Streamline your UK business travel with prepaid travel cards

Managing business travel expenses has long been a headache for UK companies. Traditional methods involving cash advances, personal credit cards, and lengthy reimbursement processes create administrative burdens, compliance risks, and frustrated employees.

Enter prepaid travel cards a game-changing solution that's transforming how your organization handles corporate travel spending. These innovative financial tools offer real-time control, enhanced visibility, and streamlined expense management, making business travel more efficient and cost-effective than ever before.

What is a prepaid travel card?

A prepaid travel card is a payment solution designed for UK businesses to manage domestic and international travel expenses efficiently.

These cards allow finance teams to preload funds and set spending limits, providing employees with secure, convenient payment options across global destinations.

Unlike traditional credit cards, prepaid travel cards offer superior expense control and real-time spending visibility for business travel management.

Understanding prepaid travel cards in the UK's payment landscape

How prepaid travel cards work?

Business travel prepaid cards operate on a simple preloaded model where funds are added to the card before use. This eliminates the need for credit checks or personal guarantees, making them accessible to all employees regardless of credit history. Finance teams can instantly load funds, set spending limits, and monitor transactions in real-time, ensuring complete control over travel expenditure.

Suitable for UK and global travel

These cards excel in multi-currency environments, automatically converting transactions at competitive exchange rates for overseas spending. They're accepted at millions of locations worldwide, including hotels, restaurants, transport services, and ATMs.

The cards seamlessly handle both domestic UK transactions and international purchases, making them ideal for businesses with diverse travel requirements across multiple countries and currencies.

Why UK companies should use prepaid travel cards for work trips

If you're managing business travel expenses, you've likely wrestled with the inefficiencies of traditional payment methods. Reimbursement processes drag on for weeks, company credit cards create security risks, and tracking expenses becomes a nightmare.

A prepaid travel card for business offers a streamlined alternative that addresses these pain points while delivering significant operational and financial benefits.

Unlike traditional expense management methods, business prepaid travel cards provide immediate budget control, eliminate reimbursement delays, and offer real-time spending visibility.

These cards transform how you manage travel expenses, from reducing administrative burden to improving employee satisfaction. By switching to prepaid travel cards, you can create a more efficient, transparent, and cost-effective approach to business travel management.

Allocate budgets before travel

Setting predetermined spending limits becomes seamless when you load specific amounts onto individual cards before each trip. This approach eliminates budget overruns and creates complete transparency for both employees and finance teams. You'll know exactly how much each traveler can spend, removing the guesswork from expense planning and ensuring projects stay within financial boundaries.

Eliminate reimbursement hassles

Your employees no longer need to use personal funds for business expenses and wait weeks for reimbursement. With prepaid travel cards, they access company money immediately without the stress of out-of-pocket expenses. This eliminates the administrative burden of processing expense reports and speeds up the entire payment cycle for everyone involved.

