Smart reloadable prepaid cards built for UK teams

Managing business expenses in the UK can be a tangle of receipts, reimbursements, and compliance worries. Reloadable prepaid cards offer a smarter, simpler way to control your company’s spending.

Volopay’s reloadable prepaid cards offer agility, transparency, and compliance—unlike clunky traditional banking. Whether you're a startup, scaling team, or enterprise managing local and global spend, these cards streamline payments, reduce risk, and let your team focus on growth.

What are reloadable prepaid cards for UK businesses?

Business reloadable prepaid cards explained

Reloadable prepaid cards are innovative payment tools preloaded with funds, not linked to traditional bank accounts like debit cards or borrowing like credit cards.

In the UK, reloadable prepaid cards for business help companies manage expenses securely and efficiently, offering exceptional control and flexibility for purchases like travel expenses, subscriptions, or supplier payments without any debt risk whatsoever for modern businesses.

How they function for modern UK teams

You fund business reloadable prepaid cards, manually or automatically, and issue them instantly to employees across different teams.

Real-time dashboards show every transaction clearly and transparently, while custom controls let you set specific spending limits by team, ensuring complete compliance and visibility for UK operations using reloadable prepaid cards effectively and efficiently.

Prepaid vs debit vs credit: which is right for your business?

Business reloadable prepaid cards limit spending to preloaded amounts, avoiding debt and interest, unlike credit cards. Traditional debit cards draw directly from your business account, risking overdrafts.

Reloadable prepaid cards offer superior control, no credit checks, and faster approvals, making them ideal for startups and established enterprises needing risk-free, compliant spending solutions for their operations.

Why more UK businesses are switching to reloadable prepaid cards

Outdated expense processes waste time

Chasing reimbursements or sharing a single company card creates absolute chaos for UK finance teams daily.

Reloadable prepaid cards eliminate unnecessary delays, letting employees pay directly while finance teams track expenses instantly and accurately, saving countless hours on admin work and streamlining business operations for significantly better productivity.

Limited spend control risks compliance

Traditional debit or credit cards often lack granular controls, risking non-compliant spending and regulatory issues.

Business reloadable prepaid cards let you enforce strict policies with custom limits and merchant restrictions effectively, ensuring HMRC compliance and reducing audit stress for UK businesses operating in highly regulated environments with complex requirements.

It reduces fraud and overspending

With spending capped at preloaded amounts, reloadable prepaid cards minimize fraud risk effectively and efficiently.

Advanced features like instant card freezing and merchant-specific blocks protect your funds completely, offering complete peace of mind for UK businesses while maintaining strict financial control over employee spending and operational expenses.

