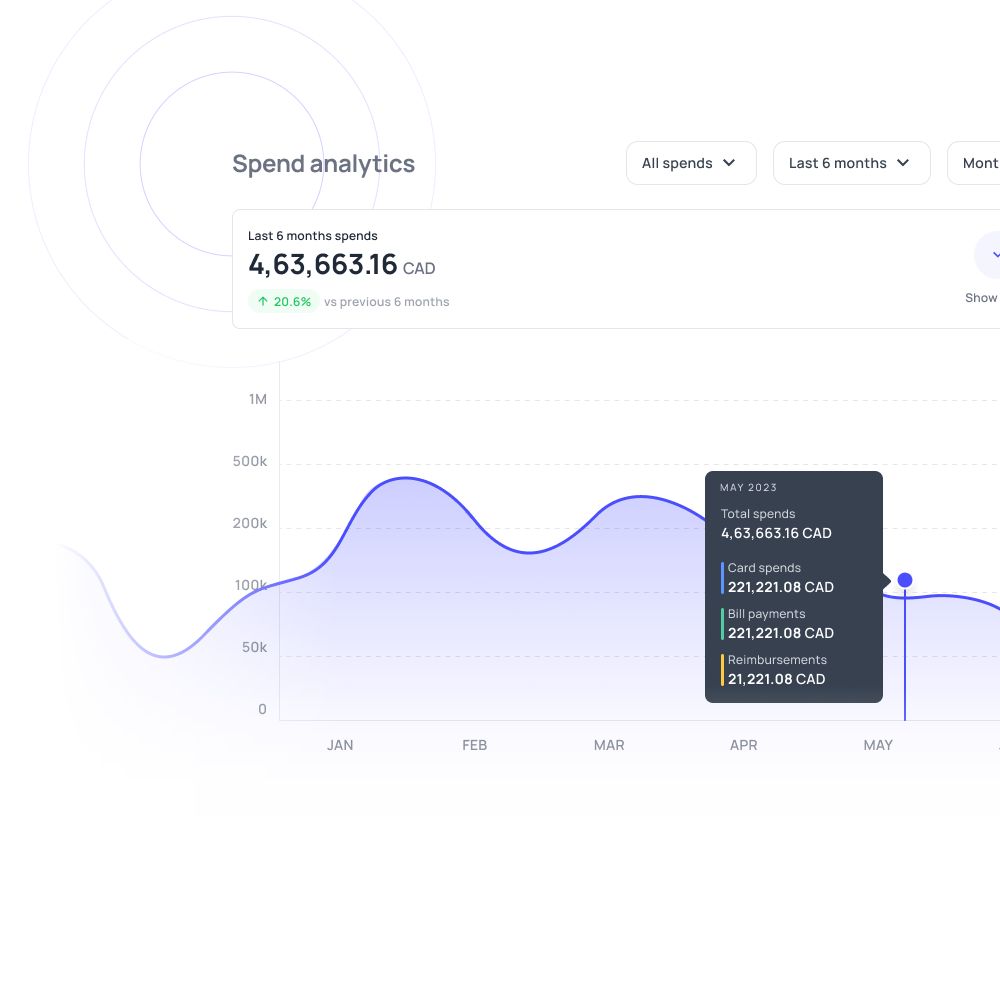

Live monitoring of expenses

Track expenses effortlessly with Volopay’s card management system. Every virtual prepaid card links to your account, updating and recording transactions in real time, ensuring no surprises for Canadian businesses.