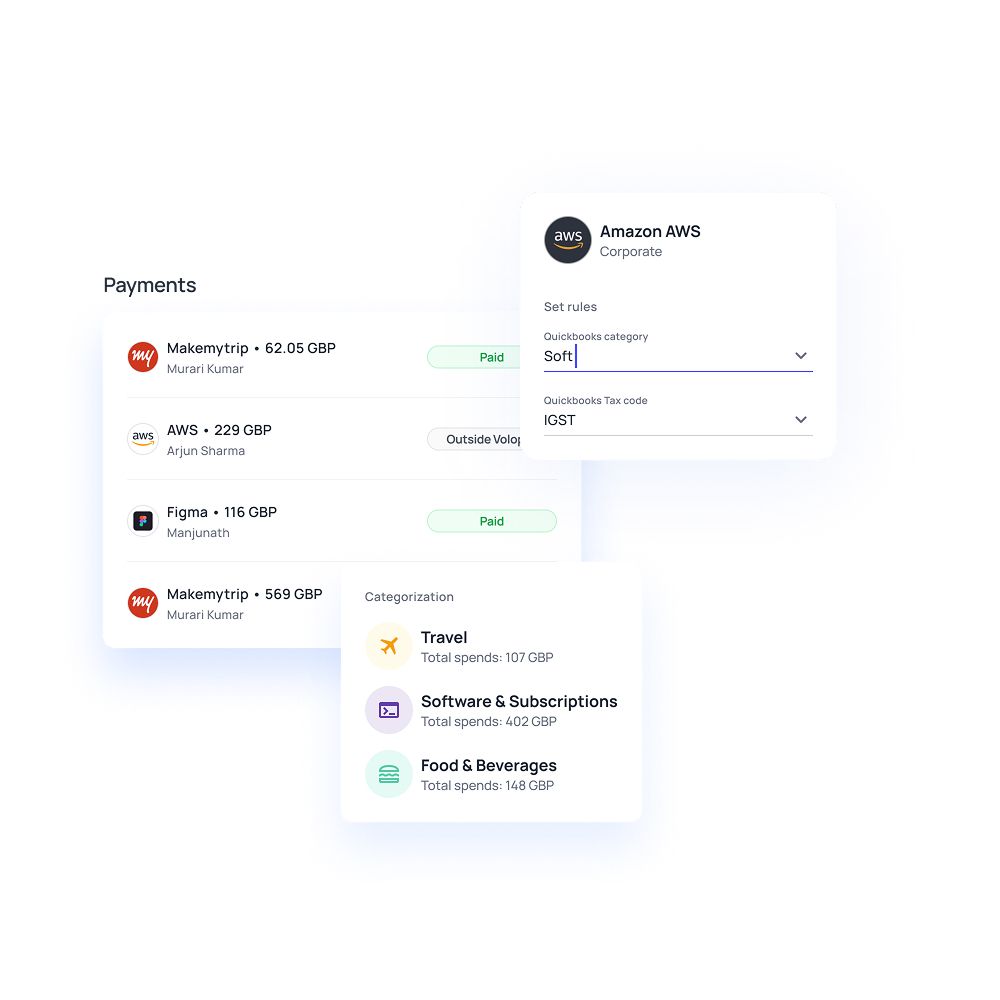

Monitor travel spends in real time

Finance teams gain instant visibility into travel spending through real-time notifications and detailed transaction tracking. You'll receive immediate alerts when cards are used, allowing you to spot unusual spending patterns quickly. This constant monitoring capability helps you make informed decisions about budget adjustments and identify potential cost-saving opportunities during business trips.

Save on international transaction costs

Prepaid travel cards typically offer competitive foreign exchange rates and eliminate hidden currency conversion fees that traditional payment methods often include. When your employees travel internationally, these cards provide better value compared to credit cards or cash exchanges. The transparent fee structure helps you budget more accurately for international business trips.