Key features of Volopay's reloadable prepaid cards

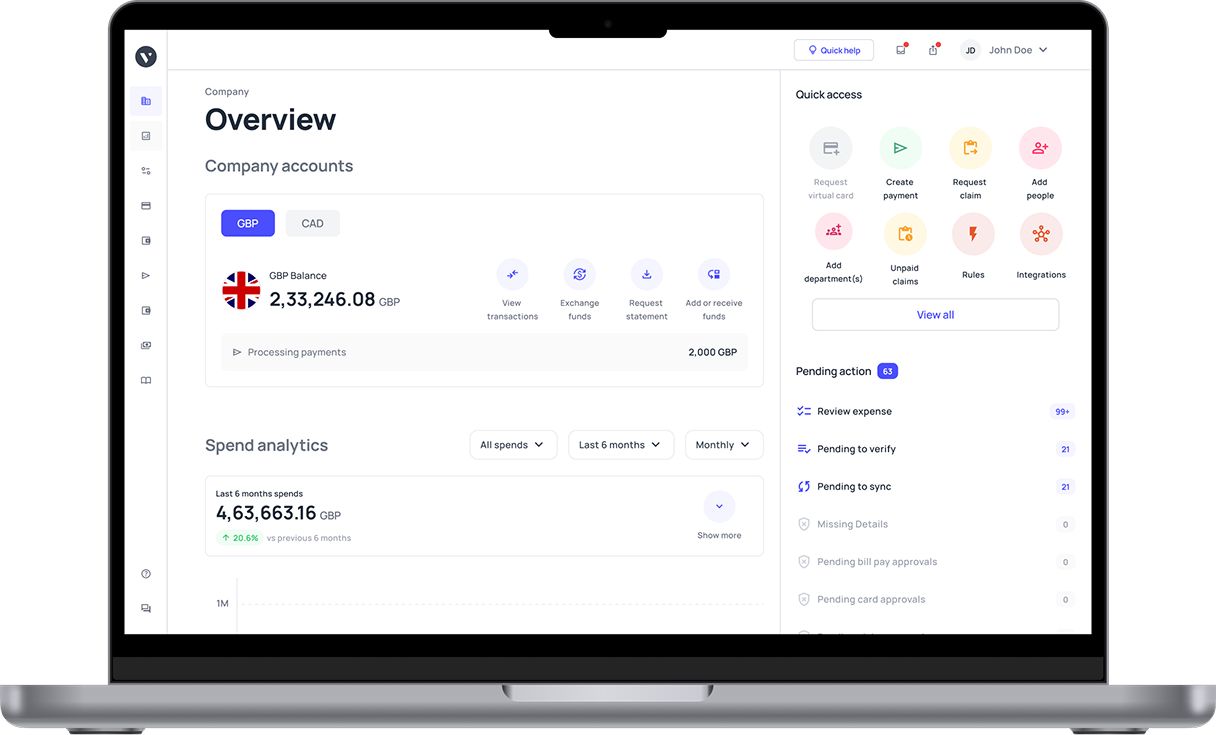

Real-time visibility into every pound spent

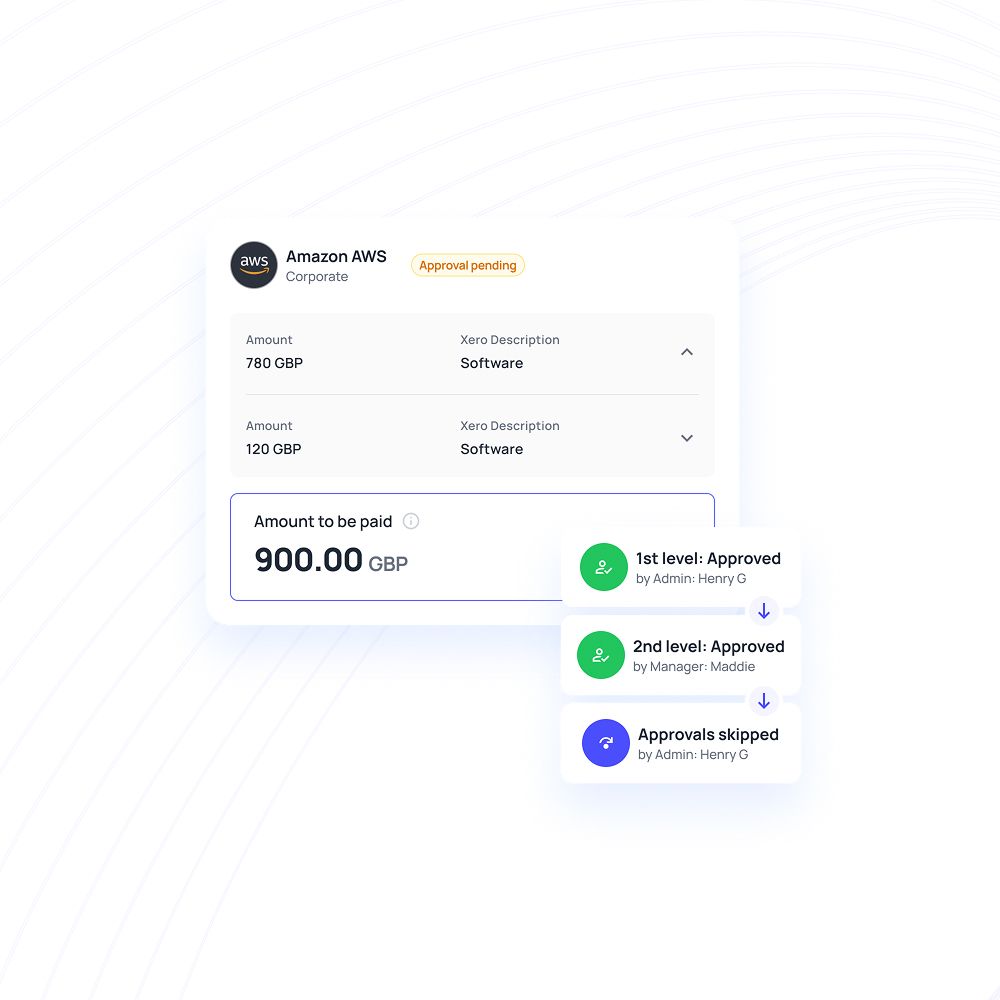

Volopay's comprehensive dashboards seamlessly provide live transaction updates, instant alerts, and audit-ready trails for business reloadable prepaid cards.

UK finance teams can monitor spending by employee, department, or project effectively, ensuring complete transparency and compliance with every purchase made through the advanced platform for better financial management.

Top-up and issue instantly, with zero friction

Fund reloadable prepaid cards manually or schedule automatic top-ups via the Volopay platform.

Issue physical or virtual cards in minutes—no waiting for bank approvals or deliveries, perfect for fast-paced UK businesses requiring immediate payment solutions for operational needs.

