Volopay corporate card for easier business payments

Ditch complicated expense tracking and slow payment processes. Volopay’s corporate expense card simplifies payments and financial management for Canadian businesses, with adjustable spending limits, automated reporting, real-time monitoring, and enhanced budgeting tools.

Whether it’s physical cards for travel or virtual cards for subscriptions, Volopay covers every business expense with ease.

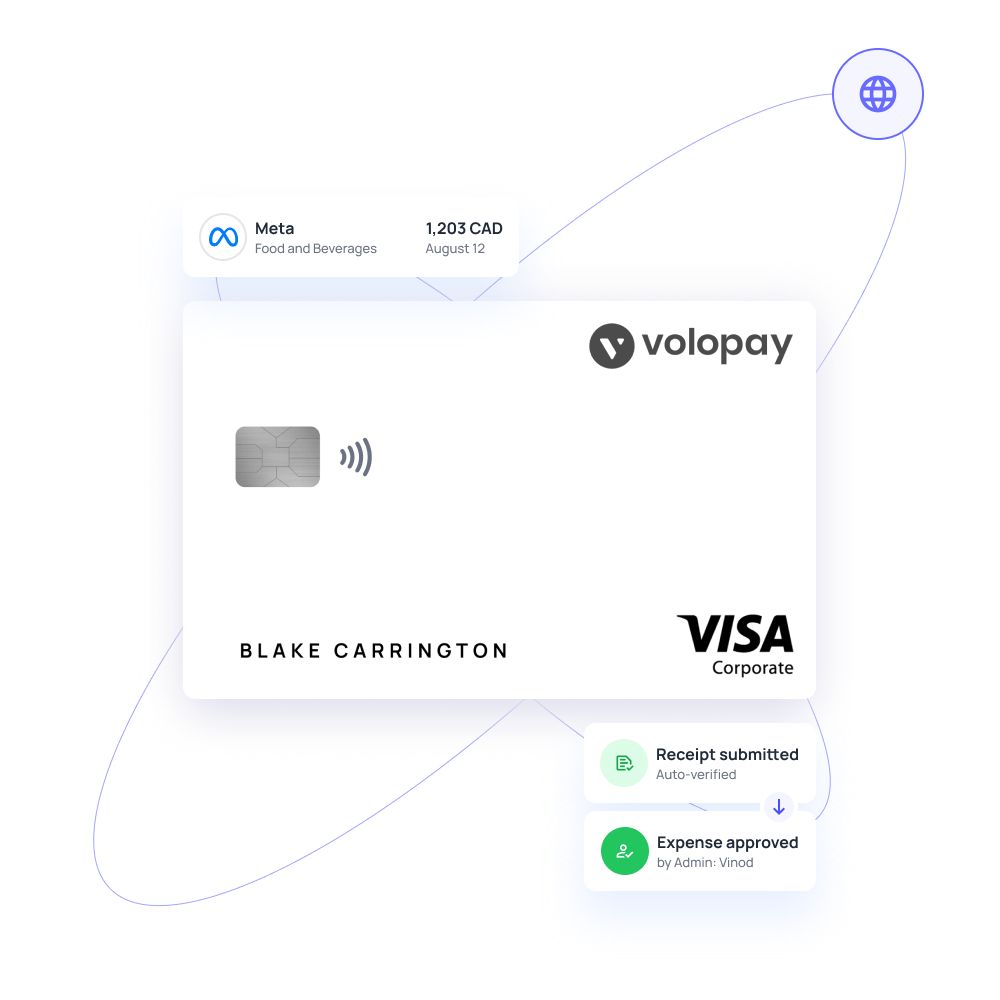

Smarter spending with approvals

With Volopay’s corporate card for startups, you can stay within budget effortlessly by setting up approval workflows for enhanced accountability. All transactions made using corporate expense cards are instantly updated on your platform, and expense reports can be completed swiftly via a mobile app.

Features like automated flagging of non-compliant expenses, strong card management tools, and discussion threads ensure every expense is tracked accurately.

Easy and secure payments

A simple swipe of your Volopay corporate card is all it takes to process payments, eliminating delays with pre-set spending limits on issued cards.