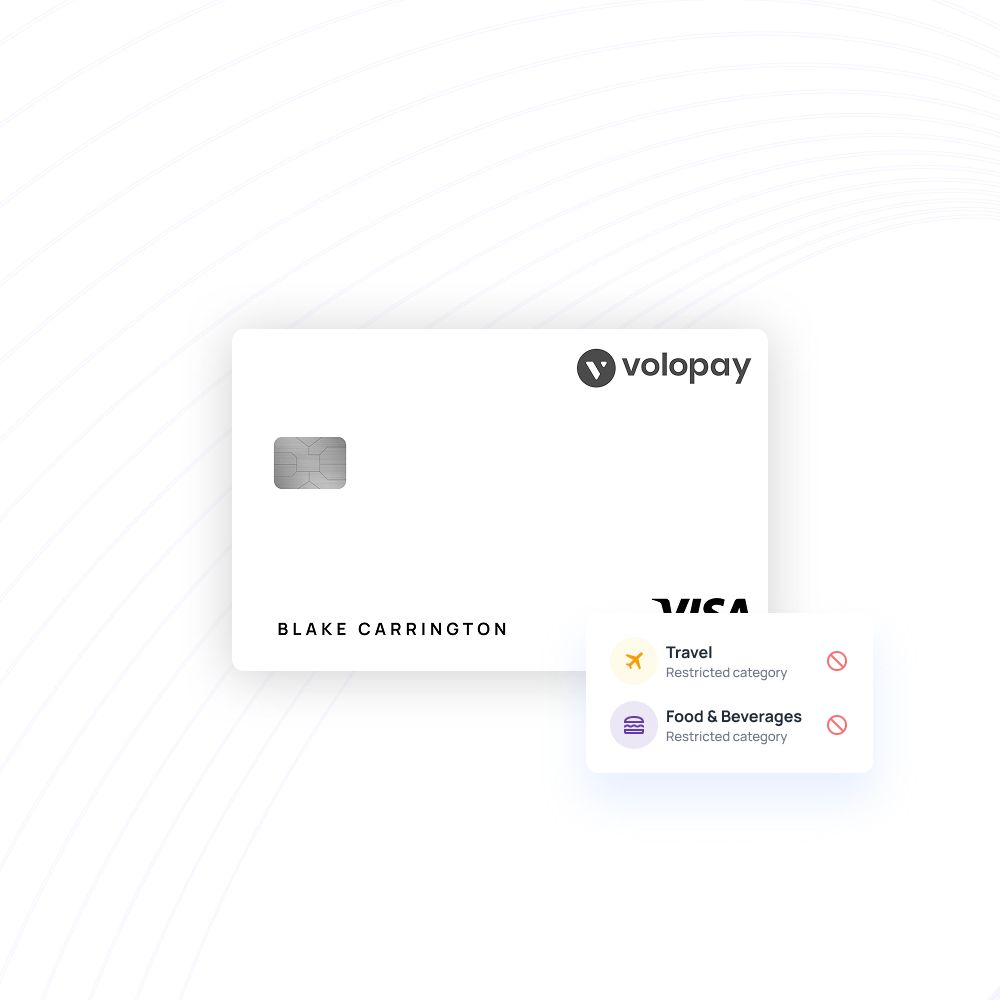

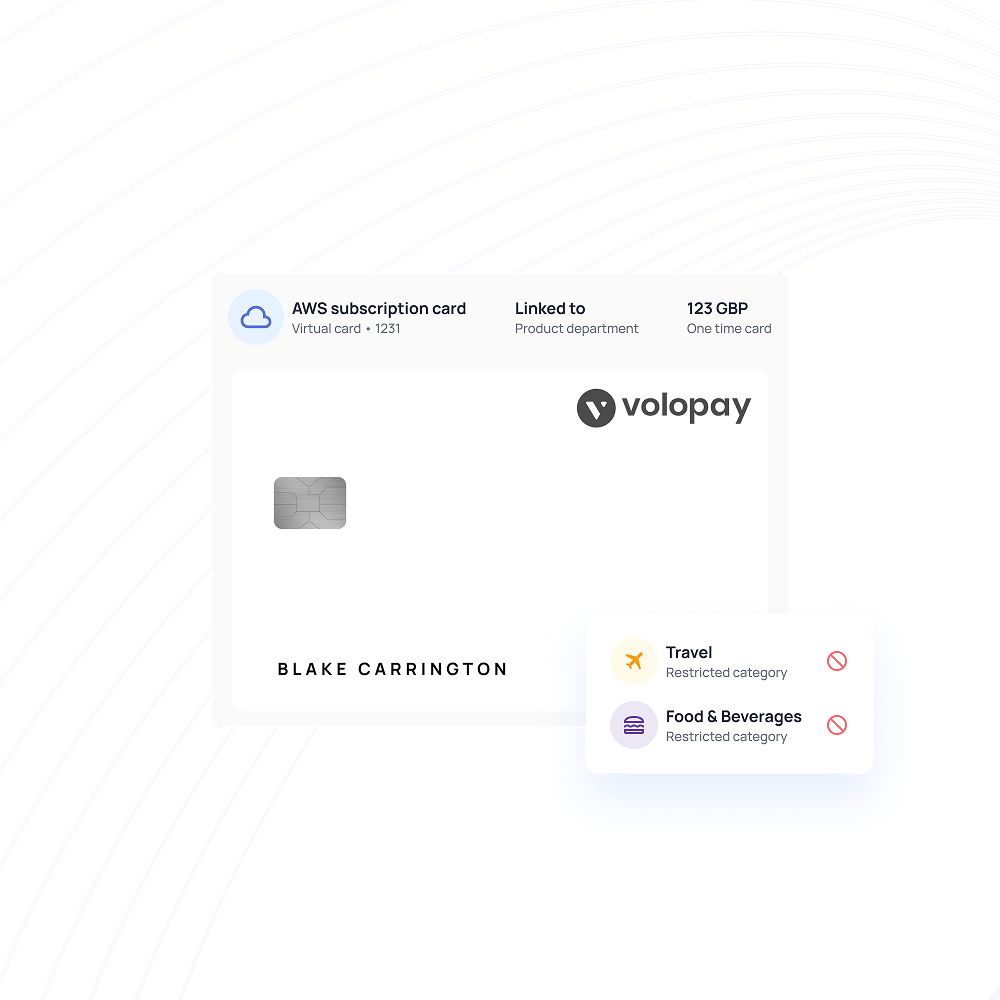

Automate travel policy enforcement

You can program spending restrictions directly into the cards, automatically blocking transactions that violate company travel policies. This removes the need for manual approval processes and ensures compliance without constant oversight.

By setting merchant category restrictions and spending limits, you enforce policy adherence while giving employees the freedom to make necessary business purchases.

Real-world use cases: UK businesses using prepaid cards effectively

Your distributed workforce needs financial flexibility when attending overseas meetings, conferences, or relocations.

Prepaid travel cards eliminate the hassle of expense claims and currency exchange while providing real-time spending visibility.

Team members can focus on business objectives rather than managing personal cash flow for company expenses.

Managing travel expenses from Birmingham to Belfast becomes effortless with pre-assigned budgets loaded onto prepaid travel cards.

Regional teams can handle local travel, accommodation, and business expenses without constant approval processes.

This approach reduces administrative burden while ensuring spending remains within predetermined parameters across all locations.

Temporary staff and consultants often require immediate access to company funds without exposing sensitive banking information.

Prepaid travel cards provide secure payment solutions for short-term projects.

This allows contractors to handle travel and accommodation expenses while protecting their business accounts from unauthorized access or potential security breaches.

Exhibition attendance and campaign execution require flexible spending with clear visibility.

