Prepaid business cards for simplified expense management

Say goodbye to poor spending visibility and out-of-pocket expenses. To make business expenses simpler, quicker, and safer, provide your employees with prepaid business debit cards or corporate prepaid cards.

Spend more wisely with customizable limits and built-in controls. Assign prepaid business cards to your employees after loading them according to your budgets. Control your spending, online buying, purchasing, and a lot more.

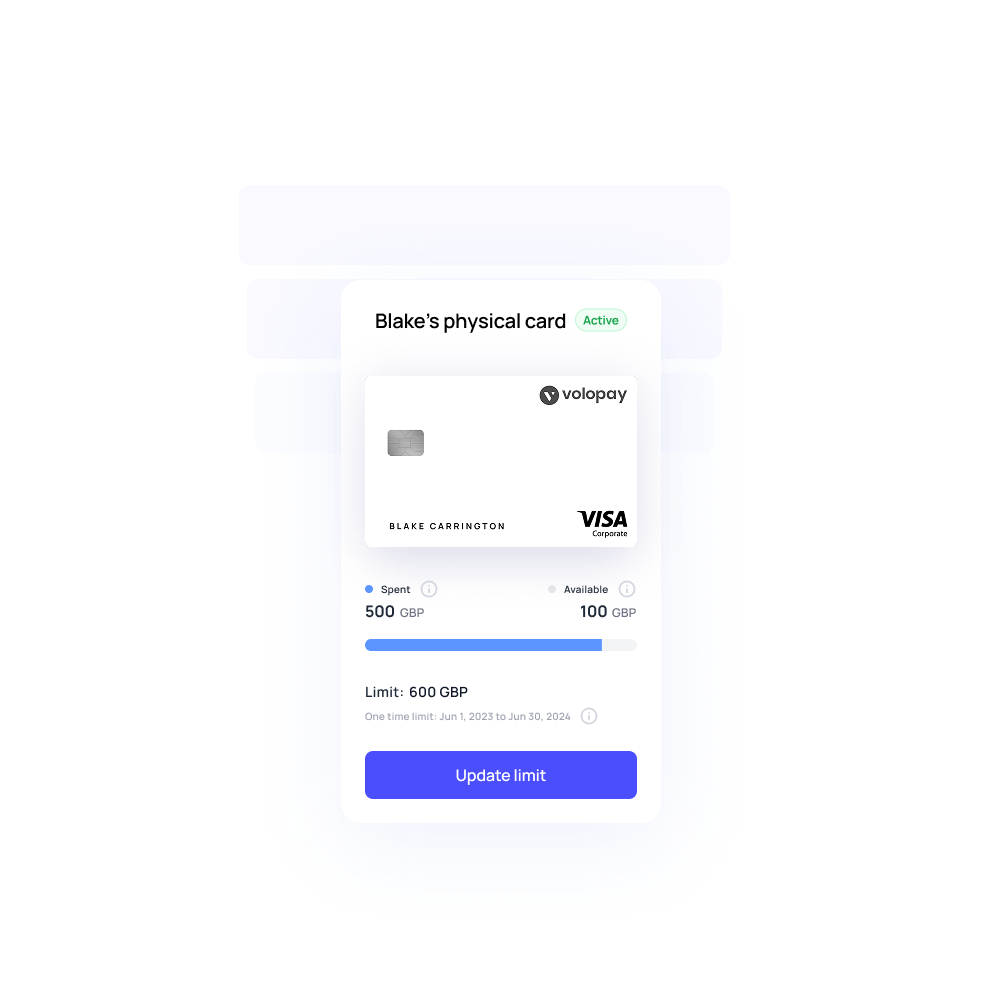

Business prepaid cards with built-in spend limits

To prevent overspending, top up your business prepaid cards or prepaid business debit cards as needed. Every employee-issued physical prepaid card or employee debit card has a unique spending limit. Spending more over the budgeted amount will be automatically prevented.

Put custom rules in place to only accept payments to particular vendors or to block particular businesses. You may also choose whether or not a card's spend limitations can be automatically updated, as well as how frequently, using the sophisticated management settings for prepaid business cards.

Easy-to-load and use prepaid business cards

Volopay's business prepaid cards or prepaid business debit cards are hassle-free. You may load your cards online with ease thanks to a card management interface that is accessible from any location with internet access. You don't have to visit the bank!

