Virtual prepaid cards to optimize your business payments

With volopay’s prepaid virtual cards, manage your online payments and subscriptions effectively. Considering your business needs, create unlimited virtual cards to streamline your business expenses and track every transaction.

Empower your employees with as many virtual cards as they need. Enhance team responsibility and visibility while keeping payments simple.

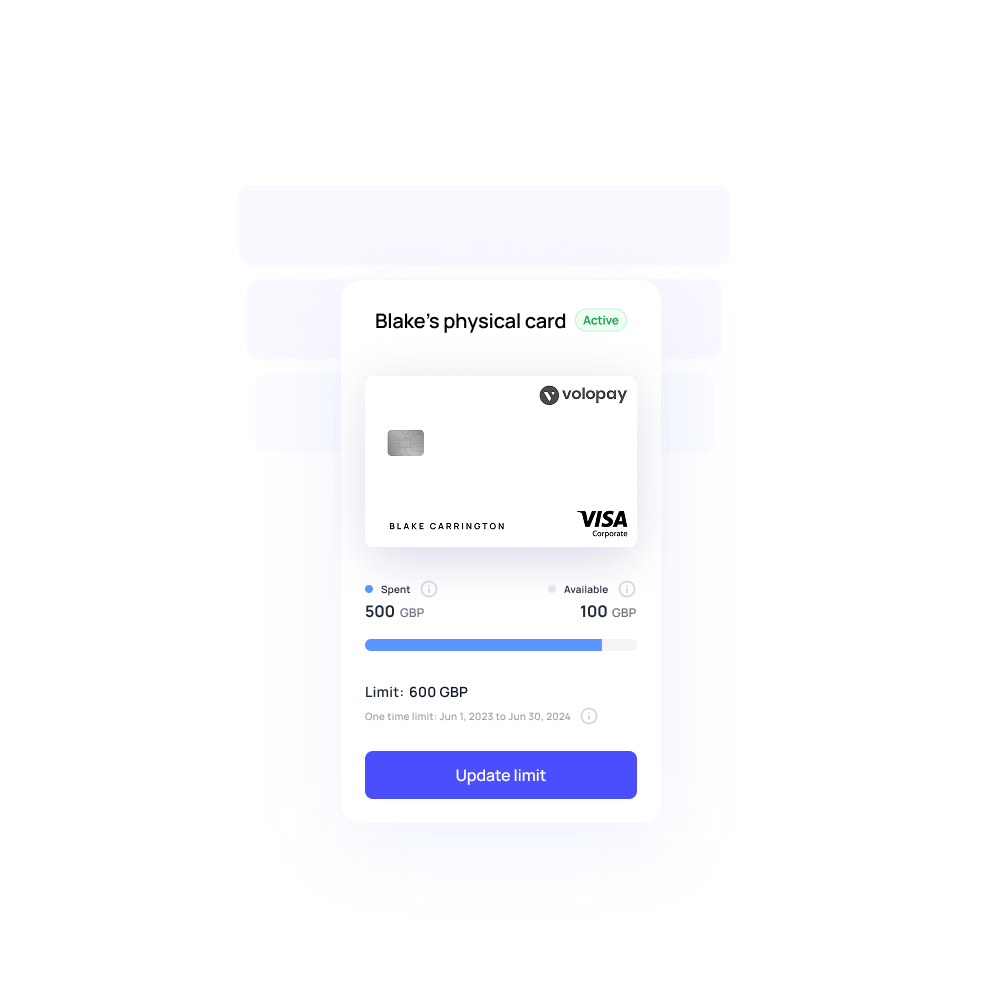

Set your spend limits

Say goodbye to uncontrolled spending. With Volopay, you can easily set individual spend limits for each virtual prepaid card you generate. You won’t have to worry about spending over your budget or outside the designated policy.

Take control over how your money is used with customizable approval workflows, merchant blocking and greenlighting, and flexible reload options.

Gain instant access to funds

With business virtual prepaid cards, you may better manage your cash flow and do away with the requirement for employee reimbursements. Virtual card payments can be made from any location as long as you have your device!

With an easy application process and a short waiting period, you’ll be able to start using your Volopay virtual prepaid cards in no time. It’s a surefire way for your team to get quick access to funds.