Prepaid cards for travel enable marketing teams to manage domestic and international event costs efficiently.

Whether attending trade shows in London or conferences in Barcelona, teams can track expenses in real-time while maintaining budgetary discipline.

Travelling sales representatives require immediate access to funds without compromising financial oversight.

Prepaid cards for travel give your sales force the autonomy to handle client entertainment, accommodation, and transport costs while maintaining strict budgetary controls.

You retain complete visibility over spending patterns and can adjust limits instantly.

Empower your business trips with smarter prepaid travel cards

Volopay: The smarter way to manage your business travel spend

Transform your business travel expenses with Volopay's prepaid cards. Our comprehensive platform streamlines expense management for UK-based teams, offering real-time visibility, intelligent controls, and seamless integration with your existing accounting systems. Experience the future of corporate travel spending with prepaid cards for travel that actually work for your business.

Centralized card & expense dashboard

Monitor all your travel spending from a single, intuitive dashboard. Track every transaction, view card balances, and manage expenses across your entire team in real-time.

Our centralized system eliminates the chaos of multiple expense reports, giving you complete visibility into your business travel costs with just a few clicks.

Intelligent spend controls

Take control of your travel budget with sophisticated spending rules. Set precise limits by vendor, expense category, geographic location, or individual cardholder.

Our intelligent system prevents overspending before it happens, ensuring your team stays within budget while maintaining the flexibility they need for effective business travel.