It's simple to spend money on company goods and purchases. When a purchase can be completed with a single swipe of the company prepaid card, employees won't have to pay out of pocket.

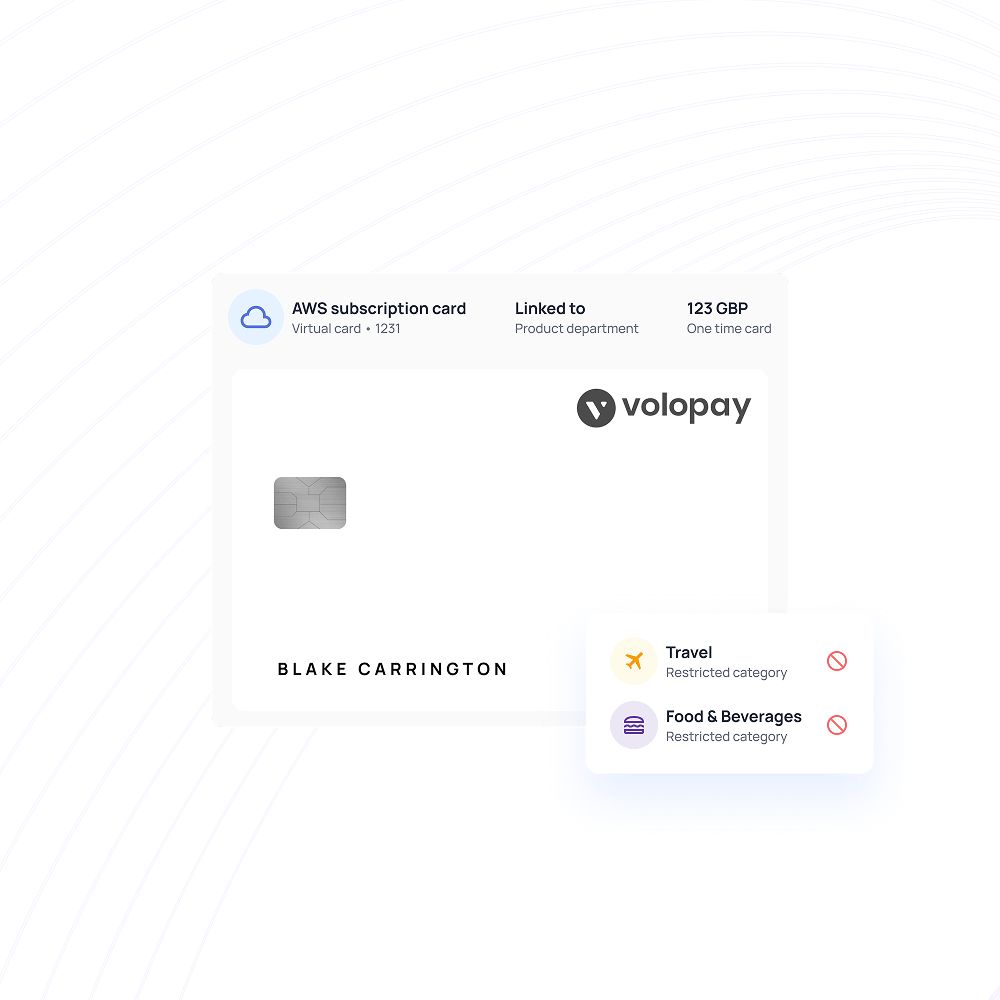

Create vendor-specific prepaid business cards

You don't have to utilize a single employee debit card for expenses from several departments, unlike a personal credit card used for business. To better manage your vendors, Volopay enables you to create several business prepaid cards or prepaid business debit cards.

It is easier to keep track of your vendor payments when you utilize separate prepaid business cards for different merchants. Use the business prepaid cards from Volopay to streamline your payments, improve visibility, and maintain transparency.

Get the perfect prepaid business cards for your business!