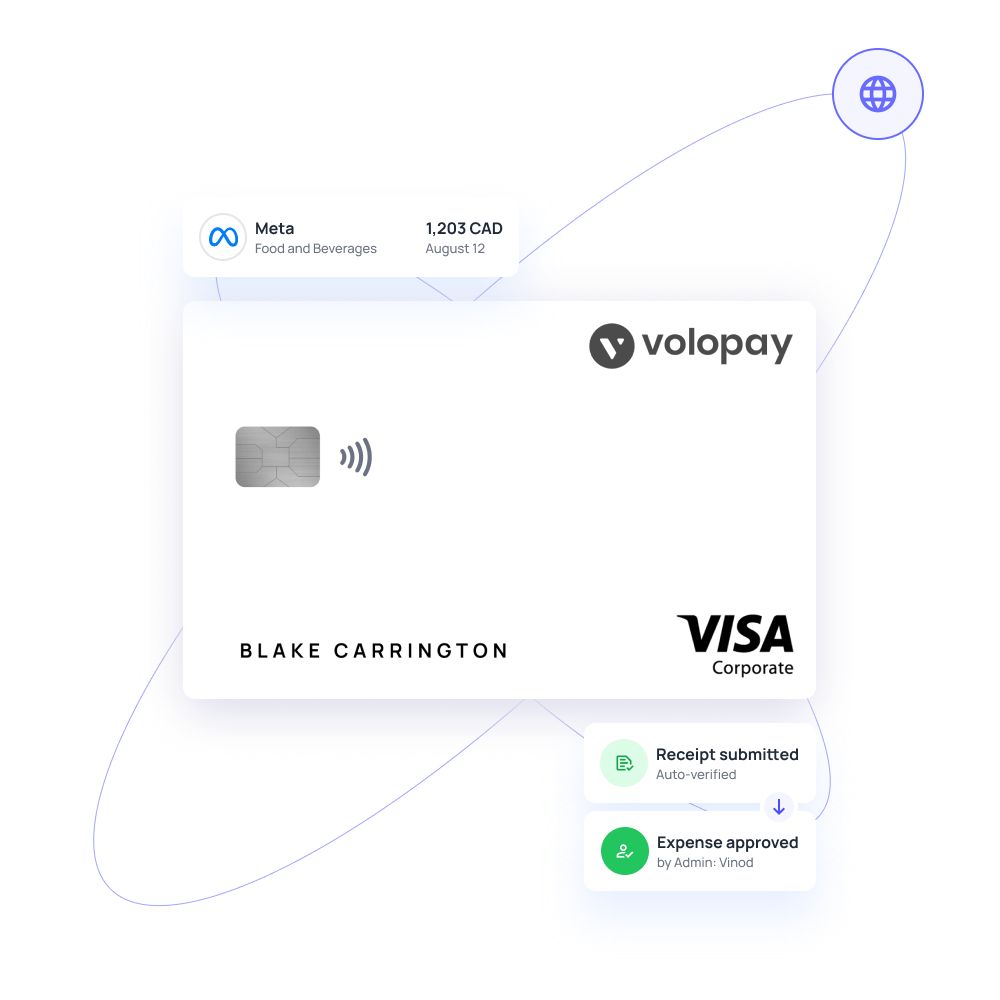

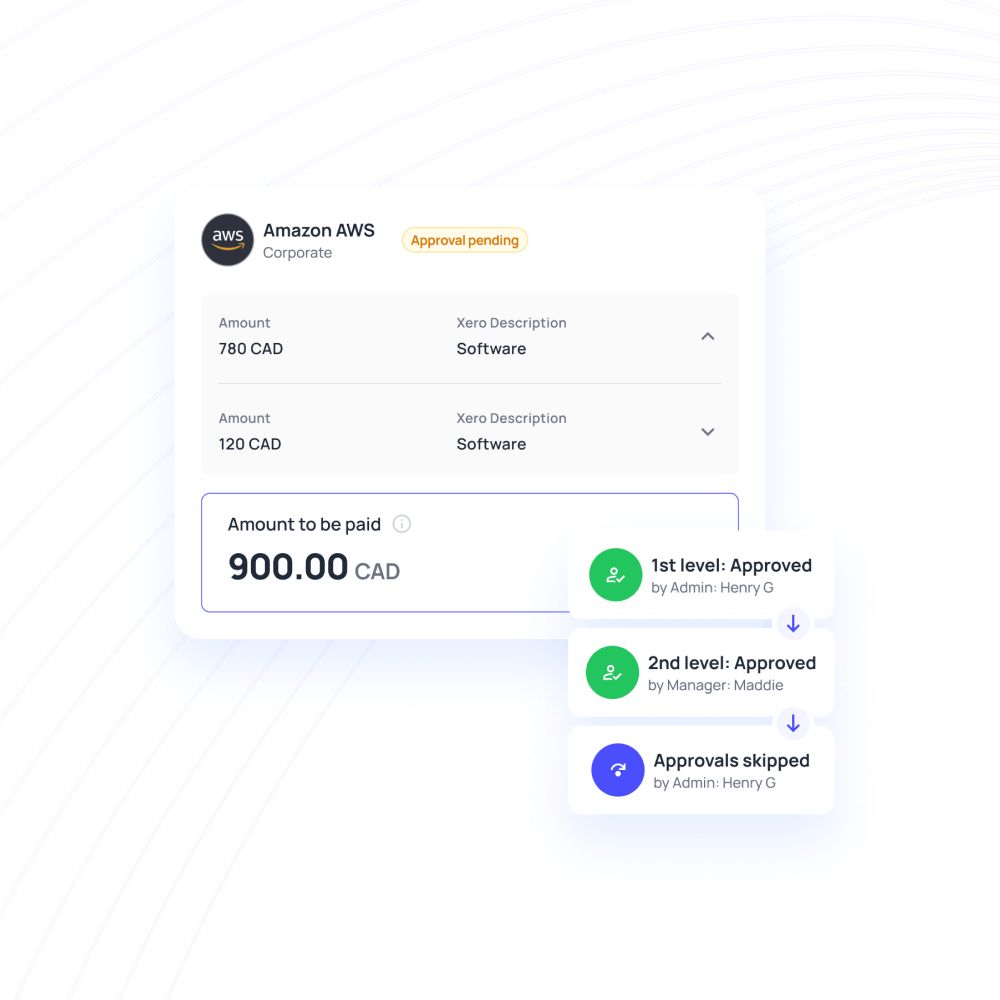

Accurate and efficient approval workflows

Volopay’s automated approval workflows promote transparency and speed. Set multi-level approvals for card requests, with instant alerts for approvers, keeping Canadian businesses compliant and efficient.

Automated expense categorization

Simplify accounting with Volopay’s automated expense categorization. Transactions are sorted instantly, making it easy to track spending without manual data entry for Canadian businesses.