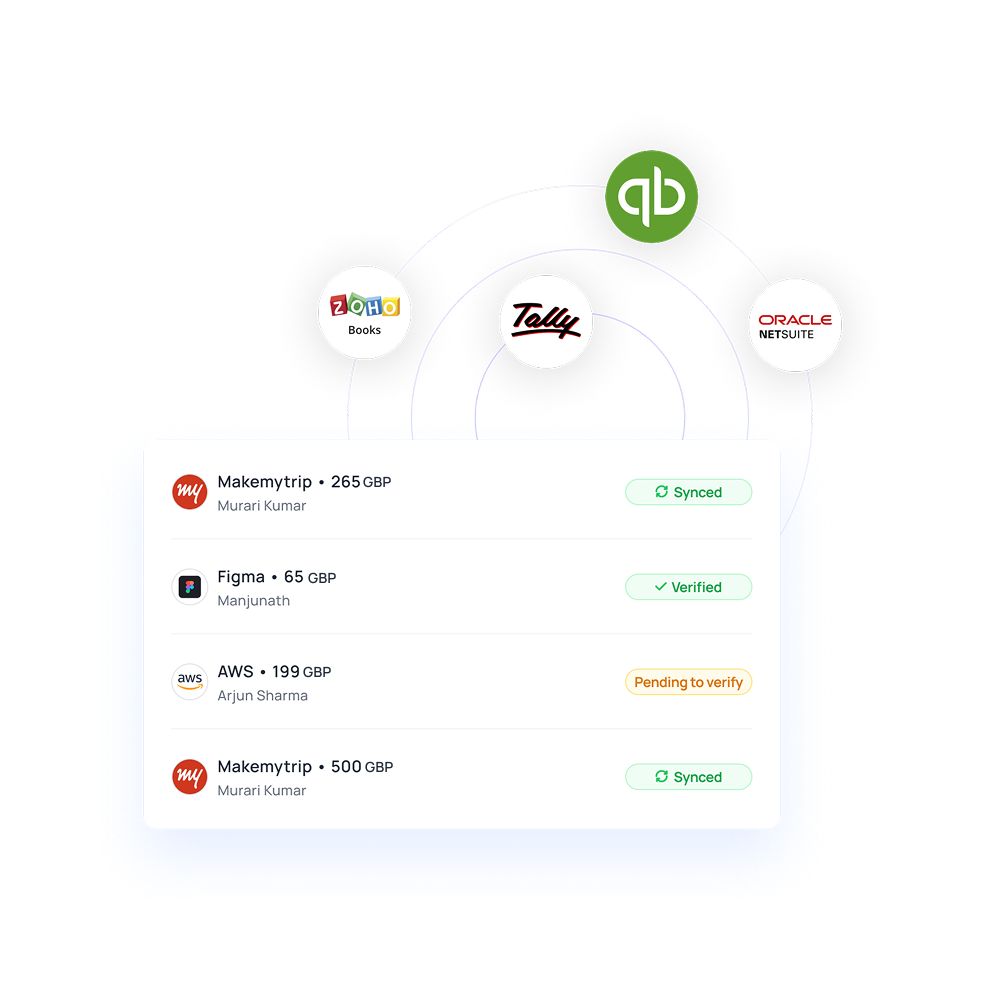

Seamless UK accounting integrations

Connect effortlessly with popular UK accounting platforms including Xero, QuickBooks, and NetSuite.

Our automated synchronization with accouting software eliminates manual data entry, reduces errors, and ensures your financial records are always up-to-date. Spend less time on administrative tasks and more time growing your business.