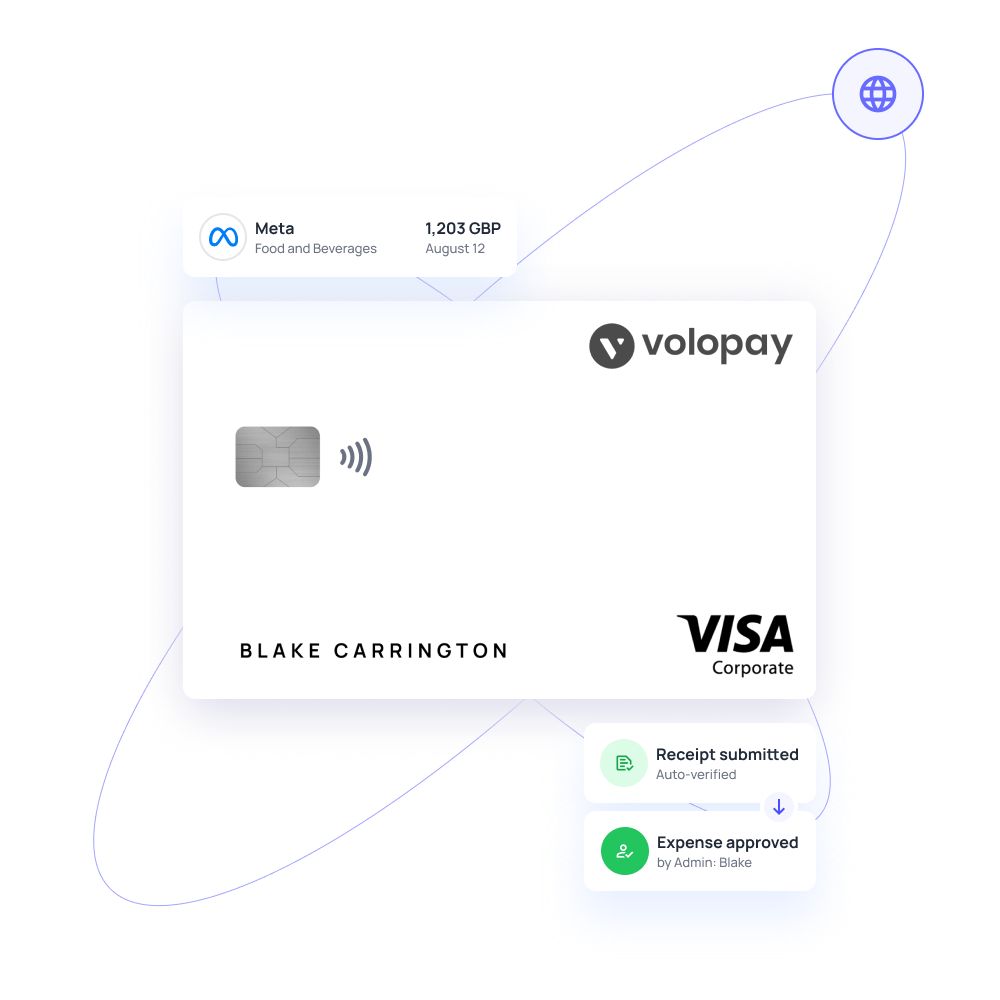

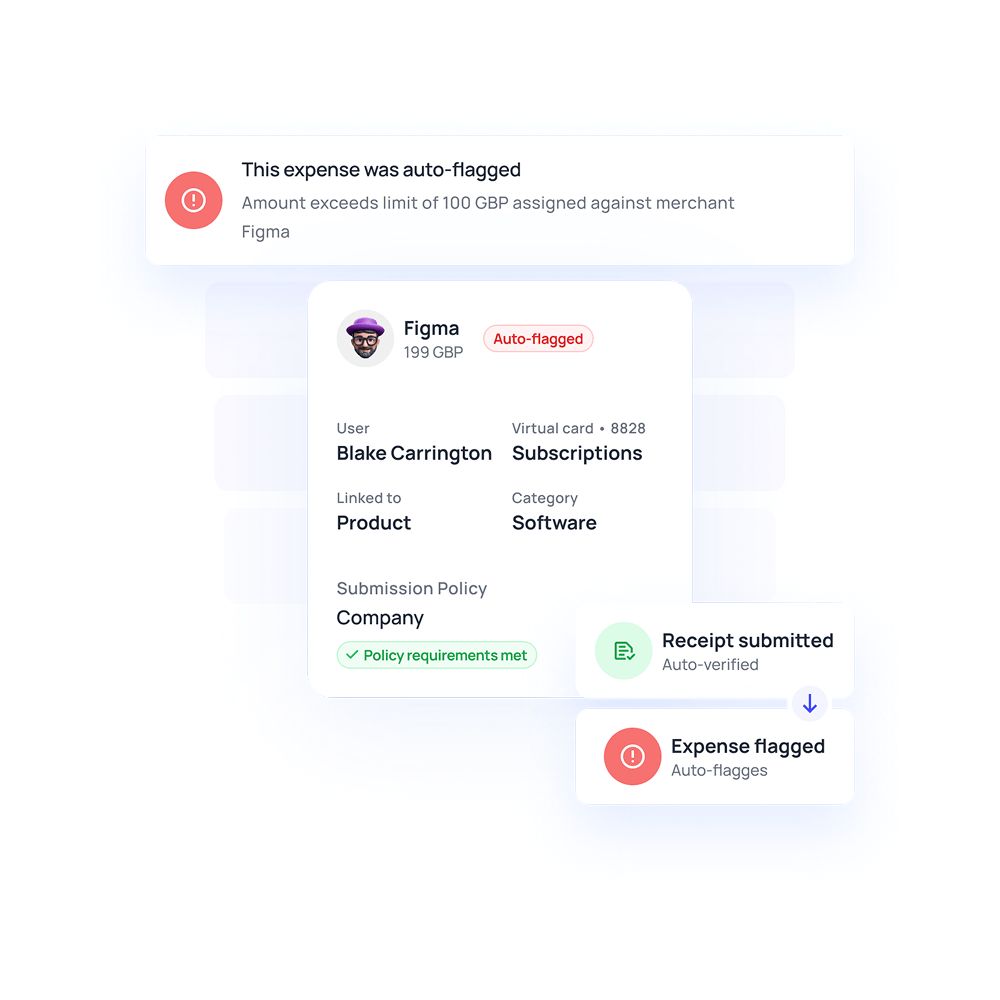

Automated expense reporting

Every transaction you make with your business prepaid cards will be automatically recorded, so you don't have to worry about missing any expenses. Both you and your employyes can benefit from automatic updates on the Volopay dashboard.

Employees will be reminded to fill out the cost record with extra details for each transaction made with a prepaid business debit card or employee debit card. Use our mobile application to personalize needed fields and enable employees to submit expenditure reports from any location.

