Streamline global business money transfers with Volopay

International payments don’t have to be a hassle. Volopay makes it easy for Canadian businesses to send funds to over 180 countries with competitive exchange rates and no hidden fees.

Our platform provides fast, secure cross-border business money transfer services tailored for Canadian business needs. Enjoy instant updates and smooth multi-currency transfers, making vendor payments and invoice processing simple so you can focus on growing your business.

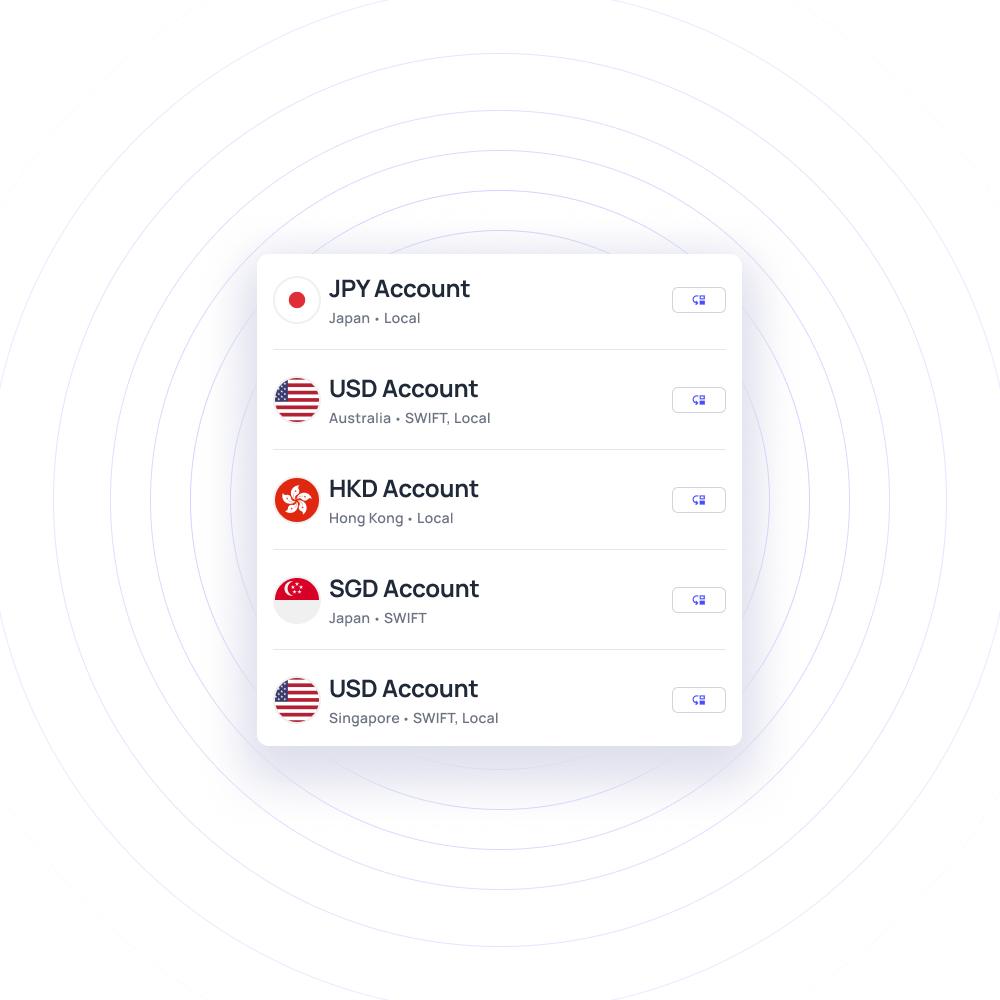

Multi-currency transfer options

Volopay simplifies sending payments in multiple currencies, making company money transfers and business-to-business international money transfers easy for Canadian businesses.

Whether paying vendors across borders or handling regional payments, our platform supports a wide range of currencies. Switch between them effortlessly without complicated processes or extra fees, ensuring smooth global operations.

Quick and secure domestic transfers

For domestic business money transfers in Canada, Volopay offers speed and security. Payments are processed instantly within the country, backed by strong security measures for peace of mind.

Whether it’s payroll or vendor payments, our system ensures funds arrive quickly and safely, keeping your Canadian business running smoothly.

Clear and affordable transfer fees

Say goodbye to surprise costs with Volopay’s B2B money transfer software. We provide clear, low fees for all transactions, whether domestic or international, tailored for Canadian businesses.