Receive instant expense notifications with each transaction, simplifying the reimbursement process and enabling employees to handle business expenses seamlessly without complications.

Track expenses in real-time

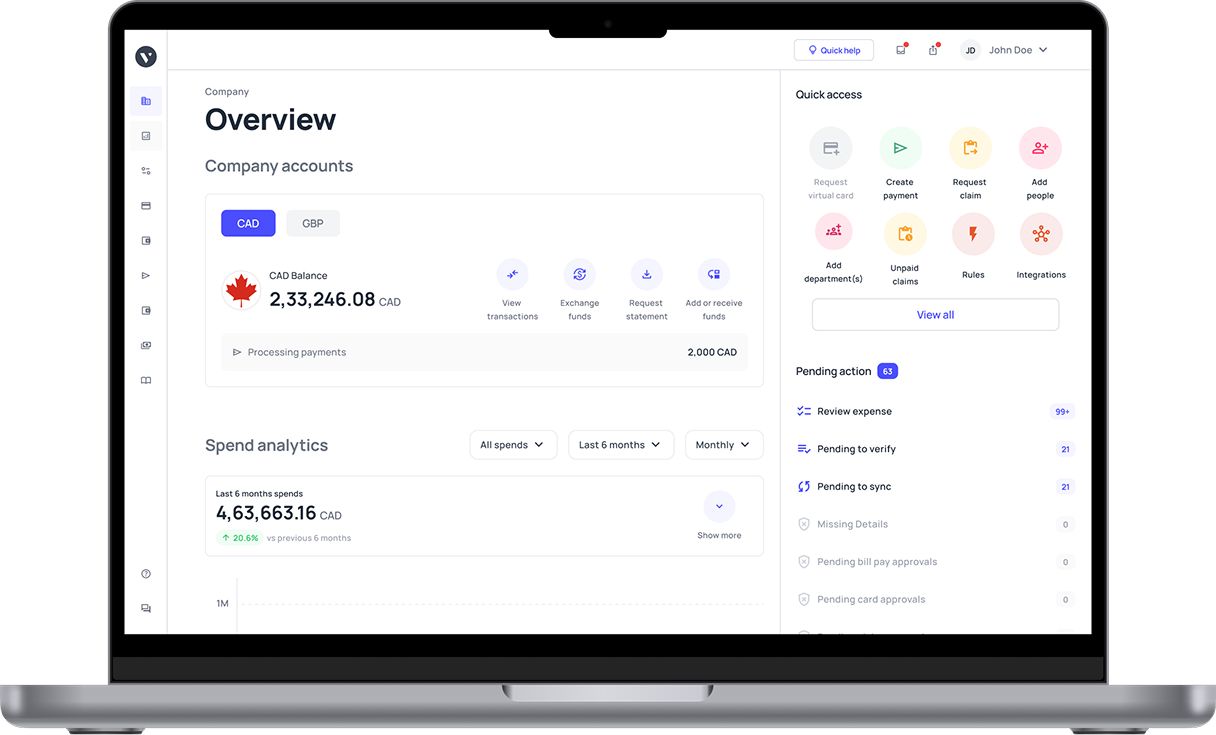

Struggling with unclear expense tracking? Volopay’s corporate cards log all transactions instantly on your dashboard.

Set auto-approval rules for specific merchants or policies, minimizing unauthorized purchases and ensuring transparent expense management for Canadian businesses.

Perfect corporate card solution for your business!