Experience seamless transactions with business virtual cards

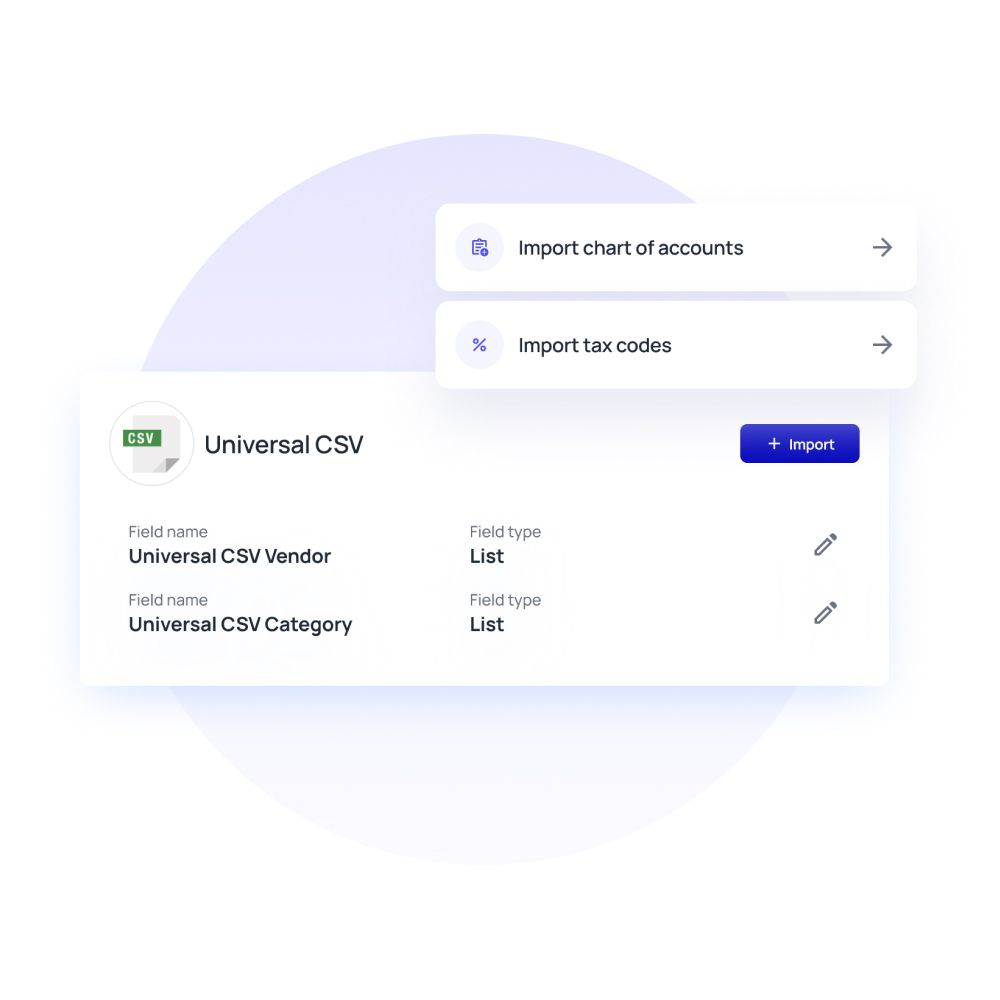

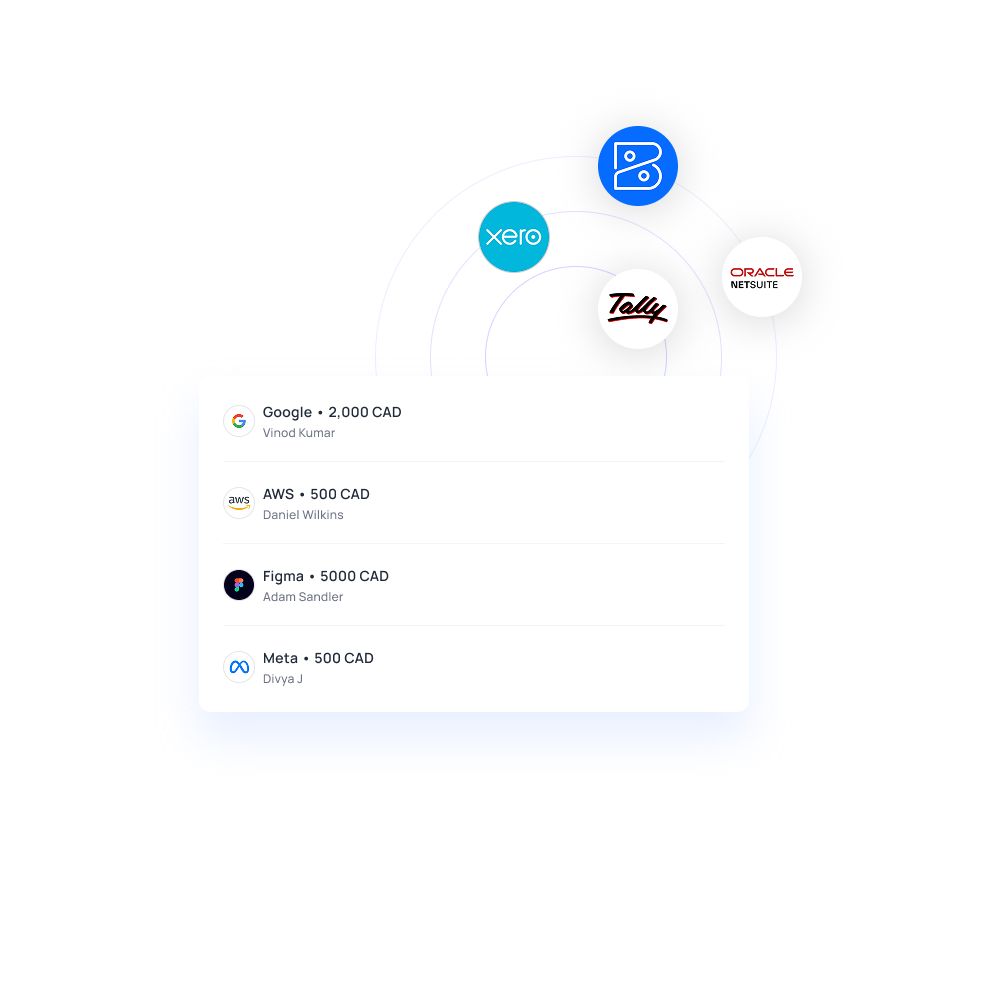

Smooth integration with accounting platforms

Integrate Volopay with popular Canadian accounting systems like Xero or Quickbooks. Direct syncing eliminates manual reconciliations, streamlining financial workflows.

Enhanced security for secure transactions

Use virtual prepaid cards for secure one-time payments, avoiding cash or card sharing. Volopay’s industry-standard security and fraud prevention measures protect Canadian businesses.