No hidden charges or inflated exchange rates—just predictable pricing that helps you budget effectively and maximize financial efficiency for your business money transfers.

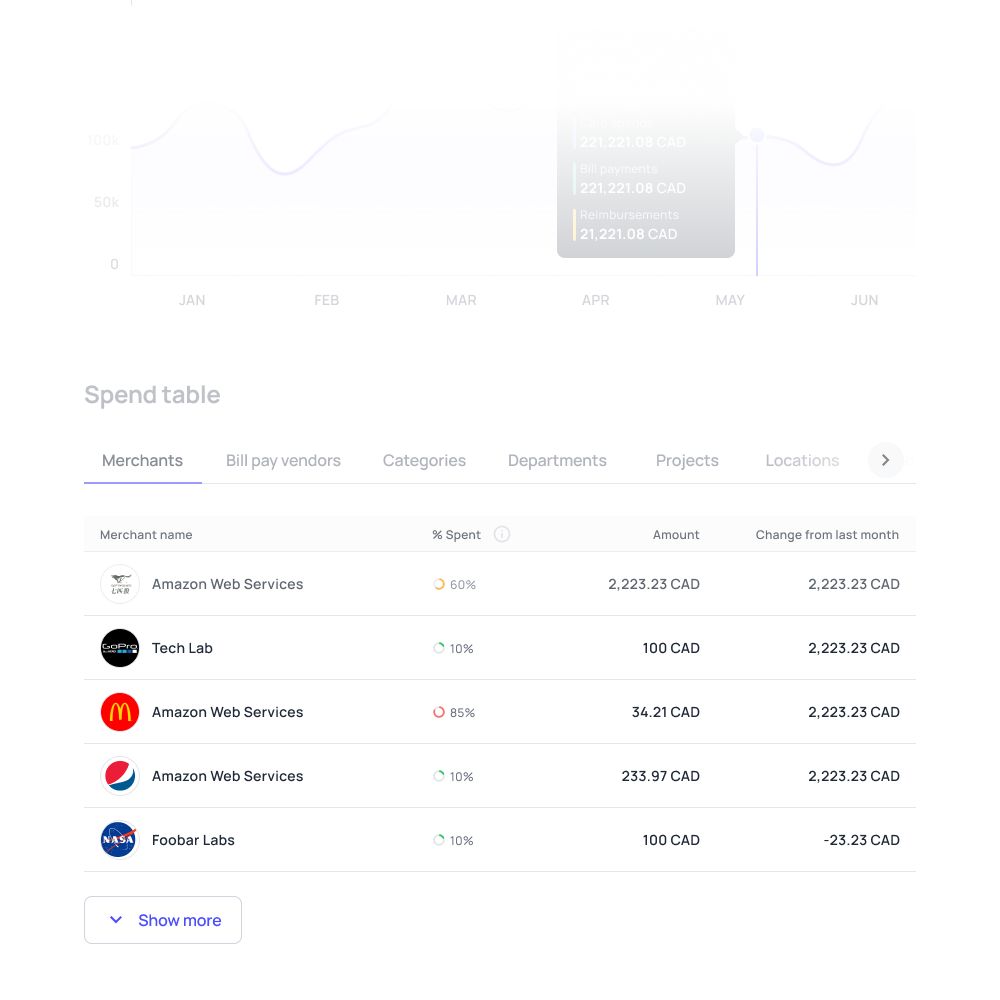

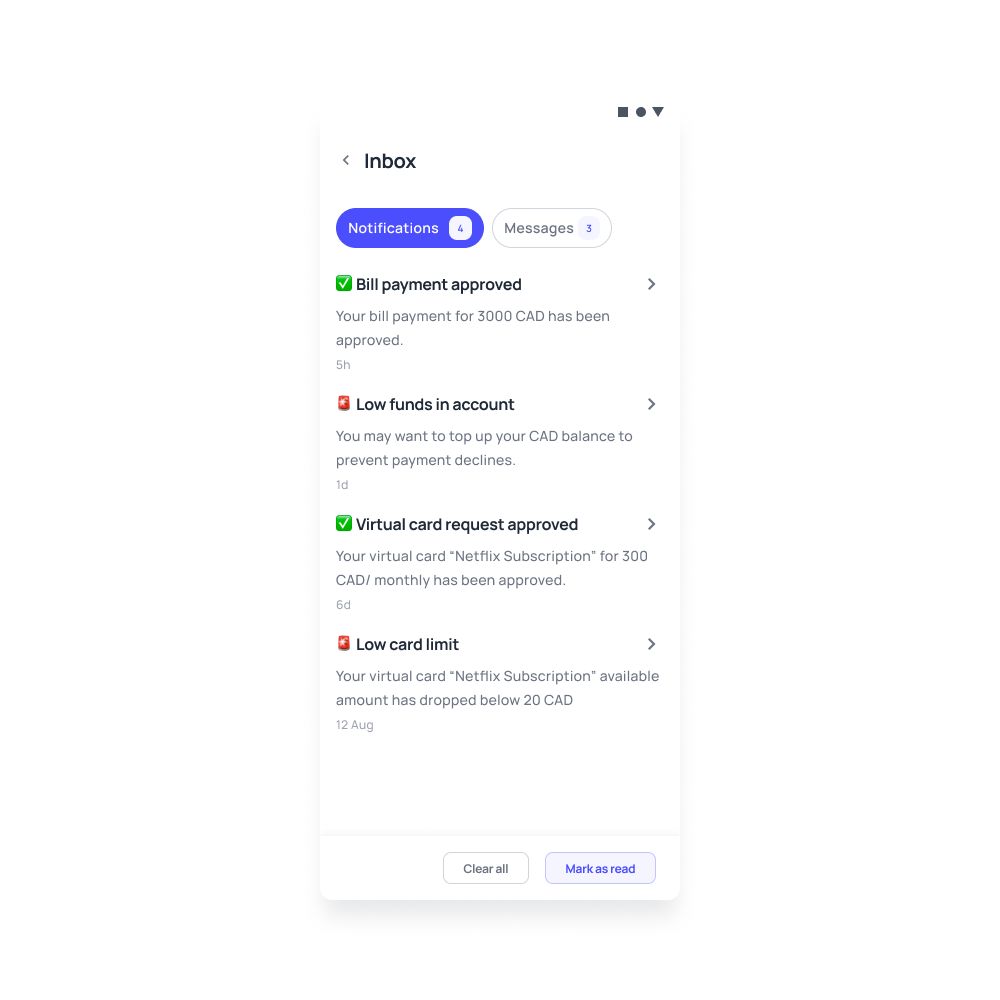

Real-time payment tracking

Stay on top of your funds with Volopay’s real-time payment tracking. Monitor every company money transfer from start to finish, whether it’s local or global.

Get instant notifications to stay updated, ensuring full visibility and confidence for your Canadian business payments.

Effortlessly manage business money transfers using Volopay!