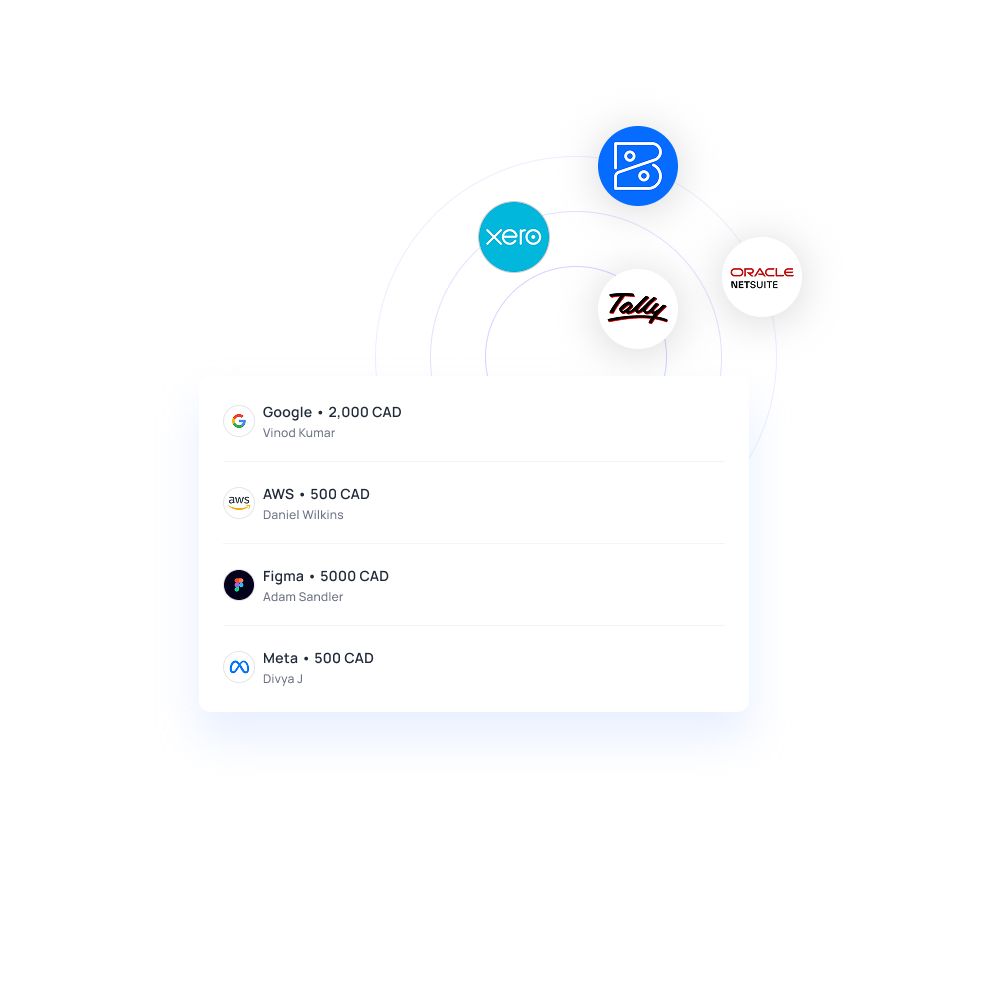

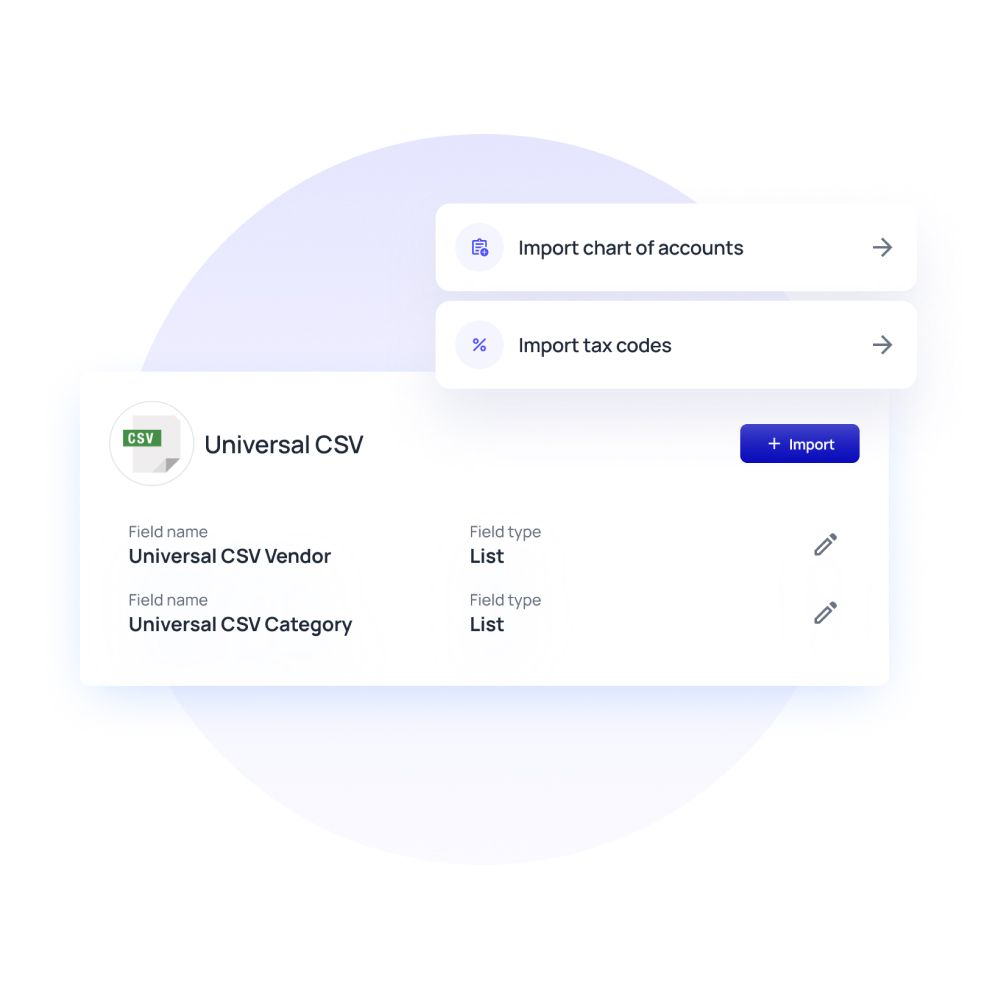

Seamless integration with accounting systems

Simplify financial management by connecting Volopay’s corporate cards to your accounting software.

Automated syncing eliminates manual data entry and reduces errors, ensuring accurate reconciliations and saving time for Canadian finance teams.

Provide multiple cards to your team

Distribute corporate cards to employees effortlessly with Volopay. Activate, freeze, or replace cards in a few clicks.

Assign individual cards for specific purposes or projects, avoiding the hassle of card sharing for Canadian teams.