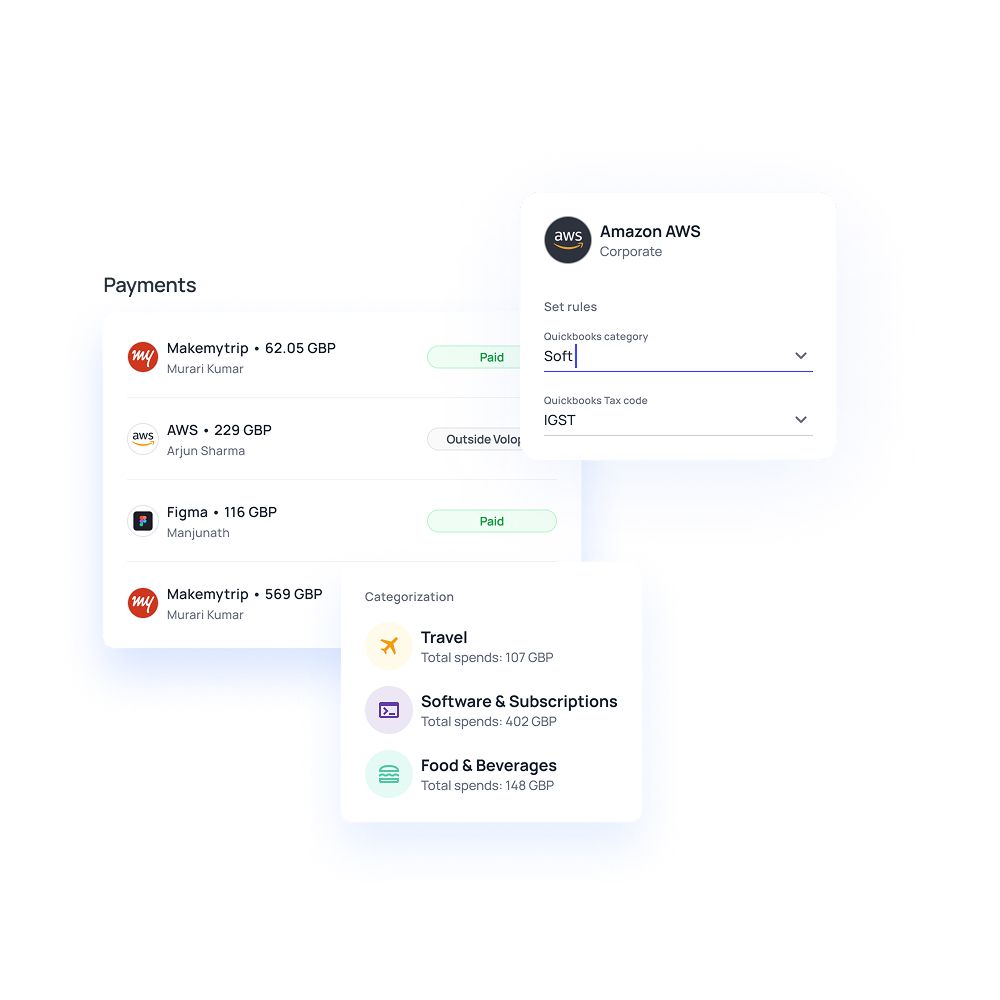

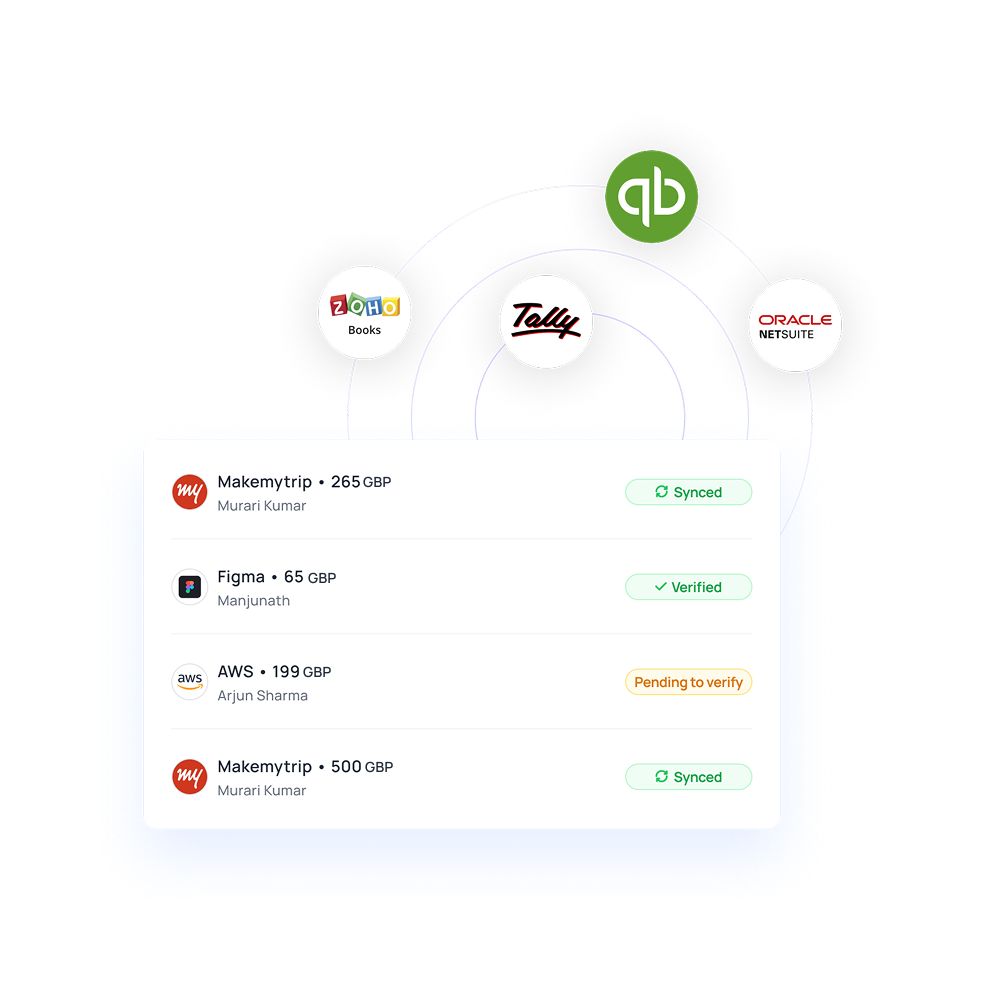

Seamless accounting system integration

Accounting for card expenses doesn't have to be challenging or time-consuming. Use Volopay to link your business prepaid cards or prepaid business debit card to your current accounting systems. This makes it possible for your data to precisely and automatically sync across several platforms.