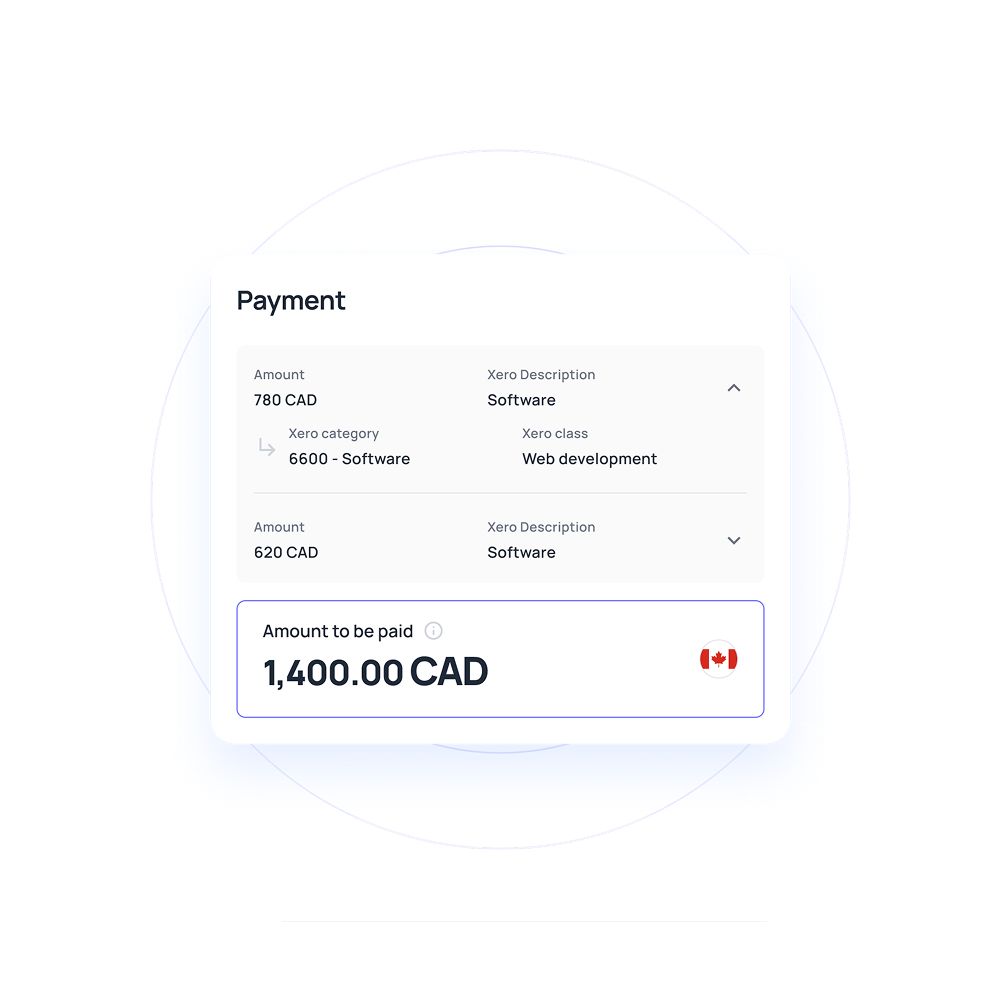

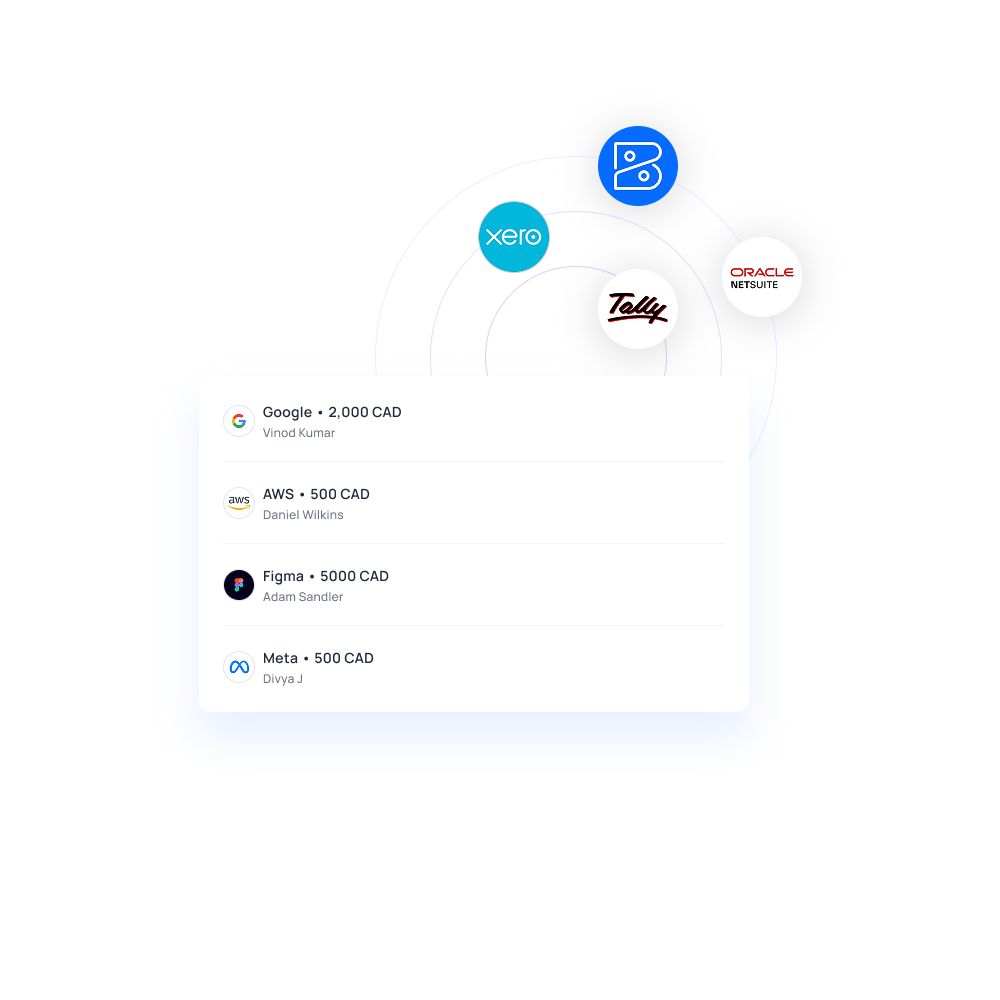

Seamless accounting system integration

Volopay integrates seamlessly with your Canadian accounting tools, eliminating manual data entry.