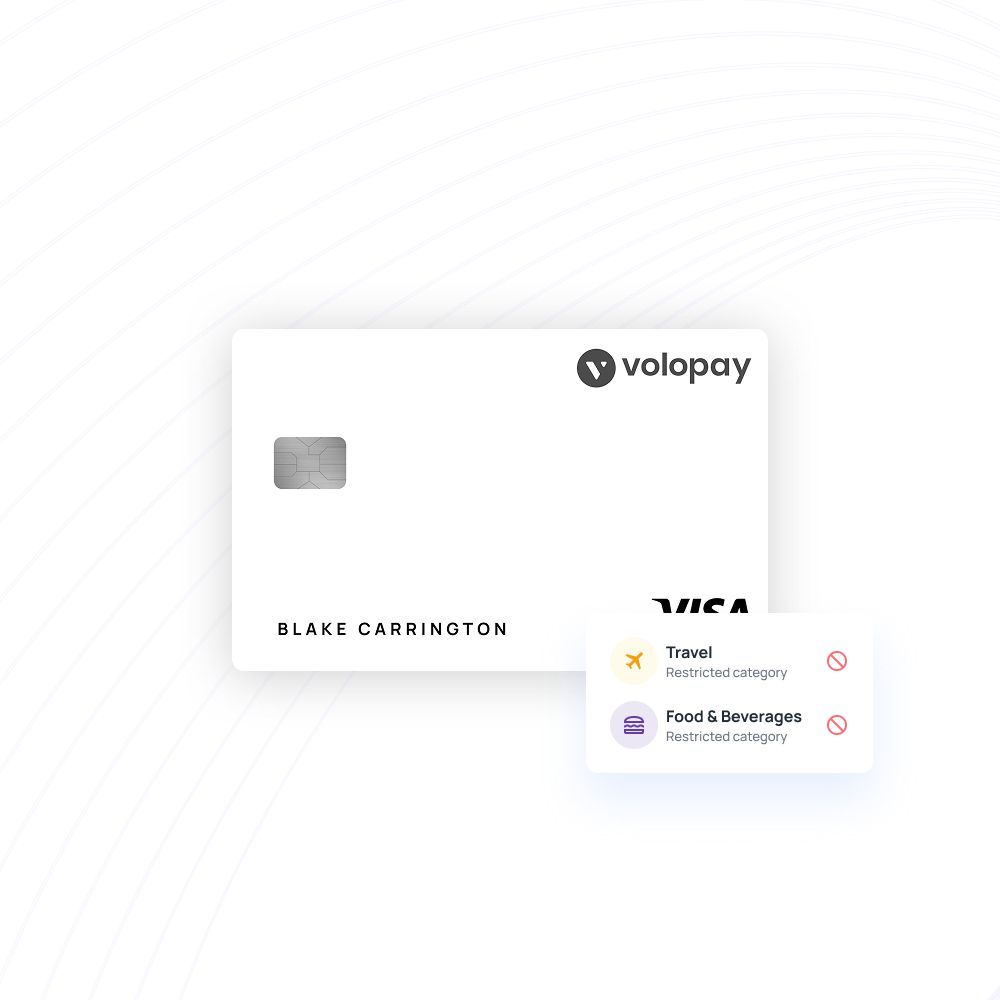

Automated expense categorization

Forget manual expense sorting. Volopay’s advanced rules automatically categorize expenses, making it easy to manage and review spending.

Employees can select categories with a single click via the app, streamlining the process for Canadian businesses.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Learn how Volopay cards can enhance your business

Simplified reimbursement

Tired of endless reimbursement claims? Volopay’s corporate cards minimize out-of-pocket expenses for Canadian employees.

Set spending limits to empower your team while preventing overspending, reducing reimbursement needs.

Improved cash flow

Healthy cash flow starts with controlled spending.

Volopay’s corporate cards help Canadian businesses stick to budgets with predefined limits, ensuring no surprise expenses disrupt finances.

Protect finances as you build business credit

Transparent transaction records and controlled spending with Volopay’s cards support your business credit without harming it.

Focus on building a strong financial foundation for your Canadian business.