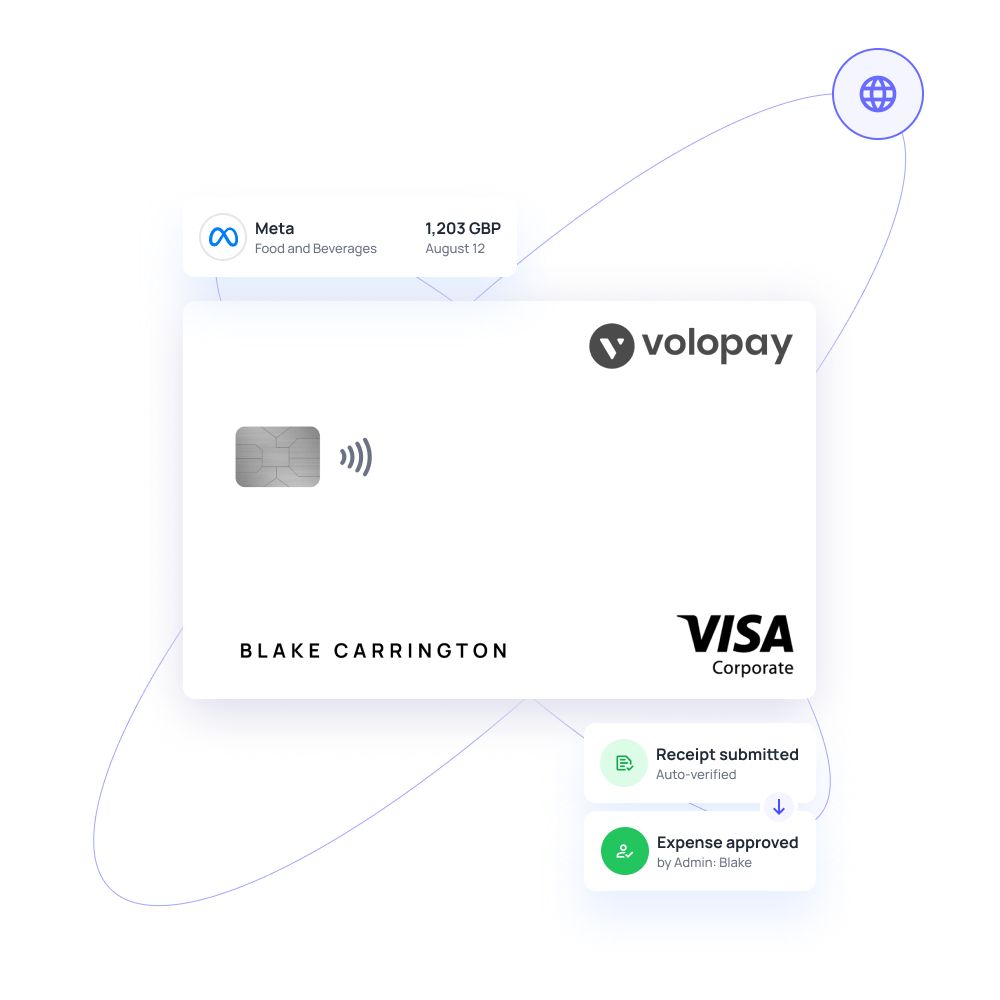

Simple and quick payments

Volopay virtual prepaid cards allow for quicker payments. Once your cards have been generated and activated on your card dashboard, you can begin using them.

When your virtual prepaid card number is all you need, making payments online becomes easy. By enabling employees to conveniently make restricted payments using virtual cards, you can maintain convenience and security at the same time.

Perfect virtual card solution for your business!

Real-time expense monitoring

Get robust expense tracking features through Volopay’s card management system. Every virtual prepaid card you generate on the platform will be automatically linked to your Volopay account. Whenever a card is used to make a payment, the expense gets updated and recorded in real-time.

There are no more surprises and undetected expenses with Volopay. Every penny you spend with a virtual card is easily trackable.