All transactions sync automatically, reducing errors and simplifying financial management. This allows your finance team to focus on strategic tasks, boosting efficiency for your Canadian business.

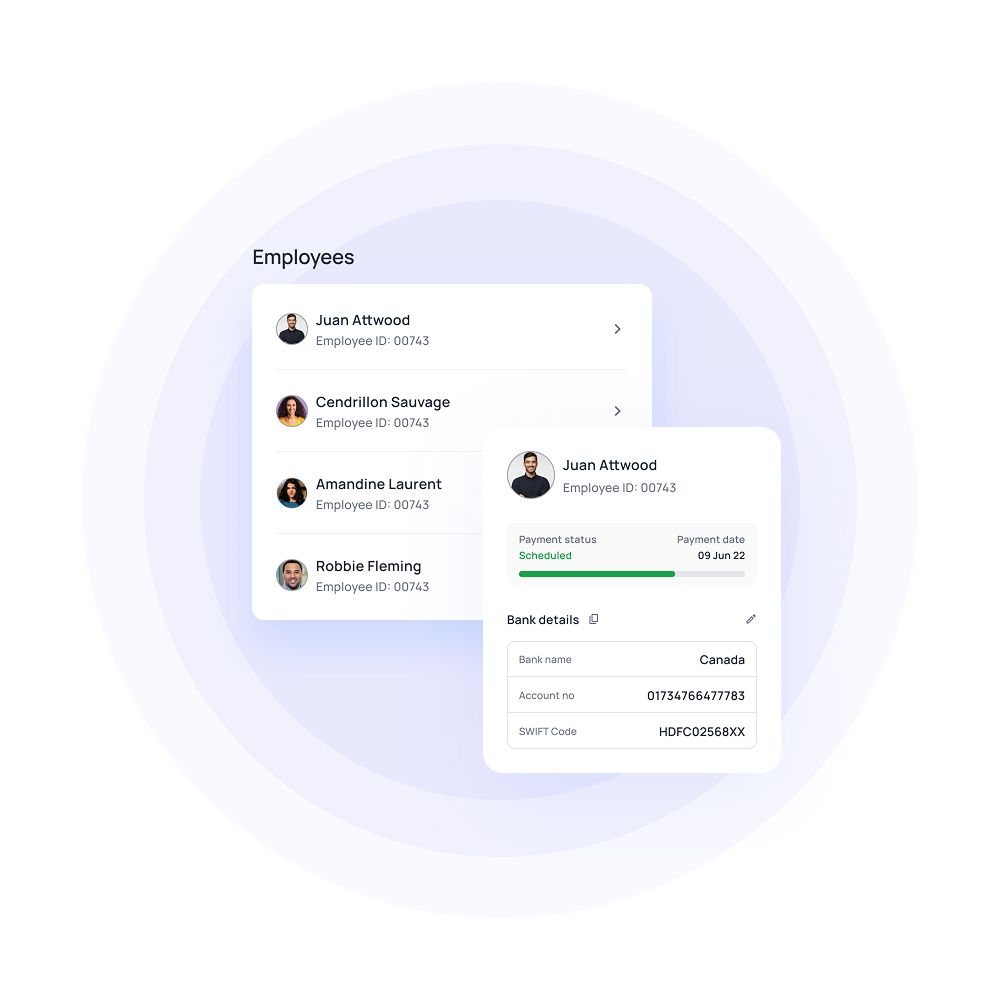

Support for bulk payment processing

Handling multiple payments? Volopay’s bulk payment feature lets Canadian businesses process large volumes of company money transfers with just a few clicks.

Ideal for payroll, vendor payouts, or recurring payments, this feature saves time and reduces repetitive tasks, making operations more efficient.

Automated payment schedules

Take the stress out of recurring payments with Volopay’s automated scheduling. Set up business money transfers in advance, and the system handles the rest.

From weekly vendor payments to monthly subscriptions, you’ll never miss a due date, keeping your Canadian business operations seamless.