To enable you to use the direct sync option for a more efficient financial workflow, our team will be pleased to assist you in setting up your integrations.

Improved security and fraud prevention

Avoid carrying a lot of cash when conducting business. You can load business prepaid cards as needed. Because every transaction involving your prepaid business debit card is immediately recorded on the ledger, it also facilitates the prevention of fraud and theft.

Your data is secure with Volopay thanks to our industry-standard certifications and security protocols. The freeze and block capabilities provide further fraud protection in the unfortunate event that an employee debit card is misplaced, stolen, or compromised.

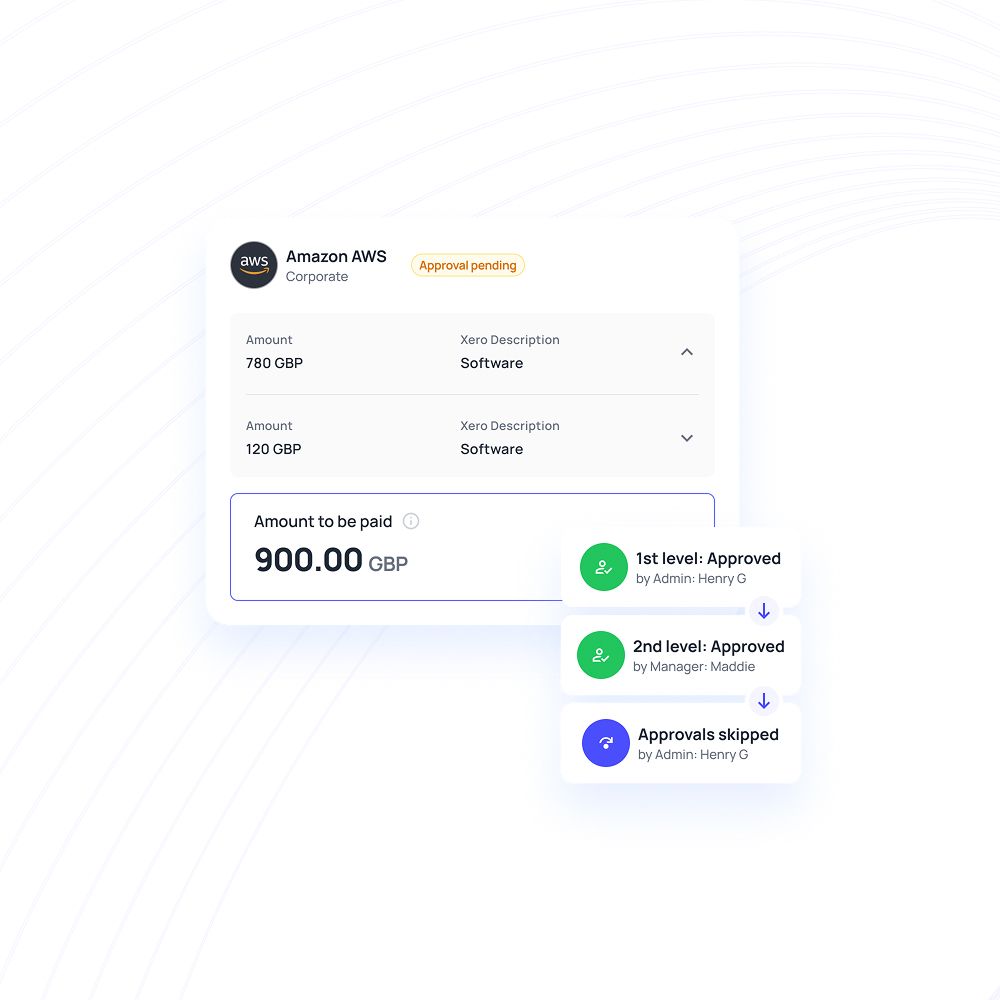

Multi-level approval workflows to manage expenses

You can implement stricter spend controls by setting pre-approved spending limitations with business prepaid cards. You can either ban particular merchants from the platform or restrict which merchants can use your prepaid business debit card to make payments.

With Volopay's employee debit cards, employees can submit expense reports for every transaction, and the platform's comment section allows approvers to clarify specifics. Approvers automatically receive reports to evaluate.