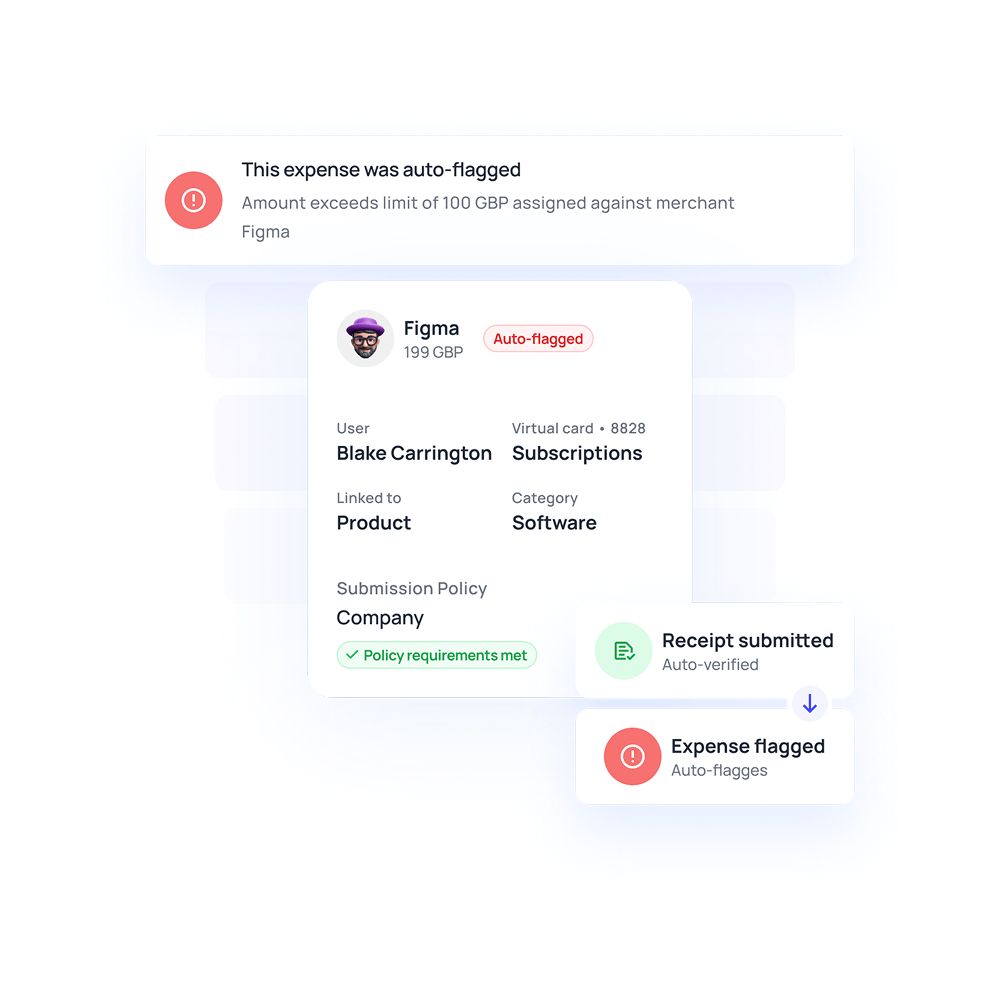

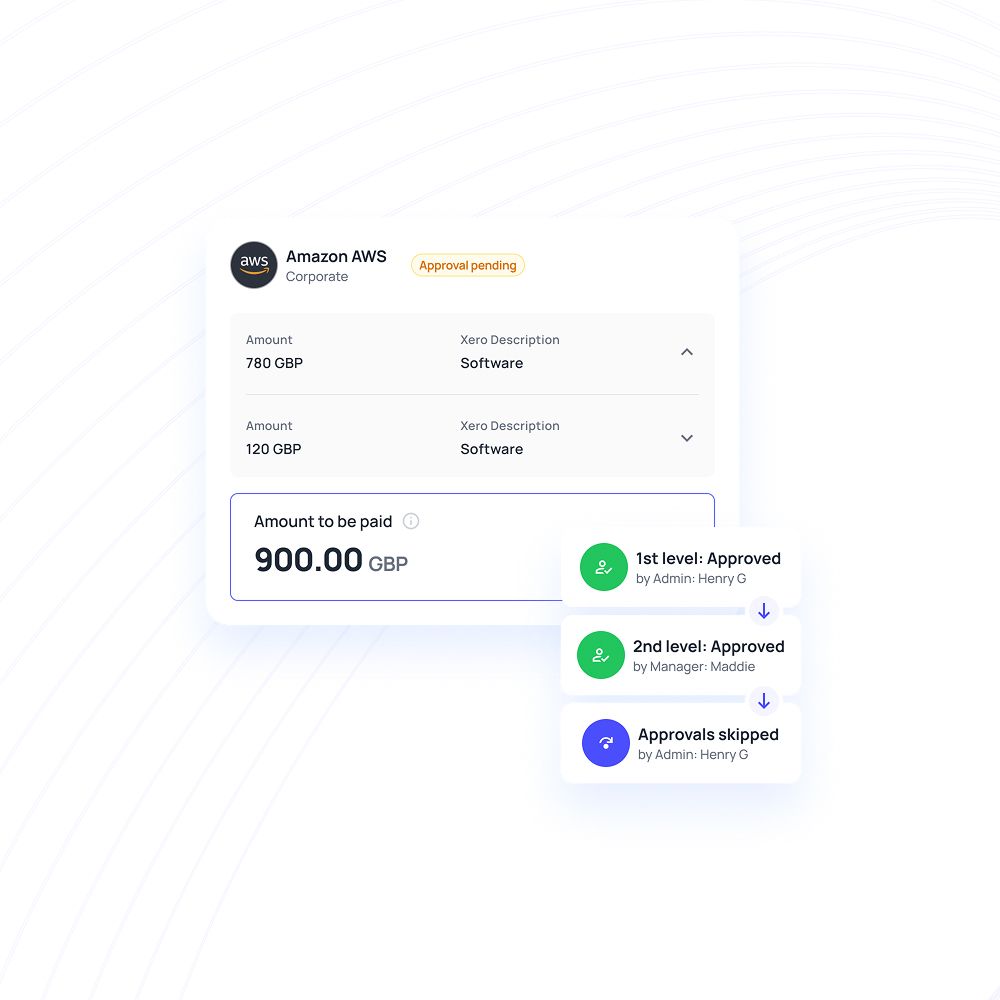

Accurate approval workflows

Make the most of Volopay’s automated approval workflows to encourage transparency while avoiding delays. Set up customizable workflows for multi-level approvals and assign virtual prepaid cards with specific project or departmental policies.

Every new card and limit request will be automatically routed through the appropriate approval workflow. Requests can be approved fast since approvers are alerted instantly. For a clear record, employees and approvers can also monitor requests within the platform.