Instant notifications for each payment

Stay informed with real-time notifications for every company money transfer.

Volopay sends instant alerts when transactions are processed, so you can monitor cash flow without constantly checking the system. This transparency keeps you in control of your Canadian business finances.

International and domestic compliance

Volopay follows strict compliance standards, ensuring all company money transfers meet Canadian and international regulations.

With robust KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, your Canadian business stays protected from legal risks while maintaining secure financial operations.

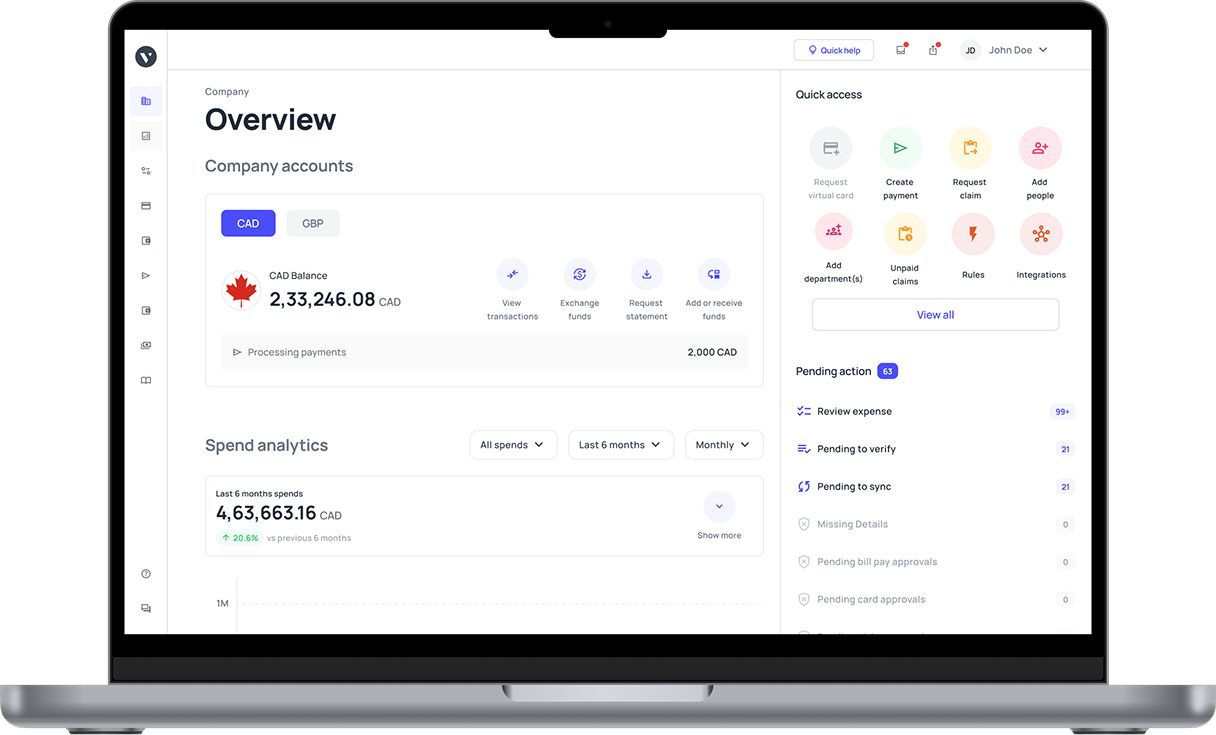

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

How Volopay money transfer works

Volopay makes managing your business money transfer simple and efficient for Canadian businesses, from account setup to payment confirmations.

Account setup

Start by setting up your Volopay business account with basic company and bank details. This quick process gives you access to all payment features, including domestic and international transfers, managed from one dashboard.

Initiate a payment

Begin a business money transfer from the payment section of the dashboard. Choose between domestic or international transfers, then enter the recipient’s details, including name, bank information, and currency.

Volopay’s intuitive interface makes this fast and easy for Canadian businesses.