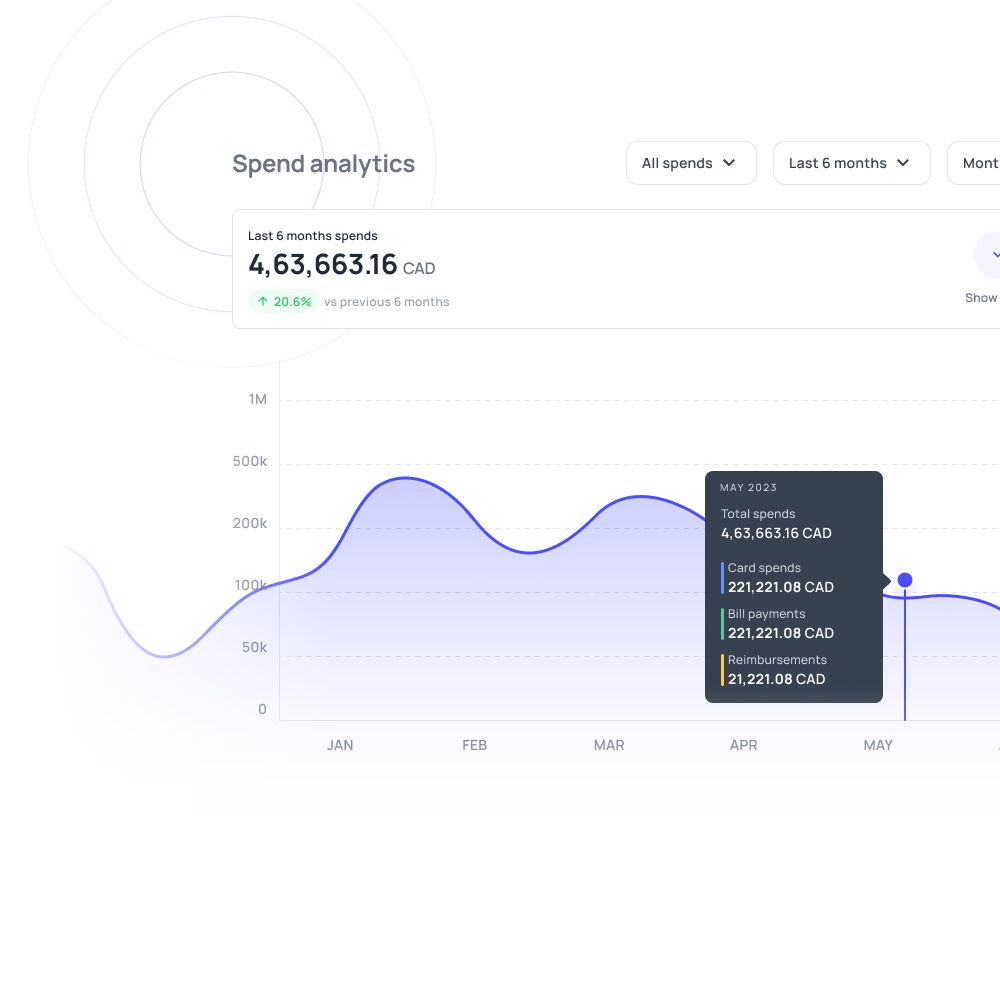

Simplified real-time expense tracking

Eliminate end-of-month surprises with Volopay’s comprehensive platform.

Every transaction is logged instantly, giving Canadian businesses full visibility into spending patterns.

Increased convenience

Move away from relying on a single owner’s card. Equip each Canadian employee with their own corporate card for effortless payments, eliminating delays and shared card hassles.

Improved vendor relationships

Avoid late vendor payments and strained relationships. Volopay’s corporate cards enable faster payments with unlimited virtual cards and pre-approved limits, keeping Canadian vendor relationships strong.

Empower your team with smart corporate cards

Managers

Volopay’s corporate cards simplify expense oversight for Canadian managers.

Implement approval workflows, monitor spending in real time, and set custom limits for compliance and informed decision-making.

Employees

Canadian employees enjoy seamless expense management with Volopay’s cards, eliminating reimbursement delays.

The user-friendly mobile app makes transaction tracking straightforward.

Finance teams

Volopay’s cards provide Canadian finance teams with real-time spending insights.

Automated reporting reduces manual tasks, improves cash flow management, and enhances efficiency.

Accounting teams

Volopay’s cards integrate with accounting systems, automating reconciliations and minimizing errors for Canadian accounting teams, speeding up month-end processes.

One card, countless advantages: Volopay corporate cards for all businesses

Volopay’s corporate cards offer Canadian startups real-time insights and automated reporting, helping founders focus on growth while maintaining cash flow control.

Canadian small businesses benefit from transparent spending and automated approvals, reducing administrative burdens and optimizing resource allocation.

For Canadian enterprises, Volopay provides advanced analytics, dynamic spending limits, and multi-level approvals, streamlining complex financial workflows for efficiency.

Consistently rated at the top

Volopay takes pride in being consistently recognized as a top performer on G2. Our G2 badges are a testament to the outstanding value and satisfaction we deliver to our users.

These recognition demonstrates our commitment to offering cutting-edge financial solutions and outstanding customer support, which positions us as a reliable option for companies all around the world.

Discover Volopay’s full suite of features

Volopay integrates approvals, corporate cards, bill payments, expense reimbursements, and accounting automation into one platform, simplifying financial management for Canadian businesses of all sizes.

Physical cards

Volopay’s physical prepaid corporate cards empower Canadian employees to handle expenses effortlessly, with spending controls and real-time tracking.