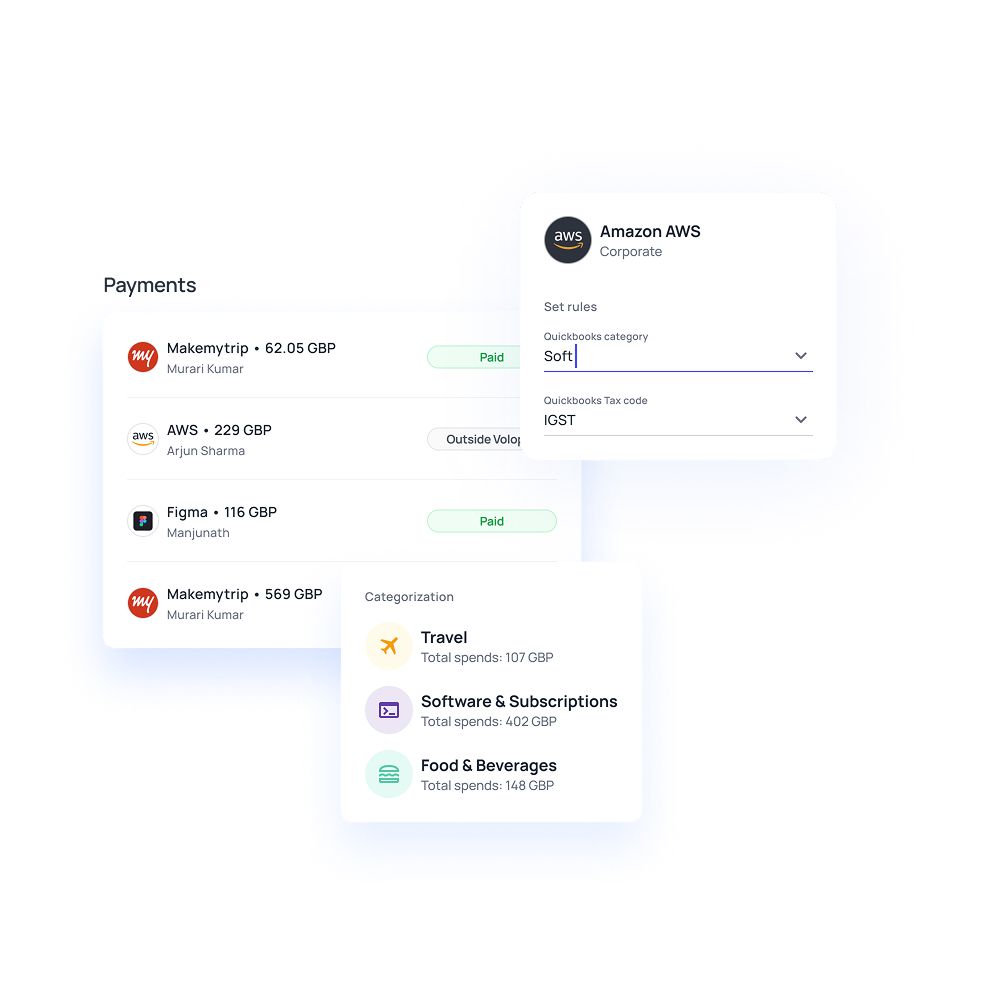

Automated expense categorization

The automated expense categorization feature of Volopay greatly simplifies accounting and tracking. Assign each transaction to the proper category automatically and create configurable spending categories.

The payment details will be recorded by the system as soon as you use a Volopay virtual prepaid card. This makes accounting simpler by allowing the platform to quickly classify your spending. Without the hassle of further data entering, categories will appear in your ledger.