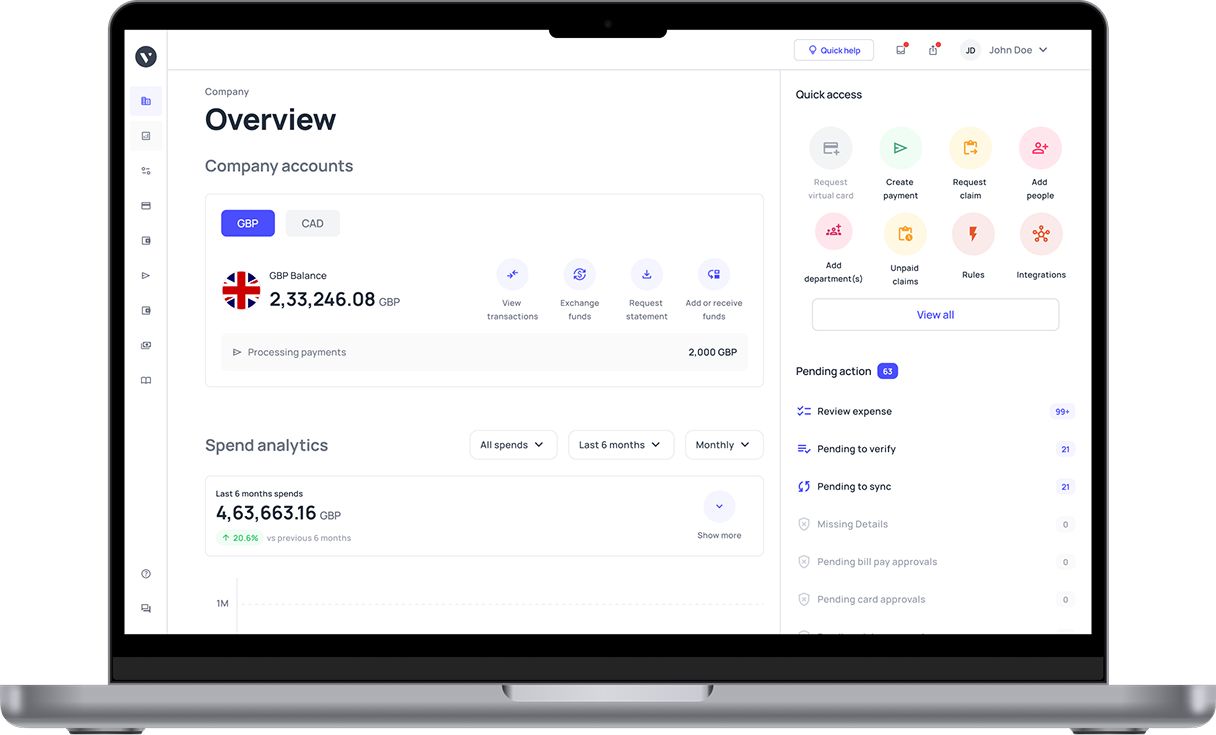

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Varied applications for prepaid business cards

Travel expenses

Empower your employees with business prepaid cards for seamless business travel management. Say goodbye to out-of-pocket expenses—equip your team with dedicated prepaid business debit cards for travel costs.

With pre-set budgets, employees can confidently cover flights, accommodation, car rentals, and other travel-related expenses while staying within approved limits, ensuring smooth and controlled spending.

Employee expenses

Out-of-pocket expenses create headaches for both employees and finance teams. Simplify the process by providing employees with business prepaid cards to handle costs like meals, entertainment, and other work-related expenses.

By loading cards with pre-approved spending limits, you can easily manage and monitor expenditures, keeping budgets in check and reducing administrative burdens.

Petty cash

Petty cash might seem convenient, but tracking how company funds are spent can quickly become a challenge.

Switch to individual physical business prepaid cards for your employees to streamline small transactions. This approach enhances transparency, giving you clear insights into every pound spent and ensuring accountability across the board.

Purchasing and procurement

Make procuring materials and services effortless with business prepaid cards. Your procurement team can establish budgets and enforce them by loading prepaid cards with the allocated amounts, ensuring spending stays on track.

Card payments are fast and efficient, keeping business operations running smoothly without delays.

Online purchases

While you can’t swipe a card online, entering your business prepaid card details makes transactions quick and secure, often completed in just a couple of minutes.

From subscription services to e-commerce platforms and digital marketing ad wallets, cards are typically the preferred payment method, offering convenience and reliability for online business needs.

One-time purchases

Forget the hassle of cash payments or bank transfers for one-off vendor or contractor purchases—use your business prepaid card for fast, straightforward transactions.