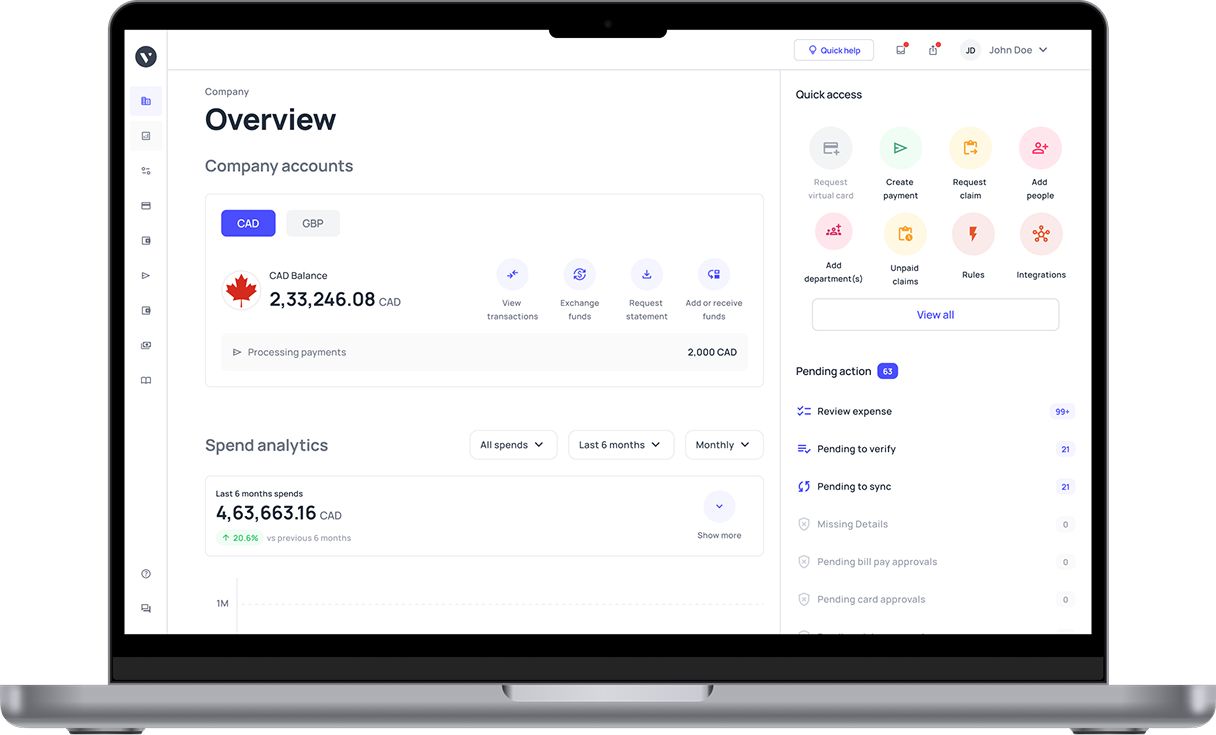

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay virtual cards tailored for all industries

Volopay’s virtual prepaid cards offer Canadian startups real-time tracking and quick card issuance, helping maintain budget control while scaling operations.

Canadian small businesses benefit from streamlined expense management and customizable spending limits, ensuring efficient operations without overspending.

Volopay’s virtual prepaid cards provide Canadian enterprises with advanced approval workflows and analytics, simplifying complex financial operations for better efficiency.

What makes Volopay virtual cards the best choice?

Easy card creation

Volopay’s intuitive platform makes creating virtual prepaid cards quick and easy, giving Canadian businesses instant access to digital cards.

No hidden charges

Volopay’s virtual cards have no hidden fees, ensuring transparent pricing for Canadian businesses with no surprises.

Unlimited card issuance

Issue unlimited virtual cards for Canadian team members or departments, ensuring everyone has access to funds when needed.

Individual card allocation

Assign virtual prepaid cards to individual employees, tracking personal spending in real time for Canadian businesses.

Department allocation

Allocate virtual cards to Canadian departments, controlling spending caps and monitoring expenses with ease.

Compliance and security

Volopay’s virtual cards ensure secure transactions with robust encryption and fraud prevention, protecting Canadian businesses.

Monitor employee spending

Track employee spending in real time with Volopay’s virtual prepaid cards, preventing overspending and ensuring transparency for Canadian businesses.