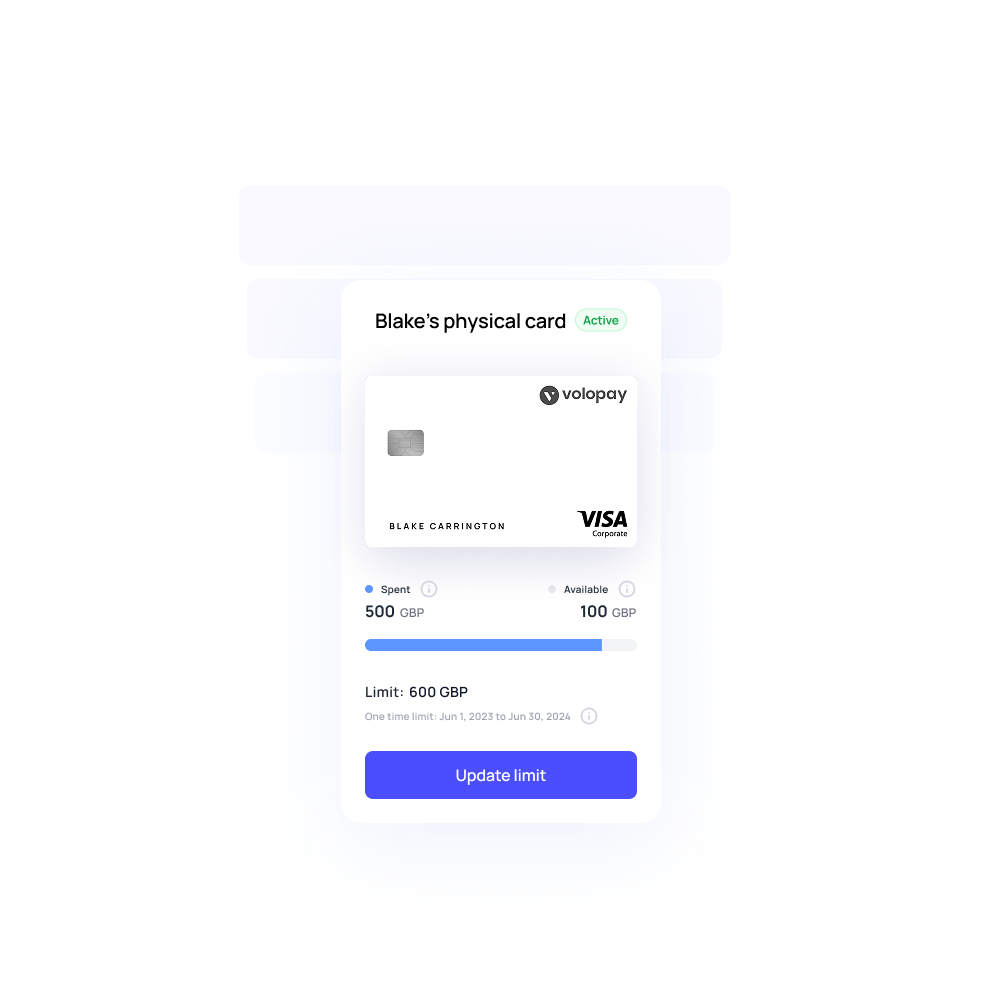

Instant virtual & physical card issuance

Need a travel card urgently? Create new cards in minutes, not days.

Whether your employee needs a virtual card for online bookings or a physical card for on-the-ground expenses, our instant issuance system delivers immediately.

Perfect for last-minute travel arrangements or emergency business trips.

Why UK finance teams trust Volopay's business prepaid cards

UK finance teams choose Volopay because traditional expense management falls short of modern business demands. While other solutions offer basic card services, Volopay delivers a comprehensive financial ecosystem that evolves with your company's travel spending needs.

Our platform eliminates the friction between travel policy enforcement and employee flexibility, creating a sustainable foundation for long-term growth. With automated compliance, real-time visibility, and intelligent spend controls, Volopay becomes your strategic partner in transforming how your organization manages business travel expenses across every stage of company development.

1. Built for CFOs and finance managers

Volopay empowers finance leadership with advanced spending insights and granular role-based permissions that align with your organizational hierarchy. Real-time dashboards provide strategic oversight of travel expenditures, while automated reporting streamlines monthly closes and board presentations.

Our platform enables CFOs to set company-wide policies and delegate operational control to finance managers, ensuring both strategic oversight and operational efficiency. Advanced analytics help identify spending patterns and optimize travel budgets across departments and teams.

2. Scales with your business

Whether you're managing 5 employees or 500, Volopay's prepaid travel card for business grows seamlessly with your organization. Our intuitive platform allows you to issue new corporate cards instantly, configure department-specific spending limits, and retire cards as team members transition.

As your business expands across regions or adds new travel policies, Volopay's flexible infrastructure adapts without requiring system overhauls or complex integrations. Scale your travel spend management effortlessly while maintaining consistent policy enforcement across all organizational levels.

3. Spend efficiency meets policy enforcement

Volopay automates approval workflows and flags spending anomalies before they become compliance issues, eliminating the need for manual micromanagement. Our intelligent system learns your travel patterns and automatically applies relevant policies, reducing administrative overhead while maintaining strict financial controls.

Real-time alerts notify managers of policy violations or unusual spending, enabling immediate intervention. This automated approach ensures compliance without slowing down business operations, allowing your team to focus on strategic initiatives rather than expense administration.

Managing your business travel expenses effectively

Secure and compliant travel spending for UK Firms

You need travel spending solutions that don't compromise on security or compliance. Volopay delivers enterprise-grade financial controls specifically designed for UK regulatory requirements, giving you complete visibility and control over your corporate travel expenses while maintaining the highest standards of data protection and audit readiness.