No need to collect sensitive bank details; simply pay through a vendor portal using your card, making the process efficient and secure.

Your expertise, your card, your benefits: Tailored for every professional

CFOs

Volopay’s business prepaid cards give CFOs unparalleled real-time oversight of company spending, strengthening financial control.

Automated expense reporting eliminates time-consuming manual reconciliation, freeing up resources for strategic tasks.

CFOs can also set tailored spending limits on each prepaid debit card, ensuring precise cash flow management and budget adherence.

CTOs

Business prepaid cards provide CTOs with centralised control over software subscriptions and tech-related purchases.

Instant transaction alerts keep tabs on team spending for critical IT tools and services.

With Volopay’s flexible spending limits, CTOs can adapt budgets to meet evolving project demands, maintaining agility in dynamic tech environments.

Accountants

Prepaid business debit cards integrate effortlessly with accounting software, automating data entry and reducing manual workloads.

Real-time expense tracking ensures financial records are always accurate and up to date, minimising errors.

Streamlined reconciliation through prepaid cards speeds up financial reporting, boosting overall efficiency for accounting teams.

Marketing managers

Volopay’s prepaid business cards make managing marketing budgets, vendor payments, and ad expenses a breeze.

Real-time spending insights allow for quick tweaks to optimise campaign budgets.

Marketing managers can assign individual debit cards to team members, ensuring tight control over campaign-specific spending while aligning with broader marketing goals.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Volopay prepaid cards: Powering growth from startups to enterprises

Volopay’s prepaid business cards empower startups with real-time spending visibility and automated expense tracking.

Flexible spending limits and instant card issuance help startups maintain strict control over cash flow, allowing them to focus on scaling operations and seizing growth opportunities without financial distractions.

Small businesses thrive with Volopay’s prepaid debit cards, which simplify everyday expense management.

Streamlined approval processes and seamless accounting integrations reduce manual tasks, boosting operational efficiency.

This allows small business owners to prioritise core activities while keeping finances organised and under control.

For large enterprises, Volopay’s business prepaid cards offer sophisticated spend controls and multi-level approval workflows.

Advanced analytics and customised reporting tools simplify complex financial operations, enabling better decision-making.

These features help enterprises optimise budget allocation and enhance overall financial efficiency.

Recognized as a leader in financial management

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our business prepaid cards

Volopay combines approvals, corporate cards, bill payments, expense reimbursements and accounting automation into one single platform.

Real-time expense reporting

Design your expense reporting system so that you get to know where, when, and why of every spend.

Multi-level approvals

Rewrite your company's spending policy and establish precise approval workflows to handle staff spending, payments, and fund requests.

Accounting automation

Safeguard your accounting structure—from card swipe to closed books—with world's fastest accounting integrations with direct integrations and real-time sync.

Bring Volopay to your business

Get started now

FAQs on prepaid cards

Absolutely, you can use your business prepaid card just like a debit card to withdraw cash from ATMs whenever you need funds.

If your company is a registered limited liability business, signing up for the Volopay platform is straightforward. You’ll just need to submit a few documents, and after a brief approval process, you’re ready to go. Once onboarded, ordering your prepaid cards is quick and simple.

Your data’s safety is our top priority. Volopay uses top-tier, industry-standard security measures and certifications to keep your information protected. If a card is ever lost or compromised, you can instantly freeze or block it to stop any unauthorised use.

We pride ourselves on transparency. There are no hidden charges with Volopay prepaid cards, and we’ll always clearly communicate any potential fees well in advance.

Yes, Volopay prepaid cards work worldwide, making international purchases and transactions a breeze while providing real-time tracking of expenses across different currencies.

Definitely! With Volopay’s mobile app, you can manage your prepaid cards on the move, from tracking spending to topping up funds, all with full functionality at your fingertips.

Yes, you can connect and oversee multiple prepaid debit cards within a single Volopay account, making it easy to manage expenses for your entire team or department.

Volopay’s prepaid cards are designed for direct business spending rather than reimbursements, offering real-time control and tracking of transactions for work-related expenses.

Topping up your prepaid debit card is hassle-free via the Volopay platform. You can add funds manually or set up automatic transfers from linked accounts as needed.

Volopay provides round-the-clock customer support, along with dedicated account managers and a wealth of online resources to help troubleshoot issues and ensure smooth operations.