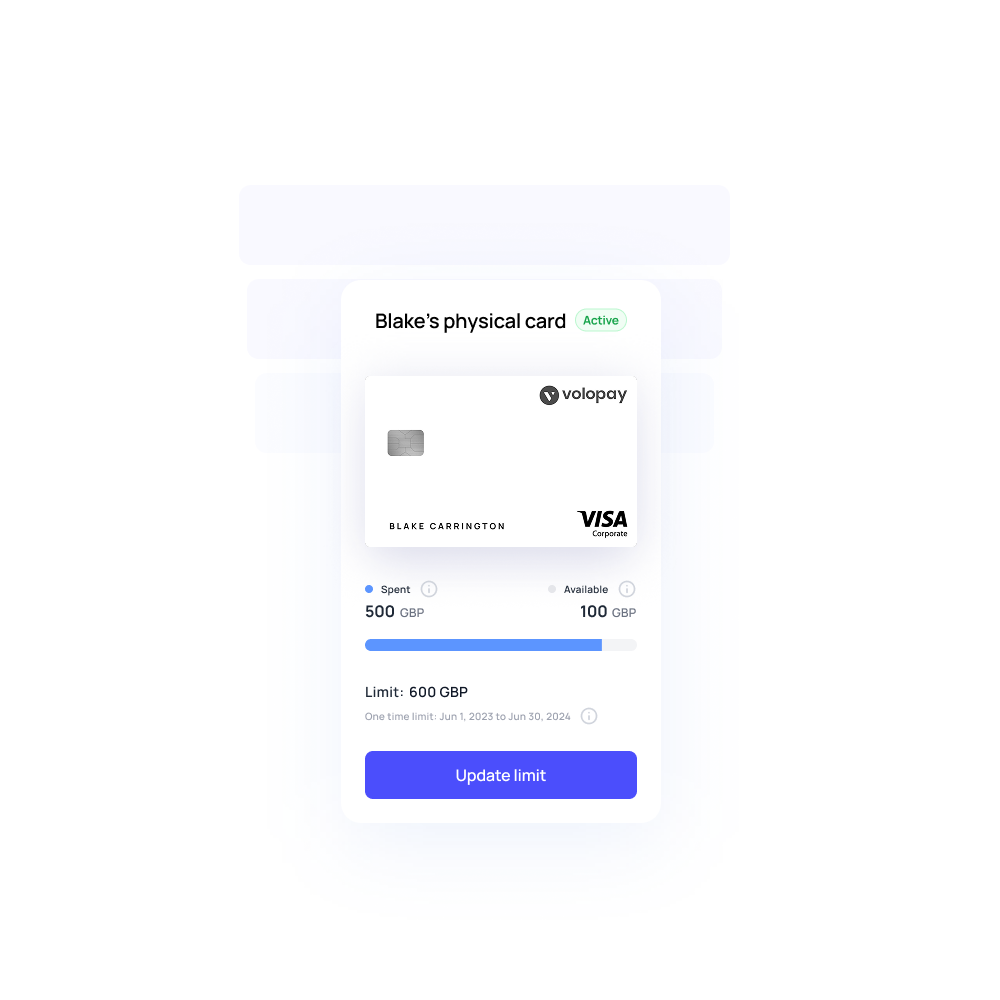

Custom limits, MCC blocks, and expiry settings

Set spending caps, restrict merchant categories (e.g., block travel or retail), and define card expiry dates on reloadable prepaid cards effectively.

These advanced controls ensure your team spends only where and when you allow, preventing misuse while maintaining strict financial governance and comprehensive control over business expenses.

Choose between physical and virtual cards

Safely use Volopay's virtual reloadable prepaid cards for secure online payments like SaaS tools or ads.

Physical cards, with EMV chips, are ideal for travel, fuel, or in-person vendor payments, giving you complete flexibility when managing different business expenses and payment requirements for various operational needs.

Control and compliance, built in

Prevent misuse by restricting reloadable prepaid cards to specific vendors, amounts, or active hours effectively.

For example, limit a card to office supplies or block usage outside business hours, ensuring UK compliance.

These controls help businesses maintain strict financial governance while empowering employees with necessary spending flexibility for operational requirements.

Volopay generates HMRC-compliant digital trails for every transaction made with business reloadable prepaid cards.

Exportable reports simplify VAT filing and audits, reducing admin stress and ensuring your records are always inspection-ready.

This comprehensive documentation supports UK businesses in maintaining regulatory compliance while streamlining financial processes for better efficiency.

Assign roles and permissions by team, function, or seniority using reloadable prepaid cards for business operations.

Marketing can have higher limits for ads, while operations stick to supplier payments, streamlining workflows for UK businesses.

This departmental control ensures appropriate spending authority while maintaining visibility and accountability across all business functions.

Optimize budgeting and cash flow with Volopay’s reloadable prepaid cards

Budget smarter, not harder

Track spending live by category, project, or department with Volopay's analytics using reloadable prepaid cards. See exactly where your pounds go, enabling precise budgeting without manual spreadsheets or guesswork. This real-time visibility helps UK businesses make informed financial decisions while maintaining control over operational expenses and strategic investments.

Eliminate credit risk for your business

Business reloadable prepaid cards only spend what's loaded, keeping your UK business debt-free permanently. Unlike credit cards, there's no risk of interest or overspending, protecting your cash flow effectively. This approach provides financial security while maintaining spending flexibility, making it ideal for businesses seeking controlled growth without financial risks.

Improve financial forecasting

Real-time spend data from reloadable prepaid cards helps you predict cash flow and refine budgets accurately. Spot trends, adjust allocations, and plan confidently, whether you're a startup or an enterprise. This data-driven approach enables better financial planning while reducing uncertainty in business operations and strategic decision-making processes.

Features that supercharge your finance stack

Integrates with popular accounting platforms

Volopay syncs transactions directly with accounting platforms, using reloadable prepaid cards for business. This automates reconciliation, ensures clean books, and speeds up month-end closes for UK businesses significantly. The seamless integration eliminates manual data entry while maintaining accurate financial records for improved operational efficiency.

Auto-tag expenses and match receipts

Volopay's OCR and AI auto-categorize transactions and match receipts from business reloadable prepaid cards, reducing manual work substantially. Employees can upload receipts via the mobile app, streamlining expense reporting processes.