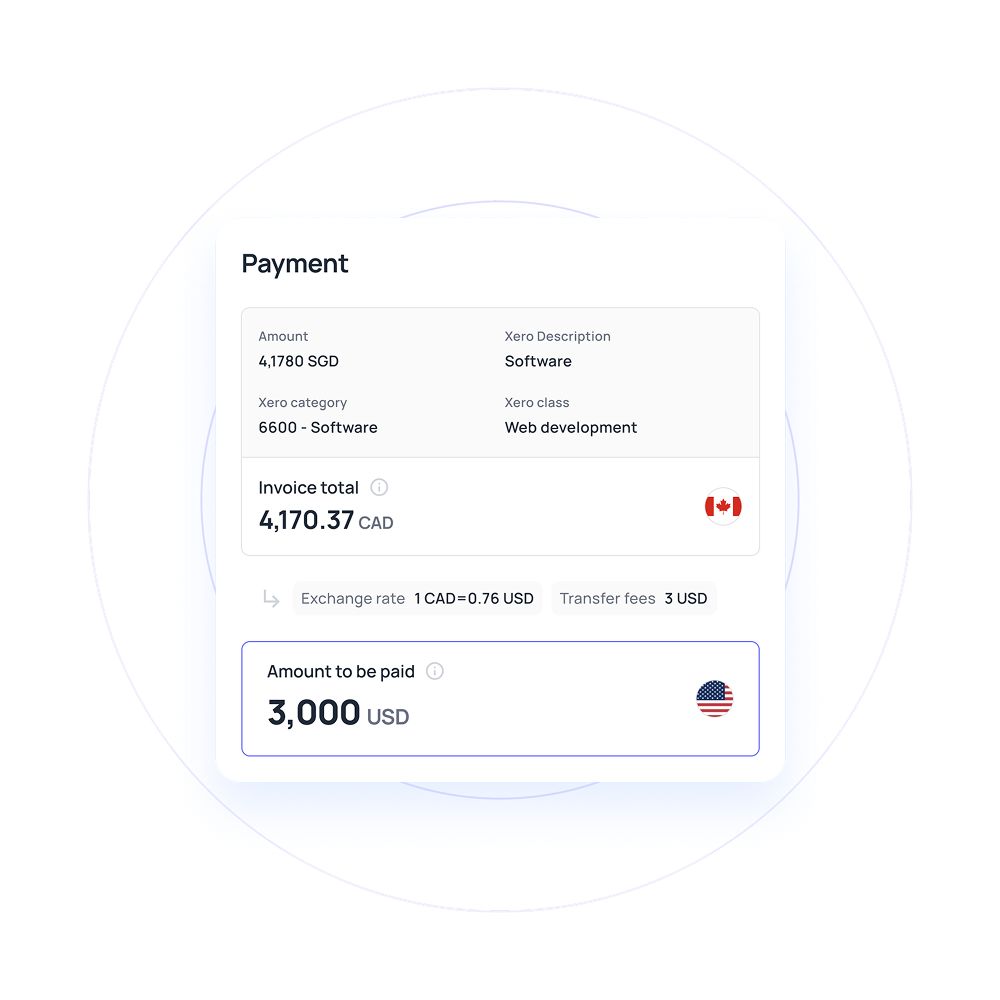

Review fees and exchange rates

Before finalizing the payment, Volopay shows a clear breakdown of fees and the current exchange rate. Review and approve the total, confident there are no hidden costs.

Our competitive rates ensure you get the best value for your Canadian business transactions.

Make the payment

Once details are confirmed, send the transfer with one click. Volopay processes payments quickly and securely, handling all complexities for you.

Whether domestic or international, your business money transfer is completed efficiently.

Receive payment updates

Track your transaction’s status in real time with updates from start to finish. Volopay keeps you informed about when your business money transfer is processed, sent, and received, ensuring transparency for Canadian businesses.

Effortlessly handle local and international payments

International money transfers

Volopay simplifies business-to-business international money transfers for Canadian businesses, supporting payments to over 180 countries. Send funds in multiple currencies with competitive exchange rates and transparent fees for money transfer for business.

The SWIFT payment system ensures secure cross-border transfers, while multi-approval workflows and real-time tracking give you full control over global finances.

Domestic money transfer

Volopay makes domestic payments fast and efficient for Canadian businesses, whether for payroll, vendor payments, or reimbursements.

Process transactions instantly with low fees and track them via an easy-to-use dashboard. Automate and schedule payments to save time and gain real-time insights into local finances.

One platform, countless opportunities: Volopay across industries

Healthcare

Canadian healthcare organizations deal with complex payment needs for equipment, suppliers, and payroll. Volopay simplifies money transfer for business with automated schedules, vendor management, and secure transactions.

Real-time tracking and regulatory compliance let providers focus on patient care while keeping finances stable.