Experience seamless transactions with business virtual cards

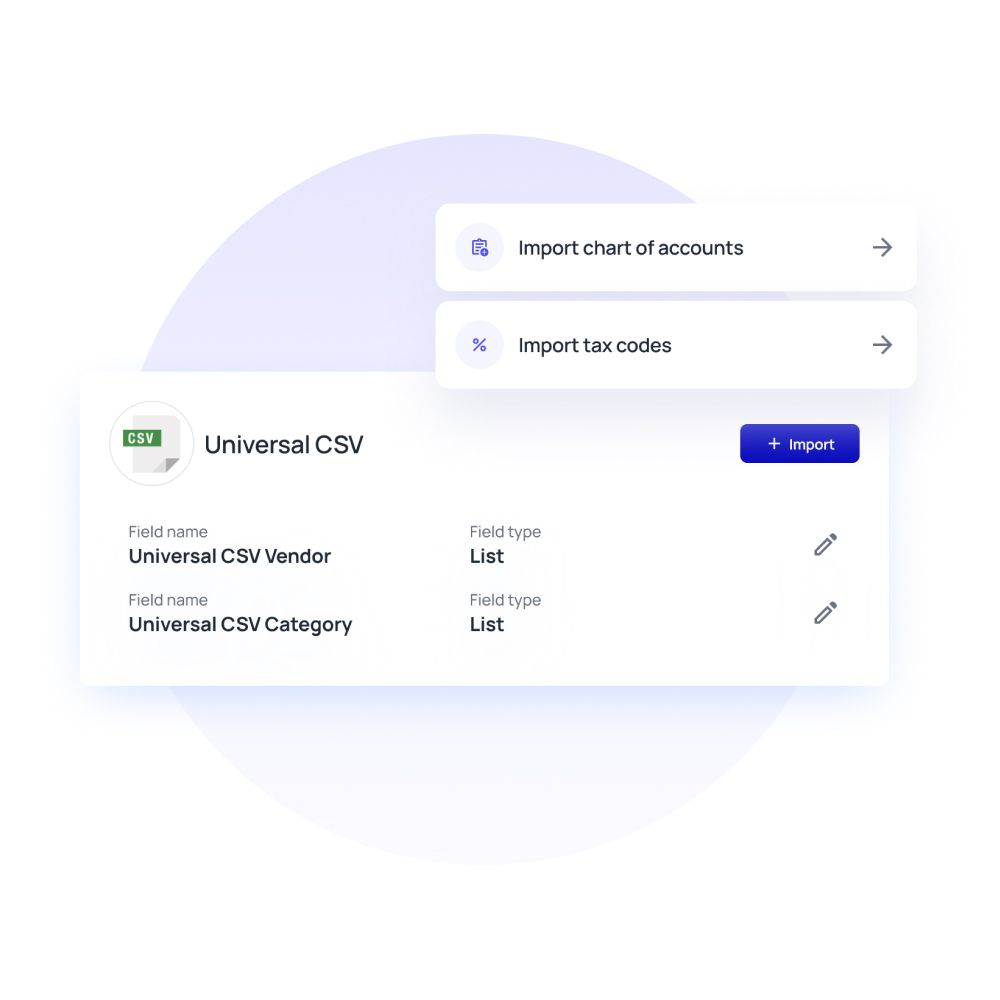

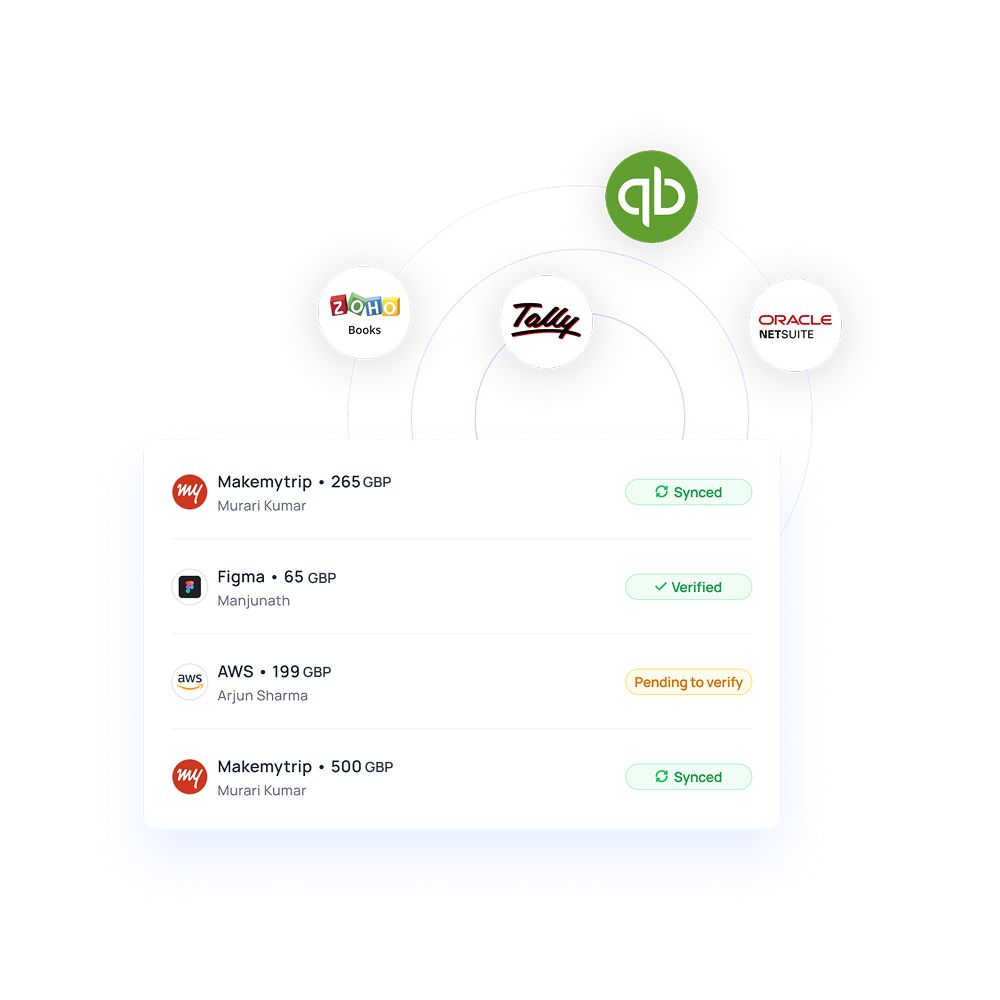

Seamless integration with accounting systems

Avoid wasting time on manual reconciliations and data entry. Volopay offers integrations with a number of popular accounting systems such as Xero, Quickbooks, and many more.