This automation saves time while ensuring accurate expense tracking and compliance with company policies for better financial management.

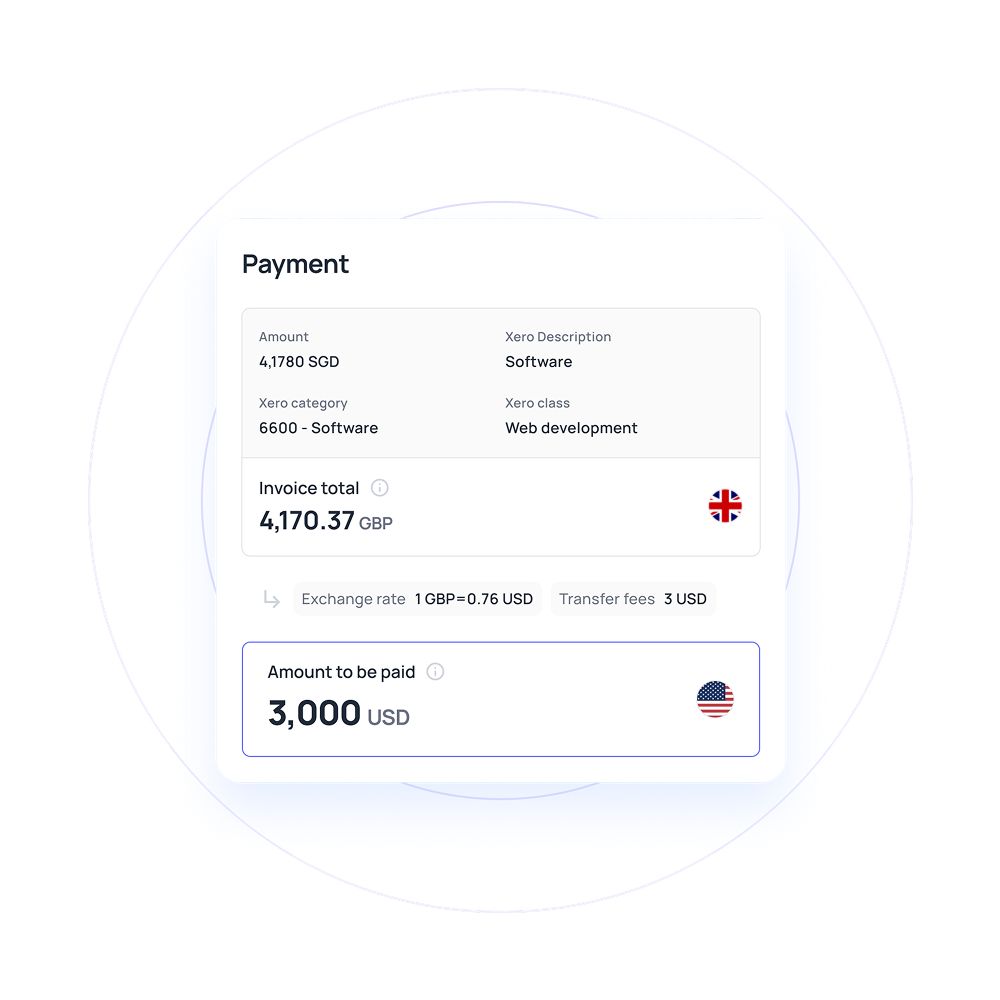

Multi-currency support for UK businesses abroad

Pay in GBP, EUR, USD, or other currencies without hefty FX fees using reloadable prepaid cards. Volopay's real-time exchange rates ensure cost-effective international payments for UK businesses with global operations.

This feature eliminates currency conversion complications while providing transparent pricing for international transactions and supplier payments.

Where business reloadable prepaid cards make the biggest impact

1. Travel, fuel and mobile teams

Equip mobile teams with reloadable prepaid cards for business to cover travel and fuel without personal spending or reimbursement delays. Track per diems easily, simplifying expense management for UK businesses with field operations. This solution eliminates cash advances while providing real-time visibility into travel expenses and operational costs.