Technology

Tech companies in Canada often manage global vendors, subscriptions, and payroll. Volopay’s B2B money transfer software streamlines these with multi-currency payments, bulk payment options, and accounting integrations.

Competitive rates for international money transfer for business help tech firms scale while keeping finances clear.

Construction

Construction projects in Canada involve multiple suppliers and workers across sites. Volopay’s bulk payment capabilities and automated workflows manage company money transfers for vendor payments, wages, and equipment costs.

Real-time tracking ensures projects stay on budget with smooth payment processing.

Hospitality

In Canada’s hospitality sector, managing supplier payments, payroll, and operational costs is critical. Volopay handles domestic and international money transfer for business, automates recurring expenses, and monitors cash flow.

Accounting integrations simplify back-office tasks, letting managers focus on guest experiences.

Logistics

Canadian logistics firms rely on efficient cash flow for smooth operations. Volopay’s B2B money transfer software streamlines freight payments, vendor settlements, and fuel reimbursements with fast transfers.

Real-time alerts and transparent fees ensure clear payment tracking and operational efficiency.

Retail

Retail businesses in Canada need to manage supplier payments, wages, and expenses efficiently. Volopay automates company money transfers and handles high transaction volumes with multi-currency and bulk payment support.

This makes it perfect for retail chains operating globally or sourcing products internationally.

Volopay’s adaptable solutions for all business types

Volopay simplifies financial management for Canadian eCommerce businesses with automated payment workflows, multi-currency support, and accounting integrations.

Handle supplier payments, track expenses, and manage global transactions efficiently, saving time and reducing errors for money transfer for business.

Canadian enterprises benefit from Volopay’s robust business money transfer platform, featuring bulk payments, automated approvals, and real-time tracking.

These tools streamline large-scale transactions and maintain cash flow visibility, ensuring smooth global financial operations.

Volopay offers Canadian small businesses affordable, user-friendly tools for domestic and international payments.

With low fees, automated schedules, and real-time tracking, small businesses can manage company money transfers easily, focusing on growth without complex systems.

Why Volopay?

Reduce costs on fees and exchange rates

Volopay provides competitive exchange rates and low, transparent fees for domestic and international transfers, ideal for money transfer for business in Canada.

Unlike banks, Volopay avoids markups, saving you money and boosting your bottom line with every transaction.

Security and compliance with standards

Volopay ensures secure company money transfers with advanced encryption and fraud detection.

Compliance with KYC and AML protocols keeps your financial operations safe and legally sound, protecting your Canadian business from risks.

Enhanced cash flow management

Volopay’s real-time tracking, automated workflows, and multi-currency support simplify cash flow management for Canadian businesses.

Instant access to payment statuses and detailed business money transfer reports helps maintain healthy finances and supports better planning.

Compliance to local and global regulations

Volopay navigates complex regulations with ease, adhering to Canadian and international compliance standards.

This ensures your transactions meet regulatory requirements across regions, giving you confidence in your global financial operations.

Consistently rated at the top

Our customers consistently rate us as a leader in accounts payable automation, expense management, and procurement.

We’re committed to providing modern financial solutions for Canadian startups and enterprises with exceptional customer support and seamless implementation.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Volopay helped BukuWarung in managing their expenses across different countries.

Volopay helped Deputy smoothly integrate with an accounting system.

Using Volopay, AdCombo eliminated the hurdles of cash flow management.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs

Yes, Volopay’s B2B money transfer software supports bulk payments for both domestic and international transactions. Process multiple company money transfers, like vendor payments or payroll, with just a few clicks, regardless of location.

Yes, Volopay enables automated recurring payments for expenses like subscriptions, vendor contracts, or salaries. Schedule payments to process automatically, ensuring timely transactions without manual effort.

Volopay currently does not offer exchange rate locking for future international payments. However, you can benefit from highly competitive real-time exchange rates at the time of each transaction.

Volopay enforces strict KYC and AML protocols to ensure compliance with international regulations. These measures prevent fraud, promote transparency, and safeguard your business during business-to-business international money transfers.

Volopay provides real-time payment tracking via the dashboard, showing the status of each money transfer from initiation to receipt. Stay informed with instant updates for full visibility and control.

Volopay secures payments with end-to-end encryption, multi-factor authentication, and advanced fraud detection. These measures protect your transactions and sensitive financial data, ensuring a safe business money transfer process.