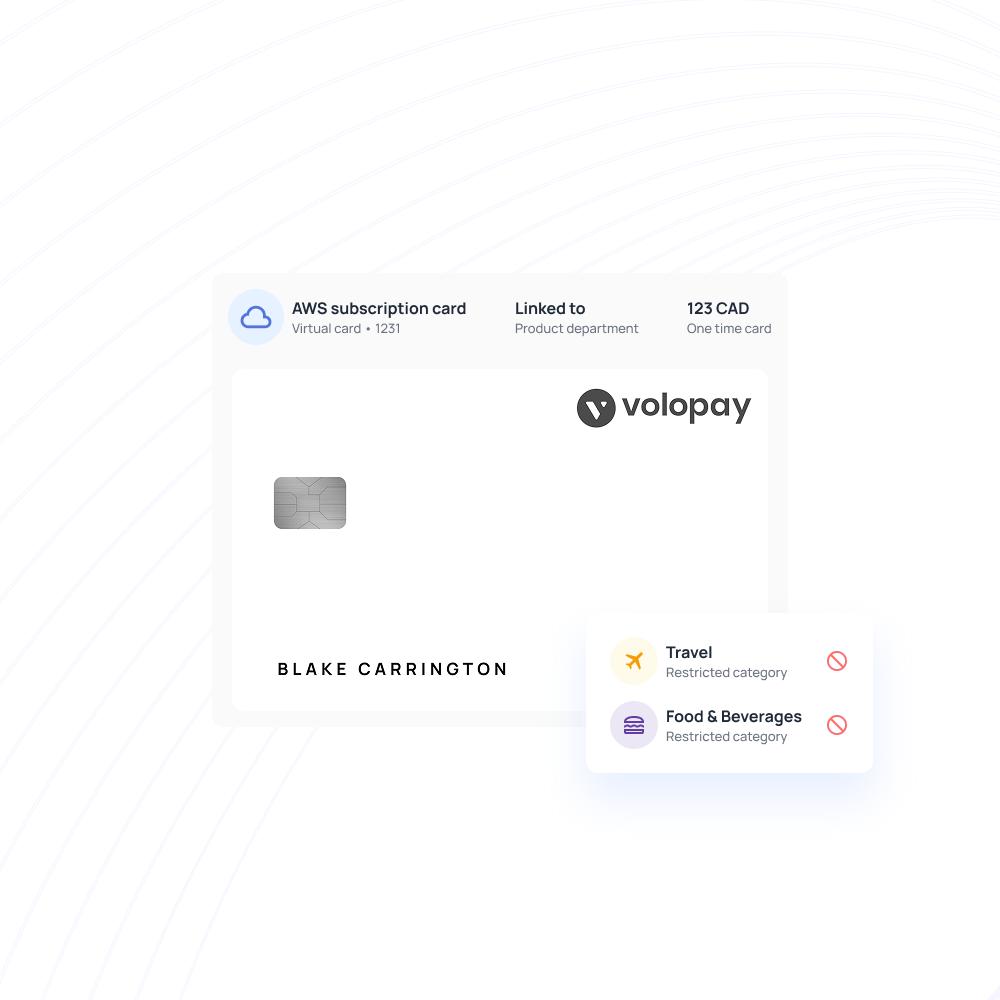

Vendor controls

Set spending caps and restrictions for vendors, managing supplier expenses and recurring payments effectively for Canadian businesses.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements, and accounting automation into one platform for Canadian businesses.

Subscription management

Simplify subscription management with Volopay’s virtual corporate cards. Assign unique cards to each subscription, set recurring payments, and manage expirations for Canadian businesses.

Real-time visibility

View all expenses in real time on Volopay’s dashboard. Transactions update instantly, showing available limits and spending details for Canadian businesses.

Multi level approvals

Set multi-level approvals for card and limit requests, ensuring compliance with automated alerts for approvers in Canadian businesses.

Accounting automation

Automatically categorize expenses and integrate with accounting software for efficient financial processes in Canadian businesses.

Bring Volopay to your business

Get started now

FAQs on virtual cards

Creating a virtual card takes just minutes on Volopay’s platform, requiring only cardholder details and a limit for Canadian businesses.

Volopay’s dashboard offers full control with tools like spending updates, freeze/block options, and adjustable limits for Canadian businesses.

Canadian businesses can onboard with Volopay and create virtual cards easily once registered, with a simple application process.

No, Volopay’s corporate virtual cards do not impact personal credit scores for Canadian businesses.

Yes, Volopay allows instant virtual card issuance for urgent needs, providing immediate fund access for Canadian businesses.

Yes, Volopay’s virtual prepaid cards support global purchases with real-time currency tracking for Canadian businesses.

Deactivate virtual cards quickly via Volopay’s platform, ensuring unused cards are terminated instantly for Canadian businesses.

Yes, Volopay’s virtual cards are ideal for recurring payments, automating tasks and tracking vendor spending for Canadian businesses.

Volopay provides real-time analytics, detailed expenditure reports, and customized insights for tracking virtual card transactions in Canadian businesses.

Yes, Volopay’s mobile app allows Canadian businesses to manage virtual cards on the go, with full control over issuance and spending.