Setting up accounting integration via the Volopay interface only requires a few clicks. Once your accounting system has been integrated, direct sync of your virtual prepaid card expenses will solve all the card accounting hassle.

Improved security for secure transactions

Instead than depending on cash that could be misplaced, bank transfers that require reimbursement, or card sharing that complicates expenditure reporting, you can also use virtual prepaid cards for one-time payments. Additionally, using secure, one-time virtual cards prevents card theft and stops illegal transactions.

Be assured of the safety of your funds. Volopay has industry-standard certifications and security measures, preventing data breaches and stolen information. Every transaction is made safely through Volopay virtual cards.

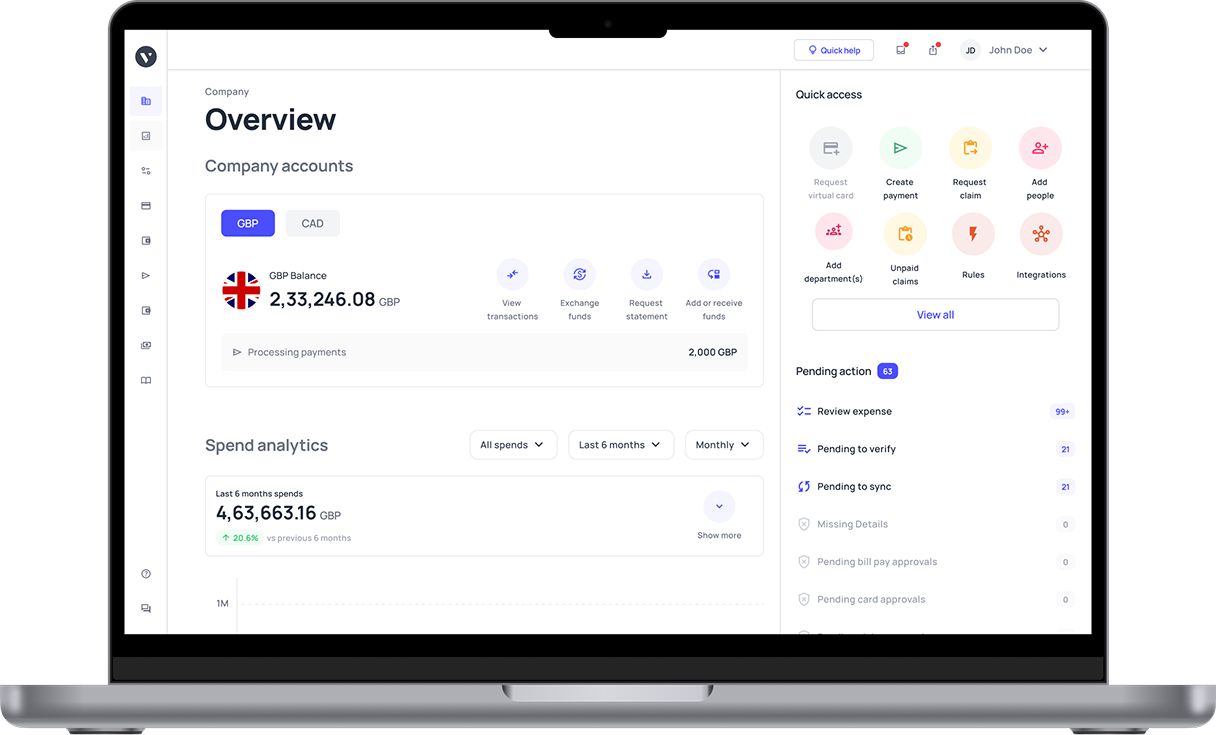

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Volopay: Virtual cards for various industries

Volopay’s virtual prepaid card offers startups an agile solution for managing expenses with real-time tracking.

Startups can quickly issue virtual cards to team members, allowing them to efficiently scale their operations while maintaining complete control over their budget.

Small businesses benefit from Volopay’s virtual card, which streamlines expense management and provides transparency.