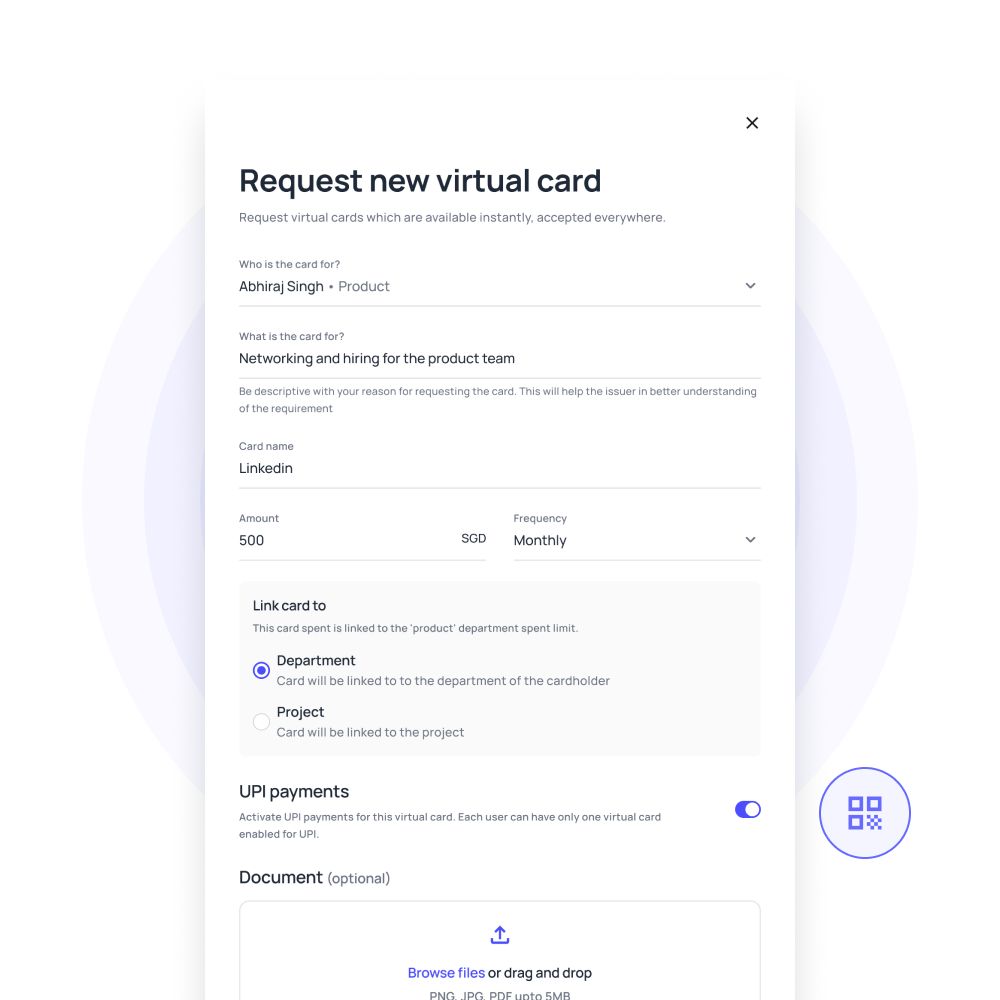

Virtual cards

Volopay’s virtual prepaid cards are ideal for online purchases, subscriptions, and vendor payments, offering secure transactions and streamlined expense management for Canadian businesses.

Bring Volopay to your business

Get started now

FAQs on corporate cards

Corporate business cards are designed for business payments, helping Canadian companies keep personal and business expenses separate.

Corporate cards are perfect for business travel, subscriptions, office supplies, online orders, and more, making expense management easy for Canadian businesses.

Yes, Volopay’s corporate cards simplify managing business travel for Canadian employees, eliminating reimbursement hassles.

Yes, Volopay corporate cards are accepted globally, as long as merchants accept card payments, perfect for Canadian businesses with international operations.

Yes, Volopay corporate expense cards make cross-border payments convenient for Canadian businesses, both online and in-store.

Your Canadian business needs to be a registered company. Check specific requirements with Volopay before applying.

No, Volopay’s corporate cards have separate credit scores, leaving your personal credit unaffected.

Volopay corporate cards provide robust security with multi-factor authentication, instant notifications, and customizable limits for Canadian businesses.

Volopay’s corporate expense card captures transaction data in real time, offering detailed insights and automated reports for Canadian accounting systems.

Immediately block the card via Volopay’s mobile app or web platform to prevent unauthorized use and request a replacement.