2. Recurring SaaS and supplier payments

Issue dedicated virtual business reloadable prepaid cards for SaaS subscriptions or supplier payments efficiently. Avoid missed renewals and insecure shared logins while keeping budgets clear and controlled. This approach ensures continuous service delivery while maintaining security and financial control over recurring business expenses and operational subscriptions.

3. Marketing budgets and client projects

Assign reloadable prepaid cards per campaign, client, or freelancer with specific spending limits for better control. Track marketing spend like ads or events in real time, ensuring clarity and budget adherence. This granular approach enables precise campaign management while maintaining visibility into marketing investments and return on advertising spend.

Volopay: The scalable prepaid solution for UK teams

All-in-one platform for expense control

Volopay combines budgeting, corporate card issuance, approvals, and reconciliation in one comprehensive platform for reloadable prepaid cards. Manage everything under a single login, reducing complexity for UK finance teams significantly.

This integrated approach with Volopay's corporate cards eliminates the need for multiple systems while providing complete visibility and control over business expenses and financial operations.

UK-based support, global scale

Access expert support tailored to UK regulations, with tools built for global transactions using business reloadable prepaid cards. Volopay ensures your business stays compliant while scaling internationally with confidence.

Our dedicated UK support team understands local requirements while providing solutions that work seamlessly across multiple countries and currencies for expanding businesses.

Built to scale with your company

Add users, cards, and limits as your team grows, using reloadable prepaid cards for business expansion. Volopay adapts to startups, SMEs, or enterprises, supporting your expansion without financial bottlenecks or system limitations.

The platform scales effortlessly with your business needs, ensuring consistent performance and functionality regardless of company size or complexity.

Smart permissions at every level

Set granular permissions for managers, employees, or departments using reloadable prepaid cards with intelligent controls. Approve or deny fund requests before spending, ensuring control at every level of your UK business operations.

This hierarchical approach maintains security while enabling efficient spending processes across all organizational levels and departments.

Fraud protection that keeps you secure

Volopay's EMV chip cards, two-factor authentication, and custom spending rules safeguard your funds using advanced business reloadable prepaid cards technology.

Freeze lost cards instantly via the app, protecting your business from fraud and unauthorized transactions. Multiple security layers ensure comprehensive protection while maintaining user convenience and operational efficiency.

How to get started with Volopay reloadable prepaid cards

Create a Volopay account online and issue physical or virtual reloadable prepaid cards without delays.

No bank visits or lengthy onboarding processes—just a few clicks to get started with your business payment solution.

The streamlined setup process gets your team operational quickly while maintaining security, control, and strict compliance standards throughout.

Configure budgets, spending rules, and team permissions via Volopay's platform using reloadable prepaid cards for business management.

No coding or IT support needed—just set it up to match your specific business needs and requirements.

The intuitive interface allows easy customization while maintaining professional-grade functionality and security features.

Move from slow reimbursements and shared cards to Volopay's real-time control using advanced business reloadable prepaid cards.

Streamline payments, boost compliance, and focus on growing your UK business with confidence.

This transformation eliminates administrative overhead while providing better financial visibility and control for sustainable business growth and operational efficiency.

Bring Volopay to your business

Get started now

FAQs about reloadable prepaid cards

Yes, Volopay lets you issue unlimited cards to employees, with custom limits and permissions per user, ensuring controlled spending across your UK team.

Top up cards manually or set automatic transfers via the Volopay platform. Funds are available instantly, streamlining expense management for your business.

Yes, Volopay cards are accepted globally, supporting multi-currency transactions with real-time exchange rates for seamless international payments.

Freeze the card instantly via the Volopay app to prevent misuse. Only preloaded funds are at risk, minimizing financial exposure for your business.

Yes, Volopay offers unlimited virtual cards for secure online payments like SaaS subscriptions, ensuring no shared logins and easy budget tracking.