The ability to easily set customizable spending limits ensures that small businesses can operate efficiently while successfully avoiding unnecessary overspending.

For large enterprises, Volopay’s virtual prepaid cards offer advanced features like multi-level approval workflows, spend analytics, and customizable restrictions.

This helps to streamline and manage complex financial operations seamlessly and securely, leading to improved operational efficiency.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Why opt for Volopay virtual cards?

Easy card creation

With its user-friendly, intuitive platform, Volopay's virtual prepaid card facilitates rapid and easy card creation, allowing users immediate access to a digital card without the need for physical issuance.

No hidden charges

By providing a no-hidden-fee structure—that is, you only pay for the precise amount you use, with no additional costs or surprises—Volopay's virtual card guarantees complete financial transparency.

Unlimited card issuance

Enjoy the flexibility of issuing an instant virtual card for any team member or department without limitations, ensuring everyone has access to essential business funds whenever needed.

Individual card allocation

Volopay’s virtual prepaid card can be easily assigned to individual employees, allowing you to track and manage personal spending for each team member in real time with complete visibility.

Department allocation

Assign virtual cards to departments so that each team has the money they need and can have complete control over their spending caps and expense monitoring.

Compliance and security

All of your transactions are safe and secure thanks to Volopay's virtual cards' advanced compliance and security features, which include robust encryption and proactive fraud prevention measures.

Monitor employee spending

With Volopay's real-time monitoring capabilities, you can easily keep tabs on employee spending, guaranteeing total transparency and successfully preventing overspending on each virtual prepaid card that is provided to your whole team.

Vendor controls

To properly manage budgets, set unique spending caps and comprehensive restrictions on your virtual prepaid card for every single vendor. This will help you keep strict control over supplier expenses and recurring payments.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Subscription management

Managing multiple subscriptions can be tough to manage and keep track of. With Volopay’s corporate virtual cards, this doesn’t have to be the case for your business.

Generate unique virtual cards and assign each card a subscription. You can set up recurring payments and expiration dates as needed.

Real-time visibility

You may view all of your costs in real time on the Volopay card management dashboard. As soon as you make a purchase using your virtual card, your expenses will be automatically updated and recorded.

It is always possible to see how much you have spent on each virtual card and how much of your limit is still available.

Multi level approvals

Set multi-level approvals for requests to change limits and cards. Only after receiving approval will employees be able to create new cards or change their current card limitations.

The Volopay platform allows for the submission of each request. When a request is submitted and requires approval, approvers will be alerted automatically.

Accounting automation

Use Volopay to automatically categorize your expenses. Your business's bookkeeping can be made easier by automatically classifying each card expense you make.

To achieve more efficient financial procedures, integrate your accounting software with your company virtual cards. The integration may be set up with just a few clicks. Discover how simple direct sync is!

Bring Volopay to your business

Get started now

FAQs on virtual cards

Using the Volopay platform to create a virtual card merely requires a few minutes and a few clicks. Entering the cardholder's information and allocating a limit is all that is required.

You can examine and control all of your card spending using Volopay's card management dashboard. Gain access to built-in spend management tools including automatic spending updates, freeze and block buttons, and adjustable limitations, among many more.

Onboard with us to begin using corporate virtual cards. The Volopay platform will make it simple for you to create and activate your cards as long as your firm is registered.

No. Corporate virtual cards have no effect on your personal credit score.

Yes, Volopay enables you to provide immediate access to funds without waiting for a real card by enabling you to produce an instant virtual card for any pressing business needs.

Yes, businesses can use Volopay's virtual prepaid card to make purchases anywhere in the world and take advantage of real-time currency tracking.

The platform makes it easy and quick to deactivate a Volopay virtual card, guaranteeing that any unused or unnecessary cards are immediately terminated.

Indeed, Volopay's virtual cards are perfect for recurring payments since they let companies automate routine tasks while keeping tabs on vendor spending caps.

With real-time analytics, thorough expenditure reports, and customized insights to efficiently track spending, Volopay offers thorough reporting for all virtual card transactions.

Yes, Volopay provides a fully functional mobile app that allows businesses to manage virtual cards on the go, offering full control over card issuance, monitoring, and spending limits.