Enforced spend limits & merchant rules

You set the boundaries, we enforce them automatically.

Define spending limits by transaction amount, restrict purchases to specific categories, or geofence spending to approved locations.

Your employees get the flexibility they need for business related travel while you maintain complete control over where and how company funds are spent.

HMRC-ready transaction logs

Your accounting team will thank you for automated, tax-compliant record-keeping that eliminates manual entry.

Our prepaid travel card tracks, categorizes, and tags every transaction with the detailed information HMRC requires.

This ensures that your travel expenses are always audit-ready and properly documented for tax purposes.

Capture receipts instantly

You'll never lose another receipt or face month-end scrambles for missing documentation.

Your employees can instantly upload receipts through our mobile app or forward them via email, automatically matching each receipt to its corresponding transaction.

This real-time capture ensures complete expense documentation and eliminates the burden of chasing missing receipts.

PCI-DSS & GDPR compliance

You can trust that your financial data meets the highest security standards.

Our platform maintains full PCI-DSS compliance for payment processing and strict GDPR adherence for data protection.

Giving you an enterprise-grade security infrastructure specifically designed for UK operations and regulatory requirements.

Audit trails and custom reports

Get complete transparency with detailed audit trails and customizable reporting.

Export transaction data for month-end closings, generate reports for departments or cost centers, and prepare audit documentation with just a few clicks.

Every transaction is tracked, categorized, and ready for review or compliance verification.

Getting started with Volopay prepaid cards in the UK

Volopay's prepaid travel card simplifies expense management for UK businesses. Our streamlined platform eliminates complex approval processes and provides instant visibility into employee spending. With automated workflows and real-time controls, businesses can manage travel expenses efficiently while maintaining complete oversight of every transaction across their organization.

Register and verify your business

Complete your business registration through our secure online portal. Upload essential documents including company registration certificates, director identification, and banking details.

Our automated verification system processes applications quickly, ensuring your business meets UK regulatory requirements while maintaining the highest security standards for financial operations.

Load funds securely

Transfer funds directly from your business current account using secure bank transfers. Our encrypted payment gateway supports major UK banks and building societies, ensuring safe transactions.

Real-time balance updates provide immediate visibility into available funds, while automated notifications keep finance teams informed of account activity and funding requirements.

Issue cards to employees instantly

Deploy virtual or physical prepaid cards for travel to employees within seconds of approval. Configure role-based permissions that align with your organizational hierarchy and travel policies.

Set individual spending limits, merchant restrictions, and geographical controls to ensure responsible usage while providing employees the flexibility they need for business travel.

Set spending rules and track usage

Implement comprehensive expense management with category-specific limits and merchant restrictions. Monitor all transactions through our real-time dashboard, receiving instant alerts for unusual activity or policy violations.

Generate detailed reports for accounting purposes while maintaining complete audit trails for compliance and expense reconciliation across all employee travel activities.

Bring Volopay to your business

Get started now

FAQs about prepaid cards for business travel

Yes, you can issue multiple prepaid cards for team members on the same trip. This allows for better expense distribution and individual spending control. Each team member receives their own card with customizable spending limits, making it easier to track expenses per person while maintaining centralized oversight of the entire trip budget.

Volopay prepaid cards are widely accepted internationally. This includes ATMs, hotels, restaurants, and retail stores worldwide. The cards work seamlessly across different countries, making them ideal for business travelers who need reliable payment solutions while abroad without worrying about card acceptance issues.

Card reloading is typically instant or takes just a few minutes through the Volopay platform. You can reload cards remotely using the mobile app or web dashboard, ensuring your team never runs out of funds during critical business trips. This real-time capability eliminates delays and keeps business operations running smoothly while traveling.

Yes, Volopay cards offer comprehensive spending controls, including merchant category restrictions. You can limit cards to specific purchase types like hotels, restaurants, fuel, or office supplies. These controls help prevent unauthorized spending and ensure funds are used only for approved business expenses, providing better financial governance during travel.

Volopay prepaid cards support multi-currency transactions with competitive exchange rates. The cards automatically convert currencies at the point of sale, eliminating the need for manual currency exchanges. This feature is particularly valuable for international business travelers who need to make purchases in various currencies throughout their trips.